Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESBANCO INC | d382604d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - WESBANCO INC | d382604dex21.htm |

| EX-2.2 - FORM OF VOTING AGREEMENT - WESBANCO INC | d382604dex22.htm |

| EX-99.2 - PRESS RELEASE - WESBANCO INC | d382604dex992.htm |

Exhibit 99.1 |

Forward-looking statements in this presentation relating to WesBanco’s

plans, strategies, objectives, expectations, intentions and adequacy of

resources, are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The information contained herein

should be read in conjunction with WesBanco’s 2011 Annual Report on

Form 10-K and documents subsequently filed with the Securities and

Exchange Commission (“SEC”), including WesBanco’s form

10-Q for the quarter ended March 31, 2012, which are available on the

SEC’s website www.sec.gov or at WesBanco’s website

www.wesbanco.com. Investors are cautioned that forward-looking

statements, which are not historical fact, involve risks and uncertainties,

including those detailed in WesBanco’s 2011 Annual Report on Form

10-K filed with the SEC under the section,

“Risk

Factors”

in

Part

1,

Item

1A.

Such

statements

are

subject

to

important factors that could cause actual results to differ materially from those

contemplated by such statements. WesBanco does not assume any duty to

update any forward-looking statements.

2

Forward-Looking Statements |

3

Compelling

Strategic Rationale

Logical expansion opportunity into largest deposit market in close proximity to

WSBC headquarters

Expands WSBC’s franchise by 13 offices along Rt.19 corridor in

Pittsburgh MSA

Builds on WSBC’s existing commercial/ retail presence in Pittsburgh

market

Solid lending team to complement WSBC’s existing lending relationships in

Pittsburgh market

Ability to leverage WSBC’s platform across Fidelity’s commercial and

retail relationships

Attractive Deposit

Franchise

Desirable branch locations

90% core deposits

Strong Financial

Results

EPS accretive in 2013, excluding merger-related expenses

Manageable earn-back period for TBV dilution of approximately four years

Double digit IRR

In

excess

of

“Well

Capitalized”

guidelines

on

a

pro

forma

basis

Low Risk

Significant experience in Pittsburgh market

Similar risk-averse cultures with like-minded customer focus

Proven track record of growth through acquisitions

Contained and manageable asset quality issues

Transaction

Highlights |

(1)

For the 12 month period ended 3/31/12 (2) Source: 2010 Census and the Bureau

of Labor Statistics Overview

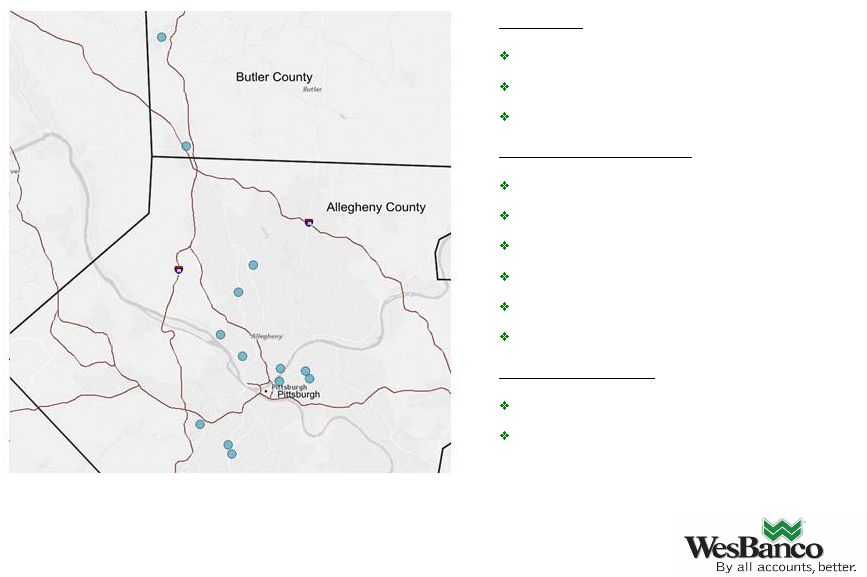

Headquartered in Pittsburgh, PA

Assets of $666mm

13 Branches

Financial

Highlights

(1)

Gross Loans ($mm): $345

Deposits ($mm): $471

Core ROAA: 0.30%

Core ROAE: 3.96%

NPAs/ Assets: 2.96%

TE/ TA: 7.46%

Pittsburgh

MSA

(2)

Population: 2.36mm

Unemployment Rate: 6.6%

4

Fidelity Bancorp, Inc. Overview |

5

WesBanco

Fidelity Bancorp

Pittsburgh MSA

Rank

Institution

Branches

Deposits

($MM)

Market

Share

1

PNC Financial Services Group

169

38,923

48.0%

2

Bank of New York Mellon Corp.

3

8,612

10.6%

3

RBS

130

6,436

7.9%

4

F.N.B. Corp.

91

3,400

4.2%

5

Dollar Bank FSB

36

3,204

4.0%

6

First Niagara Finl Group

59

2,998

3.7%

7

First Commonwealth Financial

63

2,388

2.9%

8

Huntington Bancshares Inc.

40

2,342

2.9%

9

S&T Bancorp Inc.

28

1,631

2.0%

10

TriState Capital Holdings Inc.

2

1,561

1.9%

11

Northwest Bancshares, Inc.

28

1,026

1.3%

12

ESB Financial Corp.

22

802

1.0%

13

WFSB Mutual Holding Company

8

701

0.9%

14

Pro Forma

15

523

0.6%

15

CF Financial Corp.

9

497

0.6%

16

Fifth Third Bancorp

15

457

0.6%

17

Fidelity Bancorp Inc.

13

452

0.6%

40

WesBanco Inc.

2

71

0.1%

Total For Institutions In Market

864

81,139

Source: SNL Financial as of 6/30/11.

Logical Market Extension |

Fidelity (13 Branches)

6

Source:

SNL

Financial,

Bureau

of

Labor

Statistics,

SBA

firms

and

employment

by

MSA

2007,

U.S.

Bureau

of

Land

Management,

National Association of Realtors, Geology.com and Catskillmountainkeeper.org

1. As of May 2012, not seasonally adjusted

2. Federal Housing Financing Agency, seasonally adjusted

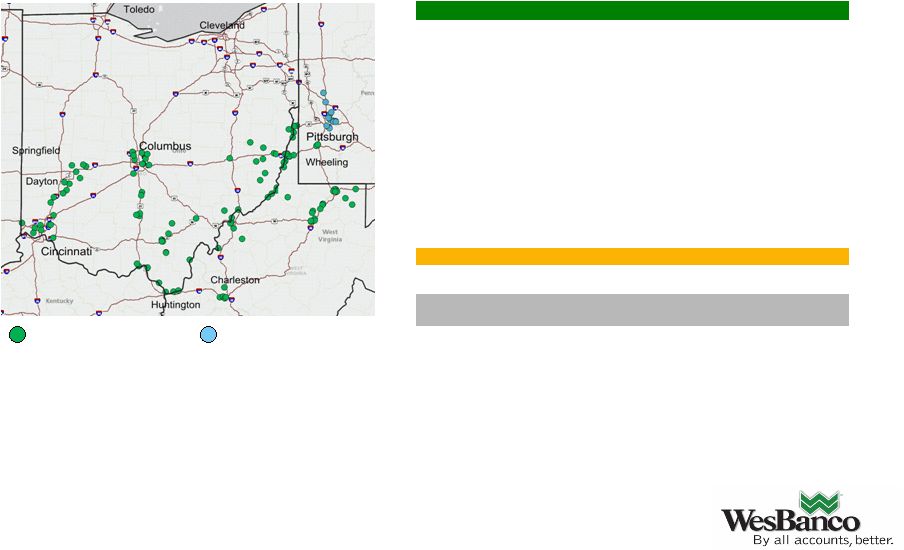

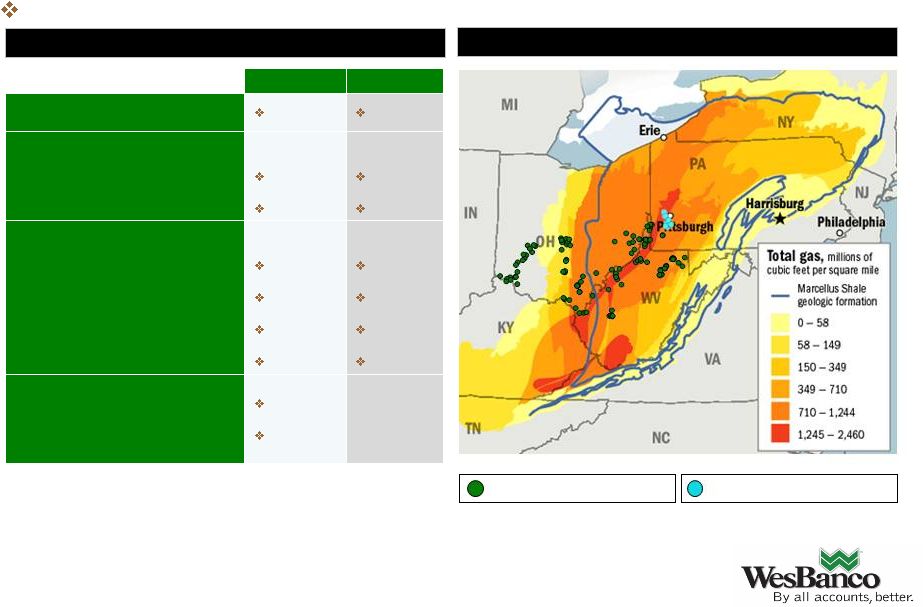

Marcellus Shale Regional Coverage

WesBanco (115 Branches)

Pittsburgh Market Highlights

Pittsburgh

National

Unemployment

6.6%

(1)

7.9%

(1)

Residential Home Price Change

(2)

:

2000Q1 -

2007Q2

2007Q2 -

2012Q1

36.6%

7.6%

63.9%

(20.6%)

CRE Vacancy Rate

Office

Industrial

Retail

Multi-family

15.6%

10.0%

8.4%

3.1%

16.2%

11.0%

11.2%

4.4%

# of Businesses

< 500 employees

> 500 employees

46,604

1,736

Attractive market; broadens WSBC coverage in Marcellus Shale region

Market Highlights |

7

Consideration

80% Stock/ 20% Cash

$4.50

in

cash

and

0.8275

(1)

shares

of

WesBanco

common

stock for each of Fidelity Bancorp’s shares

Deal Value

$70.8mm

TARP Redemption

$7.0mm of outstanding TARP preferred stock and related

warrants to be redeemed at or prior to closing

Cost Savings

35% of Fidelity Bancorp’s non-interest expense

One Time Restructuring Charge

$7.0 million

Board Representation

Fidelity Bancorp to receive one board seat

Due Diligence

Completed

Required Approvals

Both Boards of Directors have already approved

Fidelity Bancorp shareholder approval required

Regulatory approval required

Anticipated Closing

Q4 2012

(1) Determined based on 15 day WSBC average closing price of $21.75 as of 7/17/12

Transaction Summary |

8

(1) Pro Forma for the Fidelity Bancorp acquisition as of 3/31/12.

3/31/2012

Actual

Pro Forma

(1)

Tier 1 Risk Based

12.9%

11.9%

Total Risk Based

14.2%

13.1%

TCE/ TA

6.8%

6.2%

Attractive financial returns

Earnings accretion estimated at 6% after cost savings are fully realized

5.7% TBV dilution offset by earn-back period of approximately 4 years

Double digit IRR

In

excess

of

“Well

Capitalized”

guidelines

on

a

pro

forma

basis

Assumptions

35% Cost Savings

Extensive credit review process

Gross loan mark of $11.8mm or 3.4%

Pro Forma Financial Impact |

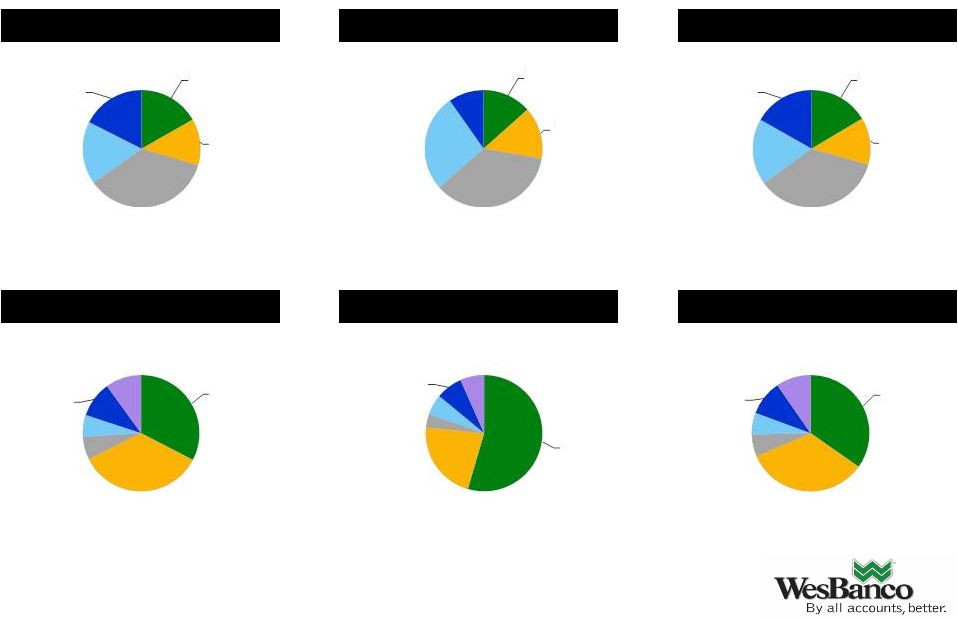

Total

Deposits: $4,474mm

Total Deposits:

$476mm

Total Deposits: $4,950mm

Total Loans: $3,236mm

Total Loans: $345mm

Total Loans: $3,581mm

Note: Source SNL Financial, as of 3/31/12

9

Demand

17%

Other

Transaction

13%

MMDA &

Savings

35%

Retail Time

17%

Jumbo

Time

18%

Demand

13%

Other

Transaction

14%

MMDA &

Savings

36%

Retail Time

27%

Jumbo

Time

10%

Demand

16%

Other

Transaction

13%

MMDA &

Savings

36%

Retail Time

18%

Jumbo

Time

17%

Residential

33%

CRE

35%

Multifamily

6%

C&D

6%

C&I

10%

Other

10%

Residential

54%

CRE

22%

Multifamily

4%

C&D

6%

C&I

7%

Other

7%

Residential

35%

CRE

34%

Multifamily

6%

C&D

6%

C&I

10%

Other

9%

WesBanco Deposits

Fidelity Bancorp Deposits

Pro Forma Deposits

WesBanco Loans

Fidelity Loans

Pro Forma Loans

Pro Forma Deposits and Loans |

10

Pricing In Line With Recent Deals

Note: Source SNL Financial, MRQ available

1. Median of deals since 2011 where the target was located in PA, WV, OH,

Midatlantic, and Northeast regions, the deal value was between $20m and

$500m, and the target had a Texas Ratio less than 100% Precedent

Transactions (1)

Deal Metrics

Deal Value

$70.8

$21.3

$163.0

$162.8

Price/ Book

1.53x

1.40x

1.38x

1.34x

Price/ Tangible Book

1.62x

1.40x

1.98x

1.50x

Core Deposit Premium

6.6%

10.2%

5.2%

6.8%

Target Financials

Total Assets

$665.8

$120.3

$1,800.2

Total Deposits

$471.5

$100.5

$1,488.1

Branches

13

2

47

Deposits per Branch

$36.3

$50.3

$31.7

Core Deposits (%)

90.2%

61.3%

86.8%

Cost of Deposits (LTM)

0.93%

1.02%

1.23%

Parkvale

Bank

Gateway

Bank |

History of successful consolidations.

WesBanco is focused on targeted M & A

opportunities in its higher growth metro markets

within our market areas.

Management, technology/ back office and

capital/

liquidity strength to compete for deals of

interest.

Current stock valuation provides for upside

potential for acquired bank’s shareholders.

11

Proven Acquisition Track Record |

12

Natural

expansion

opportunity

into

largest

deposit

market

in

close

proximity

to

WSBC

headquarters.

Builds

on

WSBC’s

existing

commercial/

retail

presence

in

Pittsburgh

market.

Provides

high

quality

branch

network

with

no

overlap

to

existing

WSBC

branches.

Attractive

financial

results.

Deployment

of

excess

capital

to

enhance

earnings

while

remaining

significantly

well-capitalized.

Summary |

1Q’11

2Q’11

3Q’11

4Q’11

1Q’12

Total common equity

$ 611,978

$ 623,037

$ 634,402

$ 633,790

$ 642,001

Less: goodwill & other

intangible assets

(284,941)

(284,336)

(283,737)

(283,150)

(282,612)

Tangible common equity

$ 327,037

$ 338,701

$ 350,665

$ 350,640

$ 359,389

Total assets

$5,368,852

$5,425,907

$5,502,158

$5,536,030

$5,600,643

Less: goodwill & other

intangible assets

(284,941)

(284,336)

(283,737)

(283,150)

(282,612)

Tangible assets

$5,083,911

$5,141,571

$5,218,421

$5,252,880

$5,318,031

Tangible common equity to

tangible assets

6.43%

6.59%

6.72%

6.68%

6.76%

Non-GAAP Financial Measures

WesBanco, Inc.

($ in thousands) |

CORE ROAA

Net Income

$ 1,685

Realized Gain on Securities

(604)

Amortization of Intangibles

11

OTTI Impact to Earnings

1,097

Tax Effect (35%)

(176)

Core Net Income

$2,013

Average Assets

$667,652

Core ROAA

0.30%

Non-GAAP Financial Measures

Fidelity Bancorp, Inc.

March 31, 2012 LTM

($ in thousands)

CORE ROAE

Net Income

$ 1,685

Realized Gain on Securities

(604)

Amortization of Intangibles

11

OTTI Impact to Earnings

1,097

Tax Effect (35%)

(176)

Core Net Income

$2,013

Average Equity

$50,855

Core ROAE

3.96% |

1Q’12

Total equity

$ 52,141

Less: goodwill & other

intangible assets

(2,653)

Tangible equity

$ 49,488

Total assets

$665,822

Less: goodwill & other

intangible assets

(2,653)

Tangible assets

$663,169

Tangible equity to tangible

assets

7.46%

Non-GAAP Financial Measures

Fidelity Bancorp, Inc.

($ in thousands) |

|