Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - U.S. SILICA HOLDINGS, INC. | d403965d8k.htm |

Investor Presentation

August 2012

U.S. Silica

U.S. Silica

Exhibit 99.1 |

Disclaimers

2

This presentation contains forward-looking statements that reflect, when made,

our current views with respect to current events and financial performance.

Such forward-looking statements are subject to many risks, uncertainties

and factors relating to our operations and business environment, which may

cause our actual results to be materially different from any future results,

express or implied, by such forward-looking statements. All statements that

address future operating, financial or business performance or our strategies or

expectations are forward-looking statements. In some cases, you can

identify these statements by forward- looking words such as

“may,” “might,”

“will,”

“should,”

“expects,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

“projects,”

“potential,”

“outlook”

or “continue,”

and other

comparable terminology. Factors that could cause actual results to differ

materially from these forward-looking statements include, but are not

limited to, those discussed in our filings with the Securities and Exchange

Commission, including our most recent Annual Report on Form 10-K and our

Quarterly Reports on Form 10-Q. New risks and uncertainties arise from time to

time, and it is impossible for us to predict these events or how

they may affect us. We disclaim

any intention or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events and/or otherwise,

except to the extent required by law. This presentation includes certain

non-GAAP financial measures, including Adjusted EBITDA and Total Segment

Contribution Margin. These measures should be considered supplemental to and

not a substitute for financial information prepared in accordance with GAAP and may

differ from similarly titled measures used by others. For a reconciliation of such

measures to the most directly comparable GAAP term, please see Appendix A

to this presentation. |

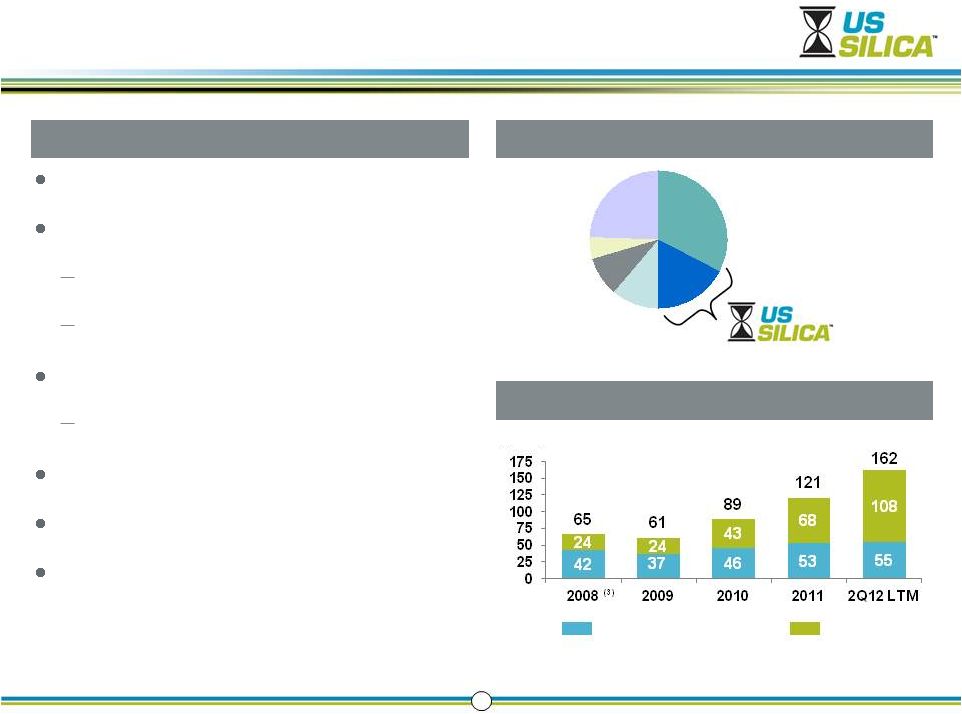

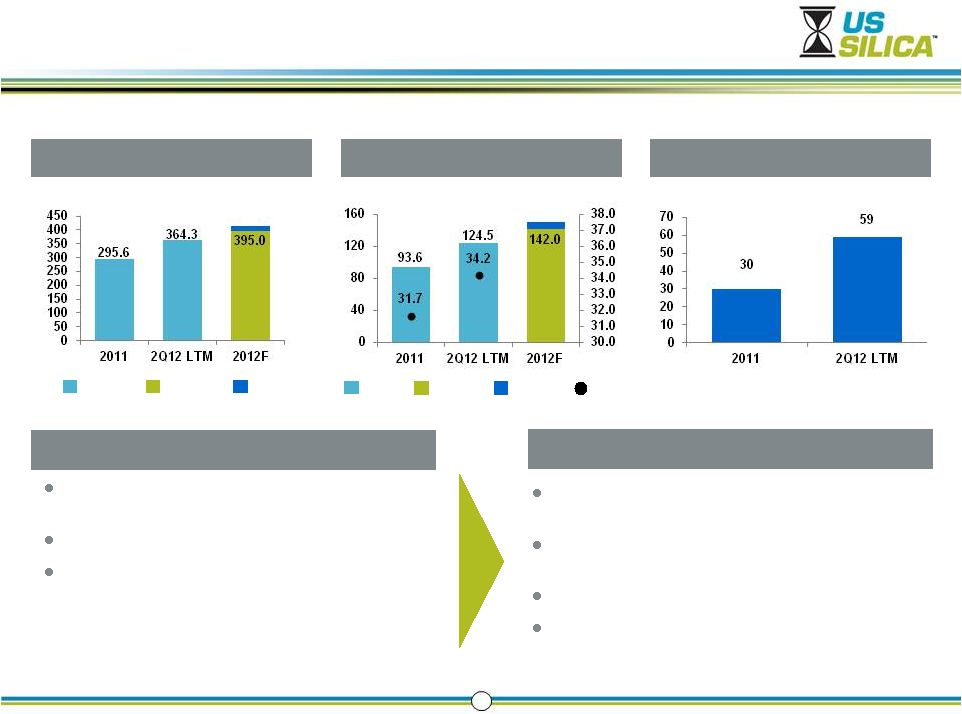

Commercial Silica Market Share

U.S. Silica is Attractively Positioned

Leading industrial minerals supplier

Over 200 products and 1,400 customers

Oil & Gas Proppants: Frac sand

Industrial & Specialty: Glass, coatings, foundry

13 facilities, many over 100 years old

Flagship Ottawa site home of ‘Ottawa White’

313 million tons of high quality reserves

6.7 million tons sold in 2Q12 LTM

2Q12 LTM revenues of $364 million and 2Q12

LTM adjusted EBITDA of $124 million

(1)

3

Company Profile

Segment

Contribution

Margin

(1)

(2)

(1)

See Appendix A for reconciliations to GAAP

(2)

Totals may not equal segments due to rounding

(3)

Includes combined results for our predecessors

Source:

Company Estimates

($MM)

Industrial and Specialty

Oil and Gas

Other |

4

Rapid Demand

Growth

Shale drilling has revolutionized U.S. energy supply

Proppant volume demand growing faster than shale drilling activity

Supply is

Constrained

Large API spec reserves and permission to operate are barriers to

entry Complex logistics and access to industrial end markets are

requirements for a low cost structure and success

Sustainable

Competitive

Advantages

146 million tons of API spec frac sand reserves

Integrated supply chain with access to all major shale basins

Significant cost advantage due to heritage infrastructure

Line of Site

Organic Growth

Transforming the ISP segment by growing our specialty and performance

products New resin coated sand (“RCS”) facility targeted for 1Q

2013 Additional Greenfield raw sand facility targeted for 2Q 2013

Leadership and Growth in a Transformative Market |

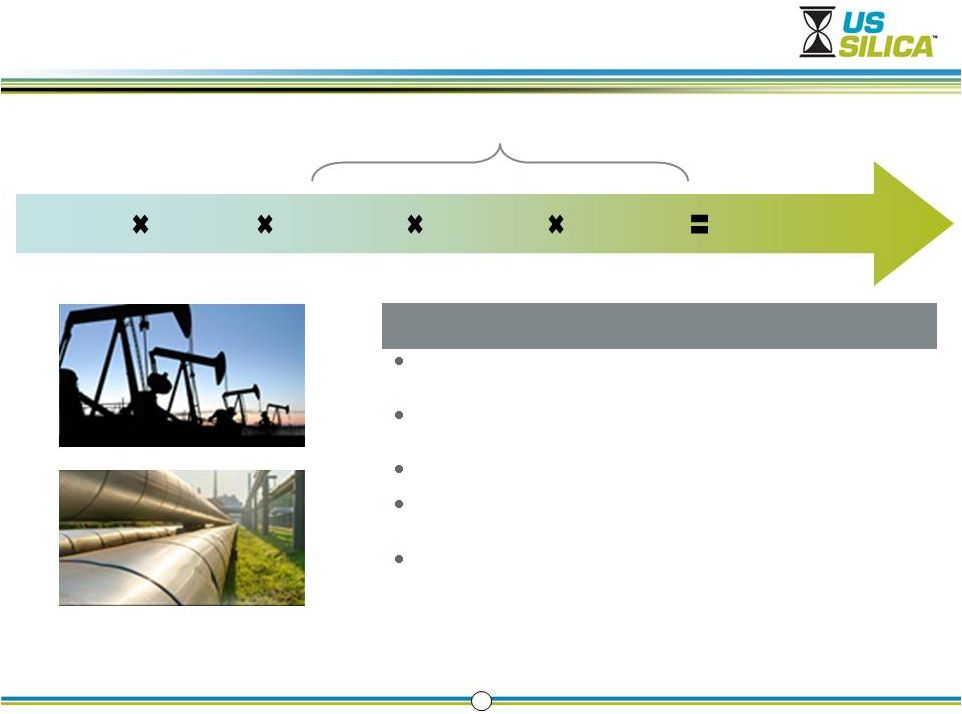

Frac

Sand Demand Outstrips Drilling Activity 5

(1)

The Freedonia Group, Inc. –

Well Stimulation Materials, March 2012 and World Well Stimulation Materials, April

2011 Horizontal

Rig Count

Wells

per Rig

Stages per

Lateral

Proppant Demand

Proppant

per Stage

Technology Enabled

Lateral

Length

Proppant growth has recently outpaced rig count growth due to

technological advances

For

example,

proppant

volumes

grew

31%

in

2011

versus

prior

year

while

horizontal

rig

count

grew

21%

(1)

Wells drilled per rig increased as operators found new efficiencies

Laterals grew longer and stages increased as fracturing technology

advanced

Proppant per stage grew denser as operators experimented with new well

designs

Growth Drivers |

New

Projects Face High Hurdles 6

Barriers to Entry

Sphericity, solubility,

size, crush strength

(14 API specifications)

Large-Scale High

Quality Reserves

High

Quality,

Cost

Effective

Supply

Rail access to

major basins

Long approval

process (1 –

3 years)

Federal / state / local

mining, air, water,

reclamation permits

Premium on know-

how and expertise

Logistics and

On-Site

Infrastructure

Permission

and

Experience to

Operate

Diversified

Customers

Ability

to “spec-in”

to industrial

customer

production

processes

Barriers to Success |

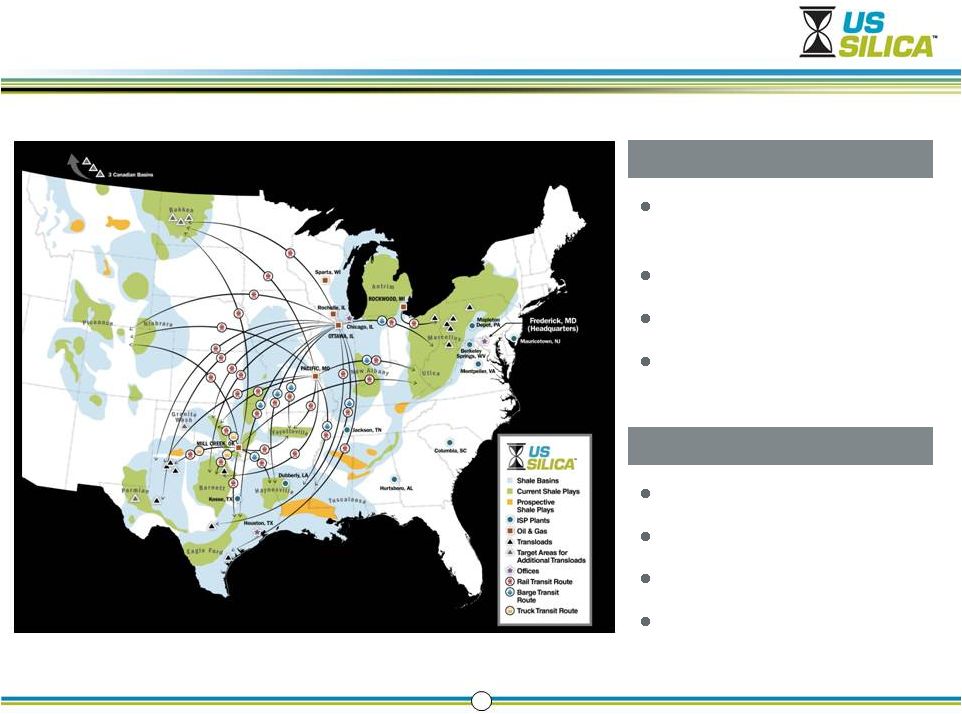

Railroad access on BNSF,

Union Pacific, CN, and CSX

Barge access

13 in-basin transloads

6 to 8 new transloads being

added in key basins

Transportation Assets

Differentiated Footprint and Logistics Capability

7

Scale

Reliability

Flexibility

Cost effectiveness

U.S. Silica Advantages

Right Product, Right Place, Right Time |

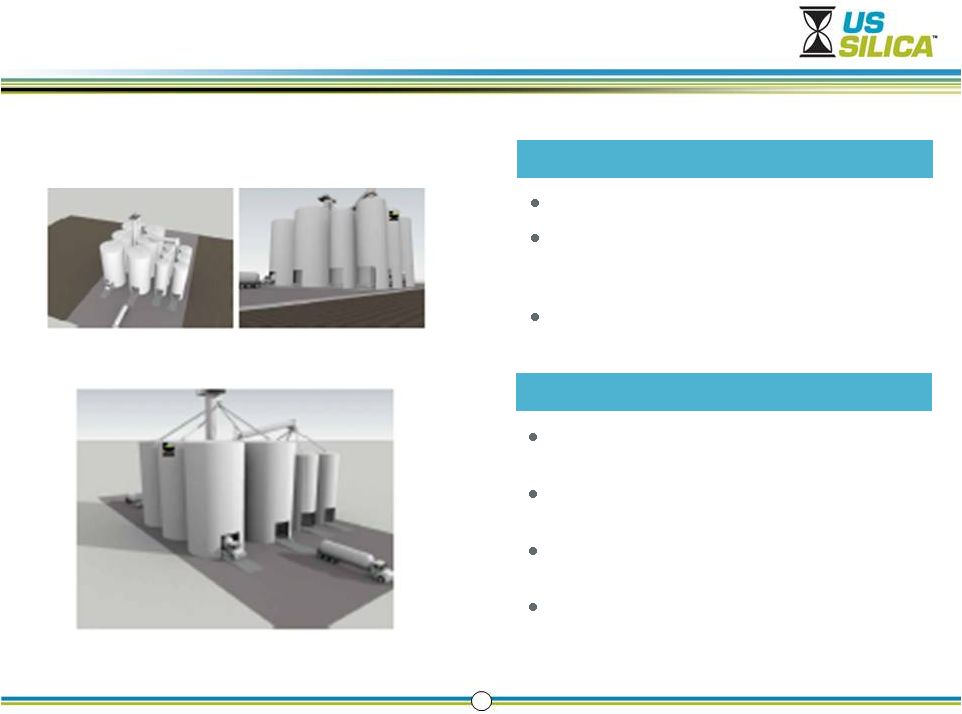

Transloads are a Highly Efficient Logistics Solution

8

Rail terminal located in the basin

Proppant is unloaded from railcars and stored until it

can be transferred to trucks for delivery to the

wellhead

Includes storage silos, equipment for

loading/unloading and local staff

What is a transload?

Dedicated storage allows us to control quality further

into the supply chain

Vertical silos, gravity fed loadout and automated

billing drive a 6-8 minute turnaround time for trucks

Track length allows unit train deliveries which are

both faster and more cost effective

Large storage capacity creates an inventory buffer

between plant and well-head which reduces

disruptions and enables high margin ‘spot sales’

Our design offers key advantages |

USS (Primary Frac

Sand Plants)

Estimated New Project

9

Plant Production Cost Per Ton

(1)

U.S. Silica Primary Frac Plants vs. New Project

Royalties

Lack of onsite

rail

Yield loss due to

lack of industrial

customers

Scale

(%)

Adjusted EBITDA Margin

(4)

Source:

Company Estimates

(1)

Excludes delivery costs

(2)

Represents the U.S. Silica four principal plants used for frac sand, and excludes

the other facilities, which have higher plant production costs (3)

Assumes new projects are built for frac sand product

(4)

See Appendix A for reconciliation to GAAP

(3)

(2)

Structural Cost Advantage Within Industry

0

10

20

30

40

2008

2009

2010

2011

2Q12

LTM

21.2

26.1

29.5

31.7

34.2 |

10

End Market

Applications

USS market

position

Glass

Smartphones, tablets,

containers,

automotive glass,

fiberglass

#1 or #2

supplier

Building

Products

Mortars and grouts,

specialty cements,

roofing shingles,

insulation

#1or #2 supplier

Foundry

Molds for high

temperature castings

and metal casting

products

#3 supplier

Chemicals

Silicon-based

chemicals used in

food processing,

detergents and

polymer additives

#1 or #2 supplier

Fillers and

Extenders

Performance

coatings:

architectural,

industrial and traffic

paints, EMC and

silicone rubber

#1 or #2 supplier

in strategic

markets

USS’s multiple plants provide supply

redundancy and low transportation costs for

customers

Often a single source supplier

Spec’d in to customer formulas due to unique

silica characteristics

Low customer turnover

Drivers of Stability

Stable and Growing Profitability

(1)

Includes combined results for our predecessors

(Segment Contribution Margin, in $MM)

(1)

Irreplaceable Industrial & Specialty Market Position

|

11

Whole Grain

Bulk

Ground

High Purity

Functional surfaces

Specialty packaging

Automotive Glass

Industrial Paints

Roofing Shingles

High end electronics

Polymers

Specialty coatings

~300 miles

Global

Transforming the ISP Segment

Shipping radius

Uses

Characteristics

$s per ton

$s per pound

Growing our Specialty and Performance Products

Implement New Technology

Specialty deposits

Enhanced processing

Investing in new production

capability for specialized

applications

Enhance R&D

New Technical Director

Product Development capability

State-of-the-art lab

Customer technical support

Invest in Talent

New VP/GM

Market Development team

Technical Sales capability |

Line-of-Sight Oil & Gas Organic Growth Elements

12

Initiatives

Description

1Q 2013:

Rochelle Resin-

Coated Proppant

(RCS)

Phase I Capacity: 200 k tons

Phase I Capital: $42-$44

million

2Q 2013: Sparta

Greenfield Mine

Phase I Capacity: 750-850 k

tons

Phase I Capital: $50-$60

million

Potential Future

Initiatives

(2013+)

Phase II of resin coating

expansion

Phase II of Sparta Greenfield

project

Additional Wisconsin

Greenfield projects

International growth

All Permits Received

1Q12

Start Up

1Q2013

Break

Ground

4Q11

RCS Timeline

Sparta Timeline

U.S. Silica’s RCS Highlights

Experienced, best-in-class team

Access to high quality coarse substrate required for oil and liquid rich

basins Located near our Ottawa facility to reduce substrate shipping

costs Access to two class one railroads and barging for outbound shipping

Infrastructure allows us to double production capacity of plant (Phase

II) U.S. Silica Sparta Highlights

38M tons of coarse, northern white reserves

Received all necessary permits to begin construction in January 2012

On-site access to class one railroad

Infrastructure allows us to double production capacity of plant (Phase II)

All Permits Received

3Q12

Site Development and

Begin Construction

2Q12

Start Up

2Q13

Combined RCS & Sparta EBITDA: Expect annualized run

rate of $40MM exiting 2013, ramping up to a run rate of

$65MM exiting 2014. Expect combined EBITDA

contribution of $50-60MM in 2014. |

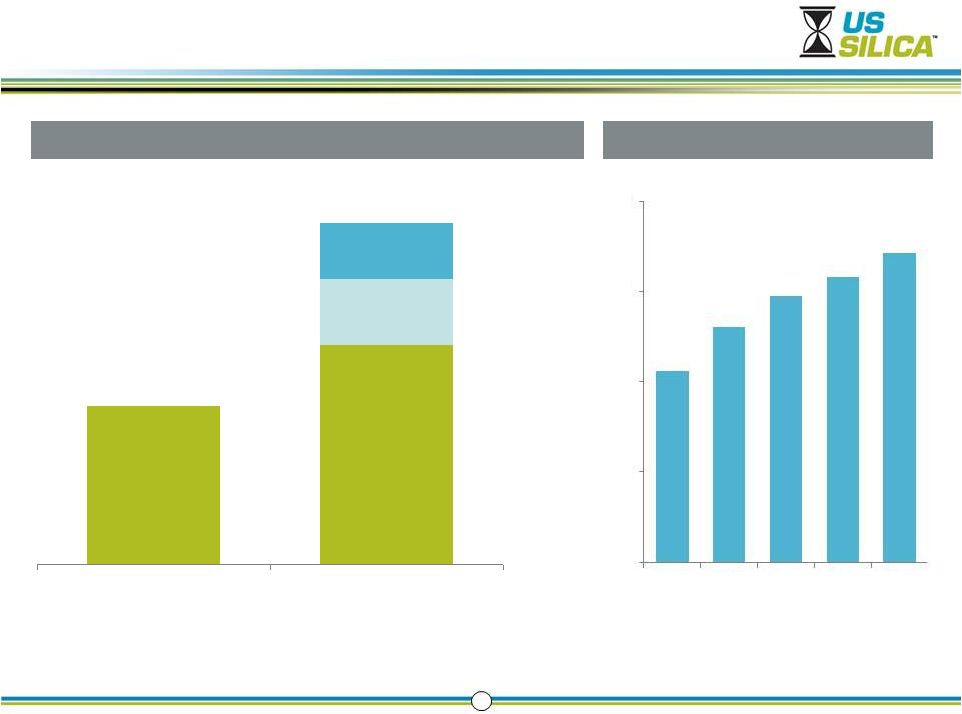

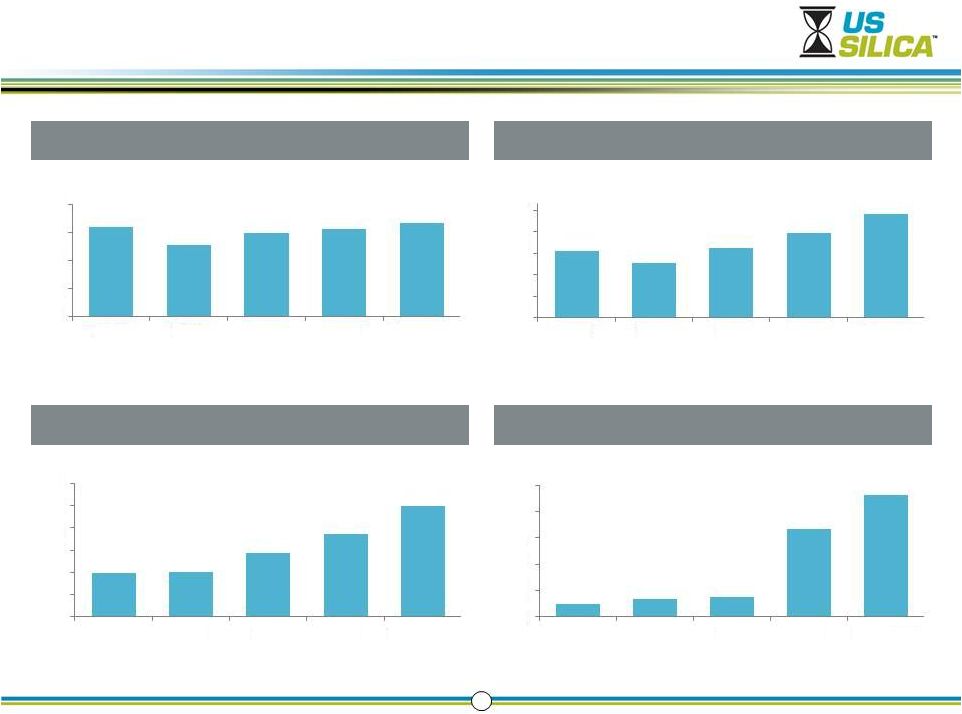

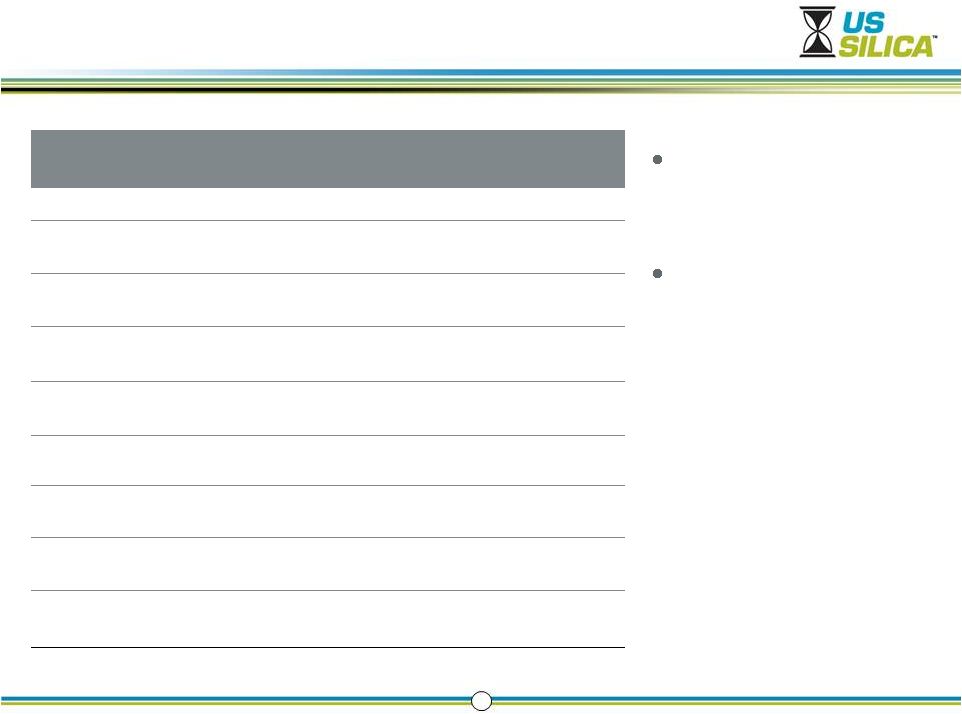

Historical Financial Summary

13

($MM)

Adjusted EBITDA

(1)

($MM)

Volume

Revenue

Capital Expenditures

($MM)

(MM Tons)

(1)

See Appendix A for GAAP reconciliation

6.4

5.1

6.0

6.3

6.7

0.0

2.0

4.0

6.0

8.0

2008

2009

2010

2011

2Q12 LTM

234

192

245

296

364

0

75

150

225

300

375

2008

2009

2010

2011

2Q12 LTM

10

13

15

67

92

0

20

40

60

80

100

2008

2009

2010

2011

2Q12 LTM

50

50

72

94

124

0

25

50

75

100

125

150

2008

2009

2010

2011

2Q12 LTM |

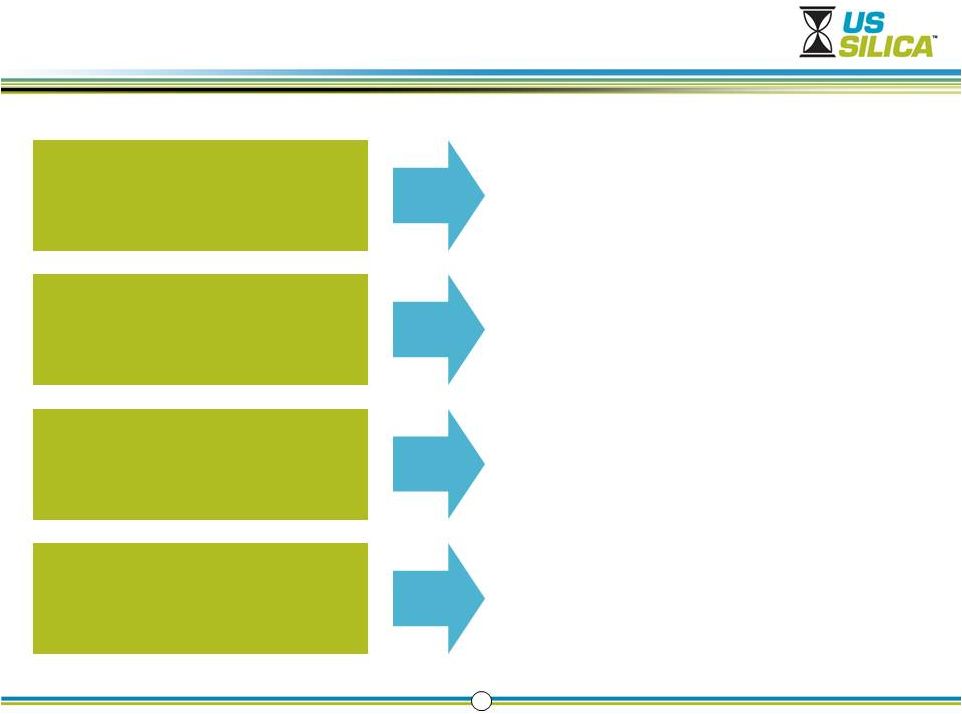

Low

End Guidance

2012 Performance and Momentum

14

Revenue

(1)

($MM)

Adjusted EBITDA and Margin

(1) (2)

($MM)

Net Income

($MM)

Today

Revenue growth with mix shift to higher margin

oil and gas segment

Strong EBITDA growth and expanding margins

Sharply accelerating net income growth

55%+ expansion in oil and gas capacity

(19%+ expansion in total capacity)

Continued mix shift to oil and gas with

contribution margins >60%

RCS start up in 1Q 2013

Sparta start up in 2Q 2013

(1)

No guidance has been provided for 2012 FY Adjusted EBITDA Margin

(2)

See Appendix A for GAAP reconciliation

(%)

Margin

415.0

Revenue

High End

Guidance

150.0

EBITDA

Low End

Guidance

High End

Guidance

Momentum |

Strong Balance Sheet to Fund Growth Initiatives

15

Summary Capitalization

(US$ in thousands)

6/30/2012

12/31/2011

Cash and Cash Equivalents

$ 102,625

$ 59,199

Asset-Based Revolving

Line-of-Credit

–

–

Term Loan Facility

257,400

257,857

Other Borrowings

3,932

3,932

Total Debt

261,332

261,789

Net Debt

158,707

203,433

Leverage (Debt/Adj EBITDA)

(1)

2.1x

2.8x

Net Leverage (Net Debt/Adj EBITDA)

(1)

1.3x

2.2x

$24.0MM capacity under

asset-based revolving

line-of-credit

Total liquidity of ~$126.6MM

for growth initiatives as of

June 30, 2012

(1)

Leverage and Net Leverage as of June 30, 2012 is calculated using LTM Adj EBITDA as

of the reporting date |

16

Leadership and Growth in a Transformative Market

Rapid Demand Growth

Proppant demand growth outpacing

unprecedented shale drilling activity

Supply is Constrained

Barriers to entry and success will

continue to limit new capacity

Scale, asset efficiency and logistics

infrastructure create advantaged position

Line of Site Organic Growth

Near-term, high return growth projects

and ISP transformation

Sustainable Competitive Advantages |

Appendix A

Appendix A |

Reconciliation (Adjusted EBITDA to Net Income)

18

Reconciliation of Adjusted EBITDA

US$ in thousands

Three Months Ended

June 30, 2012

LTM

June 30, 2012

Net Income

19,451

58,951

Total Interest Expense, Net of Interest Income

3,383

14,835

Provisions of Taxes (Benefit)

7,287

17,360

Total Depreciation, Depletion and Amortization Expenses

5,974

22,610

EBITDA

36,095

113,756

Non-Cash Deductions, Losses and Charges

-

(526)

Non-Recurring Expenses (Income)

-

(2,467)

Transaction Expenses

-

156

Permitted Management Fees and Expenses

-

8,937

Non-Cash Incentive Compensation

493

2,234

Post-Employment Expenses (Excluding Service Costs)

404

1,442

Other Adjustments Allowable Under Existing Credit Agreements

120

1,277

Adjusted EBITDA

37,112

124,497

See following page for explanation of adjustments to EBITDA

(1)

(2)

(3)

(4)

(5)

(6)

(7) |

Reconciliation (Adjusted EBITDA to Net Income)

19

(1) Includes non-cash deductions, losses and charges arising from adjustments

to estimates of a future litigation liability.

(2) Includes the gain on the sale of assets and non-recurring expenses related

to a former insurer’s liquidation.

(3) Includes fees and expenses related to the January 27, 2012 amendment of our

Term Loan Facility and Revolving Line-of-Credit.

(4) Includes fees and expenses paid to Golden Gate Capital for ongoing consulting

and management services

provided

pursuant

to

an

Advisory

Agreement

entered

into

in

connection

with

the

Golden

Gate

Capital

Acquisition;

this

Advisory

Agreement

was

terminated

in

connection

with

our

IPO.

(5) Includes vesting of incentive equity compensation issued to our

employees. (6) Includes net pension costs and net post-retirement costs

relating to pension and other post- retirement

benefit

obligations

during

the

applicable

period,

but

in

each

case

excluding

the

service

costs relating to benefits earned during such period.

(7) Reflects miscellaneous adjustments permitted under our existing credit

agreements, including such items as expenses related to reviewing growth

initiatives and potential acquisitions. |

Non-GAAP Financial Performance Measures

20

Segment Contribution

Margin

The Company organizes its business into two reportable segments, Oil & Gas Proppants and

Industrial & Specialty Products, based on end markets. The reportable segments are

consistent with how management views the markets served by the Company and the financial

information reviewed by the chief operating decision maker. The Company manages its Oil &

Gas Proppants and Industrial & Specialty Products businesses as components of an enterprise for

which separate information is available and is evaluated regularly by the chief operating decision

maker in deciding how to allocate resources and assess performance. An operating

segment’s performance is primarily evaluated based on segment contribution margin, which excludes certain

corporate costs not associated with the operations of the segment. These corporate costs are

separately stated and include costs that are related to functional areas such as operations

management, corporate purchasing, accounting, treasury, information technology, legal and human

resources. The Company believes that segment contribution margin, as defined above, is an

appropriate measure for evaluating the operating performance of its segments. However, this

measure should be considered in addition to, not a substitute for, or superior to, income from

operations or other measures of financial performance prepared in accordance with generally

accepted accounting principles. For a reconciliation of segment contribution margin to its most

directly comparable GAAP financial measure, see Note T to our financial statements in our

Quarterly Report a Form 10-Q for quarter ended June 30, 2012.

Adjusted EBITDA

Adjusted EBITDA is not a measure of our financial performance or liquidity under GAAP

and should not be considered as an alternative to net income as a measure of operating

performance, cash flows from operating activities as a measure of liquidity or any other

performance measure derived in accordance with GAAP. Additionally, Adjusted EBITDA is not

intended to be a measure of free cash flow for management’s discretionary use, as it does not

consider certain cash requirements such as interest payments, tax payments and debt service

requirements. Adjusted EBITDA contains certain other limitations, including the failure to

reflect our cash expenditures, cash requirements for working capital needs and cash costs to

replace assets being depreciated and amortized, and excludes certain non-recurring charges that may recur

in the future. Management compensates for these limitations by relying primarily on our GAAP results

and by using Adjusted EBITDA only as a supplement. Our measure of Adjusted EBITDA is not

necessarily comparable to other similarly titled captions of other companies due to potential

inconsistencies in the methods of calculation. |