Attached files

| file | filename |

|---|---|

| 8-K - KAMAN CORPORATION FORM 8-K DATED AUGUST 14, 2012 - KAMAN Corp | form8-k.htm |

Kaman Corporation (NYSE: KAMN)

Investor Presentation

August 14, 2012

2

Investment Summary

§ Significant long-term organic growth opportunities in Aerospace

and Industrial Distribution

and Industrial Distribution

§ High margin Aerospace business benefiting from increasing

commercial aircraft build rates

commercial aircraft build rates

§ Select defense platforms ramping up

§ Industrial Distribution business growing organically, gaining scale

via acquisitions, and adding complementary product platforms

via acquisitions, and adding complementary product platforms

§ Investing in new product development and applications,

acquisitions and technology for long-term growth

acquisitions and technology for long-term growth

§ Strong balance sheet to drive growth and strategic initiatives

§ Experienced management team

3

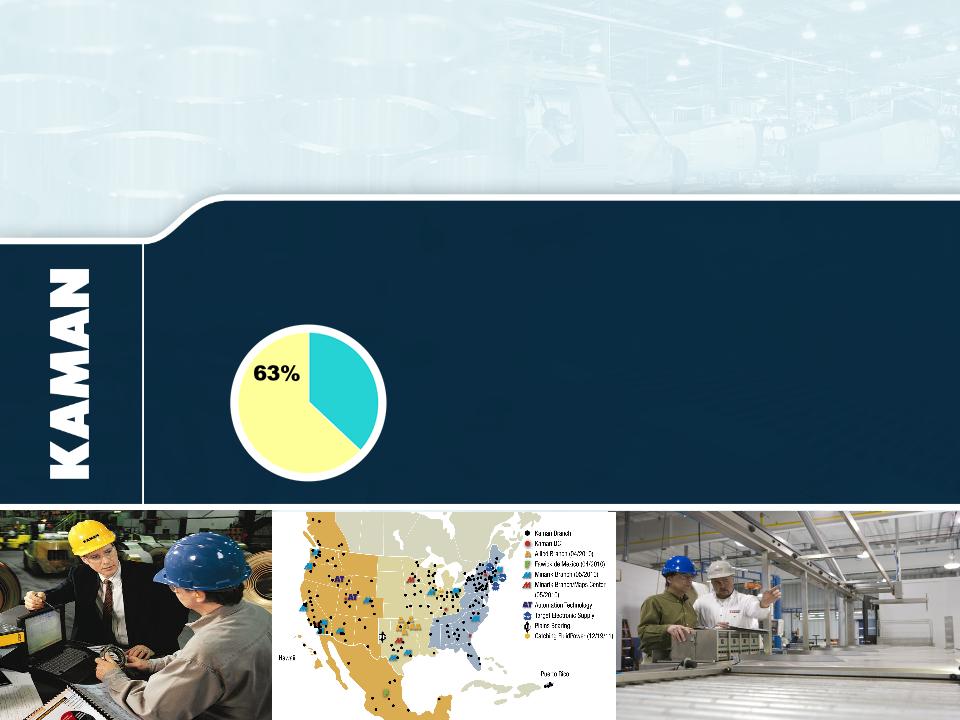

§ Two core businesses

– Aerospace

• Manufacturer and subcontractor in the global commercial and military aerospace

and defense market

and defense market

• Diverse customer base of blue chip customers and government divisions

– Industrial Distribution

• Third largest distributor in the power transmission/motion control/fluid power

market

market

• Offers over four million SKUs to over 50K customers via 235 locations

§ Publicly listed on the NYSE with a market capitalization of $855 million as of

August 6, 2012

August 6, 2012

§ 2011 sales of $1.5 billion; 4,800 Employees

Kaman Corporation - Overview

(1) Adjusted - see non-GAAP reconciliation in Table 1 of this presentation

4

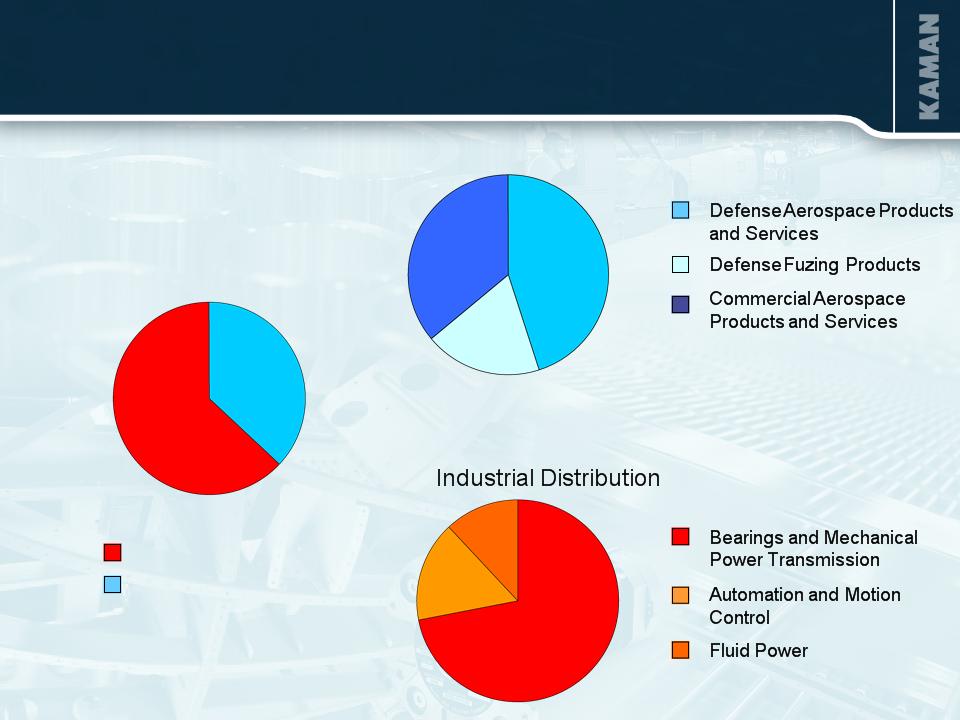

Consolidated

63%

37%

Industrial Distribution

Aerospace

72%

16%

12%

Aerospace

36%

45%

19%

Kaman Corporation - 2011 Sales Overview

5

(1) Adjusted - see non-GAAP reconciliation in Table 1 of this presentation

2011 Financial Highlights

§ Record net sales of $1.5 billion

- Industrial Distribution +14.3%

- Aerospace +12.5%

§ Operating profit was up $29 million(1) or 27%

- Industrial Distribution +59.1%

- Aerospace +14.7%(1)

§ Earnings per share +36% to $2.01(1)

- 2010 acquisitions added $0.20 to EPS

6

AEROSPACE

2011 Sales $547 Million

6

7

Aerospace

OBJECTIVE:

§ $1 billion in sales by 2014 / margins in the “high teens”

STRATEGY:

§ DEPTH - Size/financial strength to address larger, integrated work

packages from primes/OEMs and Tier 1s

packages from primes/OEMs and Tier 1s

§ DIVERSITY - Balance portfolio thru increased commercial content

§ DIFFERENTIATION - Continue to move from build-to-print to design-

and-build for higher margins and more defensible positions

and-build for higher margins and more defensible positions

§ DEVELOPMENT - Increased, focused investments in our people and

infrastructure to increase capabilities and drive improved performance

infrastructure to increase capabilities and drive improved performance

Aerospace - Progress Toward Objective

(1) Adjusted - see non-GAAP reconciliation in Table 1 of this presentation

Actual Sales

2014 Sales Objective

Operating margin,(1) (2009-2011 actuals ; 2012-2014 illustrate linear path to 2014 range,

actual results may vary)

9

Aerospace Acquisition Program 2008 - 2011

§ Three acquisitions:

- Brookhouse (U.K.)

- Global Aerosystems

- Vermont Composites

§ Annual sales acquired, $115 million

§ Average size, in sales, of $39 million

§ Average purchase price of $47 million, for a total of $140 million

10

Aerospace Business Drivers

§ Continued outsourcing trend by OEMs and Super Tier 1s to increase

flexibility and lower costs

flexibility and lower costs

§ High margin specialty bearing and aerostructure businesses

positioned to benefit from increased production rates at Boeing and

Airbus

positioned to benefit from increased production rates at Boeing and

Airbus

§ Defense platforms provide exposure to key vertical lift and reset

programs

programs

§ Legacy prime contractor capabilities provide attractive outsourcing

alternatives to today’s helicopter and fixed wing aircraft OEMs

alternatives to today’s helicopter and fixed wing aircraft OEMs

Fixed trailing edge

Fuel tank access doors

Top covers

Red denotes bearing products

Nose landing gear

Rudder

Main landing gear

Flaps

Horizontal stabilizer

Door assemblies

Engine/thrust reverser

Aircraft Programs/Capabilities

Flight controls

Doors

11

Manufacture of cockpit

Blade erosion coating

Manufacture and assembly

of tail rotor pylon

of tail rotor pylon

Manufacture, sub assembly

and joining of fuselage

and joining of fuselage

Blade manufacture,

repair and overhaul

repair and overhaul

Driveline couplings

Bushings

Flight control bearings

Aircraft Programs/Capabilities

Red denotes bearing products

12

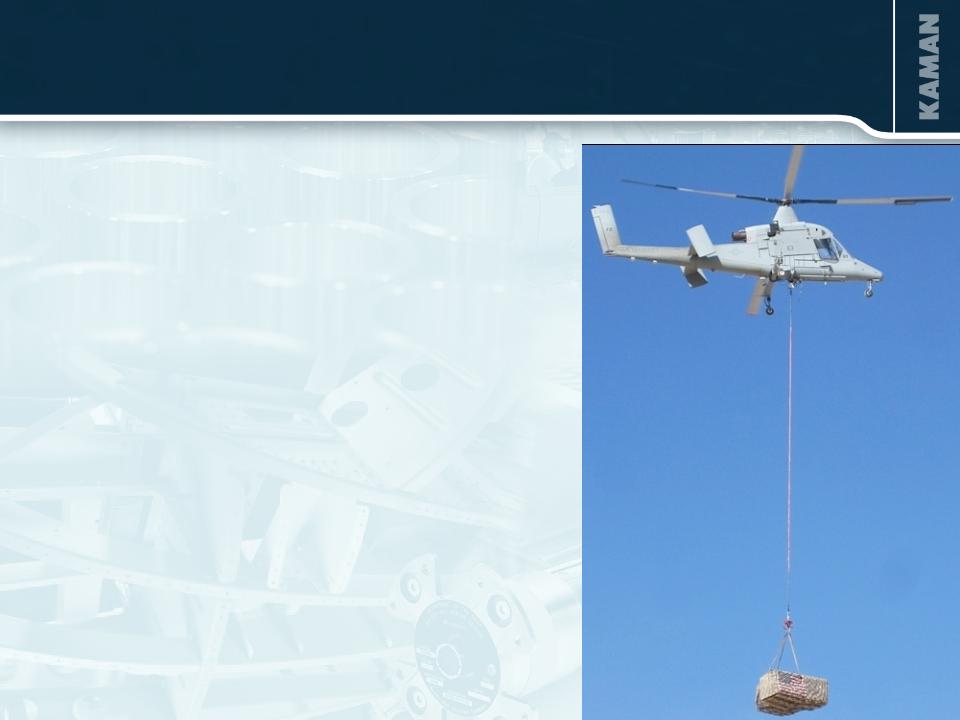

§ Kaman/Lockheed have developed an unmanned

military version of the K-MAX helicopter

military version of the K-MAX helicopter

§ Two K-MAXs have been performing unmanned

cargo resupply missions in Afghanistan since

December 2011

cargo resupply missions in Afghanistan since

December 2011

- The aircraft have successfully delivered more than

1.6 million pounds of cargo in over 520 missions

1.6 million pounds of cargo in over 520 missions

- Demonstration deployment extended through

March 2013

§ Lockheed Martin awarded unmanned K-MAX

development contracts

development contracts

- $47 million Army contract to develop autonomous

technologies

technologies

- Office of Naval Research down select to integrate,

test and demonstrate autonomous system

technology

test and demonstrate autonomous system

technology

13

Unmanned K-MAX®

14

JPF Program

§ 23 Foreign Customers

§ Backlog through 2013

§ Kaman is sole source, negotiating four year follow-on contact

15

Aerospace - Budget Impact on Defense Programs

§ Defense programs less impacted by proposed budget cuts

– UH-60 BLACK HAWK - continued demand

– Joint Programmable Fuze - backlog into 2013, foreign demand, continued

sole source

sole source

– F-35 (Joint Strike Fighter) - incremental business at any production level

– A-10 - reset, new business

– AH-1Z - new business

– C-17 - firm backlog into 2013, potential for additional foreign orders,

revenue <$10 million per year

revenue <$10 million per year

16

|

|

Projected Deliveries

|

||||

|

|

2011

|

|

2015

|

|

% Increase

|

|

Boeing 777

|

73

|

|

100

|

|

+ 37%

|

|

Boeing 747

|

9

|

|

18

|

|

+ 100%

|

|

Boeing 737

|

372

|

|

504

|

|

+ 35%

|

|

Boeing 787

|

3

|

|

120

|

|

+ + +

|

|

Airbus A320

|

425

|

|

483

|

|

+ 14%

|

|

Airbus A330/340

|

90

|

|

90

|

|

-

|

|

Airbus A380

|

23

|

|

35

|

|

+ 52%

|

|

Airbus A350

|

0

|

|

20

|

|

+ + +

|

Source: J.P. Morgan (Joseph Nadol)

Positioned to Benefit from Ramp in Commercial

Production

Production

17

18

Aerospace Awards

§ UTC Supplier Gold: Kamatics

§ Sikorsky Top 100 Supplier: Kamatics and Aerostructures - Jacksonville

§ Boeing Performance Excellence Award - Silver Level: Kaman Global

Aerosystems

Aerosystems

§ Raytheon Missile Systems Four Star Supplier Award presented to

Kaman Precision Products

Kaman Precision Products

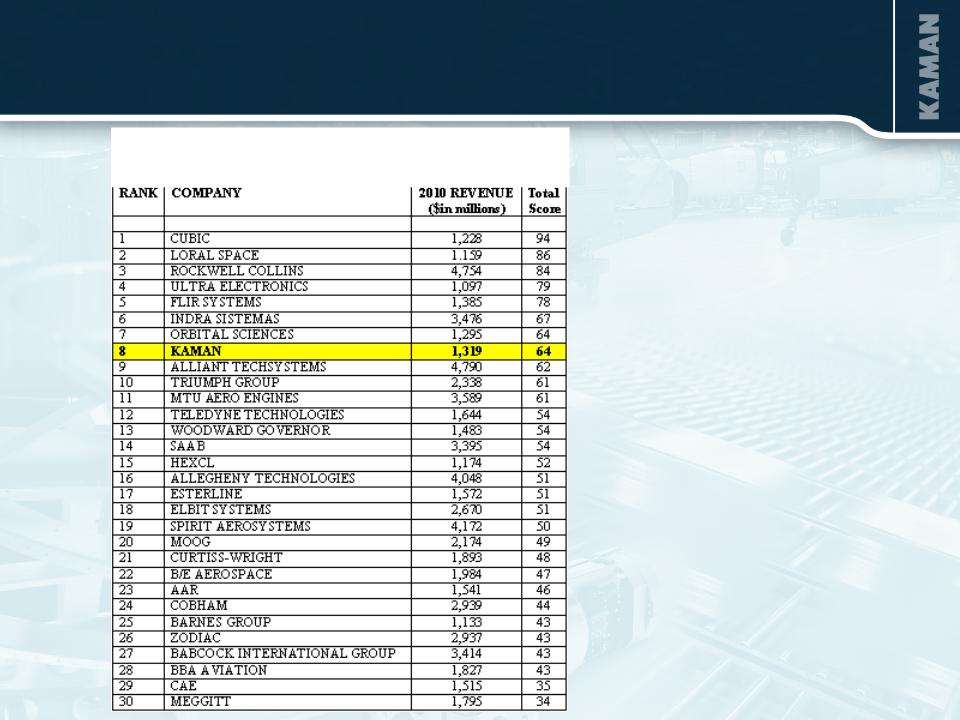

§ Aviation Week - Top Performing Companies

– 2011 #8 (companies with revenue between $1-5 billion)

– 2010 Five-Year Most Improved (companies with revenue between $1-5

billion)

billion)

19

NOW

FUTURE/VISION

Aerospace Strategic Transition

$547 Million sales $1 Billion sales

15.8% Operating margin “High Teens” operating margin

60% Build-to-print 70% Design-and-build

65% Defense 50% Defense/50% Commercial

Tier II/III Supplier Super Tier II

Small, independent businesses Integrated, coordinated,

synergistic business

synergistic business

Primarily domestic Multi-national

Competing on cost and manufacturing Competing on design-and-build

capability

manufacturing capability, and

Intellectual Property

manufacturing capability, and

Intellectual Property

INDUSTRIAL DISTRIBUTION

2011 Sales $951 Million

20

21

§ Third largest industrial distribution firm serving the $23 billion power

transmission / motion control market.

transmission / motion control market.

§ 235 locations and 5 distribution centers

§ Major product categories:

– Bearings

– Mechanical and electrical power transmission

– Fluid Power

– Motion control

– Automation

– Material handling

§ Metrics:

– $470,000 sales per employee (2011)

– 2,100 employees (approximately one third outside sales)

– 4.0 million SKUs offered

– 50,000+ customers

Industrial Distribution Overview

22

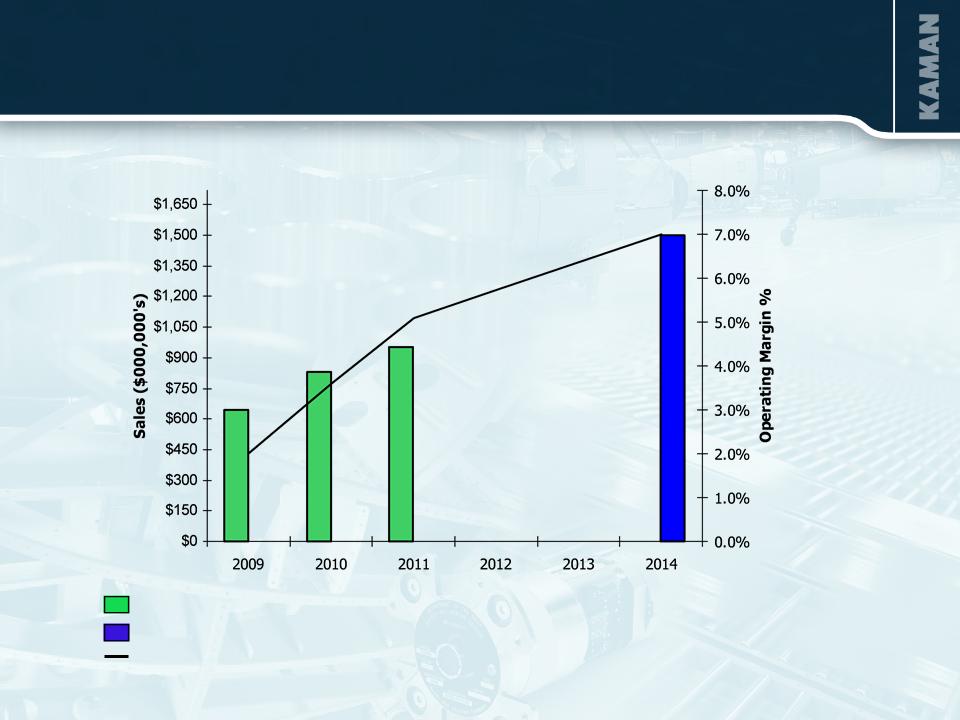

Industrial Distribution

OBJECTIVE:

§ $1.5 billion in sales - 7% operating profit margin by 2014

STRATEGY:

§ SCALE/GROWTH - Broaden product offering organically and through

acquisitions. Expand geographic footprint to enhance position in the

national accounts market

acquisitions. Expand geographic footprint to enhance position in the

national accounts market

§ PRODUCTIVITY - Recognize benefits from organizational realignment

and implement multi-faceted technology investments

and implement multi-faceted technology investments

§ PROFITABILITY - Recognize sales and cost synergies from the eight

acquisitions completed in 2010, 2011 and 2012. Enhance margins

through new higher margin product lines, a focus on pricing management

and leverage increased purchasing scale

acquisitions completed in 2010, 2011 and 2012. Enhance margins

through new higher margin product lines, a focus on pricing management

and leverage increased purchasing scale

Industrial Distribution - Progress Toward Objective

(1) Adjusted - see non-GAAP reconciliation in Table 1 of this presentation

Actual Sales

2014 Sales Objective

Operating margin,(1) (2009-2011 actuals ; 2012-2014 illustrate linear path to 2014,

actual results may vary)

24

Industrial Distribution - Acquisition of Zeller

Corporation

Corporation

§ Have entered into an asset purchase agreement to acquire Zeller Corporation

§ Zeller is a value added distributor of electrical and automation

components and engineered systems provider, encompassing the

following technologies:

components and engineered systems provider, encompassing the

following technologies:

– Motion control

– PLC based automation

– Machine vision

– Electrical controls

– Power distribution products

§ Zeller also represents other quality manufacturers including:

– Kollmorgen

– Phoenix Contact

– Rittal

– Sick

§ Zeller’s full year sales for 2012 are expected to be approximately $80

million with an operating profit margin higher than that of Kaman’s

Industrial Distribution segment

million with an operating profit margin higher than that of Kaman’s

Industrial Distribution segment

§ The transaction is expected to close in Q3 2012

25

|

Product

Platform |

Bearings & Mechanical Power

Transmission (BPT)

|

Fluid Power

|

Automation & Motion

Control |

|

% of 2011 Sales

(approximate)

|

72%

|

12%

|

16%

|

|

Market Size

|

$12.5 Billion

|

$7.2 Billion

|

$15.0 Billion

|

|

Acquisitions

since 2008 |

•Industrial Supply Corp.

•Allied Bearings Supply

•Plains Bearing

•Fawick de Mexico

•Florida Bearings

|

•Catching Fluidpower

•INRUMEC

|

•Minarik

•Automation Technology

•Target Electronic Supply

|

|

Major Suppliers

|

|

Major Product Platforms

26

Executing Strategy and Building Network

27

§ Q2 2012 sales grew 7.9% on a sales per sales day basis

§ 2011 sales were up 14.3% over the prior year to a record $951 million

§ Organic growth in 2011 was broad based

– 10 of top 10 product categories were up year-over-year

– 9 of top 10 end markets were up year-over-year

– 9 of top 10 states were up year-over-year (1 was down 1%)

§ Eight acquisitions completed in 2010, 2011 and 2012, accelerating the

top line and building scale (added ≈ $250 million in sales [annualized])

top line and building scale (added ≈ $250 million in sales [annualized])

Distribution Growth Continues

2011 Operating profit margin was 5.1%, up 150 bps over 2010;

Operating profit dollars were up 59%

28

NOW

FUTURE/VISION

Industrial Distribution Strategic Transition

$951 Million sales $1.5 Billion sales

5.1% operating margin 7.0% operating margin

Presence in 72 of the top 100 Presence in ≈ 90 of the top 100

U.S. industrial markets U.S. industrial markets

Three product platforms Three major product platforms

with increased market share in

motion/automation and fluid

power

with increased market share in

motion/automation and fluid

power

Narrow fluid power offering from Broad fluid power offering from

numerous single-technology multi-technology supplier

Suppliers

Seven ERP systems State of the art enterprise wide

business system

business system

29

Industrial Distribution Opportunities

§ Broaden product offering organically and through acquisition to win

additional business from existing customers and gain market share

additional business from existing customers and gain market share

§ Enhance margins through new higher margin product lines, a focus

on pricing management and leverage from higher sales

on pricing management and leverage from higher sales

§ Expand higher margin fluid power business via Parker national

reseller agreement

reseller agreement

§ Recognize sales and cost synergies from the eight acquisitions

completed in 2010, 2011 and 2012

completed in 2010, 2011 and 2012

§ Expand geographic footprint through additional acquisitions to

enhance Kaman’s position in the competition for national accounts

enhance Kaman’s position in the competition for national accounts

§ Improve productivity through technology investments to enhance

return on sales

return on sales

30

Outlook

The Company's expectations for 2012 are as follows:

§ Aerospace segment sales of $605 million to $625 million

§ Aerospace segment operating margins of 15.7% to 16.0%

§ Industrial Distribution segment sales of $1,035 million to $1,055 million

§ Industrial Distribution segment operating margins of 5.4% to 5.6%

§ Interest expense of approximately $11.5 million

§ Corporate expenses of approximately $44 million to $46 million

§ Tax rate of approximately 35%

§ Free cash flow of $30 million to $35 million

§ “We expect a much stronger fourth quarter than third with a variation in

net earnings of as much as 20%.”

net earnings of as much as 20%.”

31

Kaman Investment Merits

§ A Leading Market Position in Both Business Segments

§ Continued Focus on Profit Optimization, Increasing Cash

Flows and Strengthening Competitive Position

Flows and Strengthening Competitive Position

§ Strong Liquidity and Conservative Financial Profile

- Investment Grade Rating (BBB-/Stable)

§ Disciplined and Focused Acquisition Strategy

§ Experienced Management Team

32

FINANCIAL SUMMARY

37%

2011 Sales $1.50 Billion

33

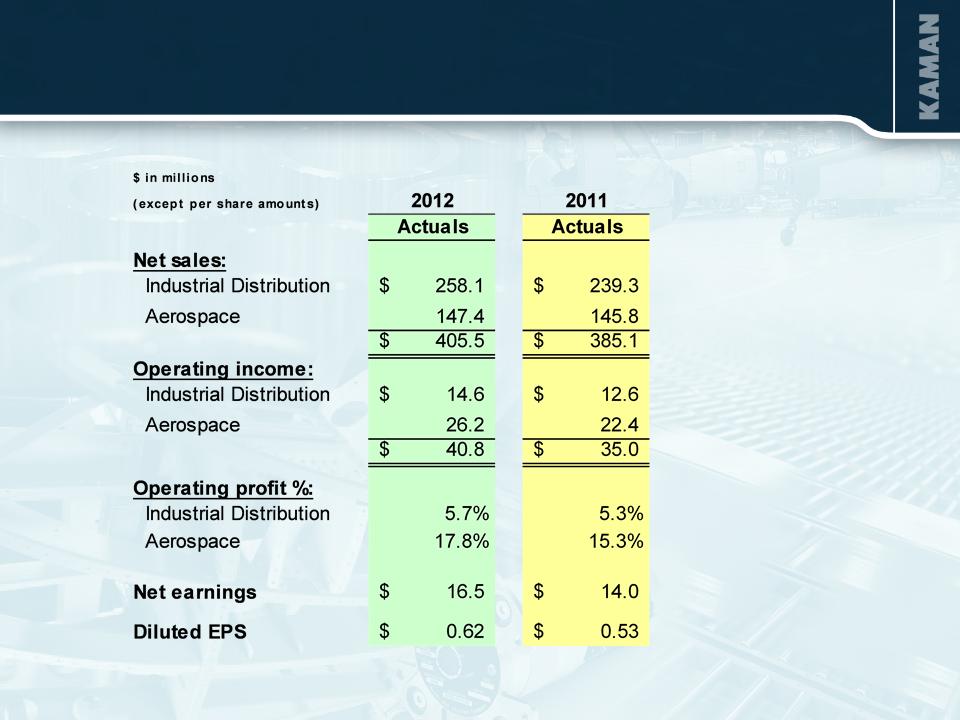

Financial Highlights - Q2

34

(1) Adjusted - see non-GAAP reconciliation in Table 1 of this presentation

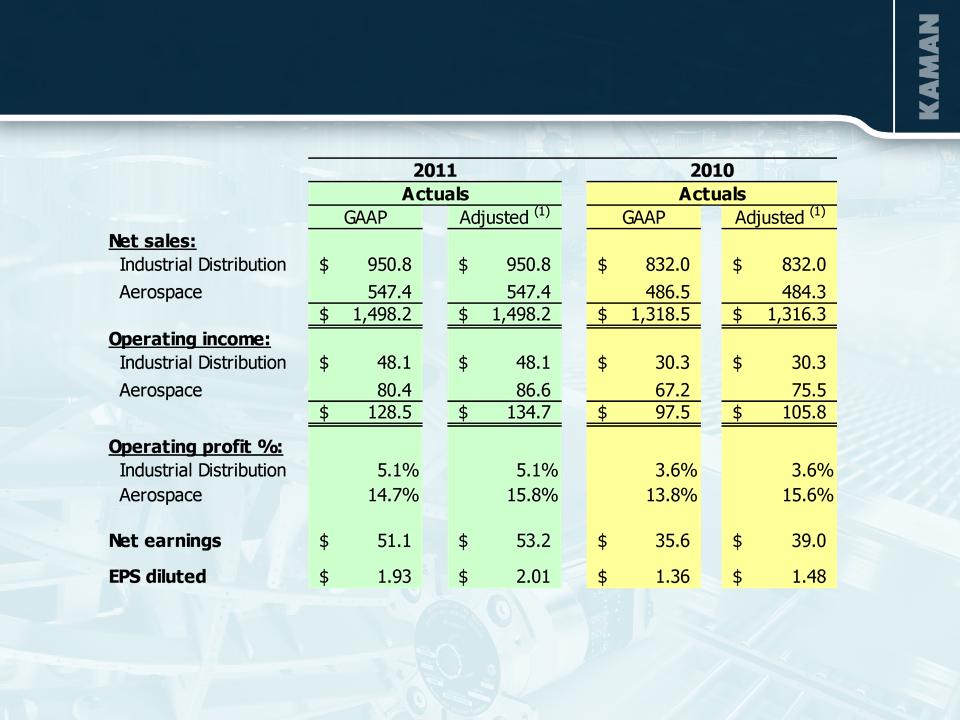

Financial Highlights - Full Year 2011

35

|

(In Millions)

|

As of 6/29/2012

|

As of 12/31/11

|

As of 12/31/10

|

|

Cash and Cash Equivalents

|

$ 15.1

|

$ 15.0

|

$ 32.2

|

|

Notes Payable and Long-term Debt

|

$ 230.3

|

$ 205.2

|

$ 148.4

|

|

Shareholders’ Equity

|

$ 399.3

|

$ 373.1

|

$ 362.7

|

|

Debt as % of Total Capitalization

|

36.6%

|

35.5%

|

29.0%

|

|

Capital Expenditures

|

$ 11.0

|

$ 28.8

|

$ 21.5

|

|

Depreciation & Amortization

|

$ 13.3

|

$ 23.2

|

$ 20.5

|

(1) Six months year to date

(1)

(1)

Balance Sheet and Capital Factors

36

26,104

26,500

Diluted weighted average shares outstanding

$ 1.48

$ 2.01

Non-GAAP adjusted net earnings per common share diluted

0.05

-

Aerospace contract pricing settlement

(0.17)

-

Look-back interest benefit

0.24

-

Goodwill impairment charge

-

0.15

FMU-143 litigation settlement

-

(0.07)

Non-recurring benefit associated with the death of a former executive

$ 1.36

$ 1.93

GAAP earnings per common share - diluted

$ 38,982

$ 53,213

Non-GAAP adjusted net earnings

1,300

-

Aerospace contract pricing settlement

(4,300)

-

Look-back interest benefit

6,371

-

Goodwill impairment charge

3,971

FMU-143 litigation settlement

-

(1,900)

Non-recurring benefit associated with the death of a former executive

$ 35,611

$ 51,142

GAAP net earnings as reported

December 31,

2010

December 31,

2011

For the twelve months ended

NET EARNINGS:

Table 1. Reconciliation of Non-GAAP Financial Information

(In thousands except per share amounts)

(In thousands except per share amounts)

37

|

AEROSPACE SEGMENT OPERATING INCOME:

|

|

|

|

|

|

For the twelve months ended

|

||

|

|

December 31,

2011

|

|

December 31,

2010

|

|

GAAP net sales - Aerospace segment

|

$ 547,403

|

|

$ 486,516

|

|

Sales adjustment due to contract pricing settlement

|

-

|

|

(2,259)

|

|

Adjusted net sales - Aerospace segment

|

$ 547,403

|

|

$ 484,257

|

|

GAAP operating income - Aerospace segment

|

$ 80,424

|

|

$ 67,151

|

|

% of GAAP net sales

|

14.7%

|

|

13.8%

|

|

|

|

|

|

|

FMU-143 litigation settlement

|

$ 6,204

|

|

$ -

|

|

Goodwill impairment charge

|

-

|

|

6,371

|

|

Aerospace contract pricing settlement

|

-

|

|

1,969

|

|

Non-GAAP adjusted operating income - Aerospace segment

|

$ 86,628

|

|

$ 75,491

|

|

% of adjusted net sales

|

15.8%

|

|

15.6%

|

Table 1. (Continued) Reconciliation of Non-GAAP

Financial Information (In thousands except per share

amounts)

Financial Information (In thousands except per share

amounts)

38

APPENDIX

39

Scoring Categories:

§ Return on invested capital

§ Earnings momentum

§ Asset management

§ Financial health

2011 AEROSPACE & DEFENSE RANKINGS FOR

COMPANIES WITH REVENUES BETWEEN $1-5 BILLION

Aviation Week Top Performing Companies

40

APPENDIX II

Executive Compensation &

Corporate Governance

Corporate Governance

41

Executive Compensation Aligned with

Shareholder Interests

Shareholder Interests

§ Alignment with the market allows Company to attract and retain

key talent

key talent

§ Company and individual performance drive base salary, annual

cash incentives and long-term incentives

cash incentives and long-term incentives

§ Total compensation only reaches the median of market when

Company financial performance also is at the median of similar

sized industrial companies

Company financial performance also is at the median of similar

sized industrial companies

§ The direct linkage to company financial performance serves

shareholder interests

shareholder interests

§ SERP and Pensions benefit accruals ended in 2010

§ Perquisites have essentially been eliminated for executive officers

(MERP, financial counseling, tax planning)

(MERP, financial counseling, tax planning)

42

§ Base Salary

§ Long-Term Incentive

§ Benefit Plans - Same plans as all other employees

§ Car Allowance - Limited to executive officers and business unit heads

§ Perquisites - Other executive perquisites eliminated

§ Management Agreements - Limited to six key executives

All compensation components compared to industrial surveys of similar

sized companies every 2-3 years

sized companies every 2-3 years

Total compensation is driven by company and individual performance

75% of CEO’s compensation in 2011 was performance related

Targeted at the median of

industrial companies of similar size

Compensation Components

43

Performance-Driven Annual Cash Incentive

§ Annual cash incentive driven by financial performance

– Corporate - compared against the 5-year average of Russell 2000:

• Return on Investment

• EPS growth

• EPS performance against plan

• Individual Performance

§ Business Units - compared against the 3-year moving average of past

performance

performance

• Return on Investment

• Growth in operating income

• Additional annual objectives determined by business priorities

Reviewed and approved by the Personnel and Compensation

Committee of the Board of Directors

Committee of the Board of Directors

44

Corporate Governance

§ Strong and Independent Board of Directors

§ Nine members; eight are independent with no relationship to the

Company other than Board service.

Company other than Board service.

§ Independent Lead Director in place since 2002

§ Board has majority voting policy for director elections

§ Directors have broad senior leadership qualifications:

– Chief executive or chief financial officer roles

– Industry experience includes aerospace, defense, engineering,

distribution and financial services, both domestic and international

distribution and financial services, both domestic and international

§ Virtually all directors serve on the board of other public companies

(generally not more than three)

(generally not more than three)

45

Forward Looking Statement

This presentation contains forward-looking information relating to the Company's business and prospects, including the Aerospace and Industrial

Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results to differ materially from

expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for government programs and thereafter

contract negotiations with government authorities, both foreign and domestic; 2) political conditions in countries where the Company does or intends to do

business; 3) standard government contract provisions permitting renegotiation of terms and termination for the convenience of the government; 4) changes

in government and customer priorities and requirements (including cost-cutting initiatives, the potential deferral of awards, terminations or reductions of

expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts resulting from Congressional actions or automatic

sequestration under the Budget Control Act of 2011); 5) satisfactory conclusion to government inquiries or investigations regarding government programs,

including satisfactory resolution of the Wichita subpoena matter; 6) domestic and foreign economic and competitive conditions in markets served by the

Company, particularly the defense, commercial aviation and industrial production markets; 7) risks associated with successful implementation and ramp up

of significant new programs; 8) potential difficulties associated with variable acceptance test results, given sensitive production materials and extreme test

parameters; 9) successful resale of the SH-2G(I) aircraft, equipment and spare parts; 10) receipt and successful execution of production orders for the JPF

U.S. government contract, including the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection

with goodwill impairment evaluations; 11) continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts

inventory; 12) cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K.

facilities; 13) profitable integration of acquired businesses into the Company's operations; 14) changes in supplier sales or vendor incentive policies; 15)

the effects of price increases or decreases; 16) the effects of pension regulations, pension plan assumptions, pension plan asset performance and future

contributions; 17) future levels of indebtedness and capital expenditures; 18) future availability of credit; 19) continued availability of raw materials and

other commodities in adequate supplies and the effect of increased costs for such items; 20 )the effects of currency exchange rates and foreign competition

on future operations; 21) changes in laws and regulations, taxes, interest rates, inflation rates and general business conditions; 22) future repurchases

and/or issuances of common stock; and 23) other risks and uncertainties set forth in the Company's annual, quarterly and current reports, proxy statements

and other filings with the SEC. Any forward-looking information provided in this presentation should be considered with these factors in mind. The

Company assumes no obligation to update any forward-looking statements contained in this presentation.

Distribution businesses, operating cash flow, and other matters that involve a number of uncertainties that may cause actual results to differ materially from

expectations. Those uncertainties include, but are not limited to: 1) the successful conclusion of competitions for government programs and thereafter

contract negotiations with government authorities, both foreign and domestic; 2) political conditions in countries where the Company does or intends to do

business; 3) standard government contract provisions permitting renegotiation of terms and termination for the convenience of the government; 4) changes

in government and customer priorities and requirements (including cost-cutting initiatives, the potential deferral of awards, terminations or reductions of

expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts resulting from Congressional actions or automatic

sequestration under the Budget Control Act of 2011); 5) satisfactory conclusion to government inquiries or investigations regarding government programs,

including satisfactory resolution of the Wichita subpoena matter; 6) domestic and foreign economic and competitive conditions in markets served by the

Company, particularly the defense, commercial aviation and industrial production markets; 7) risks associated with successful implementation and ramp up

of significant new programs; 8) potential difficulties associated with variable acceptance test results, given sensitive production materials and extreme test

parameters; 9) successful resale of the SH-2G(I) aircraft, equipment and spare parts; 10) receipt and successful execution of production orders for the JPF

U.S. government contract, including the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection

with goodwill impairment evaluations; 11) continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts

inventory; 12) cost estimates associated with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K.

facilities; 13) profitable integration of acquired businesses into the Company's operations; 14) changes in supplier sales or vendor incentive policies; 15)

the effects of price increases or decreases; 16) the effects of pension regulations, pension plan assumptions, pension plan asset performance and future

contributions; 17) future levels of indebtedness and capital expenditures; 18) future availability of credit; 19) continued availability of raw materials and

other commodities in adequate supplies and the effect of increased costs for such items; 20 )the effects of currency exchange rates and foreign competition

on future operations; 21) changes in laws and regulations, taxes, interest rates, inflation rates and general business conditions; 22) future repurchases

and/or issuances of common stock; and 23) other risks and uncertainties set forth in the Company's annual, quarterly and current reports, proxy statements

and other filings with the SEC. Any forward-looking information provided in this presentation should be considered with these factors in mind. The

Company assumes no obligation to update any forward-looking statements contained in this presentation.

Contact: Eric Remington

V.P., Investor Relations

(860) 243-6334

Eric.Remington@kaman.com