Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEDISYS INC | d400348d8k.htm |

| EX-99.2 - RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES - AMEDISYS INC | d400348dex992.htm |

August

2012 Investor Presentation

Leading Home Health & Hospice

clinical

quality

innovative

care models

better

communities

Exhibit 99.1 |

Forward-looking Statements

2

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information.

This presentation may include forward-looking statements as defined by the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are based

upon current expectations and assumptions about our business that are subject to a

variety of risks and uncertainties that could cause actual results to differ materially

from those described in this presentation. You should not rely on forward-looking

statements as a prediction of future events.

Additional information regarding factors that could cause actual results to differ

materially from those discussed in any forward-looking statements are described in

reports and registration statements we file with the SEC, including our Annual Report

on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, copies of which are available on the Amedisys internet website

http://www.amedisys.com or by contacting the Amedisys Investor Relations

department at (800) 467-2662.

We disclaim any obligation to update any forward-looking statements or any changes

in events, conditions or circumstances upon which any forward-looking statement

may be based except as required by law. |

Company

Overview 1

3

•

Founded in 1982, publicly listed 1994

•

530 care centers in 38

states

•

16,800 employees

•

$1.5 billion in 2011 revenue

•

Largest provider of skilled home health

services

•

4

th

largest hospice business

•

82% of revenue is Medicare

1

For the quarter ended June 30, 2012

Revenue Mix |

Care Center

Locations 2012 4

437 -

Home health care centers

93 -

Hospice care centers

2 -

Hospice inpatient units

*As of June 30, 2012

U.S.

AMED

Counties

3,143

1,368

44%

65+ Population

41.1 M

26.1 M

64% |

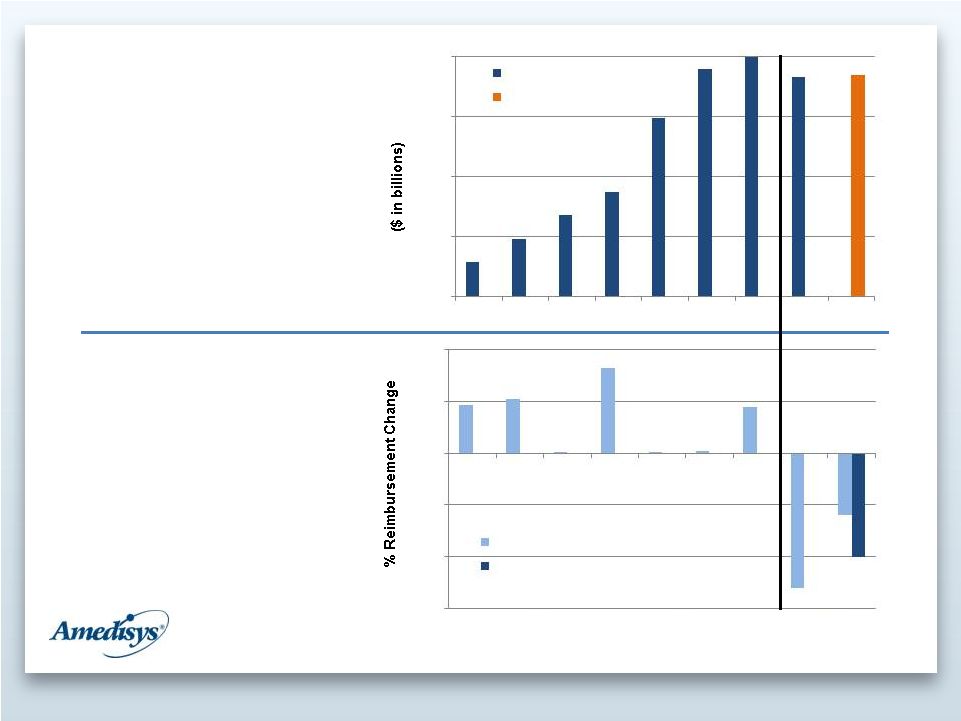

5

Medicare

Reimbursement

1

Amedisys

Revenue

1

2008 industry cut was 2.9%, however due to other HHRG

changes overall reimbursement was budget neutral.

$-

$0.4

$0.8

$1.2

$1.6

2004

2005

2006

2007

2008

2009

2010

2011

2012

Revenue

Projected Revenue

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

Industry % Change

Amedisys |

Washington

Update Industry Groups

•

NAHC

•

Partnership

•

Alliance

Topics

•

2013 Medicare Rules

•

Sequestration

•

Rebasing

•

Copay

6 |

Favorable Long

Term Trends •

Compelling demographics

•

Patient preference

•

Low cost of care delivery

•

Increased payor and hospital focus

7

*Source: Hospital numbers are from

US Census Bureau, others from MedPac March 2012 report

Hospital

LTAC

IRF

SNF

Hospice

Home

Health

Average Cost of Stay

$10,043

$38,582

$17,085

$10,833

$11,217

$5,706

Average Length of Stay

5 days

27 days

13 days

27 days

86 days

120 days

Average Per Diem Cost

$1,853

$1,450

$1,304

$400

$130

$48 |

Today and

Tomorrow 8

Traditional

HHC & HSP

Care

Management

Solutions

•

Fee for service

•

High volume / low

margins

•

Technology investments

to drive efficiency

•

Need for scale

•

Clinical quality

•

Risk-bearing partnerships

•

Value driven

•

Clinical management

technology

•

Partnering with payors and

other providers

•

Superior outcomes |

Post Acute Care

Challenges Today 9

Hospital

Physicians

Post Acute

Facilities

Payors

Home

Health

Hospice

Key Issues

Poor care coordination

Misaligned incentives

Poor communication

Patient

Multiple conditions

Numerous physicians

Polypharmacy

Patient

Home |

Post Acute

– ACO / Bundling

10

Hospital

Physicians

Post Acute

Facilities

Payors

Home

Health

Hospice

•

Aligned incentives

•

Data exchange

•

Communications

•

Care Protocol

AMED Initiatives

Healthcare at home

AMS3

Mercury Doc

Hospital partnerships

Managed care business

CMS Bundled payment

Patient

Home

pilot |

Post Acute

– Value Enhancement

11

Facilities

Physician

Payors

Patient

Home

CARE MANAGEMENT

•

Med. reconciliation

•

Multidisciplinary care

•

Telemonitoring

•

Focus on readmissions

CARE COORDINATION

•

Telefax

•

Connectivity –

Mercury Doc

CARE TRANSITIONS

•

Pre-discharge planning

•

Facility Care Coordination

•

Reporting

Agreements |

Home

Health/Hospice Medicare Spend 12

Home Health Source: CBO March 2012 Baseline report

Hospice Source: CBO March 2010 Baseline report with growth rate based on Others section of CBO

March 2012 Baseline report. Hospice CAGR = 6.4%

Home Health CAGR = 5.9%

$19

$20

$21

$22

$23

$24

$26

$28

$30

$14

$15

$16

$17

$18

$19

$21

$22

$23

$-

$10

$20

$30

$40

$50

$60

2011

2012

2013

2014

2015

2016

2017

2018

2019

Medicare Reimbursement

Home Health

Hospice |

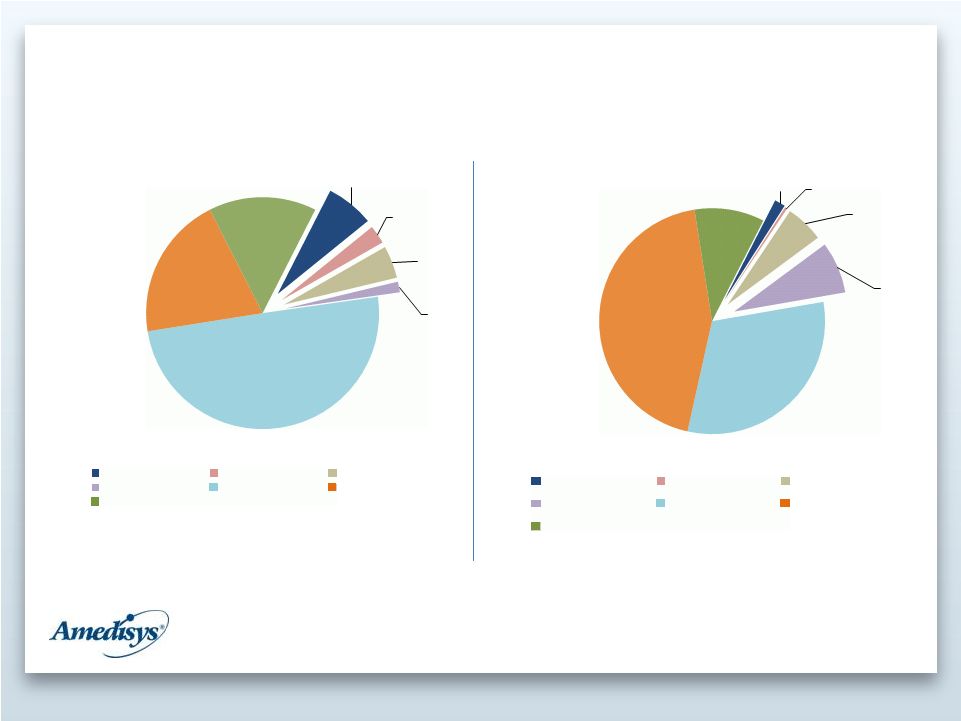

Market Share

– Medicare Revenue

13

Sources: Company financials, Medicare claims data

Non

Profit

For Profit

Non Profit

For Profit

6.7%

2.6%

4.5%

1.5%

49.8%

20.0%

15.0%

Home Health

Amedisys

LHCG

Gentiva

Almost Family

For Profit

Non Profit

Hospital Based

1.5%

0.3%

5.5%

7.4%

31.2%

44.0%

10.0%

Hospice

Amedisys

LHCG

Gentiva

Chemed (Vitas only)

For Profit

Non Profit

Hospital Based |

Business

Fundamentals 14

Clinical

Excellence

Growth

Efficiency |

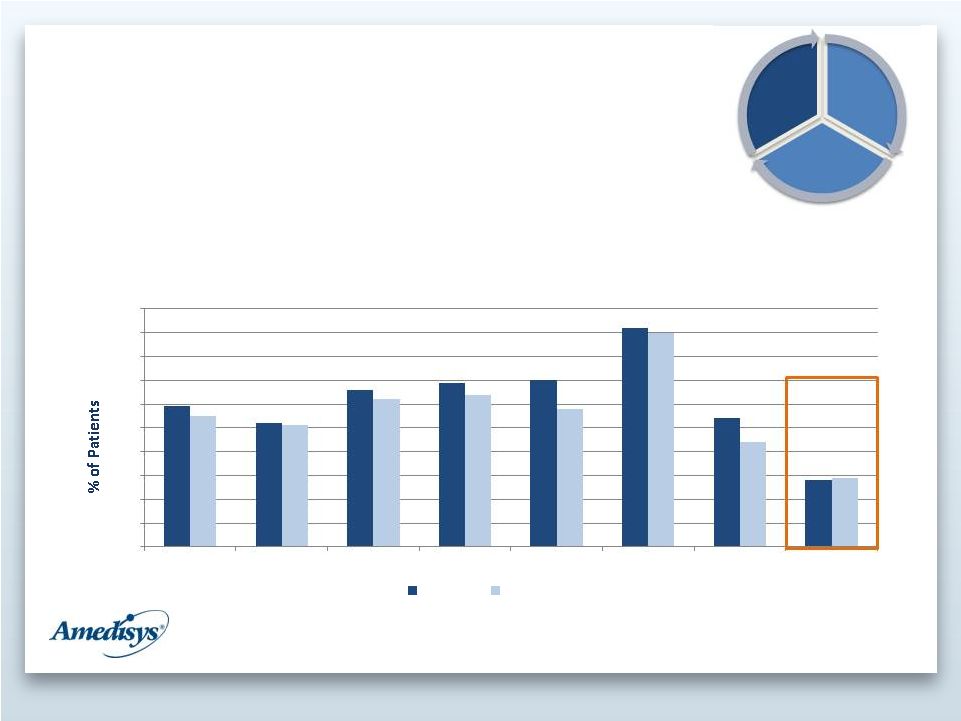

Clinical

Excellence 15

•

Clinical Outcomes

–

Exceeded 8 out of 8 outcomes vs. footprint of reported measures

*

Lower % is better

Source: Medicare

Amedisys

vs.

Footprint

–

Outcomes

TTM

March

2012

59

52

66

69

70

92

54

28

55

51

62

64

58

90

44

29

0

10

20

30

40

50

60

70

80

90

100

Ambulation

Transferring

Bathing

Pain

Breathing

Surgical Wounds

Mgmt of Oral

Meds

Acute Care

Hospitalization*

Clinical

Excellence

Efficiency

Growth

Amedisys

Footprint |

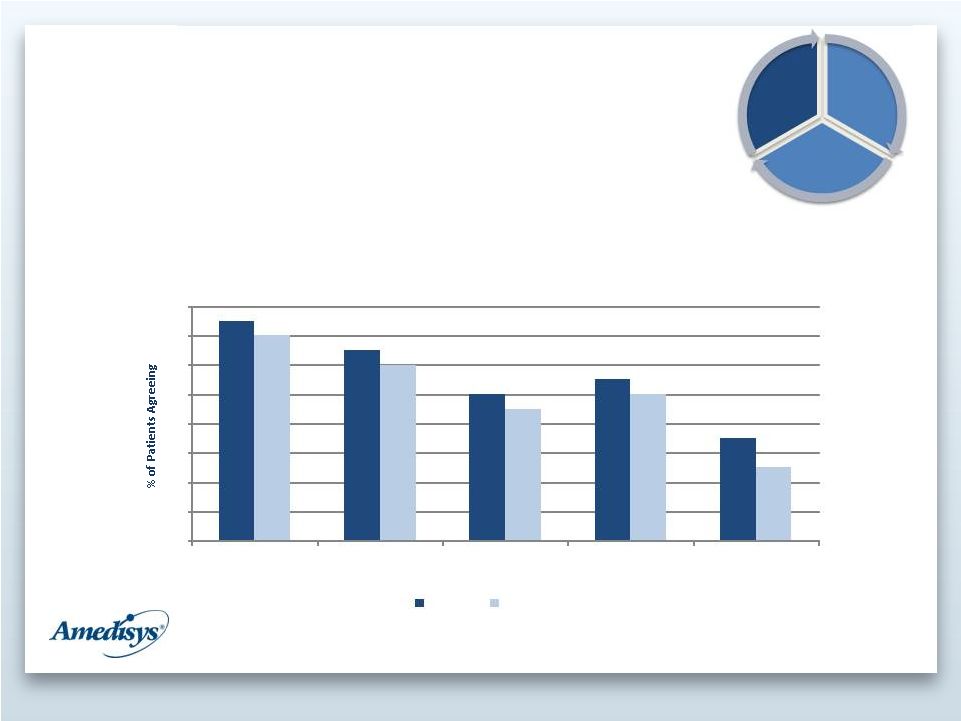

16

Clinical Excellence

•

Survey Questions

–

Exceeded all 5 survey questions vs. footprint of reported measures

Clinical

Excellence

Growth

Efficiency

89

87

84

85

81

88

86

83

84

79

74

76

78

80

82

84

86

88

90

Professional care

Communicated well

Discussed Meds, pain,

safety

Rating of 9 or 10

Recommend

Survey Questions TTM December 2011

Amedisys

Footprint |

17

•

Clinical leadership

investment

•

Enhanced clinical processes

–

Telemonitoring

–

Patient care conferences

–

Medical director

involvement

•

Specialty Programs

–

Speech language

–

Behavioral health

–

Balanced for Life

•

Future technology upgrades

–

Patient-specific care

treatment

Clinical Excellence

Growth

Efficiency

Clinical

Excellence |

Growth

18

•

Managed Care

•

Care

coordination

relationships

with

hospitals

and

health

systems

•

Market-specific

sales plans / CRM tool

•

Home health/hospice consolidation opportunities

Clinical

Excellence

Growth

Efficiency |

Operational

Efficiency 19

•

Hospice point-of-care

•

Portfolio review ongoing

•

Staffing models and clinician productivity

•

Industry leading operating system (AMS)

–

Technical

–

Economic

–

Strategic

–

Clinical

–

Quality

–

Connectivity

Clinical

Excellence

Growth

Efficiency |

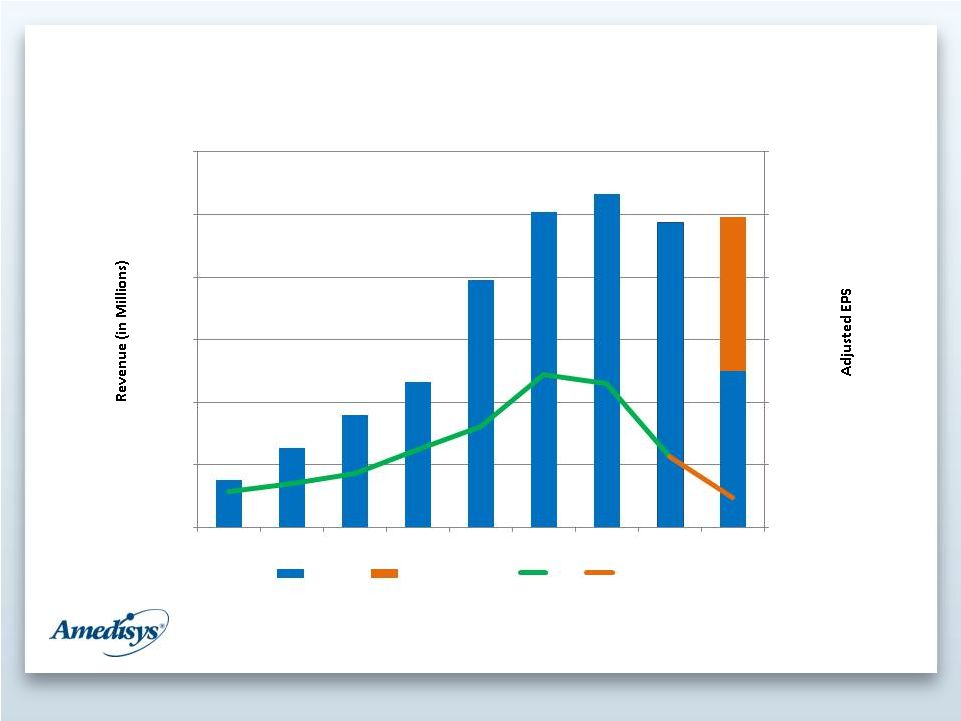

Financial

Review 20 |

Financial

Highlights 21

$-

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$-

$300

$600

$900

$1,200

$1,500

$1,800

2004

2005

2006

2007

2008

2009

2010

2011

2012

Revenue

Projected Revenue

EPS

Projected EPS |

22

Summary Financial Results

($ in millions, except per share data)

2010

(1)

2011

(1)

2Q11

(2)

2Q12

(2)

Continuing Operations

Net Revenue

$ 1,597

$ 1,466

$ 368

$ 378

Gross Margin %

50.1%

46.6%

48.6%

43.9%

EBITDA

$ 256

$ 156

$ 50

$ 26

EBITDA Margin

16.0%

10.7%

13.5%

6.8%

Fully-diluted EPS

$4.61

$2.27

$0.79

$0.27

(1)

The financial results for the years 2011 and 2010 are adjusted

for certain

items incurred in 2011 and 2010 and should be considered non-GAAP

financial measures

A

reconciliation of these non-GAAP financial measures is included as Exhibit 99.2 to our

Form 8-K filed with the Securities and Exchange Commission on February 28, 2012.

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter ended June

30, 2012 and Form 8-K as filed with the Securities and Exchange Commission on

August 7, 2012.

|

Summary Division

Results 23

($ in millions)

2010

(1)

2011

(1)

2Q11

(2)

2Q12

(2)

Home Health

Net Revenue

$ 1,458

$ 1,248

$ 322

$ 305

Gross Margin %

51%

47%

48.9%

42.8%

Hospice

Net Revenue

$ 139

$ 218

$ 47

$ 74

Gross Margin %

47%

46%

46.2%

48.4%

Continuing Operations

(1) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012. For

2010 and 2011, net revenue is adjusted for a CMS bonus payment as the result of the pay for performance

demonstration of $3.6 and $4.7 million, respectively. In addition, 2010 net revenue is

adjusted $3.7 million for the Georgia indigent care liability settlement.

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter ended June

30, 2012 as filed with the Securities and Exchange Commission on August 7, 2012.

|

24

Summary Operating Statistics

(Numbers in thousands, except rev. per

episode)

2010

(1)

2011

(1)

2Q11

(2)

2Q12

(2)

Home Health

Total visits

8,899

8,335

2,106

2,162

Episodic-based

admissions

248

234

58

59

Completed episodes

416

392

100

96

Revenue per episode

$3,312

$3,005

$3,032

$2,860

Statistics are for continuing operations only.

(1) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012.

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2012 as filed with the Securities and Exchange Commission on

August 7, 2012. |

Summary

Operating Statistics 25

2010

(1)

2011

(1)

2Q11

(2)

2Q12

(2)

Hospice

Total admissions

11,275

15,889

3,702

4,891

Daily census

2,832

4,197

3,746

5,497

Average length of stay

88

88

86

95

Statistics are for continuing operations only.

(1) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012.

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2012 as filed with the Securities and Exchange Commission on

August 7, 2012. |

26

Summary Balance Sheet

Assets

Dec. 31, 2011

Jun. 30, 2012

Cash

$ 48

$ 37

Accounts Receivable, Net

148

163

Property and Equipment

148

146

Goodwill

335

343

Other

179

169

Total Assets

$ 858

$ 858

Liabilities and Equity

Debt

$ 145

$ 128

All Other Liabilities

193

189

Equity

520

541

Total Liabilities and Equity

$ 858

$ 858

Leverage Ratio

1.0x

1.2x

Days Sales Outstanding

35

38

($ in millions) |

27

Liquidity

Available line of credit (LOC): 6/30/12 = $230M

($ in millions)

2011

2012

Cash Flow From Operations

$ 142

$ 95-105

Cap Ex

44

40-45

Debt repayments

38

34

Cash Flow, Net

60

21-26

Beginning Cash

120

Acquisitions

(132)

End Cash

$ 48 |

28

Guidance

1

Calendar Year 2012

2

Net revenue:

$1.490 -

$1.525 billion

EPS:

$0.95 -

$1.10

Diluted shares:

30.2 million

Guidance based on continuing operations excluding the effects of the following: any

future acquisitions, if any are made; effects of any share repurchases;

non-recurring costs or changes that may be incurred during the year or the impact

of any future Medicare rate changes. Provided as of the date of our form 8-K filed

with the Securities and Exchange Commission on August 7, 2012. 1

2 |

Investment

Rationale •

Favorable demographic trends

•

Positive attributes of home based care

•

IT infrastructure/scalability

•

Clinical quality and innovation

•

Strong liquidity and capital position

•

Market share capture opportunities

29

Efficient Core

Business

Care Mgmt

Solutions |

Contact

Information Kevin B. LeBlanc

Director of Investor Relations

Amedisys, Inc.

5959 S. Sherwood Forest Boulevard

Baton Rouge, LA 70816

Office: 225.299.3391

Fax: 225.298.6435

kevin.leblanc@amedisys.com

30 |