Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - HALL TEES, INC. | ex31one.htm |

| EX-32.1 - CERTIFICATION - HALL TEES, INC. | ex32one.htm |

| EX-31.2 - CERTIFICATION - HALL TEES, INC. | ex31two.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[ X ] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2012

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OF 15(d) OF THE EXCHANGE ACT OF 1934

From the transition period from ___________ to ____________.

Commission File Number 333-150829

HALL TEES, INC.

(Exact name of small business issuer as specified in its charter)

| Nevada | 26-0875401 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

7405 Armstrong, Rowlett, Texas 75088

(Address of principal executive offices)

(214) 883-0140

(Issuer's telephone number)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:. Yes [ X ] No [ ].

Indicate by check mark whether the Registrant is a large accredited filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accredited filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large Accredited Filer | [ ] | Accelerated Filer | [ ] | |

| Non-Accredited Filer | [ ] | Smaller Reporting Company | [X] |

Indicate by a check mark whether the company is a shell company (as defined by Rule 12b-2 of the Exchange Act: Yes [ ] No [ X ].

As of August 10, 2012, there were 7,755,400 shares of Common Stock of the issuer outstanding.

| 1 |

TABLE OF CONTENTS

| PART I FINANCIAL STATEMENTS | ||

| Item 1 | Financial Statements (Unaudited) | 3 |

| Item 2 | Management's Discussion and Analysis or Plan of Operation | 11 |

| Item 3 | Quantitative and Qualitative Disclosures about Market Risk | 13 |

| Item 4 | Controls and Procedures | 13 |

| PART II OTHER INFORMATION | ||

| Item 4 | Mine Safety Disclosures | 14 |

| Item 6 | Exhibits and Reports on Form 8-K | 14 |

| 2 |

|

HALL TEES, INC. Consolidated Balance Sheets June 30, 2012 and December 31, 2011 (Unaudited) |

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and Cash Equivalents | $ | 115,352 | $ | 141,106 | ||||

| Accounts Receivable, Net | 889 | 670 | ||||||

| Total Current Assets | 116,241 | 141,776 | ||||||

| Fixed Assets, Net | 49,779 | 60,115 | ||||||

| TOTAL ASSETS | $ | 166,020 | $ | 201,891 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts Payable | $ | 200 | $ | 1,107 | ||||

| Accrued Expenses | 35,918 | 36,117 | ||||||

| Amounts due Shareholder | 46,575 | 43,476 | ||||||

| Capitalized Lease Obligation | 2,922 | 5,844 | ||||||

| Total Current Liabilities | 85,615 | 86,544 | ||||||

| Total Liabilities | 85,615 | 86,544 | ||||||

| Stockholders' Equity | ||||||||

| Preferred Stock, $.001 par value, 25,000,000 shares authorized, | ||||||||

| 0 and 0 shares issued and outstanding | 0 | 0 | ||||||

| Common Stock, $.001 par value, 50,000,000 shares authorized, | ||||||||

| 7,755,400 and 7,755,400 shares issued and outstanding | 7,755 | 7,755 | ||||||

| Additional Paid-In Capital | 389,945 | 389,945 | ||||||

| Accumulated Deficit | (317,295 | ) | (282,353 | ) | ||||

| Total Stockholders' Equity | 80,405 | 115,347 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 166,020 | $ | 201,891 | ||||

The Accompanying Notes are an Integral Part of these Consolidated Financial Statements.

| 3 |

|

HALL TEES, INC. Consolidated Statements of Operations For the three and six months ended June 30, 2012 and 2011 |

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2012 | June 30, 2011 | June 30, 2012 | June 30, 2011 | |||||||||||||

| REVENUE | $ | 16,511 | $ | 8,726 | $ | 25,105 | $ | 16,770 | ||||||||

| COST OF SALES | 7,682 | 5,820 | 10,629 | 11,384 | ||||||||||||

| GROSS PROFIT | 8,829 | 2,906 | 14,476 | 5,386 | ||||||||||||

| OPERATING EXPENSES | ||||||||||||||||

| Depreciation | 5,149 | 5,294 | 10,336 | 10,622 | ||||||||||||

| Selling and Advertising Expenses | 361 | 2,775 | 516 | 3,063 | ||||||||||||

| Other General Expenses | 14,823 | 12,497 | 38,669 | 37,486 | ||||||||||||

| TOTAL OPERATING EXPENSES | 20,333 | 20,566 | 49,521 | 51,171 | ||||||||||||

| NET OPERATING LOSS | (11,504 | ) | (17,660 | ) | (35,045 | ) | (45,785 | ) | ||||||||

| OTHER INCOME | ||||||||||||||||

| Interest Income | 51 | 106 | 103 | 214 | ||||||||||||

| TOTAL OTHER INCOME | 51 | 106 | 103 | 214 | ||||||||||||

| NET LOSS BEFORE INCOME TAXES | (11,453 | ) | (17,554 | ) | (34,942 | ) | (45,571 | ) | ||||||||

| Provision for Income Taxes (Expense) Benefit | — | — | — | — | ||||||||||||

| NET LOSS | $ | (11,453 | ) | $ | (17,554 | ) | $ | (34,942 | ) | $ | (45,571 | ) | ||||

| EARNINGS PER SHARE, Basic and Diluted | ||||||||||||||||

| Weighted Average of Outstanding Shares | 7,755,400 | 7,605,400 | 7,755,400 | 7,605,400 | ||||||||||||

| Income (Loss) for Common Stockholders | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

The Accompanying Notes are an Integral Part of these Consolidated Financial Statements.

| 4 |

|

HALL TEES, INC. Consolidated Statement of Changes in Stockholders’ Equity(Deficit) For the six months ended June 30, 2012 and The Year Ended December 31, 2011 (Unaudited) |

| Common Stock | Paid-In | Accumulated | ||||||||||||||||||

| Shares | Amount | Capital | (Deficit) | Totals | ||||||||||||||||

| Stockholders' Deficit, | ||||||||||||||||||||

| January 1, 2011 | 7,605,400 | $ | 7,605 | $ | 365,095 | $ | (174,751 | ) | $ | 197,949 | ||||||||||

| Issuance of Stock for Services | 150,000 | 150 | 24,850 | — | 25,000 | |||||||||||||||

| Net Loss | (107,602 | ) | (107,602 | ) | ||||||||||||||||

| Stockholders' Equity, | ||||||||||||||||||||

| December 31, 2011 | 7,755,400 | $ | 7,755 | $ | 389,945 | $ | (282,353 | ) | $ | 115,347 | ||||||||||

| Net Loss | (34,942 | ) | (34,942 | ) | ||||||||||||||||

| Stockholders' Equity, | ||||||||||||||||||||

| June 30, 2012 (Unaudited) | 7,755,400 | $ | 7,755 | $ | 389,945 | $ | (317,295 | ) | $ | 80,405 |

The Accompanying Notes are an Integral Part of these Consolidated Financial Statements.

| 5 |

|

HALL TEES, INC. Consolidated Statements of Cash Flows For the six months ended June 30, 2012 and 2011 |

(Unaudited)

| 2012 | 2011 | |||||||

| CASH FLOWS USED BY OPERATING ACTIVITIES | ||||||||

| Net Loss | $ | (34,942 | ) | $ | (45,571 | ) | ||

| Adjustments to reconcile net loss to net cash used | ||||||||

| by operating activities: | ||||||||

| Depreciation | 10,336 | 10,622 | ||||||

| Bad Debt Expense | 516 | 0 | ||||||

| Changes in assets and liabilities: | ||||||||

| Accounts Receivable | (735 | ) | 480 | |||||

| Inventory | 0 | (3,772 | ) | |||||

| Accounts Payable | (907 | ) | 0 | |||||

| Accrued Expenses | (199 | ) | 5,801 | |||||

| Net Cash Used by Operating Activities | (25,931 | ) | (32,440 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchase of Fixed Assets | 0 | 0 | ||||||

| Net Cash (Used) by Investing Activities | 0 | 0 | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Capitalized Lease Payments | (2,922 | ) | (2,922 | ) | ||||

| Borrowings: Stockholder Advances | 3,099 | 3,783 | ||||||

| Net Cash Provided by Financing Activities | 177 | 861 | ||||||

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (25,754 | ) | (31,579 | ) | ||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 141,106 | 189,154 | ||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 115,352 | $ | 157,575 | ||||

| SUPPLEMENTAL DISCLOSURES | ||||||||

| Cash Paid During the Year for Interest Expense | $ | — | $ | — | ||||

| Cash Paid During the Year for Taxes | $ | — | $ | — | ||||

The Accompanying Notes are an Integral Part of these Consolidated Financial Statements.

| 6 |

HALL TEES, INC.

NOTES TO FINANCIAL STATEMENTS

June 30, 2012

NOTE 1 – NATURE OF ACTIVITIES AND SIGNIFICANT ACCOUNTING POLICIES

Nature of Activities, History and Organization:

Hall Tees, Inc. (The “Company”) operates as a printer and silk screener. The Company is located in Rowlett, Texas and was incorporated on September 13, 2007 under the laws of the State of Nevada.

Hall Tees, Inc., is the parent company of Hall Tees & Promotions, L.L.C., (“Hall Tees Texas”), a company incorporated under the laws of the State of Texas. Hall Tees Texas was established in 2007 and for the past fifteen months has been operating a single facility in Texas.

On September 12, 2007, Hall Tees, Inc. ("Hall Tees Nevada"), a private holding company established under the laws of Nevada, was formed in order to acquire 100% of the outstanding membership interests of Hall Tees Texas. On September 15, 2007, Hall Tees Nevada issued 7,000,000 shares of common stock in exchange for a 100% equity interest in Hall Tees Texas. As a result of the share exchange, Hall Tees Texas became the wholly owned subsidiary of Hall Tees Nevada. As a result, the members of Hall Tees Texas owned a majority of the voting stock of Hall Tees Nevada. The transaction was regarded as a reverse merger whereby Hall Tees Texas was considered to be the accounting acquirer as its members retained control of Hall Tees Nevada after the exchange, although Hall Tees Nevada is the legal parent company. The share exchange was treated as a recapitalization of Hall Tees Nevada. As such, Hall Tees Texas (and its historical financial statements) is the continuing entity for financial reporting purposes. The financial statements have been prepared as if Hall Tees Nevada had always been the reporting company and, on the share exchange date, changed its name and reorganized its capital stock.

Unaudited Interim Consolidated Financial Statements:

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States and applicable Securities and Exchange Commission (“SEC”) regulations for interim financial information. These consolidated financial statements are unaudited and, in the opinion of management, include all adjustments (consisting of normal recurring accruals) necessary to present fairly the balance sheets, statements of operations and statements of cash flows for the periods presented in accordance with accounting principles generally accepted in the United States. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to SEC rules and regulations. It is presumed that users of this interim financial information have read or have access to the audited financial statements and footnote disclosure for the preceding fiscal year contained in the Company’s Annual Report on Form 10-K. Operating results for the interim periods presented are not necessarily indicative of the results that may be expected for the year ending December 31, 2012.

Significant Accounting Policies:

The Company’s management selects accounting principles generally accepted in the United States of America and adopts methods for their application. The application of accounting principles requires the estimating, matching and timing of revenue and expense. Below is a summary of certain significant accounting policies selected by management.

The consolidated financial statements and notes are representations of the Company’s management which is responsible for their integrity and objectivity. Management further acknowledges that it is solely responsible for adopting sound accounting practices, establishing and maintaining a system of internal accounting control and preventing and detecting fraud. The Company's system of internal accounting control is designed to assure, among other items, that 1) recorded transactions are valid; 2) valid transactions are recorded; and 3) transactions are recorded in the proper period in a timely manner to produce financial statements which present fairly the financial condition, results of operations and cash flows of the Company for the respective periods being presented.

Management believes that all adjustments necessary for a fair statement of the results of the six months ended June 30, 2012 and 2011 have been made.

Basis of Presentation:

The Company prepares its consolidated financial statements on the accrual basis of accounting. All intercompany balances and transactions are eliminated. The Company’s subsidiaries are consolidated with the parent company.

| 7 |

Cash and Cash Equivalents:

All highly liquid investments with original maturities of three months or less are included in cash and cash equivalents. All deposits are maintained in FDIC insured depository accounts in local financial institutions and balances are insured up to $250,000.

Fair Value of Financial Instruments:

The carrying amounts of cash, cash equivalents, accounts receivable, capital leases, accounts payable and notes payable approximate their fair values due to the short-term maturities of these instruments.

Accounts Receivable:

Accounts receivable are carried at their face amount, less an allowance for doubtful accounts. On a periodic basis, the Company evaluates accounts receivable and establishes the allowance for doubtful accounts based on a combination of specific customer circumstances and credit conditions, based on a history of write offs and collections. The Company’s policy is generally not to charge interest on trade receivables after the invoice becomes past due. A receivable is considered past due if payments have not been received within agreed upon invoice terms. The Company provides an allowance for all receivables that are greater than 90 days old. Allowances for Doubtful Accounts totaled $3,000 and $4,780 at June 30, 2012 and December 31, 2011 respectively. Write offs are recorded at a time when a customer receivable is deemed uncollectible and during the quarter ended March 31, 2012 the Company wrote-off $2,295.

Fixed Assets:

Fixed assets are stated at cost if purchased, or at fair value in a nonmonetary exchange, less accumulated depreciation. Major renewals and improvements are capitalized; minor replacements, maintenance and repairs are charged to current operations. Depreciation is computed by applying the straight-line method over the estimated useful lives which are generally three to seven years. Leases that meet the requirements of ASC 840-10, are capitalized and included in fixed assets.

Revenue Recognition:

The Company recognizes revenue in accordance with ASC 605-10, "Revenue Recognition in Financial Statements," Revenue will be recognized only when all of the following criteria have been met:

| · | Persuasive evidence of an arrangement exists; |

| · | Ownership and all risks of loss have been transferred to buyer, which is generally upon shipment or at the time the service is provided; |

| · | The price is fixed and determinable; and |

| · | Collectability is reasonably assured. |

Earnings per Share:

Earnings per share (basic) is calculated by dividing the net income (loss) by the weighted average number of common shares outstanding for the period covered. As the Company has no potentially dilutive securities, fully diluted earnings per share is identical to earnings per share (basic).

Income Taxes:

Income from the corporation is taxed at regular corporate rates per the Internal Revenue Code. There are no provisions for current taxes due to net available operating losses.

Recent Accounting Pronouncements:

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

Estimates:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

| 8 |

NOTE 2 – FIXED ASSETS

Fixed assets at June 30, 2012 and December 31, 2011 are as follows:

| 2012 | 2011 | |||||||

| Furniture & Equipment | $ | 102,920 | $ | 102,920 | ||||

| Capitalized Leases | 29,220 | 29,220 | ||||||

| Gross Fixed Assets | 132,140 | 132,140 | ||||||

| Less: Accumulated Depreciation | (82,361 | ) | (72,025 | ) | ||||

| Net Fixed Assets | $ | 49,779 | $ | 60,115 | ||||

NOTE 3 – CAPITALIZED AND OPERATING LEASES

The Company entered into a capitalized lease obligation during 2008 for a total of $29,220. Payments of $487 including principal and interest at 12% are due monthly through December 2012. The amount due by December 31, 2012 is $4,383. The total amount outstanding at December 31, 2011 was $5,844.

Accumulated depreciation related to the capitalized leases for the periods ended June 30, 2012 and 2011 was $6,940 and $6,290, respectively.

The Company leases a 1,200 square foot warehouse space on a month to month basis for $1,000 per month. Rent expense was $3,000 for the three month periods ended June 30, 2012 and 2011 and was $6,000 for the six month periods ended June 30, 2012 and 2011.

NOTE 4 – EQUITY

The Company is authorized to issue 25,000,000 preferred shares at a par value of $0.001 per share. These shares have full voting rights. At June 30, 2012 and December 31, 2011, there were zero shares outstanding.

The Company is authorized to issue 50,000,000 common shares at a par value of $0.001 per share. These shares have full voting rights. At June 30, 2012 and December 31, 2011, there were 7,755,400 shares outstanding respectively.

The Company does not have any stock option plans or warrants.

NOTE 5 – INCOME TAXES

The Company has adopted ASC 740 “Income Taxes”, which requires the use of the liability method in the computation of income tax expense and the current and deferred income taxes payable (deferred tax liability) or benefit (deferred tax asset). Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be.

Deferred tax assets at June 30, 2012 and December 31, 2011 consisted of the following:

| 2012 | 2011 | |||||||

| Deferred Tax Asset | $ | 73,075 | $ | 64,340 | ||||

| Less: Valuation Allowance | (73,075 | ) | (64,340 | ) | ||||

| Net Deferred Tax Asset | $ | 0 | $ | 0 | ||||

The net deferred tax asset generated primarily by the Company’s net operating loss carryforward has been fully reserved. The cumulative net operating loss carry-forward is approximately $317,295 at June 30, 2012 and $282,353 at December 31, 2011, and will expire in 2030.

The difference in the income tax benefit not shown in the consolidated statements of operations and the amount that would result if the U.S. Federal statutory rate of 25% were applied to pre-tax loss for 2012 and 2011 is attributable to the valuation allowance.

The realization of deferred tax benefits is contingent upon future earnings, therefore, is fully reserved at June 30, 2012 and December 31, 2011.

| 9 |

The Company recognizes interest and penalties related to unrecognized tax benefits in general and administrative expense. During the six months ended June 30, 2012 and the year ended December 31, 2011 the Company recognized no interest and penalties.

NOTE 6 – RELATED PARTY TRANSACTIONS

The President and a Stockholder of the Company has advanced the Company $46,575 and $43,476 as of June 30, 2012 and December 31, 2011, respectively, for working capital. No interest is paid on this advance.

Under a contract with the Company beginning November 6, 2007, originally expiring December 31, 2012 and updated to end December 31, 2013, the President provides general management services to the Company for up to $4,000 per month. Payroll expense incurred under this contract totaled approximately $0 and $3,000 for the three months ended June 30, 2012 and 2011, respectively and approximately $0 and $4,960 for the six months ended June 30, 2012 and 2011, respectively.

The Company pays rent of $1,000 per month to the President for warehouse facilities. Total charges were $3,000 in each of the three months ended June 30, 2012 and 2011 and $6,000 in each of the six months ended June 30, 2012 and 2011.

NOTE 7– FINANCIAL CONDITION AND GOING CONCERN

The Company has minimal operations and has working capital of approximately $30,600 at June 30, 2012 and $55,200 as of December 31, 2011. This positive working capital at June 30, 2012 is a result of raising $302,700 under the Form S-1/A that was filed on December 7, 2009 and became effective on December 23, 2009. Without this money the working capital at June 30, 2012 would have been negative. Because of this negative amount and limited operating history and limited operations, the Company may require additional working capital to survive. If the funds the Company has are not sufficient it will also consider bank loans or additional shareholder loans. There are no assurances that the Company will be able to obtain any of these. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital cannot be generated, the Company may not be able to continue its operations.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

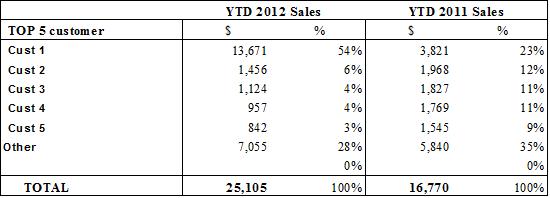

NOTE 8 – REVENUE CONCENTRATION

The Company’s five largest customers account for 72% ($18,050) of the 2012 year-to-date revenues. The table below discloses the largest customers 2012 versus 2011 for the six months ended June 30, 2012 and 2011 (note: comparison of largest customers year-over-year).

| 10 |

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS

This report contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. The Company’s actual results could differ materially from those set forth on the forward looking statements as a result of the risks set forth in the Company’s filings with the Securities and Exchange Commission, general economic conditions, and changes in the assumptions used in making such forward looking statements.

General

In the first six months of 2012 top line revenue was up 50% to $25,105. North Texas experienced a mild winter in 2012 versus a cold and wet winter in 2011 With the economy still sputtering and with Companies closely managing marketing spending we anticipate flat revenue versus 2011.

RESULTS FOR THE THREE and SIX MONTHS ENDED June 30, 2012

Our quarter ended on June 30, 2012. Any reference to the end of the fiscal quarter refers to the end of the second quarter for the period discussed herein.

REVENUE. Revenue for the three months ended June 30, 2012 was $16,511 compared to $8,726 for the three month period ended June 30, 2011. Revenue increased $7,785 or 89% and the increase is attributed to significant sales growth at one customer ($9,400) versus 2011.

Revenue for the six months ended June 30, 2012 was $25,105 compared to $16,770 for the six month period ended June 30, 2011. Revenue increased $8,335 or 50% and the increase is attributed to significant sales growth at one customer ($9,700) versus 2011. We had one large repeat customer year-over-year that accounted for 54% and 23% of revenue in 2012 and 2011, respectively.

COST OF SALES: Cost of sales (COS) were $7,682 (or 46% of revenue) for the three months ended June 30, 2012 compared to $5,820 (or 67% of revenue) for the same period in 2011. The decrease in COS is due to product mix as sales were geared toward higher margin products.

Cost of sales (COS) were $10,629 (or 42% of revenue) for the six months ended June 30, 2012 compared to $11,384 (or 68% of revenue) for the same period in 2011. The decrease in COS is due to product mix as sales were geared toward higher margin products.

OPERATING EXPENSES. Operating expenses, exclusive of depreciation expense of $5,149 and $5,294, were $15,184 and $15,272 for the three month periods ended June 30, 2012 and 2011 respectively. The flat expenses saw increases in .professional fees $2,000 and insurance $1,000 while being offset by a decrease in advertising $3,000.

Operating expenses, exclusive of depreciation expense of $10,336 and $10,622, were $39,185 and $40,549 for the six month periods ended June 30, 2012 and 2011 respectively. The Company paid $12,000 in business development consulting and marketing fees an increase of $8,000 versus 2011. This increase was more than offset by a decrease in auto expense $2,000, payroll expenses $5,000 and advertising $3,000.

NET LOSS. The Net Loss for the three months ended June 30, 2012 and 2011 was $11,453 versus $17,554 and $34,942 and $45,571 for the six months ended June 30, 2012, respectively. The main driver behind the increase in the net loss was the low level of sales as discussed above and the increased operating expenses.

| 11 |

LIQUIDITY AND CAPITAL RESOURCES.

In addition to the preceding, the Company plans for liquidity needs on a short term and long term basis as follows:

Short Term Liquidity:

The company relies on one primary funding source for short term liquidity needs: advances from the major shareholder / President of the Company. The President has advanced the Company $46,575 and $43,476 as of June 30, 2012 and December 31, 2011, respectively, for working capital. No interest is paid on this advance. This is also disclosed in Note 6.

Long Term Liquidity:

The long term liquidity needs of the Company are projected to be met primarily through the cash flow provided by operations. Cash flow from operations for the six months ended June 30, 2012 was approximately negative $25,900. The Company continually is seeking new opportunities to spur sales and increase top line revenue.

The Company has raised $302,700 by selling 605,400 shares at $0.50 per share since inception.

Capital Resources

In January 2008, the Company entered into a capital lease commitment that has a term of five years, ending December 2012. The general purpose of the lease commitment is for equipment that is used in the Company’s operations of printing and puts us on the cutting edge of “Direct to Garment” printing as discussed above. Annual commitments are $5,844 with a total five year commitment of $29,220. The balance due at June 30, 2012 was $2,922 and at December 31, 2011 was $5,844. The funds to fulfill this commitment will be primarily sourced through operations. As of June 30, 2012 the Company had negative cash used by operating activities of $25,900, and with the implementation of its business plan, forecasts cash flows to be sufficient to source payment of this commitment.

We do not expect any significant change to our equity or debt structure and do not anticipate entering into any off-balance sheet arrangements.

Material Changes in Financial Condition

WORKING CAPITAL: Working Capital decreased by approximately $24,600 to $30,600 since December 31, 2011. This decrease is due to the reduction in cash of about $26,000.

SHAREHOLDERS’ EQUITY: Shareholders’ Equity decreased by approximately $34,942 due to the net loss.

| 12 |

Item 3: Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of June 30, 2012. This evaluation was accomplished under the supervision and with the participation of our chief executive officer / principal executive officer, and chief financial officer / principal financial officer who concluded that our disclosure controls and procedures are not effective.

Based upon an evaluation conducted for the period ended June 30, 2012, our Chief Executive and Chief Financial Officer as of June 30, 2012 and as of the date of this Report, has concluded that as of the end of the periods covered by this report, we have identified the following material weakness of our internal controls:

| · | Reliance upon independent financial reporting consultants for review of critical accounting areas and disclosures and material non-standard transaction. |

| · | Lack of sufficient accounting staff which results in a lack of segregation of duties necessary for a good system of internal control. |

In order to remedy our existing internal control deficiencies, as our finances allow, we will hire additional accounting staff.

Changes in Internal Controls over Financial Reporting

We have not yet made any changes in our internal controls over financial reporting that occurred during the period covered by this report on Form 10-Q that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

| 13 |

PART II

Items No. 1, 2, 3, 4, 5 - Not Applicable.

Item No. 6 - Exhibits and Reports on Form 8-K

None noted

| (b) | Exhibits |

| Exhibit Number | Name of Exhibit | |

| 31.1 | Certification of Chief Executive Officer, pursuant to Rule 13a-14(a) of the Exchange Act, as enacted by Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2 | Certification of Chief Financial Officer, pursuant to Rule 13a-14(a) of the Exchange Act, as enacted by Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer, pursuant to 18 United States Code Section 1350, as enacted by Section 906 of the Sarbanes-Oxley Act of 2002. | |

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

HALL TEES, INC.

By /s/ William Lewis

William Lewis, President, CFO

Date: August 10, 2012

| 14 |