Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ALLIANCE FINANCIAL CORP /NY/ | d354360d8k.htm |

Exhibit 99.1 |

Forward Looking

Statements This

presentation

contains

certain

“forward-looking

statements”

(within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995)

with

respect

to

the

financial

conditions,

results

of

operations

and

business

of

Alliance.

The

words

“may,”

“could,”

“should,”

“would,”

“believe,”

“anticipate,”

“estimate,”

“expect,”

“intend,”

“plan”

and similar expressions are intended to identify forward-looking

statements. These forward-looking statements involve certain risks

and uncertainties. Factors that may cause actual results to differ materially from those contemplated by such

forward-looking statements include, among others, the following:

changes in the interest rate environment that reduce margins;

changes in the regulatory environment;

the highly competitive industry and market area in which we operate;

general economic conditions, either nationally or regionally, resulting in, among

other things, a deterioration in credit quality; changes in business

conditions and inflation; changes in credit market conditions;

changes in technology used in the banking business;

the

soundness

of

other

financial

services

institutions

which

may

adversely

affect

our

credit

risk;

certain of our intangible assets may become impaired in the future;

our controls and procedures may fail or be circumvented;

new line of business or new products and services which may subject us to

additional risks; changes in key management personnel which may adversely

impact our operations; the effect on our operations of recent legislative

and regulatory initiatives that were or may be enacted in response to the ongoing

financial crisis;

other factors detailed from time to time in our Securities and Exchange Commission

filings Although we believe that the expectations reflected in such

forward-looking statements are reasonable, actual results may differ materially from the

results discussed in these forward-looking statements. You are cautioned

not to place undue reliance on these forward-looking statements, which

speak only as of the date hereof. We do not undertake any obligation to

republish revised forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence

of unanticipated events. |

Events of

2011 Alliance Bank produced Fifth Consecutive Year of

Record Performance

•

We continued to differentiate ourselves:

•

Provided excellent customer service to our clients

•

$107 million in Residential Mortgage Closings

•

Supported local companies with our “willingness to lend”

attitude

•

$75.9 million in Commercial loan originations in 2011

•

$856.6

million

in

overall

loan

originations

over

the

last

three

years |

2011

Highlights •

2011 FDIC deposit market share numbers for the Syracuse MSA

(Metropolitan

Statistical

Area),

which

include

Onondaga,

Madison

and

Oswego Counties: Alliance Bank has maintained its #4 position, topping

Bank

of

America

and

JP

Morgan

Chase.

In

the

top

four

we

join

M&T

(#1),

KeyBank (#2) and HSBC (#3). In the Cortland Micro market, where we

remain #1, we maintained our market share of 40%.

•

Alliance Financial Corporation was once again recognized by investment

bank and financial services specialist Keefe, Bruyette & Woods (KBW) on

its Bank Honor Roll. Alliance was one of only 40 banking institutions

recognized

nationwide

for

this

distinction;

banks

must

have

over

$500

million in assets to be eligible.

•

Alliance Financial Corporation repeated as one of the Top 200 Performing

Community Banks in the Country

–

2012 ranking #113 (U.S. Banker Magazine, May 2012)

–

2011 ranking #123 (U.S. Banker Magazine, June 2011)

–

2010 ranking #189 (U.S. Banker Magazine, August 2010)

|

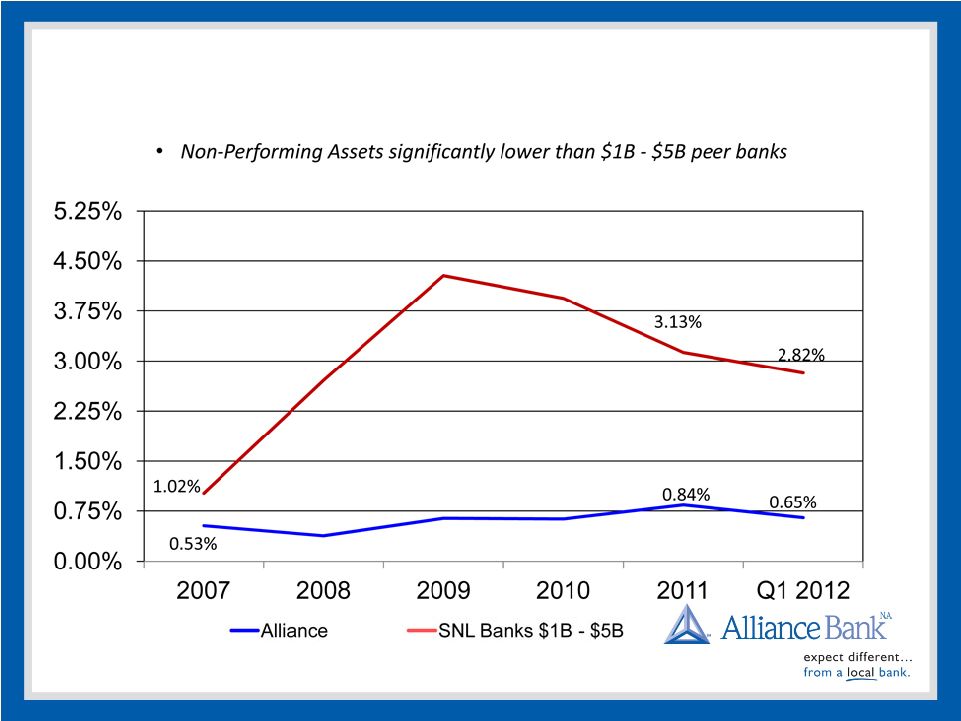

Performance of

Major Lines of Business Commercial Banking

•

$31 million of new commitments to new and existing customers in the Fourth Quarter of 2011

•

Our investment in people is generating returns

•

Credit Quality metrics compare very favorably to northeast peers

•

Our Cash Management products provide a competitive advantage

Retail Banking

•

Branches operating efficiently and providing a high level of customer service

•

Product Sales based on our customers’

needs not our assigned goals

•

Indirect Auto continues to be strategically important

•

In the last two months, closed in excess of $30 million in loans

•

Credit Quality in our Retail Loan Portfolio continues to be excellent

Investment Management

•

Assets under Management: $828 million at year-end 2011, $873 million as of 4/30/12

•

In spite of volatile markets, a significant profit contributor

•

Efforts continue to grow this business organically and via acquisition

|

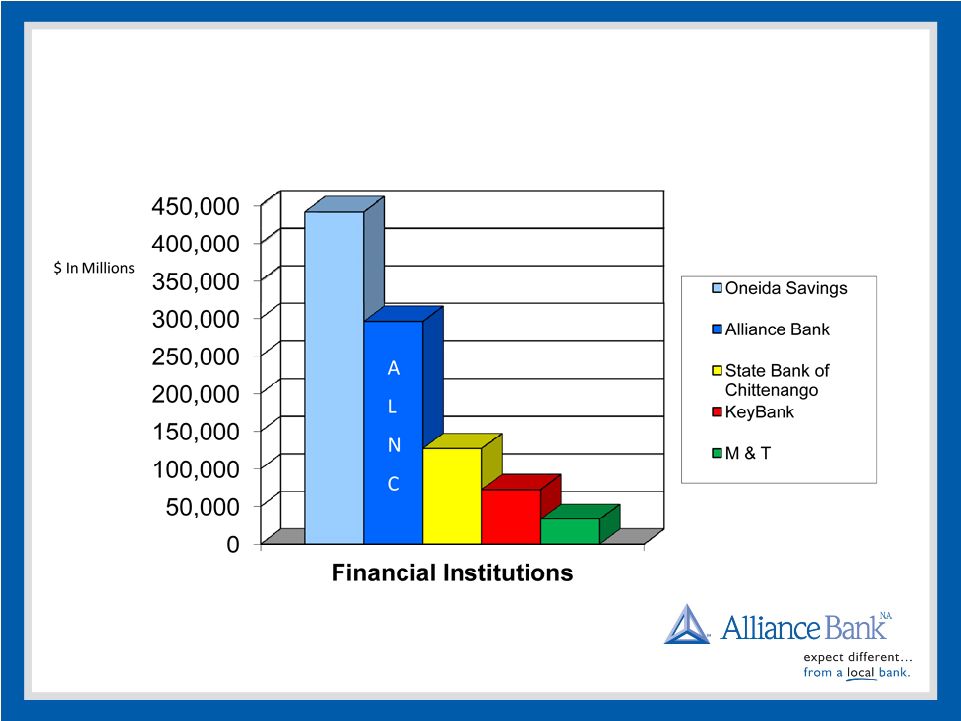

Deposit

Leadership |

Cortland

County A

L

N

C

ALNC= 40.93% of Deposit Market Share

FDIC Deposit Market Share Report (June 30, 2011) |

Madison

County A

L

N

C

ALNC=

28.66%

of

Deposit

Market

Share

FDIC Deposit Market Share Report (June 30, 2011) |

Syracuse

MSA A

L

N

C

ALNC= 7.87% of Deposit Market Share

FDIC Deposit Market Share Report (June 30, 2011) |

Oswego

County ALNC= 12.89% of Deposit Market Share

A

L

N

C

FDIC Deposit Market Share Report (June 30, 2011) |

Residential

Mortgages •

Sustained leadership share in Cortland and Madison Counties

•

Largest market share of any local bank headquartered in

Onondaga County

•

From January 2012 through April 2012, closed 320 residential

mortgages totaling approximately $45 million

•

72% were re-finances

–

Of which 62% were existing ALNC mortgages

•

28% new purchases |

A

L

N

C

2011 Onondaga County Residential Mortgage Filings

As of December 31, 2011 Onondaga County Clerk’s Office data

reported by Independent Title Agency |

J. Daniel

Mohr Chief Financial Officer

Alliance Financial Corporation |

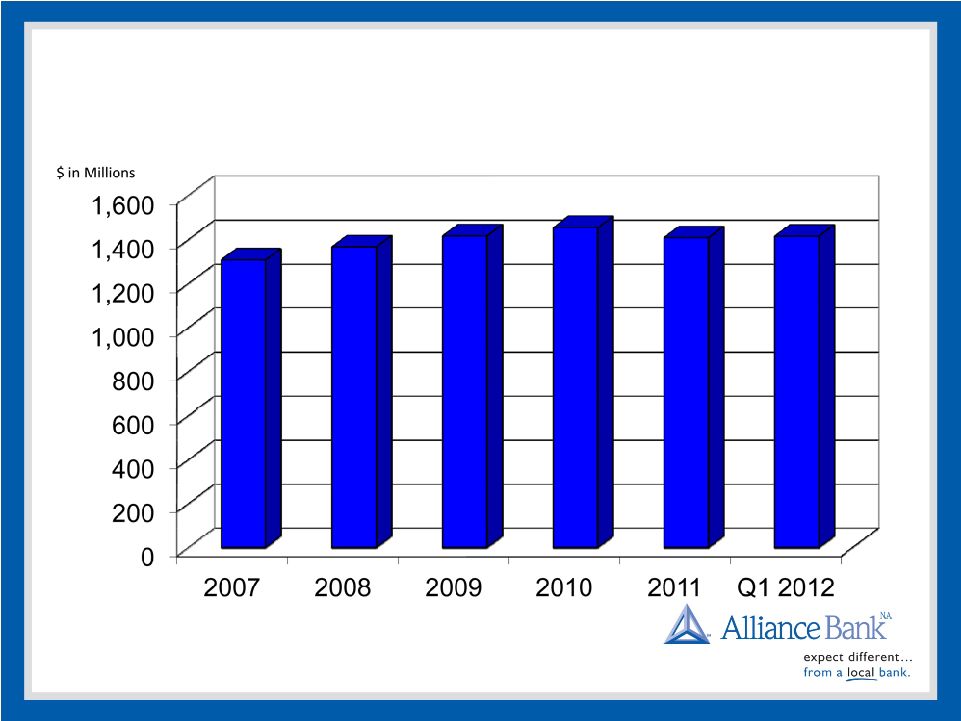

Assets

•

Navigating low interest rate environment through prudent balance

sheet management |

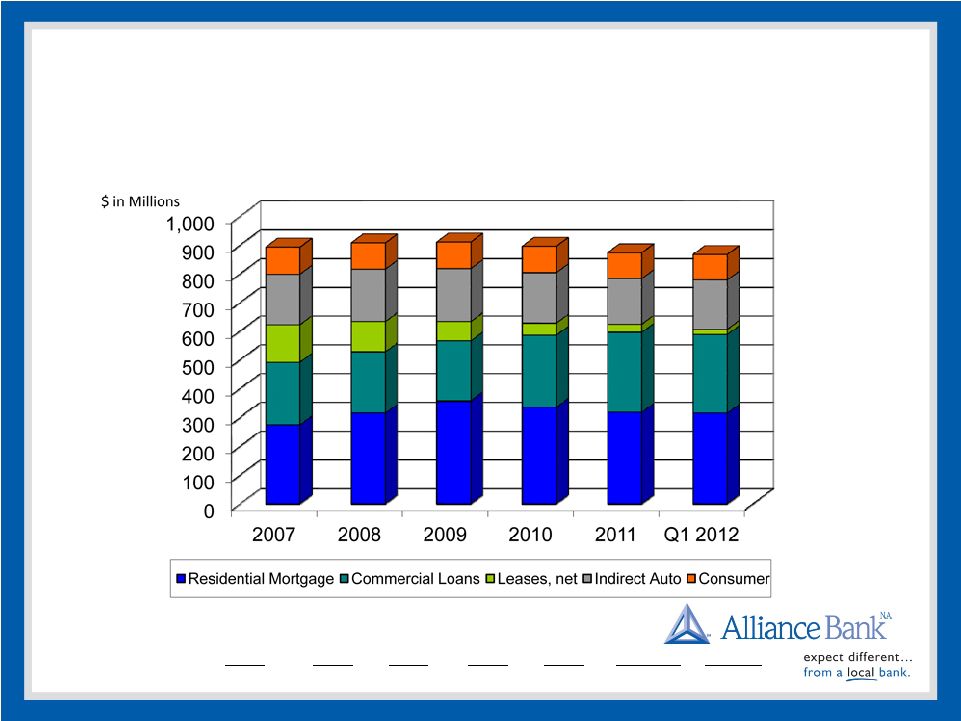

Loans and

Leases •

Well-balanced portfolio diversification

•

$255 million of originations in 2011

•

Sold $60 million of fixed rate mortgages to manage interest rate

risk

2007

2008

2009

2010

2011

Q1 2012

Change

Average yield :

6.7% 6.1% 5.5%

5.2%

4.9% 4.6% -2.1% |

Deposits

2007

2008

2009

2010

2011

Q1 2012

Change

Average cost :

3.0% 2.3% 1.3%

1.0%

0.7% 0.5% -2.5% |

Non-Performing Assets/Total Assets |

Allowance for

Credit Losses $ in Thousands

•

Substantial reserves against possible credit losses |

Strong

Capital Ratios December 31, 2011 |

Net

Income Diluted EPS

$ in Thousands

•

Record net income five consecutive

years |

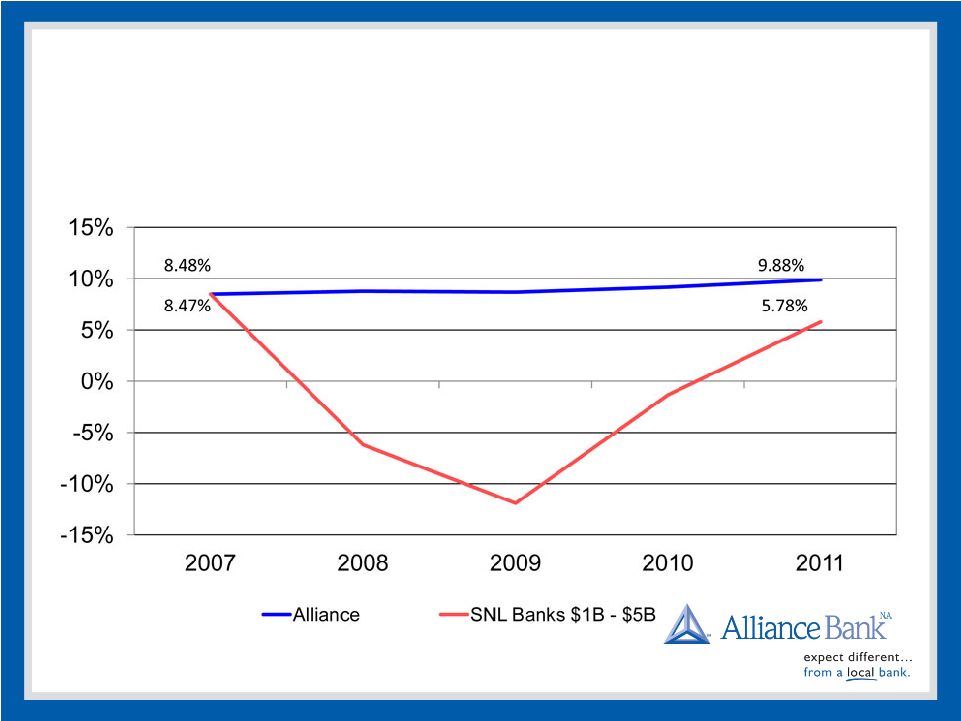

•

Disciplined community banking philosophy delivers relatively stable return on equity

Return on Average Equity |

Net Interest

Income Net Interest Margin

$ in Thousands

•

Exceptionally low interest rates pressure net interest margin

3.02%

3.35%

3.55%

3.55%

3.43%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

2007

2008

2009

2010

2011

Net Interest Income

Net Interest Margin |

Non-Interest Income

Non-Interest Income/Total Income*

$ in Thousands

*excludes non-recurring items

•

Non-interest rate sensitive income a significant component of revenue

|

Provision for

Credit Losses $ in Thousands

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2007

2008

2009

2010

2011 |

Non-Interest Expenses

$ in Thousands

0

8,000

16,000

24,000

32,000

40,000

48,000

2007

2008

2009

2010

2011 |

First Quarter

2012 Highlights 1

st

Q 2012

1

st

Q 2011

Change

Net income

$ 2,639

$ 3,306

-20.2%

Diluted EPS

$0.55

$0.70

-21.4%

Net interest income

9,841

10,983

-10.4%

Provision for credit losses

—

200

-100.0%

Non-interest income

4,476

4,586

-2.4%

Non-interest expense

10,888

10,979

-0.8%

Net interest margin

3.22%

3.44%

-22bp

Dollars in thousands, except per share amounts |

Stock Price

Performance As of May 10, 2012 |

Jack H.

Webb Chairman, President and CEO

Alliance Financial Corporation |

2012

Initiatives •

Further leverage our well respected Brand

•

Continue to provide excellent customer service

•

Sustained focus on growth within Central New York

•

Grow organically as well as via appropriate acquisitions

•

Blend traditional and evolving delivery services

•

We must appeal to the growing population that opts for

technology rather than branches

•

All of our activities and initiatives must take place while

complying with heightened regulatory oversight |

It is good to

be Alliance Financial Corporation •

We are executing our strategies from a position of strength

•

We are well capitalized

•

Credit quality metrics compare very favorably to our peer group and

national averages

•

Our People are well respected and passionate

•

Our Brand is well known and highly respected

•

Significant regulatory and compliance pressures will provide opportunities

•

Banks of many sizes will not be able to contend with evolving

requirements

•

Small banks will seek strategic partners

•

Large banks continue to lack focus on Central New York

•

Alliance is positioned for opportunity in 2012 and beyond

Alliance Bank |

Questions? |

|