Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ASSEMBLY BIOSCIENCES, INC. | v312013_8k.htm |

Exhibit 99.1

Russell H. Ellison, MD, MSc Chief Executive Officer and Chairman of the Board

1 This material contains estimates and forward - looking statements. The words “believe,” “may,” “might,” “will,” “aim,” “estimate,” “continue,” “would,” “anticipate, ”“intend,” “expect,” “plan” and similar words are intended to identify estimates and forward - looking statements. Our estimates and forward - looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or might affect our businesses and operations. Although we believe that these estimates and forward - looking statements are based upon reasonable assumptions, they are subject to many risks and uncertainties and are made in light of information currently available to us. Our estimates and forward - looking statements may be influenced by the following factors, among others : risks related to the costs, timing, regulatory review and results of our studies and clinical trials; our ability to obtain FDA approval of our product candidates; differences between historical studies on which we have based our planned clinical trials and actual results from our trials; our anticipated capital expenditures, our estimates regarding our capital requirements, and our need for future capital; our liquidity and working capital requirements; our expectations regarding our revenues, expenses and other results of operations; the unpredictability of the size of the markets for, and market acceptance of, any of our products, including VEN 309; our ability to sell any approved products and the price we are able realize; our need to obtain additional funding to develop our products, and our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; estimates and estimate methodologies used in preparing our financial statements; the future trading prices of our common stock and the impact of securities analysts’ reports on these prices; and the risks set out in our filings with the SEC, including our Annual Report on Form 10 - K. Estimates and forward - looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of known and unknown risks and uncertainties, including those described above, the estimates and forward - looking statements discussed in this material might not occur and our future results and our performance might differ materially from those expressed in these forward - looking statements due to, including, but not limited to, the factors mentioned above. Estimates and forward - looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward - looking statement because of new information, future events or other factors. Forward Looking Statements

» A Phase III biopharmaceutical company focused exclusively on gastroenterology; specifically, anal disorders - a neglected area of drug development » Development risk stratified across three late - stage products NCE and 505(b)2 registration pathways Two pivotal Phase III read - outs for two separate products expected in 2Q 2012 Possible validation of two lead programs Range of co - promotion/partnership opportunities could follow data » Products address large, underserved, and untapped markets 3 of the top 10 GI disorders Significant market potentials in specialty pharma and primary care » Well funded through key milestones Cash and cash equivalents of $ 36.9 Mil (Dec 31, 2011) $20 mm IPO (with overallocation ) in Dec 2010; $50 mm follow - on in July 2011 2 Company Overview

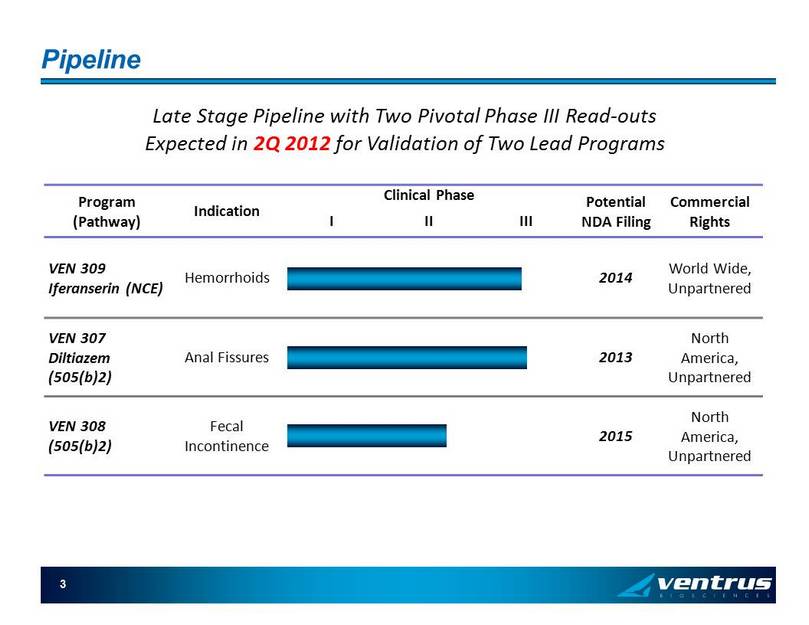

Pipeline 3 Program (Pathway) Indication Clinical Phase Potential NDA Filing Commercial Rights I II III VEN 309 Iferanserin ( NCE ) Hemorrhoids 2014 World Wide, Unpartnered VEN 307 Diltiazem (505(b)2 ) Anal Fissures 2013 North America , Unpartnered VEN 308 (505(b)2) Fecal Incontinence 2015 North America , Unpartnered Late Stage Pipeline with Two Pivotal Phase III Read - outs Expected in 2Q 2012 for Validation of Two Lead Programs

VEN 309: Iferanserin NCE for Hemorrhoids

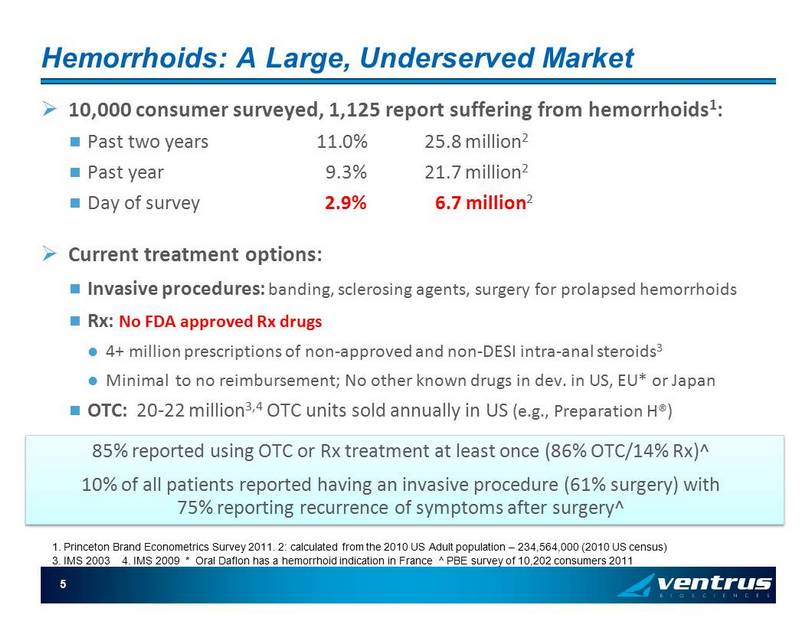

5 Hemorrhoids: A Large, Underserved Market » 10,000 consumer surveyed, 1,125 report suffering from hemorrhoids 1 : Past two years 11.0% 25.8 million 2 Past year 9.3% 21.7 million 2 Day of survey 2.9% 6.7 million 2 » Current treatment options: Invasive procedures: banding, sclerosing agents, surgery for prolapsed hemorrhoids Rx: No FDA approved Rx drugs 4+ million prescriptions of non - approved and non - DESI intra - anal steroids 3 Minimal to no reimbursement; No other known drugs in dev. in US, EU* or Japan OTC: 20 - 22 million 3,4 OTC units sold annually in US (e.g., Preparation H®) 85% reported using OTC or Rx treatment at least once (86% OTC/14% Rx)^ 10% of all patients reported having an invasive procedure (61% surgery) with 75% reporting recurrence of symptoms after surgery^ 3. IMS 2003 4. IMS 2009 * Oral Daflon has a hemorrhoid indication in France ^ PBE survey of 10,202 consumers 2011 1. Princeton Brand Econometrics Survey 2011. 2: calculated from the 2010 US Adult population – 234,564,000 (2010 US census )

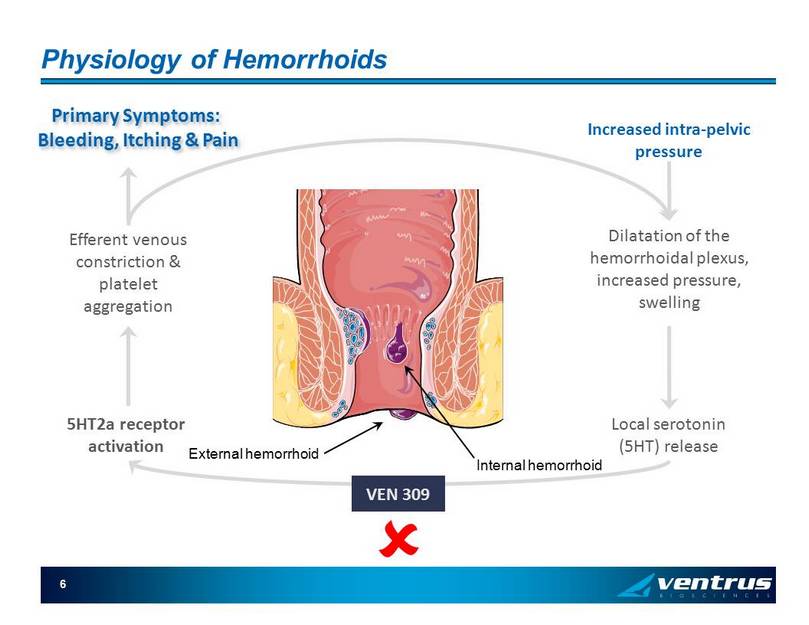

6 Physiology of Hemorrhoids Increased intra - pelvic pressure Dilatation of the hemorrhoidal plexus, increased pressure, swelling Local serotonin (5HT) release 5HT2a receptor activation Efferent venous constriction & platelet aggregation Internal hemorrhoid External hemorrhoid VEN 309 Primary Symptoms: Bleeding, Itching & Pain

7 VEN 309 ( iferanserin ) Summary Topical rectal ointment applied intra - anally BID x 2 weeks (with proprietary single - use applicator) Mechanism of Action » Selective 5HT2a antagonist » Does not cross the blood brain barrier except at doses much higher than to be used therapeutically Preclinical Safety » Systemic exposure is < 10% » Therapeutic ratio is > 17x Clinical Pharmacology » Metabolized by CYP2D6 in liver » No accumulation of the drug on twice daily dosing Clinical Data » Seven clinical trials in 359 subjects (220 exposures) » No SAEs, limited AEs (mainly GI), similar AE profile vs. placebo » Significant improvements in symptoms related to hemorrhoids including bleeding, pain and itching

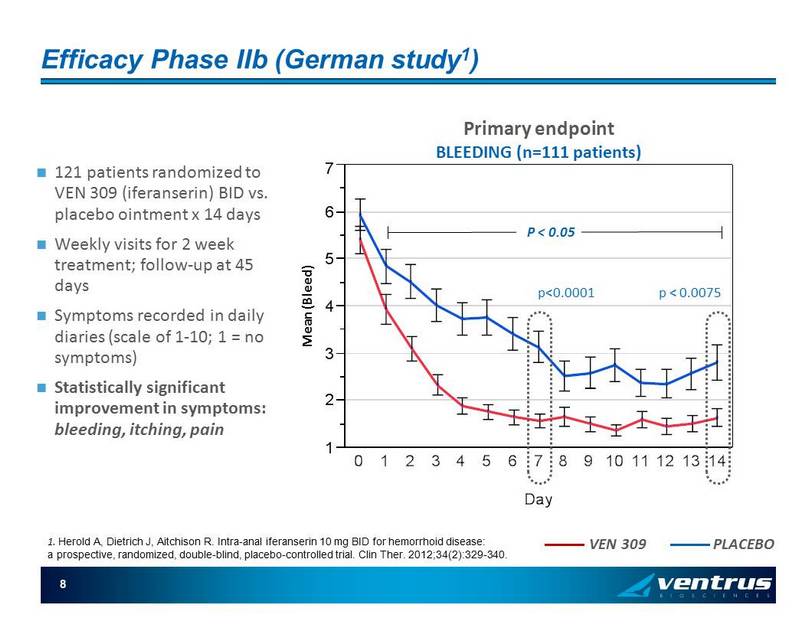

8 Efficacy Phase IIb (German study 1 ) 121 patients randomized to VEN 309 ( iferanserin ) BID vs. placebo ointment x 14 days Weekly visits for 2 week treatment; follow - up at 45 days Symptoms recorded in daily diaries (scale of 1 - 10; 1 = no symptoms) Statistically significant improvement in symptoms: bleeding, itching, pain 1 2 3 4 5 6 7 M e a n ( B l e e d ) 0 1 2 3 4 5 6 7 8 9 1011121314 Day VEN 309 PLACEBO Mean (Bleed) Primary endpoint BLEEDING (n=111 patients) P < 0.05 1. Herold A, Dietrich J, Aitchison R. Intra - anal iferanserin 10 mg BID for hemorrhoid disease: a prospective, randomized, double - blind, placebo - controlled trial. Clin Ther . 2012;34(2):329 - 340. p<0.0001 p < 0.0075

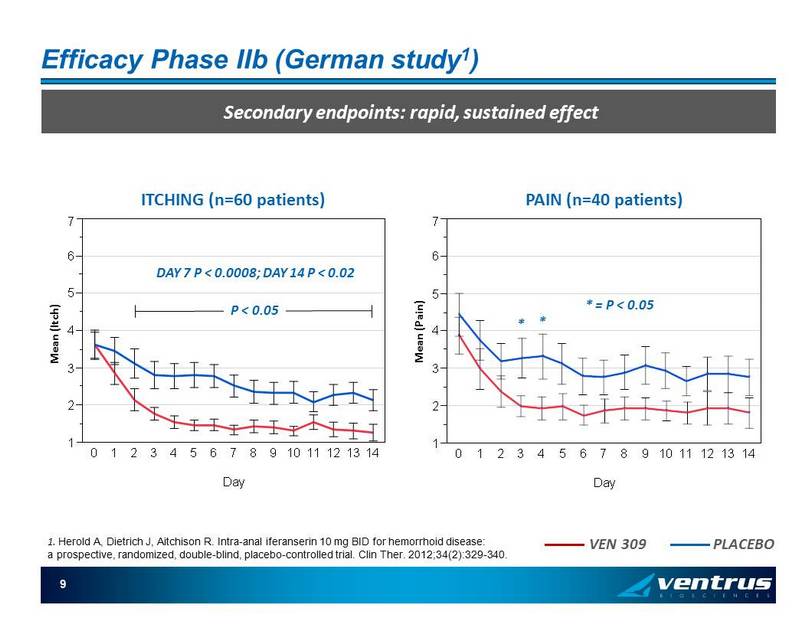

9 1 2 3 4 5 6 7 M e a n ( P a i n ) 0 1 2 3 4 5 6 7 8 9 1011 12 13 14 Day Efficacy Phase IIb (German study 1 ) Secondary endpoints: rapid, sustained effect 1 2 3 4 5 6 7 M e a n ( I t c h ) 0 1 2 3 4 5 6 7 8 9 1011121314 Day * = P < 0.05 * ITCHING (n=60 patients) PAIN (n=40 patients) P < 0.05 DAY 7 P < 0.0008; DAY 14 P < 0.02 * Mean (Itch) Mean (Pain) VEN 309 PLACEBO 1. Herold A, Dietrich J, Aitchison R. Intra - anal iferanserin 10 mg BID for hemorrhoid disease: a prospective, randomized, double - blind, placebo - controlled trial. Clin Ther . 2012;34(2):329 - 340.

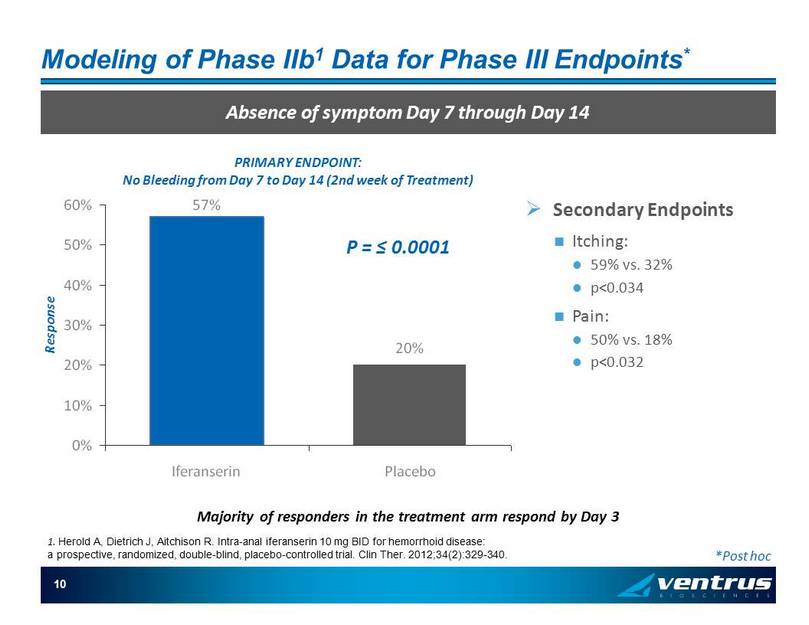

10 Modeling of Phase IIb 1 Data for Phase III Endpoints * Absence of symptom Day 7 through Day 14 Majority of responders in the treatment arm respond by Day 3 *Post hoc » Secondary Endpoints Itching: 59% vs. 32% p<0.034 Pain: 50% vs. 18% p<0.032 57% 20% 0% 10% 20% 30% 40% 50% 60% Iferanserin Placebo P = ≤ 0.0001 PRIMARY ENDPOINT: No Bleeding from Day 7 to Day 14 (2nd week of Treatment) Response 1. Herold A, Dietrich J, Aitchison R. Intra - anal iferanserin 10 mg BID for hemorrhoid disease: a prospective, randomized, double - blind, placebo - controlled trial. Clin Ther . 2012;34(2):329 - 340.

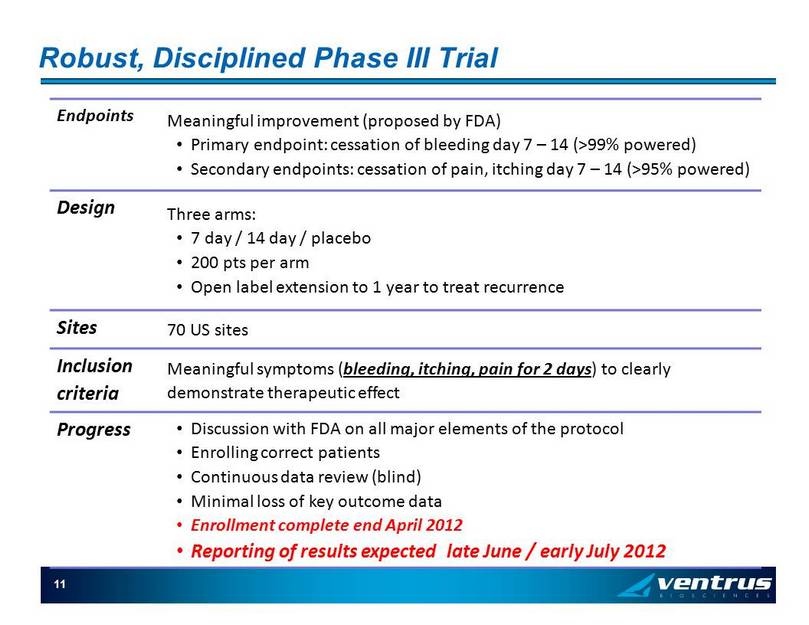

Robust, Disciplined Phase III Trial Endpoints Meaningful improvement (proposed by FDA) • Primary endpoint: cessation of bleeding day 7 – 14 (>99% powered) • Secondary endpoints: cessation of pain, itching day 7 – 14 (>95% powered) Design Three arms: • 7 day / 14 day / placebo • 200 pts per arm • Open label extension to 1 year to treat recurrence Sites 70 US sites Inclusion criteria Meaningful symptoms ( bleeding, itching, pain for 2 days ) to clearly demonstrate therapeutic effect Progress • Discussion with FDA on all major elements of the protocol • Enrolling correct patients • Continuous data review (blind) • Minimal loss of key outcome data • Enrollment complete end April 2012 • Reporting of results expected late June / early July 2012 11

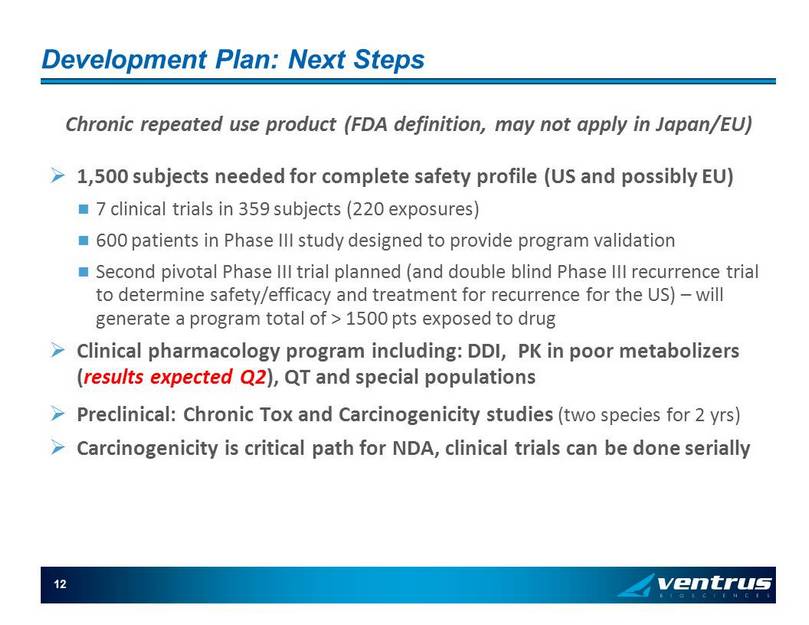

12 Development Plan: Next Steps Chronic repeated use product (FDA definition, may not apply in Japan/EU) » 1,500 subjects needed for complete safety profile (US and possibly EU) 7 clinical trials in 359 subjects (220 exposures) 600 patients in Phase III study designed to provide program validation Second pivotal Phase III trial planned (and double blind Phase III recurrence trial to determine safety/efficacy and treatment for recurrence for the US) – will generate a program total of > 1500 pts exposed to drug » Clinical pharmacology program including: DDI , PK in poor metabolizers ( results expected Q2 ), QT and special populations » Preclinical: Chronic Tox and Carcinogenicity studies (two species for 2 yrs) » Carcinogenicity is critical path for NDA, clinical trials can be done serially

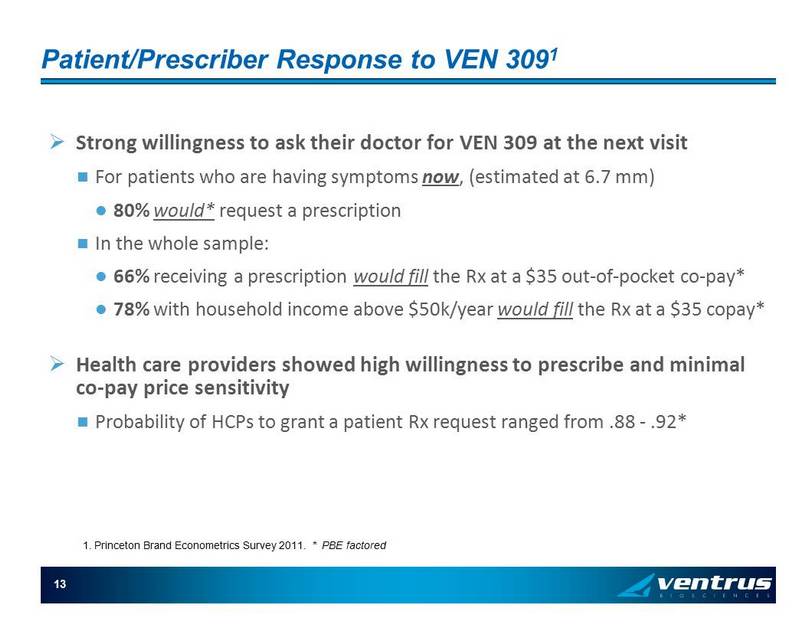

13 Patient/Prescriber Response to VEN 309 1 » Strong willingness to ask their doctor for VEN 309 at the next visit For patients who are having symptoms now , (estimated at 6.7 mm) 80% would* request a prescription In the whole sample: 66% receiving a prescription would fill the Rx at a $35 out - of - pocket co - pay* 78% with household income above $50k/year would fill the Rx at a $35 copay* » Health care providers showed high willingness to prescribe and minimal co - pay price sensitivity Probability of HCPs to grant a patient Rx request ranged from .88 - .92* 1. Princeton Brand Econometrics Survey 2011. * PBE factored

VEN 307: Diltiazem Cream Novel Treatment for Anal Fissures

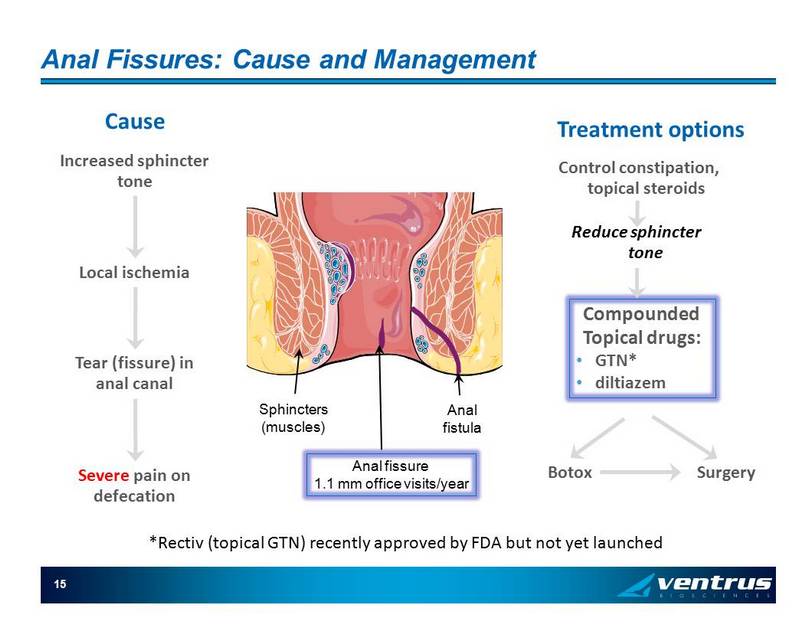

15 Anal Fissures: Cause and Management Increased sphincter tone Local ischemia Tear (fissure) in anal canal Cause Severe pain on defecation Treatment options Control constipation, topical steroids Reduce sphincter tone Compounded Topical drugs: • GTN* • diltiazem Botox Surgery Sphincters (muscles) Anal fissure 1.1 mm office visits/year Anal fistula * Rectiv (topical GTN) recently approved by FDA but not yet launched

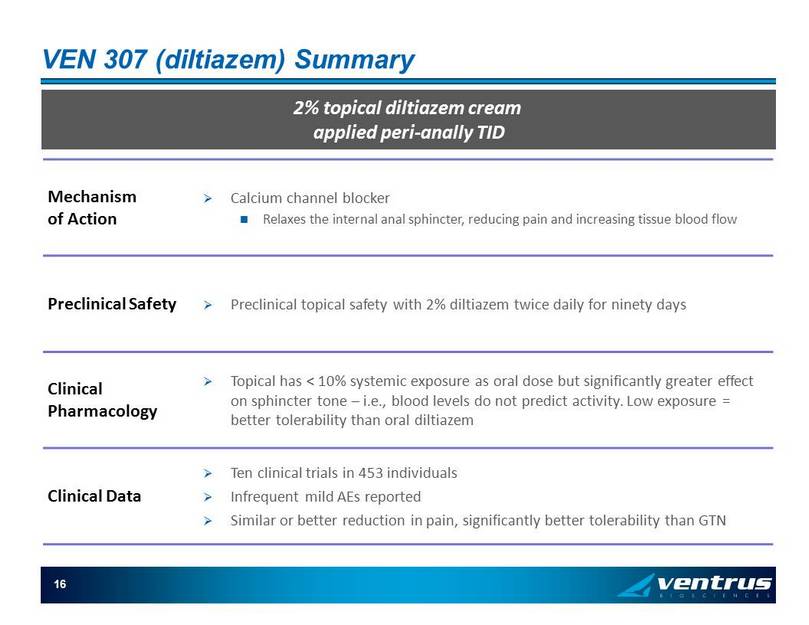

16 VEN 307 ( diltiazem ) Summary 2% topical diltiazem cream applied peri - anally TID Mechanism of Action » Calcium channel blocker Relaxes the internal anal sphincter, reducing pain and increasing tissue blood flow Preclinical Safety » Preclinical topical safety with 2% diltiazem twice daily for ninety days Clinical Pharmacology » Topical has < 10% systemic exposure as oral dose but significantly greater effect on sphincter tone – i.e., blood levels do not predict activity. Low exposure = better tolerability than oral diltiazem Clinical Data » Ten clinical trials in 453 individuals » Infrequent mild AEs reported » Similar or better reduction in pain, significantly better tolerability than GTN

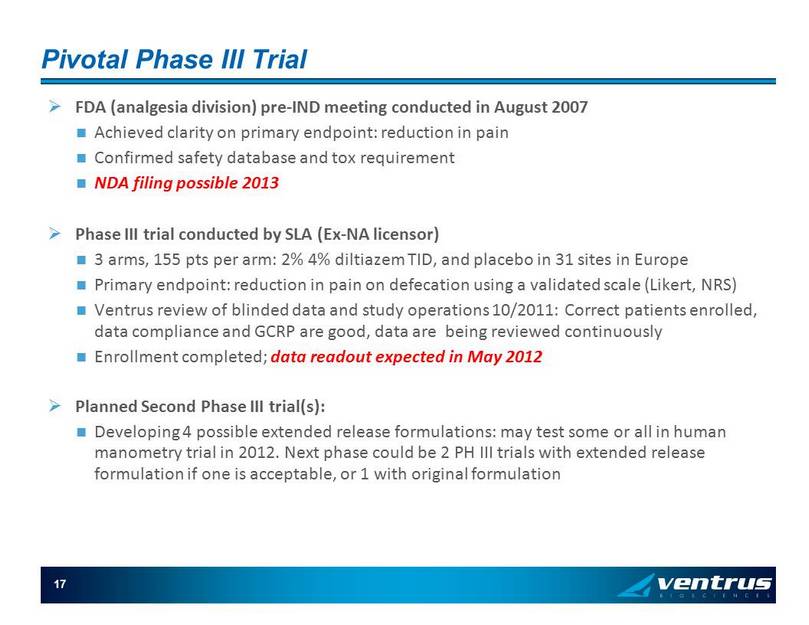

17 Pivotal Phase III Trial » FDA (analgesia division) pre - IND meeting conducted in August 2007 Achieved clarity on primary endpoint: reduction in pain Confirmed safety database and tox requirement NDA filing possible 2013 » Phase III trial conducted by SLA (Ex - NA licensor) 3 arms, 155 pts per arm: 2% 4% diltiazem TID , and placebo in 31 sites in Europe Primary endpoint: reduction in pain on defecation using a validated scale ( Likert , NRS) Ventrus review of blinded data and study operations 10/2011: Correct patients enrolled, data compliance and GCRP are good, data are being reviewed continuously Enrollment completed; data readout expected in May 2012 » Planned Second Phase III trial(s): Developing 4 possible extended release formulations: may test some or all in human manometry trial in 2012. Next phase could be 2 PH III trials with extended release formulation if one is acceptable, or 1 with original formulation

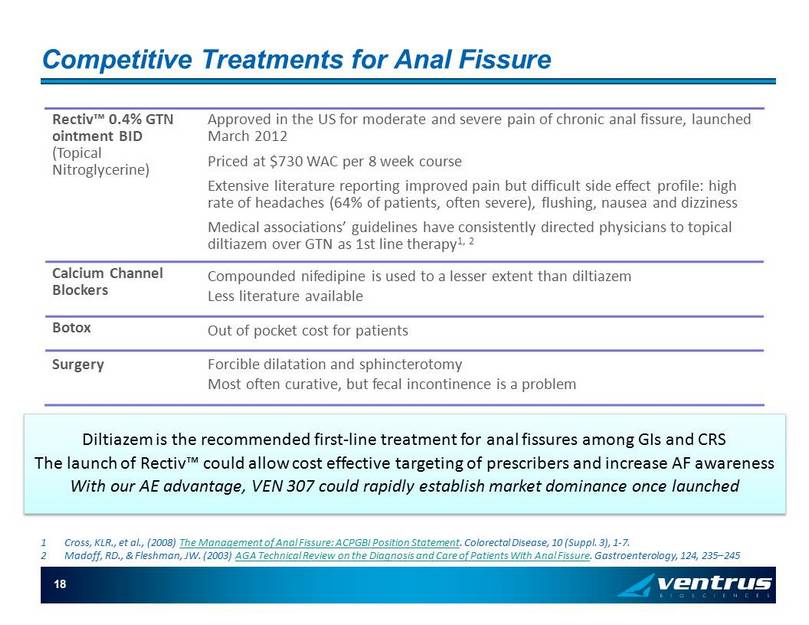

18 Competitive Treatments for Anal Fissure 1 Cross, KLR ., et al., (2008) The Management of Anal Fissure: ACPGBI Position Statement . Colorectal Disease, 10 (Suppl. 3), 1 - 7. 2 Madoff , RD., & Fleshman , JW . (2003) AGA Technical Review on the Diagnosis and Care of Patients With Anal Fissure . Gastroenterology, 124, 235 – 245 Diltiazem is the recommended first - line treatment for anal fissures among GIs and CRS The launch of Rectiv ™ could allow cost effective targeting of prescribers and increase AF awareness With our AE advantage, VEN 307 could rapidly establish market dominance once launched Rectiv ™ 0.4% GTN ointment BID (Topical Nitroglycerine) Approved in the US for moderate and severe pain of chronic anal fissure, launched March 2012 Priced at $730 WAC per 8 week course Extensive literature reporting improved pain but difficult side effect profile: high rate of headaches (64% of patients, often severe), flushing, nausea and dizziness Medical associations’ guidelines have consistently directed physicians to topical diltiazem over GTN as 1st line therapy 1, 2 Calcium Channel Blockers Compounded nifedipine is used to a lesser extent than diltiazem Less literature available Botox Out of pocket cost for patients Surgery Forcible dilatation and sphincterotomy Most often curative, but fecal incontinence is a problem

Business Overview, Milestones

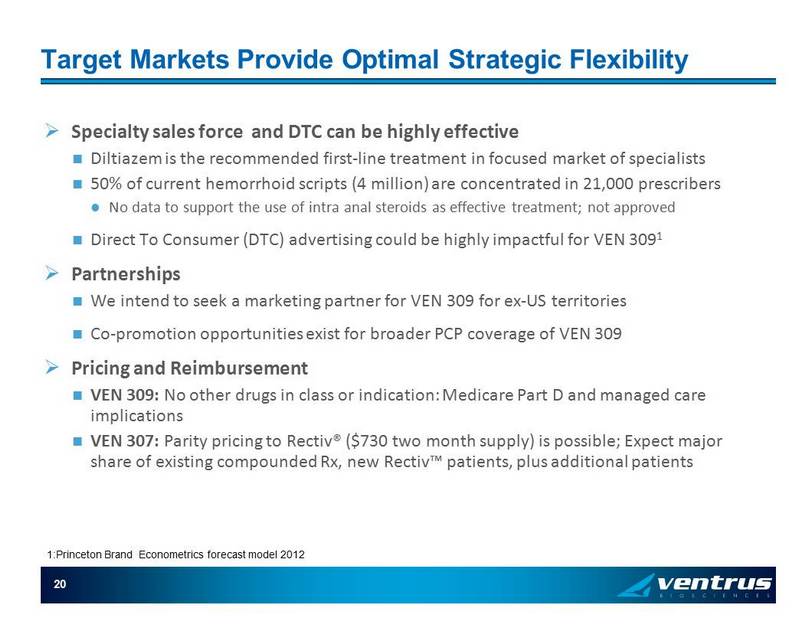

20 Target Markets Provide Optimal Strategic Flexibility » Specialty sales force and DTC can be highly effective Diltiazem is the recommended first - line treatment in focused market of specialists 50% of current hemorrhoid scripts (4 million) are concentrated in 21,000 prescribers No data to support the use of intra anal steroids as effective treatment; not approved Direct To Consumer (DTC) advertising could be highly impactful for VEN 309 1 » Partnerships We intend to seek a marketing partner for VEN 309 for ex - US territories Co - promotion opportunities exist for broader PCP coverage of VEN 309 » Pricing and Reimbursement VEN 309: No other drugs in class or indication: Medicare Part D and managed care implications VEN 307: Parity pricing to Rectiv ® ($730 two month supply) is possible; Expect major share of existing compounded Rx, new Rectiv ™ patients, plus additional patients 1:Princeton Brand Econometrics forecast model 2012

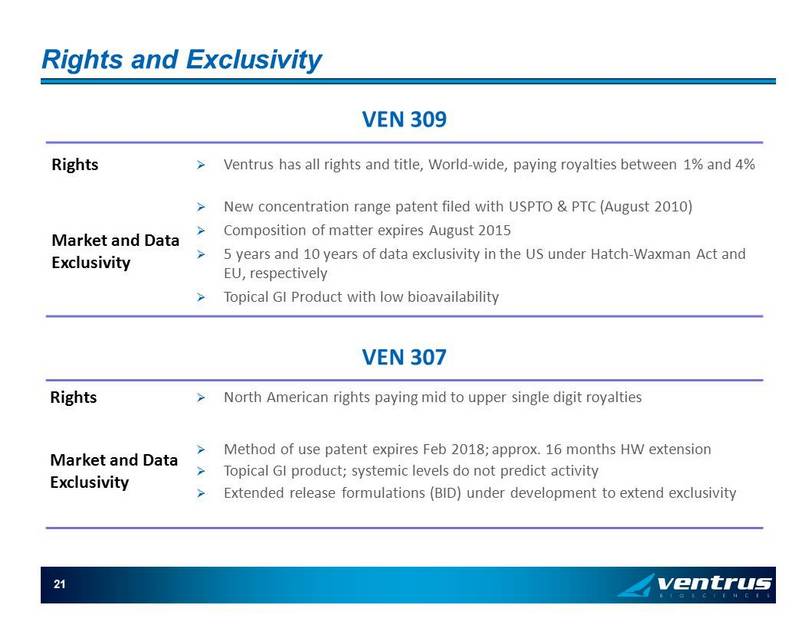

Rights and Exclusivity Rights » Ventrus has all rights and title, World - wide, paying royalties between 1% and 4% Market and Data Exclusivity » New concentration range patent filed with USPTO & PTC (August 2010) » Composition of matter expires August 2015 » 5 years and 10 years of data exclusivity in the US under Hatch - Waxman Act and EU, respectively » Topical GI Product with low bioavailability 21 VEN 309 VEN 307 Rights » North American rights paying mid to upper single digit royalties Market and Data Exclusivity » Method of use patent expires Feb 2018; approx. 16 months HW extension » Topical GI product; systemic levels do not predict activity » Extended release formulations (BID) under development to extend exclusivity

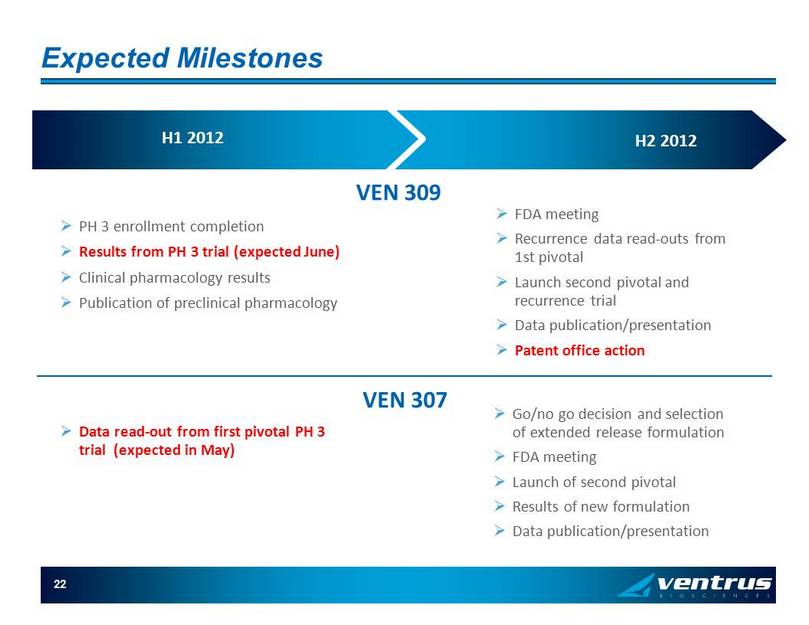

22 Expected Milestones H1 2012 H2 2012 » PH 3 enrollment completion » Results from PH 3 trial (expected June) » Clinical pharmacology results » Publication of preclinical pharmacology » FDA meeting » Recurrence data read - outs from 1st pivotal » Launch second pivotal and recurrence trial » Data publication/presentation » Patent office action VEN 309 VEN 307 » Data read - out from first pivotal PH 3 trial (expected in May) » Go/no go decision and selection of extended release formulation » FDA meeting » Launch of second pivotal » Results of new formulation » Data publication/presentation

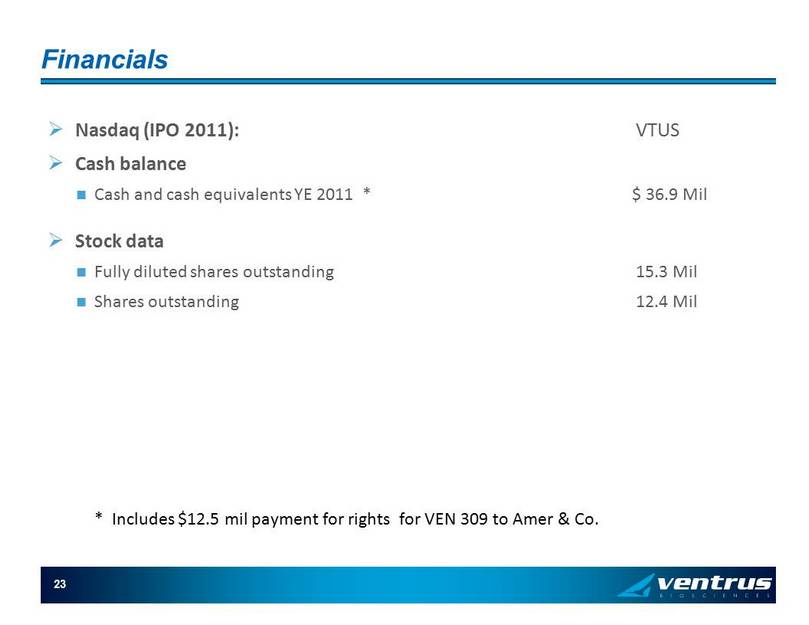

23 Financials » Nasdaq (IPO 2011): VTUS » Cash balance Cash and cash equivalents YE 2011 * $ 36.9 Mil » Stock data Fully diluted shares outstanding 15.3 Mil Shares outstanding 12.4 Mil * Includes $12.5 mil payment for rights for VEN 309 to Amer & Co.

» Development risk stratified across three late - stage products NCE and 505(b)2 registration pathways Two pivotal Phase III read - outs for two separate products expected in 2Q 2012 Possible validation of two lead programs Range of co - promotion/partnership opportunities could follow data » Products address large, underserved, and untapped markets 3 of the top 10 GI disorders Significant market potentials in specialty pharma and primary care » Well funded through key milestones Cash and cash equivalents of $ 37 mm (Dec. 31, 2011) $20 mm IPO (with overallocation ) in Dec 2010; $50 mm follow - on in July 2011 24 Conclusion

Russell H. Ellison, MD, MSc Chief Executive Officer and Chairman of the Board