Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALIMERA SCIENCES INC | d382118d8k.htm |

| EX-3.6 - FORM OF BYLAW AMENDMENT - ALIMERA SCIENCES INC | d382118dex36.htm |

| EX-99.1 - PRESS RELEASE OF ALIMERA SCIENCES, INC. DATED JULY 18, 2012 - ALIMERA SCIENCES INC | d382118dex991.htm |

| EX-4.10 - FORM OF WARRANT TO PURCHASE SHARES OF SERIES A PREFERRED STOCK - ALIMERA SCIENCES INC | d382118dex410.htm |

| EX-4.11 - FORM OF REGISTRATION RIGHTS AGREEMENT - ALIMERA SCIENCES INC | d382118dex411.htm |

| EX-10.36 - SECURITIES PURCHASE AGREEMENT - ALIMERA SCIENCES INC | d382118dex1036.htm |

| EX-3.5 - FORM OF CERTIFICATE OF DESIGNATION OF SERIES A CONVERTIBLE PREFERRED STOCK - ALIMERA SCIENCES INC | d382118dex35.htm |

Exhibit 99.2

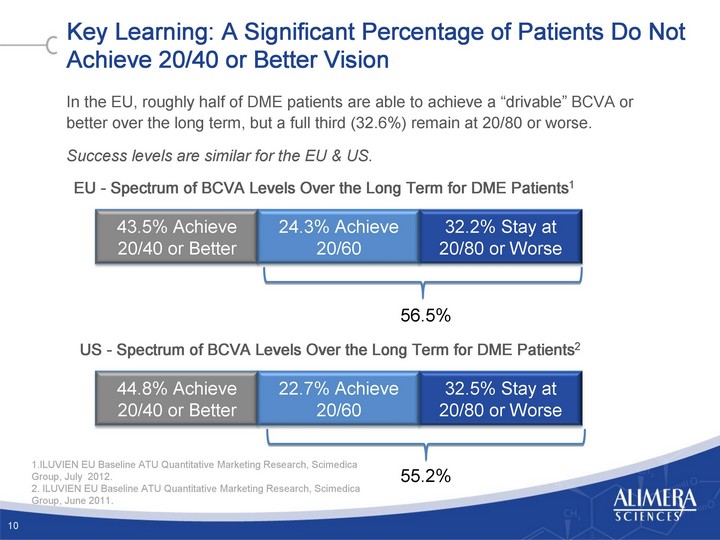

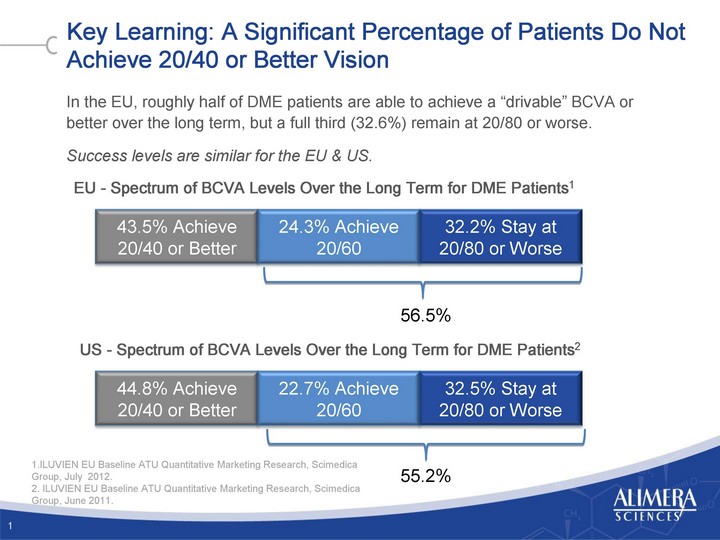

| Key Learning: A Significant Percentage of Patients Do Not Achieve 20/40 or Better Vision In the EU, roughly half of DME patients are able to achieve a "drivable" BCVA or better over the long term, but a full third (32.6%) remain at 20/80 or worse. Success levels are similar for the EU & US. 1 EU - Spectrum of BCVA Levels Over the Long Term for DME Patients1 US - Spectrum of BCVA Levels Over the Long Term for DME Patients2 43.5% Achieve 20/40 or Better 24.3% Achieve 20/60 32.2% Stay at 20/80 or Worse 44.8% Achieve 20/40 or Better 22.7% Achieve 20/60 32.5% Stay at 20/80 or Worse 56.5% 55.2% 1.ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. 2. ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, June 2011. |

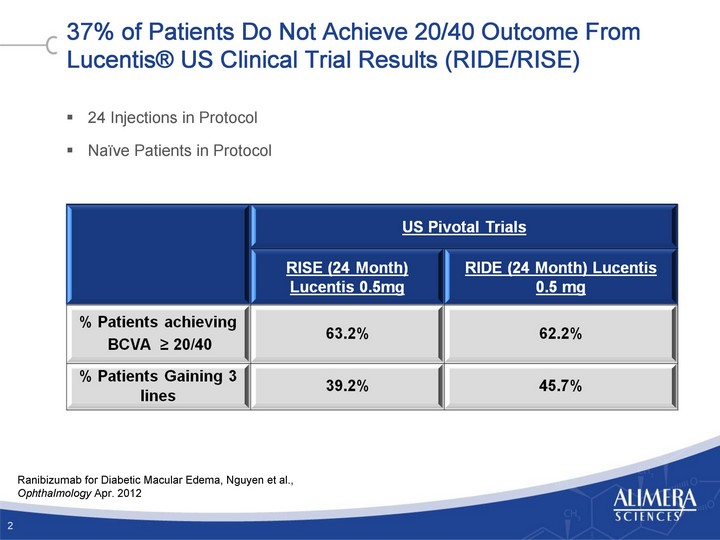

| 37% of Patients Do Not Achieve 20/40 Outcome From Lucentis(r) US Clinical Trial Results (RIDE/RISE) 24 Injections in Protocol Naive Patients in Protocol 2 Ranibizumab for Diabetic Macular Edema, Nguyen et al., Ophthalmology Apr. 2012 |

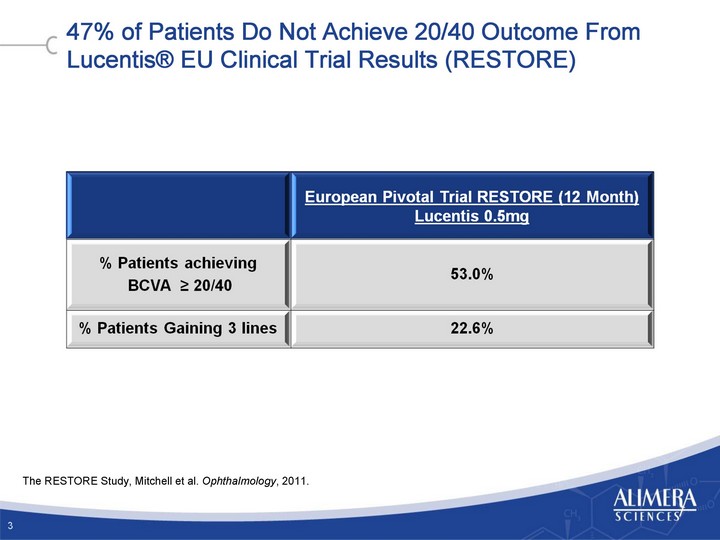

| 47% of Patients Do Not Achieve 20/40 Outcome From Lucentis(r) EU Clinical Trial Results (RESTORE) 3 The RESTORE Study, Mitchell et al. Ophthalmology, 2011. |

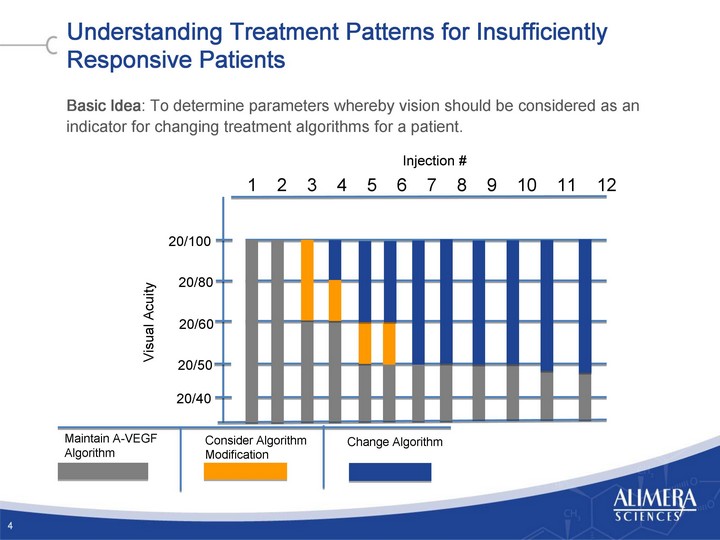

| Understanding Treatment Patterns for Insufficiently Responsive Patients Basic Idea: To determine parameters whereby vision should be considered as an indicator for changing treatment algorithms for a patient. 4 Visual Acuity 20/60 20/40 20/50 20/80 20/100 Injection # 1 2 3 4 5 6 7 8 9 10 11 12 Maintain A-VEGF Algorithm Change Algorithm Consider Algorithm Modification |

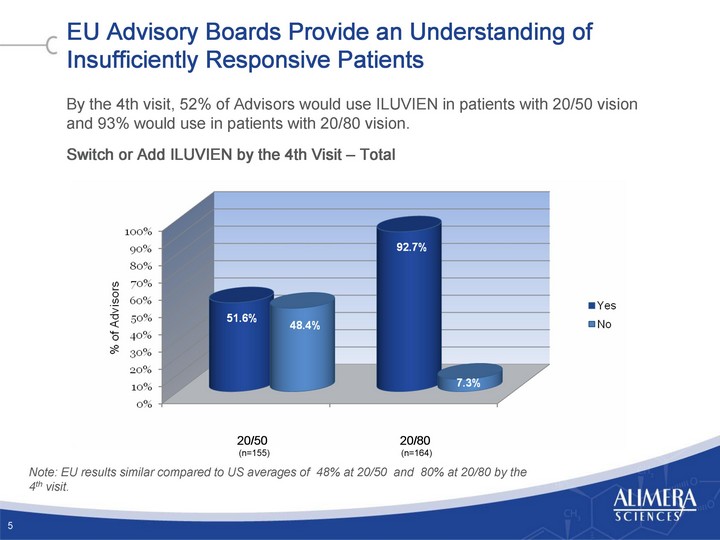

| EU Advisory Boards Provide an Understanding of Insufficiently Responsive Patients By the 4th visit, 52% of Advisors would use ILUVIEN in patients with 20/50 vision and 93% would use in patients with 20/80 vision. Switch or Add ILUVIEN by the 4th Visit - Total 5 20/50 20/80 (n=155) (n=164) Note: EU results similar compared to US averages of 48% at 20/50 and 80% at 20/80 by the 4th visit. |

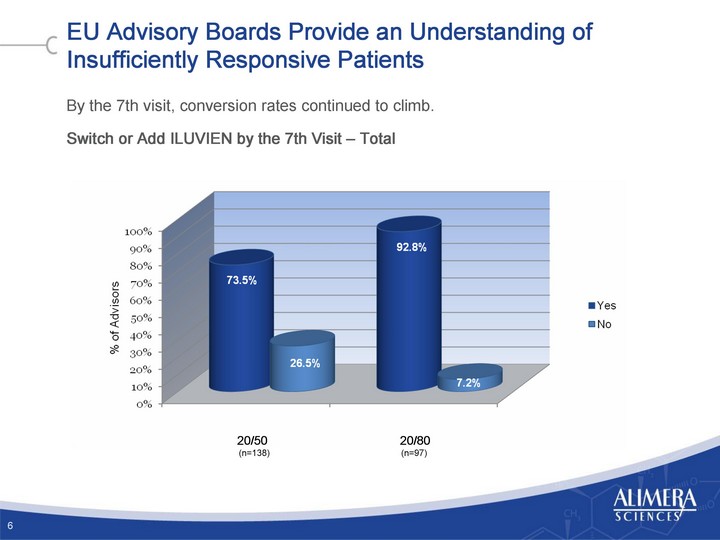

| EU Advisory Boards Provide an Understanding of Insufficiently Responsive Patients By the 7th visit, conversion rates continued to climb. Switch or Add ILUVIEN by the 7th Visit - Total 6 20/50 20/80 (n=138) (n=97) |

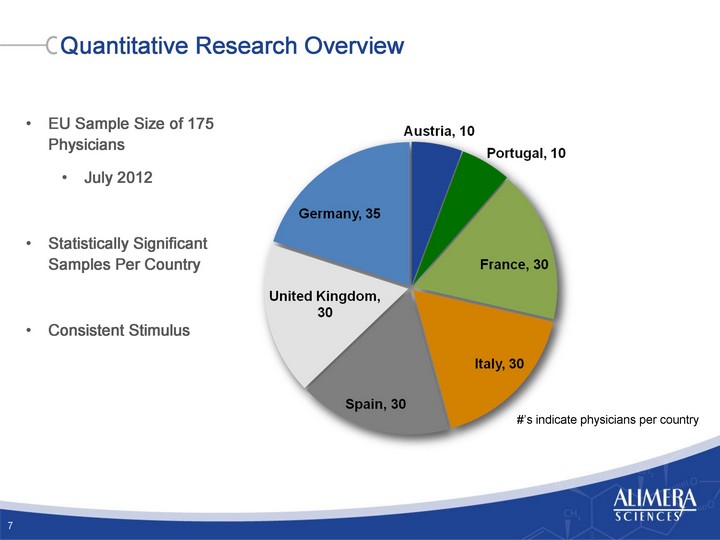

| Quantitative Research Overview 7 EU Sample Size of 175 Physicians July 2012 Statistically Significant Samples Per Country Consistent Stimulus #'s indicate physicians per country |

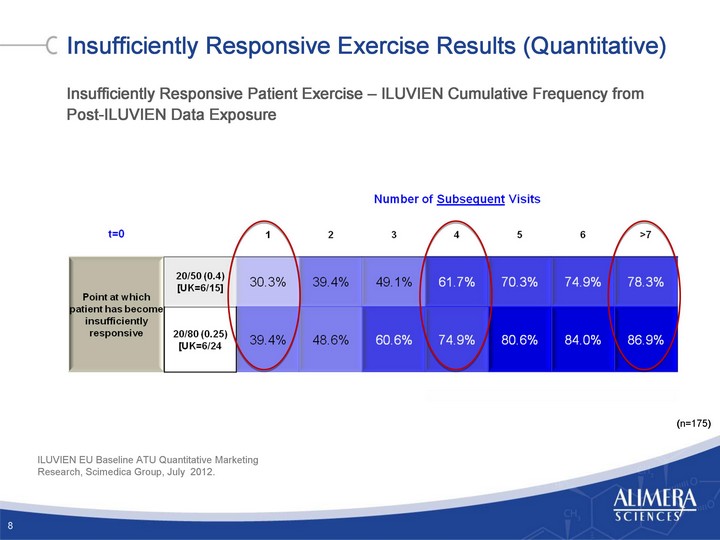

| Insufficiently Responsive Exercise Results (Quantitative) Insufficiently Responsive Patient Exercise - ILUVIEN Cumulative Frequency from Post-ILUVIEN Data Exposure 8 (n=175) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. |

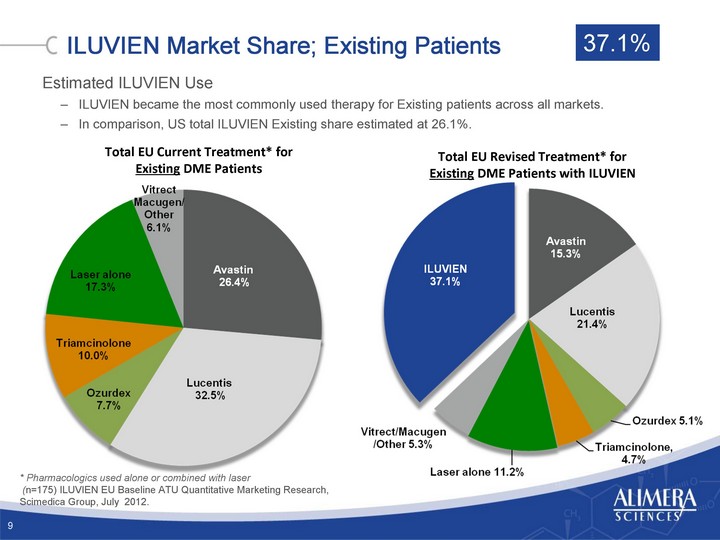

| ILUVIEN Market Share; Existing Patients Total EU Current Treatment* for Existing DME Patients * Pharmacologics used alone or combined with laser (n=175) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. Total EU Revised Treatment* for Existing DME Patients with ILUVIEN 9 Estimated ILUVIEN Use ILUVIEN became the most commonly used therapy for Existing patients across all markets. In comparison, US total ILUVIEN Existing share estimated at 26.1%. 37.1% |

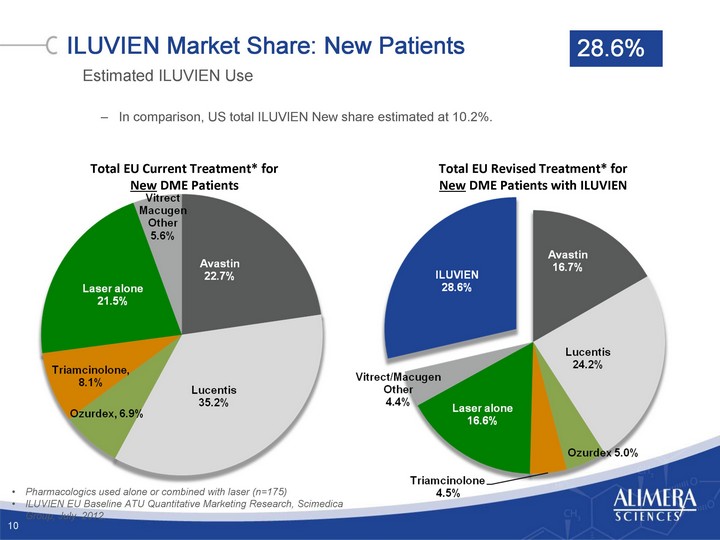

| ILUVIEN Market Share: New Patients Estimated ILUVIEN Use In comparison, US total ILUVIEN New share estimated at 10.2%. 10 Total EU Current Treatment* for New DME Patients Total EU Revised Treatment* for New DME Patients with ILUVIEN Pharmacologics used alone or combined with laser (n=175) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. 28.6% |

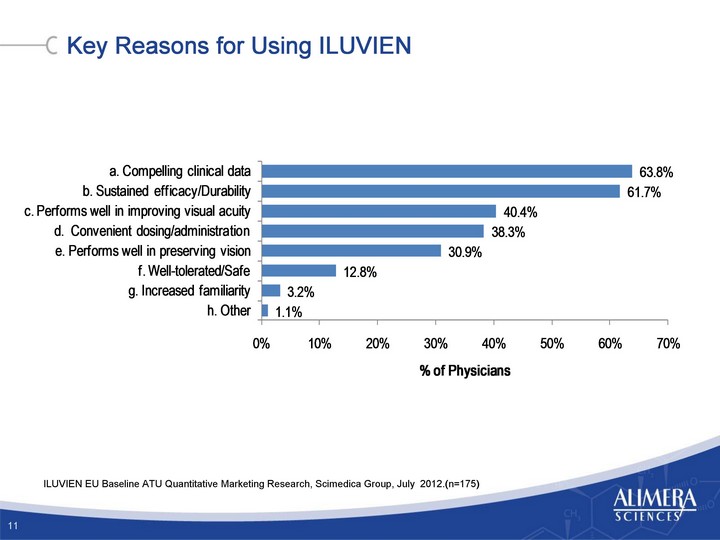

| Key Reasons for Using ILUVIEN 11 ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012.(n=175) |

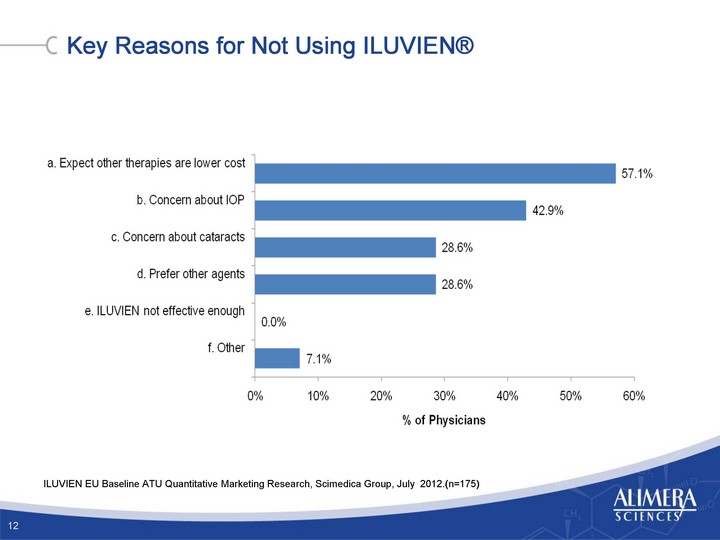

| Key Reasons for Not Using ILUVIEN(r) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012.(n=175) 12 |

| Pricing and Reimbursement |

| Physician Response Qualitative and Quantitative Findings Dave Holland, Co-Founder, SVP, Sales and Marketing |

| Engaging Retinal-Treating Physicians Meeting Interaction Advisory Boards Quantitative ATU Data 2 |

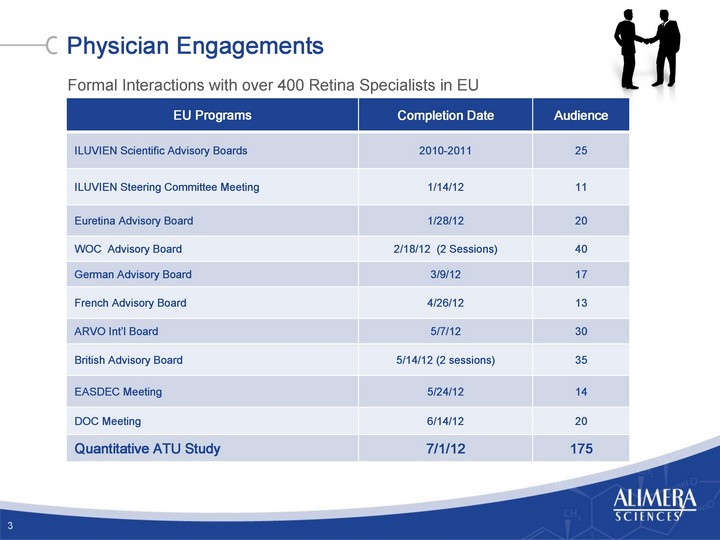

| Physician Engagements EU Programs Completion Date Audience ILUVIEN Scientific Advisory Boards 2010-2011 25 ILUVIEN Steering Committee Meeting 1/14/12 11 Euretina Advisory Board 1/28/12 20 WOC Advisory Board 2/18/12 (2 Sessions) 40 German Advisory Board 3/9/12 17 French Advisory Board 4/26/12 13 ARVO Int'l Board 5/7/12 30 British Advisory Board 5/14/12 (2 sessions) 35 EASDEC Meeting 5/24/12 14 DOC Meeting 6/14/12 20 Quantitative ATU Study 7/1/12 175 3 Formal Interactions with over 400 Retina Specialists in EU |

| Physician Response to ILUVIEN 4 Desire for ILUVIEN is Strong Physicians acknowledge their greatest unmet need in treating DME is therapies that can provide a sustained duration of effect Physicians recognize that a sizeable portion of their population is chronic and needs therapy beyond laser and anti-VEGF Side effects are known and considered manageable |

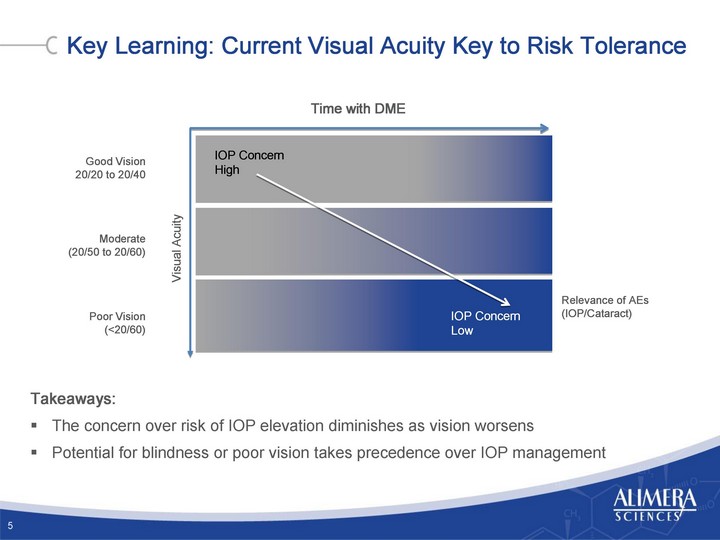

| Key Learning: Current Visual Acuity Key to Risk Tolerance Takeaways: The concern over risk of IOP elevation diminishes as vision worsens Potential for blindness or poor vision takes precedence over IOP management 5 Time with DME Visual Acuity Good Vision 20/20 to 20/40 Poor Vision (<20/60) Relevance of AEs (IOP/Cataract) IOP Concern Low IOP Concern High Moderate (20/50 to 20/60) |

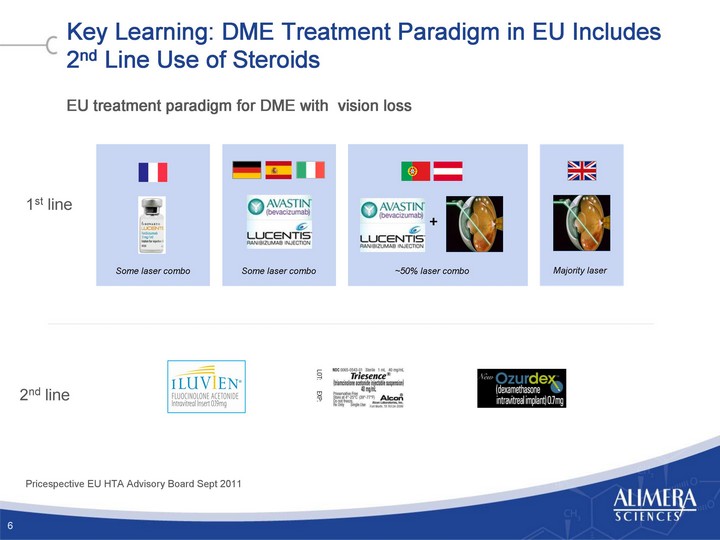

| Key Learning: DME Treatment Paradigm in EU Includes 2nd Line Use of Steroids EU treatment paradigm for DME with vision loss 6 Pricespective EU HTA Advisory Board Sept 2011 1st line 2nd line Some laser combo Some laser combo ~50% laser combo + Majority laser |

| Key Learning: Awareness that DME is Not a Static Disease Prolonged Inflammation Associated with DME May Cause Cumulative Damage Changes to the Retinal Structure May Be Occurring and Duration of Disease Appears to be Linked New Factors Become Important for Consideration in Treating DME These may not have been as important earlier in the disease 7 |

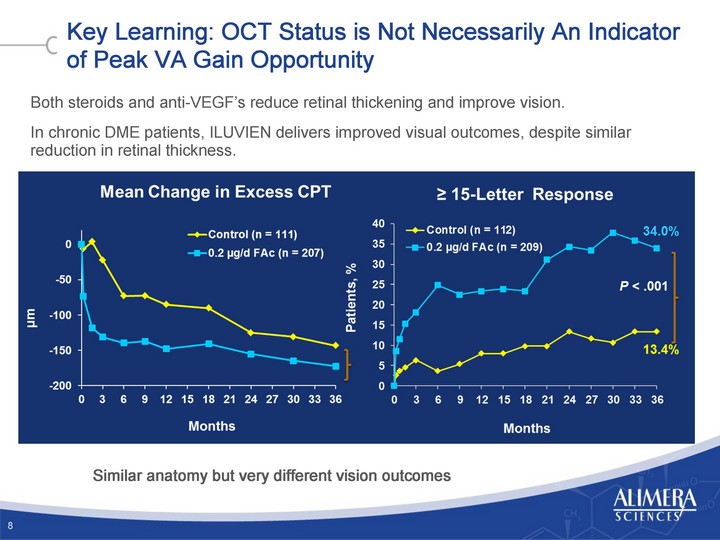

| Key Learning: OCT Status is Not Necessarily An Indicator of Peak VA Gain Opportunity Both steroids and anti-VEGF's reduce retinal thickening and improve vision. In chronic DME patients, ILUVIEN delivers improved visual outcomes, despite similar reduction in retinal thickness. 8 Similar anatomy but very different vision outcomes |

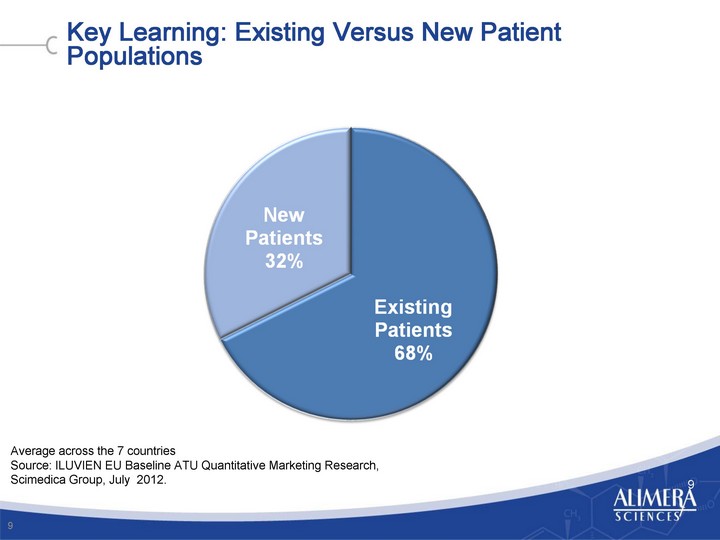

| Key Learning: Existing Versus New Patient Populations 9 9 Average across the 7 countries Source: ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. |

| Key Learning: A Significant Percentage of Patients Do Not Achieve 20/40 or Better Vision In the EU, roughly half of DME patients are able to achieve a "drivable" BCVA or better over the long term, but a full third (32.6%) remain at 20/80 or worse. Success levels are similar for the EU & US. 10 EU - Spectrum of BCVA Levels Over the Long Term for DME Patients1 US - Spectrum of BCVA Levels Over the Long Term for DME Patients2 24.3% Achieve 20/60 32.2% Stay at 20/80 or Worse 22.7% Achieve 20/60 32.5% Stay at 20/80 or Worse 56.5% 55.2% 1.ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. 2. ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, June 2011. |

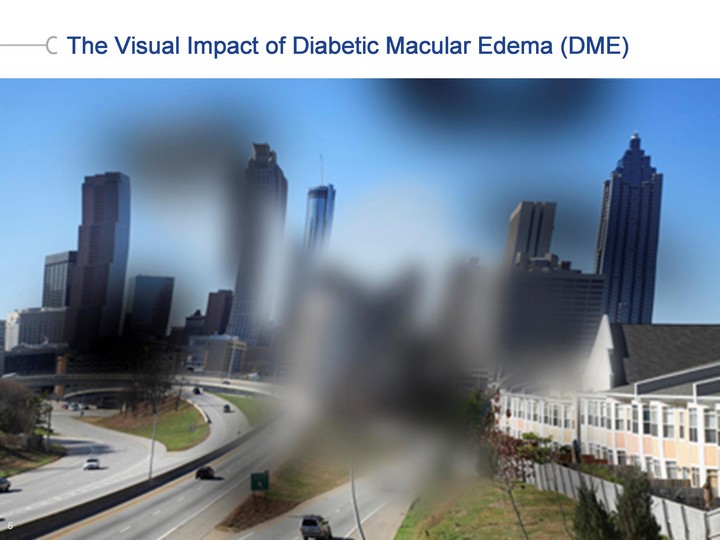

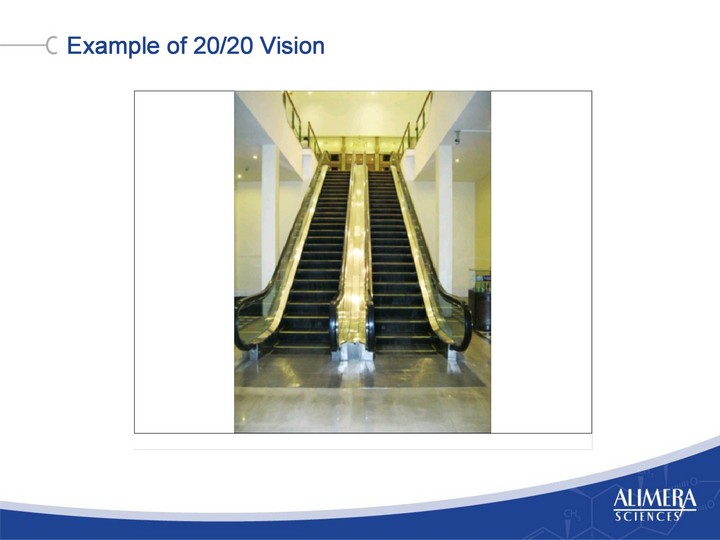

| Example of 20/20 Vision Example of 20/20 Vision |

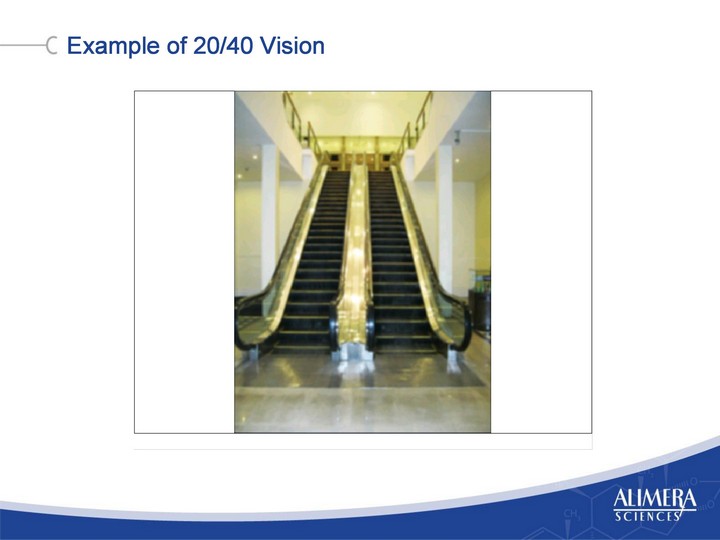

| Example of 20/40 Vision Example of 20/40 Vision |

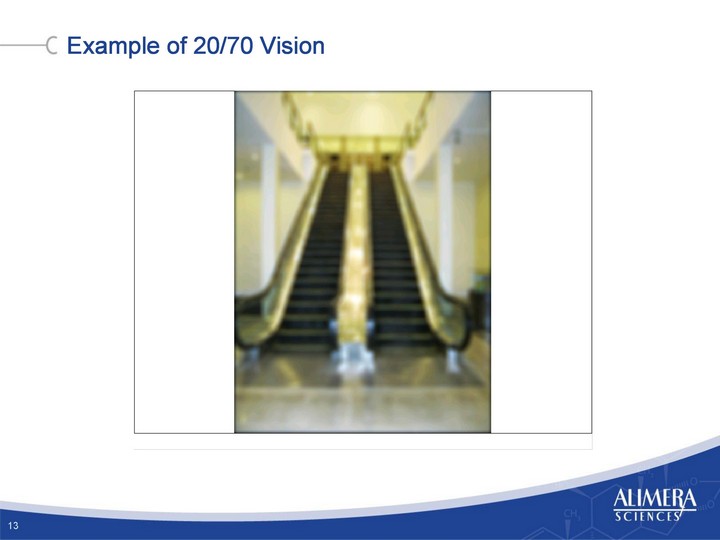

| Example of 20/70 Vision 13 13 |

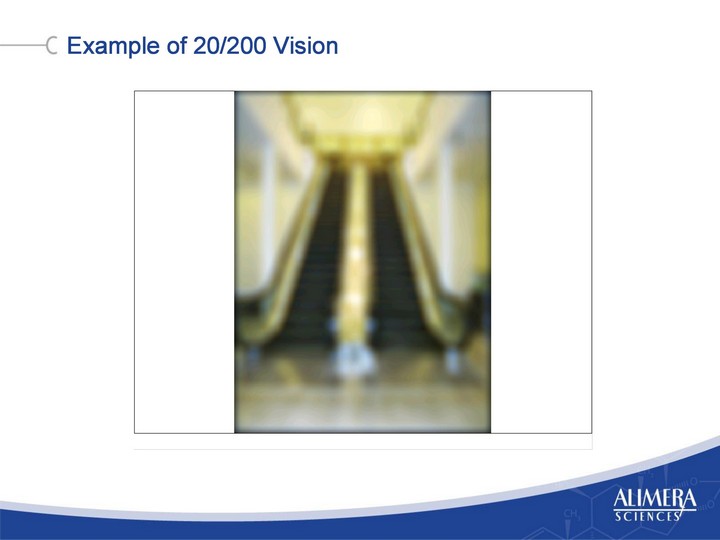

| Example of 20/200 Vision Example of 20/200 Vision |

| Key Learning: A Significant Percentage of Patients Do Not Achieve 20/40 or Better Vision In the EU, roughly half of DME patients are able to achieve a "drivable" BCVA or better over the long term, but a full third (32.6%) remain at 20/80 or worse. Success levels are similar for the EU & US. 1 EU - Spectrum of BCVA Levels Over the Long Term for DME Patients1 US - Spectrum of BCVA Levels Over the Long Term for DME Patients2 24.3% Achieve 20/60 32.2% Stay at 20/80 or Worse 22.7% Achieve 20/60 32.5% Stay at 20/80 or Worse 56.5% 55.2% 1.ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. 2. ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, June 2011. |

| 37% of Patients Do Not Achieve 20/40 Outcome From Lucentis(r) US Clinical Trial Results (RIDE/RISE) 24 Injections in Protocol Naive Patients in Protocol 2 Ranibizumab for Diabetic Macular Edema, Nguyen et al., Ophthalmology Apr. 2012 |

| 47% of Patients Do Not Achieve 20/40 Outcome From Lucentis(r) EU Clinical Trial Results (RESTORE) 3 The RESTORE Study, Mitchell et al. Ophthalmology, 2011. |

| Understanding Treatment Patterns for Insufficiently Responsive Patients Basic Idea: To determine parameters whereby vision should be considered as an indicator for changing treatment algorithms for a patient. 4 Visual Acuity 20/60 20/40 20/50 20/80 20/100 Injection # 1 2 3 4 5 6 7 8 9 10 11 12 Maintain A-VEGF Algorithm Change Algorithm Consider Algorithm Modification |

| EU Advisory Boards Provide an Understanding of Insufficiently Responsive Patients By the 4th visit, 52% of Advisors would use ILUVIEN in patients with 20/50 vision and 93% would use in patients with 20/80 vision. Switch or Add ILUVIEN by the 4th Visit - Total 5 20/50 20/80 (n=155) (n=164) Note: EU results similar compared to US averages of 48% at 20/50 and 80% at 20/80 by the 4th visit. |

| EU Advisory Boards Provide an Understanding of Insufficiently Responsive Patients By the 7th visit, conversion rates continued to climb. Switch or Add ILUVIEN by the 7th Visit - Total 6 20/50 20/80 (n=138) (n=97) |

| Quantitative Research Overview 7 EU Sample Size of 175 Physicians July 2012 Statistically Significant Samples Per Country Consistent Stimulus #'s indicate physicians per country |

| Insufficiently Responsive Exercise Results (Quantitative) Insufficiently Responsive Patient Exercise - ILUVIEN Cumulative Frequency from Post-ILUVIEN Data Exposure 8 (n=175) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. |

| ILUVIEN Market Share; Existing Patients Total EU Current Treatment* for Existing DME Patients * Pharmacologics used alone or combined with laser (n=175) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. Total EU Revised Treatment* for Existing DME Patients with ILUVIEN 9 Estimated ILUVIEN Use ILUVIEN became the most commonly used therapy for Existing patients across all markets. In comparison, US total ILUVIEN Existing share estimated at 26.1%. 37.1% |

| ILUVIEN Market Share: New Patients Estimated ILUVIEN Use In comparison, US total ILUVIEN New share estimated at 10.2%. 10 Total EU Current Treatment* for New DME Patients Total EU Revised Treatment* for New DME Patients with ILUVIEN Pharmacologics used alone or combined with laser (n=175) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012. 28.6% |

| Key Reasons for Using ILUVIEN 11 ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012.(n=175) |

| Key Reasons for Not Using ILUVIEN(r) ILUVIEN EU Baseline ATU Quantitative Marketing Research, Scimedica Group, July 2012.(n=175) 12 |

| Pricing and Reimbursement |

| Market Access Progress for ILUVIEN Completed Work Cost Effectiveness and Budget Impact Models Global Value Dossier Engagement with Consultants Work in Progress Preparation of Country Dossiers (France, Spain and Italy) NICE Committee Meeting Progress Submissions to AWMSG and SMC Germany Update Austrian and Portugal Submissions 1 |

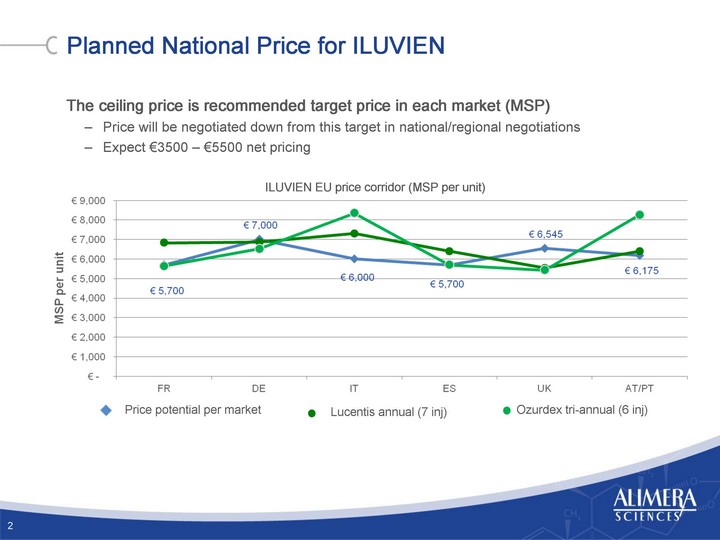

| Planned National Price for ILUVIEN The ceiling price is recommended target price in each market (MSP) Price will be negotiated down from this target in national/regional negotiations Expect €3500 - €5500 net pricing 2 ILUVIEN EU price corridor (MSP per unit) Ozurdex tri-annual (6 inj) |

| Market Opportunity and Launch Timing Rick Eiswirth, COO & CFO |

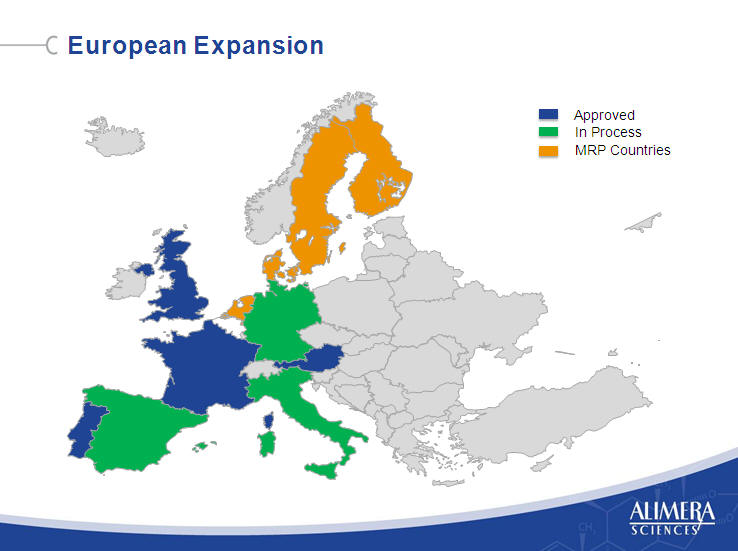

| European Launch Strategy Pursue Direct Commercial Launch in Northern European Markets Evaluate Options and Timing in the Economically Challenged Southern European Markets Pursue Expansion Through the Mutual Recognition Procedure 4 |

| Country Persons with Diabetes1 Persons Diagnosed with Diabetes2 Person Diagnosed with Diabetes with CSME3 Existing CSME Patients4 Germany 5,022,000 3,163,860 215,499 142,203 UK ** 3,064,000 1,930,320 131,455 89,389 France 3,238,000 2,039,940 138,920 95,855 Italy 3,560,000 2,242,800 152,735 97,750 Spain 2,840,000 1,789,200 121,845 85,292 Portugal 1,021,000 643,230 43,804 34,167 Austria 510,000 321,300 21,881 14,223 Nordic Region 1,026,000 646,380 44,019 29,764 Benelux Region 1,418,000 893,340 60,836 41,135 Total 21,699,000 13,670,370 930,954 629,778 1 International Diabetes Federation, Diabetes Atlas, Fifth Edition, 2011, Total Diabetics 2 International Diabetes Federation, Diabetes Atlas, Fifth Edition, 2011, Undiagnosed Diabetics 3 6.8% rate, Global Prevalence and Major Risk Factors of Diabetic Retinopathy (Yah, Joanne WY, (Diabetes Care, Mar 2012, Volume 35) 4 Existing patient population seeing physician. ILUVIEN EU Baseline ATU Quantitative marketing Research, Scimedica Inc., July2012 European Market Opportunity 5 |

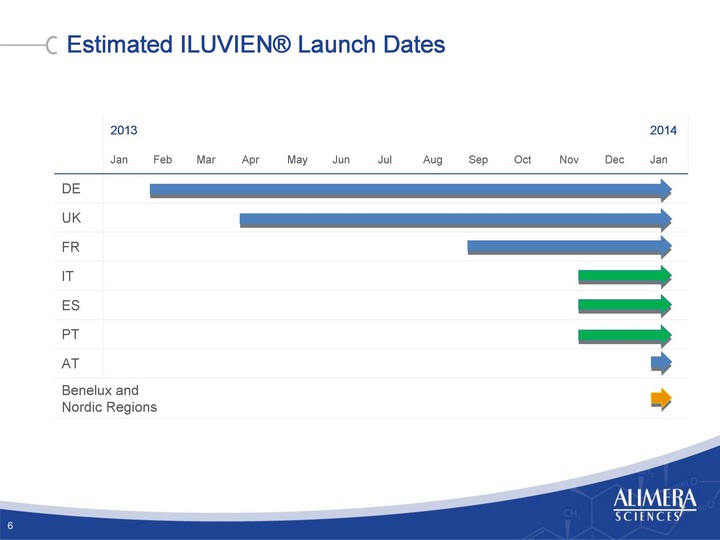

| Estimated ILUVIEN(r) Launch Dates 6 2013 2014 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan DE UK FR IT ES PT AT Benelux and Nordic Regions Benelux and Nordic Regions Benelux and Nordic Regions |

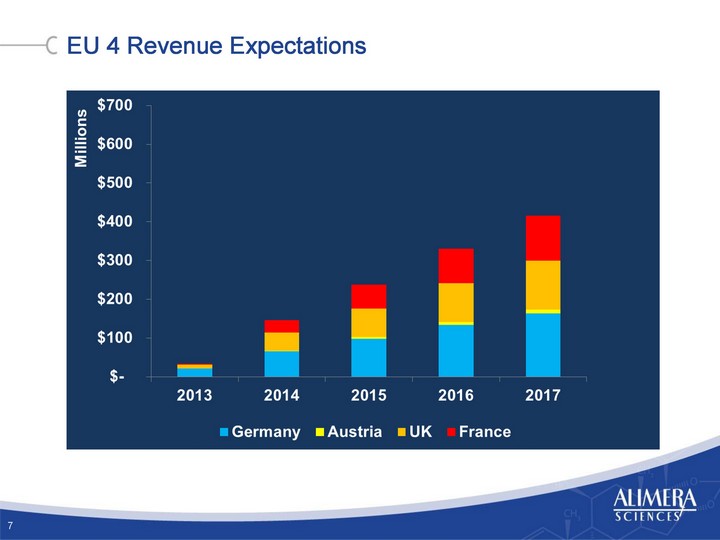

| EU 4 Revenue Expectations 7 7 |

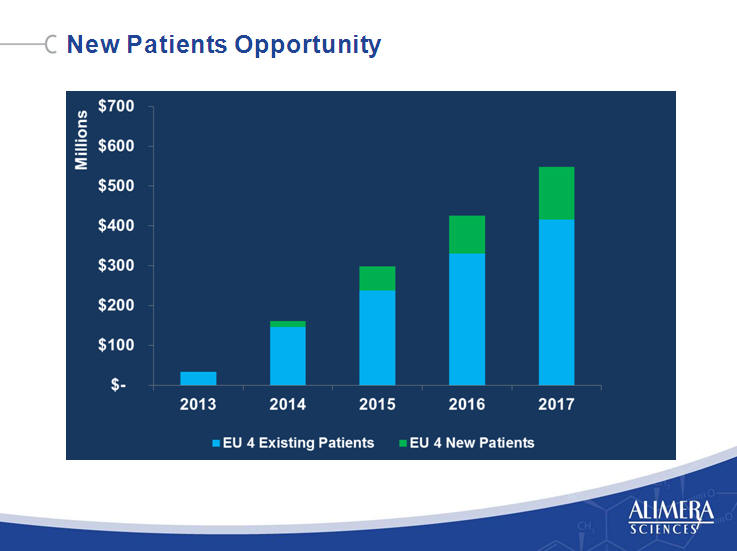

| New Patients Opportunity 8 8 |

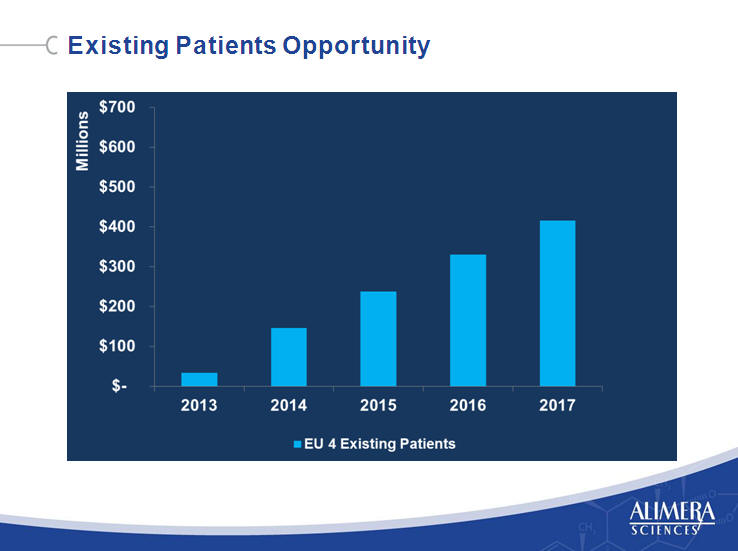

| Existing Patients Opportunity 9 9 |

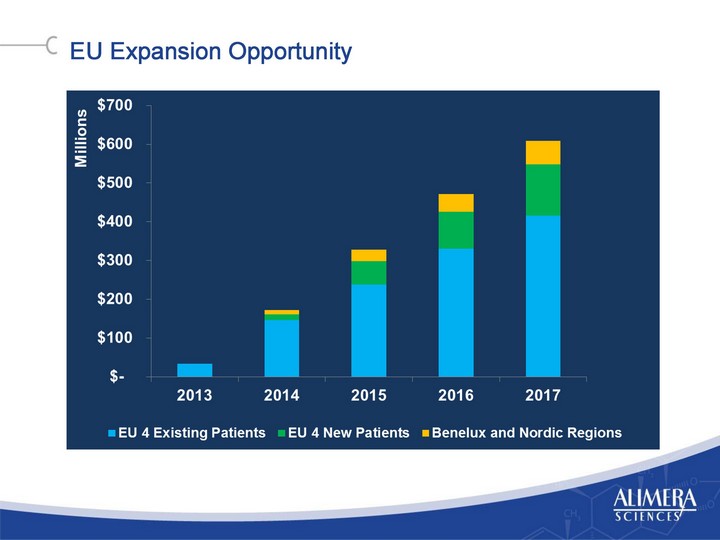

| EU Expansion Opportunity EU Expansion Opportunity |

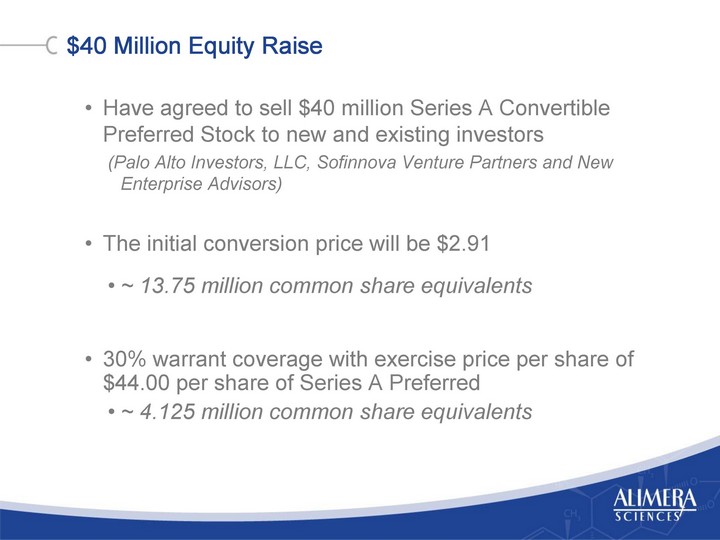

| $40 Million Equity Raise Have agreed to sell $40 million Series A Convertible Preferred Stock to new and existing investors (Palo Alto Investors, LLC, Sofinnova Venture Partners and New Enterprise Advisors) The initial conversion price will be $2.91 ~ 13.75 million common share equivalents 30% warrant coverage with exercise price per share of $44.00 per share of Series A Preferred ~ 4.125 million common share equivalents |

| Commercial Next Steps Dan Myers, Co-Founder, President and CEO |

| Commercial Activity Streamlined EU Commercial Structure Similar to US Launch Plans Alimera Management Group Based in EU Leveraging Third Party Expertise 3PL Outsourcing 100% Dedicated Contract Sales Force Ongoing Activity Communications Development Leveraging US Work Congress and Advisory Board Plans in Place for Fall Pricing and Reimbursement |

| 2012 Analyst Day Q&A Session |