Attached files

| file | filename |

|---|---|

| 8-K - CIG WIRELESS FORM 8-K FOR 8-14-2012 - CIG WIRELESS CORP. | cigwireless8-k.htm |

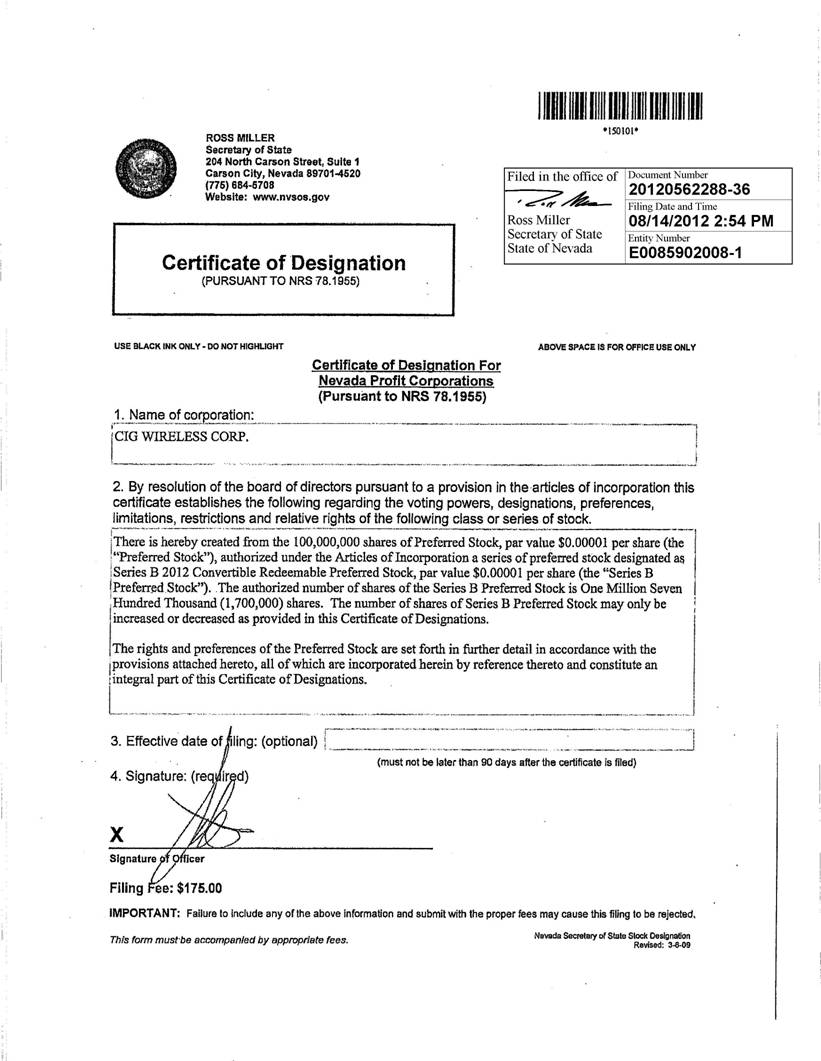

Exhibit 3.5

CERTIFICATE OF DESIGNATIONS

OF

SERIES B 2012 CONVERTIBLE REDEEMABLE PREFERRED STOCK

OF

CIG WIRELESS CORP.

Pursuant to Section 78.1955 of Nevada Revised Statutes

CIG Wireless Corp., a Nevada corporation (the “Company”), does hereby certify that:

FIRST: The original articles of incorporation of the Company were filed with the Secretary of State of Nevada on February 12, 2008 (the articles of incorporation of the Company, as such may be amended or restated from time to time, are referred to herein as the “Articles of Incorporation”).

SECOND: This Certificate of Designations of Series B 2012 Convertible Redeemable Preferred Stock was duly adopted in accordance with the Articles of Incorporation and Section 78.1955 of the Nevada Revised Statutes (the “NRS”) by the written consent of the Board of Directors of the Company on July 25, 2012 and filed with the Secretary of State of Nevada on August 14, 2012.

THIRD: No shares of Series B Preferred Stock (as defined below) have been issued as of the date hereof.

FOURTH: There is hereby created from the 100,000,000 shares of Preferred Stock, par value $0.00001 per share (the “Preferred Stock”), authorized under the Articles of Incorporation a series of preferred stock designated as Series B 2012 Convertible Redeemable Preferred Stock, par value $0.00001 per share (the “Series B Preferred Stock”). The authorized number of shares of the Series B Preferred Stock is One Million Seven Hundred Thousand (1,700,000) shares. The number of shares of Series B Preferred Stock may only be increased or decreased as provided in this Certificate of Designations.

A. The Board of Directors is also authorized to increase or decrease the number of shares of Series B Preferred Stock, prior or subsequent to the issue of that series, but not below the number of shares of such series then outstanding. In case the number of shares of any series shall be so decreased, the shares constituting such decrease shall resume the status that they had prior to the adoption of the resolution originally fixing the number of shares of such series.

B. For purposes of this Certificate of Designations, the following terms shall have the follow meanings:

(i) “Additional Amount” means, on a per share of Series B Preferred Stock basis, any accrued but unpaid Dividends.

(ii) “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized or required by law to remain closed.

(iii) “Capital Stock” means: (A) in the case of a corporation, corporate stock; (B) in the case of an association or business entity, any and all shares, interests, participations, rights or other equivalents (however designated) of corporate stock; (C) in the case of a partnership or limited liability company, partnership interests (whether general or limited) or membership interests; and (D) any other interest or participation that confers on a Person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing Person.

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

(iv) “Common Stock” means the Company’s common stock, par value $0.00001 per share.

(v) “Conversion Price” means Three United States Dollars (USD$3.00) (subject to adjustment from time to time for any stock splits, stock dividends, recapitalizations, combinations, reverse stock splits or other similar events).

(vi) “Conversion Amount” means the sum of (A) the Additional Amount and (B) the Stated Value.

(vii) “Liquidation” means any of the following: (i) any liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, (ii) filing for bankruptcy pursuant to applicable federal and/or state laws, (iii) any actions that directly and/or indirectly are construed as steps in taking the Company private.

(viii) “Person” means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization and a government or any department or agency thereof.

(ix) “Required Holders” means the Holders of shares of Series B Preferred Stock representing greater than 50.0% of the aggregate shares of Series B Preferred Stock then outstanding.

(x) “Threshold Period” means the third anniversary after the initial date of issuance of the Series B Preferred Stock.

C. The rights, preferences and privileges of the Series B Preferred Stock are as follows:

(1) Voting Rights. Except as otherwise provided herein, in the Articles of Incorporation or as required by law, the holders of the shares of the Series B Preferred Stock (each a “Holder,” and collectively the “Holders”) and the holders of the Company’s shares of Common Stock shall be entitled to vote on all matters submitted or required to be submitted to a vote of the stockholders of the Company and shall be entitled to the number of votes equal to the number of whole shares of Common Stock into which such shares of Series B Preferred Stock are convertible pursuant to the provisions hereof, at the record date for the determination of stockholders entitled to vote on such matters or, if no such record date is established, at the date such vote is taken or any written consent of stockholders is solicited. In each such case, except as otherwise required by law or in an appropriate Certificate of Designation, the holders of shares of Preferred Stock (including Series B Preferred Stock) and shares of Common Stock shall vote together and not as separate classes. Fractional votes shall not, however, be permitted and any fractional voting rights resulting from the above formula (after aggregating all shares of Common Stock into which shares of Series B Preferred Stock held by each holder could be converted) shall be rounded down to the nearest whole number.

(2) Dividends. The Holders shall be entitled to receive dividends (“Dividends”) on the Stated Value (as defined below) of such shares of Series B 6% Preferred Stock at the dividend rate of six percent (6%) per annum (the “Dividend Rate”), which shall be cumulative. All Dividends shall be payable in cash. Dividends on the shares of Series B 6% Preferred Stock shall commence accruing on the date of issuance and shall be computed on the basis of a 365-day year and actual days elapsed. Dividends shall accrue until paid and shall be payable biannually, within twenty (20) Business Days after each of December 31 and June 30 of each year following declaration of such Dividend by the Board of Directors; provided, however, in the event of non-declaration or non-payment of such Dividends, any and all accrued Dividends shall nonetheless remain due and payable no later than the conversion date specified in the Conversion Notice thereafter by inclusion in the

2

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

applicable conversion in accordance with Section 4(c) (each, a “Dividend Date”). If a Dividend Date is not a Business Day, then the Dividend shall be due and payable on the Business Day immediately following such Dividend Date. Any and all Dividends shall be due and payable only as and when declared by the Board of Directors.

(3) Stated Value. Each share of Series B Preferred Stock shall have a “Stated Value” equal to Three United States Dollars (USD$3.00) per share.

(4) Conversion of Shares of Preferred Stock. Shares of Series B Preferred Stock shall be convertible into shares of Common Stock on the terms and conditions set forth in this Section 4 at any time. The term “Conversion Shares” shall mean the shares of Common Stock issuable upon conversion of shares of Series B Preferred Stock. The Company shall not issue any fractional shares of Common Stock upon any conversion. All shares of Common Stock (including fractions thereof) issuable upon conversion of more than one share of Series B Preferred Stock by a Holder shall be aggregated for purposes of determining whether the conversion would result in the issuance of a fractional share of Common Stock. If, after the aforementioned aggregation, the issuance would result in the issuance of a fractional share of Common Stock, the Company shall, in lieu of issuing such fractional share, issue one whole share of Common Stock to the Holder thereof. The Holders of the Series B Preferred Stock shall pay any and all taxes that may become due or payable with respect to the issuance and delivery of shares of Common Stock upon conversion of shares of Series B Preferred Stock.

(a) Conversion. With respect to each share of Series B Preferred Stock, at any time or times on or after the date of issuance of such shares of Series B Preferred Stock, (i) any Holder shall be entitled to convert all or a portion of such Holder’s shares of Series B Preferred Stock into fully paid and non-assessable shares of Common Stock (each an “Optional Conversion”), in accordance with this Section 4(a), Section 4(b) and Section 4(c); and (ii) the shares of Series B Preferred Stock shall automatically convert to Common Stock upon the closing of an underwritten public offering of Company shares of Common Stock for a total gross offering value of not less than forty million U.S. Dollars (USD$40,000,000) (the “Automatic Conversion” and referred to together with the Optional Conversion, as “Conversion”). No further shares of Preferred Stock will be issued after the date of disclosure regarding such underwritten offering.

(b) Conversion Rate. Subject to anti-dilution adjustment as provided in Section 4(d), upon a Conversion pursuant to Section 4(a), the conversion of each share of Series B Preferred Stock shall be as set forth in this Section 4(b). Upon a conversion pursuant to Section 4(a), all accrued and unpaid Dividends on shares of Series B Preferred Stock through the date of conversion, may, at the election of the Holder, be paid in additional shares of Common Stock in accordance with and pursuant to the terms set forth herein. Each share of Series B Preferred Stock, plus the amount of any accrued but unpaid Dividends per share of Series B Preferred Stock then remaining if elected by the Holder, will convert into the number of fully paid and nonassessable shares of Common Stock using the following formula (the “Conversion Rate”):

Conversion Amount

Conversion Price

(c) Mechanics of Conversion.

(i) To convert shares of Series B Preferred Stock into Conversion Shares pursuant to Section 4(a) on any date, the Holder thereof shall (i) transmit by facsimile (or otherwise deliver), for receipt on or prior to 11:59 p.m. Eastern Time on such date, a copy of an executed notice of conversion (the “Conversion Notice”) to the Company, and (ii) surrender to a common carrier for delivery to the Company within five (5) Business Days of such date the Preferred Stock Certificates (as hereinafter defined) representing the shares of Series B Preferred Stock being converted (or an indemnification undertaking with respect to such shares in the case of their loss, theft or destruction). The term “Preferred Stock Certificates” shall mean the original certificates representing the shares of Series B Preferred Stock.

3

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

(ii) On or before the third (3rd) Business Day following the date of receipt of a fully executed and completed Conversion Notice (the “Conversion Notice”), the Company shall (x) issue and deliver to the address as specified in the Conversion Notice, a certificate, registered in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder shall be entitled, or (y) provided that the Conversion Shares have been registered under the Securities Act of 1933, as amended (the “Securities Act”) or there is an effective resale registration statement covering the resale of the Conversion Shares and the Conversion Shares have no direct and /or indirect selling limitations and/or restrictions, or the shares may be sold without registration under the Securities Act subject to no direct and/or indirect selling limitations and/or restrictions have been met, upon the request of a Holder, credit such aggregate number of shares of Common Stock to which the Holder shall be entitled to such Holder’s or its designee’s balance account with The Depository Trust & Clearing Corporation through its Deposit Withdrawal Agent Commission system. If the number of shares of Series B Preferred Stock represented by the Preferred Stock Certificate(s) submitted for conversion pursuant to Section 4(c)(i) is greater than the number of shares of Series B Preferred Stock being converted, then the Company shall, as soon as practicable and in no event later than five (5) Business Days after receipt of the Preferred Stock Certificate(s) and at its own expense, issue and deliver to the Holder thereof a new Series B Preferred Stock certificate representing the number of shares of Series B Preferred Stock not converted. The person or persons entitled to receive the shares of Common Stock issuable upon a conversion of shares of Series B Preferred Stock shall be treated for all purposes as the record holder or holders of such shares of Common Stock on the applicable conversion date.

(iii) The Series B Preferred Stock shall not be convertible into Common Stock of the Company if such Holder would become the “beneficial owner”, as such term is defined under the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder, of more than 4.9% of the issued and outstanding shares of Common Stock of the Company as of the effective date of such conversion.

(iv) The Holder covenants and agrees not to sell any Common Stock into which the Series B Preferred Stock is converted on the exchange or market in which the Common Stock is then traded or quoted, that on any given trading day, will exceed more than ten percent (10%) of the aggregate trading volume of the trading day immediately preceding such sale date.

(d) Anti-Dilution Provisions. The Conversion Rate in effect at any time and the number and kind of securities issuable upon conversion of the shares of Series B Preferred Stock shall be subject to adjustment from time to time upon the happening of certain events as follows:

(i) Adjustment for Stock Splits and Combinations. If the Company at any time or from time to time on or after the Original Issuance Date effects a subdivision of the outstanding shares of Common Stock, the Conversion Price then in effect immediately before that subdivision shall be proportionately decreased, and conversely, if the Company at any time or from time to time on or after the Original Issuance Date combines the outstanding shares of Common Stock into a smaller number of shares, the Conversion Price then in effect immediately before the combination shall be proportionately increased. Any adjustment under this Section 4(d)(i) shall become effective at the close of business on the date the subdivision or combination becomes effective.

(ii) Adjustment for Certain Dividends and Distributions. If the Company at any time or from time to time on or after the Original Issuance Date makes or fixes a record date for the determination of holders of shares of Common Stock entitled to receive, a dividend or other distribution payable in additional shares of Common Stock, then and in each such event the Conversion Price then in effect shall be decreased as of the time of such issuance or, in the event such record date is fixed, as of the close of business on

4

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

such record date, by multiplying the Conversion Price then in effect by a fraction (1) the numerator of which is the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business on such record date plus the number of shares of Common Stock issuable in payment of such dividend or distribution; and (2) the denominator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business on such record date; provided, however, that if such record date is fixed and such dividend is not fully paid or if such distribution is not fully made on the date fixed therefor, the Conversion Price shall be recomputed accordingly as of the close of business on such record date and thereafter the Conversion Price shall be adjusted pursuant to this Section 4(d)(ii) as of the time of actual payment of such dividends or distributions.

(iii) Adjustments for Other Dividends and Distributions. In the event the Company at any time or from time to time on or after the Original Issuance Date makes, or fixes a record date for the determination of holders of shares of Common Stock entitled to receive, a dividend or other distribution payable in securities of the Company other than shares of Common Stock, then and in each such event provision shall be made so that the Holders of shares of Series B Preferred Stock shall receive upon conversion thereof, in addition to the number of shares of Common Stock receivable thereupon, the amount of securities of the Company which they would have received had their shares of Series B Preferred Stock been converted into shares of Common Stock on the date of such event and had they thereafter, during the period from the date of such event to and including the conversion date, retained such securities receivable by them as aforesaid during such period, subject to all other adjustments called for during such period under this Section 4(d) with respect to the rights of the Holders of the shares of Series B Preferred Stock.

(iv) Adjustment for Reclassification, Exchange and Substitution. In the event that at any time or from time to time on or after the Original Issuance Date, the shares of Common Stock issuable upon the conversion of the shares of Series B Preferred Stock is changed into the same or a different number of shares of any class or classes of stock, whether by recapitalization, reclassification or otherwise (other than a subdivision or combination of shares or stock dividend or a reorganization, merger, consolidation or sale of assets, provided for elsewhere in this Section 4(d)), then and in any such event each Holder of shares of Series B Preferred Stock shall have the right thereafter to convert such stock into the kind and amount of stock and other securities and property receivable upon such recapitalization, reclassification or other change, by holders of the maximum number of shares of Common Stock into which such shares of Series B Preferred Stock could have been converted immediately prior to such recapitalization, reclassification or change, all subject to further adjustment as provided herein.

(v) Reorganizations, Mergers, Consolidations or Sales of Assets. If at any time or from time to time on or after the Original Issuance Date there is a capital reorganization of the shares of Common Stock (other than a recapitalization, subdivision, combination, reclassification or exchange of shares provided for elsewhere in this Section 4(d)) or a merger or consolidation of the Company with or into another corporation, or the sale of all or substantially all of the Company’s properties and assets to any other person, then, as a part of such reorganization, merger, consolidation or sale, provision shall be made so that the Holders of the shares of Series B Preferred Stock shall thereafter be entitled to receive upon conversion of the shares of Series B Preferred Stock the number of shares of stock or other securities or property to which a holder of the number of shares of Common Stock deliverable upon conversion would have been entitled on such capital reorganization, merger, consolidation, or sale. In any such case, appropriate adjustment shall be made in the application of the provisions of this Section 4(d) with respect to the rights of the Holders of the shares of Series B Preferred Stock after the reorganization, merger, consolidation or sale to the end that the provisions of this Section 4(d) (including adjustment of the Conversion Rate then in effect and the number of shares purchasable upon conversion of the shares of Series B Preferred Stock) shall be applicable after that event and be as nearly equivalent as is practicable.

(e) No Impairment. The Company will not, by amendment of its Articles of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of

5

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Company but will at all times in good faith assist in the carrying out of all the provisions of this Section 4 and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the Holders of the shares of Series B Preferred Stock against impairment.

(f) Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Rate pursuant to this Section 4, the Company at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each Holder of shares of Preferred Stock a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Company shall, upon the written request at any time of any Holder of shares of Series B Preferred Stock, furnish or cause to be furnished to such Holder a like certificate setting forth (i) such adjustments and readjustments, (ii) Conversion Rate and Conversion Price at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of the shares of Preferred Stock.

(g) Status of Converted Shares. In the event any shares of Series B Preferred Stock shall be converted pursuant to Section 4 hereof, the shares of Series B Preferred Stock so converted shall be canceled and shall not be reissued as shares of Series B Preferred Stock.

(5) Reservation of Authorized Shares. The Company shall, so long as any of the shares of Series B Preferred Stock are outstanding, take all action necessary to reserve and keep available out of its authorized and unissued shares of Common Stock, solely for the purpose of effecting the conversion of the shares of Series B Preferred Stock, 100% of such number of shares of Common Stock as shall from time to time be sufficient to effect the conversion of all of the shares of Series B Preferred Stock then outstanding.

(6) Redemption. If any shares of Series B Preferred Stock remain outstanding on or after the Threshold Period, the Company may, as determined at the sole discretion of the Company at any time after the Threshold Period, redeem such shares of Series B Preferred Stock in cash in amount equal to the outstanding Conversion Amount for such shares of Series B Preferred Stock at the Conversion Price in accordance with Section 4, and at such redemption date any and all accrued Dividends, together with any and any applicable Additional Amount, shall be due and payable thereon.

(7) Liquidation, Dissolution, Winding-Up. In the event of any Liquidation (as defined below) of the Company, the Holders shall be entitled to receive out of the assets of the Company legally available for distribution therefrom (the “Liquidation Funds”) on a pro rata basis, before any amount shall be paid to the holders of any of the Capital Stock of the Company of any class junior in rank to the shares of Series B Preferred Stock in respect of the preferences as to the distributions and payments on a Liquidation of the Company, an amount per share of Series B Preferred Stock equal to the sum of (a) the Stated Value of all shares of Series B Preferred Stock then outstanding and (b) all Dividends, if any, which have accrued or are payable under Section 2 hereof, but have not been paid and received by the Holders of the shares of Series B Preferred Stock, up to and including the date full payment is tendered to the Holder of such share of Series B Preferred Stock with respect to such Liquidation. No Holder of shares of Series B Preferred Stock shall be entitled to receive any amounts with respect thereto upon any Liquidation other than the amounts provided for herein; provided that a Holder of shares of Series B Preferred Stock shall be entitled to all amounts previously accrued with respect to amounts owed hereunder. The form of consideration in which the Liquidation Preference is to be paid to the Holders of the shares of Series B Preferred Stock as provided in this Section 7 shall be the form of consideration received by the Company or the other holders of the Company’s Capital Stock, as the case may be.

(8) Ranking. The Series B Preferred Stock shall rank: (a) senior to (i) the Common Stock, and (ii) any other class or series of Capital Stock of the Company either specifically ranking by its terms junior to the Series B Preferred Stock or not specifically ranking by its terms senior to or on parity with the Series B

6

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

Preferred Stock, (b) on parity with Series B Preferred Stock and any other class or series of Capital Stock of the Company specifically ranking by its terms on parity with the Series B Preferred Stock, and (c) junior to the Class A Interests of Communications Infrastructure Group, LLC, and junior to any other class or series of Capital Stock specifically ranking by its terms senior to the Series B Preferred Stock, in each case, as to payment of dividends, distributions of assets upon a Liquidation Event or otherwise. The rights of the shares of Common Stock shall be subject to the preferences and relative rights of the shares of Series B Preferred Stock. The rights of the shares of Common Stock shall be subject to the preferences and relative rights of the shares of Series B Preferred Stock. The Company may hereafter authorize or issue additional or other Capital Stock that is of senior or pari-passu rank to the shares of Series B Preferred Stock in respect of the preferences as to distributions and payments upon a Liquidation Event. The Company shall be permitted to issue preferred stock that is junior in rank to the shares of Series B Preferred Stock in respect of the preferences as to dividends and other distributions, amortization and redemption payments and payments upon the liquidation, dissolution and winding up of the Company. In the event of the merger or consolidation of the Company with or into another corporation, the shares of Series B Preferred Stock shall maintain their relative powers, designations and preferences provided for herein (except that the shares of Series B Preferred Stock may not be pari passu with, or junior to, any Capital Stock of the successor entity, other than as expressly approved by the Board of Directors of the Company prior to such merger or consolidation) and no merger shall result inconsistent therewith.

(9) Vote to Issue, or Change the Terms of Shares of Series B Preferred Stock. In addition to any other rights provided by law, except where the vote or written consent of the holders of a greater number of shares is required by law or by another provision of the Articles of Incorporation, the affirmative vote at a meeting duly called for such purpose or the written consent without a meeting of the Required Holders, voting together as a single class, shall be required before the Company may: (a) amend or repeal any provision of, or add any provision to, the Articles of Incorporation or bylaws, or file any articles of amendment, certificate of designations, preferences, limitations and relative rights of any series of preferred stock, if such action would adversely alter or change the preferences, rights, privileges or powers of, or restrictions provided for the benefit of the shares of Series B Preferred Stock, regardless of whether any such action shall be by means of amendment to the Articles of Incorporation or by merger, consolidation or otherwise; or (b) increase or decrease (other than by conversion) the authorized number of shares of shares of Series B Preferred Stock.

(10) Lost or Stolen Certificates. Upon receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing shares of Series B Preferred Stock, and, in the case of loss, theft or destruction, of any indemnification undertaking by the Holder to the Company in customary form and, in the case of mutilation, upon surrender and cancellation of the shares of Preferred Stock Certificate(s), the Company shall execute and deliver new preferred share certificate(s) of like tenor and date.

(11) Qualified Financing. For purposes of assuring financing for the operations, growth and development of the Company, the Company is expressly permitted to take any and all of the following actions pursuant to due authorization of the Board of Directors: (i) to encumber its assets; (ii) to issue one or more additional series of Preferred Stock; (iii) to cause the Company to offer and issue additional shares of Common Stock, warrants, options or other securities; and/or (iv) in each case of the foregoing, to grant such rights, preferences, terms and conditions as determined by the Board of Directors (each, a “Qualified Financing”). The Holders will not be permitted to sell or transfer Preferred Stock or Conversion Shares for a period to be specified by the Board of Directors (not to exceed 180 days) following the effective date of any Qualified Financing, provided that all officers and directors are similarly bound.

(12) Dispute Resolution. In the case of a dispute as to the arithmetic calculation of the Conversion Rate, the Company shall select an independent investment bank or a certified public accountant to determine the arithmetic calculation of the Conversion Rate. The Company shall cause, at the Company’s expense, the investment bank or the accountant, as the case may be, to perform the determinations or calculations and notify

7

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

the Company and the Holders of the results no later than thirty (30) Business Days from the time it receives the disputed determinations or calculations. Such investment bank’s or accountant’s determination or calculation, as the case may be, shall be binding upon all parties absent manifest error.

(13) Transfer of Shares of Series B Preferred Stock. The shares of Series B Preferred Stock are restricted and a Holder may not assign or transfer any of the shares of Series B Preferred Stock or the accompanying rights hereunder held by such Holder without the consent of the Company. Upon the issuance of any Dividend Shares, Conversion Shares or other shares of Common Stock in accordance with Sections 2, 4, 6 or 8, such shares of Common Stock shall remain restricted unless registered with the U.S. Securities & Exchange Commission or pursuant to an available exemption from registration. The restrictions contained in this Section 13 shall apply to all of the Holder’s assignees, transferees, successors and assigns.

(14) Series B Preferred Stock Register. The Company shall maintain at its principal executive offices (or such other office or agency of the Company as it may designate by notice to the Holders), a register for the Series B Preferred Stock, in which the Company shall record the name and address of the persons in whose name the Series B Preferred Stock have been issued, as well as the name and address of each transferee. The Company may treat the person in whose name any share of Series B Preferred Stock is registered on the register as the owner and holder thereof for all purposes, notwithstanding any notice to the contrary, but in all events recognizing any properly made transfers.

(15) Notices. Whenever notice is required to be given hereunder, unless otherwise provided herein, such notice shall be given in writing and will be mailed by personal delivery, courier, certified mail, return receipt requested, or delivered against receipt to the party to whom it is to be given: (a) if to the Company, at the Company’s executive offices; or (b) if to a Holder, at the address set forth on Company’s books and records.

[Signature Page Follows]

8

CIG Wireless Corp. - Certificate Of Designations

Series B 2012 Convertible Redeemable Preferred Stock

IN WITNESS WHEREOF, this Certificate of Designations was duly adopted by the Board of Directors in accordance with the Articles of Incorporation and Section 78.1955 of the NRS and executed as of this 14th day of August, 2012.

CIG WIRELESS CORP.

By: /s/ PAUL MCGINN

Name: Paul McGinn

Title: President and Chief Executive Officer

9