Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

This presentation as well as other written or oral communications made from time to time by us, may contain certain

forward-looking information within the meaning of the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including events

or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the

negative thereof or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties.

These forward-looking statements are only predictions and estimates regarding future events and circumstances and

involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or

achievements expressed or implied by such forward-looking statements. This information is based on various

assumptions by us that may not prove to be correct.

forward-looking information within the meaning of the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including events

or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the

negative thereof or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties.

These forward-looking statements are only predictions and estimates regarding future events and circumstances and

involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or

achievements expressed or implied by such forward-looking statements. This information is based on various

assumptions by us that may not prove to be correct.

Important factors to consider and evaluate in such forward-looking statements include:

· changes in the external competitive market factors that might impact our results of operations;

· changes in laws and regulations, including without limitation changes in capital requirements under the federal

prompt corrective action regulations;

prompt corrective action regulations;

· changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated

events;

events;

· our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

· the timing of acquisition or investment transactions;

· constraints on our ability to consummate an attractive acquisition or investment transaction because of

significant competition for these opportunities;

significant competition for these opportunities;

· the failure of the Bank to complete any or all of the transactions described herein on the terms currently

contemplated;

contemplated;

· local, regional and national economic conditions and events and the impact they may have on us and our

customers;

customers;

· ability to attract deposits and other sources of liquidity;

· changes in the financial performance and/or condition of our borrowers;

· changes in the level of non-performing and classified assets and charge-offs;

Forward-Looking Statements

Forward-Looking Statements

· changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under

relevant regulatory and accounting requirements;

relevant regulatory and accounting requirements;

· the integration of the Bank’s recent FDIC-assisted acquisitions may present unforeseen challenges;

· inflation, interest rate, securities market and monetary fluctuations;

· the timely development and acceptance of new banking products and services and perceived overall value of

these products and services by users;

these products and services by users;

· changes in consumer spending, borrowing and saving habits;

· technological changes;

· the ability to increase market share and control expenses;

· continued volatility in the credit and equity markets and its effect on the general economy; and

· the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as

well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other

accounting standard setters;

well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other

accounting standard setters;

· the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating

successfully or such integration being more difficult, time-consuming or costly than expected;

successfully or such integration being more difficult, time-consuming or costly than expected;

· material differences in the actual financial results of merger and acquisition activities compared with

expectations, such as with respect to the full realization of anticipated cost savings and revenue enhancements

within the expected time frame;

expectations, such as with respect to the full realization of anticipated cost savings and revenue enhancements

within the expected time frame;

· revenues following any merger being lower than expected; and

· deposit attrition, operating costs, customer loss and business disruption following the merger, including, without

limitation, difficulties in maintaining relationships with employees being greater than expected.

limitation, difficulties in maintaining relationships with employees being greater than expected.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are

beyond our control. Although we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Accordingly, there

can be no assurance that actual results will meet expectations or will not be materially lower than the results

contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date of this document or, in the case of documents referred to or incorporated by reference,

the dates of those documents. We do not undertake any obligation to release publicly any revisions to these forward-

looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of

unanticipated events, except as may be required under applicable law.

beyond our control. Although we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Accordingly, there

can be no assurance that actual results will meet expectations or will not be materially lower than the results

contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date of this document or, in the case of documents referred to or incorporated by reference,

the dates of those documents. We do not undertake any obligation to release publicly any revisions to these forward-

looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of

unanticipated events, except as may be required under applicable law.

Pro Forma Capitalization

(1) Book value and tangible book value per share estimates based on 6/30/2012 basic shares outstanding of ~11.3 million, plus ~1.1 million shares issued after 6/30/2012 raising a total of ~$15 million,

plus ~3.4 million shares assumed to be issued in this $50 million private placement at midpoint of offering price range of $14.50 per share. 9/30/2012E capital ratios include 6/30/2012 capital levels, plus

mid point of estimated Q3 2012 earnings per the 8-K filed on 8/24/2012, plus ~$14.9 million in net proceeds raised after 6/30/2012, plus net proceeds of $47.5 million from this $50 million private

placement.

plus ~3.4 million shares assumed to be issued in this $50 million private placement at midpoint of offering price range of $14.50 per share. 9/30/2012E capital ratios include 6/30/2012 capital levels, plus

mid point of estimated Q3 2012 earnings per the 8-K filed on 8/24/2012, plus ~$14.9 million in net proceeds raised after 6/30/2012, plus net proceeds of $47.5 million from this $50 million private

placement.

(2) Based on preliminary analysis of transaction, management expects to record a bargain purchase gain of ~$8.0 to ~$10.0 million. Estimated range also based on the assumption that Customers issues

common stock to Acacia shareholders at 1.15x BV in the month end prior to the close, which is expected to be in Q4 2012.

common stock to Acacia shareholders at 1.15x BV in the month end prior to the close, which is expected to be in Q4 2012.

(3) Pro forma book value and tangible book value information presented for informational purposes only. These are current estimates based on management’s preliminary analysis of the Acacia transaction,

which is expected to close in Q4 2012.

which is expected to close in Q4 2012.

§ Best returns for shareholders when cycle is turning

§ Goal is 15%+ average annual returns for shareholders

§ We needed four elements to execute

– A bank charter

– Very experienced and motivated management team

– Unique and clear strategy

– Superior execution

Introduction

Company Overview

Source: SNL Financial and Company data

Note: Deposit data representative of 6/30/2011; includes Acacia Federal Savings Bank and CMS Bank deposits

*Source: SNL Financial as of 6/30/2011. Represents deposits pro forma for the acquisition of Acacia Federal Savings Bank (expected to close in Q4 2012) and CMS Bancorp (expected to close in Q2 2013).

Actual deposits transferred likely to be lower.

Actual deposits transferred likely to be lower.

1.Pro forma assets assumes $2.7 billion of estimated assets for Customers Bancorp as of Q3 2012, plus ~$490 million of assets expected to be acquired through the Acacia Federal Savings acquisition that is

expected to close in Q4 2012, plus ~$247 million of assets from the CMS Bancorp acquisition expected to close in Q2 2013.

expected to close in Q4 2012, plus ~$247 million of assets from the CMS Bancorp acquisition expected to close in Q2 2013.

2.As of June 30, 2012.

3.Acacia Federal Savings Bank acquisition expected to close in Q4 2012 (subject to regulatory approval).

4.CMS Bancorp Inc. acquisition expected to close in Q2 2013 (subject to regulatory approval).

§ Pro forma $3bn institution with 21 sales

offices(1)

offices(1)

§ Average deposits per branch exceeding $125

million (2)

million (2)

§ Operating in key Mid-Atlantic markets

– Southeastern Pennsylvania (Bucks, Berks,

Chester and Delaware counties)

Chester and Delaware counties)

– New York (Westchester county)

– New Jersey (Mercer county)

§ Entering Washington DC market(3)

§ Expanding presence in Westchester county(4)

§ Attractive target market demographics

– 17.6% higher median household income

compared to national average

compared to national average

– 3.2% higher projected growth compared to

national average

national average

CMS

Customers Bancorp

Acacia

Management Track Record

Sovereign Cumulative Shareholder Returns with Jay Sidhu as CEO:

March 1989 - December 2006

Source: SNL Financial.

1,474%

Dec-06

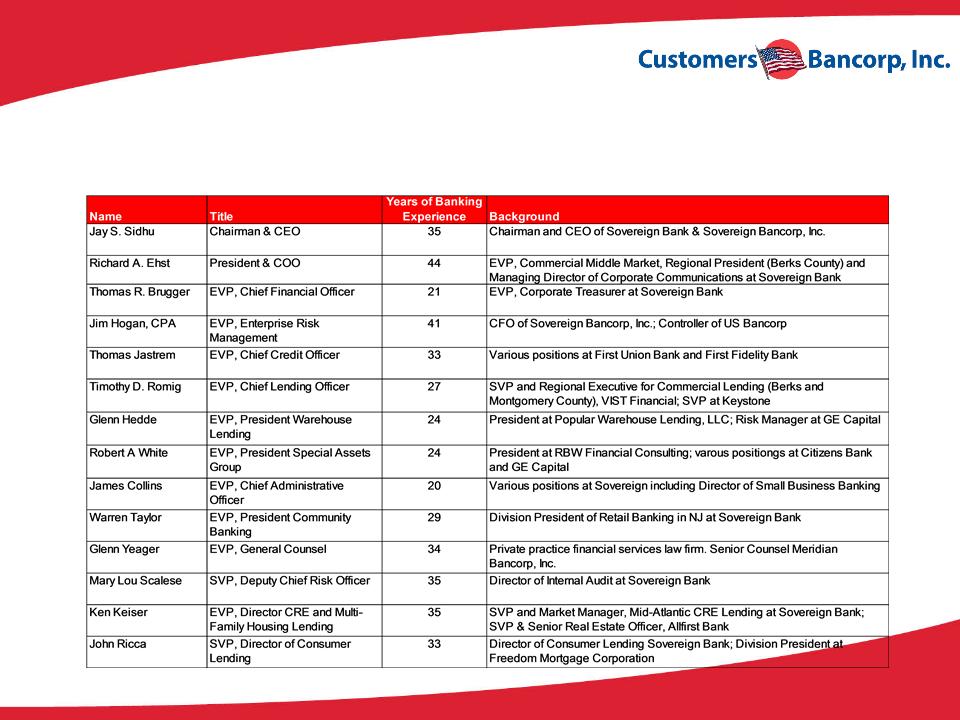

Seasoned Management Team

§ Experienced and cohesive management team with an average tenure of 30 years experience

– 9 out of 14 senior executives previously worked at Sovereign

§ ~20% ownership by management and insiders

High Quality Independent Board of Directors (1)

(1) Bhanu Choudhrie’s appointment to the Board of Directors is pending regulatory approval.

§ Jay Sidhu joins $270 million

asset Customers Bank (FKA

New Century Bank)

asset Customers Bank (FKA

New Century Bank)

§ Identified existing credit

problems, adequately reserved

and recapitalized the bank

problems, adequately reserved

and recapitalized the bank

§ Actively worked out problem

loans

loans

§ Recruited experienced

management team

management team

Execution Timeline

§ Enhanced credit and risk

management

management

§ Developed infrastructure for

organic growth

organic growth

§ Built out warehouse lending

platform and doubled deposit and

loan portfolio

platform and doubled deposit and

loan portfolio

§ Completed acquisitions:

– ISN Bank (FDIC-assisted)

– USA Bank (FDIC-assisted)

– Berkshire Bancorp (Whole

bank)

bank)

§ Recruited proven lending

teams

teams

§ Built out Consumer and Multi-

family lending platforms

family lending platforms

§ De Novo expansion; 4-6 sales

offices per year

offices per year

§ 10%+ ROE; ~1% ROA

§ Announced acquisitions:

– Acacia Federal Savings

– CMS Bancorp

§ Target $5B institution by

2014

2014

2009

Assets: $350M

Equity: $22M

2010

Assets: $1.4B

Equity: $105M

2011

Assets: $2.1B

Equity: $148M

2012(1)

Assets: ~$3.0B

Equity: ~$300M

(1) Pro forma assets assumes $2.7 billion of estimated assets for Customers Bancorp as of Q3 2012, plus ~$490 million of assets expected to be acquired through the Acacia Federal Savings acquisition

that is expected to close in Q4 2012, plus ~$247 million of assets from the CMS Bancorp acquisition expected to close in Q2 2013. Pro forma equity includes Q2 2012 actual equity of $158 million, plus

~$14 million of net proceeds raised after Q2 2012, plus assumed net proceeds of $47.5 million from this private placement, plus shares issued to selling shareholders of Acacia Federal Savings Bank,

expected to close in Q4 2012, plus estimated earnings for the second half of 2012 (Q3 2012 earnings per the Company’s 8-K filed on 8/24/2012).

that is expected to close in Q4 2012, plus ~$247 million of assets from the CMS Bancorp acquisition expected to close in Q2 2013. Pro forma equity includes Q2 2012 actual equity of $158 million, plus

~$14 million of net proceeds raised after Q2 2012, plus assumed net proceeds of $47.5 million from this private placement, plus shares issued to selling shareholders of Acacia Federal Savings Bank,

expected to close in Q4 2012, plus estimated earnings for the second half of 2012 (Q3 2012 earnings per the Company’s 8-K filed on 8/24/2012).

§ Superior credit quality

§ Revenues = 2x Expenses; resulting in 0.90% to 1.00% ROA and

double digit ROE

double digit ROE

§ Focus on doing a few things very well

§ Strong risk management Culture

– ERM (Enterprise Risk Management) process in place

– Extensive review of all risks at board and management levels

with best practices in corporate governance standards

with best practices in corporate governance standards

§ Solid capital levels to support risk and growth

Critical Success Factors

Concierge Banking

§ Takes banker to the

customer’s home or

office, 12 hours a

day, 7 days a week

customer’s home or

office, 12 hours a

day, 7 days a week

§ Appointment banking

approach

approach

§ Customer access to

private bankers

private bankers

§ “Virtual Branches”

out of sales offices

out of sales offices

Sales Force

§ Experienced

bankers who own

a portfolio of

customers

bankers who own

a portfolio of

customers

§ Customer

acquisition &

retention strongly

incentivized

acquisition &

retention strongly

incentivized

Pricing

§ Low cost banking

model allows for more

pricing flexibility

model allows for more

pricing flexibility

§ Significantly lower

overhead costs vs. a

traditional branch

overhead costs vs. a

traditional branch

§ Pricing/profitability

measured across

relationship

measured across

relationship

Technology

§ Implementation of

technology suite allows

for unique product

offerings:

technology suite allows

for unique product

offerings:

§ Remote account

opening & deposit

capture

opening & deposit

capture

§ Internet/mobile

banking

banking

§ Free ATM

deployment in U.S.

deployment in U.S.

Deposit Strategy - High Touch, High Tech

§ Organic deposit growth of 100% over past 3 years

Cost of Funds

Plus: Branch Operating

Expense

Expense

Less: Fees

= All-in Cost < Competitors

Goal: All-in cost less than wholesale funding cost over the long-term

CAGR: 97%

CAGR: 99%

CAGR: 50%

Delivering Organic Growth - Deposits

Source: Company documents

Deposit Growth

DDA Growth

Deposits per Branch

Cost of Deposits

Lending Strategy - Local Lending Plus Specialty Niche

Commercial Lending

Small Business

§ Target companies with less than

$5.0 million annual revenue

$5.0 million annual revenue

§ Loans (incl. SBA loans)

originated by branch network

and specialist small business

relationship managers

originated by branch network

and specialist small business

relationship managers

§ Warehouse Lending

§ Diversify earning assets and

revenue stream

revenue stream

§ Lower interest rate and credit

risk line of business

risk line of business

Business Banking

§ Target companies with up to

$100 million annual revenues

$100 million annual revenues

§ Very experienced teams

Multifamily & CRE

§ Focus Markets: New York &

Philadelphia MSAs

Philadelphia MSAs

§ Average Loan Size: $7.0 million

Real Estate Secured Lending

§ Select home equity and

residential mortgage

residential mortgage

§ Conservative underwriting

standards (>700 FICO score)

standards (>700 FICO score)

§ No indirect auto, unsecured

loans or credit cards

loans or credit cards

Consumer Lending

Specialty Lending

Summary

Delivering Organic Growth - Loans

($ in millions)

Loans HFI (excludes Warehouse Loans)*

Source: Company documents

*Average Balance

(1) Includes held for sale loans

(2) Represents average quarterly balance

$509

$513

$552

$696

$772

$856

§ Experienced C&I team acquired from

local and regional banks

local and regional banks

§ Centralized credit committee approval

for all loans

for all loans

§ CRE from C&I customers included in

CRE loans

CRE loans

§ Average C&I loan < $1 million

§ Average loans per relationship manager

only $23 million; full capacity in about

$50 million

only $23 million; full capacity in about

$50 million

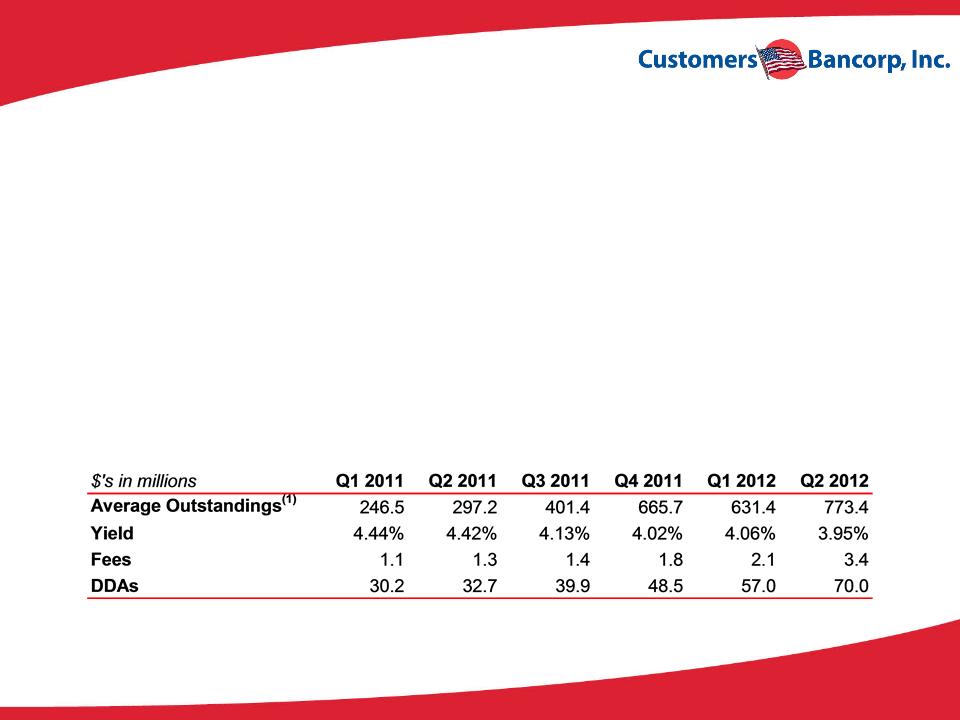

Top 10 Warehouse Lending Platform

§ Exit by larger players has created opportunity to provide liquidity at attractive spreads

§ Warehouse segment led by professionals with over 25+ years experience in the sector

§ Low-risk lending business due to high quality collateral and no put back risk to Customers

– No losses since inception in 2009

§ Steady growth over the past two years; currently have approximately 75 clients

– Deposit relationship and source of fee income

§ Longer term goal (2-3 years) for warehouse lending to comprise up to 25% or less of total assets

§ No negative operating leverage if mortgage market were to weaken

Source: Company documents

(1) Average outstanding for the respective quarter

Strong Asset Quality

($ in millions)

Non-Covered Nonperforming Assets

Source: SNL Financial and Company data

* Reported nonperforming non-covered by FDIC assets (nonaccrual loans and leases, renegotiated loans and leases, and real estate owned) as a percent of assets

§ Clean bank with strong risk management - less than 1% of NPAs from non-FDIC covered and acquired

loans

loans

§ Proactively addressing all credit issues from legacy and acquired portfolios

($ in millions)

Originated Nonperforming Assets

Key Financial Targets

|

Criteria

|

Target

|

Q3 2012 Pre-

Release (1) |

Q4 2012

Target |

|

Return on Equity

|

10% or greater

|

10%

|

10% or greater

|

|

Return on Assets

|

.90% to 1.00%

|

.70%

|

.90% to 1.00%

|

|

Net Interest Margin

|

3.00% to 3.25%

|

3.05%

|

3.00% to 3.25%

|

|

Efficiency Ratio

|

50%

|

60%

|

50%

|

|

Loan-to-Deposit

|

90% to 100%

|

100%

|

90% to 100%

|

Source: Company data

1. Represents mid point of the Company’s guidance per Form 8-K filed on 8/24/2012.

Strong Income Growth

Revenue Growth (2)

(1)Adjusted PTPP earnings is calculated as: Core income + estimated income taxes at 35% + provision expense. PTPP excludes non-recurring income and expense items.

(2)Revenue = Net interest income before provision plus noninterest income.

(3)Represents gross loans held for investment divided by total deposits.

(4)Core income, on a diluted per-share basis. Core income is net income before extraordinary item, less net income attributable to noncontrolling interest, the after-tax portion of income from investment

(non-trading) securities and nonrecurring items. The assumed tax rate is 35%.

(non-trading) securities and nonrecurring items. The assumed tax rate is 35%.

Adjusted PTPP Earnings (1)

Core EPS (4)

Loan-to-Deposit (%) (3)

Increasing Profitability

Net Interest Margin (%)

(1)Adjusted PTPP Earnings is calculated as: Core income + estimated income taxes at 35% + provision expense. PTPP excludes non-recurring income and expense items.

(2)Core income is net income before extraordinary item, less net income attributable to noncontrolling interest, the after-tax portion of income from investment (non-trading) securities and nonrecurring items. The

assumed tax rate is 35%.

assumed tax rate is 35%.

(3)Core income is net income before extraordinary item, less net income attributable to noncontrolling interest, the after-tax portion of income from investment (non-trading) securities and nonrecurring items. The

assumed tax rate is 35%.

assumed tax rate is 35%.

Core ROAA (%) (2)

Core ROAE (%) (3)

Adjusted PTPP/Average Assets (1)

Enhancing Shareholder Value

Source: SNL Financial, Company documents

*Pro-forma $50mm capital raise at $14.50 per share (midpoint of proposed price range). Also, includes ~$15mm additional capital raise at $13.99 per share in Q3 2012 and Q3 2012 net income of $4.35M

(midpoint of management guidance per Form 8-K filing on 8/24/2012).

(midpoint of management guidance per Form 8-K filing on 8/24/2012).

1. Based on preliminary analysis of transaction, management expects to record a bargain purchase gain of ~$8.0 to ~$10.0 million. Estimated range also based on the assumption that Customers issues

common stock to Acacia shareholders at 1.15x BV in the month end prior to the close, which is expected to be in Q4 2012.

common stock to Acacia shareholders at 1.15x BV in the month end prior to the close, which is expected to be in Q4 2012.

§ 43% increase in tangible book value per share in the past 8 quarters

§ Acacia acquisition is expected to grow tangible book value by ~$0.92 per share (1)

43%

BV/Share

$9.66

$12.52

$12.61

$13.02

$13.99

$15.12

$14.98

Estimated Acacia Acquisition Impact

§ Completed two FDIC-assisted acquisitions with total assets of ~$300 million and pre-tax total

bargain purchase gain of ~$40M

bargain purchase gain of ~$40M

§ Completed one $135 million asset whole bank deal accretive to earnings and book value within

three months

three months

§ Announced two other accretive acquisitions:

Experienced Acquirer

|

Target

|

Purchase

Price/ BV |

Valuation

of Customers Shares |

Expected

Bargain Purchase After-Tax Gain |

Notes

|

|

Acacia Federal Savings

Bank § Expected close: Q4 2012

§ ~$490M assets acquired

|

0.56x

|

1.15x BV

|

$8-$10M

|

No nonperformers/high

risk loans acquired No material deal charges

Immediately accretive to

BV, capital and earnings |

|

CMS Bancorp

§ Expected close: Q2 2013

§ ~$247M asset bank

|

0.95x

|

1.25x BV

|

NA

|

Accretive to capital,

earnings, and book value within 6 months |

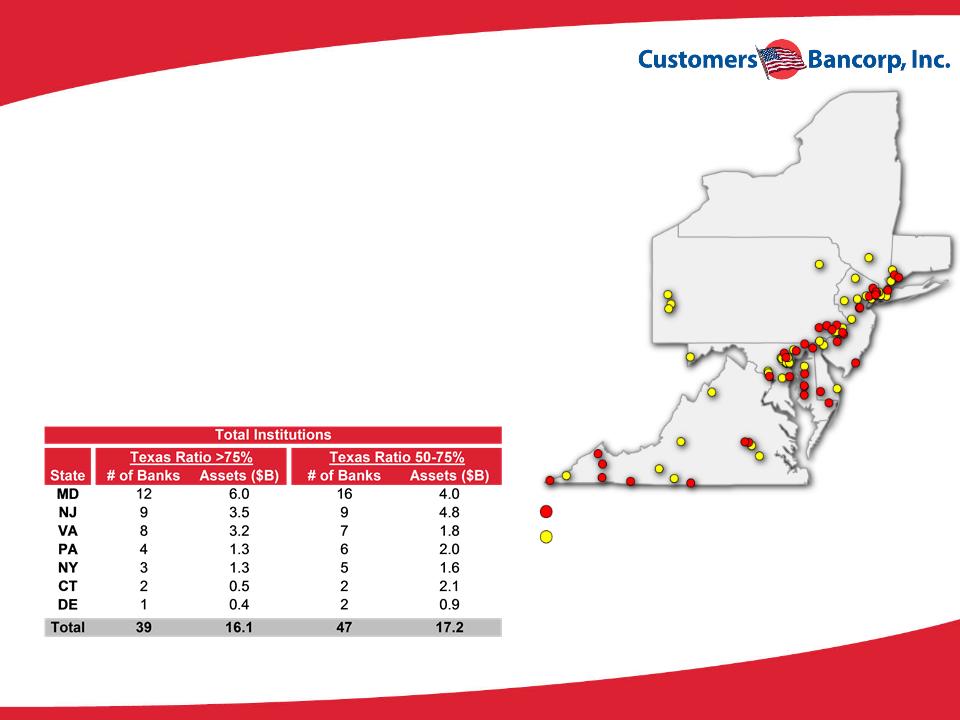

Acquisition Opportunities

§ 86 stressed banks with ~$33 billion in assets in our target

markets

markets

– Significantly larger pool of smaller healthy banks that

cannot generate double digit ROE

cannot generate double digit ROE

§ Limited competition to acquire these banks

§ Disciplined M&A strategy focused on TBV, earnings, and

capital accretion within 12 months of closing

capital accretion within 12 months of closing

Source: SNL Financial

Note: Data for all institutions headquartered in CT, CE, MD, NJ, NY, PA, and VA with assets less than $2B

Texas Ratio >75%

Texas Ratio 50-75%

Appendix

Asset Quality

Source: Company documents

Note: Held-for-Sale Loan balance is $284 million as of Q2 2012

(1) Includes Consumer, Mortgage and Manufactured loan types

Asset Quality by Loan Type: 6/30/12