Attached files

| file | filename |

|---|---|

| EX-5 - EXHIBIT 5 - Longhai Steel Inc. | exhibit5.htm |

| EX-3.1 - EXHIBIT 3.1 - Longhai Steel Inc. | exhibit3-1.htm |

| EX-3.2 - EXHIBIT 3.2 - Longhai Steel Inc. | exhibit3-2.htm |

| EX-23.1 - EXHIBIT 23.1 - Longhai Steel Inc. | exhibit23-1.htm |

| EX-23.2 - EXHIBIT 23.2 - Longhai Steel Inc. | exhibit23-2.htm |

| As filed with the Securities and Exchange Commission on September 17, 2012 |

| Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________________

FORM S-1

REGISTRATION

STATEMENT UNDER

THE SECURITIES ACT OF 1933

LONGHAI STEEL INC.

(Exact name

of registrant as specified in its charter)

| Nevada | 3310 | 11-3699388 |

| (State or other jurisdiction of | (Primary Standard Industrial | (IRS Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

No. 1 Jingguang Road, Neiqiu County

Xingtai City,

Hebei Province 054000

People’s Republic of China

+86 (319)

686-1111

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

____________________________

Chaojun Wang

Chief Executive Officer

No. 1 Jingguang Road, Neiqiu County

Xingtai City, Hebei

Province 054000

People’s Republic of China

+86 (319)

686-1111

Copies to:

Louis A. Bevilacqua, Esq.

Joseph R. Tiano, Jr., Esq.

Pillsbury Winthrop Shaw Pittman

LLP

2300 N Street, N.W.

Washington, DC 20037

(202) 663-8000

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

____________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be

registered(1) |

Proposed maximum

offering price per share |

Proposed maximum

aggregate offering price |

Amount of

registration fee |

| Common Stock, $0.001 par value | 1,600,003(2) | $1.02(4) | $1,632,003.06 | $187.03 |

| Common Stock, $0.001 par value, issuable upon exercise of warrants | 960,003(3) | $1.00(5) | $960,003 | $110.02 |

| Total | 2,560,006 | $2,592,006.06 | $297.04 |

| (1) |

In accordance with Rule 416(a), the Registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

| (2) |

Represents shares of the Registrant’s common stock being registered for resale that have been issued to the selling stockholders named in this registration statement. |

| (3) |

Represents shares of the Registrant’s common stock issuable upon exercise of three-year warrants to purchase shares of common stock that have been issued to the selling stockholders named in this registration statement. |

| (4) |

Estimated pursuant to Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee, based on the average of the high and low prices reported on the OTC Bulletin Board on September 14, 2012. |

| (5) |

Calculated in accordance with Rule 457(g) based upon the exercise price of the warrants held by selling stockholders named in this registration statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

2

|

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. |

Subject to completion, dated September 17, 2012

2,560,006 Shares

Common Stock, $0.001 par value

____________________________

This prospectus relates to 2,560,006 shares of common stock that may be sold from time to time by the selling stockholders named in this prospectus, which includes:

- 1,600,003 shares of common stock; and

- 960,003 shares of common stock issuable to the selling stockholders upon the exercise of warrants.

We will not receive any proceeds from the sales by the selling stockholders, but we will receive funds from the exercise of warrants held by the selling stockholders, if exercised for cash.

Our common stock is quoted on the OTC Bulletin Board maintained by the Financial Industry Regulatory Authority, Inc. under the symbol “LGHS.” The closing bid price for our common stock on September 14, 2012 was $1.02 per share, as reported on the OTC Bulletin Board.

Any participating broker-dealers and any selling stockholders who are affiliates of broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the Securities Act, and any commissions or discounts given to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common stock.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2012.

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | 1 |

| Risk Factors | 7 |

| Special Note Regarding Forward-Looking Statements | 18 |

| Use of Proceeds | 19 |

| Determination of Offering Price | 19 |

| Market Price of and Dividends on our Common Equity and Related Stockholder Matters | 20 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 |

| Our Corporate History and Structure | 30 |

| Our Industry | 33 |

| Our Business | 35 |

| Description of Property | 42 |

| Legal Proceedings | 42 |

| Management | 43 |

| Executive Compensation | 47 |

| Security Ownership of Certain Beneficial Owners and Management | 49 |

| Transactions with Related Persons, Promoters and Certain Control Persons; Director Independence | 51 |

| Description of Capital Stock | 53 |

| Shares Eligible For Future Sale | 56 |

| Selling Stockholders | 57 |

| Plan of Distribution | 60 |

| Legal Matters | 62 |

| Experts | 62 |

| Where You Can Find More Information | 62 |

| Financial Statements | F-0 |

You should rely only on the information provided in this prospectus. Neither we nor the selling stockholders have authorized anyone to provide you with additional or different information. The selling stockholders are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front of the document.

i

PROSPECTUS SUMMARY

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus, including the financial statements, the notes thereto and matters set forth under “Risk Factors.”

Except as otherwise indicated by the context and for the purposes of this prospectus only, references in this prospectus to:

-

“we,” “us,” “our,” or the “Company” are to the combined business of Longhai Steel Inc., a Nevada corporation, and its consolidated subsidiaries and variable interest entity, or VIE;

-

“Kalington” are to our wholly-owned subsidiary Kalington Limited, a Hong Kong company;

-

“Kalington Consulting” are to Kalington’s wholly-owned subsidiary Xingtai Kalington Consulting Service Co., Ltd., a PRC company;

-

“Longhai” are to our VIE Xingtai Longhai Wire Rod Co., Ltd., a PRC company;

-

“Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China;

-

“PRC” and “China” are to the People’s Republic of China;

-

“SEC” are to the U.S. Securities and Exchange Commission;

-

“Securities Act” are to the Securities Act of 1933, as amended;

-

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

-

“Renminbi” and “RMB” are to the legal currency of China; and

-

“U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

In this prospectus, we are relying on and we refer to information and statistics regarding the Chinese steel industry, which we have obtained from various cited public sources. Any such information is publicly available for free and has not been specifically prepared for us for use or incorporation in this prospectus or otherwise.

1

THE COMPANY

Overview

We are a manufacturer of steel wire products in eastern China. We produce steel wire ranging from 5.5 mm to 18 mm in diameter on two wire production lines, which have a combined annual capacity of approximately 1.5 million metric tons, or MT, per year. Our products are sold to a number of distributors who transport the wire to nearby wire processing facilities where it is further processed by third parties.

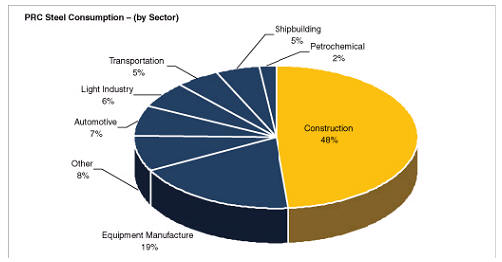

Demand for our steel wire is driven primarily by spending in the construction and infrastructure industries. We have benefited from strong fixed asset investment and construction growth as the PRC has rapidly grown increasingly urbanized and invested in modernizing its infrastructure.

We sell our products to a number of distribution companies that transport our wire to nearby wire processors. Downstream manufacturers process our wire into screws, nails, and wire mesh used to reinforce concrete and for fencing. Our products are manufactured on an on-demand basis, and we usually collect payment in advance. Sales prices are set at the market price for wire on a daily basis. Our customers generally prepay for their orders, and the final price may be adjusted to the market price on the day of pick up. This allows us to maintain a low inventory of both wire and billet and protects us from exposure to commodity price volatility. In order to increase sales and be competitive in the market, we occasionally offer discounted wholesale prices to customers at our discretion. Our sales efforts are directed toward developing long-term relationships with customers who are able to purchase in large quantities.

Our production facilities are located at a 197,500 square meter property in Xingtai, Hebei Province. Our production facilities include a steel rolling mill, the unique feature of which is that two rolling lines are arranged in a “Y”-layout, i.e., two wire drawing lines share one furnace, one coarse and intermediate rolling mill, and other supporting equipment. This particular design facilitates cost savings and higher output at a higher quality. In the third quarter of 2011, we entered into a five year operating lease for a newly constructed wire plant adjacent to our current facilities. The new facility has an area of 90,500 square meters and an annual capacity of 600,000 MT and will increase our production capacity by approximately 60%. The new facility is leased at a yearly cost of $2.2 million from Xingtai Longhai Steel Group Co., Ltd., or Longhai Steel Group, a related party.

Our revenue for the fiscal years ended December 31, 2011 and 2010 was $608 million and $475 million, respectively, and our net income was $11.2 million and $11.3 million, respectively.

Our Industry

According to www.chinaisa.org.cn, the official website of China Iron and Steel Association, China is the world’s largest producer of steel, with annual production in 2010 and 2011 of 627 million MT and 690 million MT, respectively. China accounts for roughly 70% of 2011 global steel production, which equals to twice the total output of the rest of the world combined, according to www.chinaisa.org.cn. China’s steel industry, while enormous in total scale, is a fractured industry where a great number of producers each account for a small amount of total output. China’s steel industry includes a wide range of producers, including smaller, inefficient backyard operations, huge state owned enterprises beset with unnecessarily large, unionized labor forces and their accompanying pension burdens, as well as newly constructed steel plants possessing facilities built according to the highest technology and efficiency standards in the world.

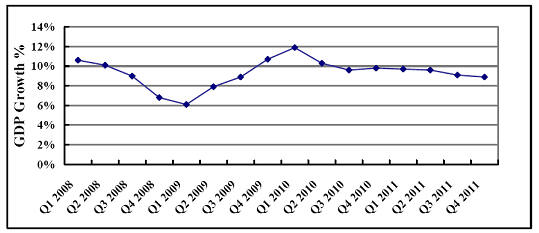

The steel industry is a fundamental cornerstone of the economy and growth in the steel industry has coincided with consistent and strong growth in the PRC economy as a whole. China’s real gross domestic product, or GDP, year over year quarterly growth has averaged well over 9% since 2000, with a low of 6.1% in the first quarter of 2009, and has rebounded through 2011.

We believe that GDP growth will gradually slow down but remain positive as China continues its industrialization and urbanization process. According to the first China Economy Summit held on January 17, 2010, China’s urbanization ratio is 48%, versus 85% in developed economies and the global average of 55. China’s urbanization rate is expected to increase by 1 percentage point every year for the next 20 years. We believe China’s urbanization will provide sustainable investment and become a key factor in bolstering China’s growth.

2

Our Growth Strategies

We believe that the market for high quality steel wire will continue to grow in the PRC. The PRC adopted a policy to reduce outdated steel production capacity and make it more difficult to approve new steel wire plant construction in July 2005 in an effort to encourage consolidation of facilities; therefore, our expansion plan is to build capacity through the acquisition of facilities at attractive prices from competitors who lack our management experience, efficient labor force, and financial resources. We plan to continue to improve margins through increased efficiencies in our production process and by adding higher grade steel wire to our product portfolio.

We intend to pursue the following strategies to achieve our goal:

-

Expand production utilizing a newly leased facility: In the third quarter of 2011, we entered into a five year operating lease for a newly constructed wire plant adjacent to our current facilities. The new facility has an area of 90,500 square meters and an annual capacity of 600,000 MT. The new facility is leased at a yearly cost of $2.2 million from Longhai Steel Group, a related party. The wire plant produces wire of a higher grade with higher margins than our current products. The facility produces wire made of Carbon Structure Steel, Cold Heading Steel and Welding Rod Steel, with a diameter range of 5.5mm – 18mm, which has a wide range of applications such as steel wire rope, steel strand, steel belted radial tires and steel welding rod. We are in the process of upgrading the facility. Once fully upgraded, the new facility will increase our production capacity by approximately 60% and will have the capability to produce alloy steel, cold forging steel and welding rods. These higher margin products will allow us to also address demand in additional markets beyond construction and infrastructure.

-

Identify and acquire modern, high quality producers at low valuations: In light of a restriction on building new wire making facilities in China, we plan to expand our business and operations through the acquisition of steel wire producers with production facilities in the vicinity of our current facilities. We expect to limit our acquisition targets to producers with facilities that have had a major overhaul or modernization of production machinery in the last 2 – 3 years, as we expect such facilities to achieve better production efficiency, lower maintenance costs and increased output, as compared to less modern facilities, and will help us to more rapidly achieve higher margins and increase our market share.

-

Expansion to create economies of scale: We expect that our acquisition of modernized facilities will result in increased wire-making capacity, resulting in greater bargaining power with supplier pricing and otherwise enable us to capitalize on economies of scale and/or widen our product portfolio to produce at higher margins.

Risk Factors

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed more fully in the section titled “Risk Factors,” including for example:

-

our ability to produce steel wire at a consistently profitable margin as we have historically;

-

the impact that a downturn or negative changes in the steel market may have on sales;

-

our ability to obtain additional capital in future years to fund our planned expansion;

-

economic, political, regulatory, legal and foreign exchange risks associated with our operations; or

-

the loss of key members of our senior management and our qualified sales personnel.

Any of the above risks could materially and negatively affect our business, financial position and results of operations. An investment in our common stock involves risks. You should read and consider the information set forth in “Risk Factors” and all other information set forth in this prospectus before investing in our common stock.

Our Corporate History and Structure

We were originally incorporated under the laws of the State of Georgia on December 4, 1995. On March 14, 2008, the Georgia Corporation was merged with and into a newly formed Nevada corporation named Action Industries, Inc. Prior to our reverse acquisition of Kalington discussed below, we were primarily in the business of providing prepaid long distance calling cards and other telecommunication products and had not commenced planned principal operations. As a result of our reverse acquisition of Kalington, active business operations were revived. On July 16, 2010, we amended our Articles of Incorporation to change our name to “Longhai Steel Inc.” to reflect our new business.

3

On March 26, 2010, we completed a reverse acquisition transaction through a share exchange with Kalington and its shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Kalington in exchange for 10,000 shares of our Series A Preferred Stock, which constituted 98.5% of our issued and outstanding capital stock on an as-converted basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Kalington became our wholly-owned subsidiary and the former shareholders of Kalington became our controlling stockholders.

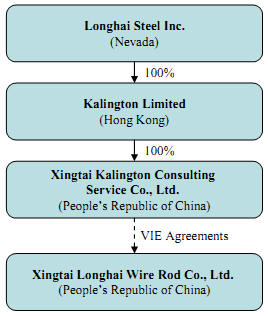

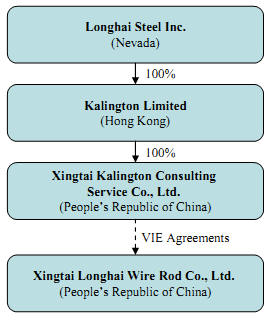

As a result of our acquisition of Kalington, we now own all of the issued and outstanding capital stock of Kalington, which in turn owns all of the issued and outstanding capital stock of Kalington Consulting. In addition, we effectively and substantially control Longhai through the VIE agreements discussed below.

On March 19, 2010, prior to the reverse acquisition transaction, Kalington Consulting and Longhai entered into a series of agreements, or the VIE Agreements, pursuant to which Longhai became Kalington Consulting’s VIE. The use of VIE agreements is a common structure used to acquire PRC companies, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. Through the VIE Agreements, we exercise effective control over the operations of Longhai and receive the economic benefits of Longhai. As a result, under United States generally accepted principles, or U.S. GAAP, we are considered the primary beneficiary of Longhai and thus consolidate its results in our consolidated financial statements. See “Our Corporate History and Structure—Our Corporate History—VIE Agreements” for a description of the VIE Agreements.

The following chart reflects our corporate organizational structure:

Corporate Information

We presently maintain our principal office at No. 1 Jingguang Road, Neiqiu County, Xingtai City, Hebei Province, 054000, People’s Republic of China. Our telephone number is (86) 319 686-1111. We maintain a website at www.longhaisteelinc.com. Information available on our website is not incorporated by reference in and is not deemed a part of this prospectus.

4

THE OFFERING

|

Common stock offered by selling stockholders |

2,560,006 shares, consisting of 1,600,003 shares of common stock and 960,003 shares of common stock issuable upon the exercise of warrants held by the selling stockholders. This number represents 21.15% of our current outstanding common stock on a fully diluted basis (based on 12,105,421 shares of common stock outstanding as of September 14, 2012). | |

|

Common stock outstanding before the offering |

12,105,421 shares. | |

|

Common stock outstanding after the offering assuming exercise of all outstanding warrants |

13,065,421 shares. | |

|

Proceeds to us |

We will not receive any proceeds from the sale of shares by the selling stockholders. We will, however, receive approximately $960,000 from the exercise of the warrants held by the selling stockholders, if exercised for cash. | |

|

Trading market |

Our common stock is quoted on the OTC Bulletin Board under the symbol “LGHS.” |

5

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following table summarizes selected financial data regarding our business and should be read in conjunction with our financial statements and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary consolidated statement of operations data for the years ended December 31, 2011 and 2010 and the summary balance sheet data as of December 31, 2011 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The selected balance sheet data as of December 31, 2010 are derived from our audited consolidated financial statements not included in this prospectus.

Our audited consolidated financial statements for the years ended December 31, 2011 and 2010 are prepared and presented in accordance with U.S. GAAP. The summary consolidated financial data for the periods ended June 30, 2012 and 2011 are derived from our unaudited consolidated financial statements included in this prospectus. The summary financial data information is only a summary and should be read in conjunction with the historical consolidated financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

| Six Months Ended June 30, | Years Ended December 31, | |||||||||||

| 2012 | 2011 | 2011 | 2010 | |||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Statements of Operations Data | ||||||||||||

| Revenue | $ | 296,262,619 | $ | 292,014,638 | $ | 608,038,370 | $ | 475,022,529 | ||||

| Cost of revenue | (285,946,421 | ) | (284,508,440 | ) | (589,318,547 | ) | (456,446,007 | ) | ||||

| Gross profit | 10,316,198 | 7,506,198 | 18,719,823 | 18,576,522 | ||||||||

| General and administrative expenses | (1,508,185 | ) | (1,110,390 | ) | (1,603,272 | ) | (2,408,214 | ) | ||||

| Selling expense | (400,988 | ) | (5,599 | ) | - | - | ||||||

| Other operation expense | (500,337 | ) | - | - | - | |||||||

| Income from operations | 7,906,688 | 6,390,209 | 17,116,551 | 16,168,308 | ||||||||

| Interest income | 4,755 | 3,254 | 8,619 | 5,047 | ||||||||

| Interest expense | (888,390 | ) | (1,400,867 | ) | (2,382,054 | ) | (876,492 | ) | ||||

| Other income/(expenses) | 13,983 | (9,405 | ) | (39,008 | ) | (9,598 | ) | |||||

| Total other income and expenses | (869,652 | ) | (1,407,018 | ) | (2,412,443 | ) | (881,043 | ) | ||||

| Income before income taxes | 7,037,036 | 4,983,191 | 14,704,108 | 15,287,265 | ||||||||

| Income tax expense | (1,974,876 | ) | (1,282,954 | ) | (3,509,860 | ) | (3,951,602 | ) | ||||

| Net income | $ | 5,062,160 | $ | 3,700,237 | $ | 11,194,248 | $ | 11,335,663 | ||||

| Earnings per share – basic | $ | 0.49 | $ | 0.37 | $ | 1.12 | $ | 1.14 | ||||

| Earnings per share-diluted | 0.48 | 0.37 | 1.12 | 1.14 | ||||||||

| Weighted average shares outstanding – basic | 10,346,114 | 10,000,000 | 10,001,401 | 9,965,068 | ||||||||

| Weighted average shares outstanding – diluted | 10,454,153 | 10,000,000 | 10,001,401 | 9,965,068 | ||||||||

| Comprehensive Income | ||||||||||||

| Net income | $ | 5,062,160 | $ | 3,700,237 | $ | 11,194,248 | $ | 11,335,663 | ||||

| Other comprehensive income | 402,245 | 1,068,105 | 1,953,352 | 1,359,726 | ||||||||

| Comprehensive income | $ | 5,464,405 | $ | 4,768,342 | $ | 13,147,600 | $ | 12,695,389 | ||||

| As of June 30, | As of December 31, | |||||||||||

| 2012 | 2011 | 2011 | 2010 | |||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Balance Sheet Data | ||||||||||||

| Current assets | $ | 104,474,469 | $ | 70,566,378 | $ | 73,444,124 | $ | 53,332,563 | ||||

| Total assets | 125,639,524 | 94,263,982 | 96,055,109 | 77,981,253 | ||||||||

| Current liabilities | 61,249,864 | 44,869,667 | 38,567,258 | 33,491,127 | ||||||||

| Total liabilities | 61,249,864 | 45,030,878 | 38,567,258 | 33,661,813 | ||||||||

| Stockholders’ equity | 64,344,660 | 49,233,104 | 57,487,851 | 44,319,440 | ||||||||

6

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We face risks related to general domestic and global economic conditions.

Our current operating cash flows provide us with stable funding capacity. However, the uncertainty arising out of domestic and global economic conditions, including the recent disruption in credit markets, poses a risk to the PRC economy and may impact our ability to manage normal relationships with our customers, suppliers and creditors. If the current situation deteriorates significantly, our business could be materially negatively impacted, as demand for our products and services may decrease from a slow-down in the general economy, or supplier or customer disruptions may result from tighter credit markets.

Our business is dependent upon continued infrastructure and construction spending and our growth may be inhibited by the inability of potential customers to fund purchases of our products and services.

Our products are dependent on the continued growth of infrastructure and construction projects in the PRC. There is no guarantee that the PRC will continue to invest in infrastructure and construction.

We will require additional capital to fund our future activities. If we fail to obtain additional capital, we may not be able to fully implement our planned expansion.

Historically, we have financed our business plan and operations primarily with internally generated cash flow and bank borrowings. The success of our planned expansion depends on substantial capital expenditures that may not be sufficiently fueled by internally generated cash flow and bank borrowings. Our future contractual commitments include a five-year operating lease obligation with an annual lease cost of $2.2 million. We entered into the lease agreement on August 1, 2011, with Longhai Steel Group, a related party, for a newly constructed wire plant adjacent to our current facilities. The new facility will enable us to increase our production capacity by approximately 60%. We also require capital to fund the purchase of raw materials and other working capital needs to increase production at the new facility.

If we fail to raise enough capital, we may not be able to fully implement our business plan. Even if additional capital is available, we may not be able to obtain debt or equity financing on terms favorable to us, or at all. If cash generated by operations or available under our credit facility is not sufficient to meet our capital requirements, the failure to obtain additional financing could result in a curtailment of our operations relating to exploration and development of our projects. In addition, we will require additional working capital to support other long-term growth strategies, which include identifying suitable points of market entry for expansion, growing the number of points of sale for our products, so as to enhance our product offerings and benefit from economies of scale.

Our working capital requirements and the cash flow provided by future operating activities, if any, may vary greatly from quarter to quarter, depending on the volume of business and the level of steel prices during the period. We may not be able to obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our current outstanding securities. In addition, we may grant registration rights to investors purchasing our equity or debt securities in the future. If we are unable to raise additional financing, we may be unable to implement our long- term growth strategies, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis.

Our quarterly operating results are likely to fluctuate, which may affect our stock price.

Our quarterly revenues, expenses, operating results and gross profit margins vary from quarter to quarter. As a result, our operating results may fall below the expectations of securities analysts and investors in some quarters, which could result in a decrease in the market price of our common stock. The reasons our quarterly results may fluctuate include:

7

- variations in the price of steel and steel wire;

- changes in the general competitive and economic conditions; and

- delays in, or uneven timing in the delivery of, customer orders.

Period to period comparisons of our results should not be relied on as indications of future performance.

If we are unable to attract and retain senior management and qualified technical and sales personnel, our operations, financial condition and prospects will be materially adversely affected.

Our future success depends in part on the contributions of our management team and key technical and sales personnel and our ability to attract and retain qualified new personnel. In particular, our success depends upon the continuing employment of our Chief Executive Officer and Interim Chief Financial Officer, Mr. Chaojun Wang, our Chief Technology Officer, and Ms. Dongmei Pan. There is significant competition in our industry for qualified managerial, technical and sales personnel, and we cannot assure you that we will be able to retain our key senior managerial, technical and sales personnel or that we will be able to attract, integrate and retain other such personnel that we may require in the future. If we are unable to attract and retain key personnel in the future, our business, operations, financial condition, results of operations and prospects could be materially adversely affected.

We do not carry business interruption insurance, so we have to bear losses ourselves.

We are subject to risk inherent to our business, including equipment failure, theft, natural disasters, industrial accidents, labor disturbances, business interruptions, property damage, product liability, personal injury and death. We carry insurance for our equipment but we do not carry any business interruption insurance or third-party liability insurance to cover risks associated with our business. As a result, if we suffer losses, damages or liabilities, including those caused by natural disasters or other events beyond our control and we are unable to make a claim against a third party, we will be required to bear all such losses from our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

Our management may have potential conflicts of interest with our related party, Longhai Steel Group, that could adversely affect our company.

Our Chief Executive Officer, the Interim Chief Financial Officer and primary shareholder, Chaojun Wang, is also the controlling shareholder of Longhai Steel Group. Prior to the reorganization of Longhai in preparation for the reverse merger, Longhai operated largely as a member of Longhai Steel Group. As a result, Longhai had a number of related party transactions with Longhai Steel Group. For example, Longhai purchased substantially all of its steel billets requirement from Longhai Steel Group and leases space from Longhai Steel Group for its facilities.

Although Longhai has taken steps to reduce the number of related party transactions with Longhai Steel Group and has implemented safeguards to reduce the potential for related party transactions to benefit Longhai Steel Group to the detriment of Longhai, any related party transactions between Longhai and Longhai Steel Group may present conflicts of interest for our management. For example, although Longhai’s facility lease agreement with Longhai Steel Group restricts Longhai Steel Group’s ability to unilaterally terminate or change the terms of the lease, Longhai’s management—who also manage Longhai Steel Group — could have an incentive to amend these provisions of the lease to remove these protections or to increase lease payments to the benefit of Longhai Steel Group. Similarly, although Longhai purchases its steel billet needs from third parties (which, in turn, purchase from Longhai Steel Group) rather than from Longhai Steel Group directly, Longhai Steel Group could take steps to increase the costs of such billet to Longhai’s detriment. In particular, Longhai Steel Group is able to supply steel to Longhai less expensively than competitors because, while the base price of steel billet is comparable across the region, (i) Longhai Steel Group’s cost of transporting steel to Longhai is lower given its proximity to Longhai and (ii) Longhai Steel Group can deliver hot steel billet given such proximity, which reduces Longhai’s energy costs and factors into Longhai’s calculation of its true steel billet costs. Longhai Steel Group could use this advantage to increase its price to a level that is higher than it would otherwise charge, knowing that the ultimate price to Longhai would remain comparable after factoring in such additional benefits. At the same time, the management of Longhai could cause Longhai to purchase steel from third parties that purchase from Longhai Steel Group, even where such purchases would not be in Longhai’s best economic interest.

While we have adopted a majority independent board of directors and have implemented a code of ethics to reduce the likelihood of such conflicts of interest, such potential conflicts of interest might occur from time to time, and the effect of any such conflict could be materially adverse to our Company.

8

RISKS RELATED TO THE VIE AGREEMENTS

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

Kalington Consulting manages and operates our steel wire production business through Longhai pursuant to the rights it holds under the VIE Agreements. Almost all economic benefits and risks arising from Longhai’s operations are transferred to Kalington Consulting under these agreements. Details of the VIE Agreements are set out in “Our Corporate History and Structure—Our Corporate History—VIE Agreements.”

There are risks involved with the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. Our PRC counsel has provided a legal opinion that the VIE Agreements are binding and enforceable under PRC law, but has further advised that if the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

- imposing economic penalties;

- discontinuing or restricting the operations of Longhai or Kalington Consulting;

- imposing conditions or requirements in respect of the VIE Agreements with which Longhai or Kalington Consulting may not be able to comply;

- requiring our company to restructure the relevant ownership structure or operations;

- taking other regulatory or enforcement actions that could adversely affect our company’s business; and

- revoking the business licenses and/or the licenses or certificates of Kalington Consulting, and/or voiding the VIE Agreements.

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Longhai, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to manage and operate Longhai under the VIE Agreements may not be as effective as direct ownership.

We conduct our steel wire production business in the PRC and generate virtually all of our revenues through the VIE Agreements. Our plans for future growth are based substantially on growing the operations of Longhai. However, the VIE Agreements may not be as effective in providing us with control over Longhai as direct ownership. Under the current VIE arrangements, as a legal matter, if Longhai fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) reply on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control Longhai, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.

As the VIE Agreements are governed by PRC law, we would be required to rely on PRC law to enforce our rights and remedies under them, and PRC law may not provide us with the same rights and remedies as are available in contractual disputes governed by the law of other jurisdictions.

The VIE Agreements are governed by the PRC law and provide for the resolution of disputes through arbitral proceedings pursuant to PRC law. If Longhai or its shareholders fail to perform the obligations under the VIE Agreements, we would be required to resort to legal remedies available under PRC law, including seeking specific performance or injunctive relief, or claiming damages. We cannot be sure that such remedies would provide us with effective means of causing Longhai to meet its obligations, or recovering any losses or damages as a result of non-performance. Further, the legal environment in China is not as developed as in other jurisdictions. Uncertainties in the application of various laws, rules, regulations or policies in the PRC legal system could limit our liability to enforce the VIE Agreements and protect our interests.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through the payments we receive pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes, which could result in our being subject to higher tax liability or cause other adverse financial consequences.

9

The controlling shareholder of Longhai may have potential conflicts of interest with our company that may adversely affect our business.

Mr. Chaojun Wang, our Chief Executive Officer and Interim Chief Financial Officer, is also the largest shareholder of Longhai. Conflicts could arise from time to time between our interests and the interests of Mr. Wang. Conflicts could also arise between us and Longhai that would require our shareholders and Longhai’s shareholders to vote on corporate actions necessary to resolve the conflict. There can be no assurance in any such circumstances that Mr. Wang will vote his shares in our best interest or otherwise act in the best interests of our company. If Mr. Wang fails to act in our best interests, our operating performance and future growth could be adversely affected.

We rely on the approval certificates and business license held by Kalington Consulting and any deterioration of the relationship between Kalington Consulting and Longhai could materially and adversely affect our business operations.

We operate our steel wire production business in China on the basis of the approval certificates, business license and other requisite licenses held by Kalington Consulting and Longhai. There is no assurance that Kalington Consulting and Longhai will be able to renew their licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold.

Further, our relationship with Longhai is governed by the VIE Agreements, which are intended to provide us with effective control over the business operations of Longhai. However, the VIE Agreements may not be effective in providing control over the application for and maintenance of the licenses required for our business operations. Longhai could violate the VIE Agreements, become insolvent, suffer from difficulties in its business or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputations and business could be materially harmed.

If Kalington Consulting exercises the purchase option it holds over Longhai’s share capital pursuant to the VIE Agreements, the payment of the purchase price could materially and adversely affect our financial position.

Under the VIE Agreements, Longhai’s shareholders have granted Kalington Consulting an option for the maximum period of time allowed by law to purchase all of the equity interest in Longhai at a price equal to the capital paid in by the transferors, adjusted pro rata for purchase of less than all of the equity interest, unless applicable PRC laws and regulations require an appraisal of the equity interest or stipulate other restrictions regarding the purchase price of the equity interest. Since Longhai is already our contractually controlled affiliate, our exercise of the option would not bring immediate benefits to our Company, and we would only do so if Longhai or its shareholders fail to perform the obligations under the VIE Agreements and we are unable to obtain specific performance, injunctive relief, or other damages in PRC courts, or otherwise protect our interests. The parties have agreed that if the applicable PRC laws and regulations require an appraisal of the equity interest or stipulate other restrictions regarding the purchase price of the equity interest at the time that the option is exercised, then the purchase price will be set at the lowest price permissible under the applicable laws and regulations. However, due to uncertainties in the application of various laws, rules, regulations or policies in PRC legal system, we cannot be sure that if we choose to exercise such option, any appraisal of equity interest or other stipulated restrictions required by PRC law will not materially increase the payment price for the option and adversely affect our results of operations.

RISKS RELATED TO DOING BUSINESS IN CHINA

If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably.

Recently, U.S. public companies that have substantially all of their operations in China, particularly companies like us which have completed so-called reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our Company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation will be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations will be severely affected and your investment in our stock could be rendered worthless.

10

Adverse changes in political, economic and other policies of the Chinese government could have a material adverse effect on the overall economic growth of China, which could materially and adversely affect the growth of our business and our competitive position.

Most of our business operations are conducted in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including:

- the degree of government involvement;

- the level of development;

- the growth rate;

- the control of foreign exchange;

- the allocation of resources;

- an evolving regulatory system; and

- a lack of sufficient transparency in the regulatory process.

While the Chinese economy has experienced significant growth in the past 30 years, growth has been uneven, both geographically and among various sectors of the economy. The Chinese economy has also experienced certain adverse effects due to the recent global financial crisis. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us.

The Chinese economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of the productive assets in China is still owned by the Chinese government. The continued control of these assets and other aspects of the national economy by the Chinese government could materially and adversely affect our business. The Chinese government also exercises significant control over Chinese economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on overall economic growth, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our businesses.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary and affiliate in the PRC. Our principal operating subsidiary and controlled affiliate, Kalington Consulting and Longhai, respectively, are subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involves uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

11

You may have difficulty enforcing judgments against us.

Our principal operating subsidiary and affiliate, Kalington Consulting and Longhai, respectively, are located in the PRC. We conduct most of our current operations in the PRC, and most of our assets are located outside the United States. In addition, most of our officers and directors are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons are also located outside the United States. As a result, it could be difficult for investors to effect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiary and/or controlled affiliate. It may also be difficult for you to enforce in U.S. courts judgments predicated on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as -0.8% . These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

All of our revenues are generated in RMB and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar- denominated investments we make in the future. Please refer to a further discussion of exchange rates in the Section titled “Foreign Currency Exchange Rates” of this report.

12

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiary’s ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

Substantially all of our sales are earned by our PRC subsidiary. However, as discussed more fully under “Our Business —Regulation—Dividend Distributions,” PRC regulations restrict the ability of our PRC subsidiary to make dividends and other payments to its offshore parent company. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75. Circular 75 requires PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an SPV for the purpose of engaging in an equity financing outside of China. See “Our Business—Regulation—Circular 75” for a detailed discussion of Circular 75 and its implementation.

We have asked our stockholders, who are PRC residents as defined in Circular 75, to register with the relevant branch of SAFE as currently required in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, we cannot provide any assurances that they can obtain the above SAFE registrations required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders.

In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

13

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.

On August 9, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, among other things, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the PRC parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to the PRC Ministry of Commerce, or MOFCOM, and other relevant government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the PRC business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

Under the Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

On March 16, 2007, the National People’s Congress of China passed a new Enterprise Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. See “Our Business—Regulation—Taxation” for a detailed discussion of the EIT Law.

It remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries may qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 5% or 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 5% or 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our stock.

We face uncertainty from China’s Circular on Strengthening the Administration of Enterprise Income Tax on NonResident Enterprises’ Share Transfer that was released in December 2009 with retroactive effect from January 1, 2008.

The Chinese State Administration of Taxation, or SAT, released a circular on December 15, 2009 that addresses the transfer of shares by nonresident companies, generally referred to as Circular 698. Circular 698, which was effective retroactively to January 1, 2008, may have a significant impact on many companies that use offshore holding companies to invest in China.

14

Circular 698, which provides parties with a short period of time to comply with its requirements, indirectly taxes foreign companies on gains derived from the indirect sale of a Chinese company. Where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise by selling the shares in an offshore holding company, and the latter is located in a country or jurisdiction where the effective tax burden is less than 12.5% or where the offshore income of his, her, or its residents is not taxable, the foreign investor is required to provide the tax authority in charge of that Chinese resident enterprise with the relevant information within 30 days of the transfers. Moreover, where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise through an abuse of form of organization and there are no reasonable commercial purposes such that the corporate income tax liability is avoided, the PRC tax authority will have the power to re-assess the nature of the equity transfer in accordance with PRC’s “substance-over-form” principle and deny the existence of the offshore holding company that is used for tax planning purposes. There is uncertainty as to the application of Circular 698. For example, while the term "indirectly transfer" is not defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the country or jurisdiction and to what extent and the process of the disclosure to the tax authority in charge of that Chinese resident enterprise. In addition, there are not any formal declarations with regard to how to decide “abuse of form of organization” and “reasonable commercial purpose,” which can be utilized by us to balance if our Company complies with the Circular 698. As a result, we may become at risk of being taxed under Circular 698 and we may be required to expend valuable resources to comply with Circular 698 or to establish that we should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anticorruption laws, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. We have operations, agreements with third parties and we make all of our sales in China. The PRC also strictly prohibits bribery of government officials. Our activities in China create the risk of unauthorized payments or offers of payments by the employees, consultants, sales agents or distributors of our company and its affiliate, even though they may not always be subject to our control. It is our policy to implement safeguards to discourage these practices by our employees, and we have implemented a policy to comply specifically with the FCPA. In spite of these efforts, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our company and its affiliate may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the U.S. government may seek to hold our company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC. Accordingly, our public disclosure should be reviewed in light of the fact that no governmental agency that is located in China where substantially all of our operations and business are located have conducted any due diligence on our operations or reviewed or cleared any of our disclosure.

We are regulated by the SEC and our reports and other filings with the SEC are subject to SEC review in accordance with the rules and regulations promulgated by the SEC under the Securities Act and the Exchange Act. Unlike public reporting companies whose operations are located primarily in the United States, however, substantially all of our operations are located in China. Since substantially all of our operations and business takes place in China, it may be more difficult for the Staff of the SEC to overcome the geographic and cultural obstacles that are present when reviewing our disclosure. These same obstacles are not present for similar companies whose operations or business take place entirely or primarily in the United States. Furthermore, our SEC reports and other disclosure and public pronouncements are not subject to the review or scrutiny of any PRC regulatory authority. For example, the disclosure in our SEC reports and other filings are not subject to the review of the China Securities Regulatory Commission, a PRC regulator that is tasked with oversight of the capital markets in China. Accordingly, you should review our SEC reports, filings and our other public pronouncements with the understanding that no local regulator has done any due diligence on our company and with the understanding that none of our SEC reports, other filings or any of our other public pronouncements has been reviewed or otherwise been scrutinized by any local regulator.

15

RISKS RELATED TO THIS OFFERING AND THE MARKET FOR OUR COMMON STOCK GENERALLY

Our common stock is quoted on the OTC Bulletin Board, which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTC Bulletin Board under the symbol “LGHS.” The OTC Bulletin Board is a significantly more limited market than established trading markets such as the New York Stock Exchange or NASDAQ. The quotation of our shares by the OTC Bulletin Board may result in a less liquid market available for existing and potential shareholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future. We cannot assure you that we will be able to successfully be listed on a national exchange, or that we will be able to maintain such listing.

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our stock becomes a “penny stock,” we may be subject to Rule 15g-9 under the Exchange Act, or the Penny Stock Rule. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market, thus possibly making it more difficult for us to raise additional capital.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Future sales or perceived sales of our common stock could depress our stock price.