Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex991.htm |

| EX-95.1 - EXHIBIT 95.1 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex951.htm |

| EX-32.2 - EXHIBIT 32.2 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex322.htm |

| EX-32.1 - EXHIBIT 32.1 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex321.htm |

| EX-31.2 - EXHIBIT 31.2 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex312.htm |

| EX-31.1 - EXHIBIT 31.1 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex311.htm |

| EX-23.1 - EXHIBIT 23.1 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex231.htm |

| EX-21.1 - EXHIBIT 21.1 - U.S. SILICA HOLDINGS, INC. | slca-20171231x10xkxex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2017 | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-35416

U.S. Silica Holdings, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 26-3718801 | |

(State or other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

8490 Progress Drive, Suite 300

Frederick, Maryland 21701

(Address of Principal Executive Offices) (Zip Code)

(301) 682-0600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Act:

Title of each class: | Name of each exchange on which registered: | |

Common Stock, par value $0.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Securities Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the outstanding common stock held by non-affiliates of the registrant as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, was $2,870,547,820 based on the closing price of $35.49 per share, as reported on the New York Stock Exchange.

As of February 16, 2018, 80,539,945 shares of the common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of Form 10-K Certain sections of the Proxy Statement for the 2018 Annual Meeting of Shareholders for U.S. Silica Holdings, Inc.

U.S. Silica Holdings, Inc.

FORM 10-K

For the Fiscal Year Ended December 31, 2017

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

• | fluctuations in demand for commercial silica; |

• | the cyclical nature of our customers’ businesses; |

• | operating risks that are beyond our control, such as changes in the price and availability of transportation, natural gas or electricity; unusual or unexpected geological formations or pressures; cave-ins, pit wall failures or rock falls; or unanticipated ground, grade or water conditions; |

• | our dependence on five of our plants for a significant portion of our sales; |

• | the level of activity in the natural gas and oil industries; |

• | decreased demand for frac sand or the development of either effective alternative proppants or new processes to replace hydraulic fracturing; |

• | federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related regulatory action or litigation affecting our customers’ operations; |

• | our rights and ability to mine our properties and our renewal or receipt of the required permits and approvals from governmental authorities and other third parties; |

• | our ability to implement our capacity expansion plans within our current timetable and budget and our ability to secure demand for our increased production capacity, and the actual operating costs once we have completed the capacity expansion; |

• | our ability to succeed in competitive markets; |

• | loss of, or reduction in, business from our largest customers; |

• | increasing costs or a lack of dependability or availability of transportation services and transload network access or infrastructure; |

• | extensive regulation of trucking services; |

• | our ability to recruit and retain truckload drivers; |

• | increases in the prices of, or interruptions in the supply of, natural gas and electricity, or any other energy sources; |

• | increases in the price of diesel fuel; |

• | diminished access to water; |

• | our ability to successfully complete acquisitions or integrate acquired businesses; |

• | our ability to make capital expenditures to maintain, develop and increase our asset base and our ability to obtain needed capital or financing on satisfactory terms; |

• | our substantial indebtedness and pension obligations; |

• | restrictions imposed by our indebtedness on our current and future operations; |

• | contractual obligations that require us to deliver minimum amounts of frac sand or purchase minimum amounts of services; |

• | the accuracy of our estimates of mineral reserves and resource deposits; |

1

• | a shortage of skilled labor and rising costs in the mining industry; |

• | our ability to attract and retain key personnel; |

• | our ability to maintain satisfactory labor relations; |

• | our reliance on patents, trade secrets and contractual restrictions to protect our proprietary rights; |

• | our significant unfunded pension obligations and post-retirement health care liabilities; |

• | our ability to maintain effective quality control systems at our mining, processing and production facilities; |

• | seasonal and severe weather conditions; |

• | fluctuations in our sales and results of operations due to seasonality and other factors; |

• | interruptions or failures in our information technology systems; |

• | the impact of a terrorist attack or armed conflict; |

• | extensive and evolving environmental, mining, health and safety, licensing, reclamation and other regulation (and changes in their enforcement or interpretation); |

• | silica-related health issues and corresponding litigation; |

• | our ability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property; and |

• | other factors included and disclosed in Part I, Item 1A, “Risk Factors” and elsewhere in this Annual Report on Form 10-K. |

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other filings with the Securities and Exchange Commission (the “SEC”) and public communications. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

2

PART I.

ITEM 1. | BUSINESS |

Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “U.S. Silica,” “the Company,” “our business,” “our company” refer to U.S. Silica Holdings, Inc. and its consolidated subsidiaries as a combined entity. Adjusted EBITDA as used herein is a non-GAAP measure. For a detailed description of Adjusted EBITDA and a reconciliation to the most comparable GAAP measure, please see the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations – How We Evaluate Our Business – Adjusted EBITDA.”

Our Company

Business Overview

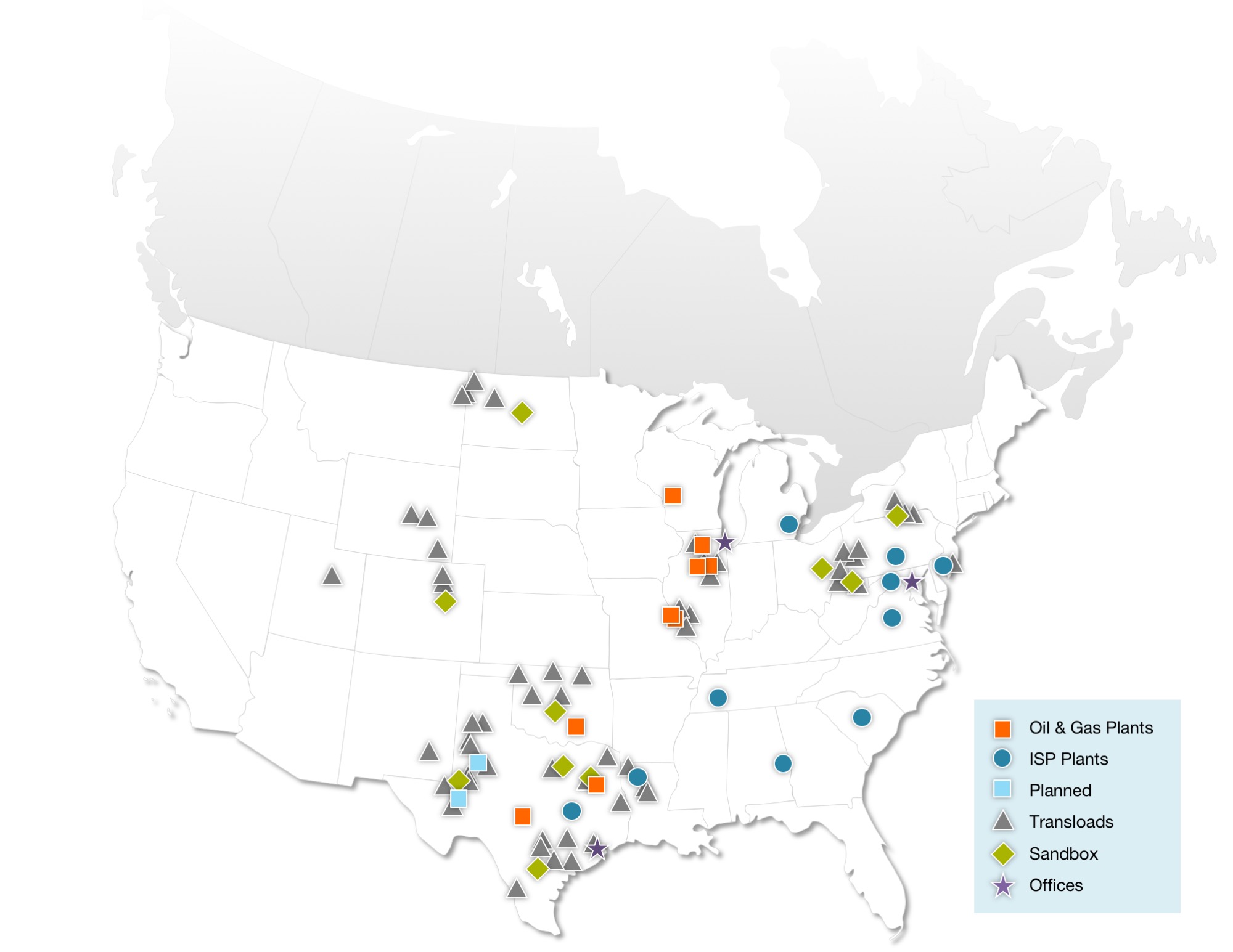

We are one of the largest domestic producers of commercial silica, a specialized mineral that is a critical input into a variety of attractive end markets. During our 118-year history, we have developed core competencies in mining, processing, logistics and materials science that enable us to produce and cost-effectively deliver over 239 products to customers across these markets. As of December 31, 2017, we operate 19 production facilities across the United States and control 765 million tons of reserves of commercial silica, which can be processed to make 323 million tons of finished products that meet American Petroleum Institute ("API") frac sand specifications.

On August 16, 2016, we completed the acquisition of New Birmingham, Inc. ("NBI"), a regional sand producer located near Tyler, Texas. On August 22, 2016, we completed the acquisition of Sandbox Enterprises, LLC ("Sandbox" or the “Sandbox Acquisition”) as a “last mile” logistics solution for frac sand in the oil and gas industry.

On April 1, 2017, we completed the acquisition of White Armor, a product line of cool roof granules used in industrial roofing applications. On August 16, 2017, we completed the acquisition of Mississippi Sand, LLC ("MS Sand"). MS Sand is a frac sand mining and logistics company based in St. Louis, Missouri.

For more information regarding these acquisitions, see Note D - Business Combinations to our Financial Statements in Part II, Item 8 to this Annual Report on Form 10-K.

Our operations are organized into two segments based on end markets served: (1) Oil & Gas Proppants and (2) Industrial & Specialty Products. In our largest end market, oil and gas proppants, our frac sand is used to stimulate and maintain the flow of hydrocarbons in oil and natural gas wells. We produce a wide range of frac sand sizes and are capable of efficient delivery of large quantities of API grade frac sand to most of the major U.S. shale basins via our logistics network. Our silica is also used as an economically irreplaceable raw material in a wide range of industrial applications, including glassmaking and chemical manufacturing. Additionally, in recent years a number of attractive new end markets have developed for our high-margin, performance silica products, including high-performance glass, specialty coatings, polymer additives and geothermal energy systems. Our segments are complementary because our ability to sell to a wide range of customers across end markets allows us to maximize recovery rates in our mining operations, optimize our asset utilization and reduce the cyclicality of our earnings.

Corporate History

U.S. Silica Holdings, Inc. was incorporated under the laws of the State of Delaware on November 14, 2008. U.S. Silica Company, which has been a domestic producer of commercial silica for 118 years, became a wholly-owned subsidiary of the Company on November 25, 2008. On January 31, 2012, we completed our initial public offering of our common stock.

Our Strengths

We attribute our success to the following strengths:

• | Large-scale producer with a diverse and high-quality reserve base. Our 19 geographically dispersed production facilities control 765 million tons of reserves, including API size frac sand and large quantities of silica with distinct characteristics, giving us the ability to sell over 239 products to customers in both our Oil & Gas Proppants segment and Industrial & Specialty Products segment. Our large-scale production, logistics capabilities and long reserve life make us a preferred commercial silica supplier to our customers. Our consistent, reliable supply of large quantities of silica gives our customers the security to customize their production processes around our commercial silica. Furthermore, our large scale provides us earnings diversification and a larger addressable market. |

• | Geographically advantaged footprint with intrinsic transportation advantages. The strategic location of our facilities and our logistics capabilities enable us to enjoy high customer retention and a larger addressable market. |

3

In our Oil & Gas Proppants segment, our network of frac sand production facilities with access to Class I rail either onsite or by truck and the strategic locations of our transloads serve to create an addressable market that includes every major U.S. shale basin. We believe we are one of the few frac sand producers capable of cost-effectively delivering API grade frac sand to most of the major U.S. shale basins by on-site rail.

• | On August 16, 2017, we completed the acquisition of MS Sand, a frac sand mining and logistics company based in St. Louis, Missouri. |

• | In July 2017, we purchased a new Greenfield site near Lamesa, Texas, which depending on market conditions, could become operational as early as the second quarter of 2018 and add approximately 2.6 million tons of annual frac sand capacity. |

• | In May 2017, we purchased a new Greenfield site in Crane County, Texas, which depending on market conditions, could become operational as early as the first quarter of 2018 and add approximately 4 million tons of annual frac sand capacity. |

• | On August 16, 2016, we acquired NBI, the ultimate parent company of NBR Sand, LLC, a regional sand producer located near Tyler, Texas. This facility allows customers to ship regional sand directly to the wellheads in the Texas and Louisiana basins by truck, which provides us with a delivered cost advantage. |

• | On August 22, 2016, we completed the acquisition of Sandbox, a provider of logistics solutions and technology for the transportation of proppant used in hydraulic fracturing in the oil and gas industry. Sandbox provides “last mile” logistics to oil and gas companies. Sandbox has operations in Texas (Midland/Odessa, Kenedy, Dallas/Fort Worth, Tyler); Morgantown, West Virginia; western North Dakota; northeast of Denver, Colorado; Oklahoma City, Oklahoma; Cambridge, Ohio and Mansfield, Pennsylvania, where its major customers are located, which allowed us to expand our frac sand offering directly to customers' wellhead locations. |

Additionally, due to the high weight-to-value ratio of many silica products in our Industrial & Specialty Products segment, the proximity of our facilities to our customers’ facilities often results in us being their sole supplier. This advantage has enabled us to enjoy strong customer retention in this segment, with our top five Industrial & Specialty Products segment customers purchasing from us for an average of over 50 years.

• | Low-cost operating structure. We focus on building and operating facilities with low delivered cost that will allow us to be successful through market cycles. We believe the combination of the following factors contributes to our low-cost structure and our high margins: |

• | our ownership of the vast majority of our reserves, resulting in mineral royalty expense that was less than 0.1% of our sales in 2017; |

• | the close proximity of our mines to their respective processing plants, which allows for a cost-efficient and highly automated production process; |

• | our processing expertise, which enables us to create over 239 products with unique characteristics while minimizing waste; |

• | our integrated logistics management expertise and geographically advantaged facility network, which enables us to reliably ship products by the most cost-effective method available, whether by truck, rail or barge, to meet the needs of our customers, whether at in-basin transload locations or directly at wellhead locations via our Sandbox operations; |

• | our large customer base across numerous end markets, which allows us to maximize our mining recovery rate and asset utilization; and |

• | our large overall and plant-level operating scale. |

• | Strong reputation with our customers and the communities in which we operate. We believe that we have built a strong reputation during our 118-year operating history. Our customers know us for our dependability and our high-quality, innovative products, as we have a long track record of timely delivery of our products according to customer specifications. We also have an extensive network of technical resources, including materials science and petroleum engineering expertise, which enables us to collaborate with our customers to develop new products and improve the performance of their existing applications. We are also well known in the communities in which we operate as a preferred employer and a responsible corporate citizen, which generally serves us well in hiring new employees and securing difficult to obtain permits for expansions and new facilities. |

• | Experienced management team. The members of our senior management team bring significant experience to the dynamic environment in which we operate. Their expertise covers a range of disciplines, including industry-specific |

4

operating and technical knowledge as well as experience managing high-growth businesses. We believe we have assembled a flexible, creative and responsive team that can quickly adapt to the rapidly evolving unconventional oil and natural gas drilling landscape.

Our Business Strategy

The key drivers of our growth strategy include:

• | Expand our Oil & Gas Proppants production capacity and product portfolio. We continue to consider and execute several initiatives to increase our frac sand production capacity and augment our proppant product portfolio. We are evaluating Greenfield opportunities and are expanding production capacities and maximizing production efficiencies of our existing facilities. |

• | Increase our presence and product offering in industrial and specialty products end markets. Our research and business development teams work in tandem with our customers to develop new products, which we expect will either increase our presence and market share in certain industrial and specialty products end markets or allow us to enter new markets. We manage a robust pipeline of new products in various stages of development. Some of these products have already come to market, resulting in a positive impact on our financial results. We continue to work toward offering more value-driven industrial and specialty products that will enhance the profitability of the business. For instance, on April 1, 2017, we completed the White Armor acquisition, a product line of cool roof granules used in industrial roofing applications. |

• | Optimize product mix and further develop value-added capabilities to maximize margins. We continue to actively manage our product mix at each of our plants to ensure we maximize our profit margins. This requires us to use our proprietary expertise in balancing key variables, such as mine geology, processing capacities, transportation availability, customer requirements and pricing. We expect to continue investing in ways to increase the value we provide to our customers by expanding our product offerings, improving our supply chain management, upgrading our information technology, and creating a world class customer service model. |

• | Expand our supply chain network and leverage our logistics capabilities to meet our customers’ needs in each strategic oil and gas basin. We continue to expand our logistics network to ensure product is available to meet the in-basin needs of our customers. This approach allows us to provide strong customer service and puts us in a position to take advantage of opportunistic spot market sales. Our plant sites are strategically located to provide access to key Class I railroads, which enables us to cost effectively send product to each of the strategic basins in North America. We can ship product by truck, barge and rail with an ability to connect to short-line railroads as necessary to meet our customers’ evolving in-basin product needs. We believe that our supply chain network and logistics capabilities are a competitive advantage that enables us to provide superior service for our customers. We expect to continue to make strategic investments and develop partnerships with transload operators and transportation providers that will enhance our portfolio of supply chain services that we can provide to customers. As of December 31, 2017, we have storage capacity at 56 transloads located near all of the major shale basins in the United States. Our acquisition of Sandbox extends our delivery capability directly to our customers' wellhead locations, which increases efficiency and provides a lower cost logistics solution for our customers. Sandbox has operations in Texas (Midland/Odessa, Kenedy, Dallas/Fort Worth, Tyler); Morgantown, West Virginia; western North Dakota; northeast of Denver, Colorado; Oklahoma City, Oklahoma; Cambridge, Ohio and Mansfield, Pennsylvania, where its major customers are located. |

• | Evaluate both Greenfield and Brownfield expansion opportunities and other acquisitions. We expect to continue leveraging our reputation, processing capabilities and infrastructure to increase production, as well as explore other opportunities to expand our reserve base. |

◦ | We may accomplish this by developing Greenfield projects, where we can capitalize on our technical knowledge of geology, mining and processing and our strong reputation within local communities. For instance, in May 2017, we purchased a new Greenfield site in Crane County, Texas, which depending on market conditions, could become operational as early as the first quarter of 2018 and add approximately 4 million tons of annual frac sand capacity. Additionally, in July 2017, we purchased a new Greenfield site near Lamesa, Texas, which depending on market conditions, could become operational as early as the second quarter of 2018 and add approximately 2.6 million tons of annual frac sand capacity. |

◦ | We are continuing to actively pursue acquisitions to grow by taking advantage of our asset footprint, our management’s experience with high-growth businesses, and our strong customer relationships. Our primary objective is to acquire assets with differing levels of frac sand qualities that are complementary to our Oil & Gas Proppants segment, with a focus on mining, processing and logistics to further enhance our |

5

market presence. We prioritize acquisitions that provide opportunities to realize synergies (and, in some cases, the acquisition may be immediately accretive assuming synergies), including entering new geographic and frac sand product markets, acquiring attractive customer contracts and improving operations. On August 16, 2016, we completed our acquisition of NBI, the ultimate parent company of NBR Sand, LLC, a regional sand producer located near Tyler, Texas. On August 22, 2016, we completed the acquisition of Sandbox, a provider of logistics solutions and technology for the transportation of proppant used in hydraulic fracturing in the oil and gas industry. On August 16, 2017, we completed our acquisition of MS Sand, a frac sand mining and logistics company based in St. Louis, Missouri. We are in active discussions to acquire additional assets fitting this strategy, which, if completed, could be “significant” under Regulation S-X and could require additional sources of financing. There can be no assurance that we will reach a definitive agreement and complete any of these potential transactions. See the risk factors disclosed in Item 1A of Part I of this Annual Report on Form 10-K, including the risk factor entitled, “If we cannot successfully complete acquisitions or integrate acquired businesses, our growth may be limited and our financial condition may be adversely affected.”

• | Maintain financial strength and flexibility. We intend to maintain financial strength and flexibility to enable us to better manage through industry downturns and pursue acquisitions and new growth opportunities as they arise. In March 2016, we completed a public offering of 10,000,000 shares of our common stock for total cash net proceeds of $186.2 million. In November 2016, we executed another offering of 10,350,000 shares of common stock raising net cash proceeds of $467.0 million. As of December 31, 2017, we had $384.6 million of cash on hand and $45.5 million of availability under our revolving credit facility (the "Revolver"). |

Our Products

In order to serve a broad range of end markets, we produce and sell a variety of commercial silica products, including whole grain and ground products, as well as other industrial mineral products that we believe complement our commercial silica products.

Whole Grain Silica Products—We sell whole grain commercial silica products in a range of shapes, sizes and purity levels. We sell whole grain silica that has a round shape and high crush strength to be used as frac sand in connection with oil and natural gas recovery, and we have the capability to produce resin coated sand.

We also sell whole grain silica products in a range of size distributions, grain shapes and chemical purity levels to our customers involved in the manufacturing of glass products, including a low-iron whole grain product sold to manufacturers of architectural and solar glass applications. In addition, we sell several grades of whole grain round silica to the foundry industry and provide whole grain commercial silica to the building products industry. Sales of whole grain commercial silica products and coated proppants accounted for approximately 91%, 86%, and 88% of our total sales revenue for 2017, 2016 and 2015, respectively.

Ground Silica Products—Our ground commercial silica products are inherently inert, white and bright, with high purity. We market our ground silica in sizes ranging from 40 to 250 microns for use in plastics, rubber, polishes, cleansers, paints, glazes, textile fiberglass and precision castings. We also produce and market fine ground silica in sizes ranging from 5 to 40 microns for use in premium paints, specialty coatings, sealants, silicone rubber and epoxies. We believe we are currently the only commercial silica producer in the United States that manufactures a 5-micron product. Sales of ground silica products accounted for approximately 7%, 12%, and 9% of our total sales revenue for 2017, 2016 and 2015 respectively.

Industrial Mineral Products—We also produce and sell certain other industrial mineral products, such as aplite and magnesium silicate. Aplite is a mineral used to produce container glass and insulation fiberglass and is a source of alumina that has a low melting point and a low tendency to form defects in glass. We also produce and sell a highly selective adsorbent made from a mixture of silica and magnesium, used extensively in preparative and analytical chromatography. Sales of our other industrial mineral products accounted for approximately 2%, 2%, and 3% of our total sales revenue for 2017, 2016 and 2015, respectively.

Our Industry

The commercial silica industry consists of businesses that are involved in the mining, processing and distribution of commercial silica. Commercial silica, also referred to as “silica,” “industrial sand and gravel,” “sand,” “silica sand” and “quartz sand,” is a term applied to sands and gravels containing a high percentage of silica (silicon dioxide, SiO2) in the form of quartz. Commercial silica deposits occur throughout the United States, but mines and processing facilities are typically located near end markets and in areas with access to transportation infrastructure. Other factors affecting the feasibility of commercial silica production include deposit composition, product quality specifications, land-use and environmental regulation, including

6

permitting requirements, access to electricity, natural gas and water and a producer’s expertise and know-how. New entrants face serious hurdles to establish their operations, including:

• | the difficulty of finding silica reserves suitable for use as frac sand, which, according to the API, must meet stringent technical specifications, including, among others, sphericity, grain size, crush resistance, acid solubility, purity and turbidity; |

• | the difficulty of securing contiguous reserves of silica large enough to justify the capital investment required to develop a mine, processing plant, product storage and rail track; |

• | a lack of industry-specific geological, exploration, development and mining knowledge and experience needed to enable the identification, acquisition and development of high-quality reserves; |

• | the difficulty of identifying reserves with the above characteristics that either are located in close proximity to oil and natural gas reservoirs or have the rail access needed for low-cost transportation to major shale basins; |

• | the difficulty of securing mining, production, water, air, refuse and other federal, state and local operating permits from the proper authorities, a process that can require up to three years; and |

• | the difficulty of assembling a large, diverse portfolio of customers to optimize operations. |

Extraction Processes

Commercial silica deposits are formed from a variety of sedimentary processes and have distinct characteristics that range from hard sandstone rock to loose, unconsolidated dune sands. While the specific extraction method utilized depends primarily on the deposit composition, most silica is mined using conventional open-pit bench extraction methods and begins after clearing the deposit of any overlaying soil and organic matter. The silica deposit composition and chemical purity also dictate the processing methods and equipment utilized. For example, broken rock from a sandstone deposit may require one, two or three stages of crushing to liberate the silica grains required for most markets. Unconsolidated deposits may require little or no crushing, as silica grains are not tightly cemented together.

We conduct only surface mining operations and do not operate any underground mines, although we do lease underground reserves at our Festus, MO, operation, which are being mined underground by a contractor. Mining methods at our facilities include conventional hard rock mining, hydraulic mining, surface or open-pit mining of loosely consolidated silica deposits and dredge mining. Hard rock mining involves drilling and blasting in order to break up sandstone into sizes suitable for transport to the processing facility by truck, slurry or conveyor. Hydraulic mining involves spraying high-pressure water to break up loosely consolidated sandstone at the mine face. Surface or open-pit mining involves using earthmoving equipment, such as bucket loaders, to gather silica deposits for processing. Lastly, dredging involves gathering silica deposits from mining ponds and transporting them by slurry pipelines for processing. We may also use slurry pipelines in our hydraulic and open-pit mining efforts to expedite processing. Silica mining and processing typically has less of an environmental impact than the mining and processing of other minerals, in part because it uses fewer chemicals. Our processing plants are equipped to receive the mined sand, wash away impurities, eliminate oversized or undersized particles and remove moisture through a multi-stage drying process. Our 19 production facilities are located primarily in the eastern half of the United States, with operations in Alabama, Illinois, Louisiana, Michigan, Missouri, New Jersey, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, West Virginia and Wisconsin. Each of our facilities operates year-round, typically in shift schedules designed to optimize facility utilization in accordance with market demand. Our facilities receive regular preventative maintenance, and we make additional capital investments in our facilities as required to support customer volumes and internal performance goals. For more information related to our production facilities, see Item 2, “Properties”.

We believe we have a broad and high quality mineral reserves base due to our strategically located mines and facilities. At December 31, 2017, we estimate that we had approximately 765 million tons of proven and probable mineral reserves. The quantity and nature of the mineral reserves at each of our properties are estimated by our mining engineers. Our mining engineers update our reserve estimates annually, making necessary adjustments for reserve usage at each location during the year and additions or reductions due to property acquisitions and dispositions, quality adjustments and mine plan updates. Before acquiring new reserves, we perform surveying, drill core analysis and other tests to confirm the quantity and quality of the acquired reserves. In some instances, we acquire the mineral rights to reserves without actually taking ownership of the properties. For more information related to our production facilities, deposits and reserves, see Item 2, “Properties”.

Production Processes

After extracting the ore, the silica is washed with water to remove fine impurities such as clay and organic particles. In some deposits, these fine contaminants or impurities are tightly bonded to the surface of the silica grain and require attrition scrubbing to be removed. Other deposits require the use of flotation to collect and separate contaminants from the silica. When

7

these contaminants are weakly magnetic, special high intensity magnets may be utilized in the process to improve the purity of the final commercial silica product. After the silica has been washed, most output is dried prior to sale.

The next step in the production process involves the classification of commercial silica products according to their chemical purity, particle shape and particle size distribution. Generally, commercial silica is produced and sold in either whole grain form or ground form. Whole grain silica generally ranges from 12 to 140 mesh. Mesh refers to the number of openings per linear inch on a sizing screen. Whole grain silica products are sold in a range of shapes, sizes and purity levels to be used in a variety of industrial applications, such as oil and natural gas hydraulic fracturing proppants, glass, foundry, building products, filtration and recreation. Some whole grain silica is further processed to ground silica of much smaller particle sizes, ranging from 5 to 250 microns. A micron is one-millionth of a meter.

Quality Control

We maintain a standard of excellence through our mining and processing facilities some of which include ISO 9001-registered quality systems. We use automated process control systems that efficiently manage the majority of the mining and processing functions, and we monitor the quality and consistency of our products by conducting hourly tests throughout the production process to detect variances. All of our major facilities operate a testing laboratory to evaluate and ensure the quality of our products and services. We also provide customers with documentation verifying that all products shipped meet customer specifications. These quality assurance functions ensure that we deliver quality products to our customers and maintain customer trust and loyalty.

In addition, we have certain company-wide quality control mechanisms. We maintain a company-wide quality assurance database that facilitates easy access and analysis of product and process data from all plants. We also have fully staffed and equipped corporate laboratories that provide critical technical expertise, analytical testing resources and application development to promote product value and cost savings. The labs consist of different departments: a foundry lab, a paint and coatings lab, an analytical lab, a minerals-processing lab and an oil and gas lab. The foundry lab is fully equipped for analyzing foundry silica based on grain size distribution, acidity, acid demand value and turbidity, which is a measure of silica cleanliness. The paint and coatings lab provides formulation, application, and testing of paints, coatings and grouts for end use in fillers and extenders as well as building products. The analytical lab performs various analyses on products for quality control assessment. The minerals processing lab models plant production processes to test variations in deposits and improve our ability to meet customer requirements. The oil and gas lab performs testing and provides in-depth analysis of all types of hydraulic fracturing proppants to verify products meet specifications, such as API size and crush strength specifications. Additionally, this lab is responsible for the development of new resin coated products and the technical oversight of our Rochelle, Illinois facility.

Distribution

We ship our commercial silica products direct to our customers by truck, rail or barge and through our network of in-basin transloads. Recent trends in the oil and gas market and the expansion of our logistics footprint have resulted in more of our product volumes being transported by high-efficiency unit trains over the past two years. During 2017, we shipped 349 unit trains to both our transload sites and our customers. Our recent acquisition of Sandbox extends our delivery capability directly to our customers' wellhead locations. Sandbox provides “last mile” logistics to companies in the oil and gas industry, which increases efficiency and provides a lower cost logistics solution for our customers. Sandbox has operations in Texas (Midland/Odessa, Kenedy, Dallas/Fort Worth, Tyler); Morgantown, West Virginia; western North Dakota; northeast of Denver, Colorado; Oklahoma City, Oklahoma; Cambridge, Ohio and Mansfield, Pennsylvania, where its major customers are located.

For bulk commercial silica, transportation cost represents a significant portion of the overall product cost. Generally, we utilize trucks for shipments of 200 miles or less from our plant sites and to distribute our bagged products. Given the weight-to-value ratio of most of our products, the majority of our shipments outside this 200-mile radius are by rail. As a result, facility location is one of the most important considerations for producers and customers. Generally, our plant sites are strategically located to provide access to all Class I railroads or in strategic shale basins, which enables us to cost effectively send product to points of end use in North America.

We are continuously looking to increase the number of available transload points to which we have access. This approach allows us to provide strong customer service and puts us in a position to take advantage of opportunistic spot market sales. As of December 31, 2017, we have 56 transload facilities strategically located in or near all major shale basins in the United States. For more information related to our transload facilities, see Item 2, “Properties”.

Both we and our customers lease a significant number of railcars for shipping purposes, as well as to facilitate the short-term storage of our products, particularly our frac sand products. As of December 31, 2017, we leased a fleet of 7,111 railcars, of which no empty cars were in storage.

8

In addition to bulk shipments, commercial silica products can be packaged and shipped in 50 to 100 pound bags or bulk super sacks. Bag shipments are usually made to smaller customers with batch operations, warehouse distributor locations or for ocean container shipments made overseas. The products that are shipped in bags are often higher value products, such as ground and fine.

Primary End Markets

The special properties of commercial silica-chemistry, purity, grain size, color, inertness, hardness and resistance to high temperatures-make it critical to a variety of industries. Commercial silica is a key input in the well completion process, specifically, in the hydraulic fracturing techniques used in unconventional oil and natural gas wells. In the industrial and specialty products end markets, stringent quality requirements must be met when commercial silica is used as an ingredient to produce thousands of everyday products, including glass, building and foundry products and metal castings, as well as certain specialty applications such high-performance glass, specialty coatings, polymer additives and geothermal energy systems. Due to the unique properties of commercial silica, it is an economically irreplaceable raw material in a wide range of industrial applications. Our major end markets include:

Oil and Gas Proppants

Commercial silica is used as a proppant for oil and natural gas recovery in conventional and unconventional resource plays. Unconventional oil and natural gas production requires hydraulic fracturing and other well stimulation techniques to recover oil or natural gas that is trapped in the source rock and typically involves horizontal drilling. Frac sand is pumped down oil and natural gas wells at high pressures to prop open rock fissures in order to increase the flow rate of hydrocarbons from the wells. Proppants are also used in the "refracturing" process where older wells are restimulated using newer technologies and additional frac sand as a viable and lower-cost alternative to drilling new wells. The frac sand market experienced substantial growth from 2008 until 2014, driven by the growth in the use of hydraulic fracturing. From 2015 and through most of 2016, the frac sand market was negatively impacted due to reduced oil and gas drilling and completion activity in North America. Oil and gas drilling activity increased throughout 2017, leading to more completion activity. Leading indicators for completion activity suggest stabilization or even an increase in the near future.

Glass

Commercial silica is a critical input into and accounts for 55% to 75% of the raw materials in glass production. The glassmaking markets served by commercial silica producers include containers, flat glass, specialty glass and fiberglass. Demand typically varies within each of these end markets.

The container glass, flat glass and fiberglass end markets are generally mature end markets. Demand for container glass has historically grown in line with population growth, and we expect similar growth in the future. Flat glass and fiberglass tend to be correlated with construction and automotive production activity. While construction activity has improved during the past few years, automotive production activity has experienced recent declines. To the extent construction and domestic automotive production activity grow in the coming years, we expect that demand in these end markets will continue to increase. Some of the anticipated growth in the glass markets may be offset through the use of recycled glass.

Building Products

Commercial silica is used in the manufacturing of building products for commercial and residential construction. Whole grain commercial silica products are used in flooring compounds, mortars and grouts, specialty cements, stucco and roofing shingles. Ground commercial silica products are used by building products manufacturers in the manufacturing of certain fiberglass products and additionally as functional extenders and to add durability and weathering properties to cementious compounds. In addition, geothermal wells are an alternative energy source that requires specialized ground silica products in their well casings for effectiveness. The market for commercial silica used to manufacture building products is driven primarily by the demand in the construction markets. The historical trend for this market has been one of growth, especially in demand for cementious compounds for new construction, renovation and repair. We have seen an increase in permits and housing starts since 2012, and those gains continued in 2017. To the extent the housing market growth continues in the coming years, we expect that demand in this end market will increase.

Foundry

Commercial silica products are used in the production of molds for metal castings and in metal casting products. In addition, commercial whole grain silica is sold to coaters of foundry silica, or coated internally, who then sell their product to foundries for cores and shell casting processes. The demand for foundry silica primarily depends on the rate of automobile and light truck production, construction and production of heavy equipment like rail cars. Over the past decade, there has been some movement of foundry supply chains to Mexico and other offshore production areas. We have experienced increases in

9

foundry demand since 2011. During 2017, several of the foundry markets continued to see growth. To the extent production levels continue to strengthen in the coming years, we expect that demand in this end market will increase.

Chemicals

Both whole grain and ground silica products are used in the manufacturing of silicon-based chemicals, such as sodium silicate, that are used in a variety of applications, including food processing, detergent products, paper textile, specialty foundry applications and as inputs for some precipitated silicas. This end market is driven by the development of new products by the chemicals manufacturers, including specialty coatings and polymer additives as well as the growth of “green” tires. We expect this end market to grow as these manufacturers continue their product and applications development.

Fillers and Extenders

Commercial silica products are sold to producers of paints and coating products for use as fillers and extenders in architectural, industrial and traffic paints and are sold to producers of rubber and plastic for use in the production of epoxy molding compounds and silicone rubber. The commercial silica products used in this end market are most often ground silica, including finer ground classifications. The market for fillers and extenders is driven by demand in the construction and automotive production industries as well as by demand for materials in the housing remodeling industry. We have experienced increases in demand in these sectors since 2011. To the extent these industries continue to grow in the coming years, we expect demand to increase.

Our Customers

We sell our products to a variety of end markets. Our customers in the oil and gas proppants end market include major oilfield services companies and exploration and production companies that are engaged in hydraulic fracturing. Sales to the oil and gas proppants end market comprised approximately 82%, 65%, and 67% of our total sales revenue in 2017, 2016 and 2015, respectively.

Our primary markets have historically been core industrial end markets with customers engaged in the production of glass, building products, foundry products, chemicals and fillers and extenders. Our diverse customer base drives high recovery rates across our production. We also benefit from strong and long-standing relationships with our customers in each of the industrial and specialty products end markets we serve. Sales to our industrial and specialty products end markets comprised approximately 18%, 35%, and 33% of our total sales revenue in 2017, 2016 and 2015, respectively.

Sales to our two largest customers, which are Oil & Gas Proppants customers, accounted for 15% and 12% of our total sales during the year ended December 31, 2017. No other customers accounted for 10% or more of our total sales.

Competition

Both of our reporting segments operate in highly competitive markets that are characterized by a small number of large, national producers and a larger number of small, regional or local producers. According to a January 2018 publication by the United States Geological Survey (“USGS”), in 2017, there were 200 producers of commercial silica with a combined 340 active operations in 35 states within the United States. Competition in the industry across both of our reporting segments is based on price, consistency and quality of product, site location, distribution capability, customer service, reliability of supply, breadth of product offering and technical support. As transportation costs are a significant portion of the total cost to customers of commercial silica, in many instances transportation costs can represent more than 50% of delivered cost, the commercial silica market is typically local, and competition from beyond the local area is limited. Notable exceptions to this are the frac sand and fillers and extenders markets, where certain product characteristics are not available in all deposits and not all plants have the requisite processing capabilities, necessitating that some products be shipped for extended distances. Because the markets for our products are typically local, we also compete with smaller, regional or local producers. For more information regarding competition, see “Risk Factors—Risks Related to Our Business—Our future performance will depend on our ability to succeed in competitive markets, and on our ability to appropriately react to potential fluctuations in demand for and supply of our products.”

Seasonality

Our business is affected to some extent by seasonal fluctuations in weather that impact our production levels and our customers' business needs. For example, during the second and third quarters we sell more commercial silica to our customers in the building products and recreation end markets due to increased construction activity resulting from more favorable weather. First and fourth quarters can experience lower sales, and sometimes production levels, largely from adverse weather hampering logistical capabilities and general decreased customer activity levels.

10

Intellectual Property

Other than operating licenses for our mining and processing facilities, there are no third-party patents, licenses or franchises material to our business. Our intellectual property primarily consists of trade secrets, know-how and trademarks, including our name US SILICA® and products with trademarked names such as OTTAWA WHITE®, MIN-U-SIL®, MYSTIC WHITE II®, Q-ROK®, SIL-CO-SIL®, PREMIUM HICKORY®, US SILICA WHITE®, InnoProp® and SANDBOX® among others. We own patents and have patent applications pending related to Sandbox, our "last mile" logistics solution. All of the issued patents have an expiration date after August 20, 2027 with a majority of issued patents expiring after December 21, 2031. With respect to our other products, we principally rely on trade secrets, rather than patents, to protect our proprietary processes, methods, documentation and other technologies, as well as certain other business information. Although we do seek patents from time to time, patent protection requires a costly and uncertain federal registration process that would place our confidential information in the public domain. As a result, we typically utilize trade secrets to protect the formulations and processes we use to manufacture our products and to safeguard our proprietary formulations and methods. We believe we can effectively protect our trade secrets indefinitely through the use of confidentiality agreements and other security measures.

Condition of Physical Assets and Insurance

Our business is capital intensive and requires ongoing capital investment for the replacement, modernization and/or expansion of equipment and facilities. For more information, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources.”

We maintain insurance policies against property loss and business interruption and insure against risks that are typical in the operation of our business, in amounts that we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to environmental liability and political risk. There can be no assurance that claims would be paid under such insurance policies in connection with a particular event. See Item 1A, “Risk Factors”.

Commercial Team

Our commercial team consists of approximately 92 individuals responsible for all aspects of our sales process, including pricing, marketing, transportation and logistics, product development and general customer service. This necessitates a highly organized staff and extensive coordination between departments. For example, product development requires the collaboration of our market development team, sales team, our production facilities and our corporate laboratories. Our sales team interacts directly with our customers in determining their needs, our production facilities fulfill the orders and our corporate laboratories are responsible for ensuring that our products meet those needs.

Our commercial team can be divided into five units:

• | Sales—Our sales team is organized by both region and end market. We have an experienced group of dedicated sales team members for the oil and gas proppants and the industrial and specialty end markets. Our oil and gas proppants team is led out of our Houston office and is regionally positioned in the oil and gas markets across the U.S. This staff consists of experienced experts in the use of frac proppants in the oil and gas industry. Our industrial and specialty products sales team is strategically located near our major customers. As we make decisions to enter or expand our presence in certain end markets or regions, we will continue to add dedicated team members to support that growth. |

• | Marketing—Our marketing team coordinates all of our new and existing customer outreach efforts and identifies emerging market trends and new product opportunities. This includes producing exhibits for trade shows and exhibitions, manufacturing product overview materials, participating in regional industry meetings and other trade associations and managing our advertising efforts in trade journals. |

• | Transportation and Logistics—Our transportation and logistics team manages domestic and international shipments by directing inbound and outbound rail, barge and truck traffic, supervising equipment maintenance, coordinating with rail carriers to ensure equipment availability, ensuring compliance with shipping regulations and strategically planning for future growth. With our Sandbox acquisition we can deliver frac sand directly to wellheads. |

• | Technical—Our technical team is anchored by our Industrial & Specialty Products laboratory in Berkeley Springs, West Virginia and our Oil & Gas laboratory in Houston, Texas. At these facilities, we perform a variety of analyses including: |

• | analytical chemistry by X-Ray Fluorescence (“XRF”) and Inductively Coupled Plasma (“ICP”) spectroscopy; |

11

• | particle characterization by sieve, SediGraph, Brunauer, Emmett and Teller (“BET”) surface area and microscopy; |

• | ore evaluation by mineral processing, flotation and magnetic separation; |

• | API frac sand evaluation, including crush resistance; and |

• | American Foundry Society (“AFS”) green sand evaluation by various foundry sand tests. |

Many other product analyses are performed locally at our 19 production facilities to support new product development, plant operations and customer quality requirements.

We also have a variety of other technical competencies including process engineering, equipment design, facility construction, maintenance excellence, environmental engineering, geology and mine planning and development. Effective integration of these capabilities has been a critical component of our business success and has allowed us to establish and maintain an extensive, high-quality silica sand reserve base, maximize the value of our reserves by producing and selling a wide range of high-quality products, optimize processing costs to provide strong value to customers and prioritize operating in a safe and environmentally sustainable manner.

• | Customer Service—Our customer service team is dedicated to creating an exceptional customer experience and making it easy to do business with our company. The organization aims to accomplish this by consistently exceeding our customers’ expectations, continually improving our performance, offering efficient and timely responses to customer needs, being available to our customers 24/7 and providing customers with personal points of contact on whom they can rely. |

Employees

As of December 31, 2017, we employed a workforce of 2,202 employees, the majority of whom are hourly wage plant workers living in the areas surrounding our mining facilities. The majority of our hourly employees are represented by labor unions that include the Teamsters Union; United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union; Laborers International Union of North America; Glass, Molders, Pottery, Plastics and Allied Workers International Union; and International Union of Operating Engineers A.F.L. - C.I.O. We believe that we maintain good relations with our workers and their respective unions and have not experienced any material strikes or work stoppages since 1987.

Our employees average approximately 8 years of tenure with us, and we have an annual employee turnover rate of 12%, excluding the impact of reductions in workforce as part of the restructuring actions. We believe our stable workforce has directly contributed to improved process efficiencies and safety, which in turn help drive cost reductions. We believe our labor rates compare favorably to other mining and manufacturing facilities in the same geographic areas. We maintain workers’ compensation coverage in amounts required by law and have no material claims pending. We also offer all full-time employees a competitive package of employee benefits, which includes medical, dental, life and disability coverage.

Regulation and Legislation

Mining and Workplace Safety

Federal Regulation

The U.S. Mine Safety and Health Administration (“MSHA”) is the primary regulatory organization governing the commercial silica industry. Accordingly, MSHA regulates quarries, surface mines, underground mines and the industrial mineral processing facilities associated with quarries and mines. The mission of MSHA is to administer the provisions of the Federal Mine Safety and Health Act of 1977 and to enforce compliance with mandatory safety and health standards. MSHA works closely with the Industrial Minerals Association, a trade association in which we have a significant leadership role, in pursuing this mission. As part of MSHA’s oversight, representatives perform at least two unannounced inspections annually for each above-ground facility. For additional information regarding mining and workplace safety, including MSHA safety and health violations and assessments in 2017, see Item 4, “Mine Safety Disclosures”.

We also are subject to the requirements of the U.S. Occupational Safety and Health Act (“OSHA”) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA Hazard Communication Standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and the public. OSHA regulates the customers and users of commercial silica and provides detailed regulations requiring employers to protect employees from overexposure to silica bearing dust through the enforcement of permissible exposure limits and the OSHA Hazard Communication Standard.

Internal Controls

12

We adhere to a strict occupational health program aimed at controlling exposure to silica bearing dust, which includes dust sampling, a respiratory protection program, medical surveillance, training and other components. Our safety program is designed to ensure compliance with the standards of our Occupational Health and Safety Manual and MSHA regulations. For both health and safety issues, extensive training is provided to employees. We have safety committees at our plants made up of salaried and hourly employees. We perform annual internal health and safety audits and conduct annual crisis management drills to test our plants’ abilities to respond to various situations. Health and safety programs are administered by our corporate health and safety department with the assistance of plant Environmental, Health and Safety Coordinators.

Motor Carrier Regulation

Our trucking services are regulated by the U.S. Department of Transportation ("DOT"), the Federal Motor Carrier Safety Administration ("FMCSA") and by various state agencies. These regulatory authorities have broad powers, generally governing matters such as authority to engage in motor carrier operations, as well as motor carrier registration, driver hours of service, safety and fitness of transportation equipment and drivers, transportation of hazardous materials and periodic financial reporting. In addition, each driver is required to have a commercial driver’s license and may be subject to mandatory drug and alcohol testing. We may be audited periodically by these regulatory authorities to ensure that we are in compliance with various safety, hours-of-service, and other rules and regulations.

The transportation industry is subject to possible other regulatory and legislative changes (such as the possibility of more stringent environmental, climate change, security and/or occupational safety and health regulations, limits on vehicle weight and size and a mandate to implement electronic logging devices) that may affect the economics of our trucking services by requiring changes in operating practices or by changing the demand for motor carrier services or the cost of providing truckload or other transportation or logistics services.

Environmental Matters

We and the commercial silica industry are subject to extensive governmental regulation on, among other things, matters such as permitting and licensing requirements, plant and wildlife protection, hazardous materials, air and water emissions and environmental contamination and reclamation. A variety of state, local and federal agencies enforce this regulation.

Federal Regulation

At the federal level, we may be required to obtain permits under Section 404 of the Clean Water Act from the U.S. Army Corps of Engineers for the discharge of dredged or fill material into waters of the United States, including wetlands and streams, in connection with our operations. We also may be required to obtain permits under Section 402 of the Clean Water Act from the U.S. Environmental Protection Agency (“EPA”) (or the relevant state environmental agency in states where the permit program has been delegated to the state) for discharges of pollutants into waters of the United States, including discharges of wastewater or storm water runoff associated with construction activities. Failure to obtain these required permits or to comply with their terms could subject us to administrative, civil and criminal penalties as well as injunctive relief.

The U.S. Clean Air Act and comparable state laws regulate emissions of various air pollutants through air emissions permitting programs and the imposition of other requirements. These regulatory programs may require us to install expensive emissions abatement equipment, modify our operational practices and obtain permits for our existing operations, and before commencing construction on a new or modified source of air emissions, such laws may require us to reduce emissions at existing facilities. As a result, we may be required to incur increased capital and operating costs because of these regulations. We could be subject to administrative, civil and criminal penalties as well as injunctive relief for noncompliance with air permits or other requirements of the U.S. Clean Air Act and comparable state laws and regulations.

As part of our operations, we utilize or store petroleum products and other substances such as diesel fuel, lubricating oils and hydraulic fluid. We are subject to applicable requirements regarding the storage, use, transportation and disposal of these substances, including the relevant Spill Prevention, Control and Countermeasure requirements that the EPA imposes on us. Spills or releases may occur in the course of our operations, and we could incur substantial costs and liabilities as a result of such spills or releases, including those relating to claims for damage or injury to property and persons.

Additionally, some of our operations are located on properties that historically have been used in ways that resulted in the release of contaminants, including hazardous substances, into the environment, and we could be held liable for the remediation of such historical contamination. The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also known as the Superfund law, and comparable state laws impose joint and several liability, without regard to fault or legality of conduct, on classes of persons who are considered to be responsible for the release of hazardous substances into the environment. These persons include the owner or operator of the site where the release occurred and anyone who disposed or arranged for the disposal of a hazardous substance released at the site. Under CERCLA, such persons may be subject to

13

liability for the costs of cleaning up the hazardous substances, for damages to natural resources, and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment.

In addition, the Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes regulate the generation, transportation, treatment, storage, disposal and cleanup of hazardous and non-hazardous wastes. Under the auspices of the EPA, the individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. In the course of our operations, we generate industrial solid wastes that may be regulated as hazardous wastes.

Our operations may also be subject to broad environmental review under the National Environmental Policy Act (“NEPA”). NEPA requires federal agencies to evaluate the environmental impact of all “major federal actions” significantly affecting the quality of the human environment. The granting of a federal permit for a major development project, such as a mining operation, may be considered a “major federal action” that requires review under NEPA. Therefore, our projects may require review and evaluation under NEPA. As part of this evaluation, the federal agency considers a broad array of environmental impacts, including, among other things, impacts on air quality, water quality, wildlife (including threatened and endangered species), historical and archaeological resources, geology, socioeconomics and aesthetics. NEPA also requires the consideration of alternatives to the project. The NEPA review process, especially the preparation of a full environmental impact statement, can be time consuming and expensive. The purpose of the NEPA review process is to inform federal agencies’ decision-making on whether federal approval should be granted for a project and to provide the public with an opportunity to comment on the environmental impacts of a proposed project. While NEPA requires only that an environmental evaluation be conducted and does not mandate a result, a federal agency could decide to deny a permit, or impose certain conditions on its approval, based on its environmental review under NEPA, or a third party may challenge the adequacy of a NEPA review.

Federal agencies granting permits for our operations also must consider impacts to endangered and threatened species and their habitat under the Endangered Species Act. We also must comply with and are subject to liability under the Endangered Species Act, which prohibits and imposes stringent penalties for the harming of endangered or threatened species and their habitat. Federal agencies also must consider a project’s impacts on historic or archaeological resources under the National Historic Preservation Act, and we may be required to conduct archaeological surveys of project sites and to avoid or preserve historical areas or artifacts.

State and Local Regulation

Because our operations are located in numerous states, we are also subject to a variety of different state and local environmental review and permitting requirements. Some states in which our projects are located or are being developed have state laws similar to NEPA; thus our development of new sites or the expansion of existing sites may be subject to comprehensive state environmental reviews even if they are not subject to NEPA. In some cases, the state environmental review may be more stringent than the federal review. Our operations may require state law based permits in addition to federal permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project’s impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations and scenic areas. Some states also have specific permitting and review processes for commercial silica mining operations, and states may impose different or additional monitoring or mitigation requirements than federal agencies. The development of new sites and our existing operations also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building and transportation requirements.

As demand for frac sand in the oil and natural gas industry has driven a significant increase in current and expected future production of commercial silica, some local communities have expressed concern regarding silica sand mining operations. These concerns have generally included exposure to ambient silica sand dust, truck traffic, water usage and blasting. In response, certain state and local communities have developed or are in the process of developing regulations or zoning restrictions intended to minimize dust from getting airborne, control the flow of truck traffic, significantly curtail the amount of practicable area for mining activities, provide compensation to local residents for potential impacts of mining activities and, in some cases, ban issuance of new permits for mining activities. To date, we have not experienced any material impact or disruption to our existing mining operations or planned capacity expansions as a result of these types of concerns.

We have a long history of positive engagement with the communities that surround our existing mining operations. We have an annual employee turnover rate of 12%, excluding the impact of reductions in workforce as part of the restructuring actions, and have had no significant strikes in more than 30 years, evidence of the strong relationship we have with our employees. We believe this strong relationship helps foster good relations with the communities in which we operate. Although additional regulatory requirements could negatively impact our business, financial condition and results of operations, we believe our existing operations are less likely to be negatively impacted by virtue of our good community relations.

14

Planned expansion of our mining and production capacity in new communities could be more significantly impacted by increased regulatory activity. Difficulty or delays in obtaining or inability to obtain new mining permits or increased costs of compliance with future state and local regulatory requirements could have a material negative impact on our ability to grow our business. In an effort to minimize these risks, we continue to be engaged with local communities in order to grow and maintain strong relationships with residents and regulators.

Costs of Compliance

We may incur significant costs and liabilities as a result of environmental, health and safety requirements applicable to our activities. Failure to comply with environmental laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of investigatory, cleanup and site restoration costs and liens, the denial or revocation of permits or other authorizations and the issuance of injunctions to limit or cease operations. Compliance with these laws and regulations may also increase the cost of the development, construction and operation of our projects and may prevent or delay the commencement or continuance of a given project. In addition, claims for damages to persons or property may result from environmental and other impacts of our activities.

The process for performing environmental impact studies and reviews for federal, state and local permits for our operations involves a significant investment of time and monetary resources. We cannot control the permit approval process. We cannot predict whether all permits required for a given project will be granted or whether such permits will be the subject of significant opposition. The denial of a permit essential to a project or the imposition of conditions with which it is not practicable or feasible to comply could impair or prevent our ability to develop a project. Significant opposition and delay in the environmental review and permitting process also could impair or delay our ability to develop a project. Additionally, the passage of more stringent environmental laws could impair our ability to develop new operations and have an adverse effect on our financial condition and results of operations.

Availability of Reports; Website Access; Other Information