Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - NCR CORP | exhibit991-pressrelease.htm |

| 8-K - FORM 8-K - NCR CORP | form8-kxpensionstrategyann.htm |

Bill Nuti, Chairman & CEO, NCR Bob Fishman, CFO, NCR July 31, 2012 Pension Strategy Update Exhibit 99.2

Note to Investors Comments made during this conference call and in the related presentation materials may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements use words such as “seek,” “potential,” “expect,” “strive,” “continue,” “continuously,” “accelerate,” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could.” They include statements as to NCR’s anticipated or expected results; future financial performance; projections of revenue, profit growth and other financial items; expectations regarding pension metrics, future contributions and funding obligations, and the economic and other effects thereof; plans with respect to lump sum payment options to be offered to certain pension plan participants and the effects thereof; possible changes in pension accounting policies and the effects thereof, including with respect to recurring pension expense; strategies and intentions regarding NCR’s pension plans; discussion of other strategic initiatives and related actions; comments about future market or industry performance; and beliefs, expectations, intentions, and strategies, among other things. Forward-looking statements are based on management’s current beliefs, expectations and assumptions, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR’s control. These forward-looking statements are not guarantees of future performance, and there are a number of factors, including those detailed from time to time in NCR’s SEC reports, including those listed in item 1a “Risk Factors” of its Annual Report on Form 10-K, that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements. These materials are dated July 31, 2012, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. While NCR reports its results in accordance with generally accepted accounting principles in the United States, or GAAP, comments made during this conference call and the related presentation materials will include references to the “non- GAAP” measures free cash flow, non-pension operating income (NPOI) and non-GAAP earnings per share, each of which excludes certain items, such as pension expense, from its comparable GAAP measure. Information regarding these non- GAAP measures, reconciliations to their comparable GAAP measures and other related items are available on the Investor Relations page of NCR’s website at www.ncr.com, and certain of these non-GAAP measures are discussed in the reports that NCR files with the SEC. Management’s calculation of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. Any non-GAAP measures referenced during this event should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. 2

Reinventing NCR 3 ‘We’ve had some big rocks to move’ Eliminating legacy issues… …to focus on transformational growth

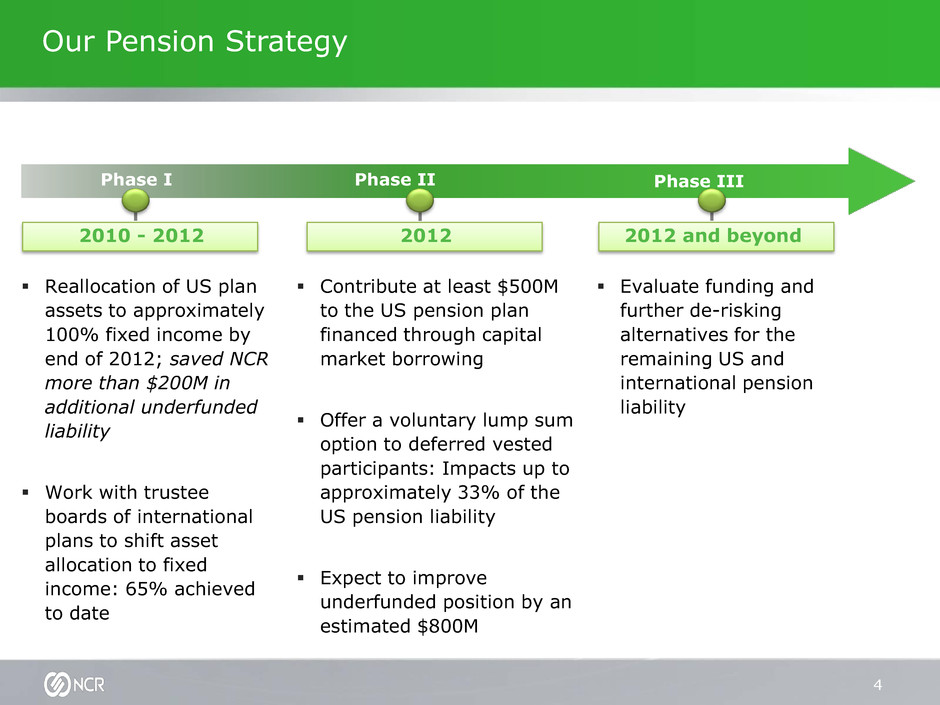

Our Pension Strategy Phase I Phase II Phase III 2010 - 2012 2012 2012 and beyond Reallocation of US plan assets to approximately 100% fixed income by end of 2012; saved NCR more than $200M in additional underfunded liability Work with trustee boards of international plans to shift asset allocation to fixed income: 65% achieved to date Contribute at least $500M to the US pension plan financed through capital market borrowing Offer a voluntary lump sum option to deferred vested participants: Impacts up to approximately 33% of the US pension liability Expect to improve underfunded position by an estimated $800M Evaluate funding and further de-risking alternatives for the remaining US and international pension liability 4

Phase II: Executive Summary 5 Contribute at least $500M to the US qualified pension plan in 2012 Planned contribution will be financed through capital market borrowing Reduces overall enterprise risk by substantially reducing volatility and size of liability Reduces US pension plan underfunding by an estimated $800M Improves free cash flow by reducing annual pension contributions. No annual US qualified plan pension cash contributions expected through 2017 Offer a voluntary lump sum payment option to deferred vested participants of the US pension plan Impacts approximately 23,000 former employees; ~33% of the US pension liability Letters offering the lump sum payment option expected to be sent to former employees on August 31, 2012; Participants will have until October 31, 2012 to make a decision Lump sum Payouts to accepting deferred vested participants expected to be completed by December 2012 Considering a change to pension accounting policy in 2013 Actuarial gains and losses will be recognized in the year in which they are incurred, rather than amortized over time; Recorded annually on the income statement in fourth quarter Policy change will have no impact on cash flow or pension funding requirements Ongoing recurring pension expense expected to be $30M - $50M per annum

56% 39% 5% 38% 59% 3% Phase I: 2010-2012 Reduce risk and volatility by re-allocating our domestic pension portfolio to fixed-income securities by year-end 2012 – At the end of 2011, we had allocated approx. 80% of pension assets to fixed income assets as compared to 59% at the end of 2010. By the end of 2012, we target a portfolio of approximately 100% fixed income assets Continuing to work with trustee boards of international pension plans to make similar changes where possible – Approximately 65% of international plan assets now invested in fixed income – Continue to shift retirement benefits from defined benefit to defined contribution Phase I has been very effective in reducing volatility and stabilizing underfunded position compared to previous allocation model 100% Equity Fixed income Other 2009 2011 2012E 18% 80% 2% 2010 US Pension Plan Asset Allocation ~ 6

Follow-Through on Investor Day Communication Prefund & Begin process to settle liabilities Economics Investor Complexity Financial Flexibility GAAP/Non- GAAP EPS NPOI/FCF Conversion Liquidity Enterprise Risk P/E Impacts NPV Analysis Debt Capacity Fund minimum, Complete asset shift (Stay the Course) Liability Management exercise to hedge interest rate risk Prefund & Begin process to settle liabilities Prefund & Immunize Pension Strategies Evaluated Selected Strategy = 7

NCR’s Pension Strategy – Phase II Catalyst NCR’s legacy pension liability is large relative to market capitalization and the underfunded position creates income statement volatility Objectives Substantially reduce volatility and size of the pension liability - underfunded position improves by an estimated $800M Improve free cash flow by reducing annual pension contributions - expected to eliminate obligation to make 2012-2017 cash contributions to U.S. qualified plan Reduce administrative costs of managing the pension plan - positive NPV event in excess of $100M expected Decrease differential between GAAP and non-GAAP financials As a result, investors will be able to focus on NCR's growth strategy 8

Phase II: Transaction Benefits Reduces overall enterprise risk by reducing the size of the pension plan Reduces US pension plan underfunding by an estimated $800M No annual US qualified plan pension cash contributions expected through 2017(1) NPV positive; reduced administrative costs Locks in attractive financing rates; represents a major step towards permanently reducing the pension liability Enhances clarity of the underlying business Maintains flexibility for strategic imperatives (1) Subject to pension actuarial assumptions 9

Questions 10