Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - WABASH NATIONAL Corp | v313676_8k.htm |

WNC ANNUAL SHAREHOLDER MEETING May 17, 2012 Dick Giromini, President & CEO Wabash National Corporation

2 SAFE HARBOR STATEMENT This presentation will contain certain forward - looking statements, as defined by the Private Securities Litigation Reform Act of 1995 . These forward - looking statements are, however, subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward - looking statements . Without limitation, these risks and uncertainties include increased competition, dependence on new management, reliance on certain customers and corporate partnerships, shortages of raw materials, dependence on industry trends, access to capital, acceptance of new technology and products, and government regulation . Listeners should review and consider the various disclosures made by the Company in this presentation and in its reports to its stockholders and periodic reports on Forms 10-K and 10-Q . We cannot give assurance that the expectations reflected in our forward - looking statements will prove to be correct . Our actual results could differ materially from those anticipated in these forward - looking statements . All written and oral forward - looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations . © 2012 Wabash National, L.P. All rights reserved. Wabash®, Wabash National®, DuraPlate ®, DuraPlate HD®, ArcticLite®, DuraPlate AeroSkirt® , TrustLock Plus® and RoadRailer® are marks owned by Wabash National, L.P. Transcraft®, Eagle® and Benson® are marks owned by Transcraft Corporation.

3 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

4 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

5 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

6 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

7 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

8 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

9 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

10 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

11 CELEBRATING PAST, PRESENT AND FUTURE INNOVATION Ehrlich Innovation Center

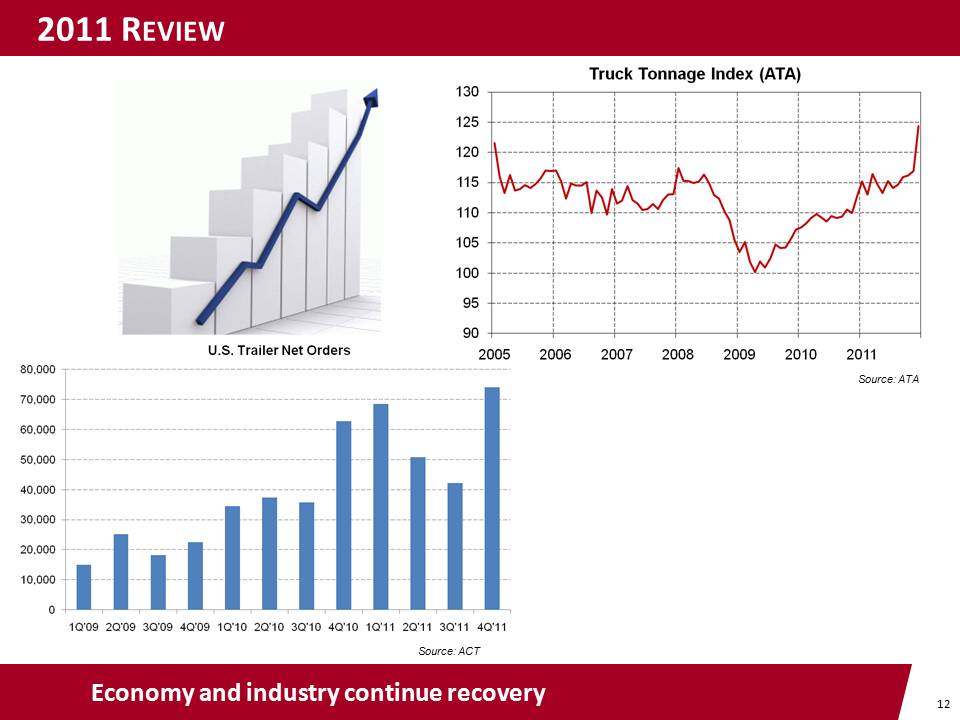

12 2011 REVIEW Economy and industry continue recovery Source: ATA Source: ACT

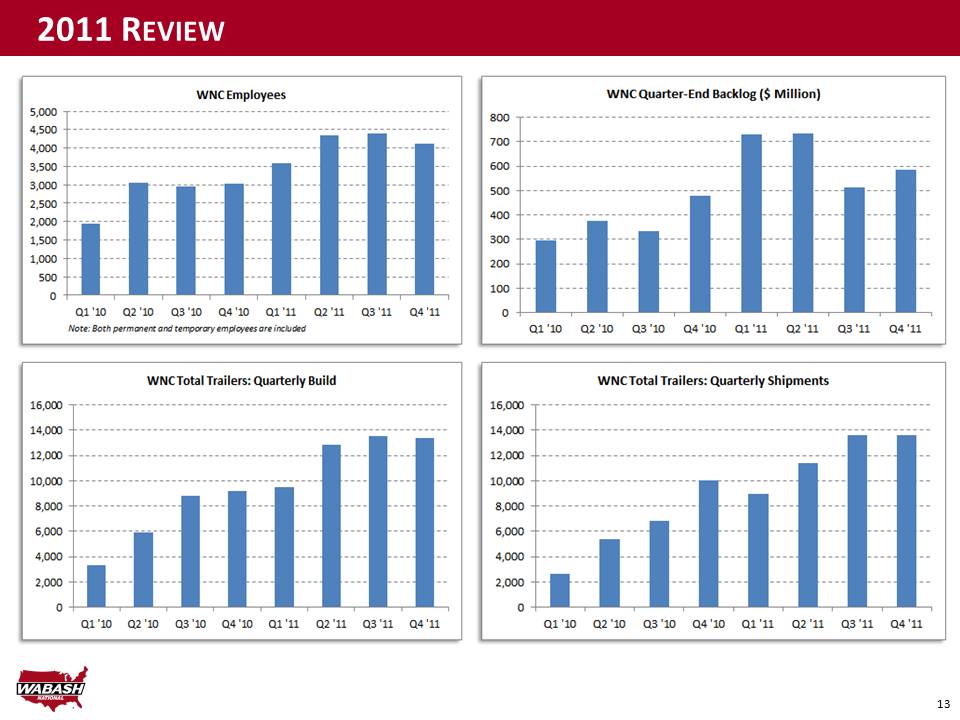

13 2011 REVIEW

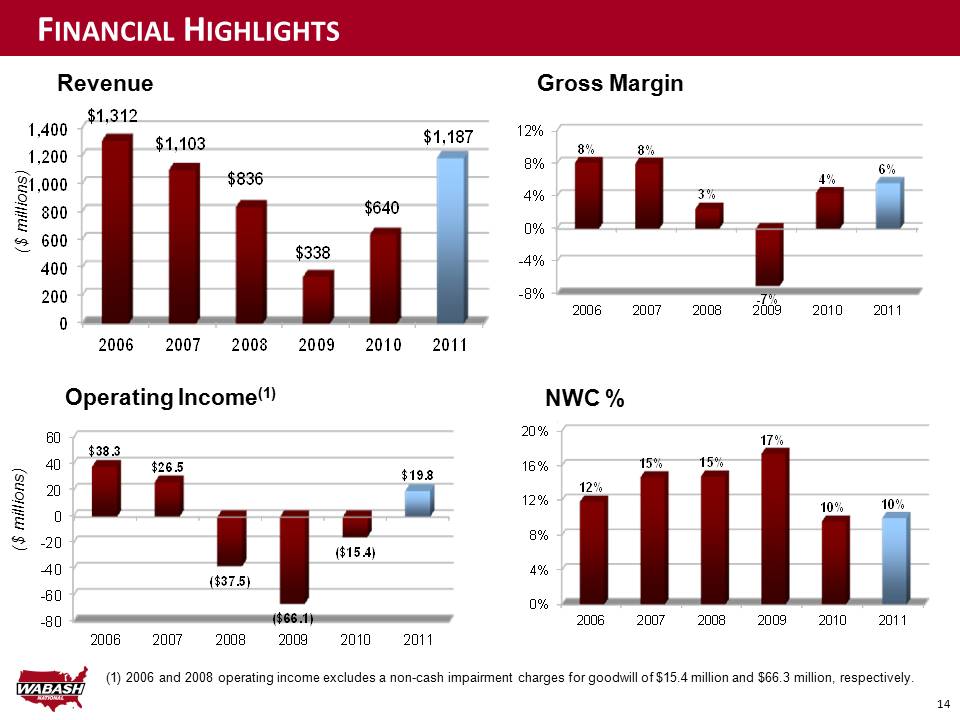

14 0 200 400 600 800 1,000 1,200 1,400 2006 2007 2008 2009 2010 2011 $1,312 $1,103 $836 $338 $640 $1,187 -8% -4% 0% 4% 8% 12% 2006 2007 2008 2009 2010 2011 8% 8% 3% - 7% 4% 6% 0% 4% 8% 12% 16% 20% 2006 2007 2008 2009 2010 2011 12% 15% 15% 17% 10% 10% Revenue ($ millions) Gross Margin (1 ) 2006 and 2008 operating income excludes a non - cash impairment charges for goodwill of $15.4 million and $66.3 million, respectively. Operating Income (1) ($ millions) FINANCIAL HIGHLIGHTS NWC % -80 -60 -40 -20 0 20 40 60 2006 2007 2008 2009 2010 2011 $38.3 $26.5 ($37.5) ($66.1) ($15.4) $19.8

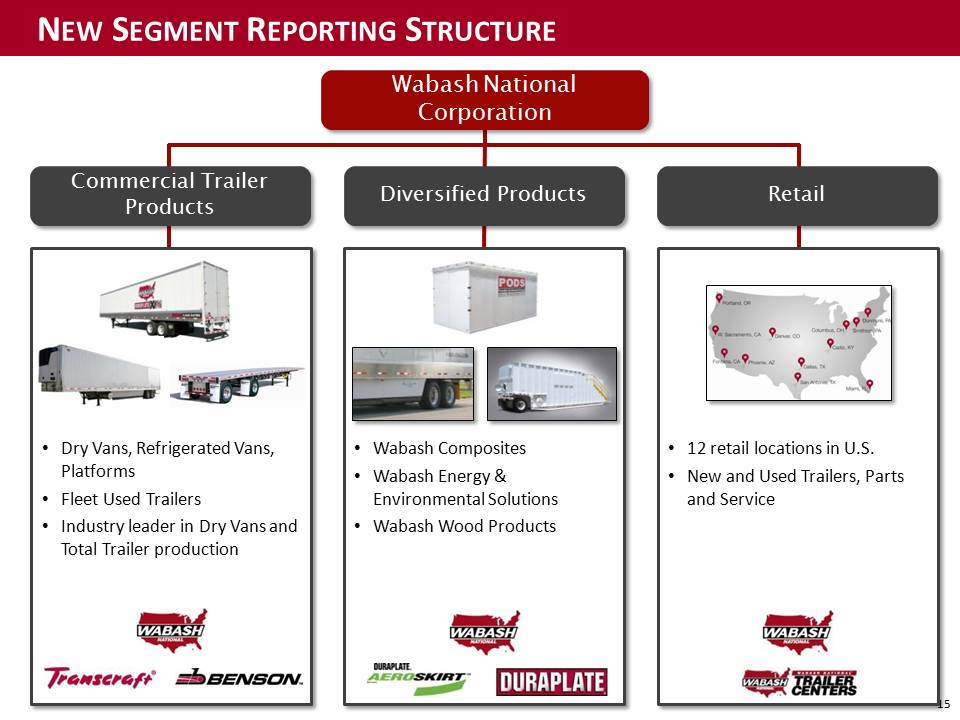

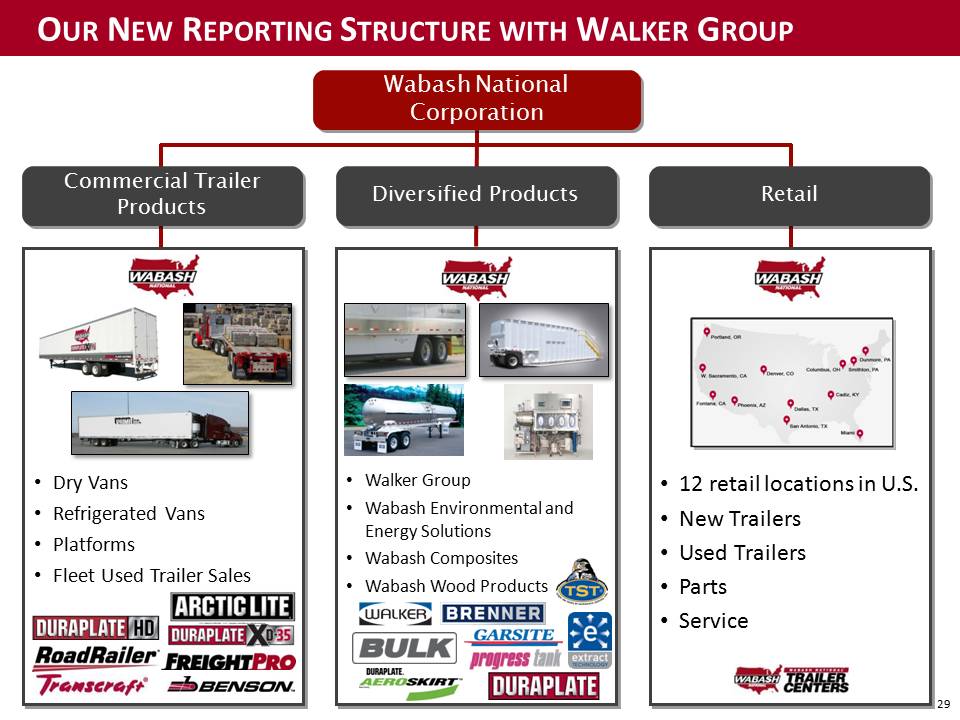

15 Commercial Trailer Products Wabash National Corporation Diversified Products Retail • Dry Vans, Refrigerated Vans, Platforms • Fleet Used Trailers • Industry leader in Dry Vans and Total Trailer production • Wabash Composites • Wabash Energy & Environmental Solutions • Wabash Wood Products • 12 retail locations in U.S. • New and Used Trailers, Parts and Service NEW SEGMENT REPORTING STRUCTURE

16 INNOVATION LEADS THE WAY TO DIVERSIFICATION Frac tanks DuraPlate ® XD - 35® ID/Stop Indicators: Brakes Applied DuraPlate ® AeroSkirt ® Tire Hauler

17 WABASH COMPOSITES : EXCEEDING EXPECTATIONS New product offerings constantly in development 2008 2009 2010 2011 2012 $10M $24M Revenue: Start Up $56M ~$70M+ Cargo Trailers Foldable Portable Storage Container Mobile Emergency Shelter Cargo Trailer

18 WABASH ENERGY & ENVIRONMENTAL SOLUTIONS Strategic entry into energy and environmental sectors Frac Tanks - $70 Million/5 - year Supply Agreement

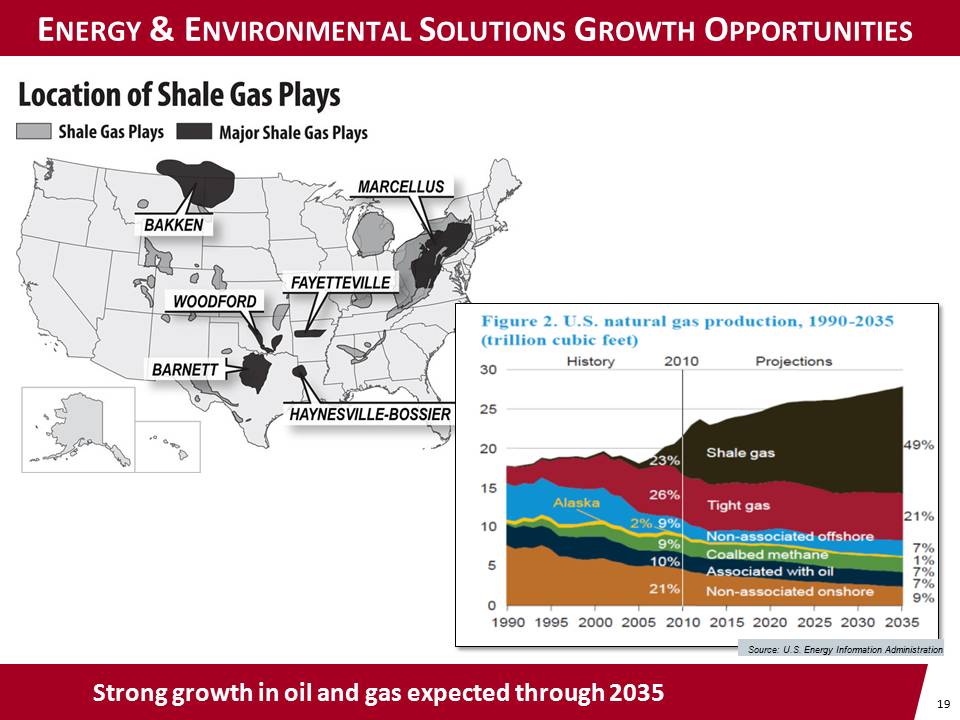

19 ENERGY & ENVIRONMENTAL SOLUTIONS GROWTH OPPORTUNITIES Strong growth in oil and gas expected through 2035 Source : U.S. Energy Information Administration

20 ENERGY & ENVIRONMENTAL SOLUTIONS GROWTH OPPORTUNITIES Leverage existing physical and intellectual assets for rapid launch Carbon Steel Vacuum Tanks • Strong demand environment • Leverages our core competencies in carbon steel fabrications

21 RETAIL : WABASH NATIONAL TRAILER CENTERS Increasing revenue streams WNTC Parts Store opened in 2011 Cadiz, KY Expanded mobile service

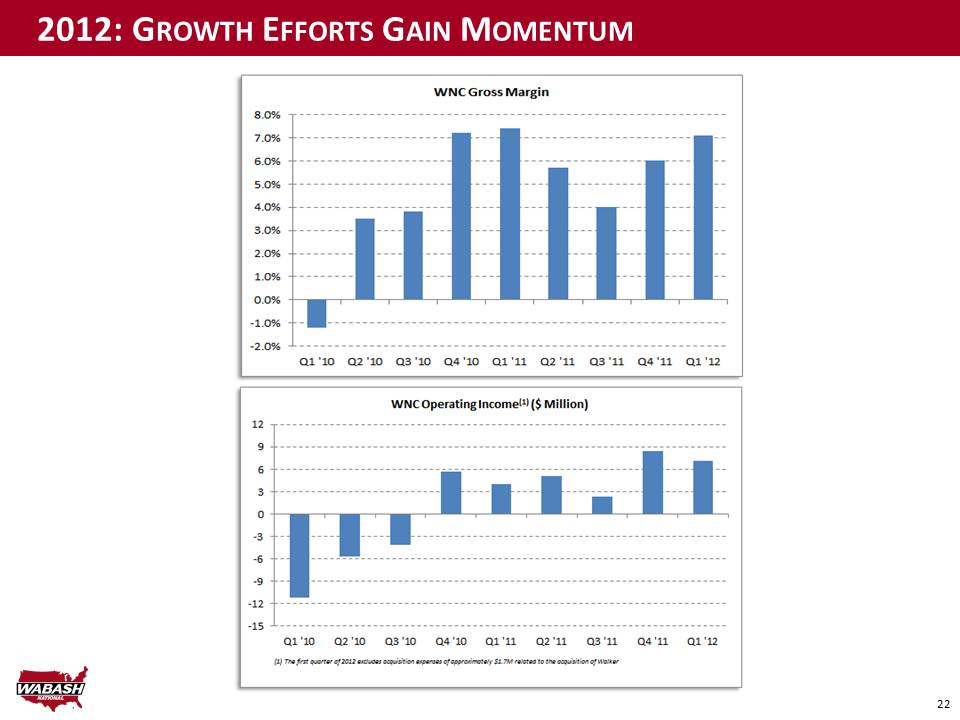

22 2012: GROWTH EFFORTS GAIN MOMENTUM

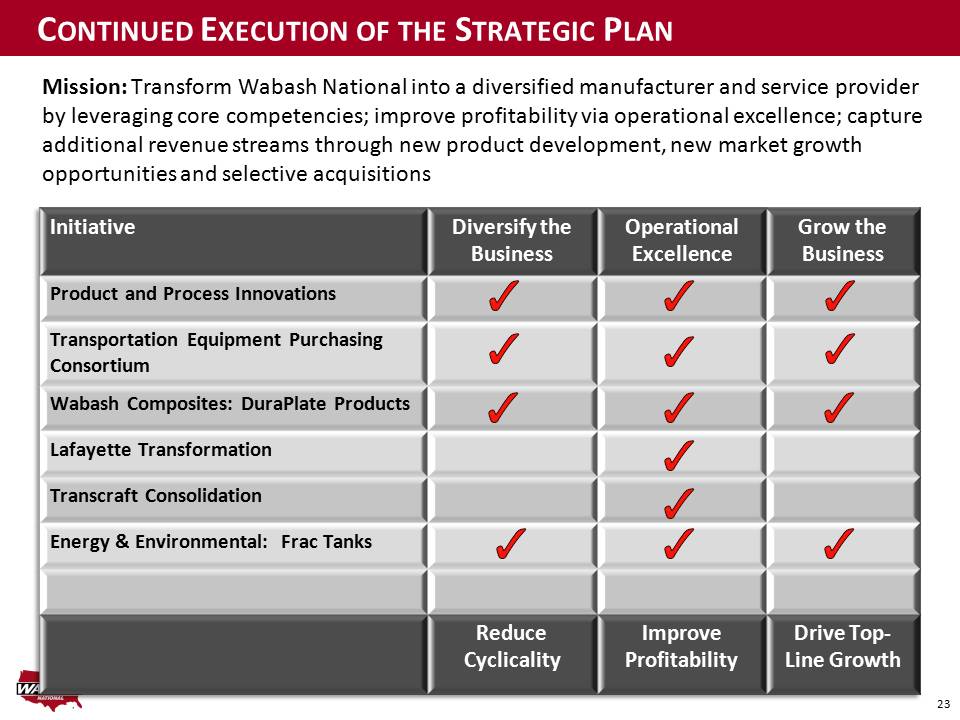

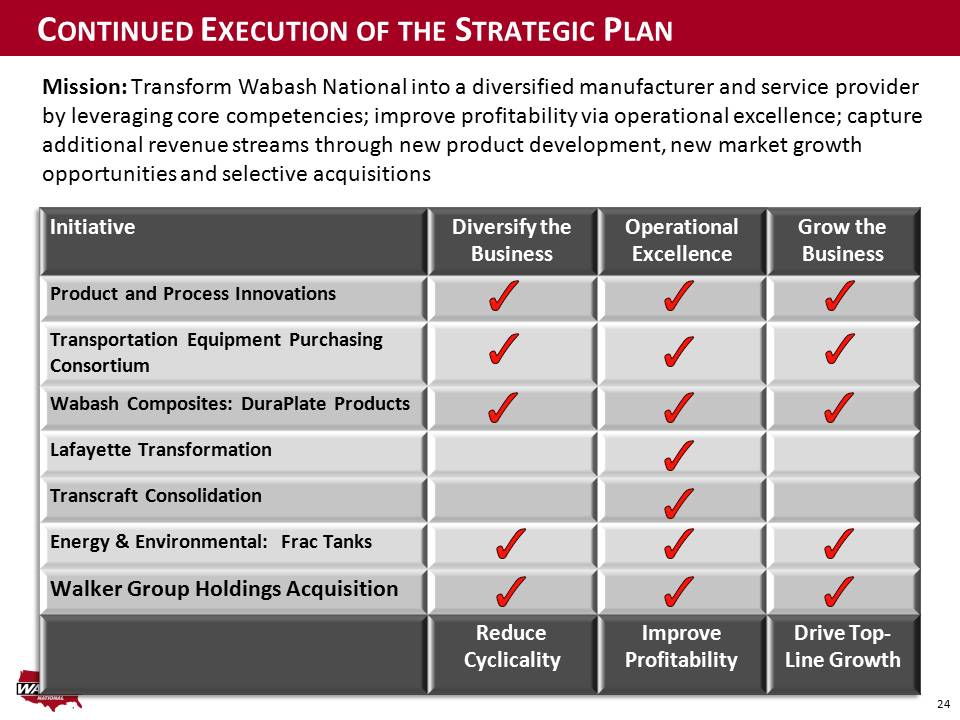

23 Mission: Transform Wabash National into a diversified manufacturer and service provider by leveraging core competencies; improve profitability via operational excellence; capture additional revenue streams through new product development, new market growth opportunities and selective acquisitions CONTINUED EXECUTION OF THE STRATEGIC PLAN Initiative Diversify the Business Operational Excellence Grow the Business Product and Process Innovations Transportation Equipment Purchasing Consortium Wabash Composites: DuraPlate Products Lafayette Transformation Transcraft Consolidation Energy & Environmental: Frac Tanks Reduce Cyclicality Improve Profitability Drive Top - Line Growth

24 Mission: Transform Wabash National into a diversified manufacturer and service provider by leveraging core competencies; improve profitability via operational excellence; capture additional revenue streams through new product development, new market growth opportunities and selective acquisitions CONTINUED EXECUTION OF THE STRATEGIC PLAN Initiative Diversify the Business Operational Excellence Grow the Business Product and Process Innovations Transportation Equipment Purchasing Consortium Wabash Composites: DuraPlate Products Lafayette Transformation Transcraft Consolidation Energy & Environmental: Frac Tanks Walker Group Holdings Acquisition Reduce Cyclicality Improve Profitability Drive Top - Line Growth

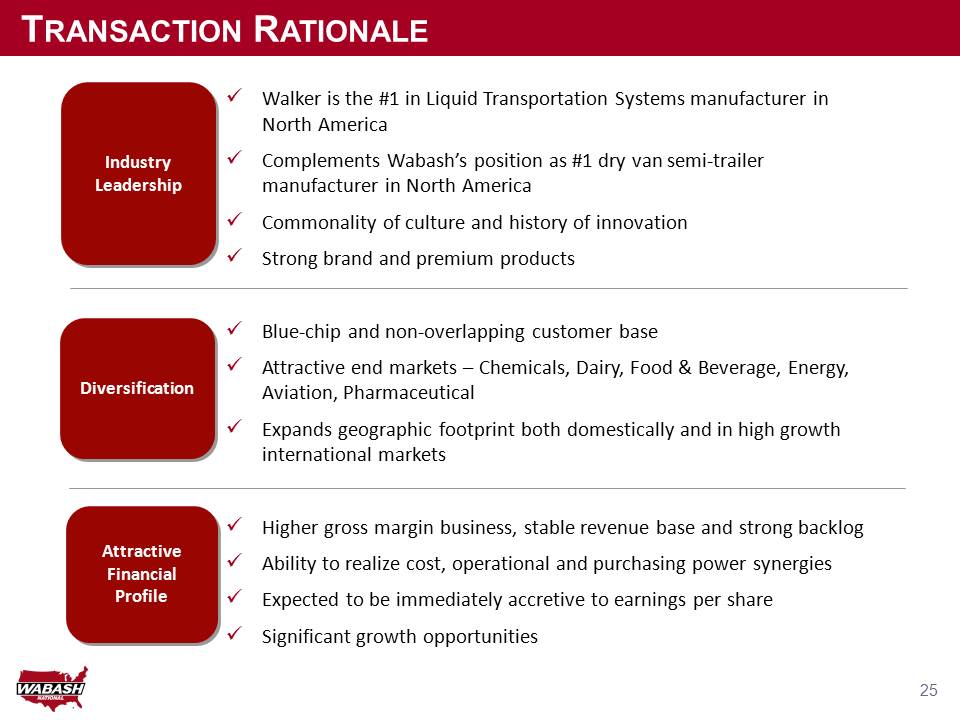

25 TRANSACTION RATIONALE x Walker is the #1 in Liquid Transportation Systems manufacturer in North America x Complements Wabash’s position as #1 dry van semi - trailer manufacturer in North America x Commonality of culture and history of innovation x Strong brand and premium products x Blue - chip and non - overlapping customer base x Attractive end markets – Chemicals, Dairy, Food & Beverage, Energy, Aviation, Pharmaceutical x Expands geographic footprint both domestically and in high growth international markets x Higher gross margin business, stable revenue base and strong backlog x Ability to realize cost, operational and purchasing power synergies x Expected to be immediately accretive to earnings per share x Significant growth opportunities Industry Leadership Diversification Attractive Financial Profile

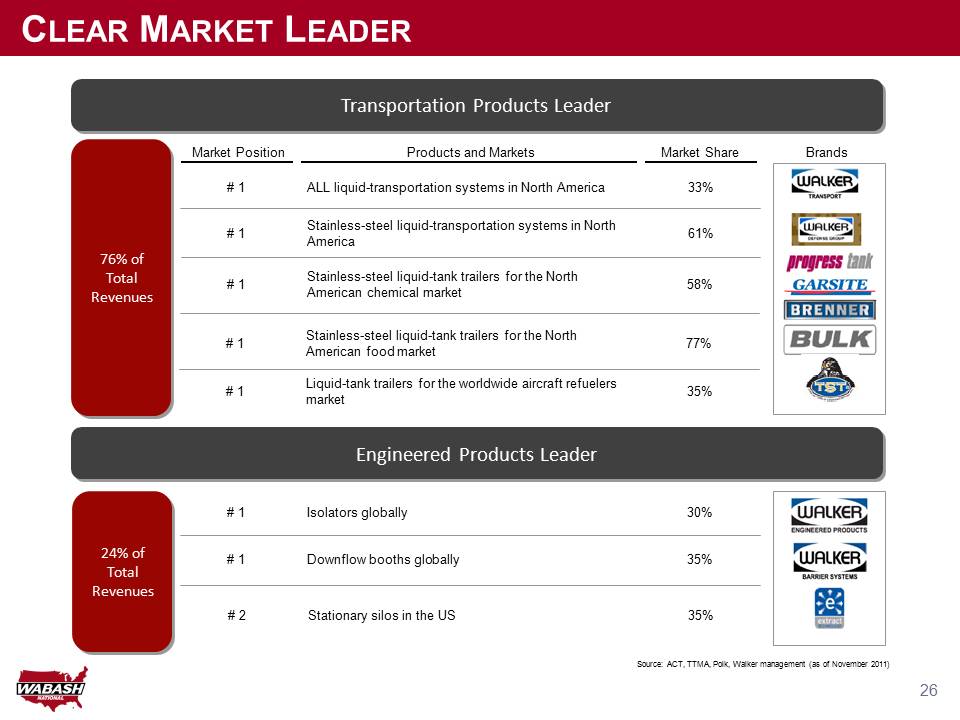

26 CLEAR MARKET LEADER Market Position Products and Markets Market Share Brands # 1 ALL liquid - transportation systems in North America 33% # 1 Stainless - steel liquid - transportation systems in North America 61% # 1 Stainless - steel liquid - tank trailers for the North American chemical market 58% # 1 Stainless - steel liquid - tank trailers for the North American food market 77% # 1 Liquid - tank trailers for the worldwide aircraft refuelers market 35% # 1 Isolators globally 30% # 1 Downflow booths globally 35% # 2 Stationary silos in the US 35% Source: ACT, TTMA, Polk, Walker management (as of November 2011) Transportation Products Leader Engineered Products Leader 76% of Total Revenues 24% of Total Revenues

27 WALKER : STRONG, DIVERSE PRODUCT PORTFOLIO Stainless - Steel Dairy Trailer Refined Petroleum Truck 7,000 Gallon Refueler Towable Hydrant Dispenser Liquid Tank Trailers Truck - Mounted Tanks Aviation Refuelers Carts and Hydrant Dispensers ENGINEERED PRODUCTS Stainless - Steel Vertical Silos WEP Processor Pharmair Containment Booth Vertical Silos and Horizontal Storage Tanks Processors and Mixers Downflow Booths and Containment Facilities TRANSPORTATION PRODUCTS Isolators Tray Dryer Isolator

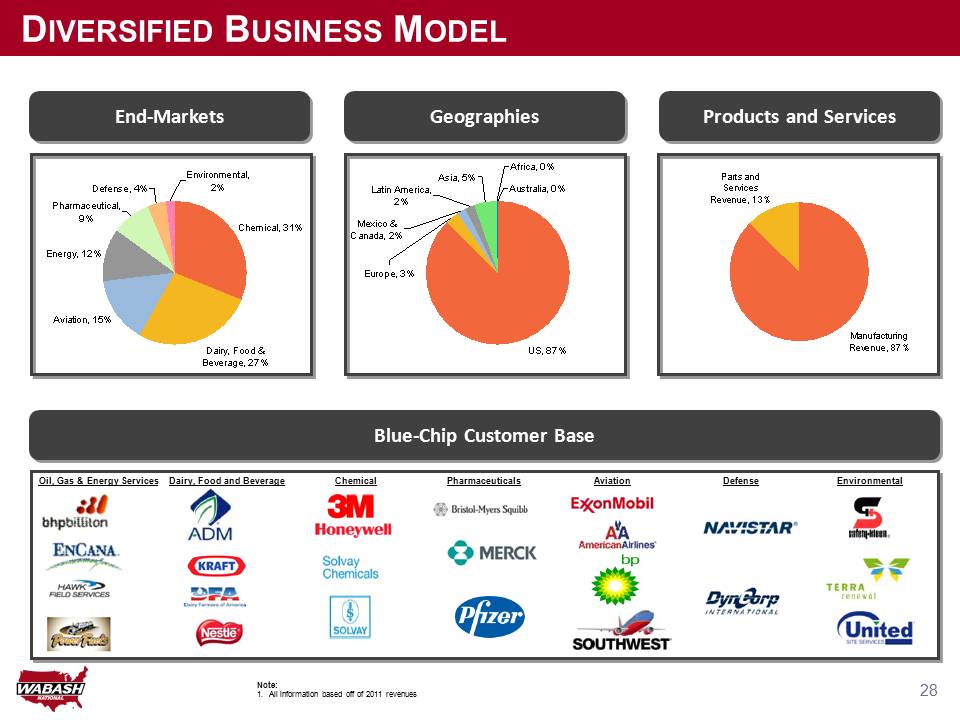

28 DIVERSIFIED BUSINESS MODEL End - Markets Geographies Products and Services Blue - Chip Customer Base Oil, Gas & Energy Services Dairy, Food and Beverage Chemical Pharmaceuticals Aviation Defense Environmental Note: 1. All information based off of 2011 revenues US, 87% Australia, 0% Asia, 5% Africa, 0% Latin America, 2% Mexico & Canada, 2% Europe, 3% Parts and Services Revenue, 13% Manufacturing Revenue, 87% Chemical, 31% Dairy, Food & Beverage, 27% Aviation, 15% Energy, 12% Pharmaceutical, 9% Defense, 4% Environmental, 2%

29 Commercial Trailer Products Wabash National Corporation Diversified Products Retail • Dry Vans • Refrigerated Vans • Platforms • Fleet Used Trailer Sales • Walker Group • Wabash Environmental and Energy Solutions • Wabash Composites • Wabash Wood Products • 12 retail locations in U.S. • New Trailers • Used Trailers • Parts • Service OUR NEW REPORTING STRUCTURE WITH WALKER GROUP

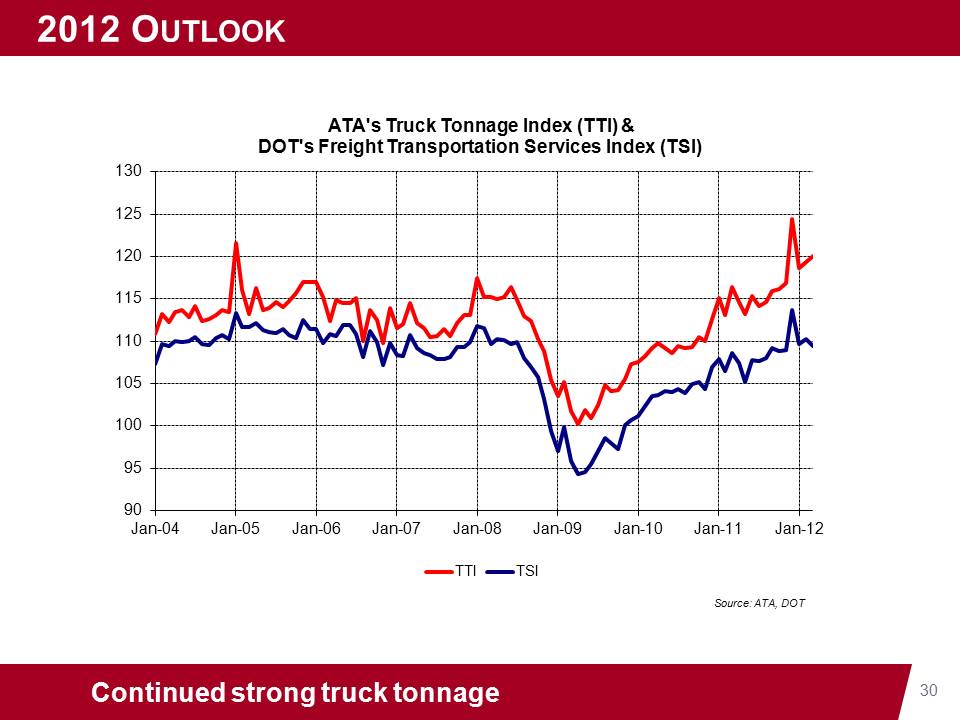

30 2012 OUTLOOK Continued strong truck tonnage Source: ATA, DOT 90 95 100 105 110 115 120 125 130 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 ATA's Truck Tonnage Index (TTI) & DOT's Freight Transportation Services Index (TSI) TTI TSI

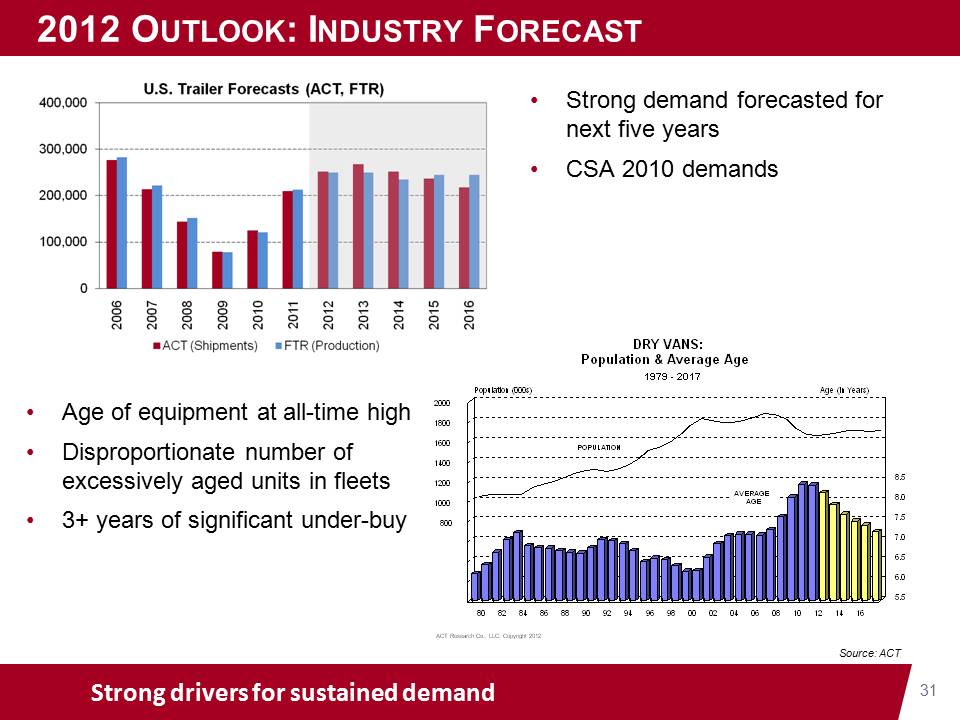

31 2012 OUTLOOK : INDUSTRY FORECAST Strong drivers for sustained demand Source: ACT DRY VANS: Population & Average Age 1979 - 2017 ACT Research Co., LLC: Copyright 2012 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 0 200 400 600 800 1000 1200 1400 1600 1800 2000 Population (000s) 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 Age (in Years) POPULATION AVERAGE AGE • Strong demand forecasted for next five years • CSA 2010 demands • Age of equipment at all - time high • Disproportionate number of excessively aged units in fleets • 3+ years of significant under - buy

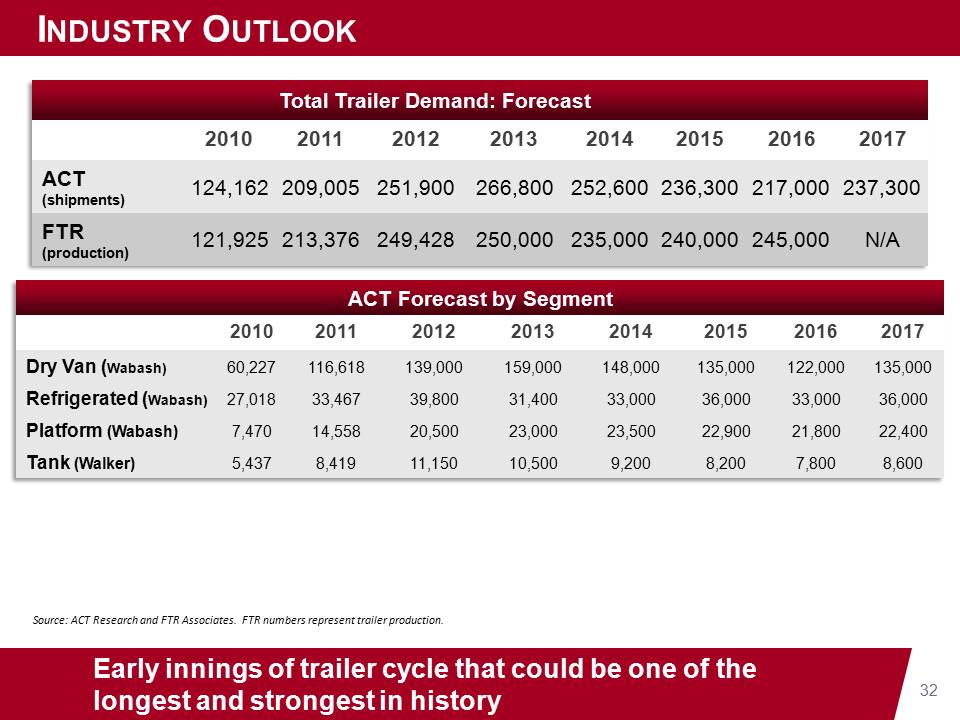

32 INDUSTRY OUTLOOK Early innings of trailer cycle that could be one of the longest and strongest in history Source: ACT Research and FTR Associates. FTR numbers represent trailer production . ACT Forecast by Segment 2010 2011 2012 2013 2014 2015 2016 2017 Dry Van (Wabash) 60,227 116,618 139,000 159,000 148,000 135,000 122,000 135,000 Refrigerated (Wabash) 27,018 33,467 39,800 31,400 33,000 36,000 33,000 36,000 Platform (Wabash) 7,470 14,558 20,500 23,000 23,500 22,900 21,800 22,400 Tank (Walker) 5,437 8,419 11,150 10,500 9,200 8,200 7,800 8,600 Total Trailer Demand: Forecast 2010 2011 2012 2013 2014 2015 2016 2017 ACT (shipments) 124,162 209,005 251,900 266,800 252,600 236,300 217,000 237,300 FTR (production) 121,925 213,376 249,428 250,000 235,000 240,000 245,000 N/A

33 2012 AND BEYOND : EXECUTING ON STRATEGIC INITIATIVES • Favorable Demand Environment • Strong demand and volume in truck trailer and tank industries • Energy sector projects long - term strength • Focus on Execution and Results • Continue to create customer - driven innovation that transforms the transportation industry • Continue our organic and strategic diversification efforts • Demonstrated commitment to operational excellence exhibited through ISO 9001:2008 registration Poised to deliver superior performance