Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - INTERSECTIONS INC | intersections-8k_060412.htm |

Stephens Investment Conference

June 6, 2012

June 6, 2012

Industry Leadership through Innovation, Experience

and Execution

and Execution

2

Safe Harbor Statement

Statements in this presentation relating to future plans, results, performance, expectations,

achievements and the like are considered “forward-looking statements.” Those forward-

looking statements involve known and unknown risks and are subject to change based on

various factors and uncertainties that may cause actual results to differ materially from those

expressed or implied by those statements. Factors and uncertainties that may cause actual

results to differ include, but are not limited to, the risks disclosed in the company’s filings with

the U.S. Securities and Exchange Commission. The company undertakes no obligation to revise

or update any forward-looking statements.

achievements and the like are considered “forward-looking statements.” Those forward-

looking statements involve known and unknown risks and are subject to change based on

various factors and uncertainties that may cause actual results to differ materially from those

expressed or implied by those statements. Factors and uncertainties that may cause actual

results to differ include, but are not limited to, the risks disclosed in the company’s filings with

the U.S. Securities and Exchange Commission. The company undertakes no obligation to revise

or update any forward-looking statements.

2

3

Agenda

Corporate Overview

Financial Update

4

About Us

► More than 34 million consumers protected

► Comprehensive solutions

► Preferred partner to the financial services industry

► Trailing 12 month Revenue of $373 million*

► Trailing 12 month Adjusted EBITDA before share

related compensation of $55.5 million*

related compensation of $55.5 million*

► NASDAQ listed (Ticker: INTX) since 2004

Since 1996, Intersections has been the leading provider of consumer identity theft protection

solutions.

solutions.

*As of the Quarter ended March 31, 2012.

5

Leadership, Experience, Stability, Passion

Since 1996

• Co-founded Intersections Inc.

Michael R. Stanfield

Chairman and

Chief Executive Officer

Chairman and

Chief Executive Officer

Since 2006

John G. Scanlon

Executive Vice President,

Chief Financial Officer

Executive Vice President,

Chief Financial Officer

Since 2003

• Former Senior Vice President at The Motley Fool

Steven A. Schwartz

Executive Vice President,

Consumer Services

Executive Vice President,

Consumer Services

Since 2003

• Previously served as Senior Vice President and General Counsel

• Founder of intellectual property and technology practice at major law firms; General Counsel of publicly held credit technology

company; and Trial Attorney at U.S. Department of Justice

company; and Trial Attorney at U.S. Department of Justice

Neal B. Dittersdorf

Executive Vice President,

Chief Legal Officer

Executive Vice President,

Chief Legal Officer

As of 6/6/12

6

Identity Theft Protection Market Overview

Identity Theft

Protection

Market:

Protection

Market:

Identity Theft

Protection

Market:

Protection

Market:

$2.5B to $3.5B

and Growing

and Growing

$2.5B to $3.5B

and Growing

and Growing

Endorsed

Direct to

Consumer

Only an estimated 12% of consumers pay for an Identity Protection Subscription Service;

indicating a huge, untapped market **

indicating a huge, untapped market **

*Market Size based on internal estimates, the high end of $3.5 billion was referenced in Javelin’s Fifth Annual ID Protection Services Scorecard (August 2011). Javelin’s 2011 ID protection market estimates were

expanded in 2011 to include a wider array of antivirus and PC protection services.

expanded in 2011 to include a wider array of antivirus and PC protection services.

** According to Javelin‘s Fifth Annual ID Protection Services Scorecard (August 2011) 20% of consumers received a core Identity Protection Service of which 41% were for free, limited feature and /or limited duration

subscriptions.

subscriptions.

Market Size*

7

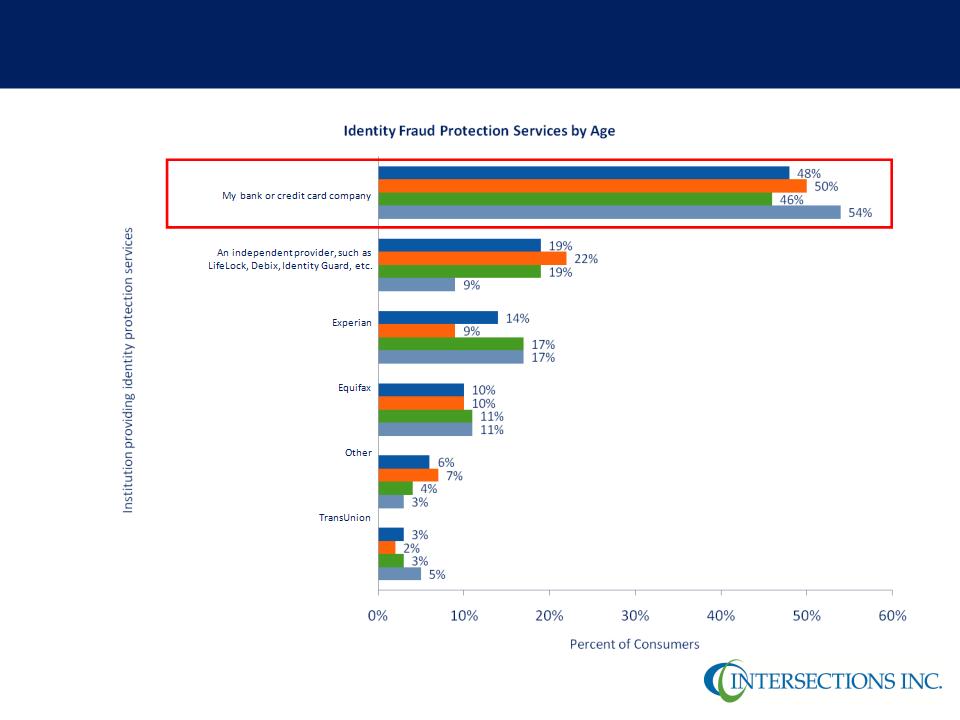

Consumers Trust Their Banks for Their Identity Protection

Source: Javelin 2010 Annual Identity Protection Services Scorecard, Identity Fraud Protection Services by Age.

<Gen Y

<Gen X

<Baby boomers

<All Consumers

8

Banking Partners Require a Wide Spectrum of World Class Skills

Products

► Best in Class Comprehensive and Multi-layered

Solutions

Solutions

► Track Record of Innovation

► Incorporating Advanced Technology

Customer

► In-house and Off Shore Customer Service Centers

► Highly Secure Environment to Protect Data

► Seamless Customer Experience to Support Brand

► Secure and High Brand Quality Print Capabilities

Partnership

► Marketing and Operational Expertise

► Dedicated Client Services Team Put Clients' Needs

First

First

► Flexible Program Management to Meet Evolving

Objectives

Objectives

…and more

9

Honored as one of the Top 500 Innovative Information

Technology Companies (2010 and 2011)

Technology Companies (2010 and 2011)

10

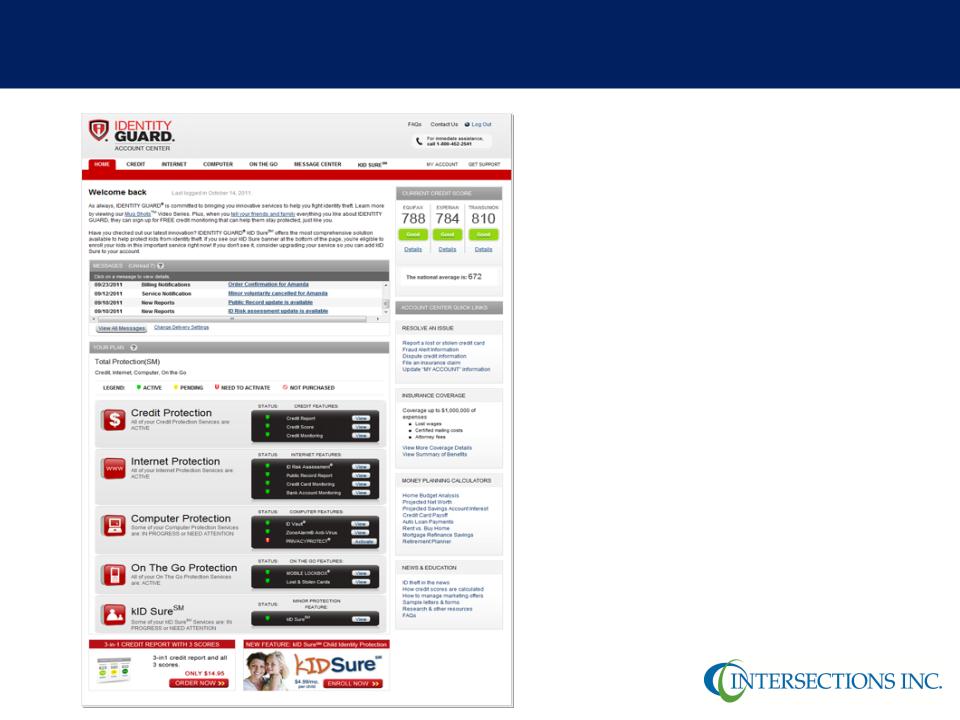

What Is a Comprehensive Identity Theft Protection Product?

Consumer Benefits May Include:

► Customized 1B or 3B Credit Reports and Credit

Scores

Scores

► Daily, monthly, and quarterly monitoring of credit

files by one or all 3 Bureaus: Equifax, Experian &

TransUnion

files by one or all 3 Bureaus: Equifax, Experian &

TransUnion

► Alternative data monitoring of public record

information, new account openings, exposed data

on the internet, etc.

information, new account openings, exposed data

on the internet, etc.

► Mobile Data Storage Software

► Antivirus, Anti-Keylogging, and other Software Tools

► Credit Education

► Identity Theft Insurance

► Exclusive access to The Identity Theft Assistance

Corporation (ITAC), a financial services industry

sponsored non-profit that assists identity theft

victims

Corporation (ITAC), a financial services industry

sponsored non-profit that assists identity theft

victims

11

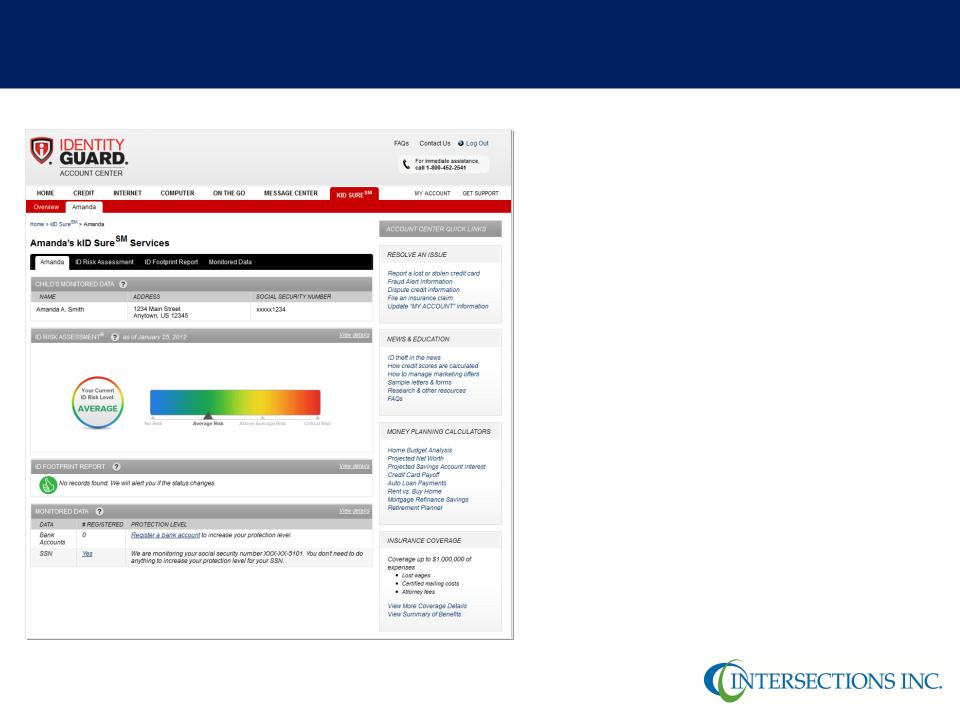

Innovations Such as kID SureSM Continually Refresh the Category

How kID SureSM Helps Protect Kids

► All-new, patent-pending technology

scours thousands of data sources

providing

scours thousands of data sources

providing

o Ongoing visibility into potential exposure

of a child’s personal data

of a child’s personal data

o A comprehensive “Digital Footprint”

report showing detected data

report showing detected data

o Alerts to certain kinds of activity

detected

detected

► kID SureSM scans for:

o SSN Exposure

o Criminal Records

o DMV Records

o Utilities Records

12

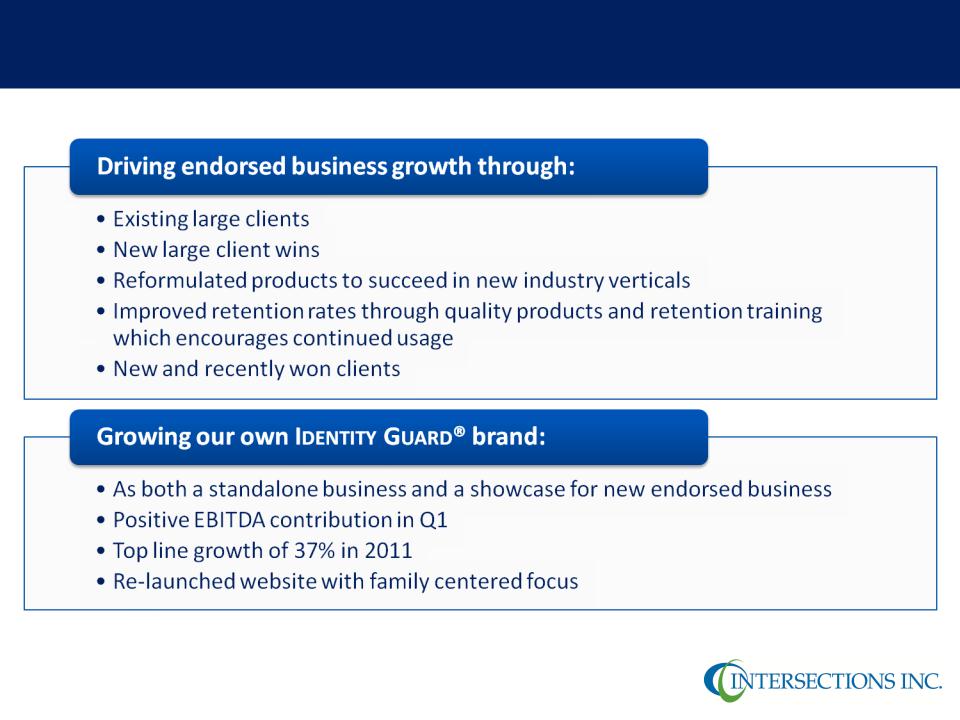

Strategic Focus on Marketing of Identity Theft Protection Services

As of 6/6/12

13

Agenda

Corporate Overview

Financial Update

14

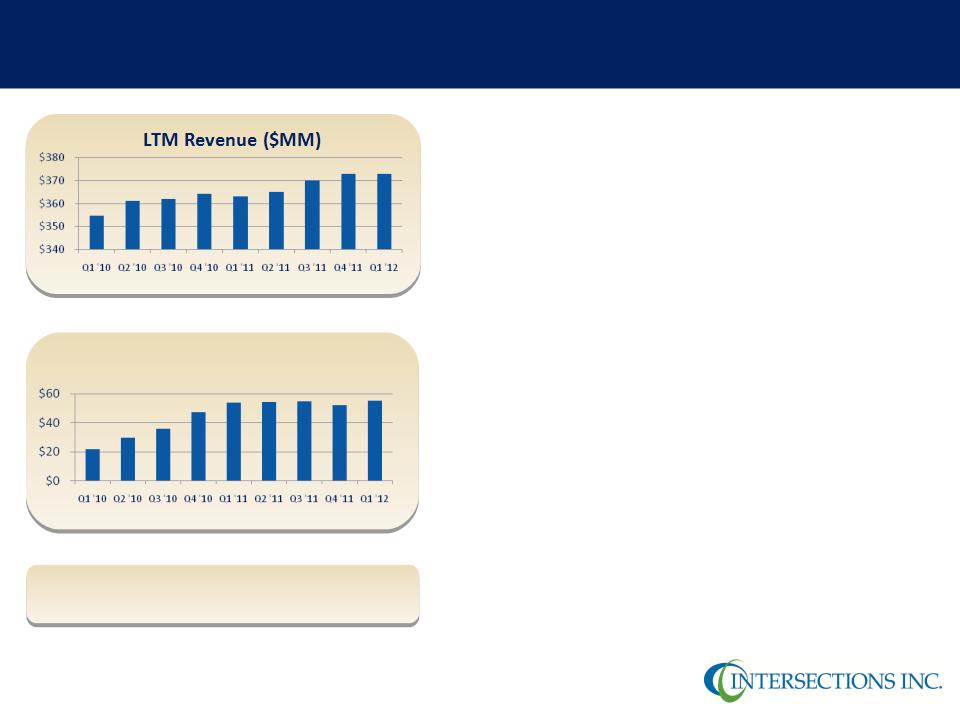

Attractive Economic Profile

► Flexible economic arrangements with clients

o High margin fee for service

“indirect” arrangements

o High return on marketing investment

“direct” arrangements

► Detailed financial modeling at the client, product

and marketing channel level based on cumulative

knowledge from more than 34 million customers

served

and marketing channel level based on cumulative

knowledge from more than 34 million customers

served

► High visibility recurring revenue and cash flow

business model from 4.8 million subscribers

business model from 4.8 million subscribers

► Returning capital to shareholders via share

repurchases and dividends

repurchases and dividends

Annualized Dividend Yield @ 7.0%

Dividend Yield is based on May 31, 2012 closing price of $11.43

Adjusted EBITDA is a non-GAAP financial measure. Our consolidated financial statements, other data and reconciliations of these non-GAPP financial measures to the most directly comparable GAAP financial

measures and related notes can be found in the “GAAP and Non-GAAP Measures” link under the “Investor & Media "page on our website at www.intersections.com. Includes an estimated $2.3 million in

severance expenses recorded in the 4th quarter of 2011.

measures and related notes can be found in the “GAAP and Non-GAAP Measures” link under the “Investor & Media "page on our website at www.intersections.com. Includes an estimated $2.3 million in

severance expenses recorded in the 4th quarter of 2011.

Consolidated results adjusted for sale of SI. EBITDA adjusted for share related compensation and non-cash impairment charges.

LTM Adjusted EBITDA ($MM)

15

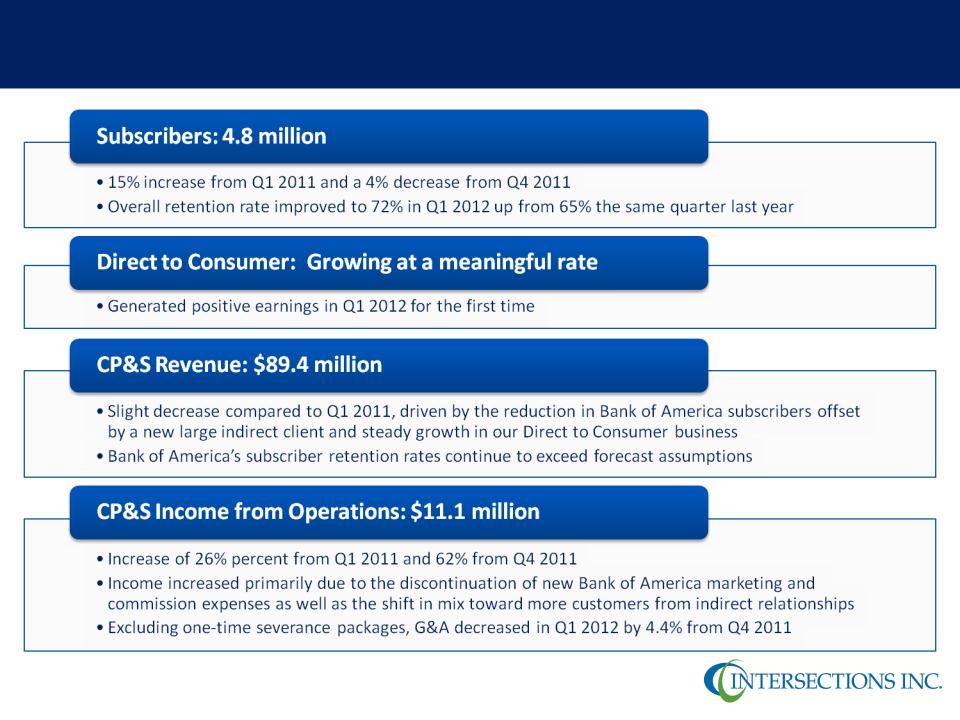

Q1 2012 Consolidated Highlights Financial Results

Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

16

Q1 2012 Consumer Product and Services (CP&S) Highlights

Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

17

Continuing Shift Towards A Higher Percentage of Indirect Subscribers

Marketing arrangements are based on the

economic risk and reward of the specific

marketing campaign.

economic risk and reward of the specific

marketing campaign.

► Direct Marketing Arrangement

o Intersections recognizes the gross

amount billed to the subscriber

amount billed to the subscriber

o Intersections bears most of the new

subscriber marketing expenses

subscriber marketing expenses

o Intersections pays commissions and/or

bounties to marketing partners

bounties to marketing partners

► Indirect Marketing Arrangement

o The client pays Intersections a service

fee or percentage of the revenue

fee or percentage of the revenue

o The client bears the new subscriber

marketing expenses

marketing expenses

o No commissions paid by Intersections

Please see the company’s release and website at www.intersections.com for additional details on results.

18

Income Statement Impacts of Mix Shift

|

Line Item

|

Impact

|

|

Revenue

|

Generally declines as mix shifts to indirect for the

same size of subscriber base |

|

Marketing & Commissions

|

Generally declines as mix shifts to indirect for the

same size of subscriber base |

|

Product Costs

|

Generally driven by subscriber count and specific product attributes rather than

direct/indirect mix. Declines as ratio of new accounts to existing subscribers declines.

|

|

G&A Costs

|

Largely independent of mix. Driven by technology & marketing investments and

number of clients. |

|

EBITDA

|

Result of trends noted above.

|

Management estimates.

19

Strong Shareholder Value Proposition

Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

* In accordance with Rule 10b5-1 under the Securities Exchange Act of 1934, Intersections entered into a trading plan to facilitate repurchases by the Company of up to

$2.5 million of its common stock. It is anticipated that the repurchase plan will commence on June 10, 2012 and will remain in effect until July 31, 2012 but may be

limited or terminated at any time without prior notice.

$2.5 million of its common stock. It is anticipated that the repurchase plan will commence on June 10, 2012 and will remain in effect until July 31, 2012 but may be

limited or terminated at any time without prior notice.

• To be paid on June 8, 2012 to

stockholders of record as of business on

May 29, 2012

stockholders of record as of business on

May 29, 2012

• Represents an effective annual yield of

approximately 7.0% (based on 5/31/12

closing price of $11.43)

approximately 7.0% (based on 5/31/12

closing price of $11.43)

• $12.1 million in regular dividends since

January 1, 2011

January 1, 2011

• $20 million authorized by our Board for share

repurchases

repurchases

• Entered into a trading plan in accordance with

10b5-1 to facilitate repurchases of up to $2.5

million of our common stock*

10b5-1 to facilitate repurchases of up to $2.5

million of our common stock*

• $19.6 million returned to shareholders

through repurchases in 2011

through repurchases in 2011

20

Well-positioned to Capitalize on Industry Trends and Leverage Our Unique

Advantages

Advantages

• 11.6 million adults were victims of identity theft in 2011

(12.6 percent y-o-y increase); with total dollar fraud

amount of $18 billion

(12.6 percent y-o-y increase); with total dollar fraud

amount of $18 billion

• Estimated 15 percent of U.S. consumers received

notification of data breach in 2011, an increase of 67

percent from 2010.

notification of data breach in 2011, an increase of 67

percent from 2010.

• Increasing trends in non-card frauds, computer-based

crimes, and counterfeit software

crimes, and counterfeit software

Favorable Industry Dynamics *

• 4.8 million subscribers currently protected; more than 34

million protected since inception

million protected since inception

• Recognized as the innovator and product leader in the

identity protection industry

identity protection industry

• Most comprehensive identity protection product suite

available

available

• Multiple medium to large existing clients/portfolios

• Consumer Direct

• Recently added clients and additional new client wins

• New product launches such as Identity Guard Platinum and

kIDSureSM

kIDSureSM

Attractive Financial Characteristics

• Proven subscription model creates strong, predictable cash

flow

flow

• Strong cash flow from operations of $16.1 million, and $30.6

million in cash & equiv. on balance sheet as of March 31, 2012

million in cash & equiv. on balance sheet as of March 31, 2012

• Will pay a 8th consecutive quarterly dividend on June 8, 2012,

an effective dividend Yield of 7.0%

an effective dividend Yield of 7.0%

•Javelin‘s 2012 Identity Fraud Report: Social media and Mobile Forming New Fraud Frontier (February 2012)

•Dividend Yield is based on May 31, 2012 closing price of $11.43

Corporate Headquarters

Intersections Inc.

3901 Stonecroft Boulevard

Chantilly, VA 20151

Toll-free: 800.695.7536

www.intersections.com

NASDAQ : INTX

Investor Relations

Eric Miller

Senior Vice President

Corporate Finance and Investor Relations

Tel: 703.488.6100

emiller@intersections.com