Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d363593d8k.htm |

ENCORE CAPITAL GROUP, INC.

WELL-POSITIONED, DEEP STRENGTHS,

DRIVING GROWTH

2012 Investor Day

New York, NY

June 6, 2012

Exhibit 99.1 |

PROPRIETARY

2

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not historical facts, including, most

importantly,

those

statements

preceded

by,

or

that

include,

the

words

“will,”

“may,”

“believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions,

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities Litigation Reform Act of 1995 (the “Reform Act”).

These statements may

include,

but

are

not

limited

to,

statements

regarding

our

future

operating

results

and

growth.

For all “forward-looking statements,”

the Company claims the protection of the

safe

harbor

for

forward-looking

statements

contained

in

the

Reform

Act.

Such

forward-

looking statements involve risks, uncertainties and other factors which may cause actual

results, performance or achievements of the Company and its subsidiaries to be

materially different from any future results, performance or achievements expressed or

implied by such forward-looking statements. These risks, uncertainties and other

factors are discussed in the reports filed by the Company with the Securities and

Exchange Commission,

including

the

most

recent

reports

on

Forms

10-K,

10-Q

and

8-K,

each

as

it

may be amended from time to time.

The Company disclaims any intent or obligation to

update these forward-looking statements. |

PROPRIETARY

PRESENTING TODAY

Brandon Black

Chief Executive Officer

Dr. Christopher Trepel

Chief Scientific Officer

Paul Grinberg

Chief Financial Officer

Jack Nelson

President, Propel Financial Services

3 |

PROPRIETARY

ENCORE IS A GROWING COMPANY WITH SOPHISTICATED

OPERATIONS AND DEEP CONSUMER EXPERTISE

4

1

in

9

American

consumers

have

accounts with us

2.5

million

satisfied their obligations

$2

billion

26%

Adjusted

EBITDA

†

5-year

compound annual growth rate

2,600

$800

million

twelve months

†

See endnote

employees

worldwide

in

estimated

remaining

collections

collected

in

the

last

consumers

have |

PROPRIETARY

OUR SUCCESS IS DRIVEN BY OUR CORE COMPETENCIES

5

COST

LEADERSHIP

PRINCIPLED

INTENT

ANALYTIC

STRENGTH

CONSUMER

INTELLIGENCE

Legal collections

Marketing

analytics

Consumer Credit

Research Institute

ENCORE’S KEY

COMPETITIVE

ADVANTAGES

International

operations

Account

Manager

expertise

Portfolio valuation

and purchasing

Operational

modeling |

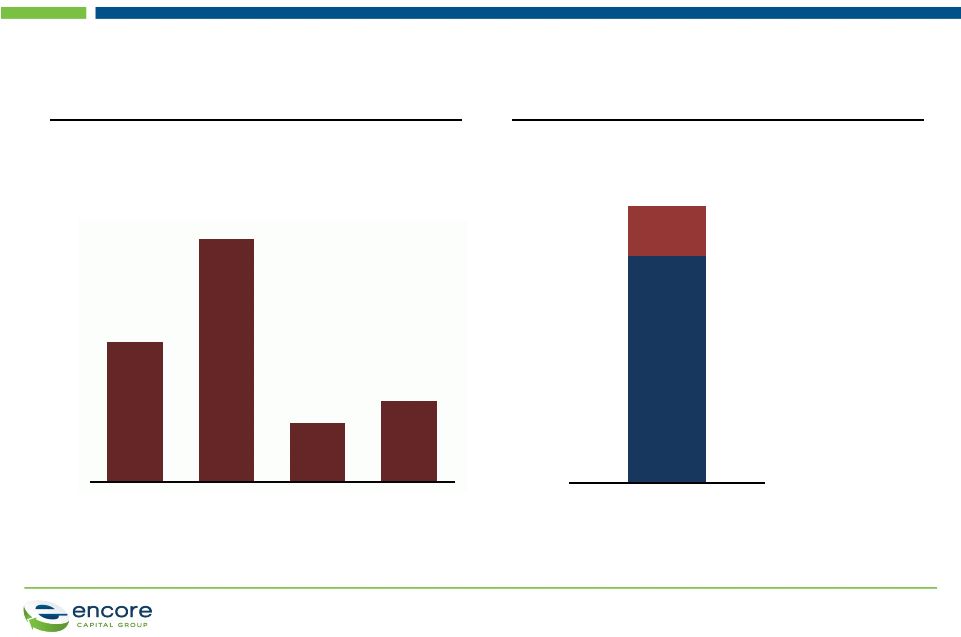

PROPRIETARY

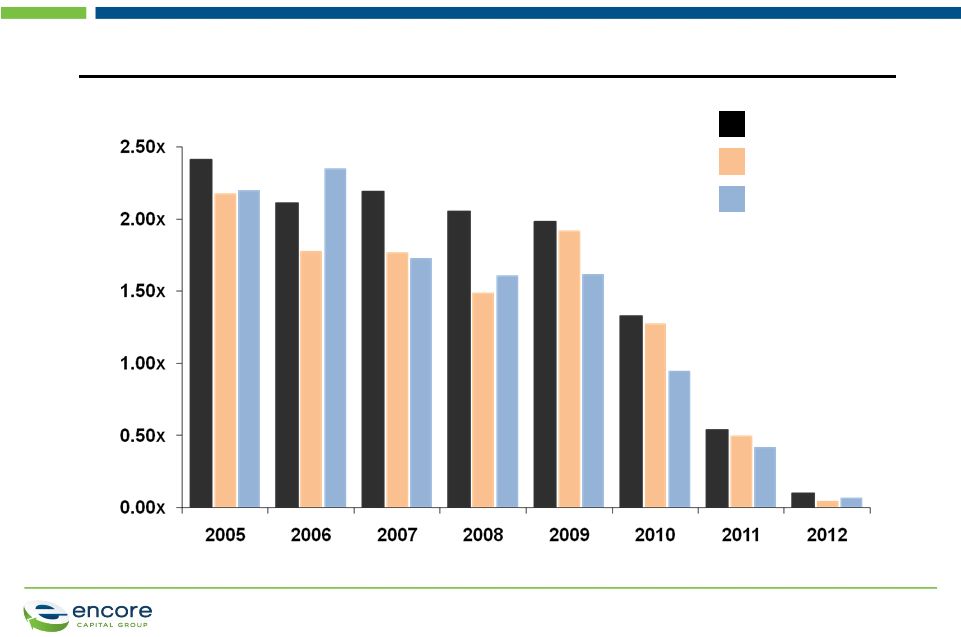

OUR VALUATION AND OPERATING CAPABILITIES HAVE

ESTABLISHED ENCORE AS THE INDUSTRY LEADER

6

Cumulative actual collection multiples by vintage year, as of March 31, 2012

(Total collections / Purchase price)

Source: SEC filings

ECPG

Peer 1

Peer 2 |

PROPRIETARY

AND THE DRAMATIC IMPROVEMENT IN OUR COST TO COLLECT

HAS GIVEN US A KEY COMPETITIVE ADVANTAGE

7

Overall cost to collect

(%) |

PROPRIETARY

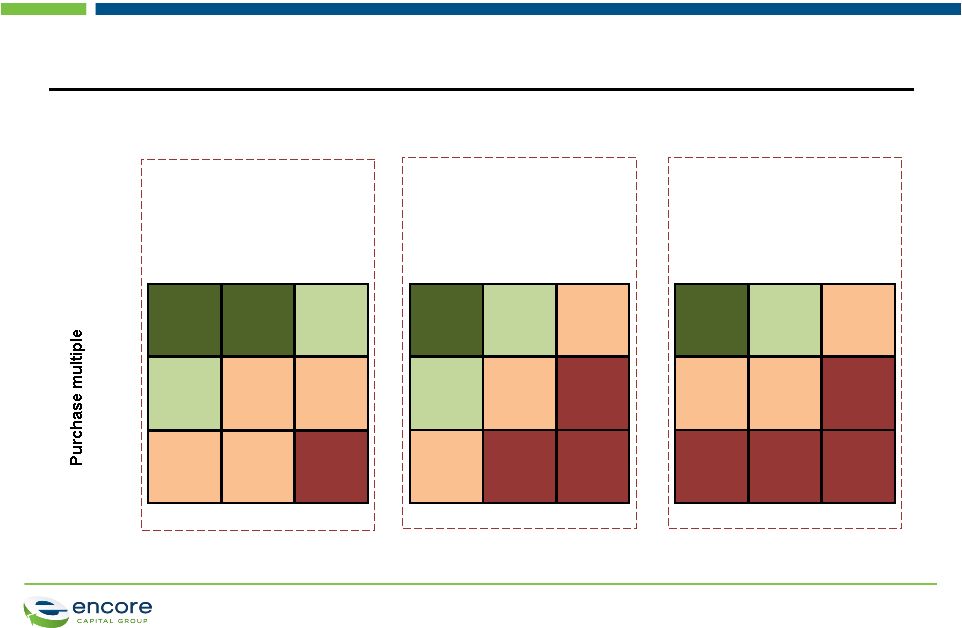

OUR OPERATING MODEL AND COST ADVANTAGES ALLOW US TO

REMAIN PROFITABLE WHEN OTHERS CANNOT

8

2.5

2.2

2.0

Interplay of multiples with the costs of debt and collection

(Unlevered IRR)

Cost to collect

Cost of debt:

7%

40%

45%

50%

15.7

10.6

8.3

5.2

2.9

3.4

(2.5)

(2.5)

(9.0)

Cost of debt:

4%

40%

45%

50%

17.4

12.5

7.4

5.8

5.3

10.3

0.9

0.9

(4.1)

Cost to collect

Cost of debt:

10%

40%

45%

50%

13.9

6.0

2.6

8.5

0.3

(7.7)

(0.3)

(7.7)

(18.1)

Cost to collect |

PROPRIETARY

New asset

classes

Expand core

footprint

Performing

loans

Expand along the

debt life cycle

AS WE LOOK TO THE FUTURE, WE ARE EXPLORING WAYS TO

LEVERAGE OUR CORE COMPETENCIES

9

Chapter 13

Chapter 7

Pre-charge off

delinquencies

Early

delinquencies

Auto

debt

Tax

liens

Mortgage

debt

Countries with

mature credit

systems

Emerging

markets

Credit

cards

Telecom

and other

utilities

Penetrate

existing market

Consumer

loans

Contingency

collections

First party

collection

services

Municipal

obligations

Student

loans

Utilities

National

Existing asset

classes

Purchase

Unsecured

International

Expand

geographically

Bankrupt

accounts

Focus on

bankruptcy

Outsourcing

services

Expand

along value

system

Secured

loans

Cover

different

type of debt

Chapter 13

Chapter 7

Pre-charge off

delinquencies

Early

delinquencies

Auto

debt

Tax

liens

Mortgage

debt

Countries with

mature credit

systems

Emerging

markets

Credit

cards

Telecom

and other

utilities

Penetrate

existing market

Consumer

loans

Contingency

collections

First party

collection

services

Municipal

obligations

Student

loans

Utilities

Defaulted

National

Existing asset

classes

Purchase

Unsecured

Defaulted |

PROPRIETARY

TODAY, YOU WILL HEAR ABOUT FOUR KEY FACTORS IN OUR

ONGOING SUCCESS

10

Industry-leading

growth strategy

focused on low-

and

middle-income

consumer economics

Strategic

growth into

new asset

classes and

geographies

Consumer-

focused

operational

platform

R&D as a

differentiating,

competitive

strength

Active

management

of regulatory

and legislative

environment |

PROPRIETARY

ENCORE PROVIDES AN ESSENTIAL SERVICE AND ITS MODEL SHOULD

BECOME THE INDUSTRY STANDARD

11

Contingency

collection agency

•

Four-to-six month

collection cycle

Pressure

•

Artificial deadlines

•

Multiple collection

companies

•

Counterproductive

incentive structure

•

Consumer is

confused and

frustrated

•

Consumer has 84

months to recover

financially

Partnership

•

Create partnership

strategy and set goals

•

Tailor work strategies to

individual circumstances,

giving time for a

consumer to recover

•

Maximizes repayment

likelihood, creates

consistency, and

ensures fair treatment

Relationship is

transactional…

..and often ends in

asset transfer

Original

creditor

•

Attempt immediate

resolution during

delinquency cycle

(days 30 –

180)

•

Consumer is

“charged-off”

by

issuer on day 181

•

Issuer offers to sell

unsecured, charged-

off debt or service

through 3rd party

agencies

Collection

time frame

Consumer

treatment

Outcome |

PROPRIETARY

WE INTRODUCED THE INDUSTRY’S FIRST CONSUMER BILL OF

RIGHTS TO ESTABISH OUR COMMITMENTS TO CONSUMERS

•

Positions Encore as an industry leader

–

Sets the standard by which the

industry should be judged

12

•

Clearly states what consumers

should expect from Encore

•

Gives concrete assurance regarding

Encore’s conduct

–

Suspends interest during

payment plans

–

Prohibits “robo-messaging”

–

Halts collections under certain

circumstances |

PROPRIETARY

WHICH IS A CORNERSTONE OF OUR COMPREHENSIVE GOVERNMENT

AFFAIRS STRATEGY

13

•

Have proactively met with the CFPB several times on

policy matters

•

Assembled compliance-focused task force with

representation from all key areas across the company

•

Leading active lobbying efforts in collaboration with other

major industry players

•

Have successfully informed bills across a number of states

•

Building a working group in several states to address

remaining questions

•

Individual discussions continue with certain states

Consumer Financial

Protection Bureau

State legislative

landscape

State Attorneys

General |

PROPRIETARY

OPERATIONALLY, WE'RE BUILDING A PLATFORM THAT ENCOURAGES

A DIFFERENT KIND OF RELATIONSHIP WITH OUR CONSUMERS

14

Addressing

debt cycles

•

Acknowledging the limitations of our consumers’

household balance sheets

•

Living the Consumer Bill of Rights

Making focused

investments

•

Creating specialized work groups

•

Leveraging our industry-leading cost efficiency

•

Increasing direct control over consumer experience

Improving

consumer

experience

•

Using market-based surveys and tests to

understand consumer satisfaction

•

Partnering to develop new products and services

•

Pointing consumers to the best external references |

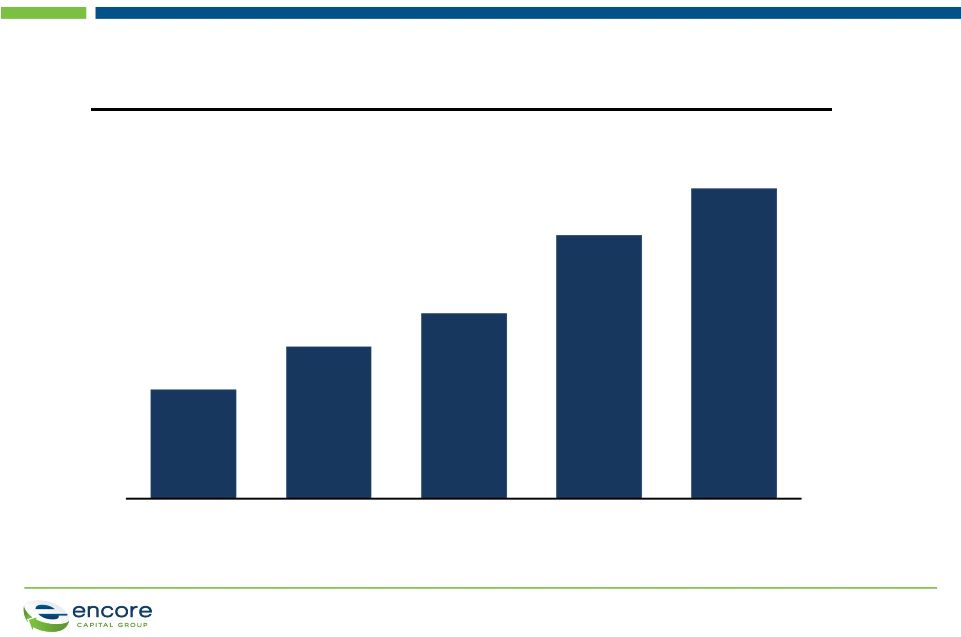

PROPRIETARY

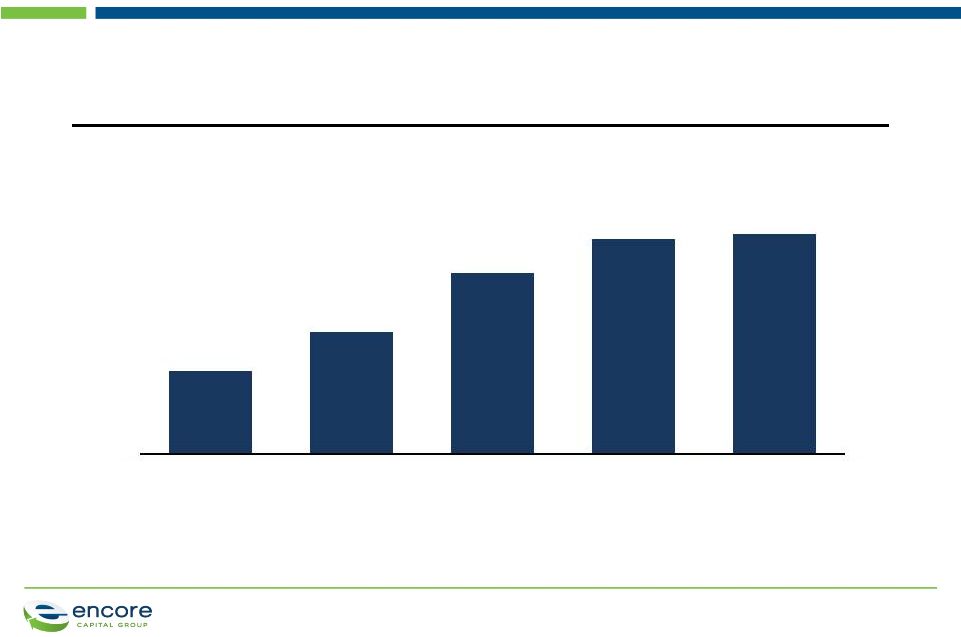

WE’VE SEEN A SIGNIFICANT INCREASE IN THE NUMBER OF

CONSUMERS WITH MULTIPLE OBLIGATIONS

15

Multiple obligations held within new portfolios, by purchase vintage

(% of unique consumers)

17

25

37

44

45

2008

2009

2010

2011

2012(E) |

PROPRIETARY

Recovery

and

growth

•

Develop tools and

frameworks to

break the debt cycle

•

Embrace a

household balance

sheet approach to

solvency

WE ARE MORE CLOSELY ALIGNING OUR ENGAGEMENT MODEL TO

OUR CONSUMERS’

NEEDS AND GOALS

16

Engage

and

discuss

•

Understand consumer

preferences

•

Deliver customized

outreach

•

Conduct satisfaction

surveys

•

Score performance

and provide feedback

•

Leverage proprietary

models

Promote

repayment

•

Provide affordable

payment options

•

Support financial

education activities

Systematically

resolve

obligations

Measure and

understand |

PROPRIETARY

WE’VE ESTABLISHED SPECIALIZED COLLECTION TEAMS TO

OPTIMIZE REPAYMENT RATES AND CONSUMER EXPERIENCE

17

Internal call center share of non-legal collections

(%)

Increasing work group

specialization and control

allows for:

Increasing call center specialization

(Number of distinct teams)

•

Discounts that are better

customized to consumer

circumstance

•

Increasing numbers of

deep discounts for those

consumers most in need

10

11

15

17

73

79

88

89 |

PROPRIETARY

OUR CALL CENTER PRODUCTIVITY HAS STEADILY IMPROVED

THROUGH SPECIALIZATION

18

Productivity of Phoenix Call Center

(Dollars collected per paid hour)

148

207

252

359

422

2007

2008

2009

2010

2011 |

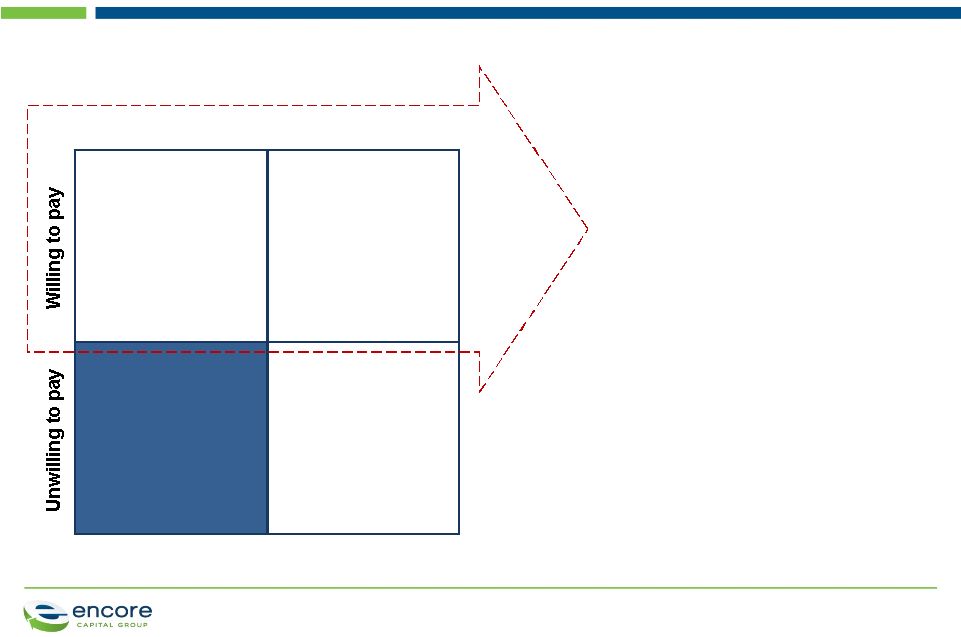

PROPRIETARY

THE NEW PRODUCT OFFERINGS ESTABLISH A DIFFERENT

DIALOGUE WITH CONSUMERS AND PROMOTE RECOVERY

19

Able to pay

Unable to pay

•

Maintain

engagement

•

Develop a

lasting

relationship

•

Create hope and

build goodwill

•

Provide support

and tools

•

No

conversation

•

Products and frameworks in

development

New approaches to financial

literacy challenges

Validation of IPA’s Borrow Less

Tomorrow™

program

Providing credit education

•

• |

PROPRIETARY

ANALYTICS AND BEHAVIORAL RESEARCH ARE FUNDAMENTAL TO

OUR SUCCESS

Dr. Christopher Trepel

Chief Scientific Officer

20 |

PROPRIETARY

UNDERSTANDING FINANCIALLY STRESSED CONSUMER BEHAVIOR IS

AT THE HEART OF OUR COMPANY’S EVOLUTION

Reporting

and alerts

Statistical analysis

and forecasting

•

Valuation based on

individual consumer

characteristics

•

Basic business

functionality focused

on public company

needs

Analytics

Data

•

Early technology

investment in large

databases and

analysis software

•

Significant investment

in credit bureau and

skip tracing data

1999

2001

Predictive modeling

and optimization

Behavioral science

field studies

•

First-mover advantage

created through

development of

advanced operational

models focused on

consumer behavior

and financial ability

•

Industry-first

investment to

understand financially

stressed consumers'

decisions, choices, and

activities

•

Data critical mass

achieved through

owned consumer

accounts and

specialized data

vendor programs

•

Access to unique

data held by private

companies and

agencies, and

analyzed by

academic experts

2005

2011

21 |

PROPRIETARY

22 |

PROPRIETARY

COMMITMENT TO ANALYTIC RIGOR UNDERPINS EVERY ASPECT OF

OUR OPERATIONAL STRATEGY

23

Test-based

marketing

campaigns

Psychographic

consumer

segmentation

Analytic focus

and strength

Broad information

advantage

Specialized analytics

staff across multiple

business groups

Commitment to starting

with good questions

and following the data

Activity-level

cost database

Suit decision

algorithms and

business rules |

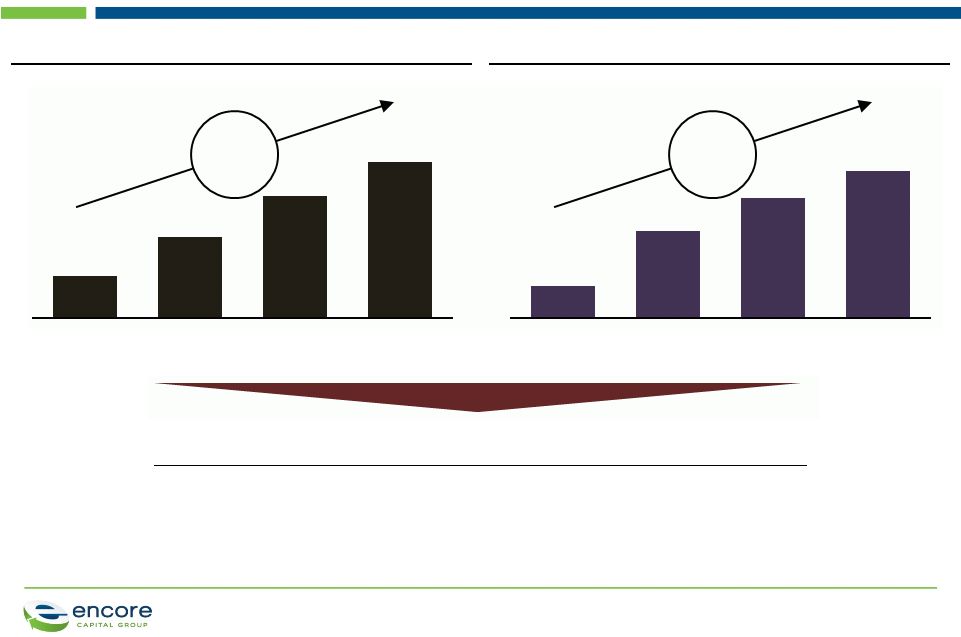

PROPRIETARY

THE DEMAND FOR INFORMATION AND NEW THINKING ABOUT

CONSUMER FINANCIAL BEHAVIOR HAS NEVER BEEN STRONGER

18.5

23.4

U.S. families without savings or

other liquid assets

(%)

8.5

10.0

(%)

Low-

and middle-income consumers were hit especially hard during

the 2008 recession and are continuing to struggle financially

Debt repayment is essential to improve household balance sheet

stability and insulate families against insolvency

24

U.S. families with $30,000+ in

credit card and unsecured debt

2009

2011

2009

2011

Source:

Stafford et al. (May 2012) Mortgage Distress and Financial Liquidity: How U.S. Families are

Handling Savings, Mortgages and Other Debts. Survey Research Center, Institute for Social

Research, University of Michigan. |

PROPRIETARY

WE MAXIMIZE OUR IMPACT BY ASKING IMPORTANT QUESTIONS

ABOUT CONSUMERS AND THEIR CIRCUMSTANCES

What can we do to

ethically promote

repayment

behavior?

How do consumers

prioritize their

spending and

saving options?

When do we nudge

consumers using

behavioral

economics?

Conduct research to

understand financially

stressed consumers’

financial decision-making

Promote financial literacy

and recovery through a

tailored suite of products

and services

Integrate experimental

psychology and behavioral

finance with operational

strategy

25 |

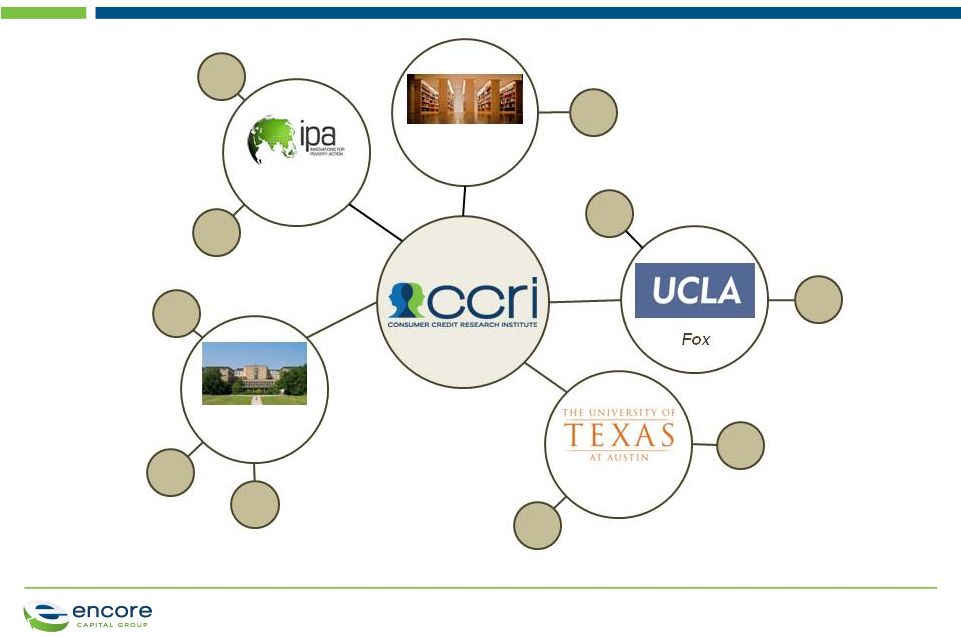

PROPRIETARY

WE ARE COLLABORATING WITH LEADING INSTITUTIONS TO AUGMENT

OUR SCIENTIFIC EXPERTISE

Consumer

payments

Econometrics

Credit

availability

Governmental

agencies

Behavioral decision

theory

Risk and

uncertainty

Fox

Poldrack

Brain systems for

decision-making and

executive function

Cognitive

Neuroscience

Microeconomic

analysis of social and

economic challenges

Public policy

centers

Household

finance

Behavioral

Economics

Zinman

Karlan

26 |

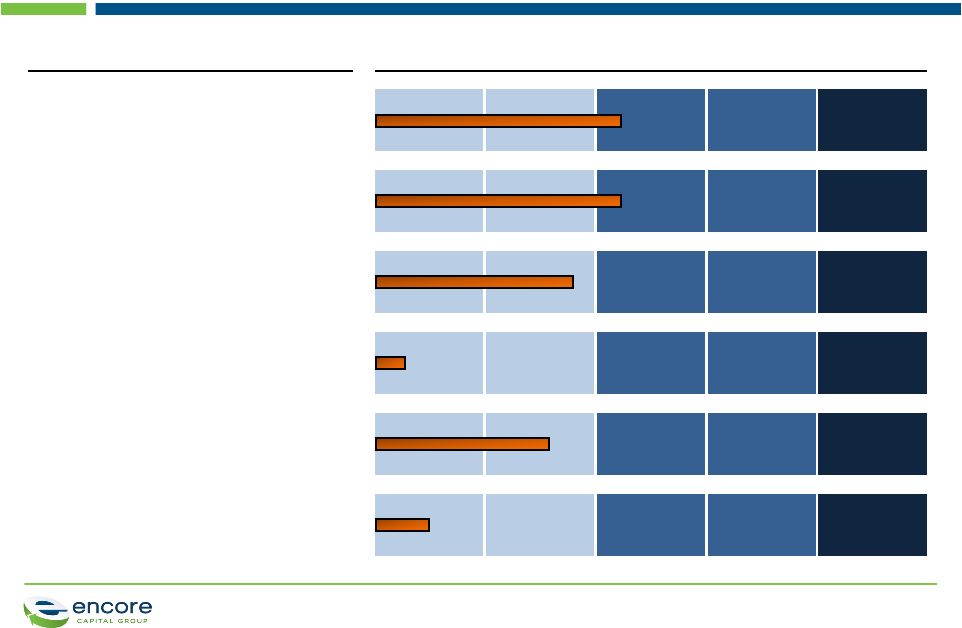

PROPRIETARY

OUR RESEARCH PIPELINE IS ROBUST AND FOCUSED ON BOTH

TRADITIONAL AND NOVEL PROGRAMS

Program

Concept

Planning

Pilot

Study

Full

Study

Application

Focus

Consumer

parametrics

•

Scientific understanding

of consumer decision

triggers and biases

Model

enhancement

•

Describe consumer

trajectories to enhance

operational strategies

Settlement

economics

•

Supply and demand

factors that shape

repayment behavior

Information

mapping

•

Combining data sets to

reveal new variable

inter-relationships

Debiasing

platforms

•

Develop new tools to

improve consumer

decision-making

Credit

availability

•

Understand the effect of

collections on credit

availability and repayment

27 |

PROPRIETARY

OUR INNOVATIVE RESEARCH AND DEVELOPMENT PLATFORM WILL

CREATE SIGNIFICANT NEW VALUE FOR ENCORE

Valuation and

purchasing

•

Identify hidden portfolio segments that carry incremental, new value

and every additional opportunity to bid safely and aggressively

•

Provide additional valuation protection against weak portfolios and

bidding protection against overpayment

Policy and

regulation

•

Provide

new

basis

for

a

“seat

at

the

table”

with governmental, policy

center, and non-profit constituencies

•

Encourage third parties to think differently about Encore’s goals and

motives

Operations

•

Drive new insights by combining traditional sources of data (e.g., issuer,

credit bureau, prior affiliation) with direct consumer surveys, data mining,

and psychographic information

•

Inform and guide highly rigorous marketing tests that pinpoint consumer

repayment triggers

28 |

PROPRIETARY

RECENT STRATEGIC TRANSACTIONS POSITION US WELL FOR OUR

NEXT STAGE OF GROWTH

Paul Grinberg

Chief Financial Officer

29 |

PROPRIETARY

WE THINK ABOUT GROWTH OVER THREE HORIZONS

30

Horizon 1

Defend and extend existing businesses

Expand beyond existing boundaries

Build emerging businesses

Horizon 2

Horizon 3

2012

2015

•

•

•

•

•

•

•

Explore new geographies

Leverage deep consumer insights

Expand tax lien transfer business in Texas and open new

markets across the U.S.

Secure low-balance asset purchasing commitments

Build upon our cost advantages

Concentrate on the acquisition of competitor portfolios

Help define the rules that will govern the industry in future years

|

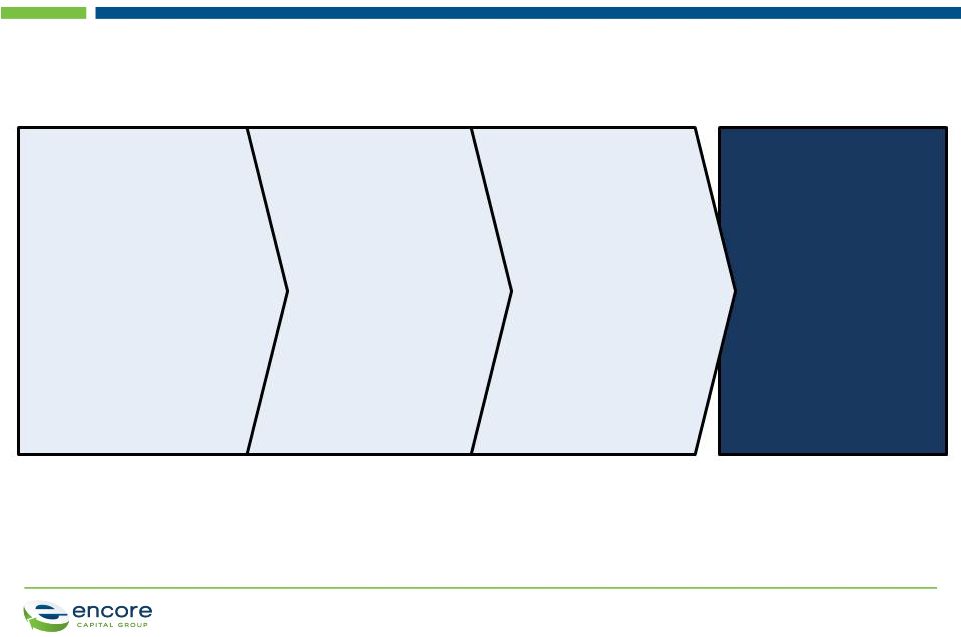

PROPRIETARY

IN

THE

LAST

30

DAYS,

WE’VE

MADE

THREE

KEY

STRATEGIC

MOVES

31

Encore’s largest

portfolio

acquisition

Our analytical and

operating

advantages

enabled the

successful

valuation and

integration of the

large purchase

Divestiture of our

bankruptcy

servicing subsidiary

We transitioned

Ascension Capital

Group to a

capable owner

with expertise in

the bankruptcy

space

Acquisition of

Propel Financial

Services

We identified and

pursued a strong

cultural and

strategic fit that

lends itself to

strong long-term

growth |

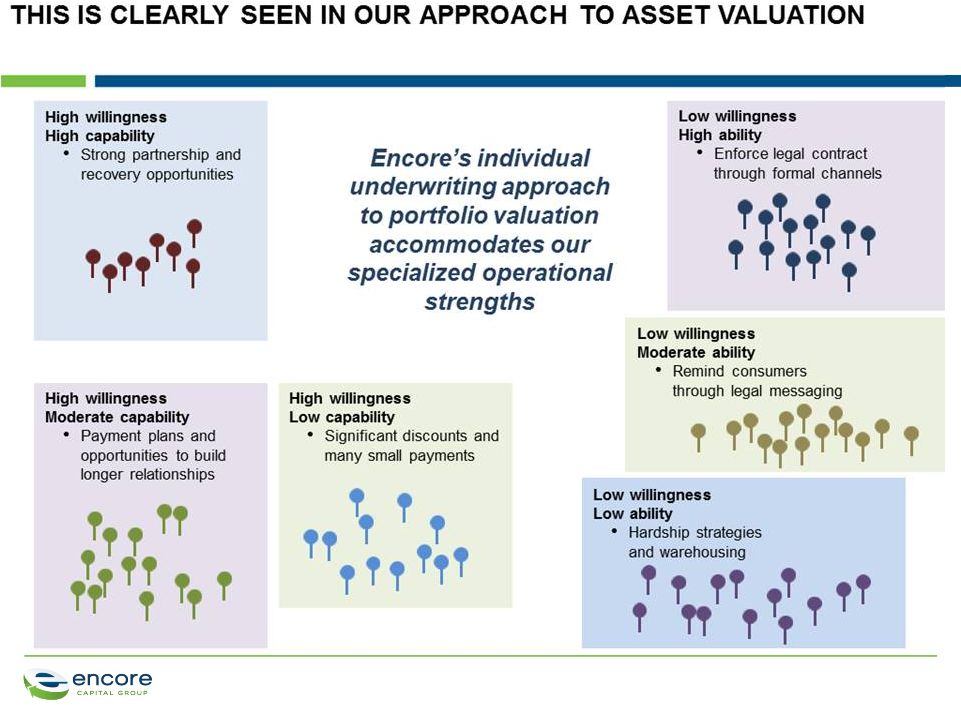

PROPRIETARY

ENCORE IS WELL POSITIONED TO PROVIDE A SOLUTION FOR

COMPETITORS WHO EXIT THE MARKET

32

Protection from the

“winner’s curse”

Our operational

advantages insulate us

against overpaying

•

Powerful operational

models and practices

•

Superior forecasting

methodology

Industry-leading

models used to

estimate individual

consumer willingness

and ability to pay

•

Enabled us to

identify and

acquire the most

valuable pools

Careful consumer

segmentation

Significant history

of acquiring assets

in the resale market

gave us an analytic

advantage when

conducting

operational due

diligence

Practice makes

perfect

Acquisition

of large

competitor’s

assets |

PROPRIETARY

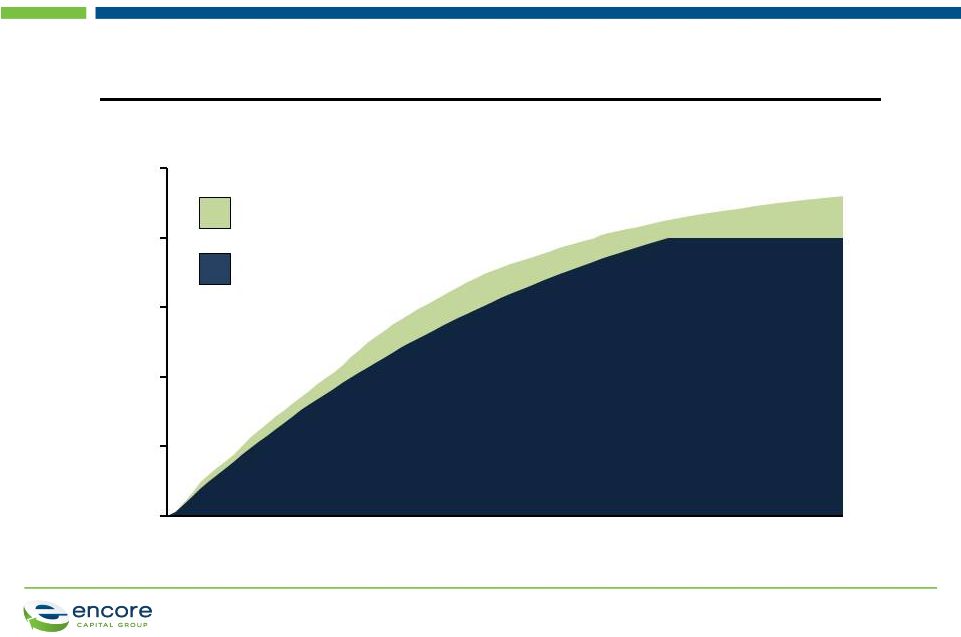

OUR CONFIDENCE IS TIED TO THE SUCCESSFUL COMPLETION OF

ONE OF THE INDUSTRY’S FEW DEALS OF THIS SIZE

33

$90M portfolio purchase in 2005, cumulative collections

($M)

Initial

expectations:

$199M

Results to date:

$230M

Actual

collections

Estimated

collections

50

100

150

200

250

Jun-05

Jun-

06

Jun-

07

Jun-

08

Jun-

09

Jun-

10

Jun-

11 |

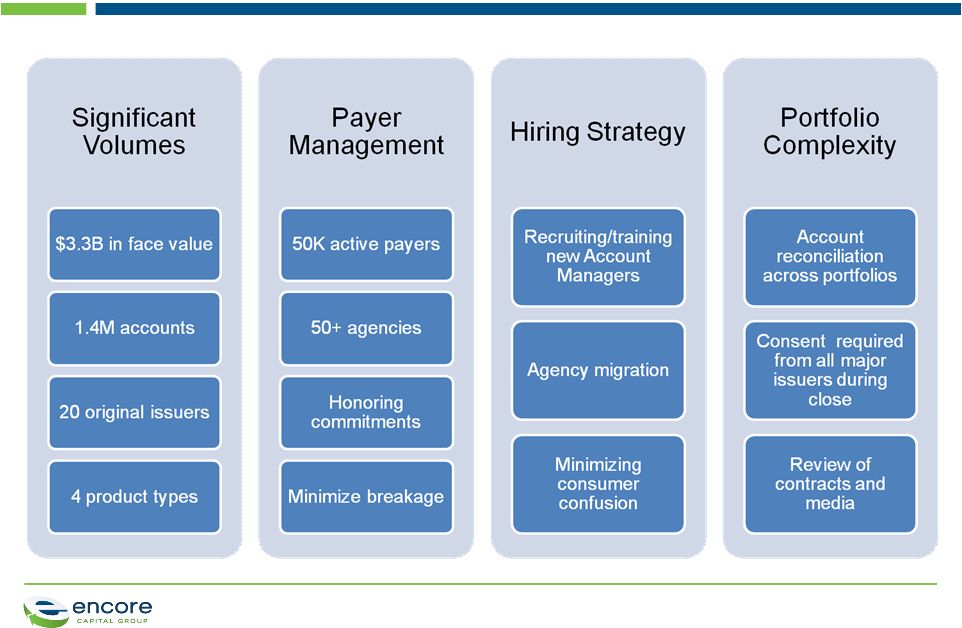

PROPRIETARY

OUR OPERATIONAL STRENGTHS ARE UNIQUELY SUITED TO

EXECUTING COMPLEX DEALS

34 |

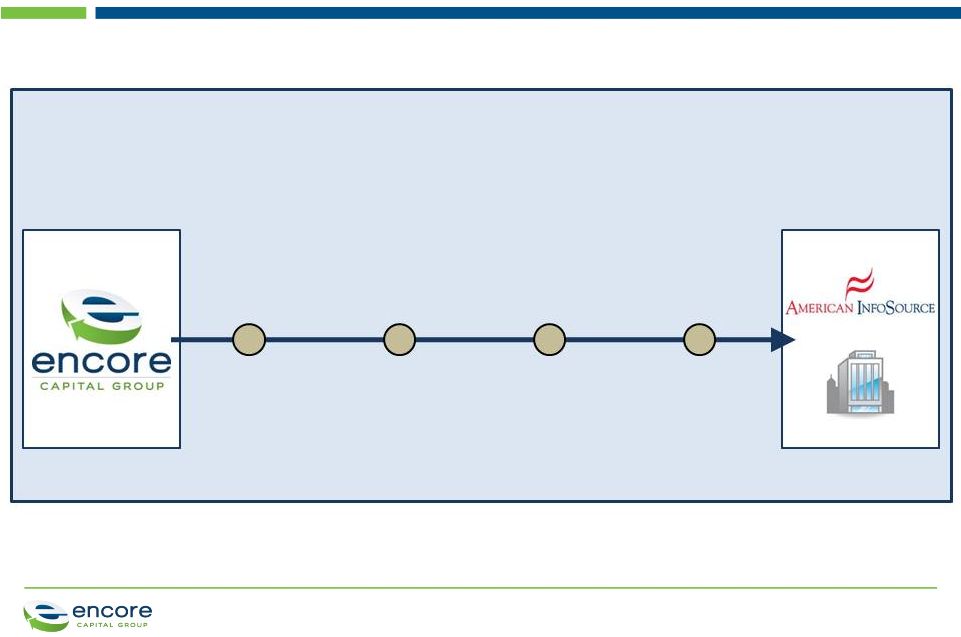

PROPRIETARY

WE HAVE TRANSITIONED OUR BANKRUPTCY BUSINESS TO A

BETTER-SUITED OWNER

35

Bankruptcy

volumes have

declined

ACG has not

been, and

would not

be, material

to Encore

Business

requires a

significant

technology

investment

Buyer has

focused IT and

bankruptcy

expertise, and

currently serves

large, financial

institutions |

PROPRIETARY

WE STUDIED MANY MARKETS AND GEOGRAPHIES BEFORE FINDING

AN OPPORTUNITY THAT SATISFIED OUR ACQUISITION CRITERIA

36

•

Used to fund essential services

•

Allows consumers to protect home from

foreclosure and avoid financial penalties

•

Propel was recognized as a 2011 “Top

Workplace”

by San Antonio Express-News

Consumer

focused

model

Meaningful

market

opportunity

•

Between $7B and $10B sold each year

•

Advantageous timing as large players exit the

market for non-financial reasons

Leverage

Encore’s

strengths

•

Consumer intelligence platform focused on

helping financially stressed individuals

•

Industry-leading asset valuation methodology

•

Low-cost operational platform

Acquisition of

dominant player

in the tax lien

space

Asset class

diversification

Geography

Operational

strengths |

PROPRIETARY

THE BUSINESS MODELS ARE VERY SIMILAR, AS BOTH PROVIDE

ESSENTIAL SERVICES FOR CONSUMERS AND CREDITORS

37

Leading provider of

debt management

and recovery

solutions for

consumers and

property owners

across a broad range

of asset classes

Property

Owners

Structured payment plans to

help residential and commercial

property owners settle tax

obligations and avoid

foreclosure

Consumer

Debt Holders

Robust collection plans to

maximize ability of consumers

to repay obligations and

ensure that consumers are

treated fairly

Financial

Institutions

Payment for

consumer debt

obligations

Local Tax

Authorities

Payment for residential

and commercial

property tax obligations |

PROPRIETARY

OUR BALANCE SHEET REMAINS STRONG

($M)

Covenant analysis*

Cash flow leverage ratio

Debt

Trailing

4-quarter

Adjusted

EBITDA

†

Debt/Adjusted EBITDA* (maximum 2.0x)

Minimum net worth

Excess room

Interest coverage ratio

EBIT/interest expense (minimum 2.0x)

2010

385.3

346.7

1.11

95.1

5.0

2011

389.0

445.0

0.87

133.5

5.7

Q1 2012 TTM

715.5

515.4

1.39

140.7

4.8

38

*

Subject to adjustments at closing based on originations and collections

‡

Encore only for 2010 and 2011; pro forma includes Encore with May 2012 competitor

portfolio purchases and Propel Financial Services acquisition †

See endnote

‡

Pro forma |

PROPRIETARY

WITH PROPEL, WE’VE ACQUIRED EXPERTISE, AN INDUSTRY-

LEADING PLATFORM, AND A HIGHLY PROFITABLE PORTFOLIO

39

Acquisition

characterized by

complementary

strengths, very

strong economics,

and significant

growth potential

Strong portfolio and platform

•

Opportunities to leverage

Encore’s core strengths

Similar economics to core

business

Smooth earnings profile

•

Used DCF analysis to

value acquisition

•

Fast-growing, highly secure

$140M portfolio, earning

>13% interest |

PROPRIETARY

INTRODUCING PROPEL FINANCIAL SERVICES

Jack Nelson

President, Propel Financial Services

40 |

PROPRIETARY

WE WORK WITH CONSUMERS THROUGH A WELL-DEFINED PROCESS

41

Property

owner

becomes

delinquent

Propel

contacts

consumers

Consumers

respond to

outreach

Propel pays

county taxes

Consumer

repays tax

lien transfer

to Propel

•

Delinquent Tax

Roll (DTR)

created on

February 1

st

•

48% statutory

penalty fee

timeline begins

•

The DTR is

released by

the counties

•

Direct mail

marketing

campaigns

begin

•

Property

owners contact

Propel and

apply for tax

lien transfers

•

Propel

negotiates an

appropriate

repayment plan

•

Propel pays

delinquent

county taxes

•

County

records and

transfers tax

lien rights to

Propel

•

Consumer

makes monthly

payments to

Propel

•

Propel services

the accounts

directly |

PROPRIETARY

OUR PRODUCT CREATES BENEFITS FOR ALL CONSTITUENTS

42

•

Stop the accruing

of penalties

•

Get time to repay

their obligation

•

Avoid foreclosure

•

Obtain peace of

mind

Property

owners

•

Collect otherwise

delayed revenue

•

More funds become

available for

essential services

like schools and

hospitals

•

Maintain positive

relationships with

constituents

Tax

authorities

•

Preserve equity

values

•

Avoid costly

foreclosure

proceedings and

potential REOs

Secured

lenders |

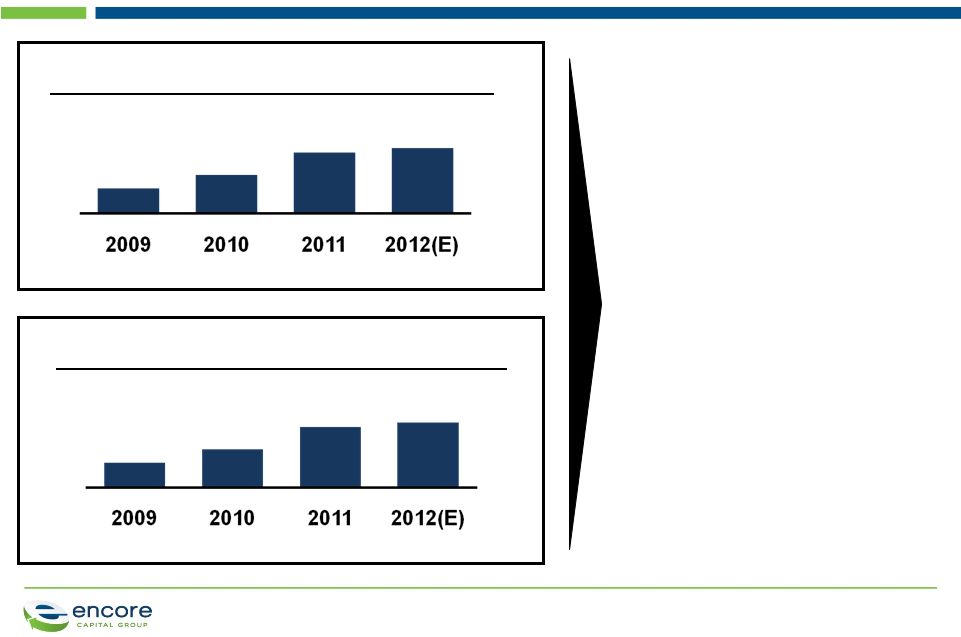

PROPRIETARY

WHICH HAS ALLOWED US TO GROW OUR PORTFOLIO WHILE

MAINTAINING AN EXCEPTIONALLY LOW RISK PROFILE

43

Propel originations

($M)

18

35

53

68

CAGR

55%

Propel portfolio size

($M)

26

72

99

121

CAGR

67%

•

$6,000 average balance

•

7-year term

•

3.5-year weighted average life

•

13-14% typical interest rate

Residential portfolio characteristics

•

$180,000 average property value

•

4% average LTV

•

0.3% foreclosure rate

•

Zero losses

2008

2009

2010

2011

2008

2009

2010

2011 |

PROPRIETARY

THE COMPETITIVE LANDSCAPE IS FAVORABLE AND THE TEXAS

MARKET IS LARGE AND RELATIVELY UNTAPPED

44

Unserved

market

Funded

tax liens

Propel Financial

Services

Largest

competitor

2

nd

largest

competitor

All other

competitors

82

18

2011 market penetration

(%)

Propel market share

(Originations, %)

37

16

10

37 |

PROPRIETARY

WE WILL LEVERAGE SOME OF ENCORE’S CORE COMPETENCIES

TO DRIVE GROWTH

45

Leveraging Encore’s industry-leading

consumer analytics will strengthen our ability

to underwrite and provide service to our

customers

Consumer

analytics

Applying Encore’s in-depth marketing

analytics will improve ROI on direct mail

campaigns

Direct mail

marketing

Encore’s robust call center operations will

allow us to provide broader inbound and

outbound customer acquisition and support

services

Customer

support |

PROPRIETARY

WE PLAN TO EXPAND IN OUR CORE MARKET AND INTO OTHER

STATES

46

Working to penetrate

the 80% of the Texas

market that has yet

to use a tax lien

transfer

Existing

market

Lobbying to introduce

legislation in other

states that will create

new markets

New

markets

Exploring alternative

tax lien models that

will allow us to

expand into new

markets

New

opportunities |

PROPRIETARY

SUMMARY AND CONCLUSION

Brandon Black

President and Chief Executive Officer

47 |

PROPRIETARY

ON A NORMALIZED BASIS, WE EXPECT TO DEPLOY NEARLY $500

MILLION THIS YEAR

48

2012 purchasing outlook

($M)

2012 normalized capital deployment

($M)

Encore core

business

Propel

410

90

500

130

240

55

75

Q1

Q2

Q3

Q4 |

PROPRIETARY

49

ENCORE’S LONG-TERM PROSPECTS CONTINUE TO BE STRONG AND

ARE GAINING STRENGTH

•

Operating results continue to be strong and are exceeding

our internal projections

•

Acquisition of the market leader in tax lien transfer business

provides flexibility for future purchase needs

•

Working collaboratively with legislators and policymakers to

shape the future of the collection industry

•

Significant purchases in the second quarter will drive

growth throughout 2012 and into 2013 |

PROPRIETARY

ENDNOTE

†

The Company has included information concerning Adjusted EBITDA because

management utilizes this information in the evaluation of its operations and

believes that this measure is a useful indicator of the Company's ability

to generate cash collections in excess of operating expenses through the

liquidation of its receivable portfolios.

Adjusted EBITDA has not been prepared

in accordance with generally accepted accounting principles (GAAP). The

Company has included a reconciliation of Adjusted EBITDA to reported

earnings under GAAP, in the financial tables included in the Appendix, and in

the Company’s Form 8-K filed today.

50 |

PROPRIETARY

51

APPENDIX |

PROPRIETARY

52

RECONCILIATION OF ADJUSTED EBITDA

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note:

The

periods

3/31/07

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20

3/31/07

6/30/07

9/30/07

12/31/07

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

GAAP net income, as reported

4,991

(1,515)

4,568

4,187

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

Interest expense

4,042

4,506

4,840

5,260

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

Contingent interest expense

3,235

888

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

11,733

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

3,437

(1,031)

1,315

2,777

4,509

4,225

2,408

(1,442)

5,973

4,166

5,948

4,609

Depreciation and amortization

869

840

833

810

722

766

674

652

623

620

652

697

Amount applied to principal on receivable portfolios

28,259

29,452

26,114

29,498

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

Stock-based compensation expense

801

1,204

1,281

1,001

1,094

1,228

860

382

1,080

994

1,261

1,049

Impairment charge for goodwill and identifiable

intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

Acquisition related expense

-

-

-

-

-

-

-

-

-

-

-

-

Adjusted EBITDA

45,634

46,077

38,951

43,533

58,488

52,997

47,250

49,262

63,797

64,682

70,023

66,103

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

GAAP net income, as reported

10,861

11,730

12,290

14,171

13,679

14,775

15,370

17,134

11,406

Interest expense

4,538

4,880

4,928

5,003

5,593

5,369

5,175

4,979

5,515

Contingent interest expense

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

-

-

-

-

-

-

-

-

Provision for income taxes

6,490

6,749

6,632

9,075

8,601

9,486

9,868

10,351

7,344

Depreciation and amortization

673

752

816

958

1,053

1,105

1,194

1,309

1,363

Amount applied to principal on receivable portfolios

58,265

64,901

63,507

53,427

85,709

83,939

73,187

69,462

104,603

Stock-based compensation expense

1,761

1,446

1,549

1,254

1,765

1,810

2,405

1,729

2,266

Impairment charge for goodwill and identifiable

intangible assets

-

-

-

-

-

-

-

-

10,349

Acquisition related expense

-

-

-

-

-

-

-

-

489

Adjusted EBITDA

82,588

90,458

89,722

83,888

116,400

116,484

107,199

104,964

143,335

|