Attached files

| file | filename |

|---|---|

| 8-K - COVER PAGE - TFS Financial CORP | slidescoverpage.htm |

Investor Conference Call July 31, 2012 Exhibit 99.1

2 Forward-Looking Statements This presentation contains forward-looking statements, which can be identified by the use of such words as estimate, project, believe, intend, anticipate, plan, seek, expect and similar expressions. These forward-looking statements include: Statements of our goals, intentions and expectations; Statements regarding our business plans and prospects and growth and operating strategies; Statements concerning trends in our provision for loan losses and charge-offs; Statements regarding the asset quality of our loan and investment portfolios; and Estimates of our risks and future costs and benefits. These forward-looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could affect the actual outcome of future events: Significantly increased competition among depository and other financial institutions; Inflation and changes in the interest rate environment that reduce our interest margins or reduce the fair value of financial instruments; General economic conditions, either nationally or in our market areas, including employment prospects and conditions that are worse than expected; Decreased demand for our products and services and lower revenue and earnings because of a recession or other events; Adverse changes and volatility in the securities and credit markets; Legislative or regulatory changes that adversely affect our business, including changes in regulatory costs and capital requirements and changes related to our ability to pay dividends and the ability of Third Federal Savings and Loan Association of Cleveland, MHC to waive dividends; Our ability to enter new markets successfully and take advantage of growth opportunities, and the positive short-term dilutive effect of potential acquisitions or de novo branches, if any; Changes in consumer spending, borrowing and savings habits; Changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board and the Public Company Accounting Oversight Board; Future adverse developments concerning Fannie Mae or Freddie Mac; Changes in monetary and fiscal policy of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; Changes in policy and/or assessment rates of taxing authorities that adversely affect us; The timing and the amount of revenue that we may recognize; Changes in expense trends (including, but not limited to, trends affecting non-performing assets, charge offs and provisions for loan losses); The impact of the continuing governmental effort to restructure the U.S. financial and regulatory system; The extensive reforms enacted in the Dodd-Frank Act which will impact us; The adoption of implementing regulations by a number of different regulatory bodies under the Dodd-Frank Act, and uncertainty in the exact nature, extent and timing of such regulations and the impact they will have on us; The impact of coming under the jurisdiction of new federal regulators; Changes in our organization, or compensation and benefit plans; Inability of third-party providers to perform their obligations to us; Adverse changes and volatility in real estate markets; A slowing or failure of the moderate economic recovery; The strength or weakness of the real estate markets and of the consumer and commercial credit sectors and their impact on the credit quality of our loans and other assets; and. The ability of the U.S. Federal Government to manage federal debt limits. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward- looking statements.

3 Overview of TFS Financial Corporation Organized in 1997 as the mid-tier stock holding company for Third Federal Savings & Loan Association of Cleveland (“Thrift”), which was founded in 1938 by Ben and Gerome Stefanski Completed first step IPO conversion in April 2007. TFSL (NASDAQ) As of June 30, 2012, there were 308.9 million shares outstanding, of which 73.5% were held by the Mutual Holding Company FINANCIAL SUMMARY: June 30, 2012 Sept 30, 2011 Assets $ 11.4 B $ 10.9 B Deposits $ 9.0 B $ 8.7 B Shareholders’ Equity $ 1.8 B $ 1.8 B Market Capitalization $ 3.0 B $ 2.5 B

4 Strategic Overview Our business model is to originate and service first mortgage loans and continue to service existing home equity loans and lines, which we fund with core retail deposits Historically a fixed rate lender, but Smart Rate adjustable rate mortgage product has been major part of originations since introduced to market in July 2010 ARM portion of production (57% current fiscal YTD; 55% fiscal 2011; 19% fiscal 2010) First mortgage loans and retail deposits have been generated mainly in OH/FL footprint New state expansion began in May 2011, offering our Smart Rate adjustable rate mortgage to refinance customers through our Customer Service and Internet Channels and using our underwriting standards and processing requirements of our traditional markets Only non-commissioned Third Federal associates have been and continue to be used to gather applications, underwrite and process the requests to generate mortgage loans and home equity loans and lines First mortgage originations continue to be made using stringent, conservative lending standards. For first mortgages originated during the current fiscal year, the average FICO score was 783, and the average LTV was 62%. Being a low-cost provider is a critical strategic advantage Historically, stock repurchases and dividends have supplemented shareholder returns, but are currently suspended by regulatory action

5 Ohio 22 full service branches in Northeast Ohio 4 loan production offices in the Columbus area (Central Ohio) 4 loan production offices in the Cincinnati area (Southwestern Ohio) Markets of Operation Florida Organic, de novo expansion into Florida started in 2000 9 full service branches along the West Coast from New Port Richey to Naples 8 full-service branches along the East Coast from Palm Gardens to Hallandale Source: SNL Financial for market data as of June 30, 2011 Deposits from Company data as of June 30, 2012 Deposits Market Market MSA Branches ($M) Share (%) Rank Tampa-St.Petersburg-Clearwater, FL 5 1,206 1.86 8 Miami-Fort Lauderdale, FL 8 1,078 0.66 26 Cape Coral-Fort Myers, FL 2 282 2.14 14 Sarasota-Bradenton-Venice, FL 1 291 1.53 12 Naples-Marco Island, FL 1 134 1.18 17 Florida Totals 17 2,991 0.66 22 Deposits Market Market MSA Branches ($M) Share (%) Rank Cleveland-Elyria-Mentor, OH 19 5,433 11.23 3 Akron, OH 3 533 4.21 8 Ohio Totals 22 5,966 2.64 9

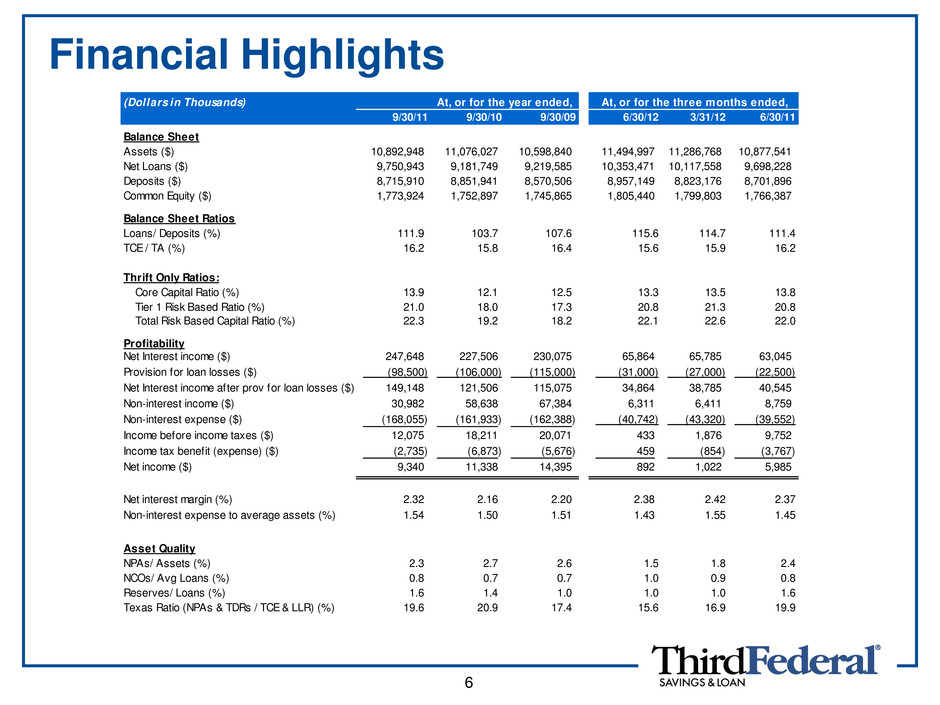

6 Financial Highlights (Dollars in Thousands) At, or for the year ended, 9/30/11 9/30/10 9/30/09 6/30/12 3/31/12 6/30/11 Balance Sheet Assets ($) 10,892,948 11,076,027 10,598,840 11,494,997 11,286,768 10,877,541 Net Loans ($) 9,750,943 9,181,749 9,219,585 10,353,471 10,117,558 9,698,228 Deposits ($) 8,715,910 8,851,941 8,570,506 8,957,149 8,823,176 8,701,896 Common Equity ($) 1,773,924 1,752,897 1,745,865 1,805,440 1,799,803 1,766,387 Balance Sheet Ratios Loans/ Deposits (%) 111.9 103.7 107.6 115.6 114.7 111.4 TCE / TA (%) 16.2 15.8 16.4 15.6 15.9 16.2 Thrift Only Ratios: Core Capital Ratio (%) 13.9 12.1 12.5 13.3 13.5 13.8 Tier 1 Risk Based Ratio (%) 21.0 18.0 17.3 20.8 21.3 20.8 Total Risk Based Capital Ratio (%) 22.3 19.2 18.2 22.1 22.6 22.0 Profitability Net Interest income ($) 247,648 227,506 230,075 65,864 65,785 63,045 Provision for loan losses ($) (98,500) (106,000) (115,000) (31,000) (27,000) (22,500) Net Interest income after prov for loan losses ($) 149,148 121,506 115,075 34,864 38,785 40,545 Non-interest income ($) 30,982 58,638 67,384 6,311 6,411 8,759 Non-interest expense ($) (168,055) (161,933) (162,388) (40,742) (43,320) (39,552) Income before income taxes ($) 12,075 18,211 20,071 433 1,876 9,752 Income tax benefit (expense) ($) (2,735) (6,873) (5,676) 459 (854) (3,767) Net income ($) 9,340 11,338 14,395 892 1,022 5,985 Net interest margin (%) 2.32 2.16 2.20 2.38 2.42 2.37 Non-interest expense to average assets (%) 1.54 1.50 1.51 1.43 1.55 1.45 Asset Quality NPAs/ Assets (%) 2.3 2.7 2.6 1.5 1.8 2.4 NCOs/ Avg Loans (%) 0.8 0.7 0.7 1.0 0.9 0.8 Reserves/ Loans (%) 1.6 1.4 1.0 1.0 1.0 1.6 Texas Ratio (NPAs & TDRs / TCE & LLR) (%) 19.6 20.9 17.4 15.6 16.9 19.9 At, or for the three months ended,

7 Capital Position as of June 30, 2012 13.32% 20.82% 22.08% 15.63% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% Tangible Common Equity Ratio (TFSL) Core Capital Ratio (Thrift) Tier 1 Risk-based Ratio (Thrift) Total Risk-Based Capital Ratio (Thrift) Well Capitalized 6.00% 10.00% 5.00% TFSL/Thrift

8 Deposit Overview Deposits have increased while average interest cost has decreased Profile of Retail Deposits $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 Fiscal Year End 9/30/09 Fiscal Year End 9/30/10 Fiscal Year End 9/30/11 Quarter End 12/31/11 Quarter End 3/31/12 Quarter End 6/30/12 (in bi llio ns ) 0% 1% 2% 3% 4% (av era ge co st) CDs Savings NOW Avg Cost

9 Adjustable Rate Loan Production Smart Rate adjustable product began July 2010 In the nine months ended 6/30/12, total loan production of $2.07 billion was 57% ARM and 43% fixed Average credit score of quarter ended 6/30/12 ARM production was 783, with average LTV of 61% 0 10 20 30 40 50 60 70 80 90 100 110 FY 2009 FY 2010 FY 2011 9 mo. ended 6/30/12 % Fixed vs. % Adjustable First Mortgage Loan Production Adjustable Fixed

10 Adjustable Rate Growth As of 6/30/12, 46% of all real estate loans, including equity loan products, are adjustable rate In May 2011, we began expansion of our Smart Rate adjustable rate mortgage into 10 new states PA, NJ, IL, NC, VA, CT, TN, CO, OR and WA New state expansion represents $256 million in closed loans as of 6/30/12 Total ARMs of $2.8 billion represents 33% of all first mortgages at 6/30/12, compared to 14% of all first mortgages as of 9/30/10 0 5 10 15 20 25 30 35 (pe rc en tag e) Adjustable Mortgages as a Percentage of Total First Mortgage Portfolio

11 Loan Delinquencies and Charge-offs 6/30/12 loan balances include $233 million of loans held for sale Information does not include $4.2 billion of loans serviced for others Decline in delinquencies in quarter ended 12/31/11 was greatly aided by charge off of SVA, which was $55.5 million at 9/30/11 Dollars in millions Loan Balances 6/30/12 6/30/12 9/30/11 9/30/10 6/30/12 3/31/12 9/30/11 9/30/10 Residential non-Home Today Ohio $6,212 1.0% 1.4% 1.9% $4 $4 $9 $5 Florida $1,383 2.8% 5.1% 5.2% 5 4 9 7 Other 386 0.2% 0.7% 1.5% - - - - - Total $7,981 1.3% 2.1% 2.5% $9 $8 $18 $12 Residential Home Today Ohio $212 20.6% 30.0% 34.8% $5 $6 $7 $5 Florida 9 14.4% 32.1% 32.1% - - - - Total $221 20.3% 30.1% 34.6% $5 $6 $7 $5 Home Equity Loans and Lines of Credit Ohio $871 1.1% 1.6% 2.0% $2 $1 $10 $7 Florida 649 1.7% 3.3% 4.1% 6 3 29 33 California 270 1.2% 1.4% 1.5% 1 1 5 4 Other 449 1.0% 2.1% 2.4% 2 4 5 5 Total $2,239 1.3% 2.2% 2.6% $11 $9 $49 $49 Other $71 0.6% 4.3% 4.2% $0 $0 $1 $2 Overall Total $10,512 1.7% 2.9% 3.5% $25 $23 $75 $68 Quarter-end Net Charge Offs Delinquencies at: FYE

12 Loan Portfolio Trends Non-performing assets and delinquencies are trending downward Troubled debt restructuring loans have leveled off Non-Performing Assets $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 9/3 0/0 7 9/3 0/0 8 9/3 0/0 9 9/3 0/1 0 9/3 0/1 1 12/ 31/ 11 3/3 1/1 2 6/3 0/2 012 (in th ou sa nd s) Delinquenices $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,00 $400,000 9/3 0/0 7 9/3 0/0 8 9/3 0/0 9 9/3 0/1 0 9/3 0/1 1 12 /31 /11 3/3 1/1 2 6/3 0/2 01 2 (in th ou sa nd s) Troubled Debt Restructuring $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 9/3 0/0 7 9/3 0/0 8 9/3 0/0 9 9/3 0/1 0 9/3 0/1 1 12 /31 /11 3/3 1/1 2 6/3 0/2 01 2 (in th ou sa nd s) Decline in NPA’s and delinquencies in quarter ended 12/31/11 was greatly aided by charge off of SVA, which was $55.5 million at 9/30/11.

13 Regulatory Status Provisions of the February 7, 2011 MOU that require further Company action revolve around the new Interest Rate Risk modeling system that was implemented during the quarter ended March 31, 2012 and the further refinement and enhancement of our Enterprise Risk Management process. These actions will be subject to future regulatory validation. The Company has begun to make new home equity lines of credit available to existing home equity customers, with the expectation of future rollout to all markets. Dividends and stock buyback program still subject to regulatory 45-day non-objection No direction on proposed Fed rules for MHC dividend waivers

14 Investor Conference Call July 31, 2012 Investor Questions