Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - DORAL FINANCIAL CORP | d393425dex993.htm |

| EX-99.1 - EX-99.1 - DORAL FINANCIAL CORP | d393425dex991.htm |

| 8-K - 8-K - DORAL FINANCIAL CORP | d393425d8k.htm |

Doral Financial Corporation

Q2 2012 Investor Presentation

August 9, 2012

Exhibit 99.2 |

Disclaimer

2

This presentation may include forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). These include comments with respect to our objectives and

strategies, and the results of our operations and our business.

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

They

often

include

words

such

as

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates,”

or

words

of

similar

meaning,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could”

or

“may.”

We

intend

these

forward-looking

statements to be covered by the safe harbor provisions of the PSLRA.

Forward-looking statements provide our expectations or predictions of future

conditions, events or results. They are, by their nature, subject to risks

and uncertainties. They are not guarantees of future performance, and actual results may differ materially.

By their nature, these forward-looking statements involve numerous assumptions

and uncertainties, both general and specific, including those discussed in

Doral Financial Corporation’s 2011 Annual Report on Form 10-K and other filings we make with the

Securities and Exchange Commission. Risk factors and uncertainties that could cause

the Company's actual results to differ materially from those described in

forward-looking statements can be found in the Company's 2011 Annual Report on Form 10-K,

which

is

available

in

the

Company's

website

at

www.doralfinancial.com,

as

they

may

be

updated

from

time

to

time

in

the

Company’s periodic and other reports filed with the Securities and Exchange

Commission. The statements in this presentation speak only as of the date

they are made. We do not undertake to update forward-looking

statements

to

reflect

the

impact

of

circumstances

or

events

that

arise

after

the

date

the

forward-looking

statements

were

made. |

Q2

Overview 3

Maintained strong regulatory capital levels and book value per common share

o

Book Value remained steady at $3.82 / common share

Continued revenue growth with Net Interest Income increasing by $2MM to $54MM

o

Asset Substitution and lower deposit costs increased NIM to 291bps (6 bps

increase) Asset quality continued to stabilize with NPLs decreasing by

$8MM o

Coverage ratios remain strong at 2.5% of Loans; NPL Coverage Ratio 41.4%

Elevated expenses required to meet higher credit and compliance standards

o

$8MM higher expenses during Q2; $3.5MM unlikely to recur

US earnings absorb increased credit and compliance costs.

|

4

FDIC Consent Order

4

Certain Consent Order Requirements

Doral’s Actions

Meet minimum capital requirements at

Doral Bank (8% Leverage Ratio, 10%

Tier-1 Risk Based, 12% Total Risk

Based)

•

Increased Doral Financial Corporation Regulatory Capital by

$223MM in 1Q ’12

•

As a result, Doral Bank currently exceeds the Consent Order

capital requirements and Doral Financial Corporation remains a

source of capital strength for the bank.

Eliminate or charge off all assets

classified as “Loss”

by FDIC

•

Charged off $113MM over the last 12-months

•

Added $175MM of provisions over the last 12 months

Improvements to credit and risk

administration function.

Added 151 credit, risk and regulatory staff over the last 12-

months.

Invested $5MM during 2012 in third-party subject matter experts

to validate and accelerate process and procedure improvements.

Consent Order requires shift from portfolio level to loan level credit

administration |

Profitability

Pro

forma

Income

($MM)

2Q ‘12

Net Interest Income

$54.1

Non Interest Income

21.3

Non Interest Expense

67.5

Provision

$5.2

Tax Expense (Benefit)

(1.1)

Income (Ex-Special Items)

$3.8

Less: Special Items

Credit & Administrative Expenses

$3.5

Reserve for US Tax Position

1.9

Reported Net Income

$(1.6)

$1.6MM Net Loss impacted by increased expenses and two

special items.

o

Year to Date Net Income is $1MM

Net Revenue grew by $2MM over Q1 driven by increased yield

from asset substitution and lower deposit costs.

o

Net Interest Margin improved to 291 bps

o

Deposit prices fell below 1% during the quarter

Operating Expenses increased by $8MM to $71MM impacted

by both temporary and longer-lasting increases in credit and

administration related costs.

o

$3.5MM of temporary credit and administration expenses.

o

Invested ~$4MM in additional staff and credit costs associated

with higher credit and compliance standards.

Tax Expense negatively impacted by recognition of $1.9MM of

expense associated with a 2008 US tax return item.

o

Potential to recover this expense in future periods

Excluding the noted Special Items, Doral generated $3.8MM of Income.

5

1

Non-GAAP presentation of financial results

1 |

Doral

Financial Corporation Profile 6

Company Overview

Capital Ratios continue to exceed required levels:

o

Tier-1 Leverage Ratio: 9.9%

o

Total Risk-Based Capital Ratio: 14.2%

Book Value of $3.82 per common share

o

As a result of an election to remain subject to the 1994 tax

code, the valuation allowance against Doral’s remaining

deferred tax asset increased $69MM to $321MM

representing $2.50 per share.

Doral Operates Three Business Segments:

1.

PR Residential:

Mortgage and retail banking generates

significant non-interest income from origination and

servicing activities

o

Residential mortgage loans are fixed rate, with an average

balance under $120K.

2.

PR Commercial:

Shrinking portfolio with significant asset

coverage

o

36% of loans are NPL; NPL Coverage Ratio is 38%

3.

US:

Growing business with superior returns:

o

US loans have grown to $2B (30% of total loans) with a

2.5% ROAA and NIM of 425bps

o

NPAs currently at 26 bps

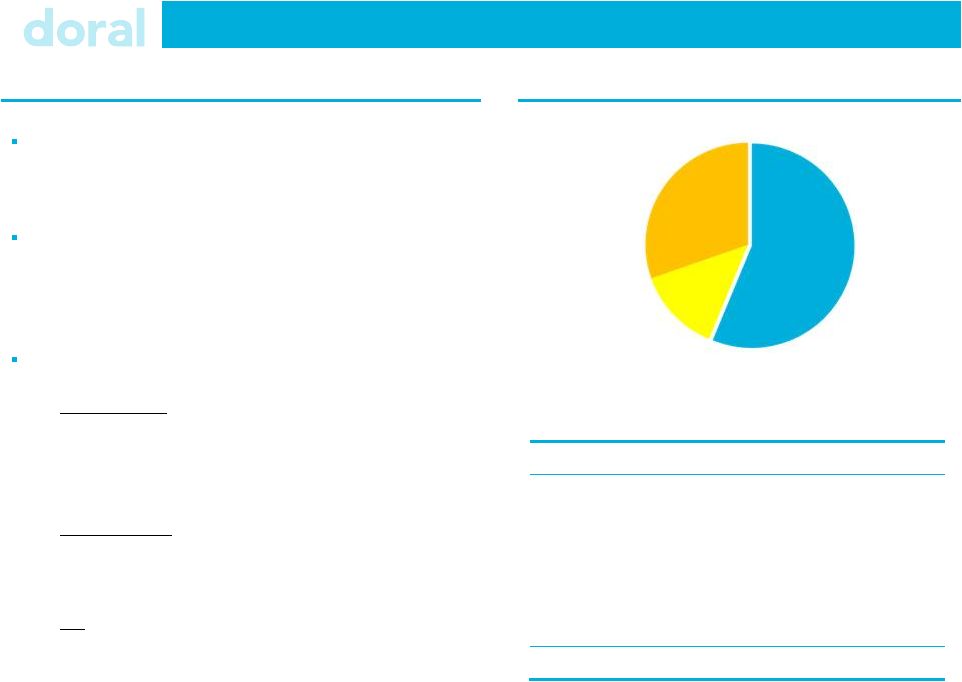

Loan Portfolio Composition ($6.5B)

$ mm

Loan Category

PR

USA

Total

Residential

$3,631

$13

$3,644

CRE

557

447

1,004

C&I

36

1,407

1,443

Construction &

Development

274

92

366

Consumer / Other

30

-

30

Total

$4,528

$1,959

$6,487

PR Residential

(57%)

US

(30%)

PR Commercial

(13%) |

Puerto Rico Operating Segments

Desirable Mortgage & Retail Banking Franchise

Contributes $39.7MM (80%) of Doral’s Puerto Rico

Net Revenue

o

51% of revenue is generated from non-interest income

Affordable residential mortgage loan portfolio of

$3.6B

o

2.7%

coverage

ratio

/

loans;

NPL

Coverage

Ratio

1

is

36%

o

6.0% average yield on performing loans

o

Monthly mortgage originations of $70+MM

o

Additional serviced portfolio of $7.7B

Retail Banking deposit balance of $1.6B

o

260k+ retail bank customers

o

26 Branches with average balance of $63MM per branch

Doral maintains a $321MM valuation allowance

against its Puerto Rico deferred tax asset.

o

Allowance equals $2.50 per share of additional book value

Discontinued CRE, C&I, Construction & Land Portfolio

Doral does not originate new commercial, construction or

land loans in Puerto Rico

o

$105MM (11% ) reduction from 2Q ’11

Increasing demand for new affordable housing units

o

72 construction units sold year to date ($15MM)

o

Sales represent 45% of available units in the period

($MM)

$

NPL $

NPL %

Coverage

1

CRE

$557

$192

34%

29%

C&I

$36

$3

8%

333%

Construction & Land

$274

114

42%

55%

Total Loans

$867

$309

36%

38%

1

NPL Coverage Ratio = (reserve + partial charge-off) / (NPA+ partial

charge-off) CRE (64%)

Construction &

Land (32%)

C&I (4%)

7 |

8

Asset Substitution Strategy

Doral has successfully transformed towards higher-yield, lower-risk

loans. US growth platforms now represent 27% of loans and investment

securities. •

1999: Established US Platform in New York

•

2007: Sold Doral Bank US Loans, Branches & Deposits

•

2008: Re-launched Doral Bank in the US

•

2008: Launched doralbankdirect.com produce line

•

2009: Established Doral Leveraged Asset Management

•

2010: Opened retail branches in New York and

Florida

•

2011: Launched Doral Property Finance division

•

2011: Merged Doral Bank FSB (thrift) with Doral Bank

•

2011: Reached $1.6B MM in Assets; $27 MM in Profit

•

2012: 7 Branches with $585MM in Deposits

•

2012: Achieved $23MM YTD Pre-Tax Income

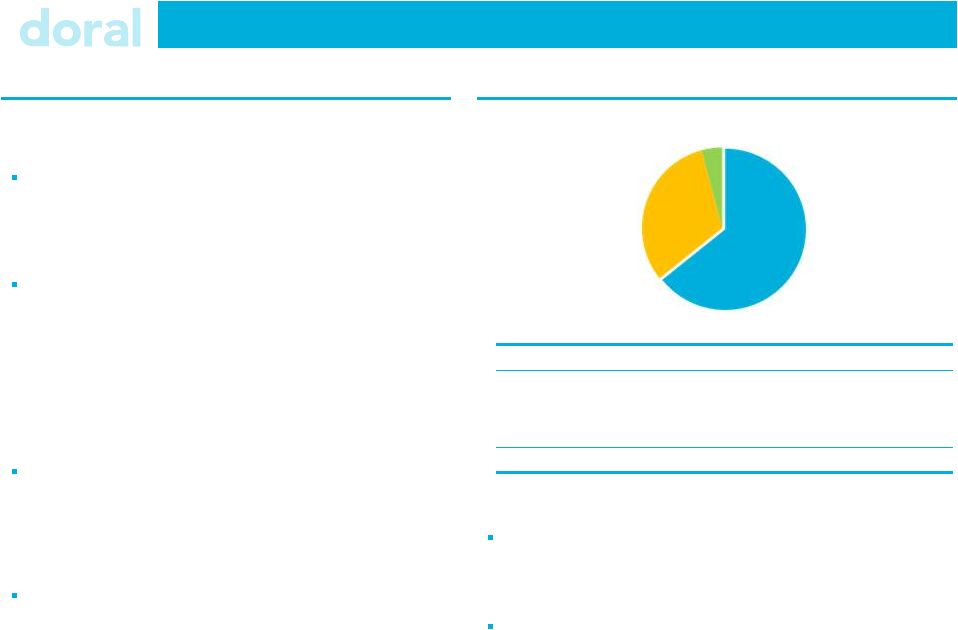

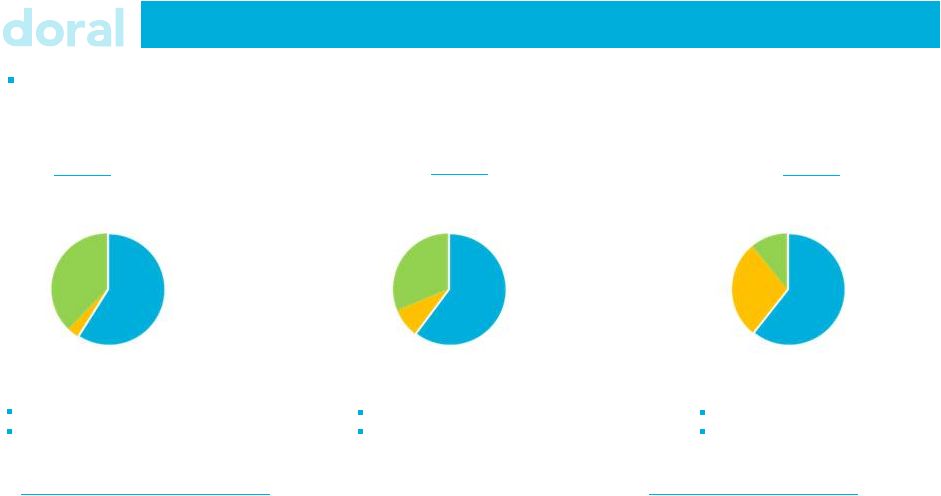

PR

$5.4B (61%)

US

$0.5B (5%)

Securities

$2.9B (34%)

4Q ‘09

PR

$4.5B (63%)

US

$2.0B (27%)

Securities

$0.7B (10%)

2Q ‘12

PR

$5.0B (67%)

US

$0.9B (12%)

Securities

$1.5B (21%)

1Q ‘11

Key Events in US Platform Development

Total: $8.8B

NIM $45.9MM (187bps)

Total: $7.4B

NIM $43.2MM (223bps)

Total: $7.2B

NIM $54.1MM (291bps) |

9

US Growth Platforms

Income ($MM)

2Q ’12

Net Interest Income

$19.5

Non Interest Income

1.0

Non Interest Expense

8.0

Provision

1.0

Pre-Tax Income

$11.5

ROAA

2.50%

Net Interest Margin (bps)

425

NPA %

0.3%

Efficiency Ratio

39.0%

Doral Bank (USA)

Est. 1999

Doral Leveraged

Asset Management

Est. 2009

Doral Property

Finance

Est. 2011

Loans: $0.7B

Deposits: $0.6 B

Loans: $1.1B

Loans: $0.2B

•

New York and Florida based traditional commercial

lending and retail banking

•

CRE, Taxi Medallion, Construction & Healthcare

Receivables lending

•

5.2% average yield

•

Average deposits per retail branch of $67MM

•

Participations in broadly syndicated Shared

National Credit C&I Loans

•

Average Exposure $7MM, Average Yield 5.2%

•

2 successful CLO completed in Q2 ($416MM)

•

$1.3B in Assets Under Management

•

Platform providing leverage for transitional real

estate assets

•

Average loan facility $25MM; Average Yield 6.0%

•

Contributed 20% of US loan production in Q2

Doral operates three profitable growth platforms in the US.

nd |

10

Executive Summary

Maintaining leading affordable mortgage platform on the island.

o

Over $70MM per month of new affordable residential mortgage volume

o

40% of revenue from non-interest dependent income

o

$1.6B in retail deposits ($60MM / branch)

Discontinuing Puerto Rico CRE, Construction and Land portfolios.

o

$0.9 B of assets earning less than 5% yield.

o

36% NPL with 38% modified coverage ratio / NPLs

Expanding higher-margin, lower risk US-based growth platforms

o

$11.5MM Pre-Tax income in Q2

o

2.5% ROAA with a 425bps Net Interest Margin

o

Less than 30 bps of Non-Performing assets.

Asset substitution continues to deliver significant benefits

o

Strong Sales in Affordable Construction -- 72 units sold YTD with an additional 53 signed

options

|

Investor Relations Contact and Conference Replay Details

11

Investor Relations:

Christopher Poulton

212 / 329-3794

christopher.poulton@doralfinancial.com

Conference Call:

10.00 AM EDT August 9, 2012

(800)-288-8960 or (612) 332-0107 for Intl

Conference Call Replay:

August 9, 2012 –

September 9, 2012

(800) 475-6701 or (320) 365-3844 for Intl

Replay Code: 255987 |

Exhibit A

Summary Financials |

Summary Financials

13

($ mm)

30-Jun-12

31-Mar-12

31-

Dec –

11

30-Sep-11

30-Jun-11

Income Statement

Net Interest Income

54.1

52.1

49.4

$48.2

$45.5

Provision for Credit Losses

5.2

115.2

9.9

41.7

13.3

NII After Provisions

48.9

(63.1)

39.4

6.5

32.2

Non-Interest Income

21.3

16.6

25.3

29.6

38.8

Non-Interest Expense

71.0

63.5

61.7

64.0

63.6

Pre-Tax Income

(0.8)

(110.0)

3.1

(27.8)

7.4

Taxes

0.8

(112.6)

(8.6)

2.3

2.9

Net Income

(1.6)

2.6

11.7

(30.2)

4.5

Pre-Tax Pre-Provision Income

4.4

5.2

13.0

13.9

20.6

Balance Sheet

Total Gross Loans (incl. HFS)

$6,487

$6,355

$6,241

$6,111

$5,991

Loan Loss Reserves

153

167

103

118

93

Total Deposits

4,538

4,560

4,395

4,349

4.321

Total Assets

8,345

8,093

7,975

8,014

8,016

Profitability Metrics

Net Interest Margin

2.91%

2.85%

2.67%

2.60%

2.36%

Capital & Credit Ratios

NPL / Loans¹

11.4%

12.1%

9.8%

9.8%

10.1%

Leverage Ratio

9.92%

10.19%

9.13%

8.98%

9.07%

1 Excludes Residential loans guaranteed by FHA / VA; NPL definition adjusted in Q1

2012 |