Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FOREST CITY ENTERPRISES INC | d364279d8k.htm |

Investor

Update June 2012

Capability

Adaptability

Accountability

Exhibit 99.1 |

2

|

Information

Related to Forward-Looking Statements Statements made in this presentation that state

the Company’s or management's intentions, hopes, beliefs, expectations or

predictions of the future are forward- looking statements. It is important to note

that the Company's future events and actual results, financial or otherwise, could

differ materially from those projected in such forward-looking statements.

Additional information concerning factors that could cause future events or actual

results to differ materially from those in the

forward-looking statements are included in the “Risk Factors”

section of the

Company's SEC filings, including, but not limited to, the Company's Annual Report

and quarterly reports. You are cautioned not to place undue reliance on such

forward-looking statements.

Use of non-GAAP measures

We frequently use the

non-GAAP measures of funds from operations (“FFO”),

earnings before depreciation, amortization and deferred taxes (“EBDT”),

comparable net operating income (“NOI”), and measures based on the pro-rata consolidation method

(“pro-rata”) to explain operating performance and assist

investors in evaluating our business. In addition, we present a

schedule of

components to assist investors in determining the “net asset value”

(“NAV”) of the

Company, also a non-GAAP measure. For a more thorough discussion of FFO,

EBDT, NOI, pro-rata

measures, and NAV, including how we reconcile these measures to their GAAP

counterparts, please refer to the Supplemental Package furnished to the SEC on Form 8-K on June 7, 2012. Copies of our quarterly and

annual Supplemental Packages can be found on our website at www.forestcity.net,

or on the SEC’s website at www.sec.gov.

3 |

Company

Profile •

Founded in 1920 and traded publically since 1960, Cleveland based Forest City is known

nationally as a property owner, manager, and developer of some of the largest and most

prestigious real estate projects in the country. Forest City’s diverse portfolio includes

hundreds of premier properties located throughout the United States.

•

With a

focus

on

Core

Markets

–

the

New

York

City

metropolitan

area,

Boston,

Greater

Washington, D.C., Denver, Los Angeles, San Francisco, Dallas, Philadelphia and Chicago

–

we have overcome high barriers to entry and developed a unique franchise. Each of

these core markets are great urban centers with strong demographics and superior

growth potential.

4 |

Our

Mission Forest City is a leading owner, operator, and

developer of distinctive and diversified real estate

projects in select core markets, which create value

for our customers, shareholders, and communities

through place creation, sustainable practices, and a

long-term investment perspective.

We operate by developing meaningful relationships

and leveraging our entrepreneurial capabilities with

creative and talented associates who embrace our

core values.

Our Vision

To be the real estate leader and partner-of-choice in

creating distinctive places to live, work, and shop.

5 |

Our Strategic

Themes •

We will leverage our unique and proven

capability

as an owner, operator and

developer of distinctive real estate.

•

We will continue to show

adaptability

to

changing market conditions and stakeholder

needs.

•

We will commit to a high level of

accountability

to ourselves and to all of our

stakeholders to drive value creation.

6 |

Our

2012-2015 Strategic Plan Key Goals:

•

Increase shareholder value by:

Intensify

focus

on

the

,

both

markets and products

Continuing

to

strengthen

the

balance

sheet

and reduce risk

Driving

operational

excellence

through all aspects of our company

7

core |

Our Strategic

Foundation 8

Develop

unique,

differentiated real

estate that fuels

growth, creates a

“sense of place”

and

builds communities in

strong core markets

Be a value-added

owner and operator

of a diverse

portfolio of

profitable real

estate assets

Build a strong,

sustaining capital

structure

and

balance sheet that

allow us to further

create value and

profitable growth |

Our Investment

Profile: “Core-PLUS” 9

Core

Products:

•

High-quality portfolio of 220+ income-producing assets

•

Primarily apartments, retail, and office (including life science)

•

Consistent NOI growth, stable occupancy, low tenant concentration

Core

Markets:

•

Gateway cities with strong growth/demographics, barriers to entry

•

78% of assets in New York, D.C., Boston, Chicago, Dallas,

Denver, Los Angeles,

San Francisco, Philadelphia •

Selective expansion in new growth markets, including Dallas

PLUS:

•

Signature development capability to fuel future growth

•

Substantial entitlement at large, mixed-use projects in core markets

•

Expertise in public/private partnerships, urban infill, adaptive reuse

•

90-year+ track record, more than 50 years as a public company

|

Forest City

Initiates FFO 10

*Footnotes provided in Appendix Section

*

The table below will illustrate the differences between FFO and our historical reporting of

EBDT. The table will also reconcile these non-GAAP measures to net earnings,

the most comparable GAAP measure. FFO

EBDT

FFO

EBDT

Net earnings attributable to Forest City Enterprises, Inc.

22,752

$

22,752

$

46,343

$

46,343

$

Depreciation and Amortization -

Real Estate Groups

70,417

70,417

68,829

68,829

Impairment of depreciable rental properties

1,381

1,381

3,435

3,435

Gain on disposition of rental properties and partial interests in

rental properties (7,914)

(7,914)

(32,166)

(32,166)

Income tax expense (benefit) on non-operating earnings (loss)

- current and deferred

(1)

Gain on disposition of rental properties and partial interests in

rental properties 3,052

3,052

12,467

12,467

Impairment of depreciable rental properties

(536)

(536)

(1,332)

(1,332)

Straight-line rent adjustments

(4,835)

(2,224)

Impairment of Land Group projects

-

1,400

Deferred taxes on impairment of Land Group projects

(1)

-

(543)

Deferred income tax expense on operating earnings

(1)

14,492

24,950

Amortization of mortgage procurement costs -

Real Estate Groups

3,623

3,632

Preference payment

-

585

Allowance for projects under development revision

-

2,000

FFO/EBDT

89,152

$

102,432

$

97,576

$

127,376

$

FFO Per Share Data -

Quarterly Historical Trends

April 30,

January 31,

October 31,

July 31,

April 30,

2012

2012

(2)

2011

2011

2011

FFO

89,152

$

(40,714)

$

61,198

$

60,129

$

97,576

$

If-Converted Method (adjustments for

interest, net of tax): 3,769

-

3,769

1,852

1,798

FFO for per share data

92,921

$

(40,714)

$

64,967

$

61,981

$

99,374

$

Weighted average shares outstanding

- Basic

169,206,594

169,157,392

169,150,429

168,788,754

165,498,904

Weighted average shares outstanding -

Diluted

221,840,381

221,500,850

221,413,645

207,917,958

204,975,222

FFO Per Share

0.42

$

(0.24)

$

0.29

$

0.30

$

0.48

$

Three Months Ended April 30, 2012

Three Months Ended April 30, 2011

Three Months Ended

(in thousands)

(in thousands) |

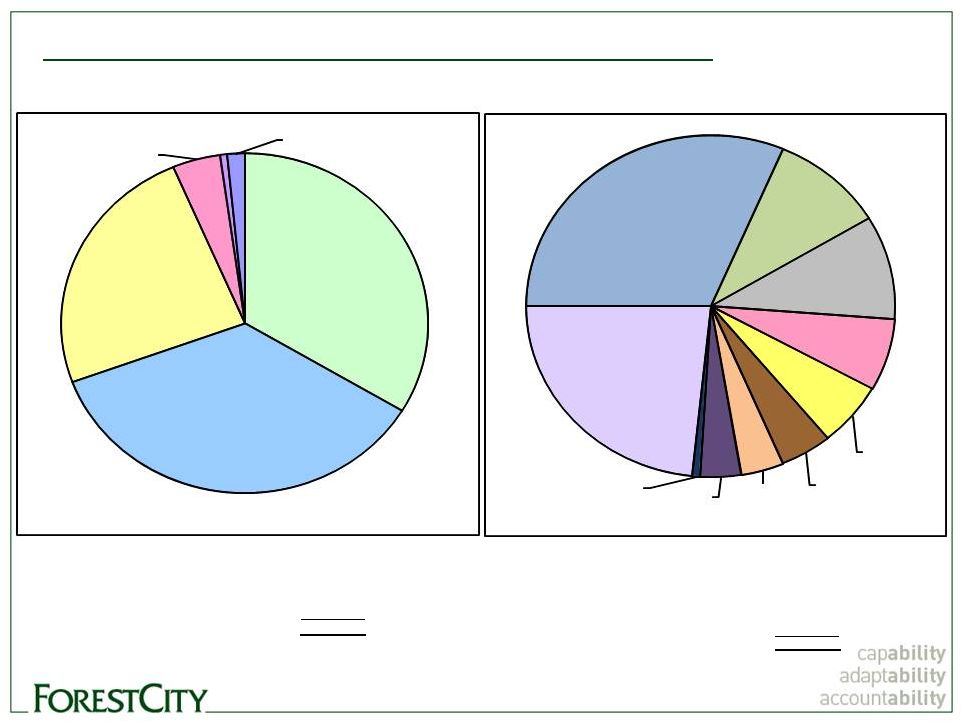

Balanced,

Diverse NOI Sources 11

1)

Includes limited-distribution subsidized senior housing.

2)

Includes write-offs of abandoned development projects, non-capitalizable development

costs, non-capitalizable marketing/promotional costs (3)

Includes Richmond, Virginia. New York

$52,785

31.4%

Los Angeles

$16,510

9.8%

Boston

$11,465

6.8%

Greater

San Francisco

$10,199

6.1%

Denver

$7,639

4.5%

Philadelphia

$6,223

3.7%

Chicago

$6,050

3.6%

Dallas

$1,171

0.7%

Non-Core

Markets

$39,258

23.4%

Greater

Washington, D.C.

(3)

$16,811

10.0%

Retail

$58,989

33.6%

Office

$62,777

35.8%

Apartments

(1)

$42,517

24.2%

Military

Housing

$7,347

4.2%

Hotels

$1,096

0.6%

Land

$2,732

1.6%

NOI by Product Type

175,458

$

NOI by Market

168,111

$

Casino Land Sale

36,484

Casino Land Sale

36,484

The Nets

(6,958)

Military Housing

7,347

Corporate Activities

(13,015)

The Nets

(6,958)

Other

(2)

(10,690)

Corporate Activities

(13,015)

Grand Total NOI

181,279

$

Other

(2)

(10,690)

Grand Total NOI

181,279

$

Net Operating Income by Product Type

Pro-Rata Consolidation

Three Months Ended April 30, 2012

Net Operating Income by Core Market

Pro-Rata Consolidation

Three Months Ended April 30, 2012

(dollars in thousands)

(dollars in thousands)

associated with Barclays Center and unallocated management and service

company overhead, net of tax credit income.

|

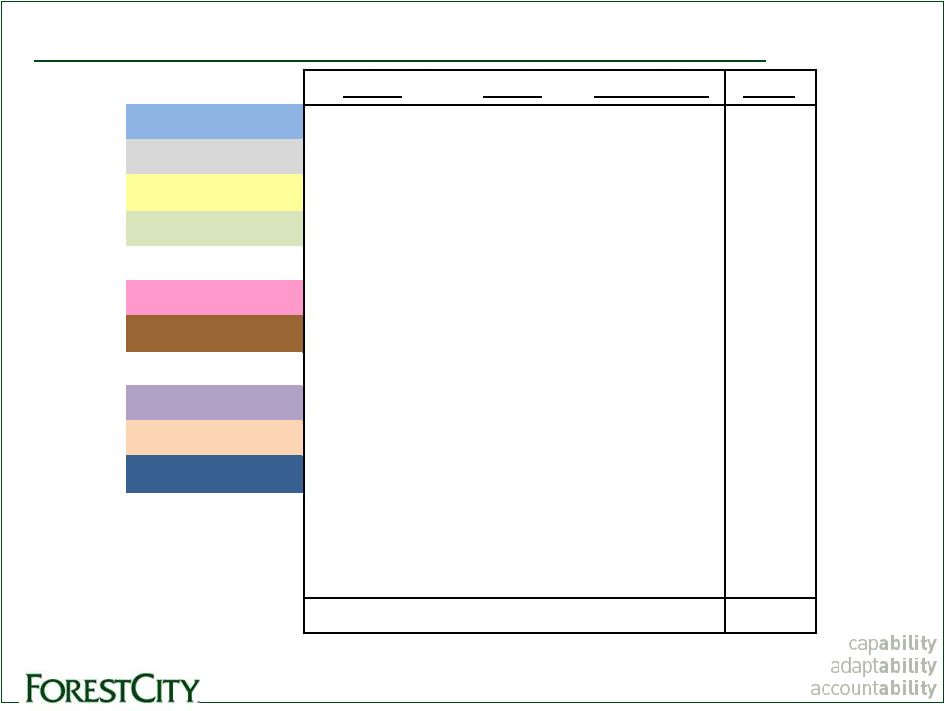

Washington DC

NOI by Market and Product Type*

12

* Excludes limited-distribution subsidized senior housing, military housing, supported

living, land, land sales, hotels, and other Three Months Ended April 30, 2012

Office

Retail

Apartments

SUM

New York

69%

21%

10%

100%

Los Angeles

0%

89%

11%

100%

San Francisco

25%

46%

29%

100%

29%

43%

28%

100%

Cleveland

38%

12%

50%

100%

Boston

77%

0%

23%

100%

Denver

7%

66%

27%

100%

Pittsburgh

26%

69%

5%

100%

Chicago

25%

22%

53%

100%

Philadelphia

20%

23%

57%

100%

Dallas

0%

0%

100%

100%

Florida

0%

70%

30%

100%

Las Vegas

0%

100%

0%

100%

Other

6%

58%

36%

100%

39%

37%

24%

100% |

NOI by Product

Type and Market* 13

Three Months Ended April 30, 2012

* Excludes limited-distribution subsidized senior housing, military housing, supported

living, land, land sales, hotels, and other Office

Retail

Apartments

New York

57%

19%

13%

Los Angeles

0%

24%

5%

San Francisco

4%

8%

8%

Washington DC

8%

12%

13%

Cleveland

9%

3%

21%

Boston

14%

0%

7%

Denver

0%

4%

3%

Pittsburgh

2%

7%

1%

Chicago

2%

2%

8%

Philadelphia

2%

2%

9%

Dallas

0%

0%

3%

Florida

0%

5%

3%

Las Vegas

0%

6%

0%

Other

2%

8%

6%

100%

100%

100% |

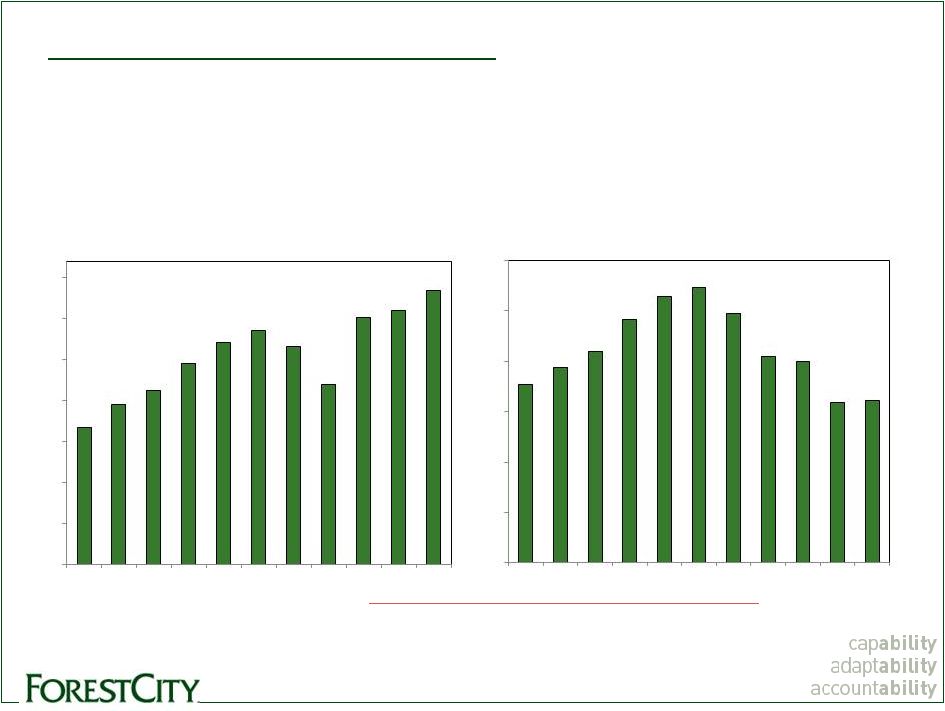

Comparable

Occupancy

%

(1)

Comparable

NOI

Growth –

Year-over-Year,

Pro

Rata

%

Source: Supplemental Packages for the three months ended April 30, 2012 and years ended

January 31, 2012, 2011, 2010, and 2009. Historical

Operations

(1)

Represents comparable occupancy for Retail and Office as of the applicable date and comparable

average occupancy year-to-date for Residential. 14

“We continue to be encouraged by the strong performance of our rental

properties

portfolio

and

by

real

estate

fundamentals

in

our

core

products

and

core markets. We are confident in our ability to drive value creation, from

within the mature portfolio, by stabilizing newly opened projects and by

activating existing entitlement, particularly at our large, mixed-use projects in

core markets.”

-

David LaRue, President and CEO

90

90 90

91

91 91

91

91

88

92

92

92

94

95

95

86

88

90

92

94

96

YE 1/31/09

YE 1/31/10

YE 1/31/11

YE 1/31/12

4/30/2012

Retail

Office

Residential

0.3

(3.9)

2.2

2.6

3.0

1.2

5.4

2.1

(2.6)

3.2

1.4

(3.9)

4.3

7.3

11.0

(6.0)

(4.0)

(2.0)

-

2.0

4.0

6.0

8.0

10.0

12.0

YE 1/31/09

YE 1/31/10

YE 1/31/11

YE 1/31/12

YTD 4/30/12

Retail

Office

Residential |

EBDT

per

Share

($

per

share)

(2)

Historical Operations

EBDT

($

in

millions)

(1)

(1)

(2)

“We

achieved

record

total

EBDT

in

2011,

propelled

by

the

strength

of

our

portfolio,

particularly

our

residential

and

retail

businesses,

where

our

comp

portfolios

outperformed

industry

averages

for

the

year.

Our

results

also

benefited

from

major

transactions

such

as

our

sale

of

land

and

air

rights to the Cleveland casino developer. Overall, 2011 was a year of solid progress and

positive momentum for Forest City”

–

David LaRue, President and CEO

15

Refer

to

the

Investors

section

of

Forest

City’s

web

site

(http://ir.forestcity.net/phoenix.zhtml?c=88464&p=IROL-reportsother )

for

Supplemental Packages for the periods referenced above, which provide reconciliation of EBDT

to its nearest GAAP equivalent. 168.0

194.4

212.4

245.0

270.5

285.0

265.7

218.9

301.1

309.9

334.4

-

50

100

150

200

250

300

350

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

1.77

1.94

2.10

2.41

2.64

2.73

2.47

2.05

2.00

1.59

1.61

-

0.50

1.00

1.50

2.00

2.50

3.00

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Per–share data reflects new Class A common shares and the “if-converted”

effect of convertible debt and convertible preferred stock issued in 2009 and

2010. |

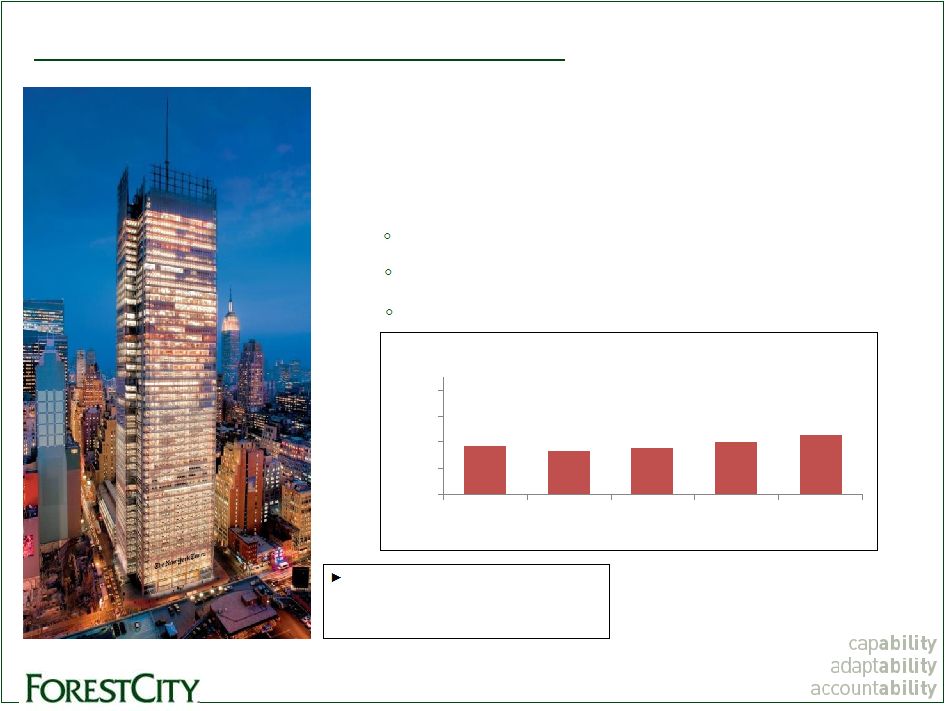

Office

Portfolio Overview •

49 properties, 13.5M s.f. in conventional and

life science office

•

Concentrations in New York and Boston

•

Key properties:

New York Times, Manhattan (left)

University Park at MIT, Cambridge

MetroTech Center, Brooklyn

The New York Times is a 52 story office

tower located in the Times Square

submarket and was designed by Pritzker

Prize winning architect Renzo Piano.

16

90.7%

90.3%

90.5%

91.0%

91.5%

87.0%

89.0%

91.0%

93.0%

95.0%

April 30,

2011

July 31,

2011

October 31,

2011

January 31,

2012

April 30,

2012

Office Comparable Occupancy Recap

For the three months ended |

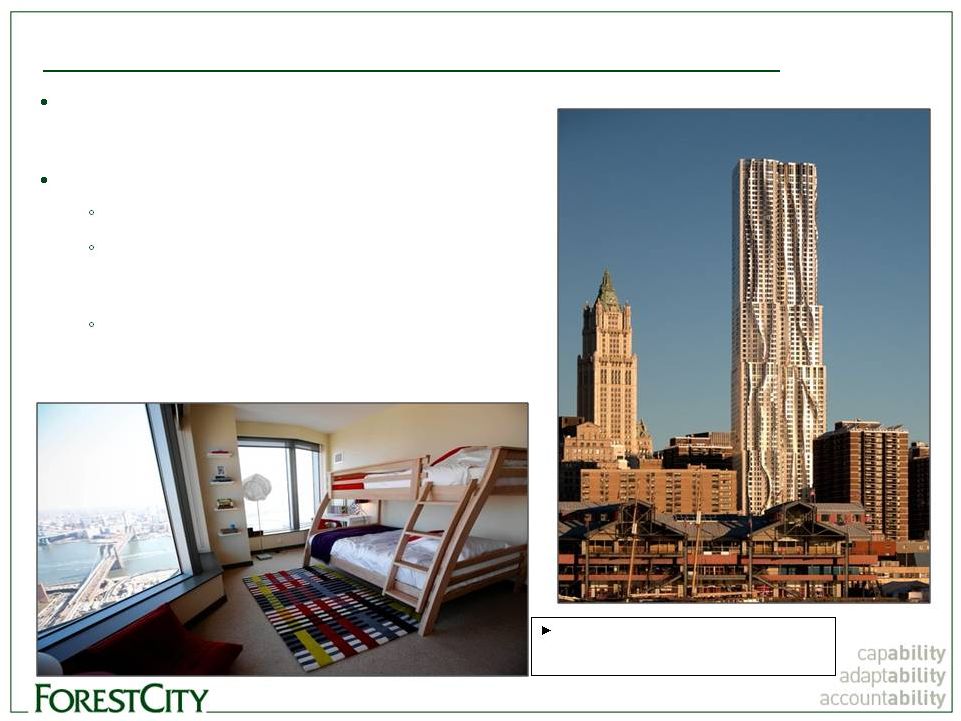

Apartment

Portfolio Overview Metro

417,

opened

in

2005

was

one

of

the

largest

adaptive –

reuse projects in LA history. There are 277 units in the 500k s.f.

building that was originally built in the 1920s as the Subway

Terminal for the city’s Red Car trolleys. The building is on both

the state and national lists of historical places.

17

4.8%

3.1%

12.0%

11.9%

11.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

April 30,

2011

July 31,

2011

October 31,

2011

January 31,

2012

April 30,

2012

Quarterly Residential Comparable NOI Increase

For three months ended:

8 Spruce Street, Manhattan

DKLB BKLN, Brooklyn

River Lofts at Tobacco Row, Richmond

Metro 417, Los Angeles (shown)

123 apartment communities, 24,416 total units at pro-rata

Key properties: |

Portfolio

Highlights – Retail

•

45

centers, 25.8M total s.f.,

15.9M GLA

•

Enclosed regional malls,

open-air lifestyle centers, big-

box/power centers, specialty

centers

•

Key properties:

18

(1) All sales data is derived from schedules provided by our

tenants and is not subject to the same internal control and

verification procedures that are applied to the other data in

the Company's supplemental package. In addition, the data is

presented on a one-month lag to be consistent with the

calendar year end of our tenants.

Short

Pump

Town

Center

is

a

two-level

1.3M

s.f.

open-air

mall

located

in

Richmond,

Virginia,

anchored

by

Nordstrom,

Macy’s

Dillard’s,

and

Dick’s

Sporting

Goods.

FCE Regional Mall Sales per Square Foot

(1)

42nd Street, New York

San Francisco Centre/

The Emporium

Short Pump Town Center,

Richmond (Shown)

Victoria Gardens,

Rancho Cucamonga, CA

$411

$417

$434

$443

$456

$370

$390

$410

$430

$450

April 30,

2011

July 31,

2011

October 31,

2011

January 31,

2012

April 30,

2012

Rolling 12-month basis for the periods presented

|

Forest City

is proud to participate in the privatization of rental residential communities

for military families.

Our portfolio includes more than 14,000 military

family homes located in eight states. These

include the Southern Group Air Force bases, the

U.S. Air Force Academy, and Naval installations

in Hawaii, Washington, Illinois, Indiana and

Tennessee.

Military

Housing

NOI

(In

Thousands)

Military Housing

19

$-

$5,000

$10,000

$15,000

$20,000

$25,000

2005

2006

2007

2008

2009

2010

2011

Property Management

$1,776

$4,092

$3,379

$6,834

$9,881

$9,872

$10,967

Asset Management

$316

$559

$1,141

$2,272

$2,192

$2,993

$3,309

Construction

$1,149

$3,344

$9,033

$12,345

$8,783

$5,634

$4,158

Development

$3,334

$8,983

$16,624

$23,541

$11,169

$5,883

$5,615

Total

$6,573

$16,978

$30,177

$44,992

$32,025

$24,381

$24,049 |

Recently

Opened: 8 Spruce Street Located in

New York City (Lower

Manhattan); Frank Gehry-designed

apartment tower.

76 stories, 899 market-rate units

700+ executed leases or 79% of total

Lower floors include a K-8 public school

and an ambulatory care center for the

New York Downtown Hospital

Over 871 units are open, remaining

units on upper floors are still under

construction

View from an upper level model unit, featured

in the Wall Street Journal on March 21, 2012

(Views from the Market Top

by Laura Kusisto)

20 |

Recently

Opened: Westchester’s Ridge Hill Located in Yonkers, NY 1.3M

s.f. mixed- use retail project opening in phases

(currently 60% leased)

LEGOLAND is expected to begin

construction in July, 2012, with an

anticipated opening in Spring of 2013

Some tenants currently open:

21 |

•

Foundry Lofts,

the

first

residential

building

at

The

Yards

mixed-

use project in the Capitol Riverfront District of Washington, D.C.

170 loft-style apartments in an adaptive–reuse of a former

Navy Yard industrial building

Initial move-ins began in December, 2011 with lease

commitments for 97% of the units already

Recently Opened: Foundry Lofts

22 |

Under

Construction: Barclays Center •

Brooklyn, New

York

State-of-the-art sports

and entertainment

venue

70% of forecasted

contractually obligated

revenues currently under

contract

Future home of the NBA Nets

First phase of the Atlantic

Yards mixed-use project,

which is expected to feature

more than 6,400 housing units,

approximately 250K s.f. of

retail, and more than 8 acres

of open space

Set to open September, 2012

23 |

Enhanced

Disclosure: Net Asset Value Components 24

*Footnotes provided in Appendix Section

*

(Dollars in millions at pro-rata)

Q1 2012

NOI

(1)

Annualized

NOI

(2)

Net Stabilized

Adjustments

(3)

Annualized

Stabilized NOI

Nonrecourse

Debt

(4)

A

B

=A + B

Commercial Real Estate

Retail

59.0

$

236.0

$

4.9

$

240.9

$

(2,641.9)

$

Office

62.8

251.2

0.5

251.7

(2,297.5)

Other

(6.3)

(25.2)

9.7

(15.5)

Total Commercial Real Estate

115.5

$

462.0

$

15.1

$

477.1

$

(4,939.4)

$

Residential Real Estate

Apartments

38.1

$

152.4

$

(2.8)

$

149.6

$

(1,975.5)

$

Subsidized Senior Housing

(5)

4.4

17.6

-

17.6

Military Housing

7.3

29.2

(14.2)

15.0

Other

(3.3)

(13.2)

-

(13.2)

Total Residential Real Estate

46.5

$

186.0

$

(17.0)

$

169.0

$

(1,975.5)

$

Total Rental Properties

162.0

$

648.0

$

(1.9)

$

646.1

$

(6,914.9)

$

Development Pipeline Debt Adj. NET

(6)

454.8

Adjusted Total Rental Properties

162.0

$

648.0

$

(1.9)

$

646.1

$

(6,460.1)

$

Book Value

Debt

Westchester's Ridge Hill

(Adjusted for amounts included in CRP)

(6)

346.2

$

(193.7)

$

8 Spruce Street

(Adjusted for amounts included in CRP)

(6)

427.4

(261.1)

Total development pipeline adjustments

773.6

(454.8)

Projects under construction

(4)

899.6

(434.3)

Adjusted projects under construction

1,673.2

$

(889.1)

$

Projects under development

(4)

939.3

$

(181.9)

$

Land held for development and sale

(4)

97.6

$

(26.6)

$

Book Value

(4)

Nonrecourse

Debt

(4)

Cash and equivalents

336.7

$

Restricted cash and escrowed funds

429.0

$

Notes and accounts receivable, net

(7)

386.9

$

Net investments and advances to unconsolidated

entities 212.6

$

Prepaid expenses and other deferred costs, net

215.2

$

Land held for divestiture

88.5

$

(28.6)

$

Book Value

(4)

Bank revolving credit facility

-

$

Senior and subordinated

debt (1,038.6)

$

Less: convertible debt

599.2

$

Construction payables

(155.1)

$

Operating accounts payable and accrued expenses

(8)

(706.4)

$

Number

of

shares

for

the

three

months

ended

April

30,

2012 (In millions)

221.8

Net Asset Value Components -

April 30, 2012

Completed Rental Properties ("CRP")

Weighted

Average

Shares

Outstanding

-

Diluted

Nonrecourse

Recourse Debt and other Liabilities

Development Pipeline

Other Tangible Assets |

Appendix

Recourse Debt Maturities

26

Asset Sales

27

Lease Expirations

28

Pipeline

30

The Yards –

Project Site Plan

36

Atlantic Yards –

Project Site Plan

37

Sustainability

38

Net Asset Value Components Footnotes

39

Funds From Operations Footnotes

40 |

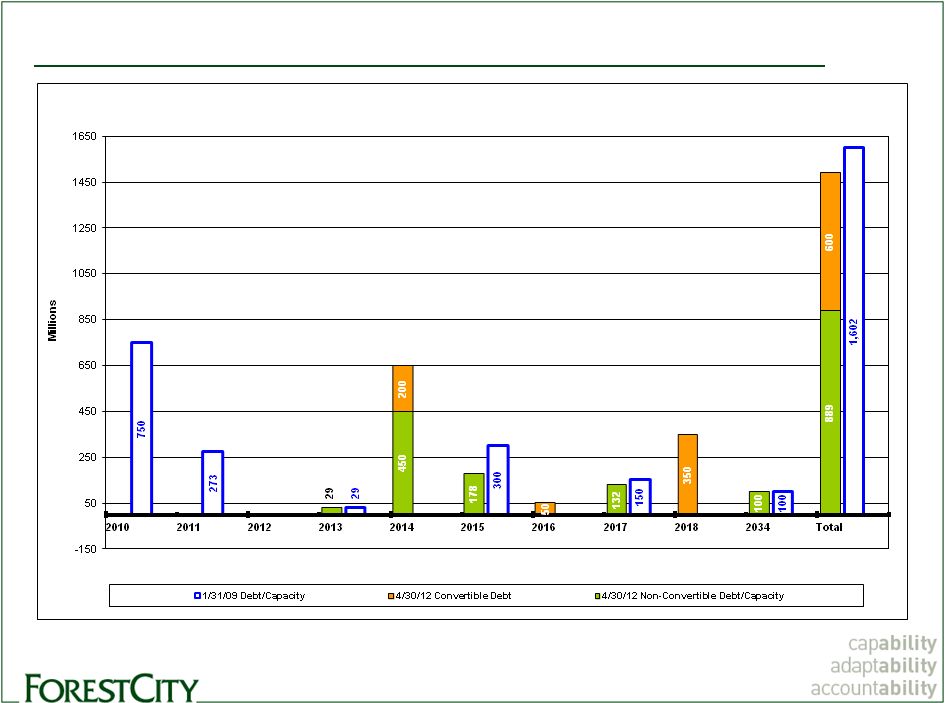

Addressing

Recourse Debt Maturities 26

Change in Recourse Debt Capacity -

4/30/2012 Compared to 1/31/09 |

Asset

Sales 27

($ in thousands at pro-rata) Cash

Net

Annualized

Cap

EBDT Year

EBDT/

Count

Proceeds

Sales Price

NOI

Rate

Prior to Sale

Proceeds

Leverage

Total (11 Yr + YTD 2012: 2001-2012)

97

1,304,861

3,138,922

207,701

6.6%

97,702

7.5%

58%

Total (10 Yr: 2002-2011)

88

1,207,394

2,928,026

191,337

6.5%

90,266

7.5%

59%

Total (7 Yr: 2005-2011)

70

1,080,576

2,573,017

163,272

6.3%

76,309

7.1%

58%

Total (5 Yr: 2007-2011)

58

720,777

1,860,871

122,134

6.6%

60,632

8.4%

61% |

Office Lease

Expirations (as of 4/30/2012) 28

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

2012

2013

2014

2015

2016

Office Lease Expirations

Percentage of Net Base Rent Expiring

As of April

30,

2012

(1)

GLA = Gross Leasable Area

(2)

Net base rent expiring is an operating statistic and is not comparable to rental revenue, a

GAAP financial measure. The primary differences arise because net base rent is

determined using the tenant’s contractual rental agreements at our ownership share of the

base rental income from expiring leases as determined within the rent agreement and it

does not include adjustments such as the impact of straight-line rent, amortization of intangible assets related to in-place leases, above and below

market leases, and contingent rental payments (which are not reasonably estimable).

(3)

Square feet of expiring leases and average base rent per square feet are operating statistics

that represent 100% of the square footage and base rental income per square foot from expiring leases.

NET

EXPIRATION

BASE RENT

YEAR

EXPIRING

(2)

2012

82

629,105

5.54 %

$ 18,223,579

6.02 %

$ 35.37

2013

99

1,203,425

10.61

25,976,786

8.58

22.77

2014

80

862,748

7.60

17,803,428

5.88

33.02

2015

53

507,152

4.47

9,539,205

3.15

21.98

2016

65

1,003,898

8.85

23,101,556

7.63

29.77

EXPIRING

OF EXPIRING

OF TOTAL

OF TOTAL

SQUARE FEET

LEASES

LEASES

(3)

LEASED GLA

(1)

BASE RENT

EXPIRING

(3)

AVERAGE

BASE

NUMBER OF

SQUARE FEET

PERCENTAGE

PERCENTAGE

RENT PER |

Retail Lease

Expirations (as of 4/30/2012) 29

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

2012

2013

2014

2015

2016

Retail Lease Expirations

Percentage of Net Base Rent Expiring

As of April 30, 2012

NET

EXPIRATION

BASE RENT

YEAR

EXPIRING

(2)

2012

212

634,085

5.08

%

$ 12,995,333

5.17

%

$ 26.27

2013

350

1,223,594

9.80

26,708,040

10.63

27.30

2014

295

1,077,675

8.63

21,067,186

8.38

27.67

2015

218

866,319

6.93

19,331,135

7.69

29.84

2016

265

1,404,114

11.24

31,550,161

12.55

36.38

EXPIRING

OF EXPIRING

OF TOTAL

OF TOTAL

SQUARE FEET

LEASES

LEASES

(3)

LEASED GLA

(1)

BASE RENT

EXPIRING

(3)

AVERAGE

BASE

NUMBER OF

SQUARE FEET

PERCENTAGE

PERCENTAGE

RENT PER

(1)

GLA = Gross Leasable Area

(2)

Net base rent expiring is an operating statistic and is not comparable to rental revenue, a

GAAP financial measure. The primary differences arise because net base rent is

determined using the tenant’s contractual rental agreements at our ownership share of the base rental income from expiring leases as determined within

the rent agreement and it does not include adjustments such as the impact of straight-line

rent, amortization of intangible assets related to in-place leases, above and below

market leases, and contingent rental payments (which are not reasonably estimable).

(3)

Square feet of expiring leases and average base rent per square feet are operating statistics

that represent 100% of the square footage and base rental income per square foot

from expiring leases. |

Pipeline:

Projects Opened 30

Note:

See

pages

34-

35

in

the

Supplemental

Package

for

the

quarter

ended

April

30,

2012

for

footnotes.

Designed to meet LEED

certifications, Las Vegas City

Hall,

was

designed

by

Forest

City

Real

Estate

Services

on

a fee basis. Thirty-three

“solar trees”

are located in

the buildings front plaza.

Cost at FCE

Cost at Full

Total Cost

Pro-Rata Share

Sq. ft./

Date

Consolidation

at 100%

(Non-GAAP) (c)

No. of

Property

Location

Dev (D)

Opened

(GAAP) (b)

(2)

(1) X (2)

Units

2012

Residential:

The Aster Town Center (d) Denver, CO

D

Q1-12/Q2-12

90.0%

90.0%

$

10.9

10.9

$

9.8

$

85

42%

Fee Development Project

Las Vegas City Hall

Las Vegas, NV

D

Q1-12

-

(e)

-

(e)

$

0.0

146.2

$

0.0

$

270,000

Openings as of April

30,

2012

Lease

Ownership % (a)

(1)

Commitment %

(in millions)

Pro-Rata

FCE Legal

FCE % (a)

(f) |

Pipeline:

Projects Under Construction 31

Note:

See

pages

34-

35

in

the

Supplemental

Package

for

the

quarter

ended

April

30,

2012

for

footnotes.

Cost at FCE

Total Cost

Pro-Rata Share

Anticipated

at 100%

(Non-GAAP) (c)

Sq. ft./

Property

Location

Opening

(2)

(1) X (2)

No. of Units

Retail Centers:

(f)

The

Yards

-

Boilermaker

Shops

Washington, D.C.

Q3-12

100.0%

100.0%

$

19.6

19.6

$

19.6

$

40,000

40,000

74%

Office:

Johns Hopkins Parking Garage

Baltimore, MD

Q3-12

85.0%

100.0%

$

29.9

29.9

$

29.9

$

492,000

Residential:

Botanica Eastbridge

Denver, CO

Q2-12

90.0%

90.0%

$

15.4

15.4

$

13.9

$

118

Continental Building

Dallas, TX

Q1-13

100.0%

100.0%

54.6

54.6

54.6

203

$

70.0

70.0

$

68.5

$

321

Arena:

Barclays Center

Brooklyn, NY

Q3-12

34.0%

34.0%

$

934.3

934.3

$

317.7

$

670,000

18,000 seats

(n)

70%

(o)

Total Under Construction (p)

$

1,053.8

1,053.8

$

435.7

$

Fee Development Project

Dept. of Health & Mental Hygiene

Baltimore, MD

Q2-14

-

(e)

-

(e)

$

0.0

135.0

$

0.0

$

234,000

Pro-Rata

Cost at Full

Gross

FCE Legal

FCE % (a)

Consolidation

Leasable

(in millions)

Projects Under Construction

as of April

30,

2012

Lease

Ownership % (a)

(1)

(GAAP) (b)

Area

Commitment % |

Pipeline:

Equity Requirements 32

For Projects Under Construction (a)

as of April 30, 2012

Less

Plus

Unconsolidated

Full

Less

Unconsolidated

Pro-Rata

Investments

Consolidation

Noncontrolling

Investments

Consolidation

100%

at 100%

(GAAP)

(b)

Interest

at Pro-Rata

(Non-GAAP)

(c)

Total Cost Under Construction

1,053.8

$

-

$

1,053.8

$

618.1

$

-

$

435.7

$

Total Loan Draws

and Other Sources at Completion (d)

638.5

-

638.5

389.8

-

248.7

Net Equity at Completion

415.3

-

415.3

228.3

-

187.0

Net Costs Incurred to Date

762.3

-

762.3

450.7

-

311.6

Loan Draws and Other Sources to Date

380.9

-

380.9

228.4

-

152.5

Net Equity to Date

381.4

-

381.4

222.3

-

159.1

% of Total Equity

92%

92%

85%

Remaining Costs

291.5

-

291.5

167.4

-

124.1

Remaining Loan Draws and Other Sources

257.6

-

257.6

161.4

-

96.2

Remaining Equity

33.9

$

-

$

33.9

$

6.0

$

-

$

27.9

$

% of Total Equity

8%

8%

15%

(dollars in millions)

(a) This schedule includes only the five projects under construction

listed on the previous page. This does not include costs associated with phased-in units, operating property renovations and military housing

(b) Amounts are presented on the full consolidation method of

accounting, a GAAP measure. Under full consolidation, costs are reported as consolidated at 100 percent if we are deemed to have control or to

be the primary beneficiary of our investments in the variable interest

entity ("VIE"). Company determines its pro-rata share

by multiplying its pro-rata ownership by the total cost of the applicable property.

(c) Cost at pro-rata share represents Forest City's share of cost,

based on the Company's pro-rata ownership of each property (a non-GAAP measure). Under the pro-rata consolidation method of accounting the

(d) "Other Sources" includes estimates of third party subsidies

and tax credit proceeds. The timing and the amounts may differ from our estimates. |

Projects

Opened or Acquired: Prior Two Years 33

Note:

See

pages

34-

35

in

the

Supplemental

Package

for

the

quarter

ended

April

30,

2012

for

footnotes.

Cost at FCE

Cost at Full

Total Cost

Pro-Rata Share

Sq. ft./

Date

Consolidation

at 100%

(Non-GAAP) (c)

No. of

Property

Location

Dev (D)

Opened

(GAAP) (b)

(2)

(1) X (2)

Units

Prior Two Years Openings as of April 30, 2012

Retail Centers:

(f)

Westchester's Ridge Hill (i)

Yonkers, NY

D

Q2-11/12

70.0%

100.0%

$

868.2

868.2

$

868.2

$

1,336,000

1,336,000

(h)

60%/68%

Village at Gulfstream Park (g) (k)

Hallandale Beach, FL

D

Q1-10

50.0%

50.0%

0.0

140.2

70.1

511,000

511,000

78%

East River Plaza (g)

Manhattan, NY

D

Q4-09/Q2-10

35.0%

50.0%

0.0

390.6

195.3

527,000

527,000

94%

$

868.2

1,399.0

$

1,133.6

$

2,374,000

2,374,000

Office:

Waterfront Station

-

East 4th & West 4th Bldgs (Sold Q2-11) (l)

Washington, D.C.

D

Q1-10

45.0%

45.0%

$

245.9

245.9

$

110.7

$

631,000

99%

Residential

8 Spruce Street (g) (j)

Manhattan, NY

D

Q1-11/12

35.7%

51.0%

$

0.0

875.7

$

446.6

$

899

79%

Foundry Lofts

Washington, D.C.

D

Q4-11

100.0%

100.0%

57.5

57.5

57.5

170

97%

Presidio Landmark

San Francisco, CA

D

Q3-10

100.0%

100.0%

96.6

96.6

96.6

161

98%

$

154.1

1,029.8

$

600.7

$

1,230

Total Prior Two Years Openings (m)

$

1,268.2

2,674.7

$

1,845.0

$

Recap of Total Prior Two Years Openings

Total 2011

$

925.7

1,801.4

$

1,372.3

$

Total 2010

342.5

873.3

472.7

Total Prior Two Years Openings (m)

$

1,268.2

2,674.7

$

1,845.0

$

Pro-Rata

Gross

FCE Legal

FCE % (a)

Leasable

Lease

Ownership % (a)

(1)

Area

Commitment %

(f) |

Projects Under

Development 34

as of April 30, 2012

Below is a summary of our active large scale development projects, which

have yet to commence construction, often referred to as our

"shadow pipeline" which are crucial to our long-term

growth. While we cannot make any assurances on the timing or delivery of these projects, our track record speaks to our ability to bring large,

complex projects to fruition when there is demand and available

construction financing. The projects listed below represent pro-rata costs of $801.8 million

($1,005.0 million at full consolidation) of Projects Under Development

("PUD") on our balance sheet and pro-rata mortgage debt of $166.2 million ($222.0 million at full consolidation).

1)

Atlantic

Yards

-

Brooklyn,

NY

2)

LiveWork

Las

Vegas

-

Las

Vegas,

NV

3) The Yards -

Washington, D.C.

4)

Colorado

Science

+

Technology

Park

at

Fitzsimons

-

Aurora,

CO

5)

The

Science

+

Technology

Park

at

Johns

Hopkins

-

Baltimore,

MD

6) Waterfront Station -

Washington, D.C.

7) 300 Massachusetts Avenue -

Cambridge, MA

Located

in

the

science

and

technology

hub

of

Cambridge,

MA,

the

300

Massachusetts

Avenue

block

represents

an

expansion

of

University

Park

@

MIT.

In

a

50/50

partnership

with

MIT,

Forest

City

is

presently

focused

on

a

project

that

reflects

a

development

program

of

approximately

260,000

square

feet

of

lab

and

office

space.

Potential

redevelopment

of

the

entire

block

is

possible with the acquisition of adjacent parcels in future phases, and

would result in an approximately 400,000 square foot project.

Atlantic Yards is adjacent to the state-of-the-art arena,

Barclays Center, which was designed by the award-winning firms Ellerbe Becket and SHoP Architects and is currently under

construction. Atlantic Yards is expected to feature more than

6,400 units of housing, including over 2,200 affordable units, approximately 250,000 square feet of retail space, and more than 8

acres of landscaped open space.

LiveWork Las Vegas is a mixed-use project on a 13.5 acre parcel in

downtown Las Vegas. At full build-out, the project will have the new 260,000 square-foot City Hall and is also expected

to include up to 1 million square feet of office space and

approximately 300,000 square feet of retail. The City Hall is owned by the city of Las Vegas, which held its dedication ceremony on

March 5, 2012.

The 184 acre Colorado Science + Technology Park at Fitzsimons is

becoming a hub for the biotechnology industry in the Rocky Mountain

region. Anchored by the University of Colorado at Denver Health

Science Center, the University of Colorado Hospital and The Denver Children’s Hospital, the park will offer cost-effective lease rates, build-to-suit office and research sites, and

flexible lab and office layouts in a cutting-edge research park.

The park is also adjacent to Forest City’s 4,700 acre Stapleton mixed-used development.

Located

in

Southwest

Washington,

D.C.,

Waterfront

Station

is

adjacent

to

the

Waterfront/Southeastern

University

MetroRail

station.

Waterfront

Station

is

expected

to

include

660,000

square

feet of office space, an estimated 400 residential units and 40,000

square feet of stores and restaurants. The 31 acre Science +

Technology Park at Johns Hopkins is a new center for collaborative research directly adjacent to the world-renowned Johns Hopkins medical and research complex.

Initial plans call for 1.1 million square feet in five buildings, with

future phases that could support additional expansion. In 2008,

the Company opened the first of those buildings, 855 North Wolfe

Street, a 279,000 square-foot office building anchored by the Johns Hopkins School of Medicine’s Institute for Basic Biomedical Sciences.

Construction of a 492,000 square-foot

parking garage at 901 N. Washington Street is currently underway

and will provide approximately 1,450 parking spaces for Johns Hopkins

and the active buildings at the Science + Technology Park when it

is completed in Q3-12. Construction of a second commercial

building totaling 234,000 square feet commenced in January 2012.

The new building is being developed on a fee

basis and will be fully leased to the Department of Health & Mental

Hygiene (DHMH) when it is expected to open in Q2-14. The

Yards is a 42 acre mixed-use project, located in the neighborhood of the Washington Nationals baseball park in the Capitol Riverfront District. The full

project is expected to include up to

2,700 residential units, 1.8 million square feet of office space, and

300,000 square feet of retail and dining space. The Yards

features a 5.5 acre publicly funded public park that is a gathering

place and recreational focus for the community. The first

residential building, Foundry Lofts, opened in November 2011 and includes a Potbelly Sandwich restaurant which opened Q1-12.

Kruba Thai & Sushi restaurant is expected to open Q2-12.

|

Military

Housing 35

as of April 30, 2012

Below is a summary of our Military Housing development projects. The

Company provides development, construction and management services

for these projects and receives agreed upon fees for these

services. The following phases still have a percentage of units opened and under construction:

Anticipated

FCE

Cost at Full

Total Cost

No.

Property

Location

Opening

Pro-Rata %

Consolidation

at 100%

of Units

Military Housing Under Construction

Hawaii Phase IV

Kaneohe, HI

2007-2014

*

476.6

$

1,141

Air Force – Southern Group:

Keesler Air Force Base

Biloxi, MS

2011-2012

0.0%

0.0

5.0

1,188

Joint Base Charleston

Charleston, SC

2011-2013

0.0%

0.0

72.0

345

Arnold Air Force Base

Tullahoma, TN

2011-2013

0.0%

0.0

10.1

22

Shaw Air Force Base

Sumter, SC

2011-2015

0.0%

0.0

156.5

630

Subtotal Air Force – Southern Group

$ 0.0

243.6

$

2,185

Total Under Construction

$ 0.0

720.2

$

3,326

* The Company's share of residual cash flow ranges from 0-20%

during the life cycle of the project. (in millions)

Summary of Military Housing Net Operating Income (14,104 end-state

units) Development fees related to our military housing projects

are earned based on a contractual percentage of the actual development costs incurred. We also recognize

additional development incentive fees upon successful completion of

certain criteria, such as incentives to realize development cost savings, encourage small and local

business participation, comply with specified safety standards and

other project management incentives as specified in the development agreements. NOI from

development and development incentive fees was $2,362,000 for the three

months ended April 30, 2012 and $1,137,000 for the three months ended April 30, 2011.

Construction management fees are earned based on a contractual

percentage of the actual construction costs incurred. We also recognize certain construction incentive fees

based upon successful completion of certain criteria as set forth in

the construction contracts. NOI from construction and incentive fees was $433,000 for the three months

ended April 30, 2012 and $1,180,000 for the three months ended April

30, 2011. Property management and asset management fees are earned based on a

contractual percentage of the annual net rental income and annual operating income, respectively,

that is generated by the military housing privatization projects as

defined in the agreements. We also recognize certain property management incentive fees based upon

successful completion of certain criteria as set forth in the property

management agreements. Property management, management incentive and asset management fees

generated NOI of $3,547,000 for the three months ended April 30, 2012

and $3,229,000 for the three months ended April 30, 2011. |

Riverfront

Park (5.5 Acres) Completed Fall 2010

Foundry Lofts Apts.

Completed November 2011

Boilermaker Shops

Retail/Office

Opening Q3-2012

The Yards –Site Plan

In total, a 42-acre mixed-use project in the Neighborhood of the Washington

Nationals baseball park in the Capitol Riverfront District of Washington, D.C.

Expected to include up to 2,700 residential units, 1.8 million square feet of office

space, and 300,000 square feet of retail and dining space.

36 |

Atlantic Yards

– Site Plan

37

Located in Brooklyn, and adjacent to the state-of-the-art arena, Barclays

Center, designed

by

Ellerbe

Becket

and

SHoP

Architects,

Atlantic

Yards

is

expected

to

feature more than 6,400 residential units (including 2,200 affordable units),

250,000 square feet of retail and more than 8 acres of landscaped open space.

|

Sustainability

at Forest City 38

•

Commitment

A corporate core value since 2003

Dedicated Sustainability Dept. and Commercial Energy Services Dept.

Accountability

and

verification

–

all

projects

prepare

a

sustainability

“scorecard”

•

Results

30+ projects certified or seeking certification (LEED, Energy Star, others)

Approx. 18.6% of total portfolio is certified (based on cost at pro-rata)

A leader in breadth of LEED certifications by project type:

•

New Construction

•

Core & Shell

•

Neighborhood Development

•

Homes

•

Existing Buildings

•

Value-added

Leveraging portfolio opportunities for energy generation/sale, reduced cost

Forest City included in Calvert Social Index since September, 2010

•

New Developments

Focus on results, not specific certifications, however use them to benchmark performance

and stay on top of best practices

December 2011 –

Joined National Better Buildings Challenge, a private sector initiative to

increase energy efficiency 20% by 2020 across 14m SF of the overall portfolio

•

Renewable Energy

In-house capability to develop and manage alternative energy projects (solar,

wind, waste-to-energy) deployed on existing Forest City assets as well as new

projects |

Net Asset

Value Components Footnotes 39

(1) Pro-rata Q1 2012 NOI is reconciled to NOI at full consolidation by Product Group for

the three months ended April 30, 2012 in the Supplemental Operating Information section

of the supplemental package for the three months ended April 30, 2012. NOI generated

from the casino land sale of $36.5 million has been excluded from total NOI used in the Net

Asset Value Component schedule.

(2) Pro-rata annualized NOI is calculated by taking the Q1 2012 NOI times a multiple of

four.

(3) The net stabilized adjustments column represents net adjustments required to arrive at a

fully stabilized NOI for those properties currently in initial lease up periods, net of

the removal of partial period NOI for recently sold properties. For those properties currently

in initial lease up periods we have included stabilization adjustments as follows:

a) Except for Westchester’s Ridge Hill and 8 Spruce Street, NOI for the

properties in lease up are reflected at 5% of the pro- rata cost disclosed in our

Development Pipeline disclosure (Current Year and Prior Two Year Openings). This assumption does

not reflect Forest City’s anticipated NOI, but rather is used in order to establish a

hypothetical basis for valuation of lease up properties. See note 6, which describes

the treatment of Westchester’s Ridge Hill and 8 Spruce Street.

b) At the conclusion of the initial development period at each of our military housing

communities, we estimate the ongoing property management fees, net of operating

expenses, to be $15.0 million.

The net stabilized adjustments are not comparable to any GAAP measure and therefore do not

have a reconciliation to the nearest comparable GAAP measure. (4) Amounts

are derived from the respective pro-rata balance sheet line item as of April 30, 2012 and are reconciled to their GAAP

equivalents in the Selected Financial Information section of the supplemental package for the

three months ended April 30, 2012.

(5) Represents limited-distribution subsidized senior housing properties. (6)

Westchester’s Ridge Hill and 8 Spruce Street have their assets shown in the Development Pipeline section of the model.

Westchester’s Ridge Hill,

mortgage debt at pro-rata consolidation which were transferred to CRP. 8 Spruce

Street, as of April 30, 2012, had $427.4 million of costs incurred at pro-rata

consolidation and $261.1 million of mortgage debt at pro-rata consolidation which were transferred to CRP.

In order to account for the phased openings of Westchester’s Ridge Hill and 8

Spruce Street as NAV components we have made the following adjustments: a) All costs

and associated debt for Westchester’s Ridge Hill and 8 Spruce Street for purposes exclusive to this disclosure are

accounted for as a component of “Adjusted Projects Under Construction” in the

Development Pipeline section of this schedule. Accordingly, all NOI, through the net

stabilized adjustments column, and debt have been removed from the CRP section of the

NAV schedule.

(7) Includes $157.7 million of straight-line rent receivable (net of $15.9

million of allowance for doubtful accounts).

(8) Includes $41.7 million of straight-line rent payable. as of April

30, 2012, had $346.2 million of costs incurred at pro-rata consolidation and $193.7 million of |

Funds From

Operations Footnotes 40

(1) The following table provides detail of Income Tax Expense (Benefit):

(2)

For the three months ended January 31, 2012, the effect of 52,343,458

shares of diluted securities were not included in the computation

of diluted FFO per share because their effect is anti-dilutive to the negative FFO for the quarter. As a result,

an adjustment to FFO is not required for interest expense of $3,769,000

related to these securities. 2012

2011

Current taxes

Operating earnings

(3,736)

$

(12,671)

$

Gain on disposition of rental properties and partial interests in

rental properties 4,865

30,304

Subtotal

1,129

17,633

Discontinued operations

Operating earnings

(169)

(623)

Gain on disposition of rental properties and partial interests in

rental properties 680

1,201

Subtotal

511

578

Total Current taxes

1,640

18,211

Deferred taxes

Operating earnings

14,302

24,540

Gain on disposition of rental properties and partial interests in

rental properties (5,322)

(22,549)

Impairment of depreciable rental properties

(536)

(1,332)

Impairment of Land Group projects

-

(543)

Subtotal

8,444

116

Discontinued operations

Operating earnings

190

410

Gain on disposition of rental properties and partial interests in

rental properties 2,829

3,511

Subtotal

3,019

3,921

Total Deferred taxes

11,463

4,037

Grand Total

13,103

$

22,248

$

Three Months Ended April 30,

(in thousands) |

Company

is

principally

engaged

in

the

ownership,

development,

management

and

acquisition

of

commercial

and

residential

real

estate

and

land

throughout

the

United

States.

Founded

in

1920

and

based

in

Cleveland,

Ohio,

Forest

City’s

diverse

portfolio

includes

hundreds

of

premier

properties

located

throughout

the

United

States.

We

are

especially

active

in

our

Core

Markets

–

New

York,

Boston,

Greater

Washington,

D.C./Baltimore,

Denver,

Los

Angeles,

Greater

San

Francisco,

Dallas,

Philadelphia

and

Chicago

–

where

we

have

overcome

high

barriers

to

entry

and

developed

a

unique

franchise.

These

are

great

urban

markets

with

strong

demographics

and

good

growth

potential.

Investor

Relations

Contact:

Jeff

Linton

Senior

Vice

President,

Corporate

Communication

Forest

City

Enterprises

216-416-3558

jefflinton@forestcity.net

Forest

City

Enterprises,

Inc.,

is

an

NYSE-listed

national

real

estate

company

with

$10.5

billion

in

total

assets

(4/30/2012).

The |