Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mondelez International, Inc. | d406434d8k.htm |

| EX-99.1 - KRAFT FOODS INC. PRESS RELEASE - Mondelez International, Inc. | d406434dex991.htm |

Unleashing a Global Snacking Powerhouse

September 6, 2012

1

Exhibit 99.2 |

Irene

Rosenfeld Chairman and CEO

2 |

Forward-looking statements

3

This slide presentation contains a number of forward-looking statements. The words

“plan,” “will,” “deliver,” “drive,”

“continue,” “focus,” “maintain,” and similar expressions are intended to identify our

forward-looking statements. Examples of forward-looking statements include, but

are not limited to, our International as an unique investment vehicle; snacks are growth categories; expectations for

BRIC countries; expectations for Next Wave markets; 5-year revenue growth outlook

for developing markets; our strategy to deliver top-tier performance; North America

growth and margin upside; expectations for Europe; driving efficiency; Global Category

Teams; global innovation platforms; selling; Priority Markets; maintaining leadership;

Power Brands and Priority Markets growth; Gum category, including market share;

Chocolate growth and developing markets as primary driver; our virtuous cycle; gross margin;

overheads; reinvesting in growth; long-term targets; Free Cash Flow; long-term

EPS; 2013 Outlook; and our expectation that efficiency will fuel growth. These

forward-looking statements involve risks and uncertainties, many of which are

beyond our control, and important factors that could cause actual results to differ

materially from those in the forward-looking statements include, but are not limited to, our failure

to successfully create two companies, continued global economic weakness, continued volatility

and increase in input costs, increased competition, pricing actions, our debt and our

ability to pay our debt and tax law changes. For additional information on these

and other factors that could affect our forward- looking statements, see our risk

factors, as they may be amended from time to time, set forth in our filings with the

SEC, including our most recently filed Annual Report on Form 10-K and subsequent reports

on Forms 10-Q and 8-K. We disclaim and do not undertake any obligation to update

or revise any forward-looking statement in this slide presentation, except as

required by applicable law or regulation.

opportunity

for

growth

as

two

independent

companies;

setting

Kraft

Foods

on

a

new

trajectory;

Mondelez

- |

Agenda

Unleashing a global snacking powerhouse

Leveraging our global categories

–

Biscuits

–

Gum and Candy

–

Chocolate

Delivering top-tier financial performance

4 |

Successfully set Kraft Foods on a new trajectory

Delivered strong performance

Transformed portfolio and geographic footprint

Successfully integrated LU and Cadbury

Enhanced market positions to become #1 or #2

in all core categories

Created a virtuous cycle in each geography

5 |

Daniel Myers

EVP, Integrated

Supply Chain

Gerd Pleuhs

EVP, Legal Affairs

and General Counsel

Mary Beth West

EVP and Chief Category

and Marketing Officer

David Brearton

EVP and Chief

Financial Officer

Our world-class leadership will build on these results

6

Irene Rosenfeld

Chairman and Chief Executive Officer

Sanjay Khosla

EVP and President,

Developing Markets

Tim Cofer

EVP and President,

Europe

Mark Clouse

EVP and President,

North America

Karen May

EVP, Human

Resources

Jean Spence

EVP, Research,

Development & Quality

Tracey Belcourt

EVP, Strategy

Lorna Davis

SVP, Global Category

Leader Biscuits

Jim Cali

SVP, Global Category

Leader Gum & Candy

Bharat Puri

SVP, Global Category

Leader Chocolate |

Opportunity to accelerate growth as two independent

companies

7

Kraft Foods Group, Inc. |

8

Fast-

Growing

Categories

Advantaged

Geographic

Footprint

Favorite

Snacks

Brands

Strong

Route-to-

Market

Proven

Innovation

Platforms

World-Class

Talent &

Capabilities

Mondelez International is a unique investment vehicle |

Snacks

are growth categories Well-aligned with consumer trends

Expandable consumption

Developing Markets consumption

supported by GDP growth

Higher margins

9 |

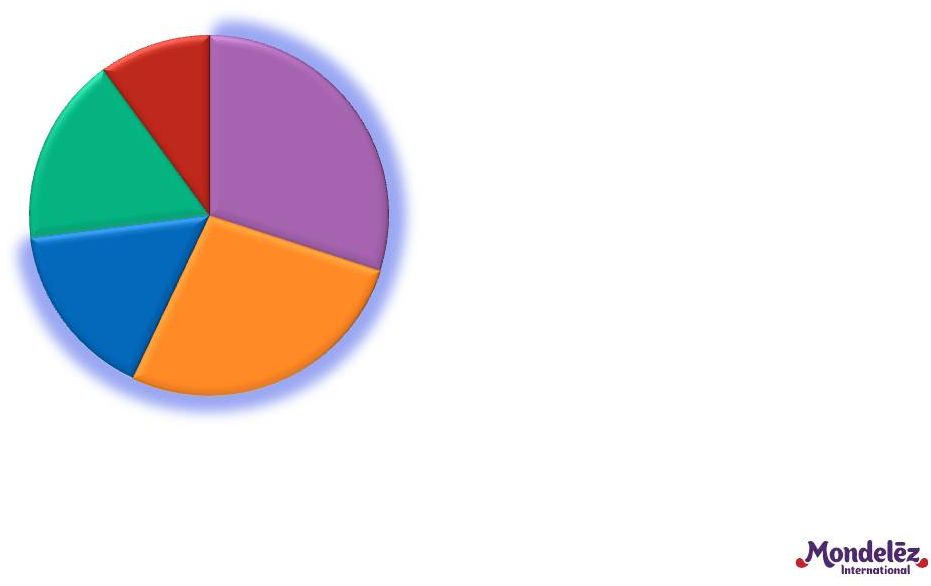

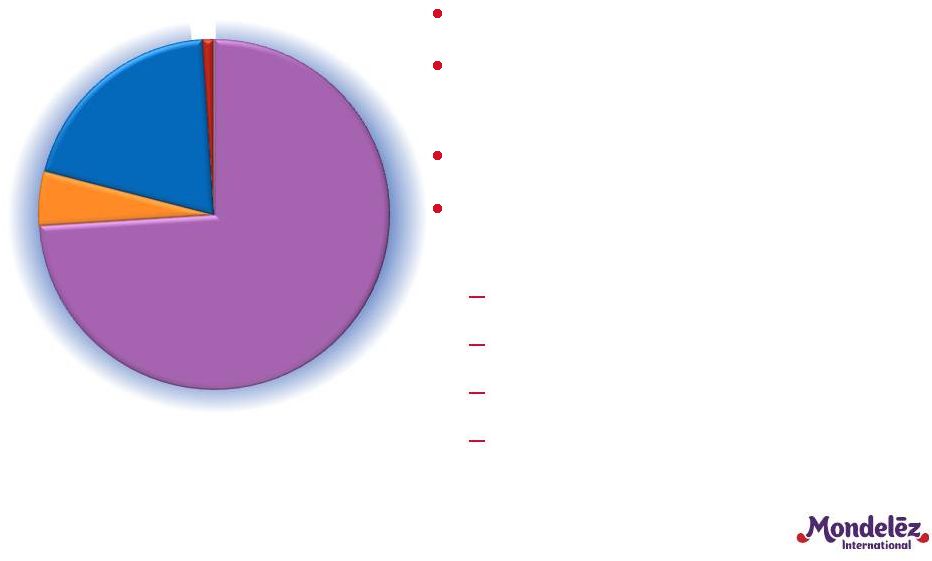

We are

a global snacks powerhouse … 10

$36 Billion in Revenues

(2)

•

Nearly 75% of revenues

in fast-growing snacks

categories

•

Beverages provide multi-

region scale, attractive

growth and strong margins

Biscuits

(1)

30%

Chocolate

27%

Gum &

Candy

16%

Beverages

17%

Cheese &

Grocery

10%

(1)

Biscuits includes salty/other snacks

(2)

Based

on

2011

reported

net

revenues;

includes

accounting

calendar

changes

and

53

Week.

rd |

…

and a leader in our categories

11

North

America

Europe

Latin

America

Asia

Pacific

Eastern

Europe

Middle East

& Africa

Global

Developing Markets

Source: Euromonitor 2011, Kraft Foods analysis

Share

Market Share Position

Biscuits

#1

#1

#1

#1

#1

#1

#1

18%

Chocolate

#5

#1

#2

#1

#2

#1

#1

15%

Gum

#2

#3

#1

#3

#2

#1

#2

30%

Candy

#3

#2

#2

#3

--

#1

#1

7%

Coffee

--

#2

--

#2

#2

#3

#2

11%

Powdered

--

--

#1

#1

#3

#2

#1

16%

Beverages |

We

offer many of the world’s favorite snacks brands 12

|

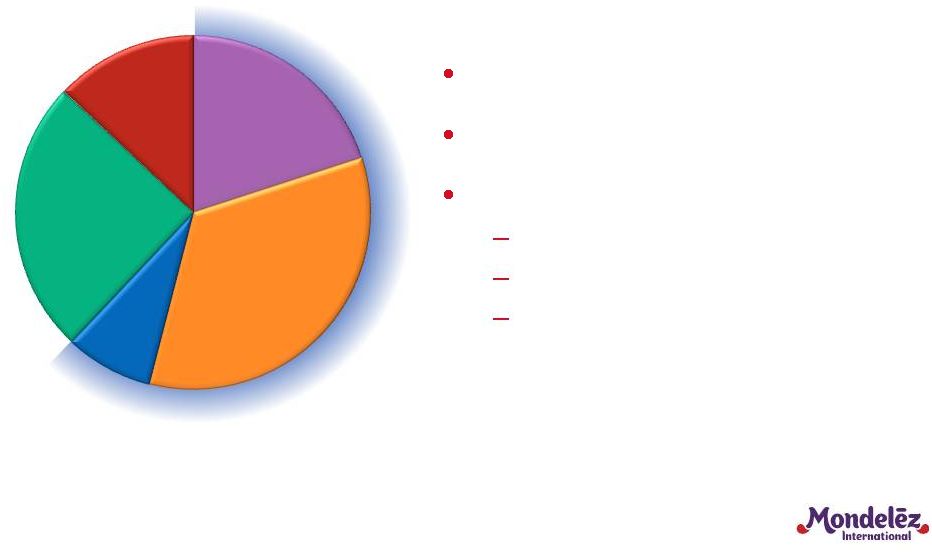

Each

region plays a critical role in our strategy $36 Billion*

Latin

America

MEA

Asia

Pacific

Europe

37%

North

America

19%

Developing

Markets

44%

CEE

•

Large, growing Developing

Markets footprint

•

Strong, advantaged

positions in North America

and Europe

•

Broad-based growth across

categories and geographies

13

*

Based

on

2011

reported

net

revenues;

includes

accounting

calendar

changes

and

53

rd

Week. |

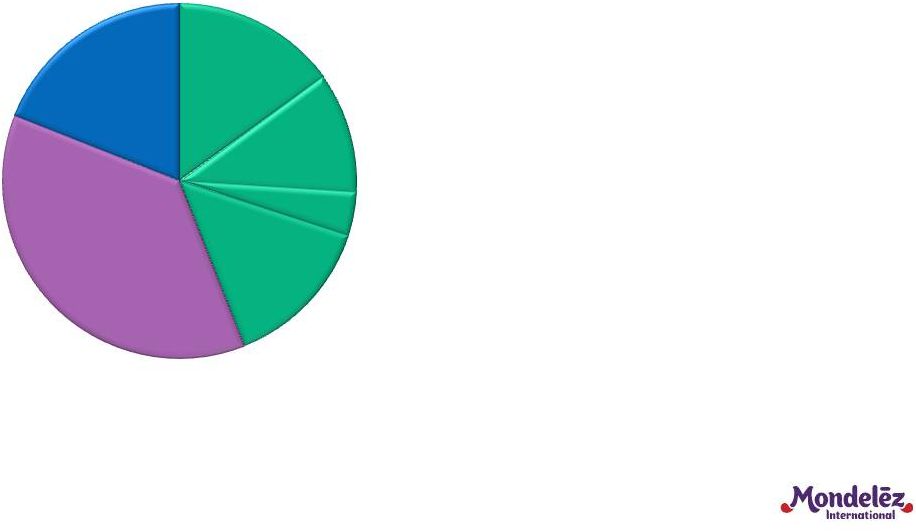

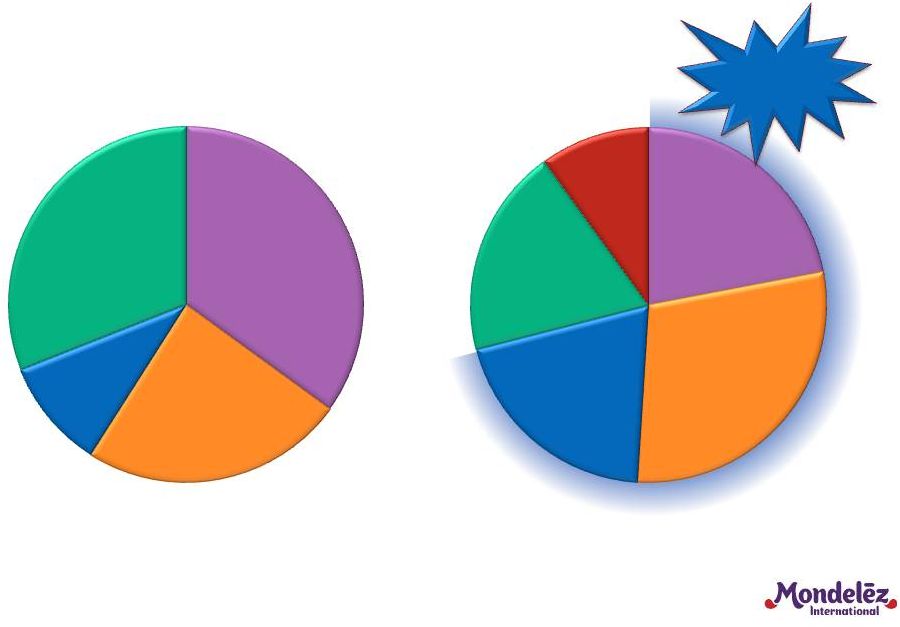

Developing Markets: Strong geographic and

category footprint

14

$16 billion

(2)

Biscuits

(1)

22%

Chocolate

29%

Gum &

Candy

20%

Latin

America

35%

Central &

Eastern

Europe

24%

Middle East

& Africa

10%

Asia Pacific

31%

70%+

Snacks

Beverages

19%

Cheese

&

Grocery

10%

(1)

Biscuits includes salty/other snacks

(2)

Based

on

2011

reported

net

revenues;

includes

accounting

calendar

changes

and

53

Week.

rd |

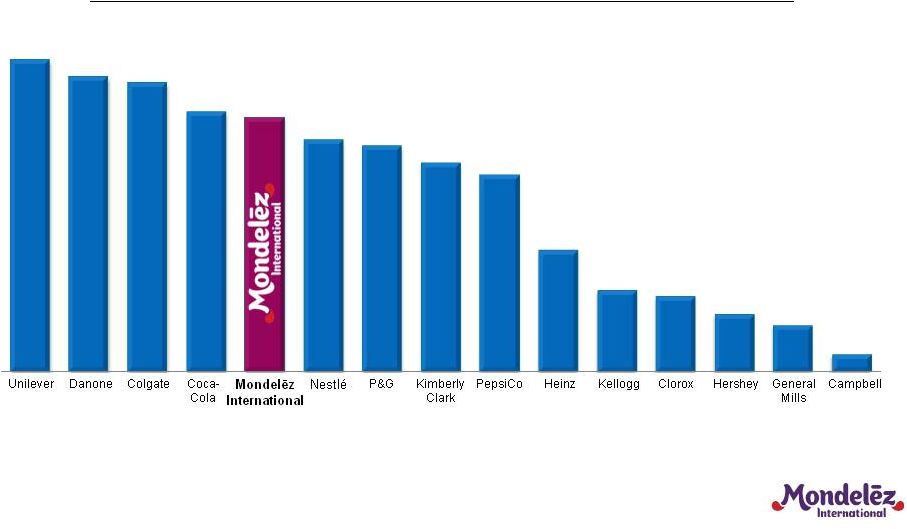

We

rank among the leading CPG players in developing markets

15

Source: Company reports and presentations. See page 93 for source

details. Percentage of Revenues from Developing Markets

54%

51%

50%

45%

44%

40%

39%

36%

34%

21%

14%

13%

10%

8%

3% |

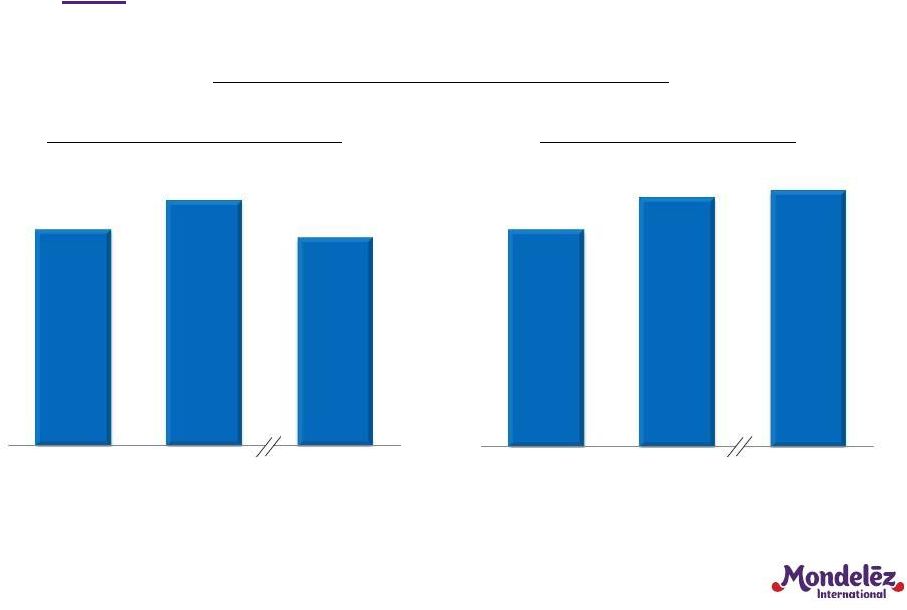

5-10-10 focus strategy has driven both

top-

and

bottom-line growth

16

Organic Net Revenue Growth

(1)

Adjusted Segment

Operating Income Margin

(2)

Kraft Foods Developing Markets

(1)

Organic Net Revenue growth excludes the impact of acquisitions in the first 12

months after the acquisition date. Reported Net Revenue growth for 2010, 2011 and

1H 2012 was 71.1%, 16.2% and 2.2%, respectively. See GAAP to Non-GAAP

Reconciliation at the end of this presentation. (2)

Adjusted Segment Operating Income margin excludes Integration Program costs and

Restructuring Program costs. Reported Segment Operating Income Margin for

2010,

2011

and

1H

2012

was

11.6%,

13.0%

and

13.7%,

respectively.

See

GAAP

to

Non-GAAP

reconciliation

at

the

end

of

this

presentation.

9.9%

13.1%

9.5%

11.2%

14.0%

14.2%

2010

2011

H1 2012

2010

2011

H1 2012 |

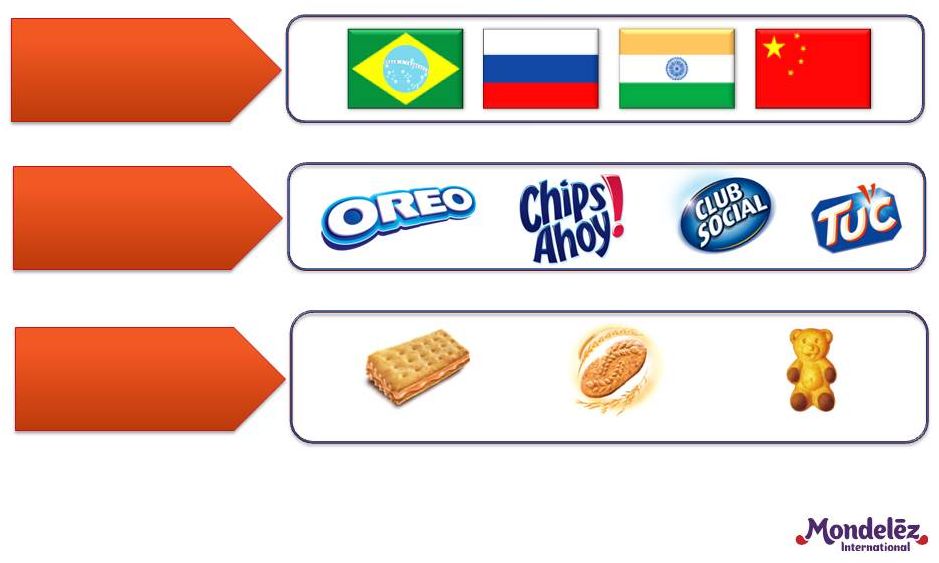

Three

priority clusters within Developing Markets 17

China

India

Russia

Brazil

5-Yr Revenue

Growth Outlook

% DM 2011

Revenue

33%

Mid-to-High Teens

BRIC |

Win in

BRIC 18

Brazil

Revenue:

$2+ billion

Portfolio

80% Snacks

15% Beverages (powdered)

5% Cheese & Grocery

Strategic Priorities

“Strengthen the Fortress”

Drive growth in North/NE Region

Russia

Revenue:

$1+ billion

Portfolio

70% Snacks

30% Beverages (soluble coffee)

Strategic Priorities

Focus on premium brands

Drive global platforms

Expand distribution |

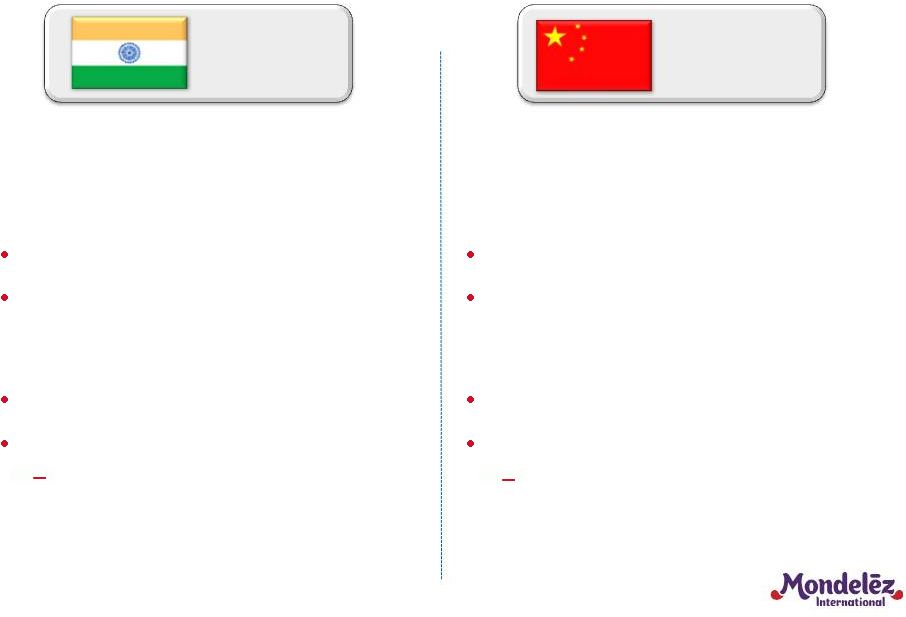

Win in

BRIC 19

India

Revenue:

$0.7 billion

Portfolio

80% Snacks, primarily Chocolate

20% Beverages (malt)

Strategic Priorities

Expand Chocolate distribution

Launch White Space categories

Launched Oreo

and Tang

in 2011;

Toblerone

in 2012

China

Revenue:

$0.8 billion

Portfolio

90% Snacks, primarily Biscuits

10% Beverages (powdered, coffee)

Strategic Priorities

Expand Biscuits distribution

Launch White Space categories

Launched Stride in August 2012 |

Middle East

& Africa

Indonesia

Three priority clusters within Developing Markets

20

China

India

Russia

Brazil

5-Yr Revenue

Growth Outlook

% DM 2011

Revenue

33%

12%

Mid-to-High Teens

Mid-to-High Teens

BRIC

Next Wave

Markets |

Next

Wave Markets: Middle East & Africa 21

Region full of opportunities

2 billion consumers by 2020

*

Additional $1 trillion of wealth from

aspirant and middle class by 2020

*

Snacks growing double-digits

Well-positioned to capture growth

Focused snacks portfolio

Broad geographic footprint

Established routes-to-market

Strong profitability

2011 Revenue: $1.6B

* Source: Canback Global Income Distribution Database and Euromonitor.

|

Middle East

& Africa

Indonesia

Australia

Japan

Mexico

Central

Europe

Three priority clusters within Developing Markets

22

China

India

Russia

Brazil

5-Yr Revenue

Growth Outlook

% DM 2011

Revenue

33%

12%

27%

Mid-to-High Teens

Mid-to-High Teens

Low-to-Mid

Single Digits

BRIC

Next Wave

Markets

Scale

Markets |

North

America: Solid growth with margin upside 23

$7 billion

(2)

Snacks “pure play”

Leading share of U.S. Biscuit

category, 2x closest competitor

Strong #2 player in Gum

Opportunity to improve growth

and profitability through

Focusing on Power Brands

Driving global innovation platforms

Harnessing power of DSD

Optimizing end-to-end supply chain

Biscuits

(1)

74%

Chocolate

5%

Gum &

Candy

20%

Other

1%

(1)

Biscuits includes salty/other snacks

(2)

Based

on

2011

reported

net

revenues;

includes

accounting

calendar

changes

and

53

rd

Week. |

Europe: Continue to drive top-tier performance in a

challenging environment

24

Biscuits

(1)

20%

Chocolate

35%

Gum &

Candy

8%

Beverages

24%

Cheese &

Grocery

13%

60%+ of revenues in Snacks

#1 or #2 share in each category

Continued margin opportunities

Portfolio mix

Productivity

Overheads

$13 billion

(2)

(1)

Biscuits includes salty/other snacks

(2)

Based

on

2011

reported

net

revenues;

includes

accounting

calendar

changes

and

53

rd

Week. |

Our

strategies to deliver top-tier performance 25

Build global Power Brands

Leverage global innovation

platforms

Revolutionize selling

Drive efficiency to fuel growth

Consistently

Deliver

Top-Tier

Revenue and

EPS Growth |

Build

Global Power Brands 26

Biscuits

40% of Biscuit

Revenue

Gum & Candy

60% of Gum &

Candy Revenue

Chocolate

50% of Chocolate

Revenue

Drive 70% of Growth |

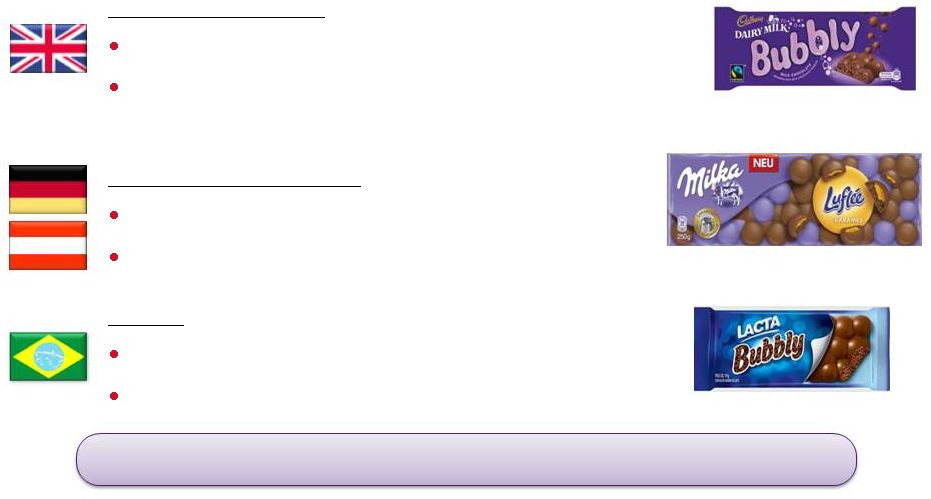

Leverage Global Innovation Platforms

27

Sustaining

Energy

Children

Wholesome

Hunger

Satisfaction

Teen Market

Penetration

Advantaged

Candy Brands

Drive Frequency

Bubbly

Hollow Wafer

Choco-Bakery

Bitesize

Biscuits

Gum & Candy

Chocolate |

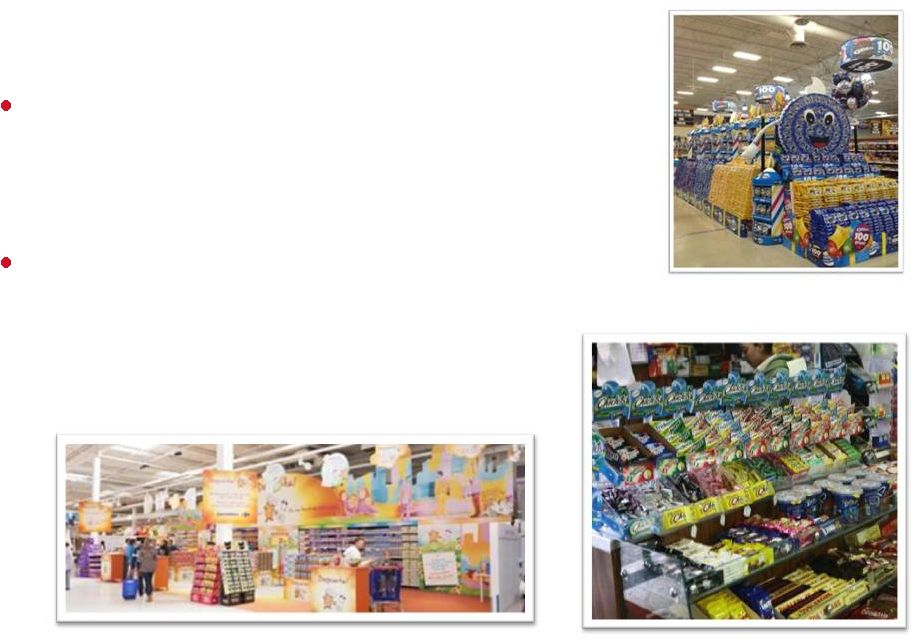

Revolutionize Selling

Near-term focus:

–

Complete integration of Cadbury

–

Capitalize on route-to-market capabilities

Long-term focus:

–

Develop best-in-class Instant Consumption

Channel / Hot Zone sales and

distribution capabilities

28 |

Drive

Efficiency to Fuel Growth Expand gross margin

–

Price to offset input cost inflation

–

Optimize product mix

–

Deliver industry-leading productivity

Reduce overheads as a percent of revenue

–

Drive top-line growth

–

Capture Restructuring Program savings

–

Align overhead support to growth priorities

29 |

Global

Category Teams are the cornerstone of these strategies

30

Drive Bigger,

Faster, More

Profitable

Initiatives

Integrated, cross-functional

teams driving a common

category agenda

–

Build brand equity

–

Develop innovation platforms

–

Prioritize resources |

…

with highly experienced leaders

31

Lorna Davis

SVP and Global

Category Leader

Biscuits

Jim Cali

SVP and Global

Category Leader

Gum & Candy

Bharat Puri

SVP and Global

Category Leader

Chocolate |

Lorna Davis

SVP and Global Biscuit

Category Leader

32 |

Our

global Biscuits business 2011 Revenue:

$11 billion

2011 Growth:

+9%*

–

Developing Markets up double-digits

–

Developed Markets up mid-single digits

Global Share Position: #1

$500+ Million Brands:

33 |

Source: Euromonitor 2011 estimates

Biscuits Retail Value ($B)

CAGR

(Cst Fx '09-'11)

$75B Biscuit category with developing markets as the

primary driver

34

$75

$45

$30

8%

11%

2%

Developed

Developing

Global |

We are

the clear global leader 35

Source: 2011 Euromonitor for global shares

Global Biscuits Market Share

Kellogg

Campbell

>4x

Closest

competitor

18%

4%

3% |

Well-positioned to maintain leadership

36

Focus resources in

Developing Markets

Focus on

Power Brands

Drive Global

Innovation

Platforms

Hunger Satisfaction

Sustaining Energy

Children Wholesome |

Focusing resources on Priority Markets

37

12%

•

Large, high-growth markets that will

drive revenue growth

•

Strong share in 3 of 4 markets

% Total

Biscuits

Revenue

58%

•

Mature markets with margin upside

to fund growth in Developing Markets

•

Leading market share positions

2%

•

Mature markets with an opportunity

to develop significant biscuit presence

•

Leverage leadership positions in

other categories

2%

•

Larger Next Wave markets with strong

growth potential

•

Solid market share positions |

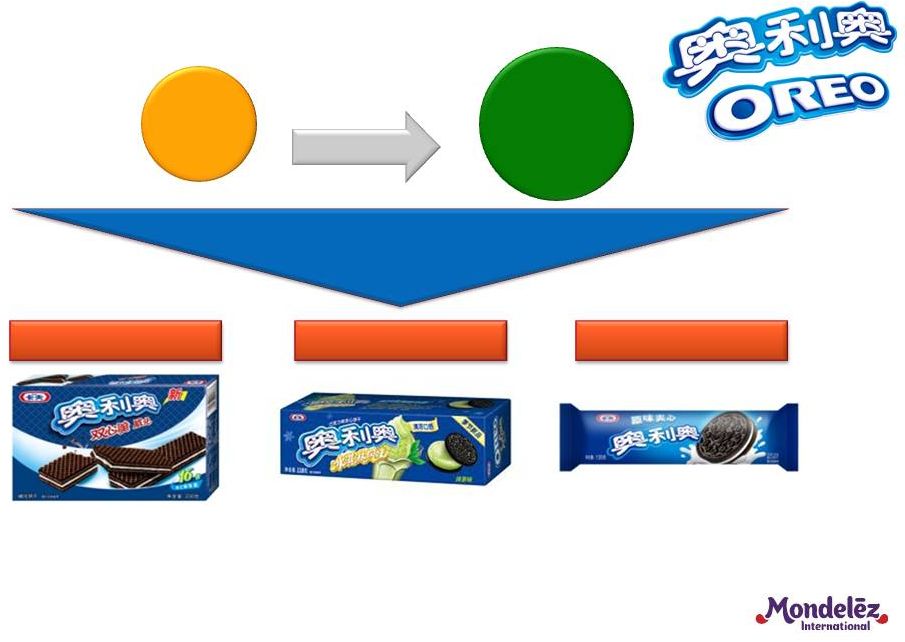

Wafer

“Green

Tea”

for

Traditional

Trade

Priority Markets case study:

Oreo in China

38

+68% CAGR

“Oreo”

GLOCAL model:

Local Form, Flavors,

Formats

$130MM

Revenue

2009

$375MM

Revenue

2011

Form

Flavor

Packaging

Oreo

Oreo

Oreo

|

Power

Brand case study: Oreo 39

Capitalize on

Strength in

Developed Markets

Expand in

Developing Markets

Enter White Space

Opportunities

Leverage successful US experience,

up 7%+ in 2011

Use the “China template”

of the

Oreo

playbook

Recent launches in Germany,

France, UK, Czech Republic & India

–

nearly $100MM revenue in 2011 |

Global

innovation case study: Sustaining Energy Focused on Breakfast

–

#2 Snacking Moment

Proprietary Sustaining

Energy Bundle

–

Anchors health and wellness credentials

Driving Category Growth

–

50%+ incremental to category

40 |

Fast

track global rollout for belVita 41

2011 Launches

2012 Launches

United States

Canada

Australia

Generated nearly $50MM of revenue

Spain, Belgium, UK and Brazil |

Drive

Power Brands and innovation platforms 42

Focus on Power Brands

and Priority Markets

Rapidly expand innovation

platforms globally

2011 Revenues

$11 Billion

Continue to grow

Mid-to-High

Single Digits |

Jim

Cali SVP and Global Gum & Candy Category

Leader

43 |

Our

global Gum & Candy business 2011 Revenue:

$6 billion

2011 Growth:

+1%*

–

Developing Markets up mid-single digits

–

Developed Markets down mid-single digits

Global Share Position: #2 in Gum, #1 in Candy

$500+ Million Brands:

44 |

CAGR

(Cst Fx '08-'11)

Gum and Candy are high margin categories

with attractive growth rates

45

Gum & Candy Retail Value ($B)

$83

Gum

Candy

Total

Candy

Gum

$48

$35

3%

4%

4%

6%

7%

7%

2%

0%

1%

Source: Euromonitor 2011 estimates (Gum Adjusted Nielsen Estimate 2011)

Developed

Developing

Global

Gum

10

15

26

26

32

57 |

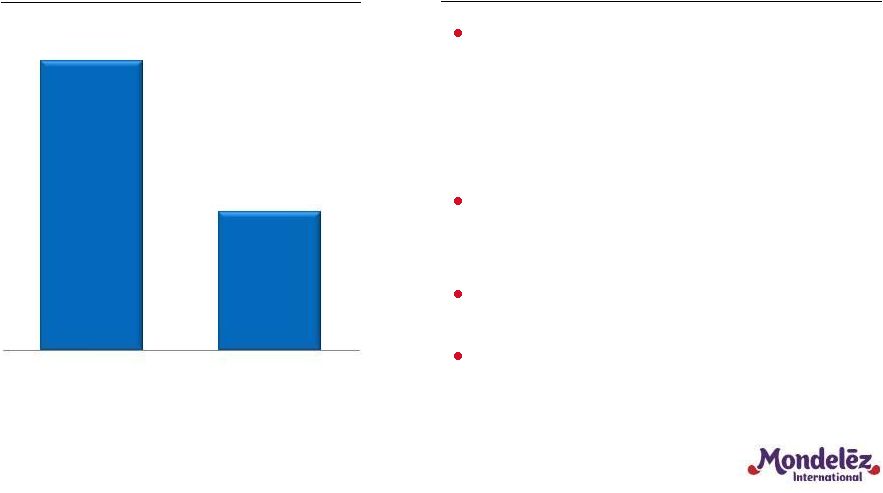

After

a decade of strong growth, the Gum category decelerated over the past 3 years

… 46

Gum Category Growth

(%CAGR)

Key Drivers to Gum

Category Slowdown

Source: Euromonitor (1998-2010), adjusted Nielsen estimates (2011)

Weak macroeconomy

–

GDP softness

–

Unemployment

–

Declining distribution (TDP’s)

Brand and A&C support reduced

and fragmented

Over “premiumization”

Penetration losses among teens

and lower frequency among

adults

7%

3%

'98-'08

'08-'11 |

…

but the Gum category has strong underlying

fundamentals

Expandable Consumption

–

Snack occasions

–

Impulse-driven

–

Responsive to innovation and marketing

Strong margins fund A&C and innovation investments

Led by global players, with product quality and

innovation insulated by proprietary technologies

47 |

We are

a leader in Gum, with a strong #2 position … 48

Global Gum Market Share

Mars-Wrigley

Perfetti-Van Melle

Source: Gum Adjusted Nielsen Estimate

32%

30%

7% |

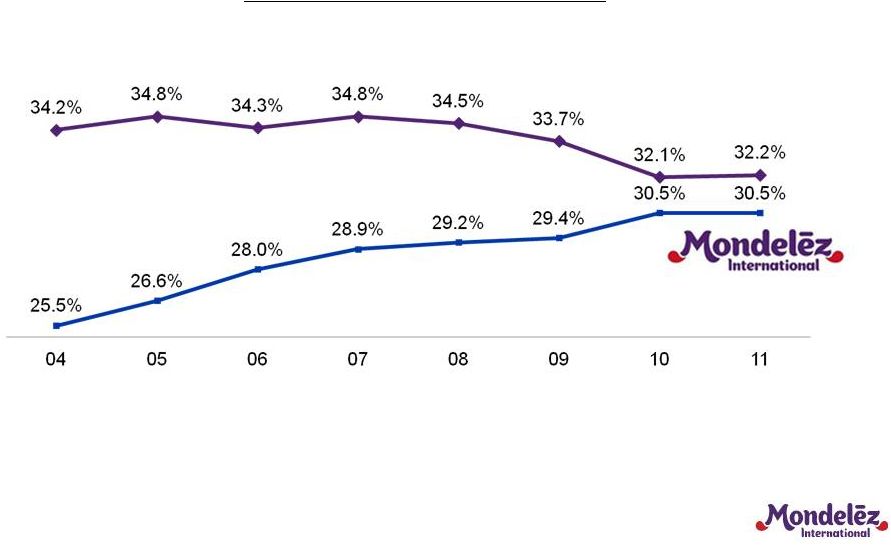

…

and a proven ability to grow share

49

Global Gum Market Share

Value Share based on Euromonitor (’04-’10), Adjusted Nielsen

Estimates (’11) Mars-

Wrigley |

We

have taken near-term actions to grow share and expand the category

50

Price/Size

Architecture

A&C

Support

Brand

Architecture

Drive penetration with entry offers

Expand consumption trading up to larger /

premium offers

Restore A&C support to mid-teens

Simplify brand architecture

Roll-out integrated marketing campaign

Entry

Mid Size

Value |

Well-positioned to restore growth and increase

market share in the long-term

51

Focus resources on

Priority Markets

Focus on

Power Brands

Drive Global

Innovation

Platforms

Drive Frequency –

Pleasure/Freshness

Teen Market

Penetration

Advantaged Candy

Brands |

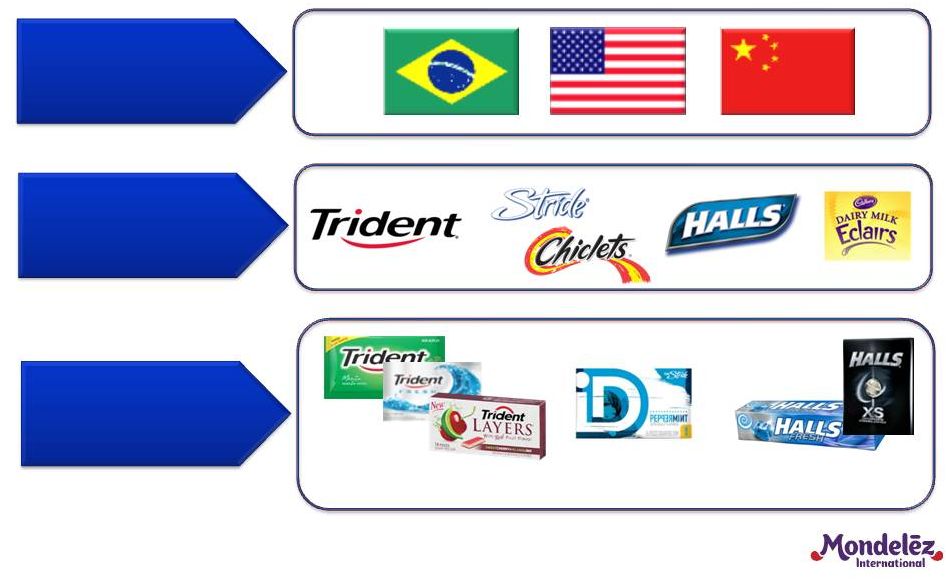

Focusing resources on Priority Markets

52

28%

Large, critical markets with strong

growth potential

Strong market share

% Total Gum

& Candy

Revenue

20%

Larger Next Wave markets with

strong growth potential

Ability to build on solid market share

19%

Mature markets with slow category

growth

Strong market position

1%

White Space market opportunity

for Gum

Launched in China in August 2012 |

Power

Brand case study: China 53

Launched Stride

in China in August 2012

Launch Bundle

Supply Chain

Sales

Preferred brand

proposition

Product and

packaging

superiority

Built strong Hot-Zone/

Impulse capabilities

Strong trade reception

Best in class

manufacturing start up

Growth/capacity plans

in place |

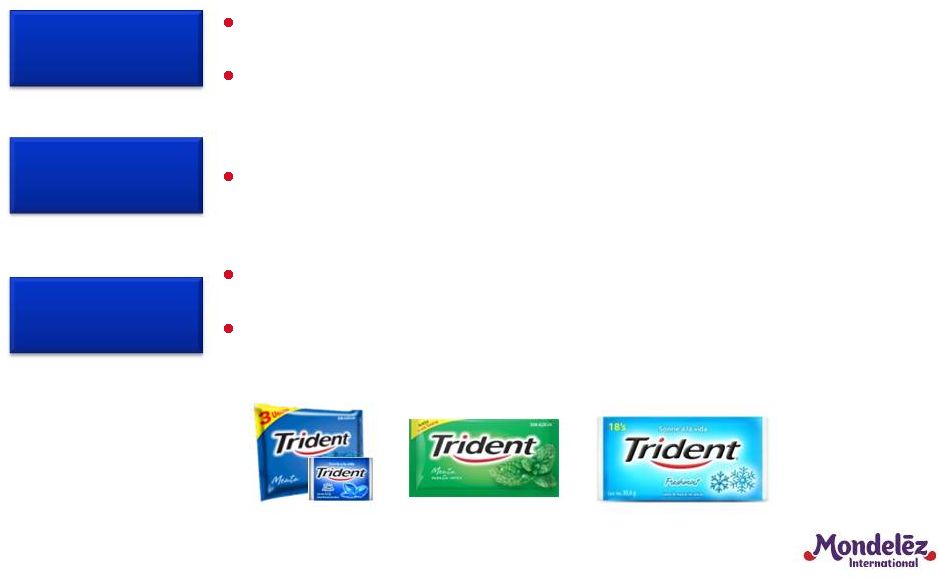

Power

Brand case study: Trident Strong Rights to Win

–

#1 global gum brand

–

High historic growth driven

by innovation

Simplify brand architecture

New master brand campaign

Innovation to drive growth,

new occasions

54

U.S.

Brazil

Unleash Power of “One”

Trident |

Global

innovation case study: ID Teen-Specific Gum

First-to-Market Technologies

Global Roll-Out

55

Heaviest user cohort

Gum/Candy flavor blends

Printed flavor swirls

Magnetic closure

Artwork from emerging young artists

Launched in U.S. in August 2012

Europe roll-out in Q4 2012

Further geographic expansion 2013-14

Co–created via teen immersion |

Rebuild

category growth Focus on Power Brands

and Priority Markets

Rebuild category growth

–

Simplify brand and

price/size architectures

–

Step-up innovation

–

Restore A&C support

56

2011 Revenues

$6 Billion

Return to

Mid-Single Digit

Growth |

Bharat Puri

SVP and Global Chocolate Category Leader

57 |

Our

global Chocolate business 2011 Revenue:

$10 billion

2011 Growth:

+6%*

–

Developing Markets up double digits

–

Developed Markets up low-single digits

Global Share Position: #1

$500+ Million Brands:

58 |

Chocolate Retail Value ($B)

CAGR

(Cst Fx '08-'11)

$101B Chocolate category growth driven by

developing markets

59

5%

$101

$35

$66

10%

2%

Source: Euromonitor 2011 estimates

Developed

Developing

Global |

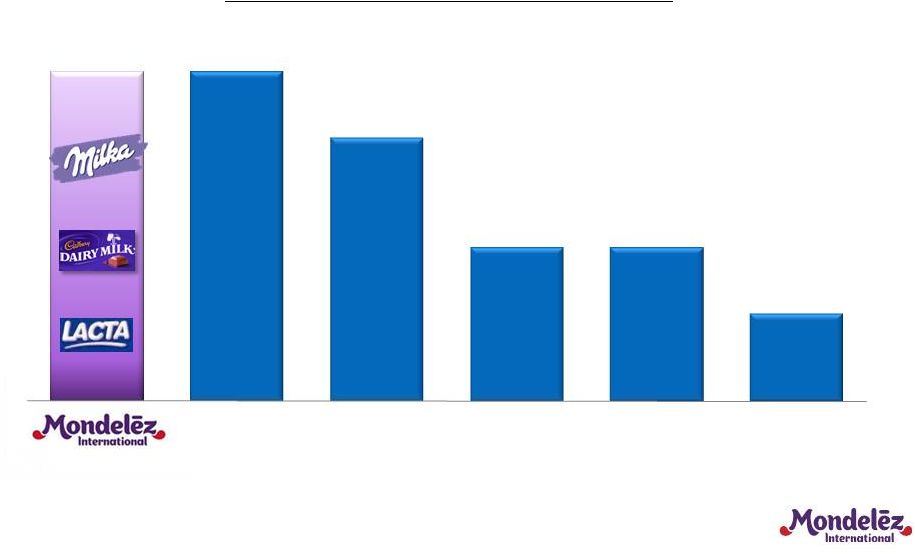

We are

a leading chocolate company 60

Source: 2011 Euromonitor for global shares

Mars

Nestle

Ferrero

Hershey

Lindt

Global Chocolate Market Share

15%

15%

12%

7%

7%

4% |

Well-positioned to continue top-tier growth

in Chocolate

61

Focus resources on

Priority Markets

Focus on

Power Brands

Drive Global

Innovation

Platforms

Bubbly

Hollow Wafer

Choco-Bakery

Bitesize |

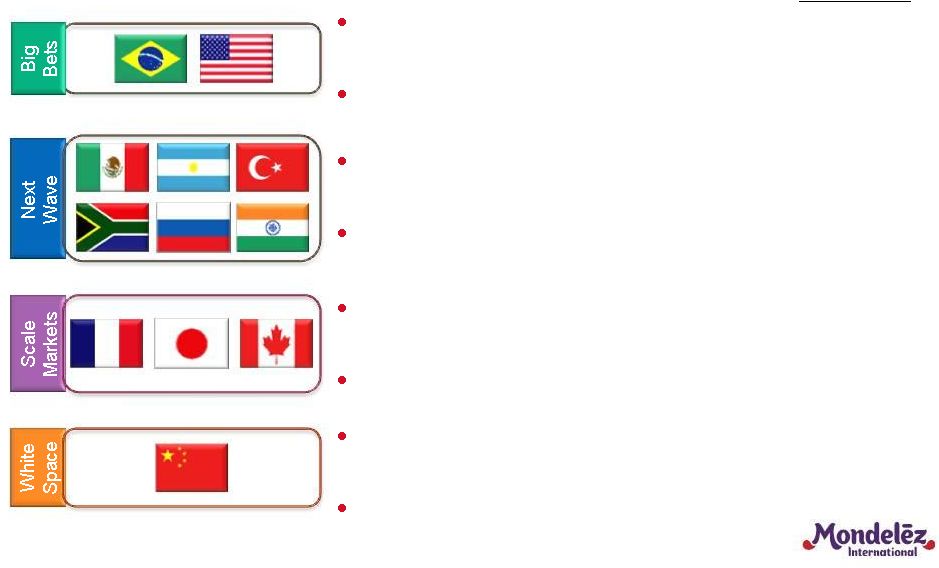

Focusing resources on Priority Markets

62

20%

Large, fastest growing markets

Market share leader or strong #2 with

fabric-of-the-nation Power Brands

Scale advantage; able to step change

growth trajectory

% Total

Chocolate

Revenue

42%

Big, mature markets with strong presence

Leveraging Power Brands to compete

and win in broader Snacking

Large markets, big growth potential

Able to leverage route-to-market

capabilities

4%

Big Bets

Next Waves

Scale |

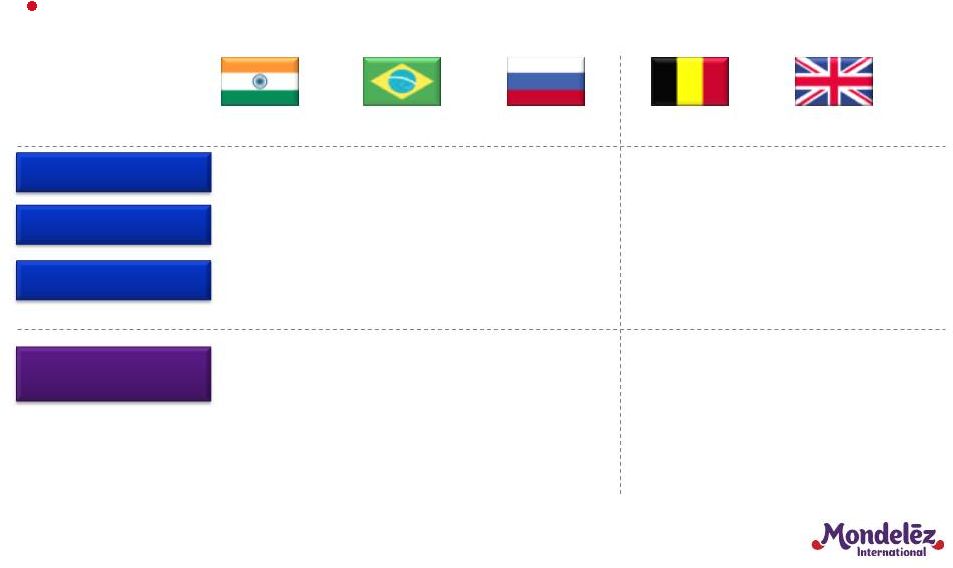

India

Brazil

Russia

Belgium

UK

2.0

0.1

18.6

1.4

22.2

4.6

42.5

5.2

55.7

10.5

3,400

10,900

15,900

37,900

35,100

8.3

7.5

3.8

2.1

1.6

Affinity Countries:

•

So. Africa

•

Indonesia

•

China

•

Egypt

•

Argentina

•

Mexico

•

Turkey

•

USA

•

Germany

•

France

•

Austria

•

Ukraine

•

Poland

Developing Markets will be the primary driver

of our future growth

63

Source: Euromonitor, AC Nielsen/ TNS Worldpanel, Kraft Market Maturity

modeling GDP growth will power consumption in Developing Markets

GDP/capita ($)

GDP growth (%)

Snacks pcc (kg)

Chocolate pcc (kg) |

Priority Markets case study: India

64

$0.25B

Revenue

2009

$0.5B

Revenue

2011

+37% CAGR

Mainstream

Aspirants

More Special

Category growth delivered through a

consumer

&

portfolio

strategy

Gifting |

65

Power Brand case study: Cadbury Dairy Milk

& Milka,

together

over

$3B |

Global

innovation case study: Bubbly 66

An aerated chocolate with an innovative, playful mood

that makes chocolate tablets more exciting

Brazil

Launched June 2012

Performing above expectations

Will be in 20 major countries by end of 2013!

United Kingdom

Launched February 2012

Most successful NPD in the UK in the

last 5 years

Germany & Austria

Launched May 2012

Biggest selling SKU in the Big Size range |

Bringing the magic of our Power Brands into new

incremental snacking occasions

Global innovation case study: Bitesize

67

United Kingdom

•

Launched in 2009

•

NPD’s growing the category: Twirl

Bites, Bitsa Wispa, Popcorn

Continental Europe

Launched in 2011

Strong share performance and

repeat in all key markets

Rolling-out to over a dozen countries by end of 2012!

|

Continue to exceed category growth rates

Focus on Power Brands

Focus on Priority Markets

–

Lead Developing Markets growth

–

Drive category growth in

Developed Markets through

broader Snacking

Expand innovation platforms

globally

68

2011 Revenues

$10 Billion

Continue to Grow

Mid-to-High

Single Digits |

Dave

Brearton EVP and CFO

69 |

Growth

algorithm driven by virtuous cycle 70

Expand

Gross Margin

Reinvest

in Growth

Leverage

Overheads

Focus on

Power Brands &

Priority Markets |

Expand

gross margin 71

Price to offset input cost

inflation

Optimize product mix

Target productivity of 4%+

of COGS

Key Enablers

Expand

Gross

Margin

Reinvest

in

Growth

Leverage

Overheads

Focus on

Power Brands &

Priority Markets |

Leverage overheads

72

Top-Line Growth

Capture Restructuring Program

savings

Align overhead spending

to growth priorities

Key Enablers

Expand

Gross

Margin

Reinvest

in

Growth

Leverage

Overheads

Focus on

Power Brands &

Priority Markets |

Reinvest in Growth

73

Priorities

Investments weighted towards

Developing Markets

Focus investments on Power

Brands and innovation

platforms

Capitalize on White Space

opportunities

Expand

Gross

Margin

Reinvest

in

Growth

Leverage

Overheads

Focus on

Power Brands &

Priority Markets |

Strong

KFT results in 1H 2012 Kraft Foods (KFT) 2012 guidance

–

Organic Net Revenue growth of around 5%

–

Operating EPS of at least 9% on a constant currency basis

1H’12 results in-line with guidance

–

Organic Net Revenue growth +4.9%*

–

Operating EPS +11.4%* on a constant currency basis

Confirmed constant currency EPS guidance in

early August

–

1H’12 FX impact was $(0.02)

–

Estimate ~$(0.08) total FX impact for FY’12 (using average

August 2012 currency rates)

74

*

Reported Net Revenues declined (0.3)%. Diluted EPS increased 2.0%. See

GAAP to Non-GAAP reconciliation at the end of this presentation.

|

2012

full year financials represent blend of KFT and Mondelez results

Q1-Q3 to reflect Kraft Foods Group as “Discontinued

Operations”

Q4 presentation to be based on actual revenue realized

and costs incurred

Full year results include variety of items

–

Stranded costs

–

Tax rate anomalies

–

Cadbury Integration Program

–

2012-2014 Restructuring Program

–

Spin-Off Costs and debt migration costs

75

- |

Transaction-related and restructuring costs

76

KFT

MDLZ

($ billions)

Pre-

Spin

Post-

Spin

Spin-Off Costs

$0.5

$0.1

Restructuring &

Implementation Costs

$0.3

$0.8

Debt Migration Costs

$0.2

$0.4 -

$0.6 |

Long-term financial targets will deliver

top-tier performance

77

Driving Shareholder Value

Long-Term Target

Organic Net Revenue Growth

5%-7%

Operating EPS Growth

Double-Digit

(constant FX) |

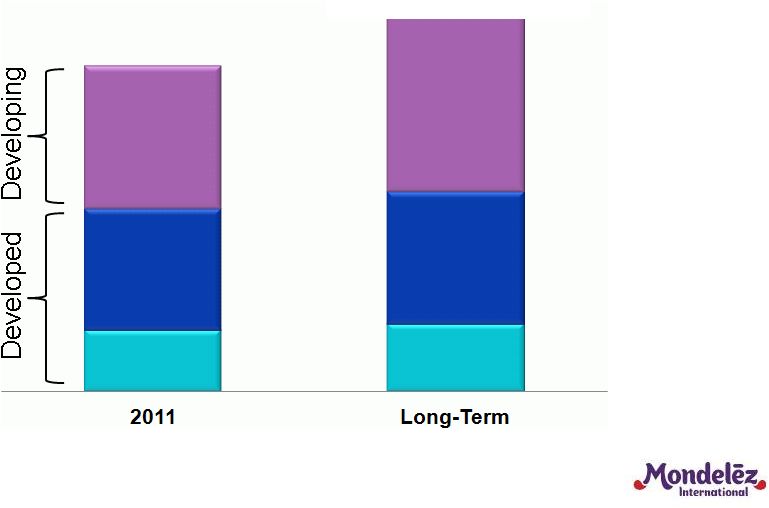

Revenue

growth target reflects large, growing Developing Markets contribution

78

Double Digit

Growth

Low-to-Mid

Single Digit

Growth

NA

EU

DM

NA

EU

DM

5%-7%

Organic Growth

$36B

*

*

Based

on

2011

reported

net

revenues;

includes

accounting

calendar

changes

and

53

rd

Week. |

Long-term EPS target reflects the following

assumptions

Operating income growth of high single digits

Interest expense essentially flat

–

Opening debt balance of ~$20B, weighted average

interest rate of ~5.75%

Tax rate in the mid-20’s

79

Double-Digit Operating EPS Growth

(constant FX) |

Priorities

for

free

cash

flow

Reinvest in the business to drive top-tier growth

Tack-on M&A, especially in Developing Markets

Return of capital to shareholders

Pay down debt to preserve balance sheet flexibility

80

Disciplined Capital Deployment |

2013

outlook consistent with long-term profile Organic net revenue growth of

5%-7% Operating EPS of $1.50 -

$1.55

–

Strong Operating Income growth at constant FX

–

Significant FX headwind of $(0.15) vs. average 2011 rates*

–

Tax rate in the mid-20’s

81

* Based on average August 2012 currency rates |

Long-term targets reflect benefits of driving

a virtuous cycle

82

Expand

Gross

Margin

Reinvest

in

Growth

Leverage

Overheads

Focus on

Power Brands &

Priority Markets

Operating

EPS Growth

5%-7%

Double-Digit

(constant FX)

Organic Net

Revenue Growth

Long-Term Targets |

Irene Rosenfeld

Chairman and CEO

83 |

Mondelez International is a unique investment vehicle

84

Fast-

Growing

Categories

Advantaged

Geographic

Footprint

Favorite

Snacks

Brands

Strong

Route-to-

Market

Proven

Innovation

Platforms

World-Class

Talent &

Capabilities

- |

Joining for Q&A

85

Sanjay Kholsa

President

Developing

Markets

Tim Cofer

President

Europe

Mary Beth West

EVP and Chief

Category and

Marketing Officer

Mark Clouse

President

North

America |

86 |

Average foreign currency rates for key countries

87

Russian Ruble

Mexican Peso

Euro

Indian Rupee

Brazilian Real

Canadian Dollar

31.92 / $US

13.17 / $US

US$1.24 / €

55.51 / $US

2.03 / $US

US$1.01 / $Cdn

August 2012

Australian Dollar

Pound Sterling

US$1.57 / £

US$1.05 / AUD

August 2011

28.67 / $US

12.20 / $US

US$1.43 / €

45.28 / $US

1.59 / $US

US$1.02 / $Cdn

US$1.64 / £

US$1.05 / AUD

Source: Oanda

Swiss Franc

0.88 / $US

0.78 / $US |

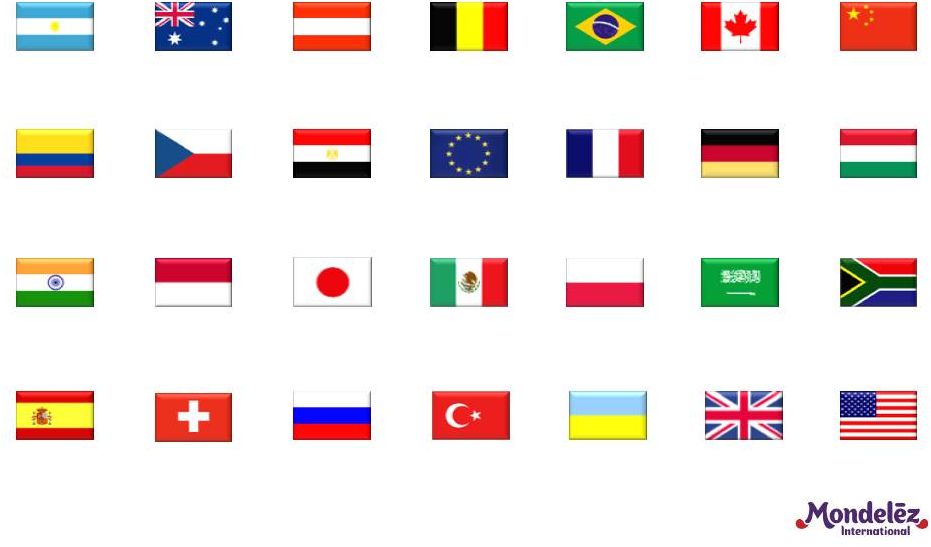

Key to

flags used in presentation 88

Indonesia

Australia

Czech

Republic

Russia

Mexico

Ukraine

Belgium

European

Union

India

Spain

Colombia

Argentina

Egypt

Japan

Austria

Turkey

Brazil

United

Kingdom

Poland

France

China

South

Africa

Hungary

Germany

United

States

Canada

Saudi

Arabia

Switzerland |

Developing Markets as a percentage of revenue –

source detail

Unilever –

Emerging markets per 2011 annual report

Danone –

Emerging markets per 2011 results presentation

Colgate –

Emerging markets per 2011 annual report

Coca-Cola –

Pacific, Latin America, Eurasia & Africa, Bottling Investments per 2011

10-K (note: developing and emerging markets represent 57% of

volume per CAGNY 2012 presentation) Nestlé

–

Emerging markets per 2011 annual report

P&G –

Developing markets per fiscal 2012 earnings call

Kimberly-Clark –

Asia, Latin America and Other per 2011 10-K

PepsiCo –

Developing and emerging markets per CAGNY 2012 presentation

Heinz –

Emerging markets per fiscal 2012 annual report

Kellogg –

Emerging markets pro forma for Pringles per CAGNY 2012 presentation

Clorox –

Latin America and Asia fiscal 2011 per CAGNY 2012 presentation

Hershey –

Sales outside NA are 10% of net revenue with Mexico, Brazil, China and India

about 7% of net revenue per Investor Day presentation June 2012.

General Mills –

Asia Pacific, Latin America per fiscal 2012 earnings release

Campbell –

Developing markets per Deutsche Bank Consumer Conference presentation

June 2012

89 |

GAAP to

Non-GAAP Reconciliation 90

As Reported

(GAAP)

Impact of

Divestitures

(1)

Impact of

Accounting

Calendar

Changes

Impact of

Currency

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

2012

Kraft Foods

26,379

$

-

$

-

$

884

$

27,263

$

(0.3)%

4.9%

2011

Kraft Foods

26,451

$

(91)

$

(361)

$

-

$

25,999

$

(1)

Impact of divestitures includes for reporting purposes Starbucks CPG business.

Net Revenues to Organic Net Revenues

For the Six Months Ended June 30,

($ in millions, except percentages) (Unaudited)

% Change |

GAAP

to Non-GAAP Reconciliation 91

As Reported

(GAAP)

Integration

Program

costs

(1)

Spin-Off

Costs

(2)

2012 - 2014

Restructuring

Program costs

(3)

Operating

(Non-GAAP)

Currency

(4)

Operating

Constant FX

(Non-GAAP)

As Reported

EPS Growth

(GAAP)

Operating

EPS Growth

(Non-GAAP)

Operating

Constant FX

EPS Growth

(Non-GAAP)

2012

Diluted EPS attributable to Kraft Foods

1.03

$

0.04

$

0.12

$

0.06

$

1.25

$

0.02

$

1.27

$

2.0%

9.6%

11.4%

2011

Diluted EPS attributable to Kraft Foods

1.01

$

0.13

$

-

$

-

$

1.14

$

-

$

1.14

$

(1)

Integration Program costs are defined as the costs associated with combining the Kraft Foods and

Cadbury businesses, and are separate from those costs associated with the acquisition. Integration Program

costs were $78 million, or $73 million after-tax including certain tax costs

associated with the integration of Cadbury, for the six months ended June 30, 2012, as compared to $240 million, or $234 million

after-tax for the six months ended June 30, 2011.

(2)

Spin-Off Costs represent non-recurring transaction and transition costs associated with

preparing the businesses for independent operations consisting primarily of financial advisory fees, legal fees,

accounting fees, tax services and information systems infrastructure duplication, and

financing and related costs to redistribute debt and secure investment grade ratings for both the North American

Grocery Business and the Global Snacks Business. Spin-Off Costs for the six

months ended June 30, 2012 were $301 million, or $202 million after-tax and include $162 million of pre-tax

financing and related costs recorded in interest and other expense, net.

(3)

Restructuring Program costs for the six months ended June 30, 2012 were $169 million, or $107

million after-tax and represent non-recurring restructuring and related implementation costs reflecting primarily

severance, asset disposals and other manufacturing related non-recurring

costs. (4)

Includes the favorable foreign currency impact on Kraft Foods foreign denominated debt and

interest expense due to the strength of the U.S. dollar. Diluted Earnings per Share to Operating EPS

For the Six Months Ended June 30,

(Unaudited)

% Growth |

GAAP

to Non-GAAP Reconciliation 92

As Reported

(GAAP)

Impact of

Divestitures

Impact of

Acquisitions

(1)

Impact of

Integration

Programs

Impact of

Accounting

Calendar

Changes

(2)

Impact of

Currency

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

For the Twelve Months Ended December 31,

2010

13,613

$

-

$

(4,753)

$

1

$

(150)

$

15

$

8,726

$

71.1%

9.9%

2009

7,956

$

(14)

$

-

$

-

$

-

$

-

$

7,942

$

For the Twelve Months Ended December 31,

2011

15,821

$

-

$

(379)

$

1

$

(183)

$

(397)

$

14,863

$

16.2%

11.2%

2010

13,613

$

(105)

$

-

$

1

$

(148)

$

-

$

13,361

$

For the Six Months Ended June 30,

2012

7,821

$

-

$

-

$

-

$

-

$

459

8,280

$

2.2%

9.5%

2011

7,656

$

-

$

-

$

-

$

(92)

-

$

7,564

$

Net Revenues to Organic Net Revenues

($ in millions, except percentages) (Unaudited)

% Change

Kraft Foods Developing Markets

(1)

Impact

of

acquisitions

reflects

the

operating

results

from

our

Cadbury

acquisition

on

February

2,

2010.

(2)

Includes

the

impacts

of

accounting

calendar

changes

and

the

53

week of shipments in 2011.

rd |

GAAP to

Non-GAAP Reconciliation 93

As Reported

(GAAP)

Integration

Program Costs

(1)

Acquisition-

Related Costs

(2)

Spin-off Costs

(3)

2012 -

2014

Restructuring

Program Costs

(4)

Adjusted

(Non-GAAP)

Segment Operating Income

1,577

$

181

$

25

$

-

$

-

$

1,783

$

Segment Operating Income Margin

11.6%

13.1%

Segment Operating Income

2,053

$

161

$

-

$

-

$

-

$

2,214

$

Segment Operating Income Margin

13.0%

14.0%

Segment Operating Income

1,069

$

39

$

-

$

-

$

5

$

1,113

$

Segment Operating Income Margin

13.7%

14.2%

Kraft Foods Developing Markets

Operating Income To Adjusted Operating Income

($ in millions, except percentages) (Unaudited)

(1)

Integration Program costs are defined as the costs associated with combining the Kraft Foods and

Cadbury businesses, and are separate from those costs associated with

the acquisition. (2)

Acquisition-related costs include transaction advisory fees, U.K. stamp taxes and the

impact of the Cadbury inventory revaluation. (3)

Spin-Off Costs represent non-recurring transaction and transition costs associated with

preparing the businesses for independent operations consisting primarily of

financial advisory fees, legal fees, accounting fees, tax services and information systems infrastructure duplication.

(4)

Restructuring Program costs represent non-recurring restructuring and related

implementation costs reflecting primarily severance, asset disposals and other manufacturing

related non-recurring costs. For

the

Twelve

Months

Ended

December

31,

2010

For

the

Twelve

Months

Ended

December

31,

2011

For

the

Six

Months

Ended

June

30,

2011 |

GAAP

to Non-GAAP Reconciliation 94

Mondelez

International

Pro Forma

Continuing

(1)

(GAAP)

Impact of

Divestitures

Impact of

Acquisitions

(2)

Impact of

Integration

Program

Impact of

Accounting

Calendar

Changes

Impact of

Currency

Mondelez

International

Pro Forma

Organic

(Non-GAAP)

Mondelez

International

Pro Forma

Continuing

(1)

(GAAP)

Mondelez

International

Pro Forma

Organic

(Non-GAAP)

2011

Biscuits

10,997

$

-

$

-

$

-

$

(221)

$

(219)

$

10,556

$

11.8%

8.9%

Chocolate

9,566

-

(287)

-

(143)

(361)

8,775

15.6%

5.9%

Gum & Candy

5,698

-

(382)

1

(3)

(158)

5,155

8.9%

0.8%

2010

Biscuits

9,837

$

-

$

-

$

-

$

(147)

$

-

$

9,690

$

Chocolate

8,276

11

-

1

(3)

-

8,285

Gum & Candy

5,231

(117)

-

-

(0)

-

5,114

Net Revenues to Organic Net Revenues by Global Category

For the Twelve Months Ended December 31,

($ in millions, except percentages) (Unaudited)

% Change

-

-

-

- |