Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOYOTA MOTOR CREDIT CORP | dp31628_8k.htm |

|

Toyota Business Highlights

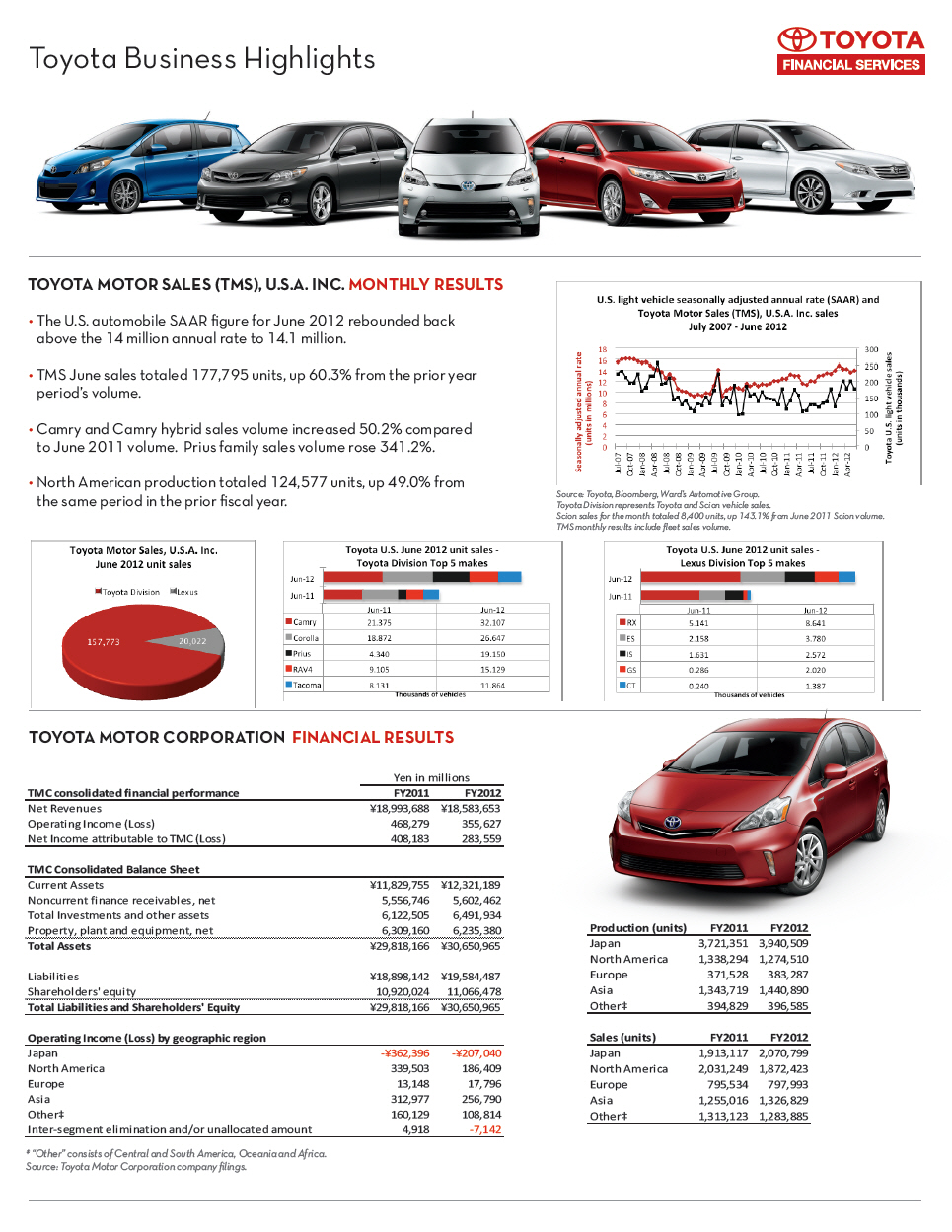

TOYOTA MOTOR SALES (TMS), U.S.A. INC. MONTHLY RESULTS

[] The U.S. automobile SAAR figure for June 2012 rebounded back above the 14

million annual rate to 14.1 million.

[] TMS June sales totaled 177,795 units, up 60.3% from the prior year period's

volume.

[] Camry and Camry hybrid sales volume increased 50.2% compared to June 2011

volume. Prius family sales volume rose 341.2% .

[] North American production totaled 124,577 units, up 49.0% from the same

period in the prior fiscal year.

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

TOYOTA MOTOR CORPORATION FINANCIAL RESULTS

Yen in millions

=================================

TMC consolidated financial performance FY2011 FY2012

=========================================================== ================ ================

Net Revenues 18,993,688 18,583,653

Operating Income (Loss) 468,279 355,627

Net Income attributable to TMC (Loss) 408,183 283,559

=========================================================== ================ ================

TMC Consolidated Balance Sheet

=========================================================== ================ ================

Current Assets 11,829,755 12,321,189

Noncurrent finance receivables, net 5,556,746 5,602,462

Total Investments and other assets 6,122,505 6,491,934

Property, plant and equipment, net 6,309,160 6,235,380

=========================================================== ================ ================

Total Assets 29,818,166 30,650,965

Liabilities 18,898,142 19,584,487

Shareholders' equity 10,920,024 11,066,478

=========================================================== ================ ================

Total Liabilities and Shareholders' Equity 29,818,166 30,650,965

=========================================================== ================ ================

Operating Income (Loss) by geographic region

=========================================================== ================ ================

Japan -362,396 -207,040

North America 339,503 186,409

Europe 13,148 17,796

Asia 312,977 256,790

Other[] 160,129 108,814

Inter-segment elimination and/or unallocated amount 4,918 -7,142

=========================================================== ================ ================

* "Other" consists of Central and South America, Oceania and Africa.

Source: Toyota Motor Corporation company filings.

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

Production (units) FY2011 FY2012

====================== ========= =========

Japan 3,721,351 3,940,509

North America 1,338,294 1,274,510

Europe 371,528 383,287

Asia 1,343,719 1,440,890

Other[] 394,829 396,585

====================== ========= =========

Sales (units) FY2011 FY2012

====================== ========= =========

Japan 1,913,117 2,070,799

North America 2,031,249 1,872,423

Europe 795,534 797,993

Asia 1,255,016 1,326,829

Other[] 1,313,123 1,283,885

====================== ========= =========

|

|

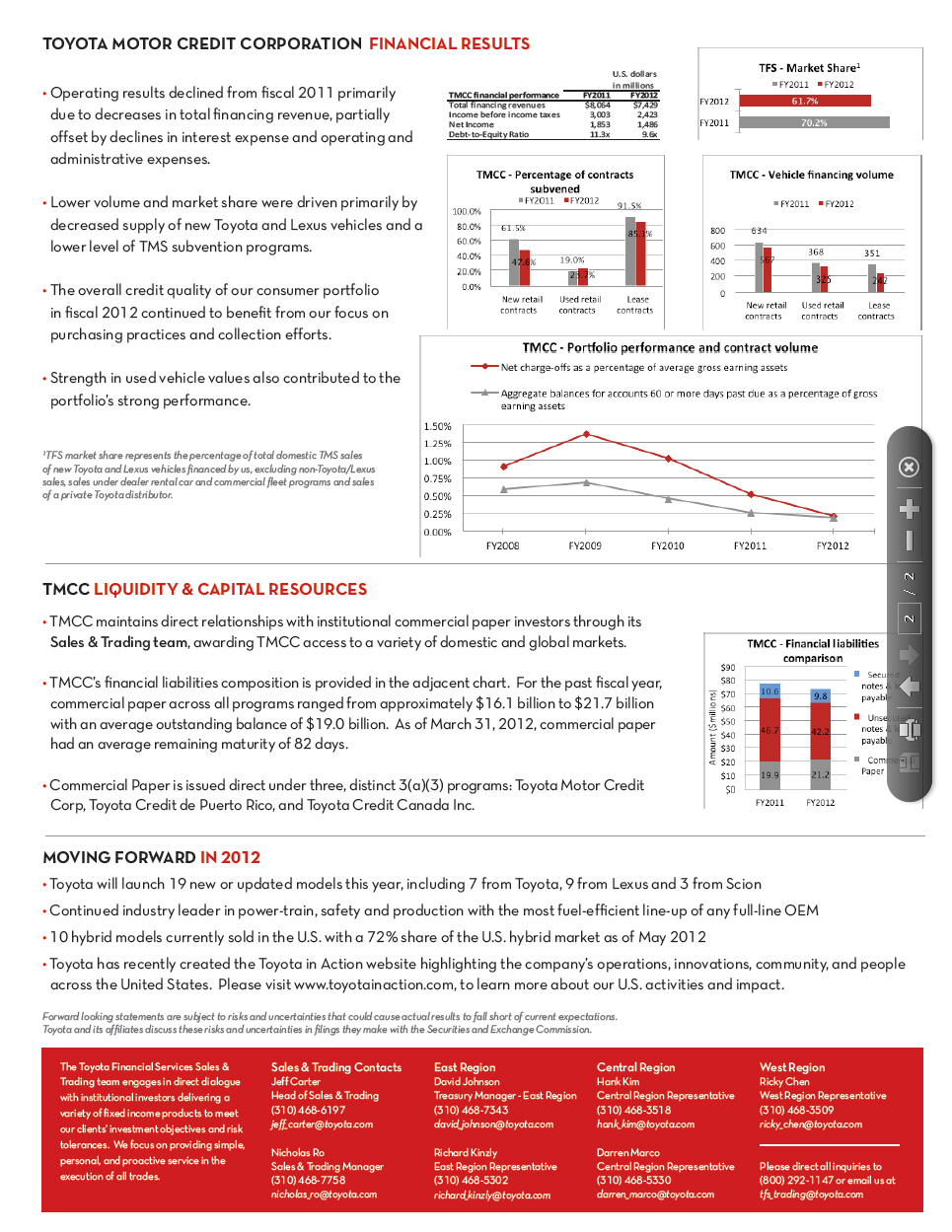

TOYOTA MOTOR CREDIT CORPORATION FINANCIAL RESULTS

[] Operating results declined from fiscal 2011 primarily due to decreases in

total financing revenue, partially offset by declines in interest expense and

operating and administrative expenses.

[] Lower volume and market share were driven primarily by decreased supply of

new Toyota and Lexus vehicles and lower level of TMS subvention programs.

[] The overall credit quality of our consumer portfolio in fiscal 2012

continued to benefit from our focus on purchasing practices and collection

efforts.

[] Strength in used vehicle values also contributed to the portfolio's strong

performance.

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

(1)TFS market share represents the percentage of total domestic TMS sales of

new Toyota and Lexus vehicles financed by us, excluding non-Toyota/Lexus sales,

sales under dealer rental car and commercial fleet programs and sales of a

private Toyota distributor.

TMCC LIQUIDITY and CAPITAL RESOURCES

[] TMCC maintains direct relationships with institutional commercial paper

investors through its Sales and Trading team, awarding TMCC access to a variety

of domestic and global markets.

[] TMCC's financial liabilities composition is provided in the adjacent chart.

For the past fiscal year, commercial paper across all programs ranged from

approximately $16.1 billion to $21.7 billion with an average outstanding

balance of $19.0 billion. As of March 31, 2012, commercial paper had an average

remaining maturity of 82 days.

[] Commercial Paper is issued direct under three, distinct 3(a)(3) programs:

Toyota Motor Credit Corp, Toyota Credit de Puerto Rico, and Toyota Credit

Canada Inc.

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

MOVING FORWARD IN 2012

[] Toyota will launch 19 new or updated models this year, including 7 from

Toyota, 9 from Lexus and 3 from Scion

[] Continued industry leader in power-train, safety and production with the

most fuel-efficient line-up of any full-line OEM

[] 10 hybrid models currently sold in the U.S. with a 72% share of the U.S.

hybrid market as of May 2012

[] Toyota has recently created the Toyota in Action website highlighting the

company's operations, innovations, community, and people across the United

States. Please visit www.toyotainaction.com, to learn more about our U.S.

activities and impact.

Forward looking statements are subject to risks and uncertainties that could

cause actual results to fall short of current expectations.

Toyota and its affiliates discuss these risks and uncertainties in filings they

make with the Securities and Exchange Commission.

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

|