Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sino Agro Food, Inc. | v322771_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Sino Agro Food, Inc. | v322771_ex99-1.htm |

GREEN & NATURAL AGRICULTURE FOR THE 21 ST CENTURY 2012 First Half Investor Presentation

SAFE HARBOR STATEMENT A number of statements being made today are forward - looking in nature . Such statements are only predictions, and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings . Sino Agro Food, Inc . (the “Company”) does not assume any obligation to revise or update these forward - looking statements to reflect subsequent events or circumstances . Information conveyed to the public today contains "forward looking statements" within the meaning of Section 27 A of the Securities Exchange Act of 1933 and Section 21 B of the Securities Exchange Act of 1934 . Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements . Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated . Forward looking statements in this action may be identified through use of words such as projects, "foresee," "expects," "will," "anticipates," "estimates," "believes," "understands," or that by statements indicating certain actions may, "could," or "might" occur . There is no guarantee past performance will be indicative of future results . Not a Broker/Dealer or Financial Advisor Sino Agro Food, Inc . is neither a Registered Broker/Dealer nor a Financial Advisor, nor does it hold itself out to be a Registered Broker/Dealer or Financial Advisor . All material and information conveyed in this presentation, on the Company's website or other media is not to be regarded as investment advice and is only for informative purposes . Conference participants should verify all claims and conduct their own due diligence before investing in Sino Agro Food, Inc . Investing in small - cap, micro cap and penny stock securities is speculative and carries a high degree of risk . No Offer of Securities None of the information featured in this presentation constitutes an offer or solicitation to purchase or to sell any securities of Sino Agro Food, Inc . Forecasts All forecasts are provided by management in this presentation and are based on information available to us at this time and management expects that internal projections and expectations may change over time . In addition, the forecasts are entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products .

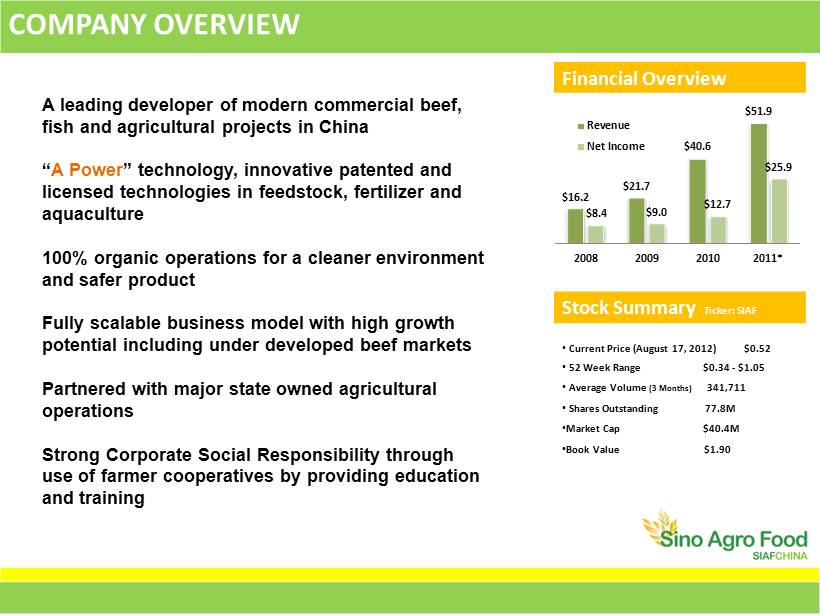

COMPANY OVERVIEW A leading developer of modern commercial beef, fish and agricultural projects in China “ A Power ” technology, innovative patented and licensed technologies in feedstock, fertilizer and aquaculture 100% organic operations for a cleaner environment and safer product Fully scalable business model with high growth potential including under developed beef markets Partnered with major state owned agricultural operations Strong Corporate Social Responsibility through use of farmer cooperatives by providing education and training Financial Overview Stock Summary Ticker : SIAF • Current Price (August 17, 2012) $0.52 • 52 Week Range $0.34 - $1.05 • Average Volume (3 Months) 341,711 • Shares Outstanding 77.8M • Market Cap $40.4M • Book Value $1.90 $16.2 $21.7 $40.6 $ 51.9 $8.4 $9.0 $12.7 $25.9 2008 2009 2010 2011* Revenue Net Income

KEY INVESTMENT HIGHLIGHTS High growth potential due to a growing middle class in China with higher demands for food quality Proven modern technologies used in creating commercial operations in key growth industries such as beef, and fish Largest consultancy and operational footprint of modern Recirculating Aquaculture System projects in China Strong local government backing and support for farming cooperatives including subsidies and grants for development Excellent track record of operating performance and revenue growth Highly experienced management team

EXPERIENCED MANAGMENT Mr. Lee Yip Kun Solomon has been a Director and our Chief Executive Officer since August 2007. From March 2004 to date he has been Group Managing Director of Capital Award Inc. Since May, 1993, he has been the CEO of Irama Edaran Sdn . Bhd. (Malaysia), a modern fishery developer. There was no formal relationship between Sino Agro Food and Irama Edaran . He received a B.A. in Accounting and Economics from Monash University, Australia in July 1972. As a member of our board, Mr. Solomon contributes his knowledge of the Company and a deep understanding of all aspects of our business, products and markets, as well substantial experience developing corporate strategy, assessing emerging industry trends, and business operations. Mr. Tan Paoy Teik has been a Director and our Chief Marketing Officer since August 2007. Since July, 2005, he has been Group Managing Director of Milux Corporation Bhd. (Malaysia), a manufacturer of home and gas appliances. He received an MBA from South Pacific University in 2005. Mr. Tan is currently the Managing Director of Milux Corporation Bhd. As such, he spends half of his business time between Milux and half with the Company. As a member of our board, Mr. Tan contributes his knowledge of the Company and a deep understanding of all aspects of our business, products and markets, as well substantial experience developing corporate strategy, assessing emerging industry trends, and business operations. Mr. Chen Bor Hann has been Director and Secretary since August 2007. Since March, 2004, he has been Director and Business Development Manager of Capital Award Inc. From September 1995 to March 2004, he was Fishery Supervisor of Irama Edaran Sdn . Bhd. (Malaysia). As a member of our board, Mr. Chen contributes his knowledge of the Company and a deep understanding of all aspects of our business, products and markets, as well substantial experience developing corporate strategy, assessing emerging industry trends, and business operations.

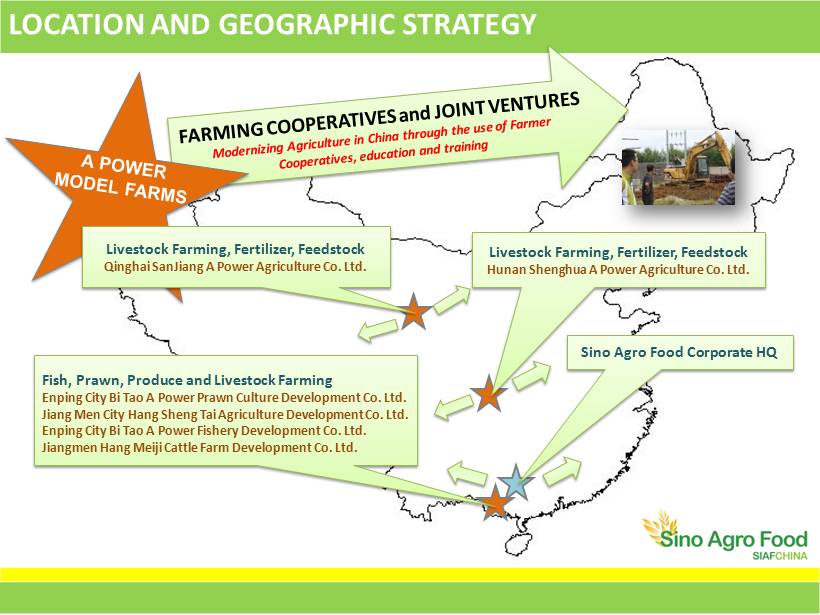

LOCATION AND GEOGRAPHIC STRATEGY Livestock Farming, Fertilizer, Feedstock Hunan Shenghua A Power Agriculture Co. Ltd. Sino Agro Food Corporate HQ Fish, Prawn, Produce and Livestock Farming Enping City Bi Tao A Power Prawn Culture Development Co. Ltd. Jiang Men City Hang Sheng Tai Agriculture Development Co. Ltd. Enping City Bi Tao A Power Fishery Development Co. Ltd. Jiangmen Hang Meiji Cattle Farm Development Co. Ltd. Livestock Farming, Fertilizer, Feedstock Qinghai SanJiang A Power Agriculture Co. Ltd.

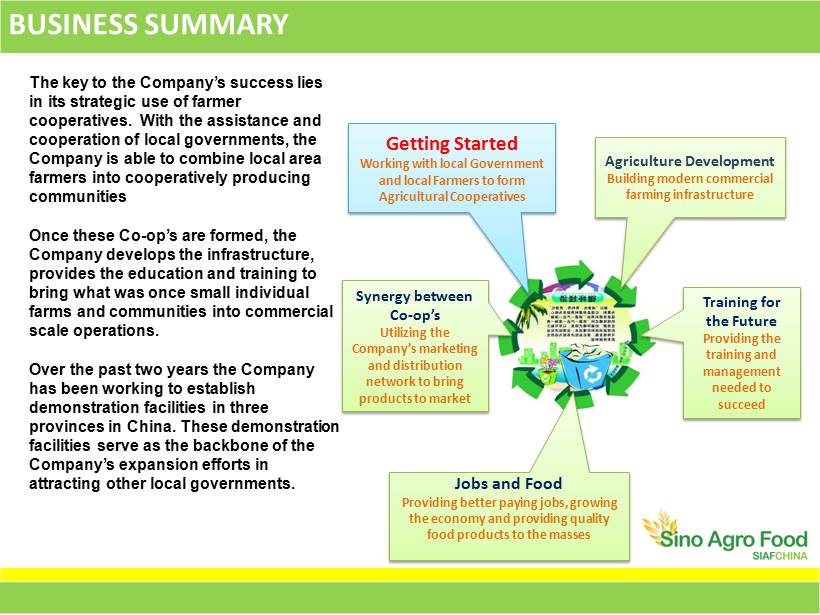

BUSINESS SUMMARY Jobs and Food Providing better paying jobs, growing the economy and providing quality food products to the masses Training for the Future Providing the training and management needed to succeed Synergy between Co - op’s Utilizing the Company’s marketing and distribution network to bring products to market Agriculture Development Building modern commercial farming infrastructure Getting Started Working with local Government and local Farmers to form Agricultural Cooperatives The key to the Company’s success lies in its strategic use of farmer cooperatives. With the assistance and cooperation of local governments, the Company is able to combine local area farmers into cooperatively producing communities Once these Co - op’s are formed, the Company develops the infrastructure, provides the education and training to bring what was once small individual farms and communities into commercial scale operations. Over the past two years the Company has been working to establish demonstration facilities in three provinces in China. These demonstration facilities serve as the backbone of the Company’s expansion efforts in attracting other local governments.

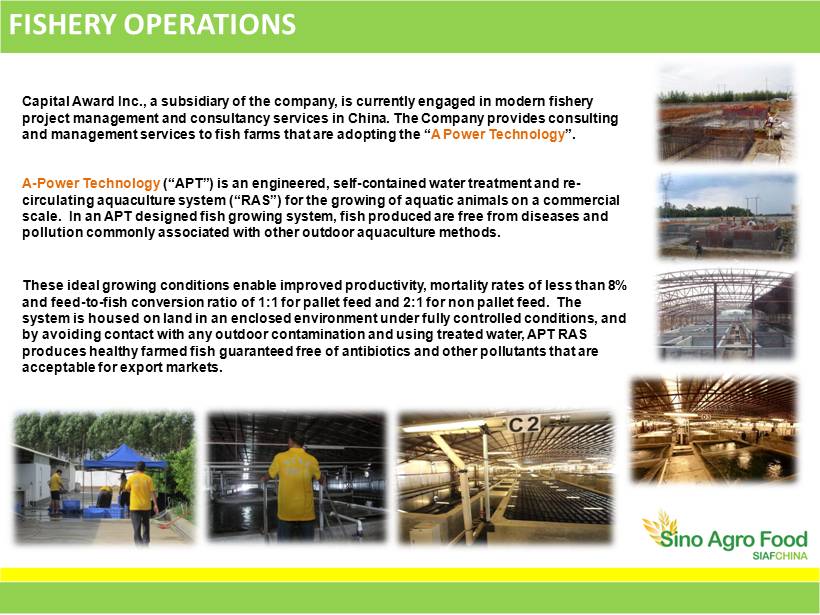

FISHERY OPERATIONS Capital Award Inc., a subsidiary of the company, is currently engaged in modern fishery project management and consultancy services in China. The Company provides consulting and management services to fish farms that are adopting the “ A Power Technology ”. A - Power Technology (“APT”) is an engineered, self - contained water treatment and re - circulating aquaculture system (“RAS”) for the growing of aquatic animals on a commercial scale. In an APT designed fish growing system, fish produced are free from diseases and pollution commonly associated with other outdoor aquaculture methods. These ideal growing conditions enable improved productivity, mortality rates of less than 8% and feed - to - fish conversion ratio of 1:1 for pallet feed and 2:1 for non pallet feed. The system is housed on land in an enclosed environment under fully controlled conditions, and by avoiding contact with any outdoor contamination and using treated water, APT RAS produces healthy farmed fish guaranteed free of antibiotics and other pollutants that are acceptable for export markets.

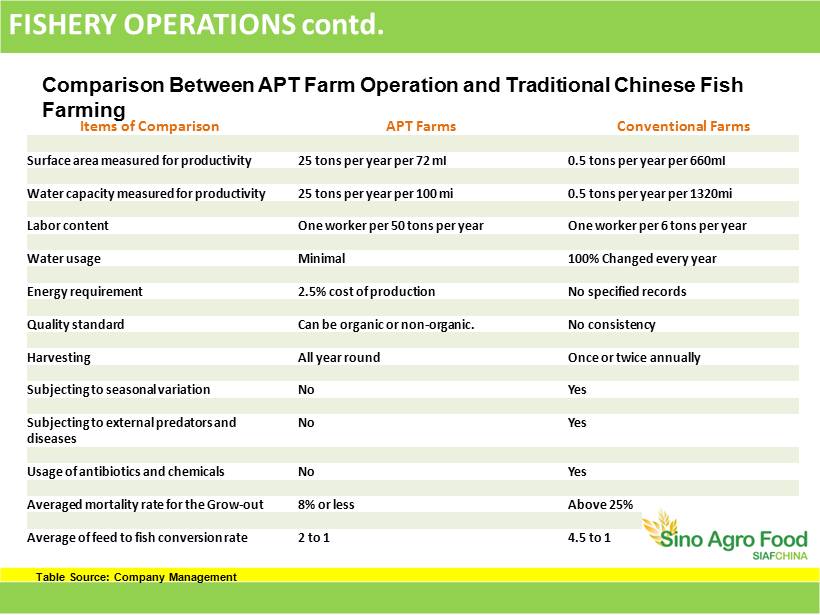

FISHERY OPERATIONS contd. Items of Comparison APT Farms Conventional Farms Surface area measured for productivity 25 tons per year per 72 mІ 0.5 tons per year per 660mІ Water capacity measured for productivity 25 tons per year per 100 mі 0.5 tons per year per 1320mі Labor content One worker per 50 tons per year One worker per 6 tons per year Water usage Minimal 100% Changed every year Energy requirement 2.5% cost of production No specified records Quality standard Can be organic or non - organic. No consistency Harvesting All year round Once or twice annually Subjecting to seasonal variation No Yes Subjecting to external predators and diseases No Yes Usage of antibiotics and chemicals No Yes Averaged mortality rate for the Grow - out 8% or less Above 25% Average of feed to fish conversion rate 2 to 1 4.5 to 1 Comparison Between APT Farm Operation and Traditional Chinese Fish Farming Table Source: Company Management

FISHERY OPERATIONS FIRST HALF 2012 » Currently the Company has 1 fully operational and 3 additional aquaculture farms under development. » Fish Farm 1 sold 336,000 “Sleepy Cod” fish averaging 532g/fish and purchased 230,000 fish averaging 350g/fish. » Prawn Farm 2 produced 40M prawn flies with a 95% survival rate and sold 37.5M averaging $25.00 per 10,000 prawn flies. » Open Dam farming provided 149,000 “Sleepy cod” fish for stocking operations at Fish Farm 1 and 151,000 fish were sold to wholesale markets averaging 514g/fish. » On April 1, 2012 Capital Award increased its equity ownership in Fish Farm 1 to 75% from 50%.

FISHERY GUIDANCE » The Company has acquired a new Feed Production Technology and Breeding Technique Technology for “Sleepy Cod” fish. The combined technologies have been shown to produce healthier, faster growing fish by combing new feeding methods with cross bred “Sleepy Cod” species. » Management will focus on increasing production, quality, marketing and distribution within current operations » (Prawn Farm 1) Enping A Power Prawn Culture Co. to begin Operations in Q3 » (Fish Farm 2) Gao Aquaculture A Power Fishery Co. to begin Operations in Q4 2013 » Management is currently working on 2 new Fishery Contracts

BEEF OPERATIONS The Company holds patents for a modern livestock feed manufacturing process and produces its own blends of enzymes for both fertilizer and feedstock production for various climates within China. These technologies combined with farm services make up the core of the Company’s livestock operations. The Company, through its joint venture agreements, also receives a percentage of beef sales produced by operations. The Huangyuan Government is currently replicating the Company’s cattle housing model for local farmers under an agreement that will allow the Company to purchase the beef for processing at its new slaughterhouse, boning and cold storage facility that will begin operations during the second quarter of 2013 Using the Company’s modern farming methods and feedstock have yielded above average results, reducing fattening time and producing the highest quality aromatic beef. The Company intends to become one of the highest quality producers of organic beef to meet the demand of a growing affluent middle class in China.

BEEF OPERATIONS FIRST HALF 2012 » Sanjiang A Power sold 915 head of over 13 month - old cattle with current inventory levels at 1,450 head. » On May 6, 2012 a supply contract was awarded for the supply of 4,000 head of young cattle. » On May 25, 2012 a development contract was executed to build a 500 MU cattle and sheep farm. » RMB20 Million loan by the Agricultural Bank of China to cover development of new Livestock Feed, Enzyme Factory and Processing facilities.

BEEF GUIDANCE » Construction to begin on an Enzyme Manufacturing Plant in Q4 2012 » Introduce Abattoir and Boning Facilities for value added processing of beef products in Q4 2013 » Hunan Shanghua A Power (Linli Hunan) to begin manufacturing and sales of Organic and Mixed Fertilizers in Q3 2012 » Hunan Shanghua A Power (Linli Hunan) to begin rearing and Beef Cattle Sales in Q4 2012 » One new additional Beef Cattle Farm contract expected in Q3 2012

ORGANIC FERTILIZER AND FEED STOCK Tri - way, a Company subsidiary, owns a patented Stock Feed Manufacturing Technology for the manufacturing of livestock feed designed for the consumption of beef cattle, cows, sheep and other animals. Raw materials used consist of crop wastes as well as locally grown and available wild wheat, wild wheat sterns, wild peas with sterns and leaves, and selective pastures grown in the wild. These raw materials are finely cut and put through a number of proprietary aging and fermentation processes which yield highly nutritional feed. The feedstock is then packed and sealed in air - tight and weather proof packaging ready for storage. The Company’s feedstock has been shown to speed fattening and provide more nutrition over competing brands. SanJiang A Power, a Company subsidiary, has also completed the development of manufacturing plants and facilities for bio - organic fertilizer production. Energy usage and production time have been decreased by some 300% over traditional methods using the Company’s facilities and technologies. The bio - organic fertilizer produced is designed to revitalize and improve the soil by eliminating toxic fat and chemicals while increasing the growth of micro - organisms and nutrients needed for healthy plant growth.

FERTILIZER AND FEED STOCK FIRST HALF 2012 » Sanjiang A Power sold 2,088 metric tons of Organic Fertilizer and has 3,029 metric tons in inventory. » Sanjiang sold 5,939 metric tons of Livestock Feed with 1,404 metric tons in inventory. » The Company acquired a new patented feedstock formula to be used in tandem with its existing base lines of feedstock. The new formula has been shown to drop fat content from 15kg down to 5kg in 15 month old beef cattle. This new feed stock is a premium product aimed at producing the finest quality beef.

PLANTATION OPERATIONS The Company currently maintains over 182 acres of land for the purpose of cultivating Hylocereus Undatus , also known as “Dragon Fruit”. The Company sells both fresh and dried products as well as various valued added products. The Company currently sells its value added products as “Steamed and dried flowers,” “Naturally dried flowers” and “Favorite dried flowers.” On February 22, 2011, the Company purchased 57 acres to develop an Asparagus farm as an alternative cash crop to the Hylocereus Undatus and to utilize the same value added processing facilities that the Company uses for its Hylocereus Undatus operations. This will allow the Company to make use of its processing facilities year round due to the different harvesting periods. Asparagus operations are expected to commence in Q4 2012. The Company began construction in 2012 to green house plantation operations in order to reduce the impact of inclement weather and better manage crop production.

PLANTATION OPERATIONS FIRST HALF 2012 » As of June 30, 2012, construction and building of half of the green houses were completed, and trials on better disease control and fertilizing programs were commenced during the first week of July, 2012. » Harvest results as of June 30, 2012 were similar to June last season, where more than 3.5 million pieces of fresh flowers at an average of RMB 0.85 per piece were sold (about 54.5% higher in price compared to the same period last year), and dried 175,350 Kg of dried flowers (equivalent to about 9.75 million pieces of fresh flowers) were sold at an average of RMB 58/Kg, which also is higher than last season’s sale price of RMB 46/Kg.

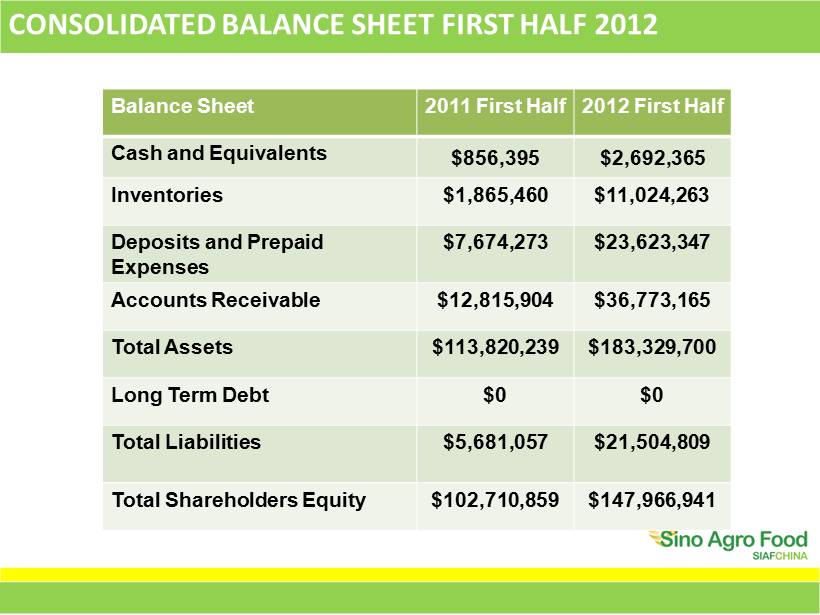

CONSOLIDATED BALANCE SHEET FIRST HALF 2012 Balance Sheet 2011 First Half 2012 First Half Cash and Equivalents $856,395 $2,692,365 Inventories $1,865,460 $11,024,263 Deposits and Prepaid Expenses $7,674,273 $23,623,347 Accounts Receivable $12,815,904 $36,773,165 Total Assets $113,820,239 $183,329,700 Long Term Debt $0 $0 Total Liabilities $5,681,057 $21,504,809 Total Shareholders Equity $102,710,859 $147,966,941

CONSOLIDATED EARNINGS FIRST HALF 2012 Earnings 2011 First Half 2012 First Half Change Revenue $9,826,901 $41,328,303 321% Gross Profit $5,754,638 $21,571,840 275% Net Income $3,922,391* $15,961,484 307% Basic EPS $0.07* $0.22 214% Diluted EPS $0.06* $0.20 233% * Does not include Discontinued Operations

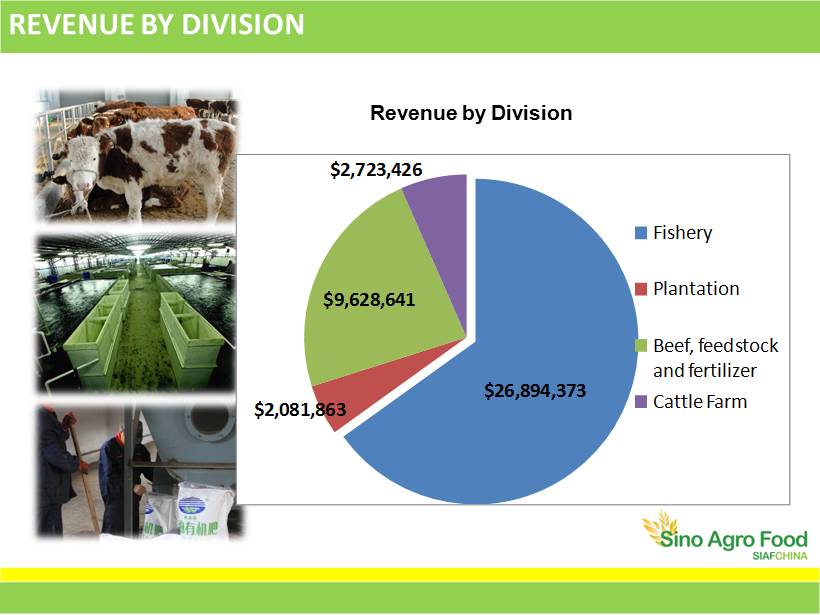

REVENUE BY DIVISION $2,081,863 $9,628,641 $2,723,426 Fishery Plantation Beef, feedstock and fertilizer Cattle Farm $26,894,373 Revenue by Division

MARKET OPPORTUNITIES China’s economy has consistently grown at a robust pace. This has not only created an affluent urban population, but a much larger and ever growing urban middle class. Combined, these two groups are increasingly demanding better products. Sino Agro Food’s aim is to meet this demand by providing quality organic food products. Beef markets in China are still relatively undeveloped. As incomes rise, demand for quality beef will rise. Sino Agro Food is aggressively developing commercial scale organic beef operations to meet this growing demand. Sino Agro Food is currently at the forefront of modern commercial beef farming in China. The seafood industry in China is expected to increase by some 40% by 2020 according to a study by Glitnir Bank. Much of this seafood is grown under polluted conditions. Sino Agro Food uses modern aquaculture methods that produce seafood that is free from chemicals and pollution. The Company will market its fish as the healthy alternative to concerned consumers.

MARKETING AND DISTRIBUTION » On May 30, 2012 a contract was executed to develop a Wholesale and Seafood Processing Shop in Guangzhou City, China. » On June 30, 2012 the Company imported 80 metric tons of mixed variety seafood from Norway. 60 metric tons were shipped to Malaysia for processing while the remaining 20 metric tons were delivered to China for processing by the newly created Wholesale and Processing Shop. » Orders for 260 metric tons of imported peeled shrimp from Vietnam and Cambodia are to be processed for sale through the new Wholesale and Seafood Processing Shops. » On June 1, 2012 the Company executed an MOU for the acquisition of 51 % controlling interest in the restaurant chain “Leonie” operating in Malaysia and Guangzhou City, China.

MARKETING AND DISTRIBUTION GUIDANCE » The Company is constructing a 2,000 square meter fish processing and wholesale shop at the new Guangzhou Fish Market. The new plans are some 3 times the original planned size. » Launch of Franchising Operations is expected in Q4 2012 » Development of “Green Life and Natural” Brand Market Chains is expected in Q4 2012 » Launch of Cold Storage and Distribution Centers for Franchised Operations is expected in Q4 2012 » Launch of Value Added Seafood Products is expected in Q4 2012 » Launch of Value Added Beef Products is expected in Q4 2012

CONSOLIDATED FINANCIAL GUIDANCE Financial Item 2011 2012 Growth Consolidated Revenue $51.9M $145M 179% Consolidated NTA $135.4M $215M 59% Weighted Issued and Outstanding Shares 60.2M 78M 30% NTA/Share $2.02 $3.05 51% EPS Basic $0.43 $0.68 58% Debt to Equity Ratio 0:0 2:50 Minimal

Contact: info@sinoagrofood.com Website: www.sinoagrofood.com Room 3711, China Shine Plaza No. 9 Lin He Xi Road Tianhe County Guangzhou City P.R.C. 510610