Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XERIUM TECHNOLOGIES INC | d345137d8k.htm |

| EX-99.1 - PRESS RELEASE - XERIUM TECHNOLOGIES INC | d345137dex991.htm |

| EX-99.3 - SUPPLEMENTAL RECONCILIATIONS OF NON-GAAP INFORMATION - XERIUM TECHNOLOGIES INC | d345137dex993.htm |

Xerium

Technologies, Inc.

First Quarter 2012

Selected Data –

Earnings Call

EXHIBIT 99.2

1 |

Forward Looking Statements

•

This presentation and the remarks we may make today about Xerium’s future

expectations, plans and prospects are forward-looking statements which

reflect our current views with respect to future events and financial

performance. Any forward- looking statements which we make in this

presentation or in our remarks today, represent our views only as of today.

We disclaim any duty to update any of these forward-looking

statements. •

Forward-looking statements involve risks and uncertainties, both known and

unknown. Our actual results may differ materially from these

forward-looking statements due to a number of factors, including those

factors discussed in our earnings press release dated May 8, 2012, and

other factors discussed in our filings with the SEC, including our Form

10-K for the year ended December 31, 2011. Copies of these filings are

available from the SEC and in the investor relations section of our website

at www.xerium.com. •

These slides, the associated remarks and comments made during our first quarter

2012 financial results conference call, our earnings release dated May 8,

2012 and the reconciliation of certain non-GAAP financial information

posted in the investor relations section of our website are integrally

related and are intended to be presented and understood together.

2 |

Bookings Analysis –

Total Xerium

3

Total Xerium order bookings for Q1 2012 were $134.4M compared to Q1 2011 bookings of

$155.4. The year over year decline is primarily due to weakness in Europe. Versus Q4 2011,

bookings improved $7.3M primarily due to strength in North America. This improvement

includes $1.0M of unfavorable currency. |

Bookings Analysis –

Paper Machine Clothing

PMC order bookings for Q1 2012 were $85.1M compared to Q1 2011 bookings of

$101.4M. The year over year decline is primarily due to weakness in

Europe. Versus Q4 2011, bookings improved $4.9M primarily due to

strength in North and South America. 4 |

Bookings Analysis –

Roll Coverings

Rolls

order

bookings

for

Q1

2012

were

$49.3M

compared

to

Q1

2011

bookings

of

$54.0.

The

year over year decline is primarily due to weakness in Europe. Versus Q4

2011, bookings improved $2.4M primarily due to strength in North

America. 5 |

Percent of Revenue from Asia-Pacific Markets

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Q1

Asia-Pacific

12.1%

12.4%

12.8%

13.9%

12.1%

13.2%

14.0%

15.6%

16.9%

17.3%

19.2%

19.0%

5%

10%

15%

20%

25%

6

Generally, over time, we expect growth in paper production to be greater in Asia-Pacific than in

the more mature North American and Western European regions. |

New

Product Sales as a Percent of Revenue Meaningful progress continues on

Xerium’s goal to increase its technological leadership. Our goal

is to derive 60% of XRM’s sales revenue from products developed within the prior five

years that make a measurable improvement in customer performance, are defendable

long term and simultaneously reduce our operating costs.

7

$ 50.9M

$ 20.8M |

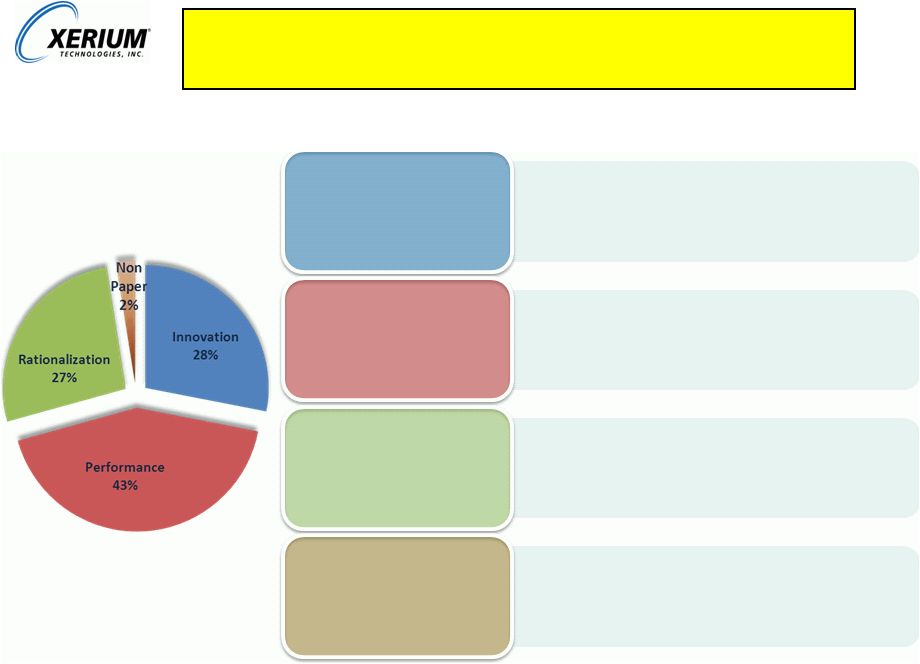

Xerium’s New Product Categorization

New products are categorized by their level of innovation and strategic purpose

8

•

Gain market share through application of unique

performance features; capture premium pricing

•

Break through or new technology, defendable intellectual

property that competitors can’t replicate

•

SmartRoll™, EDC, Impact, EnerSTAR™

•

Gain / Defend market share; recover lost pricing

potential of mature products

•

Product introductions that significantly enhance

contemporary product performance

•

New tissue products, new generation spreader rolls

•

Defend market share and price, drive internal savings

•

Product launches that while upgrading product

performance, are primarily intended to reduce

manufacturing, service and warranty costs

•

ProSeam, Avantexx

•

Provide profitable growth in non-paper markets

•

This includes new products developed for the nonwoven

textiles industry, fiber cement, oil field development, and

other markets

Innovation

Performance

Rationalization Non Paper

|

Total

Xerium Quarterly Sales and Gross Margin $US 000’s

Q1 2012 net sales decreased 6.1% from Q1 2012. Gross margins declined to

34.6% for Q1 2012 as compared to 37.7% for Q1 2011. This decrease was

primarily the result of 1) unfavorable

absorption

of

production

costs

in

Q1

2012

related

to

reduced

European

market

demand, and 2) disproportionately higher sales of lower margin products in our

rolls business. 9 |

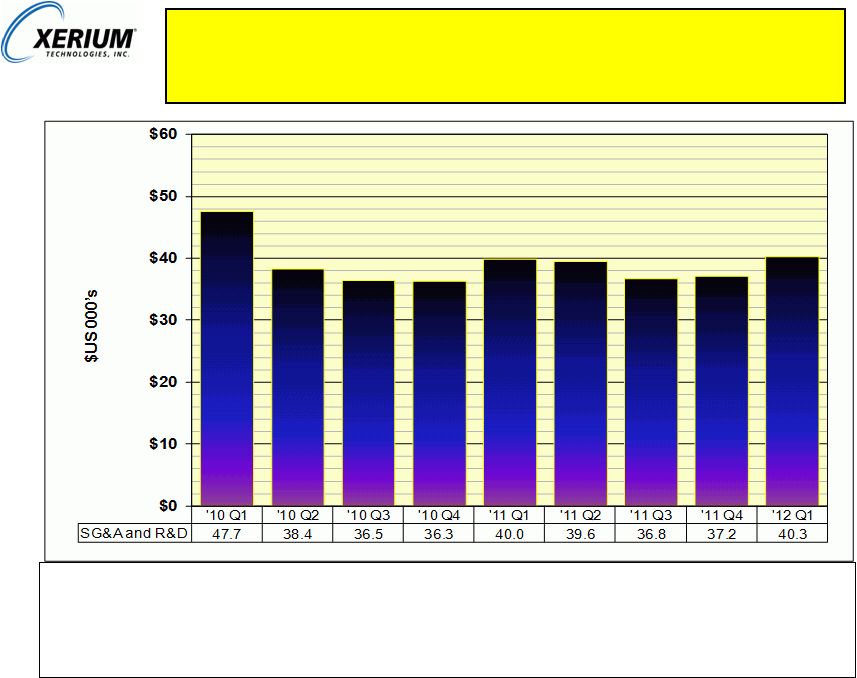

S G

& A and R&D Expense In Q1 2012, SG&A and R&D is $40.3M

as compared to Q1 2011 of $40.0M. The increase is primarily the result

of 1) the impending retirement of the CEO and the related accrual of a portion of an incentive

bonus and recruiting fees incurred and 2) expenses due to the relocation of an

office facility in Japan. Partially

offsetting

these

items

were

favorable

currency

effects

of

$0.7M

and

a

gain

recognized

in

Q1

2012 as a result of the sale of land in Brazil.

10 |

Note: Adjusted EBITDA at each quarter was the amount as calculated per the

definition in the current credit facility with the exception that we have added back

to net income (loss) per the terms of our prior credit facility financial

restructuring costs of $9.6M, $15.3M, $0.8M and $0.6M incurred as part of the

reorganization in Q1 2010, Q2 2010, Q3 2010 and Q4 2010, respectively.

A reconciliation of Trailing Twelve Month Adjusted EBITDA to Net Income (Loss)

and operating cash flows is available in the investor relations section of the

Company’s website at www.xerium.com. 11

Trailing Twelve Month (“TTM”) Adjusted EBITDA

|

12

Trade Working Capital (“TWC”) as a Percent of

Revenue

Trade working capital % improved 70 basis points versus Q1 2011. TWC improved slightly to

$145.0M in Q1 2012 from $145.2M in 4Q 2011. The improvement reflects $2.4M in lower

accounts receivable, $1.2M of increased accounts payable offset by increased inventory of

$3.4M.

Note: a reconciliation of Trade Working Capital to Revenue is available in the investor relations

section of the Company’s website at www.xerium.com. |

Total Xerium Annual Capital Expenditures

13

2009

2010

2011

2012

CAPEX

19.5

27.9

30.2

3.3

2012 Estimate

30.0

$0

$15

$30

$45

Capital expenditures for the quarter ended March 31, 2012 were $3.3M, consisting of

$1.3M in growth capex and $2.0M in maintenance capex. We are currently

targeting total capital expenditures for 2012 at approximately $30M.

|