Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RigNet, Inc. | d396792d8k.htm |

Exhibit 99.1

| Oppenheimer Technology and Communications Conference August 14-15, 2012 |

| Forward-Looking Statements Certain statements made over the course of this presentation may constitute forward-looking statements, including statements regarding the markets in which we operate, the demand for our products and services and the advantages of our services compared to others. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or other achievements. Actual results may differ materially from the results anticipated by these forward-looking statements, which apply only as of the date of this presentation, as a result of various important factors, including those described in Item 1A of our Annual Report filed on Form 10- K for the fiscal year ended December 31, 2011 and other reports filed with the Securities and Exchange Commission. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We disclaim any obligation to update any forward-looking statement for subsequently occurring events or circumstances. In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. Definitions of these non-GAAP measures and reconciliations between certain GAAP and non-GAAP measures are included in the appendix to this presentation. |

| Introduction to RigNet Founded in 2001, RigNet is a leading global provider of remote communications and collaborative applications to the oil and gas industry, both offshore and onshore Majority of revenues from recurring, multi- tenant revenue model under long-term contracts Manage a global IP / MPLS network reaching RigNet's owned, last-mile infrastructure Provide managed services to 1,000+ sites in 30+ countries on six continents1 Strong history of growth with record revenues of $33.2MM in Q2 2012, and $109.4MM in 2011 A leader in profitability with 30.4% EBITDA margin2 (1) As of June 30, 2012 (2) Adjusted EBITDA Q2 2012 Note: As of December 31, 2011. Offshore represents Eastern and Western Hemispheres; onshore represents U.S. Land as reported in Company filings. |

| Providing Reliable, Remote Communications for the Life of the Oil Field Communications for the Life of the Oil Field |

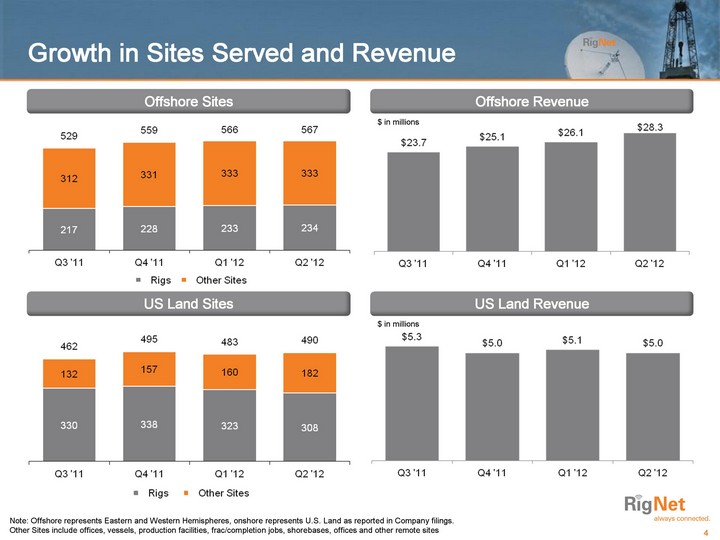

| Growth in Sites Served and Revenue Offshore Sites US Land Sites Offshore Revenue US Land Revenue Note: Offshore represents Eastern and Western Hemispheres, onshore represents U.S. Land as reported in Company filings. Other Sites include offices, vessels, production facilities, frac/completion jobs, shorebases, offices and other remote sites $ in millions $ in millions |

| RigNet's Share of Drilling Rigs Terrestrial IP Network and Office Presence RigNet POP RigNet Network Connection RigNet Offices RigNet Teleport RigNet CoreHUB Western Hemisphere (Offshore) RigNet Rigs Market Rigs RigNet Share 86 250 34% Eastern Hemisphere (Offshore) RigNet Rigs Market Rigs RigNet Share 148 514 29% U.S. Land RigNet Rigs Market Rigs RigNet Share 308 1,911 16% RigNet Rigs Global Offshore Market Rigs RigNet Share 234 764 31% Source: IHS-Petrodata RigBase Current Activity Data downloaded June 1, 2012; Baker Hughes North American Rotary Rig Count report dated June 30, 2012, Company filings Note: Primary rigs considered for rig counts include jackups, drillships and semi-submersibles. U.S. Land Service Centers |

| Growing and Attractive Market Opportunity Source: Frost & Sullivan World Satellite VSAT Markets, December 2009 Broadband VSAT Service Market: Approaching $8.0bn by 2016 Growth CAGR 2010 - 2012: 10.2% 2010 - 2016: 7.8% Upstream energy communications market represents roughly 20% of the broadband VSAT market Source: Upstream energy communications market size based on RigNet management estimates |

| Summary of Upstream Market and Relative Impact of Oil and Gas Price Movements Source: ODS-Petrodata, Spears and Associates, FactSet Top graph shows oil and natural gas prices from 2006 through first half of 2012 Bottom graph shows the number of offshore and onshore drilling rigs from 2006 through a projected 2013 The rapid drop in oil and gas prices in 2009 had a direct impact on the level of US land drilling, but a muted effect on international land drilling and essentially no effect on offshore drilling With over 80% of revenues coming from offshore rigs, RigNet is mostly hedged against rapid oil and gas price movement, though with a meaningful exposure to US land drilling In the current period, oil and gas prices have diverged, leading US land drilling to migrate toward oil-directed and liquids- directed wells INSIGHTS |

| Offshore (Primary Classes) Offshore (Primary Classes) Offshore (Primary Classes) Onshore Jackups Semi-submersibles Drillships Rig Description Up to 400 Feet of Water; contracted for 30 days to 5 years Up to 10,000 Feet of Water; contracted for 3 to 5 years Up to 12,000 Feet of Water; contracted for 3 to 5 years Contracted for 30 days to 2 years Rig Day Rate $100,000+ $350,000+ $415,000+ $22,500+ Typical Crew Size 50 100-200 100-200 20-50 # Active Units 410+ 175+ 75+ 1,950+ Overview of Rigs RigNet's communications day rates represent <1% of total rig day rates Source: ODS-Petrodata (February 20, 2012), Spears and Associates (December 2011), Company Estimates |

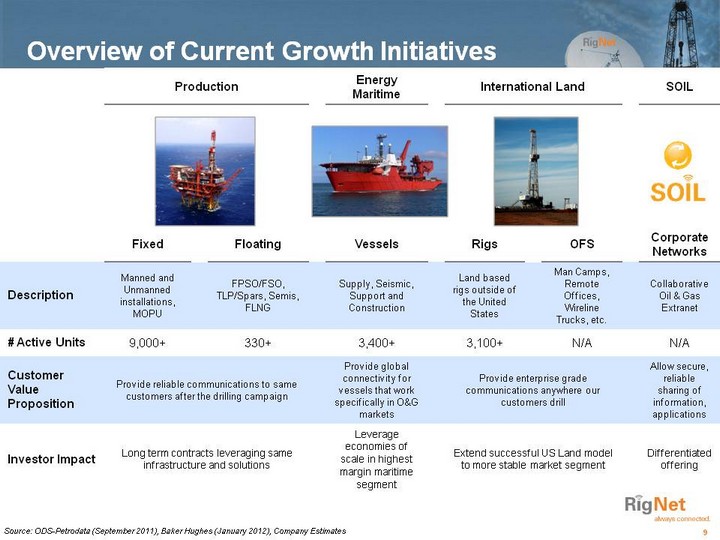

| Production Production Production Energy Maritime International Land International Land International Land SOIL Fixed Floating Vessels Rigs OFS Corporate Networks Description Manned and Unmanned installations, MOPU FPSO/FSO, TLP/Spars, Semis, FLNG Supply, Seismic, Support and Construction Land based rigs outside of the United States Man Camps, Remote Offices, Wireline Trucks, etc. Collaborative Oil & Gas Extranet # Active Units 9,000+ 330+ 3,400+ 3,100+ N/A N/A Customer Value Proposition Provide reliable communications to same customers after the drilling campaign Provide reliable communications to same customers after the drilling campaign Provide reliable communications to same customers after the drilling campaign Provide global connectivity for vessels that work specifically in O&G markets Provide enterprise grade communications anywhere our customers drill Provide enterprise grade communications anywhere our customers drill Provide enterprise grade communications anywhere our customers drill Allow secure, reliable sharing of information, applications Investor Impact Long term contracts leveraging same infrastructure and solutions Long term contracts leveraging same infrastructure and solutions Long term contracts leveraging same infrastructure and solutions Leverage economies of scale in highest margin maritime segment Extend successful US Land model to more stable market segment Extend successful US Land model to more stable market segment Extend successful US Land model to more stable market segment Differentiated offering Overview of Current Growth Initiatives Source: ODS-Petrodata (September 2011), Baker Hughes (January 2012), Company Estimates |

| The RigNet Managed Solution Corporate Data Networks Video Conferencing Corporate Internet Access VoIP RigNet typically owns all the communications infrastructure installed on each rig RigNet's technicians install, deploy and maintain the infrastructure over its life RigNet's architected solution is a sophisticated and managed network service that is designed to optimize bandwidth usage and can support complex IT application needs Existing infrastructure can easily scale to support multiple tenants and services Managed Crew Wi-Fi Bandwidth Acceleration Customer Portals Handheld Remote Video Real-time Monitoring Quick-deploy Comms Core Offerings Value Added Services |

| Compelling Returns Driven by Multi-Tenancy Model Pay-Per-Use (Off-duty Employees and Visitors) Service Companies Operators (Oil Companies) Incremental CAPEX Return on Capital Crew WiFi, Infotainment, Crew Calling Can be pay-per-use or contracted by Driller or Operator Specialized companies with varying length of stay Contracted for duration of stay Potential for several simultaneous customers Have higher data needs Contracts with RigNet vary from 1 month to several years Incremental Operational Effort Note: Illustrative |

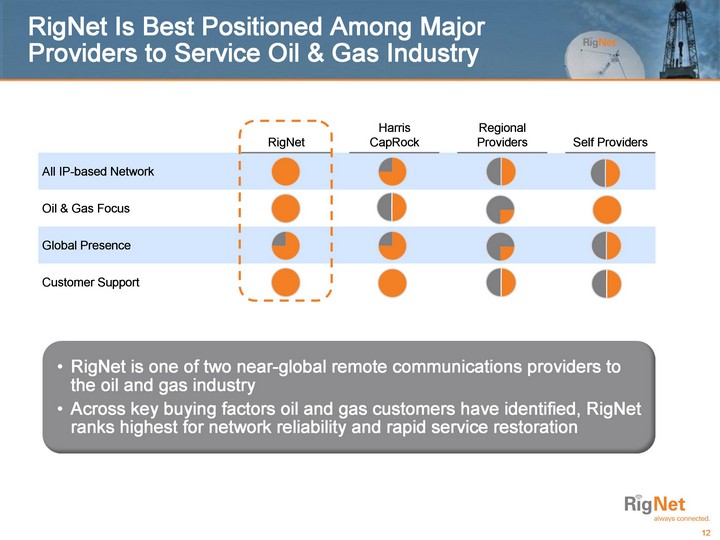

| RigNet Is Best Positioned Among Major Providers to Service Oil & Gas Industry RigNet Harris CapRock Regional Providers Self Providers All IP-based Network Oil & Gas Focus Global Presence Customer Support RigNet is one of two near-global remote communications providers to the oil and gas industry Across key buying factors oil and gas customers have identified, RigNet ranks highest for network reliability and rapid service restoration |

| Blue Chip Customer Base Drilling Companies Operators Service Companies Top 10 customers accounted for 37% of 2011 revenue BruneiShell No customer accounted for more than 12% of 2011 revenues |

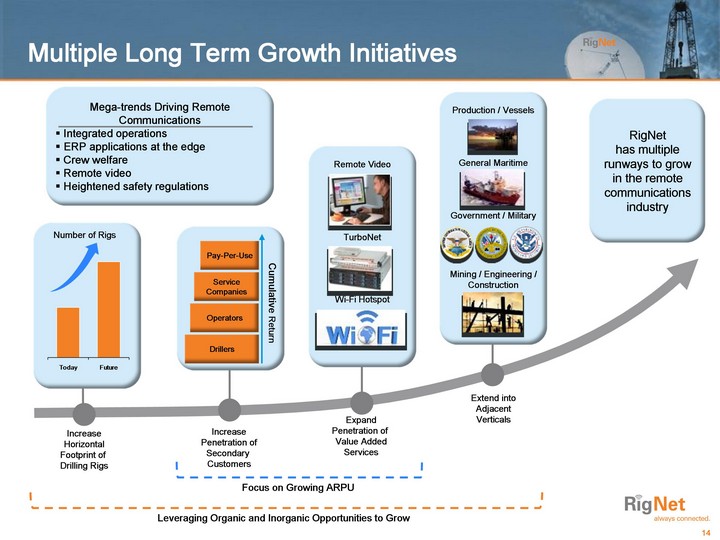

| Multiple Long Term Growth Initiatives RigNet has multiple runways to grow in the remote communications industry Increase Penetration of Secondary Customers Cumulative Return Drillers Operators Service Companies Pay-Per-Use Expand Penetration of Value Added Services Increase Horizontal Footprint of Drilling Rigs Number of Rigs Focus on Growing ARPU Extend into Adjacent Verticals Leveraging Organic and Inorganic Opportunities to Grow |

| Acquisition of Nessco Transaction Details Acquisition Rationale & Synergies Nessco acquisition adds broader set of capabilities and product offerings required by the oil & gas production market. Nessco designs, builds, installs and commissions complex telecommunications systems for offshore and onshore production facilities, providing RigNet a key entry point into the offshore production vertical Nessco's business to benefit from RigNet's global footprint, larger scale, customer relationships, and access to capital RigNet gains a new revenue source in Nessco's Systems Integration revenue stream, which contributed 65% to Nessco's FY2012 revenue. All cash purchase price of $48.9m (£31.1m) or 6.7x FY 2012 EBITDA Entered into an amended credit facility that provides both a $66.4m term facility and $10.0m revolving facility Pro forma EBITDA leverage ratio is approximately 1.5x On July 05, 2012, announced the acquisition of Nessco Group Holdings Ltd (Nessco) |

| Q2, 2012 Results Summary Revenue Adjusted EBITDA UFCF % Y-o-Y growth % margin % margin 26.9% 16.2% 19.3% 30.4% 31.6% 32.7% 29.7% 15.9% 10% 17.1% 10.4% 27.6% (1) Excluding $662K in acquisition costs for Nessco Note: UFCF defined as adjusted EBITDA - capex. $ in millions 22.5% 30.6% 13.5% Revenue of $33.2 million grew 26.9% year-over-year Adjusted EBITDA of $10.1 million grew 21.7% year-over-year Net income attributable to stockholders of $3.5 million or $0.21 per diluted share1 YTD Capital expenditures of $10.8 increased 9.0% year-over-year Cash balance of $52 million Debt of $19.2 million |

| Balance Sheet ($ in millions) 06/30/2012 Actual 6/30/2012 Pro forma1 Cash $52.0 $57.0 Debt $19.2 $66.4 Total Debt / LTM EBITDA 0.5x 1.5x Net Debt / LTM EBITDA (0.9x) 0.2x No significant debt maturities in 2012 Favorable relationships with creditors Ample liquidity (1) Nessco EBITDA based on FY 2012 (March 30, 2012) |

| RigNet share price performance since IPO IPO overview Select institutional buyers IPO priced on December 14, 2010 Listed on NASDAQ $12.00 price per share 5,750,000 shares offered (including greenshoe) 67% primary, 33% secondary T. Rowe Price Act II Capital Copia Capital Wall Street Associates Baron Franklin Source: Company filings, Wall Street research, FactSet |

| Investment Highlights Strong Organic Growth High Return on Invested Capital Industry Leading Margins High Revenue Visibility Robust Free Cash Flow |

| Oppenheimer Technology and Communications Conference August 14-15, 2012 UPDATE |