Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - API Technologies Corp. | d356001d8k.htm |

| EX-3.2 - CERTIFICATE OF DESIGNATION - API Technologies Corp. | d356001dex32.htm |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

API TECHNOLOGIES CORP.

API Technologies Corp. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware, does hereby certify:

FIRST: The Board of Directors of the Corporation has duly adopted a resolution pursuant to Section 242 of the General Corporation Law of the State of Delaware setting forth a proposed amendment to the Certificate of Incorporation of the Corporation and declaring said amendment to be advisable. The requisite stockholders of the Corporation have duly approved said proposed amendment in accordance with Section 242 of the General Corporation Law of the State of Delaware.

SECOND: That upon the effectiveness of this Certificate of Amendment, Article FOURTH is hereby amended and restated in its entirety such that, as amended, said Article shall read in its entirety as follows:

Section 4.A. The total number of shares of stock which the Corporation shall have authority to issue is Two Hundred Sixty Million One (260,000,001). The total number of shares of Common Stock which the Corporation shall have authority to issue is Two Hundred Fifty Million (250,000,000) shares, with a par value of $0.001 per share. The total number of shares of Special Voting Stock which the Corporation shall have the authority to issue is One (1) share, with a par value of $0.01 per share. The total number of shares of undesignated preferred stock which the Corporation shall have the authority to issue is Ten Million (10,000,000) shares, with a par value of $0.001 per share.

Section 4.B. Special Voting Share. The powers, preferences, rights, qualifications, limitations and restrictions of the Special Voting Stock are as follows:

1. DIVIDENDS. Neither the holder nor, if different, the owner of the Special Voting Share shall be entitled to receive dividends in its capacity as holder or owner thereof.

2. VOTING RIGHTS. Subject to paragraph 6 hereof, the holder of record of the Special Voting Share shall be entitled to all of the voting rights, including the right to vote in person or by proxy, of the Special Voting Share on any matters, questions, proposals or propositions whatsoever that may properly come before the shareholders of the Corporation at a meeting of the shareholders or in connection with a consent of the shareholders.

3. LIQUIDATION PREFERENCE. Upon any voluntary or involuntary liquidation, dissolution or winding-up of the Corporation, the holder of the Special Voting Share shall be entitled to receive out of the assets of the Corporation available for distribution to the shareholders, an amount equal to $0.01 before any distribution is made on the common stock of the Corporation or any other stock ranking junior to the Special Voting Share as to distribution of assets upon liquidation, dissolution or winding-up.

4. RANKING. The Special Voting Share shall, with respect to rights on liquidation, winding up and dissolution, rank (i) senior to all classes of common stock of the Corporation and (ii) junior to any other class or series of capital stock of the Corporation.

5. REDEMPTION. The Special Voting Share shall not be subject to redemption, except that at such time as no exchangeable shares (“Exchangeable Shares”) of API Nanotronics Sub, Inc. (other than Exchangeable Shares owned by the Corporation and its affiliates) shall be outstanding, and no shares of stock, debt, options or other agreements which could give rise to the issuance of any Exchangeable Shares to any person (other than the Corporation and its affiliates) shall exist, the Special Voting Share shall automatically be redeemed and canceled, for an amount equal to $0.01 per share due and payable upon such redemption. Upon any such redemption or other purchase or acquisition of the Special Voting Share by the Corporation, the Special Voting Share shall be deemed retired and may not be reissued.

6. OTHER PROVISIONS. Pursuant to the terms of the certain Voting and Exchange Trust Agreement dated November 6, 2006 by and between the Corporation, API Nanotronics Sub, Inc., the Corporation and Equity Transfer & Trust Company, as such agreement may be amended, modified or supplemented from time to time (the “Trust Agreement”):

(a) During the term of the Trust Agreement, the Corporation may not, without the consent of the holders of the Exchangeable Shares (as defined in the Trust Agreement), issue any shares of its Special Voting Stock in addition to the Special Voting Share;

(b) the Special Voting Share entitles the holder of record to a number of votes at meetings of holders of common shares of the Corporation equal to the number of Exchangeable Shares outstanding from time to time (other than the Exchangeable Shares held by the Corporation and its affiliates);

(c) the Trustee (as defined in the Trust Agreement) shall exercise the votes held by the Special Voting Share pursuant to and in accordance with the Trust Agreement;

(d) the voting rights attached to the Special Voting Share shall terminate pursuant to and in accordance with the Trust Agreement; and

(e) the powers, designations, preferences and relative, participating, optional and other special rights, and the qualifications, limitations and restrictions of such Special Voting Share shall be otherwise provided in the Trust Agreement.

Section 4.C. Blank-Check Preferred Stock. The board of directors is hereby expressly authorized to provide, out of the unissued shares of preferred stock, for one or more series of preferred stock and, with respect to each such series, to fix the number of shares constituting such series and the designation of such series, the voting powers, if any, of the shares of such series, and the preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions thereof, of the shares of such series. The powers, preferences and relative, participating, optional and other special rights of each series of preferred stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding.

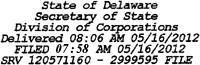

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment of Amended and Restated Certificate of Incorporation to be executed this 16th day of May, 2012.

| API TECHNOLOGIES CORP. | ||

| By: | /s/ Brian R. Kahn | |

| Name: | Brian R. Kahn | |

| Title: | Chief Executive Officer | |