Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-32498

Xerium Technologies, Inc.

(Exact name of registrant as specified in its charter)

| DELAWARE | 42-1558674 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

8537 Six Forks Road, Suite 300

Raleigh, North Carolina 27615

(Address of principal executive offices)

(919) 526-1400

Registrant’s telephone number (including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value per share | New York Stock Exchange | |

| Preferred Stock Purchase Rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

¨ |

Accelerated filer | x | |||||

| Non-accelerated filer |

¨ |

(Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

The aggregate market value of the voting common stock held by non-affiliates of the registrant on June 30, 2010 was approximately $159,685,534. There were 14,988,367 shares of the registrant’s common stock, $0.001 par value per share, outstanding as of March 02, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Proxy Statement for the 2011 Annual Meeting of Shareholders which will be filed pursuant to Regulation 14A, is incorporated by reference in Part III to the extent described therein.

Table of Contents

| PAGE | ||||||

| PART I. |

||||||

| ITEM 1. |

5 | |||||

| ITEM 1A. |

14 | |||||

| ITEM 1B. |

23 | |||||

| ITEM 2. |

23 | |||||

| ITEM 3. |

23 | |||||

| ITEM 4. |

23 | |||||

| PART II. |

||||||

| ITEM 5. |

24 | |||||

| ITEM 6. |

26 | |||||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

28 | ||||

| ITEM 7A. |

52 | |||||

| ITEM 8. |

53 | |||||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

53 | ||||

| ITEM 9A. |

53 | |||||

| ITEM 9B. |

55 | |||||

| PART III. |

||||||

| ITEM 10. |

56 | |||||

| ITEM 11. |

56 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

56 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

56 | ||||

| ITEM 14. |

56 | |||||

| PART IV. |

||||||

| ITEM 15. |

57 | |||||

| 58 | ||||||

2

Table of Contents

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This Annual Report on Form 10-K contains forward-looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Undue reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors that are, in some cases, beyond our control and that could materially affect actual results, levels of activity, performance, or achievements. Factors that could materially affect our actual results, levels of activity, performance or achievements include the following items:

| • | our financial results could be adversely affected by fluctuations in interest rates and currency exchange rates; |

| • | our credit facilities contain restrictive covenants, such as the covenants requiring compliance with minimum interest coverage and maximum leverage ratios, which become more restrictive over time, that may require us to increasingly improve our performance over time to remain in compliance therewith; |

| • | we are subject to the risk of weaker economic conditions in the locations around the world where we conduct business, including the impact of price pressures and cost reduction strategies by our customers in the paper industry; |

| • | our strategies and plans, including, but not limited to, those relating to developing and successfully marketing new products, enhancing our operational efficiencies and reducing costs, may not result in the anticipated benefits; |

| • | variations in demand for our products, including our new products, could negatively affect our net sales and profitability; |

| • | our manufacturing facilities may be required to operate at or near capacity, which could negatively affect our production, customer order lead time, product quality and labor relations; |

| • | we may not be successful in developing and marketing new technologies or in competing against new technologies developed by competitors; |

| • | due to our high degree of leverage and significant debt service obligations, we need to generate substantial operating cash flow to fund growth and unexpected cash needs; |

| • | we may be required to incur significant costs to reorganize our operations in response to market changes in the paper industry; |

| • | we are subject to the risk of terrorist attacks or an outbreak or escalation of any insurrection or armed conflict involving the United States or any other country in which we conduct business, or any other domestic or international calamity, including natural disasters; |

| • | we are subject to any future changes in government regulation; |

| • | we are subject to any changes in U.S. or foreign government policies, laws and practices regarding taxes and the repatriation of earnings; and |

| • | anti-takeover provisions could make it more difficult for a third-party to acquire us. |

Other factors that could materially affect our actual results, levels of activity, performance or achievements can be found in our “Risk Factors” section in this Annual Report on Form 10-K. If any of these risks or

3

Table of Contents

uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we project. Any forward-looking statement in this Annual Report on Form 10-K reflects our current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to our operations, results of operations, growth strategy, and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise.

All references in this Annual Report to “Xerium”, “we”, “our” and “us” means Xerium Technologies, Inc. and its subsidiaries.

4

Table of Contents

PART I

| ITEM 1. | BUSINESS |

General

We are a leading global manufacturer and supplier of two types of consumable products used primarily in the production of paper—clothing and roll covers. We market our products through the following industry-recognized brands:

| Brand |

Product Category |

Geographic Region | ||

| Huyck Wangner |

Clothing | Worldwide other than North America | ||

| Weavexx |

Clothing | North America | ||

| Stowe Woodward |

Roll Covers & Spreader Rolls | Worldwide | ||

| Mount Hope |

Spreader Rolls | Worldwide | ||

| Robec |

Spreader Rolls | Europe | ||

| Xibe |

Roll Covers | China |

Our products are installed on paper-making machines and play key roles in the process by which raw materials are converted into finished paper. A fundamental characteristic of our products is that they wear down with use in the paper production process and must be regularly replaced. In addition, our products are also installed in other industrial applications such as nonwoven and fiber cement machines. As of December 31, 2010, we have an extensive global footprint of 31 manufacturing facilities in 14 countries, strategically located in the major paper-producing regions of North America, Europe, South America and Asia-Pacific, and have 3,404 employees worldwide. We market our products, primarily using our direct sales force, to the paper industry’s leading producers. In 2010, we generated net sales of $548.3 million.

Company Overview

The consumable nature of our products positions us to make recurring net sales to our customers, and accordingly the number of paper machines in operation throughout the world and the volume of paper, pulp and board produced globally each year are primary drivers of the demand for our product.

Paper-making machines utilize different processes and have different requirements depending on the design of the machine, the raw materials used, the type of paper being made and the preferences of individual production managers. We employ our broad portfolio of patented and proprietary product and manufacturing technologies, as well as our extensive industry experience, to provide our customers with tailored solutions designed to optimize the performance of their equipment and dramatically reduce the costs of their operations. We systematically track and report the impact of these customized solutions to our customers through our ValueResults program which quantifies the optimization process on each machine.

Our clothing products are highly engineered synthetic textile belts that transport paper as it is processed in a paper-making machine. Clothing plays a significant role in the forming, pressing and drying stages of paper production. Our clothing segment represented 66%, 66% and 65% of our net sales for 2010, 2009 and 2008, respectively.

Roll cover products cover the rolls on a paper-making machine, which are the large steel cylinders over which clothing is mounted and between which the paper travels as it is processed. Our roll covers provide a surface with the mechanical properties necessary to process the paper in a cost-effective manner that delivers the sheet qualities desired by the paper producer. We currently use several hundred chemical compounds in our roll cover manufacturing process. Our roll cover segment represented 34%, 34% and 35% of our net sales for 2010, 2009 and 2008, respectively.

Our products are in constant contact with the paper stock during the manufacturing process through which the stock is processed into finished paper. As a result, our products have a significant effect on paper quality and

5

Table of Contents

the ability of a paper producer to differentiate its products, two factors which are increasingly important to paper producers. In addition, while clothing and roll covers represent only approximately 3%, on average, of a paper producer’s production costs, they can help a paper producer improve productivity and reduce overall costs. Our clothing and roll covers facilitate the paper producer’s use of less expensive raw materials (including recycled fiber), ability to run paper-making machines faster and with fewer interruptions, and ability to decrease the amount of energy required in the expensive drying portion of the paper-making process. We have found that, in certain cases, our products and services provide paper producers with cost savings that substantially offset the costs of such products and services.

We estimate that there are approximately 7,000 paper-making machines worldwide, all of which require a regular supply of clothing and roll covers. Clothing and roll covers must be replaced regularly to sustain high quality paper output and operate efficiently. Roll covers also require regular refurbishment, a service that we provide to our customers. Paper producers must typically replace clothing several times per year, replace roll covers every two to five years and refurbish roll covers several times between each replacement.

We have a reputation for technological innovation in the paper-making industry. In our clothing segment, in recent years we have focused our research and development efforts on higher-value-added, technologically advanced products, such as forming fabrics and press felts, which offer paper producers greater potential for differentiating their products through quality improvements and for increasing their operating efficiency. We pioneered a number of technologies that have become industry standards. These include, in our clothing business, synthetic forming fabrics (which replaced bronze wire technology), double-layer forming fabrics, laminated press felts and, most recently, triple-layer forming fabrics.

In our roll covers segment, we have introduced a number of innovations to our roll cover and spreader roll products in recent years, including SmartRoll™, the first continuous pressure sensing paper machine roll that enables the papermaker to maximize performance by knowing the pressure of the paper machine while the machine is running, shoe press belts which utilize our expertise in polyurethane material and manufacturing technologies, composite calender roll covers that use nanoparticle technology to improve roll cover durability and paper gloss, as well as covers that use an improved polyurethane to increase abrasion and moisture resistance as well as responsiveness and stability.

Our portfolio of patented and proprietary product and manufacturing technologies differentiates our product offerings from others in the market and allows us to deliver high value products and services to our customers. We currently have approximately 240 issued patents and approximately 105 pending patent applications. Our patents and patent applications cover approximately 65 different inventions. We currently license certain of our patents and technologies to some of our competitors, which we believe helps further demonstrate our technological leadership in the industry. We believe that the technological sophistication of our products and the capital-intensive nature of our business present significant challenges to any potential new competitors in our field.

Our business was organized in 1999 in connection with the acquisition of the paper technology group of Invensys plc. We completed our initial public offering on May 19, 2005.

Chapter 11 Filing, Emergence and Plan of Reorganization

On March 30, 2010, we and certain of our subsidiaries filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101-1532 (as amended, the “Bankruptcy Code”), in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). On May 12, 2010, the Bankruptcy Court held a hearing to consider confirmation of our amended joint prepackaged plan of reorganization (the “Plan”) and entered an order confirming the Plan. On May 25, 2010 (the “Effective Date”), the Plan became effective and we and our subsidiaries emerged from chapter 11. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Chapter 11 Filing, Emergence and Plan of Reorganization” for additional information regarding our chapter 11 proceedings.

6

Table of Contents

Recent Developments

Global Economic Environment

Our operations are highly dependent upon the paper production industry and the degree to which the paper industry is affected by global economic conditions and the availability of credit.

Beginning in 2008 and continuing through most of 2009, the global paper industry experienced a sharp reduction in production levels, caused by the general slowdown in economic activity and related paper consumption during the same period and the paper manufacturers’ reducing excessive inventories. The slowdown of production was across most grades of paper production, but most notably in packaging and newsprint grades. For packaging grades, demand is directly related to broad manufacturing and transportation activity reduction, while newsprint demand has been declining over a number of years due to the greater prevalence of electronic media, exacerbated during the recession by a reduction in print advertising. One of the results of this recession driven reduction in demand for paper products was that the paper manufacturers dramatically and quickly reduced production through curtailments of machines and complete mill shutdowns. These curtailments, which began in late 2008, served to reduce inventories and match output with demand. By early 2010, most mills and equipment not permanently shuttered had resumed production.

In 2010, however, global paper and board production began to recover, particularly in developing countries. As international shipments of manufactured goods recovered, containerboard production recovered particularly strongly, contributing over 50% of the total global improvement, though the rate of recovery slowed somewhat during the second half of 2010. Going forward, we expect that global paper and board manufacturers’ operating rates will remain near their current high levels as production keeps pace with demand. While there continues to be price pressure due to our competitors pursuing increased market share in 2010, as compared with 2009, we were successful in increasing our pricing levels in our roll covers segment and maintaining them relatively constant in our clothing segment.

Business Strategy

The primary components of our business strategy are:

Fiscally Responsible Management. We are committed to improving our capital structure and creating sufficient financial flexibility. This will allow us to continue to invest in our operations where we can expect reasonable returns, expand into markets where our products and services will create value for our customers and support the global growth of the paper-making industry. As part of this strategy, our focus on the reduction of working capital, allocation of capital investments and elimination of loss-making businesses, customers and products will drive our activities. We may incur additional operational restructuring expenses in connection with pursuing cost-savings opportunities. We believe that our potential to improve productivity includes the opportunities to enhance our manufacturing efficiency by improving our process yields and cycle times.

New Product Development. We are committed to maximizing our margins and profitability in both our clothing and roll covers segments by focusing our production and marketing efforts on higher value-added, technologically advanced products that will benefit our customers by providing them with the cost savings and quality improvement characteristics they require to be competitive. We intend to continue to offer a full range of product offerings in order to meet our customers’ needs. We believe that the development and successful introduction of new products in a systematic and customer-focused manner will allow us to meet the expected demands of global market growth and our own sales growth and profitability projections. Simultaneous standardization and simplification will help us achieve significant cost reductions and competitiveness.

Workforce Engagement. We are committed to alignment of objectives for our entire workforce. We believe that communication, training, tools and incentives associated with this alignment are essential to meeting our business plans and objectives. Human resource management systems must be in place in support of this strategy, including retention of personnel to maintain and enhance the quality of the performance of our workforce,

7

Table of Contents

visibility to career opportunities to create job growth, and incentive systems that reward the workforce for achievement of critical objectives. Our approach includes the “high-grading” and “right-sizing” of our workforce to make certain those individuals most necessary for our success are in a position to positively contribute to goal achievement.

Products

We operate through two principal business segments, clothing and roll covers. Our clothing segment products include various types of industrial textiles used on paper-making machines and other industrial applications. Through our roll covers segment, we manufacture various types of roll covers, refurbish previously installed roll covers, provide mechanical services for the internal mechanisms of rolls used on paper-making machines and manufacture spreader rolls. For additional financial information about our clothing and roll covers segments, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 15 to the accompanying audited consolidated financial statements.

Clothing Products

Our clothing segment products are large, highly engineered synthetic textile belts that transport paper as it is processed on a paper-making machine from paper stock into finished paper. Clothing products must be tailored to each machine because all paper-making machines have different physical configurations and operating parameters. Clothing generally ranges in size from approximately 3 feet to over 30 feet wide and 24 feet to more than 460 feet long and operates on paper-making machines that run at speeds up to 7,500 feet per minute. We typically sell clothing products for between $13,000 and $45,000 per unit, although we sell some of our more sophisticated forming fabrics for up to $200,000 per unit.

We manufacture the three general types of clothing products used on paper-making machines—forming fabrics, press felts and dryer fabrics—each of which is located in a different section of a machine. Forming fabrics and press felts are typically replaced several times a year, but replacement frequency varies significantly by the grade of paper being produced, the manner in which the paper-making machine is operated and the quality of raw materials used in the paper stock. Dryer fabrics are replaced less frequently, with replacement typically taking place no more than once per year.

Forming fabrics. Forming fabrics are used at the beginning of paper-making machines, where highly diluted paper stock is deposited on the forming fabric while the fabric is traveling at a very high speed. Forming fabrics allow water to drain from the paper stock, creating an initial wet sheet. Forming fabrics must be porous enough to allow water to drain evenly but tight enough to retain and align the fiber and other materials that form the sheet of paper. They must also be strong enough to withstand high mechanical stresses. Forming fabrics are custom-manufactured in single, double, and triple layer designs in a variety of meshes to suit particular machines and paper grades. Customers are increasingly demanding the higher-priced triple layer designs that remove more moisture and produce higher quality paper. In 2010, forming fabrics accounted for approximately 42% of net sales in our clothing segment.

Press felts. Press felts are used to carry the paper sheet through a series of press rolls that mechanically press water from the sheet under high pressure. Press felts are designed to maximize water removal, which reduces the amount of water that must be removed during the expensive energy-intensive drying section of the production process. Press felts must maximize water removal while maintaining the orientation of the fibers and the consistency of the thickness of the paper, without removing chemicals or fillers from the paper.

Press felts differ from forming fabrics and dryer fabrics due to the addition of several layers of staple fiber that are needled into the fabric base. The staple fiber provides a smooth surface to meet the wet sheet of paper and creates a wicking effect to remove water from the paper sheet as it is pressed under high pressure between press rolls. Press felts are manufactured in a variety of designs, including lightweight single layer felts, multi-layer laminated endless felts and seamed felts that allow for reduced installation times. In 2010, press felts accounted for approximately 41% of net sales in our clothing segment.

8

Table of Contents

Dryer fabrics. Dryer fabrics are used to transport the paper sheet through the drying section of paper-making machines, where high temperatures from large, steam-heated dryer cylinders evaporate the remaining moisture from the paper sheet. Dryer fabrics, which are less technically advanced than forming fabrics or press felts, are woven from heat-resistant yarns with a coarser mesh than forming fabrics. In 2010, dryer fabrics accounted for approximately 5% of net sales in our clothing segment.

Industrials and Other. We also manufacture other types of clothing used in other industrial applications, such as steel, plastics, leather and textiles manufacturing. In 2010, net sales for such industrial applications accounted for 11% of net sales in our clothing segment. We also manufacture auto-joining equipment used on paper-making machines. Net sales of auto-joining equipment accounted for less than 1% of net sales in our clothing segment in 2010.

New Clothing Products. In recent years, we have focused our research and development efforts on higher-value-added, technologically advanced products, such as forming fabrics and press felts, which offer paper producers the greatest potential for differentiating their products through quality improvements and for increasing their operating efficiency. Our research and development efforts have resulted in several innovative new forming fabric and press felt products, including a number of high performance products, such as triple layer forming fabrics, for use on high performance paper-making machines. In addition, we have developed new clothing products aimed at segments of the paper-making process that we have not historically served, such as the growing market for shoe press belts and other clothing products designed for use in the technologically-advanced press section of a paper-making machine.

Roll Covers Products and Services

In our roll covers segment, the majority of our sales are generated through the manufacture of roll covers. We also refurbish previously installed roll covers, provide general mechanical maintenance and repair services for the internal mechanisms of rolls and manufacture spreader rolls.

Roll covers. We manufacture, refurbish and replace covers for three kinds of rolls on paper-making machines: working rolls (including vacuum rolls and press rolls), calendar rolls and coater rolls. There can be up to 200 such rolls in a typical paper-making machine. These metal rolls, which can be up to 39 feet long, 6 feet in diameter and weigh 500 to 140,000 pounds, are covered with an exterior layer of rubber, polyurethane, composite or ceramic, each of which is designed for use in a particular phase of the paper-making process. Roll covers operate in temperatures up to 400 degrees Fahrenheit, under pressures up to 1,400 pounds per square inch and at speeds up to 7,500 feet per minute. Roll covers are typically replaced every two to five years.

Roll cover replacement is performed at the manufacturing facility of the supplier, such as Xerium, which necessitates removing the roll from the paper-making machine, transporting it to the supplier’s site and using a spare in the interim. In general, each roll on a paper-making machine is unique due to its dimensions, specific design and cover material, and therefore not interchangeable with other rolls. Because of their large size, paper producers generally maintain only one spare roll for each position on a paper-making machine. It is important that the roll cover replacement be completed quickly, because a malfunction of the spare roll could render the paper-making machine inoperable.

Due to the large size and weight of a roll, the transportation to and from a supplier’s site can be costly and is often subject to regulations on road use that restrict available routes and times of travel, and that may require safety escorts. Round-trip transcontinental travel can take several weeks and intercontinental travel is rare. We offer an extensive network of manufacturing facilities worldwide, often in close proximity to our customers, which we believe is a significant competitive advantage.

We typically sell roll covers for between $1,000 per roll (e.g., for a small installed rubber roll cover) and $300,000 per roll (e.g., for a large installed polyurethane cover). Net sales of roll covers accounted for approximately 57% of our total net sales in our roll covers segment in 2010.

9

Table of Contents

Roll Cover Refurbishment Services and Mechanical Services. Roll covers are typically refurbished several times over the two to five years they are in service before needing to be replaced. Refurbishment typically includes the regrinding of the roll cover to standard specifications and inspecting the bearings and other mechanical components of the roll. As with roll cover replacement, refurbishment is performed at the supplier’s manufacturing facility. Similar to the paper producer’s selection of a roll cover supplier, the selection of a refurbishment provider is influenced by the time and expense of transporting a roll cover. We believe our extensive network of manufacturing facilities worldwide is a significant competitive advantage. Refurbishment services typically cost between $1,000 for minor roll repairs and $50,000 for a complete overhaul on certain press rolls.

We offer a wide range of mechanical maintenance and repair services for the internal mechanisms of rolls. Paper producers are increasingly finding it economical to have the company that refurbishes or replaces a roll cover also perform work on the internal roll mechanisms at the same time, which avoids having multiple suppliers and incurring additional time and transportation charges. We began performing such services to meet the demands of our customers and attempt to gain a competitive advantage. As of December 31, 2010, we provide major mechanical services at ten locations around the world. Roll cover refurbishment services and mechanical services accounted for approximately 18% of our total net sales in our roll covers segment in 2010.

Spreader rolls. We manufacture and repair spreader rolls, which are small-diameter curved rolls used throughout a paper-making machine to stretch, smooth and remove wrinkles from the paper and clothing. There are approximately five to seven spreader rolls in a typical paper-making machine. We typically sell spreader rolls for between $1,000 and $200,000 per roll. We also rebuild and overhaul existing spreader rolls, typically for between $1,000 and $100,000 per roll. Net sales of spreader rolls and related services accounted for approximately 25% of our total net sales in our roll covers segment in 2010.

New Roll Products. We have introduced a number of innovations to our roll cover and spreader roll products in recent years, including shoe press belts which utilize our expertise in polyurethane material and manufacturing technologies, composite calendar roll covers that use nanoparticle technology to improve roll cover durability and paper gloss, as well as covers that use an improved polyurethane to increase abrasion and moisture resistance as well as responsiveness and stability. We are evaluating new products, which will use different materials and utilize different sales channels and provide enhancements to our existing product line. In late 2008, we introduced SmartRoll™, the first continuous pressure sensing paper machine roll. SmartRoll™ enables the paper maker to maximize performance by qualitatively measuring the operating pressures of the paper machine while the machine is running. To date, customers have ordered 90 SmartRoll™ units and approximately 50% of those are already operational, confirming market acceptance.

In 2010, net sales to the paper-making industry accounted for approximately 93% of our total net sales in our roll covers segment. Paper producers accounted for approximately 81% of net sales, and paper-making machine manufacturers accounted for approximately 12% of net sales. Net sales for use in other industrial applications, including steel, plastics, leather and textiles manufacturing, accounted for the remaining 7% of our net sales in our roll covers segment.

Customers

We supply leading paper producers worldwide. Our top ten customers accounted for 22.7% of net sales in 2010 and individually, no customer accounted for more than 4.7% of 2010 net sales. In 2010, 36.1% of our net sales was in North America, 34.4% was in Europe, 10.0% was in South America, 17.3% was in Asia-Pacific and 2.2% was in the rest of the world. See Note 15 to the accompanying audited consolidated financial statements for geographic information related to net sales and long-lived assets.

10

Table of Contents

Competition

Our largest competitors are Albany International Corp. (a publicly-owned U.S. company), which supplies clothing products, Voith AG (a privately-owned German company) and Metso Corporation (a publicly-owned Finnish company), both of which supply both clothing and roll products. Voith and Metso are also the leading manufacturers of paper-making machines. In addition, we also face competition from smaller regional suppliers.

We compete primarily based on the value and price of our products. Competition with respect to both clothing and roll covers, particularly as it relates to our technologically advanced forming fabrics, press felts and roll covers, is based primarily on the value that the products deliver to the paper producer through the ability of such products to reduce production costs and improve paper quality.

Competition in the clothing and roll covers market is also based on a supplier’s ability to deliver engineering and technical services. Many paper producers have been reducing their in-house engineering and technical staff and increasingly expect their suppliers to provide such services. While smaller suppliers often lack the resources necessary to invest in and provide this level of engineering and technical service, we have made investments in order to provide the following services to the paper producers: specialist advice and resident engineers, installation support, on-call “trouble-shooting” and performance monitoring and analysis of paper-making machines.

In the roll covers market, competition is also based on a supplier’s proximity to the paper producer’s facilities, which affects the transportation time and expense associated with refurbishing or replacing a roll cover, and on the supplier’s ability to provide mechanical services to a roll’s internal mechanisms while the roll cover is being refurbished or replaced. We offer an extensive network of facilities throughout the world and provide mechanical services at ten locations.

Research and Development

Our continuing ability to deliver value depends on developing product innovations. As we create new and improved products we often obtain patent protection for our innovations, which is indicative of our technical capabilities and creativity. Although we do not consider any single patent to be material to our business, we believe that, in the aggregate, our patents and other intellectual property provide us with a competitive advantage. We currently have approximately 240 domestic and foreign patents outstanding and approximately 105 pending patent applications. Our patents and patent applications cover approximately 65 different inventions. Some of our competitors license our technology from us in exchange for royalty payments, although such licensing does not represent a material amount of our business.

11

Table of Contents

Production

Clothing Production Process

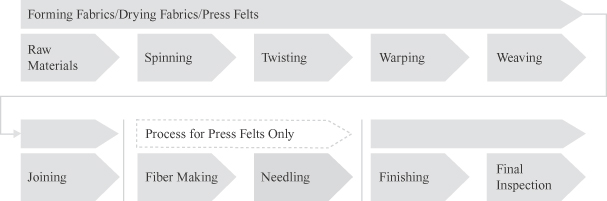

The following diagram represents the clothing production process.

The clothing production process begins with the spinning of synthetic fiber threads to produce yarn, which is then twisted in preparation for the manufacturing of clothing. Yarn, which is sometimes purchased as a raw material, is then wound on large spools prior to installation on the loom. The yarn is drawn through needles in preparation for weaving.

With the yarn prepared for weaving, a weave pattern can be installed in the loom controller. The nature of the weave pattern is critical to how the clothing performs in the paper-making process. The yarn is then woven to the desired length.

Technological advancements have resulted in weaving becoming an almost entirely automated process. Following weaving, the two ends are permanently joined to form a continuous loop of clothing. Although significant automation has occurred in the joining process, it remains the most labor intensive of the clothing production process.

Press felts then undergo a process that is not necessary for forming and dryer fabrics. An additional layer of fibers is added to the outside surface with the use of an advanced needling machine, such that a very smooth felt surface is created.

All clothing then undergoes heat setting and chemical treating. Heat setting tightens the clothing giving it the necessary mechanical properties for the paper-making process. Finally, the clothing is meticulously inspected prior to being shipped to the customer.

12

Table of Contents

Roll Cover Production Process

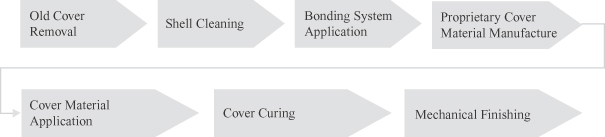

The following diagram represents the roll covering production process.

The covering on the rolls used in the paper-making process wear over time and must be periodically replaced for the roll to function properly. Rolls are removed from the paper-making machine and taken to an offsite facility for re-covering. During this time, a spare roll is placed in the machine to enable continuous operations.

The first step of the roll covering process is the removal of the old cover. A lathe and belt grinder are used to remove the old cover, exposing the roll shell. The shell is cleaned with a pressure washer and blasted with solid particles to increase the shell’s surface area for bonding of the new cover. Following the blasting process, the shell is ready to be re-covered.

The shell is then coated with proprietary bonding agents that affix the new roll cover to the shell. Each type of cover material is applied with a different process. Rubber and composite covers are extruded in a slow spinning lathe. Polyurethane covers are typically cast on the core using a mold, and ceramic covering is expelled onto the shell at high pressure.

Following application of the core material, the cover undergoes a curing process. Rubber covers are cured for 12 to 28 hours in vulcanizers under high temperature and pressure, whereas polyurethane and composite materials are cured in a hot air oven. After curing, the roll cover is ground with belts and grinding stones. A proprietary pattern of holes and grooves is then drilled into the cover to aid in water removal. Finally, the roll is balanced for proper spinning motion and meticulously checked for quality before being returned to the customer.

The roll cover production process is capital intensive and requires a variety of equipment, including lathes, belt grinders, polyurethane casting molds (for polyurethane roll covers), extruders, mix stations, vulcanizers, ovens and balancing equipment.

Environmental

Our operations and facilities are subject to a number of national, state and local laws and regulations protecting the environment and human health in the United States and foreign countries that govern, among other things, the handling, storage and disposal of hazardous materials, discharges of pollutants into the air and water and workplace safety. Because of our operations, the history of industrial uses at some of our facilities, the operations of predecessor owners or operators of some of the businesses, and the use and release of hazardous substances at these sites, the liability provisions of environmental laws may affect us.

We believe that any liability in excess of amounts provided in Note 12 to the Consolidated Financial Statements which may result from the resolution of such matters will not have a material adverse effect on the financial condition, liquidity or cash flow of the Company.

13

Table of Contents

Employees

As of December 31, 2010 we had 3,404 employees worldwide, of which 2,577 were manufacturing employees, 416 were sales and marketing employees, 96 were in research and development and 315 were administrative and other employees. As of December 31, 2010, 2,402, or 70.6%, of our employees are subject to protection as members of trade unions or various collective bargaining agreements, primarily outside of the United States. We believe that we have good relations with our employees’ trade unions and labor unions and we have not experienced any material labor disputes.

Our Corporate Information

We are subject to the information requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). Therefore, we file periodic reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

We maintain a website at www.xerium.com to provide information to the general public and our shareholders on our products and services, along with general information on Xerium. We make our periodic and current reports available, free of charge, on our web site as soon as reasonably practicable after these reports are filed with, or furnished to, the SEC. Our corporate code of business conduct and ethics, our corporate governance guidelines, and the charters of each of the Audit, Compensation, and Nominating and Corporate Governance Committees of our board of directors are also made available, free of charge, on our website. Our corporate code of business conduct and ethics, which includes our code of ethics, and related waivers (if any) are posted on our website. Copies of these documents may be obtained, free of charge, by writing Investor Relations, Xerium Technologies, Inc., 8537 Six Forks Road, Suite 300, Raleigh, North Carolina 27615, or telephoning us at 919-526-1444.

| ITEM 1A. | RISK FACTORS |

We may occasionally make forward-looking statements and estimates such as forecasts and projections of our future performance or statements of our plans and objectives. These forward-looking statements may be contained in, among other things, filings with the SEC, including this Annual Report on Form 10-K, press releases made by us and in oral statements made by our officers. Actual results could differ materially from those contained in such forward-looking statements. Important factors that could cause our actual results to differ from those contained in such forward-looking statements include, among other things, the risks described below.

Risks Relating to our Business and the Industry

A sustained downturn in the paper industry, compounded by uncertainty in global economic conditions, could adversely affect our net sales and profitability.

Historically, demand for our products has been driven primarily by the volume of paper produced on a worldwide basis. As a result, trends that affect the paper industry will impact our business and financial results.

The profitability of paper producers has historically been highly cyclical due to wide swings in the price of paper, driven to a high degree by the oversupply of paper during periods when paper producers have more aggregate capacity than the market requires. A sustained downturn in the paper industry, either globally or in a particular region, can cause paper manufacturers to reduce production or cease operations, which could adversely affect our net sales and profitability.

In response to significant changes in the sector, particularly in late 2008 and 2009, paper producers have continually sought to structurally improve the balance between the supply of and demand for paper. As part of these efforts, they have permanently shut down many paper-making machines or entire manufacturing facilities.

14

Table of Contents

Should papermakers continue to experience low levels of profitability, we would expect that further consolidation among papermakers, reducing the number of paper producers, and shutdowns of paper-making machines or facilities could occur in Europe and North America, until there is a better balance between supply and demand for paper and the profit levels of paper producers improve. This rebalancing had been accelerated during the most recent global economic recession.

Global paper production growth that does occur could be moderated by the level of industry consolidation and paper-machine shutdown activity that appears to be an underlying trend in North America and Western Europe. We believe that industry consolidation in both North America and Western Europe appears to have bottomed as market-related curtailment has abated. During 2010, global paper demand has increased and machine operating rates have escalated across most paper grades and geographic regions. However, we continue to see the trend that paper producers are focusing on cost reduction strategies and, as a result, are extending the life of roll covers and clothing products through additional maintenance cycles before replacing them. We anticipate that pricing pressure for our products will continue with the consolidation among paper producers and as the shift of paper production growth in Asia-Pacific develops.

We may be required to reorganize our operations in response to changing conditions in the paper industry, which may require significant expenditures and may not be successful.

In the past several years, we have undertaken various operational restructuring measures in response to changing market conditions in the paper industry triggered by the decline in paper prices that began in 2001. For example, between 2002 and 2010, we incurred costs of approximately $86 million in connection with our cost reduction programs including the closure of 14 manufacturing facilities worldwide.

In connection with any future plant closures, delays or failures in the transition of production from a closed facility to our other facilities could also adversely affect our financial performance. We may engage in additional cost reduction programs in the future. We may not recoup the costs of programs we have already initiated, or other programs we may in the future decide to engage in, the costs of which may be significant. In addition, our profitability may decline if our restructuring efforts do not sufficiently reduce our future costs while at the same time positioning us to maintain or increase our sales.

Fluctuations in currency exchange rates could adversely affect our net sales, profitability and compliance with our debt covenants.

Our foreign operations expose us to fluctuations in currency exchange rates and currency devaluations. We report our financial results in U.S. Dollars, but a substantial portion of our sales, expenses and debt are denominated in Euros and other currencies. As a result, changes in the relative values of U.S. Dollars, Euros and other currencies will affect our levels of net sales and profitability. Currency fluctuations, as they pertain to the Euro, generally have a greater effect on the level of our net sales due to the amount of business conducted in Euros. An increase in the U.S. Dollar against the Euro generally results in a decrease to net sales and net income. Increases in the U.S. Dollar against other currencies, such as the Brazilian Real, would not impact consolidated net sales as much, as a significant portion of sales in that country is significantly denominated in or indexed to U.S. Dollars, but generally would increase net income as local currency costs would be translated into lower U.S. Dollar expenses for financial reporting purposes. We would expect a similar but opposite effect in a period in which the value of the U.S. Dollar decreases against these currencies. Although in certain circumstances we attempt to hedge our exposure to fluctuations in currency exchange rates, our hedging strategies may not be effective. In addition, our Amended and Restated Credit Facility and Exit Facility (each defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Chapter 11 Filing, Emergence and Plan of Reorganization”) contain financial covenants that require us to maintain a minimum interest coverage ratio, a maximum leverage ratio and an annual limitation on capital expenditures. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Credit Facilities”. Our ability to comply with these covenants will depend in part upon our reported financial results, which as indicated above, are directly affected by currency fluctuations. Since each of the financial ratio covenants in our

15

Table of Contents

credit facilities are calculated by reference to the amount of our Adjusted EBITDA, currency fluctuations alone could lower the amount of our Adjusted EBITDA and therefore affect our ability to remain in compliance with our financial ratio covenants. Our credit facilities provide that for the purposes of computing debt, which is a key component in the calculation of the leverage ratio, indebtedness which is payable in foreign currencies shall be converted into U.S. Dollars using the average exchange rate for the most recently ended four fiscal quarters for which our financial statements are available. For additional information about the risks associated with fluctuations in currency exchange rates, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Foreign Exchange”.

Increased price competition in our industry could adversely affect our gross margins and net sales.

Historically, we and our competitors have been able to sell clothing and roll covers products and services at favorable prices that reflect the value they deliver to customers. This favorable pricing has been particularly available for our more technologically advanced products, such as forming fabrics, press felts and roll covers. In recent years, the financial health of our customers and continued pricing pressure from our competitors required us to reduce prices in some cases, and eliminate or decrease the size of proposed price increases in other cases, resulting in price decreases in both of our business segments. Further pricing pressure from our competitors may require further price decreases or make us unable to affect planned price increases and, thereby, adversely affect our profitability.

Our industry is competitive and our future success will depend on our ability to effectively develop and market competitive products.

The paper-making consumables industry is highly competitive. Some of our competitors are larger than us, have greater financial and other resources and are well-established as suppliers to the markets we serve. For example, while we are targeting expansion of our business in China, we face substantial competition from manufacturers already operating there that are more established and familiar with the Chinese marketplace. In addition, some of our competitors also manufacture paper-making machines and have the ability to initially package sales of their clothing and roll cover products with the sale of their machines and/or to tie the warranties on their machines to the use of their clothing and roll cover products. Our products may not be able to compete successfully with the products of our competitors, which could result in a loss of customers and, as a result, decreased net sales and profitability. We compete primarily based on the value our products deliver to our customers. Our value proposition is based on a combination of price and the technology and performance of our products, including the ability of our products to help reduce our customers’ production costs and increase the quality of the paper they produce. Our competitors could develop new technology or products that lead to a reduced demand for our products. In addition, our business depends on our customers regularly needing to replace the clothing and roll covers used on their paper-making machines. Either we or our competitors could develop new technologies that increase the useful life of clothing or roll covers, which could reduce the frequency with which our customers would need to replace their clothing and refurbish or replace their roll covers, and consequently lead to fewer sales.

Because we have substantial operations outside the United States, we are subject to the economic and political conditions of foreign nations.

We have manufacturing facilities in 14 foreign countries. In 2010, we sold products in approximately 67 countries other than the United States, which represented approximately 73.1% of our net sales. We operate in a number of foreign countries and may face challenges unique to those countries such as in hiring employees, our relations with various parties, including suppliers and governmental agencies, and in production. In the second quarter of 2010, we executed a memorandum of understanding with a Chinese paper machine clothing manufacturer which calls for us and the manufacturer to enter into discussions regarding a potential business collaboration, which, if fully implemented, could provide Xerium with in-country manufacturing capabilities within China.

16

Table of Contents

Furthermore, we may decide to do business in countries where we have not previously done business.

In such countries we face the additional uncertainty of entering a new market and its social customs, laws and practices. Should these challenges be realized, our operating results could be adversely impacted and our business or production may be delayed.

Our foreign operations are subject to a number of risks and uncertainties, including risks that:

| • | foreign governments may impose limitations on our ability to repatriate funds; |

| • | foreign governments may impose withholding or other taxes on remittances and other payments to us, or the amount of any such taxes may increase; |

| • | an outbreak or escalation of any insurrection or armed conflict may occur; |

| • | foreign governments may impose or increase investment barriers or other restrictions affecting our business; or |

| • | changes in tax policies of foreign governments may adversely affect our foreign subsidiaries. |

The occurrence of any of these conditions could disrupt our business in particular countries or regions of the world, or prevent us from conducting business in particular countries or regions, which could adversely affect our net sales and profitability. In addition, as a holding company we rely on dividends and other payments or distributions from our subsidiaries to meet our debt obligations. If foreign governments impose limitations on our ability to repatriate funds or impose or increase taxes on remittances or other payments to us, the amount of dividends and other distributions we receive from our subsidiaries could be reduced, which could reduce the amount of cash available to us to meet our debt obligations.

Our manufacturing facilities may be required to operate at or near capacity, which could negatively affect our production, customer order time, product quality and labor relations.

As part of our efforts to reduce our costs, we have attempted to reduce or eliminate excess manufacturing capacity through closure of certain of our manufacturing plants and consolidation of our production. As a result, however, from time to time our ability to meet customer demand for our products may rely on our ability to operate our remaining manufacturing facilities at or near capacity on an uninterrupted basis. Our manufacturing facilities are dependent on critical equipment, and operating such equipment at or near capacity for extended periods may result in increased equipment failures or other reliability problems, which may result in production shutdowns or periods of reduced production. Such disruptions could have an adverse effect on our operations and financial results. In addition, insufficient manufacturing capacity or other delays may cause our customer order times to increase and our product quality to decrease, which may increase warranty costs and negatively affect customer demand for our products and customer relations generally. Operating our facilities at or near capacity may also negatively affect relations with our employees, which could result in higher employee turnover, labor disputes and disruptions in our operations.

We must continue to innovate and improve our products to maintain our competitive advantage.

Our ability to retain our customers and increase our business depends on our ability to continually develop new, technologically superior products. We cannot assure that our investments in technological development will be sufficient, that we will be able to create and market new products, that such new products will be accepted by our customers or that we will be successful in competing against new technologies developed by competitors.

We believe that market recognition of the extended life of our roll cover products and the trend towards new paper-making machine designs which have fewer rolls will continue to negatively impact the demand for our roll cover products.

We have seen a trend that paper producers are placing an increasingly strong emphasis on maintenance cost reduction and, as a result, are extending the life of roll covers through additional maintenance cycles before replacing them. Market recognition of the extended life of our roll covers products negatively impacts the

17

Table of Contents

demand for these products. In addition, we have seen a trend towards new paper-making machine designs which have fewer rolls, also negatively impacting the demand for our roll cover products. If we are not able to offset these negative impacts on the demand for our roll cover products with growth from new roll cover products, the sale of roll cover products in regions which we believe have high growth potential such as China, or from other sources, the volume of our roll cover sales will be adversely affected.

The loss of our major customers could have a material adverse effect on our net sales and profitability.

Our top ten customers generated 22.7% of our net sales during 2010. The loss of one or more of our major customers, financial difficulties faced by our customers or a substantial decrease in such customers’ purchases from us, could have a material adverse effect on our net sales and profitability. Because we do not generally have binding long-term purchasing agreements with our customers, there can be no assurance that our existing customers will continue to purchase products from us.

We may fail to adequately protect our proprietary technology, which would allow competitors or others to take advantage of our research and development efforts.

We rely upon trade secrets, proprietary know-how, and continuing technological innovation to develop new products and remain competitive. If our competitors learn of our proprietary technology, they may use this information to produce products that are equivalent or superior to our products, which could reduce the net sales of our products. Our employees, consultants, and corporate collaborators may breach their obligations not to reveal our confidential information, and any remedies available to us may be insufficient to compensate our damages. Even in the absence of such breaches, our trade secrets and proprietary know-how may otherwise become known to our competitors, or be independently discovered by our competitors, which could adversely affect our competitive position.

Our success and ability to compete in the future may depend upon obtaining sufficient patent protection for proprietary technology.

Our patent applications may not result in issued patents, and even if they result in issued patents, the patents may not have claims of the scope we seek. Even in the event that these patents are not issued, the applications may become publicly available and proprietary information disclosed in the applications will become available to others. In addition, any issued patents may be challenged, invalidated or declared unenforceable. The term of any issued patent in the United States would be 20 years from its filing date, and if our applications are pending for a long time period, we may have a correspondingly shorter term for any patent that may be issued. Our present and future patents may provide only limited protection for our technology and may not be sufficient to provide competitive advantages to us. For example, competitors could be successful in challenging any issued patents or, alternatively, could develop similar or more advantageous technologies on their own or design around our patents. Also, patent protection in certain foreign countries may not be available or may be limited in scope and any patents obtained may not be as readily enforceable as in the United States, making it difficult for us to effectively protect our intellectual property from misuse or infringement by other companies in these countries. Our inability to obtain and enforce our intellectual property rights in some countries may harm our business. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important.

We may be liable for product defects or other claims relating to our products.

Our products could be defective, fail to perform as designed or otherwise cause harm to our customers, their equipment or their products. If any of our products are defective, we may be required to recall the products and/or repair or replace them, which could result in substantial expenses and affect our profitability. Any problems with the performance of our products could harm our reputation, which could result in a loss of sales to customers and/or potential customers. In addition, if our customers believe that they have suffered harm caused

18

Table of Contents

by our products, they could bring claims against us that could result in significant liability. A failure of our products could cause substantial damage to a paper-making machine. Any claims brought against us by customers may result in:

| • | diversion of management’s time and attention; |

| • | expenditure of large amounts of cash on legal fees, expenses, and payment of damages; |

| • | decreased demand for our products and services; and |

| • | injury to our reputation. |

Our insurance may not sufficiently cover a large judgment against us or a large settlement payment, and is subject to customary deductibles, limits and exclusions.

We may be adversely affected if we fail to attract and retain key personnel.

Our future success depends on the continued contributions of our key senior management personnel, including Stephen R. Light, our President, Chief Executive Officer and Chairman. The loss of services of any of our key personnel might significantly delay or prevent the achievement of our business objectives and could cause us to incur additional costs to recruit replacements. Each member of our executive management team may terminate his or her employment at any time. We do not maintain “key person” life insurance with respect to any of our executives. As of December 31, 2010, Brian J. Fox is serving as our interim Chief Financial Officer and Chief Accounting Officer. While we continue to search for a permanent Chief Financial Officer, we can give no assurances as to when, or if, we will locate a suitable candidate, and we may be adversely affected if we are unable to identify a qualified permanent Chief Financial Officer in a timely manner.

We could incur substantial costs as a result of violations of or liabilities under laws protecting the environment and human health.

Our operations and facilities are subject to a number of national, state and local laws and regulations protecting the environment and human health in the United States and foreign countries that govern, among other things, the handling, storage and disposal of hazardous materials, discharges of pollutants into the air and water and workplace safety. The U.S. Federal Comprehensive Environmental Response, Compensation and Liability Act, as amended (“CERCLA”) provides for responses to, and, in some instances, joint and several liability for releases of hazardous substances into the environment. Environmental laws also hold current owners or operators of land or businesses liable for their own and for previous owners’ or operators’ releases of hazardous or toxic substances, materials or wastes, pollutants or contaminants, including petroleum and petroleum products. Because of our operations, the history of industrial uses at some of our facilities, the operations of predecessor owners or operators of some of the businesses, and the use and release of hazardous substances at these sites, the liability provisions of environmental laws may affect us. Many of our facilities have experienced some level of regulatory scrutiny in the past and are or may be subject to further regulatory inspections, future requests for investigation or liability for regulated materials management practices.

We cannot assure that we have been or will be at all times in complete compliance with all laws and regulations applicable to us which are designed to protect the environment and human health. We could incur substantial costs, including clean-up costs, fines and sanctions and third party property damage or personal injury claims, as a result of violations of or liabilities under environmental laws, relevant common law or the environmental permits required for our operations. While we believe that the current level of reserves is adequate, the adequacy of these reserves may change in the future due to new developments in particular matters.

Adverse labor relations could harm our operations and reduce our profitability.

As of December 31, 2010, we had 3,404 employees, approximately 36% of whom were subject to protection of various collective bargaining agreements and approximately 35% of whom were subject to job protection as members of trade unions, employee associations or workers’ councils. Approximately 55% of the employees

19

Table of Contents

subject to collective bargaining agreements (or approximately 33% of our total employees) were covered by collective bargaining agreements that expire prior to December 31, 2011. We cannot be certain that we will be able to renew such collective bargaining agreements, or enter into new collective bargaining agreements, which do not adversely affect our operating results and that we will be without production interruptions, including labor stoppages. In addition, approximately 77% of the employees subject to job protection as members of trade unions, employee associations or workers’ councils (or approximately 55% of our total employees) were subject to arrangements that expire prior to December 31, 2011. We cannot be certain that the terms of employment applicable to such employees will not change in a manner which adversely affects our operating results. We cannot be certain that we will not experience disruptions in our operations as a result of labor disputes or experience other labor relations issues. If we are unable to maintain good relations with our employees, our ability to produce our products and provide services to our customers could be reduced and/or our production costs could increase, either of which could disrupt our business and reduce our net sales and profitability.

Risks Relating to our Capital Structure

Our credit facilities contain restrictive debt covenants that limit our business flexibility by imposing operating and financial restrictions on our operations.

Our credit facilities impose significant operating and financial restrictions on our operations that may restrict our ability to pursue our business strategies. These restrictions prohibit or limit, among other things:

| • | the incurrence of additional indebtedness, the payment of cash dividends and the issuance of certain redeemable capital stock; |

| • | investments and acquisitions; |

| • | disposition of assets and subsidiary interests; |

| • | transactions with affiliates; |

| • | the creation of liens on our assets; |

| • | consolidations, mergers and transfers of all or substantially all of our assets; and |

| • | our ability to change the nature of our business. |

The objectives of our restructuring efforts may not be achieved.

Our reorganization was designed to improve our consolidated balance sheet and capital structure by decreasing our outstanding consolidated debt and significantly reducing our annual interest expense. However, these efforts may not be sufficient to enable us to improve our operating results. Although we recently reduced our debt obligations under the Plan of Reorganization, we continue to have a significant amount of debt. Our ability to satisfy our ongoing debt service obligations will depend on our ability to achieve our financial forecasts. These forecasts are based on certain assumptions regarding foreign currency exchange rates, demand for paper products, the level of paper production and inventories, the number of mills producing paper and the financial health and access to capital of the paper producers. Should these assumptions prove to be incorrect, our future financial forecasts may vary significantly from what we anticipated during our restructuring, jeopardizing our ability to satisfy our debt service obligations. Accordingly, we cannot assure you that we will be able to achieve our objectives with respect to the business restructuring strategy.

We will remain highly leveraged for the foreseeable future, which could impact our financing options, financial results and liquidity position.

Although we recently reduced our debt obligations under the Plan of Reorganization, we continue to have a significant amount of debt. As of December 31, 2010, our total amount of outstanding debt, on a consolidated basis, was $481.4 million. The degree to which we are leveraged on a consolidated basis could have important

20

Table of Contents

consequences to us, including that we may be more vulnerable to economic downturns, be limited in our flexibility to plan for and react to changes in our business or strategy. In addition, in the event that we seek to refinance our debt or require additional refinancing in the future, we may be unable to do so on attractive terms or at all.

We will continue to require a significant amount of cash, which may not be available to us, to service our debt and to fund our liquidity needs.

Our ability to make payments on, refinance or repay our debt, to fund planned capital expenditures or to expand our business will depend largely upon our future operating performance. Our future operating performance is dependent upon our ability to execute our business strategy successfully. Such performance is also subject to general economic, financial and competitive factors, as well as other factors that are beyond our control. There can be no assurance that our future operating performance will generate sufficient cash to support our cash requirements, or that we will not need to reduce capital expenditures or take other actions designed to conserve our cash in order to make payments required to service our indebtedness.

Required payments with respect to our indebtedness, including additional debt repayments based on fifty percent of our “excess cash”, as defined in the Amended and Restated Credit Facility and Exit Facility, will reduce the amount of funds available for other corporate purposes, which could harm our competitiveness and/or limit opportunities to grow our business.

Fluctuations in interest rates could adversely affect our liquidity, interest expense and financial results.

Our credit facilities have variable interest rates. To the extent that we do not enter into hedging arrangements that effectively fix the interest rate on a portion of our senior debt, the interest rate on all of the debt covered by our credit facilities will fluctuate based on LIBOR and other variable interest rates. To the extent these interest rates increase, our interest expense may increase, in which event, we may have difficulty making interest payments and funding our other costs and our ability to comply with the financial covenants in our credit facilities may be adversely affected. We terminated our outstanding interest rate swaps at December 31, 2009 and have not entered into any new interest rate swap agreements since that time. Consequently, our financial statements could be exposed to the effects of interest rate fluctuations, which could have a material impact on our results of operations. However, under the Amended and Restated Credit Facility, the CDOR Rate, the LIBOR Rate and the Euribor Rate are subject to a minimum base rate of 2.00% per annum, which is currently higher than the respective base rates, which were 1.24%, 0.30281% and 1.021% at December 31, 2010, respectively.

We do not anticipate paying a dividend on our common stock in the foreseeable future, which may adversely affect the market price of our common stock.

Our credit facilities prohibit the payment of dividends on our common stock. Accordingly, we do not anticipate paying dividends on our common stock for the foreseeable future. The lack of dividend payments may adversely affect the market price of our common stock.

The market price of our common stock has been volatile since our initial public offering and may continue to be volatile.

Shares of our common stock may continue to experience substantial price volatility, including significant decreases, in response to a number of events, including:

| • | sales of our common stock by principal stockholders; |

| • | our quarterly operating results; |

| • | issuances of our common stock; |

| • | future announcements concerning our business; |

21

Table of Contents

| • | our dividend policy; |

| • | the failure of securities analysts to cover our common stock and/or changes in financial estimates and recommendations by securities analysts; |

| • | actions of competitors; |

| • | fluctuations in foreign currency exchange rates; |

| • | changes in U.S. and foreign government regulation; |

| • | general market, economic and political conditions; and |

| • | natural disasters, terrorist attacks and acts of war. |

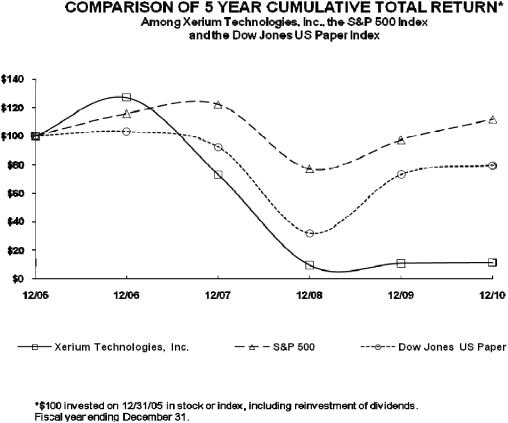

On December 31, 2010 the closing price of our common stock was $15.95 as compared with $15.20 as of December 31, 2009. During the twelve months ended December 31, 2010, the lowest closing price of our common stock was $9.40 and the highest closing price was $28.00. All share prices reflect the effective 20-to-1 reverse stock split that occurred on the Effective Date.