Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE EARNINGS RELEASE - AutoWeb, Inc. | form8k_050312.htm |

| EX-99.1 - EX 99.1 - PRESS RELEASE RE EARNINGS - AutoWeb, Inc. | ex99_1.htm |

Exhibit 99.2

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 1

AUTOBYTEL INC.

Moderator: Roger Pondel

May 3, 2012

5:00 p.m. ET

|

Operator:

|

Good day, ladies and gentlemen, and welcome to the Autobytel announces 2012 first quarter financial results conference call. At this time, all participants are in a listen-only mode. Later, we’ll have a question and answer session and instructions will follow at that time. If anyone should require assistance during the conference, please press star then zero on your touchtone telephone. As a reminder, today’s conference is being recorded for replay purposes.

|

I would now like to turn the conference over to your host for today, Mr. Roger Pondel, investor relations. Sir, you may begin.

|

Roger Pondel:

|

Thanks, Mary, and hello everyone. Welcome to Autobytel’s 2012 first quarter conference call. I’m joined today by Jeffrey Coats, President and Chief Executive Officer, and Curt DeWalt, Senior Vice President and Chief Financial Officer. Before we begin, I need to remind you that during today’s call, including the question and answer session, any projections and forward-looking statements made regarding future events or Autobytel’s future financial performance are covered by the Safe Harbor statements contained in today’s press release, the slides accompanying this presentation, and the company’s public filings with the SEC. Actual events and results may differ materially from those forward-looking

statements. Specifically, please refer to the company’s Form 10-Q for the quarter ended March 31, 2012, which has just been filed, as well as other filings made by Autobytel with the SEC. These filings identify factors that could cause results to differ materially from those forward-looking statements.

|

As always, slides are included with today’s presentation to help illustrate some of the points being made and discussed during the call. You can access the slides by clicking on the link in today’s press release, or by visiting Autobytel’s website at www.autobytel.com. When there, go to “Investor Relations” and click on “Events & Presentations.”

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 2

Also, note that during this call, we will be discussing EBITDA and cash flow, which are non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in the slides being used on this call and that are posted on Autobytel’s website.

With that, I will turn the call over to Jeff.

|

Jeff Coats:

|

Thanks, Roger. Good afternoon, everyone.

|

Today I’m pleased to report our fourth consecutive quarter of profitability, our fifth consecutive quarter of positive cash flow, and that we have grown our cash balance to $12.1 million from $7.5 million a year ago.

As I stated in our last earnings call, we are laser focused on executing against three strategic goals: driving improved purchase request quality and volume; developing enhancements to Autobytel.com to deliver greater scale and relevance; and maintaining strict operating cost controls. The results of this disciplined approach are now clearly showing, both in our purchase request quality metrics and in our financial results.

Simply put, we are upbeat about Autobytel and our market position.

A combination of demonstrated improvement and our purchase request quality, a strong SAAR forecast for 2012 that has been revised upwards several times, and exciting new Autobytel products, including a mobile platform, bode well for our customers, consumers, employees and stockholders.

I will update you on our key initiatives and why we are feeling upbeat after Curt provides the financial review. Curt?

|

Curt DeWalt:

|

Thank you, Jeff.

|

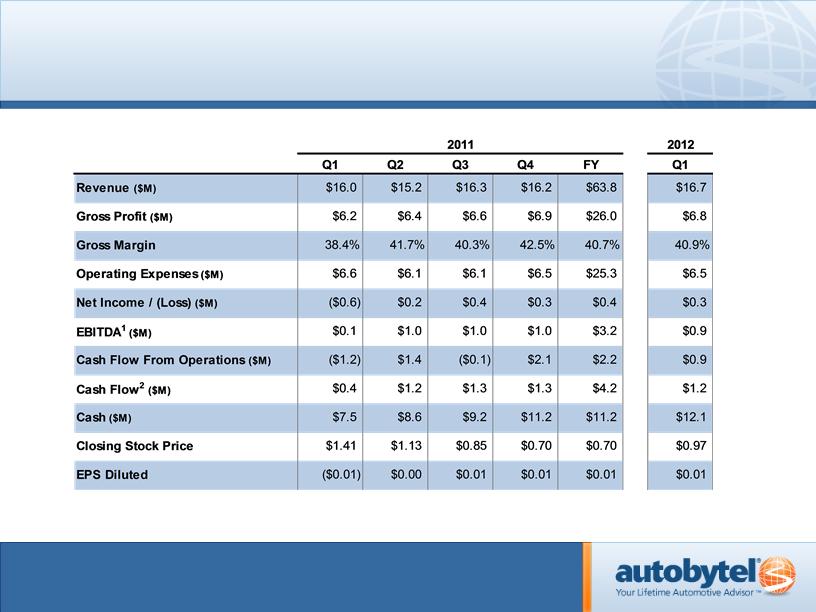

As shown on Slide 3, total revenues for the 2012 first quarter rose 4% to $16.7 million, up from $16.0 million for the prior year quarter, reflecting an increase

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 3

in wholesale, or manufacturer, purchase requests. $16.7 million represents our highest quarterly revenues since Q3 of 2008, and our highest first quarter revenues also since 2008. On a sequential basis, revenue grew approximately 3%.

On Slide 4, you can see our quarterly revenues by source for the 2012 first quarter. Total automotive purchase request revenue increased by approximately 7% over the prior year, which included a 13% increase in wholesale channels compared with last year’s first quarter. Finance request revenue declined 4% compared with the prior year as a result of a decision to eliminate lower quality purchase requests. Advertising revenue declined 14% over last year’s first quarter due primarily to timing delays of certain OEM direct marketing campaigns.

We delivered approximately 1.1 million automotive purchase requests for the 2012 first quarter, compared with 995,000 for the prior year period. 73% of the automotive purchase requests we delivered were in the wholesale channel. The remainder, 27%, was delivered in the retail, or dealer, channel, where we have continued to strengthen the business by essentially eliminating costly incentive programs previously offered to new dealer customers.

We also delivered approximately 100,000 finance requests for the first quarter versus 112,000 a year ago.

On Slide 5, you’ll see gross profit increased 11% to $6.8 million for the 2012 first quarter, up from $6.2 million for the first quarter of 2011. Gross margin improved to 40.9% versus 38.4% for last year’s first quarter. The improvement was principally related to the increase in number of the internally-generated purchase requests as well as improved efficiencies related to our search engine marketing initiatives.

Total operating expenses declined slightly for the 2012 first quarter to $6.5 million, from $6.6 million for last year’s first quarter, principally as a result of lower professional fees.

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 4

As you’ll see on Slide 6, non-cash stock-based compensation for 2012 first quarter was $281,000 versus $227,000 for the 2011 first quarter.

Amortization and depreciation totaled $508,000 for the most recent first quarter, compared with $510,000 for the prior year first quarter.

This brings EBITDA to $896,000 for the first quarter of 2012, versus $144,000 for last year’s first quarter.

We generated net income of $253,000, or $0.01 per diluted share, for the first quarter of 2012, compared with a net loss of $571,000 for the prior year first quarter.

Cash provided by operations was $894,000 for the most recent first quarter, compared with cash used in operations of $1.2 million last year.

At the end of March our cash and cash equivalents balance had grown to $12.1 million, up from $11.2 million at the end of last year, and $7.5 million at the end of last year’s first quarter.

From the commencement of our stock repurchase program on March 7th through April, we’ve purchased a total of 333,463 shares of our common stock at a range of $0.92 to $1.00 with an average price of $0.96 per share. Approximately $1.2 million remains available under the authorized $1.5 million program. The timing and the extent of future purchases will depend on market conditions, legal constraints and other considerations at Autobytel’s sole discretion.

Before I turn the call back to Jeff, I’d like to briefly comment on the status of our NASDAQ $1 minimum bid closing price deficiency. On April 15th, NASDAQ granted us our request for an additional 180 days in which to satisfy this continued listing requirement after the initial grace period expired on March 13th. The new grace period will expire on September 10th. As noted in our recently filed proxy statement, our board of directors is

proposing a reverse stock split as a potential remedy to the deficiency. If approved and implemented, the reverse stock split would be within a range of one share of

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 5

our common stock for every three to five shares of common stock, with the exact ratio to be decided by the board prior to the effective time of the reverse stock split amendment.

With that, I’ll turn the call back to Jeff.

|

Jeff Coats:

|

Thanks, Curt.

|

It’s an exciting time to be part of the automotive industry and its strong recovery. As you can see on Slide 7, most experts are forecasting ongoing industry growth for 2015, the strongest of which should occur over the next two years.

The fundamental reasons for projected growth are a generally improving economy, reductions in unemployment rates, better vehicle financing options, an aging car fleet that is being replaced, and a steady stream of exciting new model launches. With positive economic trends in the auto industry and migration of automotive ad dollars online, we are continuing to align our product development efforts to capture the opportunities these trends are creating.

More immediately, our core business of providing high quality purchase requests continues to perform well. Total automotive purchase requests were up 6% versus the prior year’s first quarter and 4% sequentially, despite U.S. Light Vehicle Retail unit sales being down 1% for the first quarter, as you can see on Slide 8.

Our continued growth is a direct result of our ability to directly generate high quality purchase requests that convert to vehicle sales for our customers. As you know, we have been focused on internal purchase request generation because those purchase requests convert into vehicle sales at a higher rate than those purchased from third party providers while also reducing associated costs and growing margins. We are seeing the impact of the improved performance of our purchase requests with retail dealers as they continue to sign onto our programs despite the fact that we have nearly eliminated all incentive programs previously offered.

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 6

Through our work with R.L. Polk and information provided by our manufacturer and dealer customers, we know from experience that the conversion rates of Autobytel’s internally generated purchase requests significantly outperform, by as much as 150%, what we believe represents an industry average closing rate of between 6% and 8%. This is the number one reason OEMs and dealers buy our purchase requests – because they convert at a significantly higher rate.

As we mentioned last quarter, the quality improvements we have made are driving increased budget allocations from our OEM and large dealer group customers, which is driving a significant increase in purchase requests.

Autobytel’s competitive advantages, which form the basis of our optimism, include what we believe to be the industry’s largest combined wholesale and retail automotive purchase request distribution network. This gives us ample opportunity to deliver our high quality purchase requests to an increasing number of customers. At the same time, we are rebuilding a premier brand that is a comprehensive consumer destination, offering original content that should allow us to generate increased consumer interaction and an increasing number of internally generated purchase requests.

As we continue to elevate Autobytel.com’s appeal by incorporating new and ever-evolving features, and by producing highly useful, interesting and authoritative content on the site, we believe consumer traffic and engagement will increase. For example, daily average viewership of our exclusive videos has grown nearly tenfold since we relaunched Autobytel’s YouTube channel at the beginning of the calendar year. Since that time we have amassed more than 1.8 million video views, helping further enhance our brand recognition.

As we mentioned on our last call, we recently teamed with AutoNation, America’s largest auto retailer, to offer consumers an easier way to sell their used cars. Our “Sell Your Car” program is a hassle-free way to sell a vehicle online in just three easy steps. Currently available in 13 states, we are working with AutoNation to take the program nationwide.

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 7

Also in partnership with AutoNation, we recently rolled out our “Ultimate Test Drive” program, which allows consumers in certain states to test drive used rental vehicles from Avis and Budget and obtain hassle-free pricing if the consumer is interested in purchasing a vehicle.

Our new “What Car is Right For Me” shopping tool eliminates the guesswork during the car shopping process by allowing consumers to choose from a wide range of options, then filter for those options that best suit their needs. We think this tool is a great way for consumers to navigate through the nearly 400 2012 vehicle models and countless older models.

Our MyGarage feature continues to offer consumers highly differentiated content, allowing the creation of a customized “garage” that contains information about all vehicles in a given household. In addition, this area of the site contains a suite of tools that allows consumers to diagnose car problems, get repair estimates and receive information from local mechanics. We will also be adding additional functionality to this area throughout the year.

We are also on track to launch the mobile version of Autobytel.com later this quarter. The mobile-optimized website will give consumers the opportunity to view photos and videos and read car reviews from their personal mobile devices. In addition, the mobile site will offer shopping tools that allow consumers to find a dealer, browse dealer inventories and request price quotes. It will also feature useful calculators that will allow consumers to estimate payments, calculate fuel savings and evaluate the advantages of a purchase vs. lease for the vehicles they are considering.

A key part of enhancing the automotive consumer experience is connecting consumers with dealers in their areas. Given this, we will be launching a newly expanded dealer directory on Autobytel.com during the third quarter of this year. This comprehensive directory will show every franchised automobile dealer in the United States. As with our mobile site, consumers will be able to browse a dealer’s inventory, request price quotes and utilize mapping tools to aid in the shopping process.

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 8

With the industry moving along an encouraging path, Autobytel.com driving enhanced consumer traffic and engagement, and our strategy to continually improve purchase request quality and volume, our outlook for 2012 is bullish. We expect strong single digit revenue growth and to more than double net income from 2011 levels. I am confident in our ability to generate positive future performance.

With that, Mary, we’ll now take questions.

|

Operator:

|

Certainly. Ladies and gentlemen, if you have a question at this time, please press star then one on your touch tone telephone. If your question has been answered or you wish to remove yourself from the queue at any time, please press the pound key. Once again, if you have a question, please press star then one. And our first question comes from Steve Dyer from Craig Hallum. Your line is open.

|

|

Steve Dyer:

|

Thanks. Good afternoon.

|

|

Jeff Coats:

|

Hi, Steve.

|

|

Steve Dyer:

|

You know, you talked about, I think, sequentially you guys outperformed overall retail sales. Year over year you lagged a little bit. What’s sort of the root of that?

|

|

Jeff Coats:

|

I think it’s just timing. You know, we’re not going to track, on a one-to-one basis, exactly what’s going on with SAAR with unit sales, so it’s just a timing issue, I think.

|

|

Steve Dyer:

|

OK. Wondering if you could expand a little bit more on some of the data capabilities – data mining, I guess, so to speak – which you’ve talked about before with Aperture and when we may see something along those lines contribute.

|

|

Jeff Coats:

|

We are still working on that. We really have not made as much progress on it as we had hoped to by now. We are in fact reviewing our partnerships and trying to determine what’s the best way forward for this. There are some interesting opportunities which we would expect to achieve this year, but it

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 9

just has not come to fruition on the timeframe we had thought we would be able to get it.

|

Steve Dyer:

|

OK, and then I think I heard right at the end of the prepared remarks, strong single digit revenue growth, which seems like it lags, you know, certainly what people are talking about for auto sales, which, you know, seems like every day SAAR estimates get hiked. So where’s the disconnect there? Where do you anticipate, you know, that you’re going to lag the industry?

|

|

Jeff Coats:

|

I don’t really think that we’re necessarily going to lag the industry. I think that kind of puts us in line with what we think the analysts are now looking at for car sales this year. Remember, if you look at the macro SAAR estimates it includes fleet, and we don’t benefit from or participate at all in what happens with fleet sales, so we’re really looking at more just the pure retail end of it.

|

|

Steve Dyer:

|

OK. How should we think about gross margins going forward, you know, sort of vis-à-vis recent levels?

|

|

Jeff Coats:

|

We do think there are still some margin expansion opportunity available to us.

|

|

Steve Dyer:

|

OK. That’s all I have. Thanks.

|

|

Jeff Coats:

|

Thank you, Steve.

|

|

Operator:

|

Thank you. Our next question comes from Jared Schramm from Roth Capital. Your line is open.

|

|

Koji:

|

Thanks for taking my questions. This is Koji for Jared.

|

|

Jeff Coats:

|

Hi, Koji.

|

|

Koji:

|

Hey, how are you doing? Your advertising revenue came in lower than what we’re modeling. Can you talk a bit more about how we should think about this going forward and maybe your overall outlook on the auto industry advertising spend?

|

|

Jeff Coats:

|

It’s not that our advertising revenue per se was off. It’s really the direct marketing component of that category. There were some OEM direct

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 10

marketing campaigns that were delayed that we would have expected to generate revenue for us in the first quarter, and they did not bring those programs through, so that’s really the primary issue there.

|

Koji:

|

Are you seeing any ad spend strengths or weaknesses from any particular manufacturer?

|

|

Jeff Coats:

|

No, not really. You know, pretty much everybody is back in the market. I mean, you know, General Motors is not doing a lot of incentives these days. In fact, you know, that’s part of their explanation for why their sales were down during the month of April, that you know, they decided to try to maintain margin at the expense of market share.

|

But for the most part, we see pretty much everybody.

|

Koji:

|

Great, last question. Since the launch of the new website, we’ve actually noticed a pretty significant uptick in the traffic to your website. Is there a particular section of the website that is performing better than others?

|

|

Jeff Coats:

|

One of the areas that’s performing the best are the top 10 lists, where people come in and they go look at, you know, the different kind of vehicles by whatever the top 10 category is. That’s actually been a very well received section of the site. Otherwise, it’s, you know, usually the make model pages as people are researching and comparing vehicles.

|

|

Koji:

|

Great. Thanks guys.

|

|

Jeff Coats:

|

Thank you.

|

|

Operator:

|

Thank you. Your next question comes from George Santana from Ascendiant. Your line is open.

|

|

George Santana:

|

Thanks for taking my question. Just to verify a couple of numbers – you had the purchase requests delivered – was that 1,100 in automotive, 100 in finance?

|

|

Curt DeWalt:

|

Yes. 1.1 million in automotive and 100,000 in finance. Correct.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 11

|

George Santana:

|

OK. And in terms of the R.L. Polk, was there anything that came out in terms of that study? I know it’s an ongoing study, as you spoke last quarter, but it seemed pretty powerful.

|

|

Jeff Coats:

|

I’m sorry, George, I didn’t understand you.

|

|

George Santana:

|

Well, you had spoken quite a bit about the R.L. Polk ongoing study.

|

|

Jeff Coats:

|

Right.

|

|

George Santana:

|

Was there any data that’s come out of that, that we can reference?

|

|

Jeff Coats:

|

Well, there’s actually a lot of data that’s come out of it, which, you know, we’re using to make some decisions about some things that we’re currently doing. I had hoped to be in a position to start talking about some of the details publicly this quarter, but we only have a couple of months of data, and we’ve decided to work with the data for another few months before we really start putting it out there publicly.

|

|

George Santana:

|

OK, fair enough.

|

|

Jeff Coats:

|

But, it is fair to say that the data that we see has reconfirmed our belief in the information that we’ve been getting back from the manufacturers and some of the larger dealer groups, that our purchase requests are indeed closing above the industry average and for many people at the high end of their range.

|

|

George Santana:

|

And the data you have suggests it’s statistically significant?

|

|

Jeff Coats:

|

Oh, yes.

|

|

George Santana:

|

OK. Well, that’s great to hear. Switching to another subject. Sorry, go ahead.

|

|

Jeff Coats:

|

Let me clarify this for you. What we’re doing is statistically significant because we’re not just doing sample studies. We’re actually running every lead that we generate and sell through this program in order to ultimately determine whether it results in a car being sold or not, so it’s across all of our automotive leads that we’re running this new program.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 12

|

George Santana:

|

OK. So we’ll hear more perhaps next quarter then.

|

|

Jeff Coats:

|

Yes.

|

|

George Santana:

|

OK, thanks. Noticing also, on a different subject, your wholesale request volume as a percentage of the total going up, which is great, that seems to imply that the auto manufacturers are really buying into this. They’re seeing the value in the leads, but I guess on the other side, when you go to the dealers, my due diligence call suggests that they don’t really know that it’s Autobytel because it’s coming in as Toyota third party or what have you – GM third party. So how do you maintain your brand identity when you switch to 73% being wholesale?

|

|

Jeff Coats:

|

Because we still have 2,500 dealer customers that are directly on our program, and they see this information. We are preparing the information packaging for how we’re going to talk to the dealers about the close rate data that we get back through Polk, and you know, through the ongoing training and support that we give to them and our other dealer products like iControl.

|

|

George Santana:

|

OK, but it’s not like there’s some kind of flexibility to say, you know, Toyota third party ABTL inside the lead so that the dealer will recognize that it’s an Autobytel lead.

|

|

Jeff Coats:

|

You can rest assured that we push wherever we can related to those programs to have our purchase requests identified so dealers know. You know, the different manufacturers have different rules, and candidly, in some cases, they have outside third parties running their programs for them, so it’s something that we are aware of. It’s something that we are trying to improve, in terms of the branding aspect. Yes.

|

|

George Santana:

|

OK, thank you. I’ll jump back in the queue.

|

|

Operator:

|

Thank you. Once again, if you have a question please press star then one. Your next question comes from Patrick Lin from Primarius Capital. Your line is open.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 13

|

Patrick Lin:

|

Hi, guys. Congrats on the quarter, particularly the strong cash flow generation. I want to just ask you real quickly if you could give us, just refresh my memory, on what your business looks like sequentially from, you know, March on through the year in terms of if there are seasonalities in what we should try to anticipate, you know, to try to model out the year. Thank you.

|

|

Curt DeWalt:

|

There is seasonality. Traditionally, the second and third quarters are the strongest of the year – first and fourth being the weakest. However, as we may recall from our call last year, because of what took place in Japan there was really kind of a pushing forward by quarter, so fourth quarter, although still somewhat weak, was stronger than what you would have expected to see, so, we came into the year with a very strong first quarter in January and February, so Q1 is probably a little stronger than we might have thought as well, but right now certainly the second half of the year will be very strong for us as well.

|

|

Patrick Lin:

|

Is there any reason to expect that cash flow generation would be less, just in terms of the way your business cycles run, during the next couple of quarters then, because it’s stronger on the top line?

|

|

Curt DeWalt:

|

No, I mean the only thing where you get caught on that, obviously, is if you have a very strong finish in a given month that the receivables jump ahead before you’re able to actually make the collections, so a working capital adjustment, but overall at this point, I’m not expecting anything that would cause us to see a major departure from what we’re seeing currently.

|

|

Patrick Lin:

|

Great. And then just one last final question. Can you just give a quick update in terms of any upcoming conferences you might be at in the next couple of months.

|

|

Jeff Coats:

|

Sure. I think the next conference we’re participating in is the B. Riley conference out here in Los Angeles on the 22nd. We’re presenting on the 22nd of May. I’m participating in a Stifel Nicolaus panel at their conference, I believe on June 19th in New York, and we’re participating in the Craig Hallum

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 14conference in Minneapolis the week of Memorial Day. I can’t remember the exact day off the top of my head.

|

Patrick Lin:

|

Terrific. Thank you very much, and congrats again.

|

|

Jeff Coats:

|

Thank you.

|

|

Curt DeWalt:

|

Thank you.

|

|

Operator:

|

Once again, if you have a question please press star then one. And we have a followup from George Santana from Ascendiant. Your line is open.

|

|

George Santana:

|

OK, thanks again. Leading from this previous question, when you’re talking about seasonality, so last year we had that kind of dip in the second quarter and then the previous two years were a little difficult to judge, but can we expect sequential quarter increases in revenues from the first quarter?

|

|

Jeff Coats:

|

We have noticed a little bit of online traffic slowing down in April. It’s possible that revenue in the second quarter might be down a little bit from the first quarter, but it’ll be, you know, much stronger than our second quarter revenue a year ago because we only did about $15.2 as a result of the Japanese earthquake and tsunami. So, I would expect we might be a little below the $16.7 this quarter, but not a lot I wouldn’t think.

|

|

George Santana:

|

OK, and from here on out your comps are pretty easy. I think the first quarter was the most difficult that we see in the near future, correct?

|

|

Jeff Coats:

|

Probably, yes.

|

|

George Santana:

|

OK. And then looking at operating expenses, I think there was some mention of conferences or of some special expenditures in the first quarter. What should we expect as far as G&A for sales and marketing going forward?

|

|

Curt DeWalt:

|

Actually, at this point, you know a lot of the big expenses for the quarter are behind us. The balance of the year should pretty much smooth out. We’re not expecting to see any large increases, so at this point, I think what you’re seeing in the way of operating expenses, we’re well on track to maintain.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

05-03-12/5:00 p.m. ET

Confirmation # 73798213

Page 15

|

George Santana:

|

OK, thanks, and great quarter guys.

|

|

Jeff Coats:

|

Thank you, George.

|

|

Operator:

|

Thank you. I show no further questions in the queue and would like to turn the conference back to Mr. Jeffrey Coats for closing remarks.

|

|

Jeff Coats:

|

Thanks, Mary. Hey, the Craig Hallum conference is Wednesday, May 30th, related to that earlier question, and it’ll be in Minneapolis. Thanks again, everybody, for joining us today. We appreciate your patience and support and assure you that our objectives are completely aligned with those of our stockholders, namely, to enhance shareholder value. We look forward to reporting further progress as the year unfolds. Thank you.

|

|

Operator:

|

Ladies and gentlemen, thank you for your participation in today’s conference. This does conclude the program, and you may all disconnect at this time.

|

|

|

END

|

Q1 2012 Results

May 3, 2012

The statements made in the accompanying conference call or contained in this presentation that are not historical facts are forward-looking statements under

the federal securities laws. These forward-looking statements, including, but not limited to future growth opportunities being created by our sharp focus on

business fundamentals, combined with a recovering automotive market, being on track to deliver top and bottom line growth in 2012, confidence in our ability

to generate positive future performance, our outlook for 2012 being bullish and anticipation for strong single-digit revenue growth and to more than double net

income, are not guarantees of future performance and involve assumptions and risks and uncertainties that are difficult to predict. Actual outcomes and

results may differ materially from what is expressed in, or implied by, these forward-looking statements. Autobytel undertakes no obligation to update publicly

any forward-looking statements, whether as a result of new information, future events or otherwise. Among the important factors that could cause actual

results to differ materially from those expressed in, or implied by, the forward-looking statements are changes in general economic conditions; the financial

condition of automobile manufacturers and dealers; disruptions in automobile production resulting from any disasters; changes in fuel prices; the economic

impact of terrorist attacks, political revolutions or military actions; failure of our internet security measures; dealer attrition; pressure on dealer fees; increased

or unexpected competition; the failure of new products and services to meet expectations; failure to retain key employees or attract and integrate new

employees; actual costs and expenses exceeding charges taken by Autobytel; changes in laws and regulations; costs of legal matters, including, defending

lawsuits and undertaking investigations and related matters; and other matters disclosed in Autobytel’s filings with the Securities and Exchange Commission.

Investors are strongly encouraged to review the company’s Annual Report on Form 10-K for the year ended December 31, 2011, and other filings with the

Securities and Exchange Commission for a discussion of risks and uncertainties that could affect the business, operating results, or financial condition of

Autobytel and the market price of the company’s stock. In addition, current year financial information could be subject to change as a result of subsequent

events or the finalization of the company’s financial statement close which culminates with the filing of the company’s Annual Report on Form 10-K for the

current year.

the federal securities laws. These forward-looking statements, including, but not limited to future growth opportunities being created by our sharp focus on

business fundamentals, combined with a recovering automotive market, being on track to deliver top and bottom line growth in 2012, confidence in our ability

to generate positive future performance, our outlook for 2012 being bullish and anticipation for strong single-digit revenue growth and to more than double net

income, are not guarantees of future performance and involve assumptions and risks and uncertainties that are difficult to predict. Actual outcomes and

results may differ materially from what is expressed in, or implied by, these forward-looking statements. Autobytel undertakes no obligation to update publicly

any forward-looking statements, whether as a result of new information, future events or otherwise. Among the important factors that could cause actual

results to differ materially from those expressed in, or implied by, the forward-looking statements are changes in general economic conditions; the financial

condition of automobile manufacturers and dealers; disruptions in automobile production resulting from any disasters; changes in fuel prices; the economic

impact of terrorist attacks, political revolutions or military actions; failure of our internet security measures; dealer attrition; pressure on dealer fees; increased

or unexpected competition; the failure of new products and services to meet expectations; failure to retain key employees or attract and integrate new

employees; actual costs and expenses exceeding charges taken by Autobytel; changes in laws and regulations; costs of legal matters, including, defending

lawsuits and undertaking investigations and related matters; and other matters disclosed in Autobytel’s filings with the Securities and Exchange Commission.

Investors are strongly encouraged to review the company’s Annual Report on Form 10-K for the year ended December 31, 2011, and other filings with the

Securities and Exchange Commission for a discussion of risks and uncertainties that could affect the business, operating results, or financial condition of

Autobytel and the market price of the company’s stock. In addition, current year financial information could be subject to change as a result of subsequent

events or the finalization of the company’s financial statement close which culminates with the filing of the company’s Annual Report on Form 10-K for the

current year.

This presentation includes a discussion of "EBITDA" and “Cash Flow,” which are non-GAAP financial measures. The company defines EBITDA as net

income before (i) interest income (expense); (ii) income tax provision (benefit); and (iii) depreciation and amortization. The company defines non-GAAP Cash

Flow as EBITDA plus non-cash stock compensation related to the company's grant of stock options and other equity instruments. The company believes

these non-GAAP financial measures provide important supplemental information to management and investors. These non-GAAP financial measures reflect

an additional way of viewing aspects of the company's operations that, when viewed with the GAAP results and the accompanying reconciliations to

corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the company's business and results of

operations. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP and should not

be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the company's consolidated financial

statements in their entirety and to not rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be

possible to compare these financial measures with other companies' non-GAAP financial measures having the same or similar names. In addition, the

company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from the company's non-

GAAP measures should not be construed as an inference that these costs are unusual, infrequent or non-recurring.

income before (i) interest income (expense); (ii) income tax provision (benefit); and (iii) depreciation and amortization. The company defines non-GAAP Cash

Flow as EBITDA plus non-cash stock compensation related to the company's grant of stock options and other equity instruments. The company believes

these non-GAAP financial measures provide important supplemental information to management and investors. These non-GAAP financial measures reflect

an additional way of viewing aspects of the company's operations that, when viewed with the GAAP results and the accompanying reconciliations to

corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the company's business and results of

operations. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP and should not

be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the company's consolidated financial

statements in their entirety and to not rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be

possible to compare these financial measures with other companies' non-GAAP financial measures having the same or similar names. In addition, the

company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from the company's non-

GAAP measures should not be construed as an inference that these costs are unusual, infrequent or non-recurring.

Copyright (c) 2012 Autobytel Inc.

2

Safe Harbor Statement

and Non-GAAP Disclosures

and Non-GAAP Disclosures

Overview

Copyright (c) 2012 Autobytel Inc.

3

§ Q1 2012 revenue grew 4% over prior year to $16.7M

§ Q1 2012 gross margin expanded 250bp Y-O-Y to 40.9%

§ Q1 2012 net income improved $824k over prior year to $253k

§ Cash improved by $0.9M over Q4 2011 and $4.6M over Q1 2011

§ Balance sheet continues to strengthen; $12.1M cash balance

§ On track to deliver top and bottom line growth in 2012

2012 Q1 Results

Copyright (c) 2012 Autobytel Inc.

4

+ $0.7M

+ 4%

+ 250bps

+ $0.8M

+ 522%

+ $0.8M

+ 144%

Comments

§ OEM and other wholesale purchase request revenue up 13% Y-O-Y and up 1% sequentially

§ Dealer revenue flat Y-O-Y, but up 10% sequentially as a result of increased demand

§ Specialty finance purchase request revenue down 4% Y-O-Y, but up 8% sequentially both due to seasonality

and a recovery from the Q4 reduction of lower quality supply

and a recovery from the Q4 reduction of lower quality supply

Revenue Results

Copyright (c) 2012 Autobytel Inc.

5

Financial Overview

1 EBITDA is equal to Net Income plus Interest, Taxes, and Depreciation and Amortization; See slide 6 for reconciliation

2 Cash Flow is equal to EBITDA plus Non-Cash Stock Compensation; See slide 6 for reconciliation

Copyright (c) 2012 Autobytel Inc.

6

EBITDA and Cash Flow

1 EBITDA is equal to Net Income plus Interest, Taxes, and Depreciation and Amortization

2 Cash Flow is equal to EBITDA plus Non-Cash Stock Compensation

3 Above financials are impacted by rounding to the nearest $0.1M

Copyright (c) 2012 Autobytel Inc.

7

Auto Industry Sales Forecast

Copyright (c) 2012 Autobytel Inc.

8

Comments

§In April, IHS increased its US Light Vehicle Sales Forecast for 2012 to 14.2M from 13.5M; AutoNation issued

a forecast of “mid 14M units” for 2012

a forecast of “mid 14M units” for 2012

§Also in April, J.D. Power increased its 2012 US Light Vehicle Sales Forecast to 14.3M due to improving economic variables

and the replacement rate of aging vehicles

and the replacement rate of aging vehicles

Source: J.D. Power and Associates unless otherwise noted

Total Sales

Fleet Sales

Retail Sales

US Light Vehicle History and Forecast by Retail, Fleet and Total Sales

Copyright (c) 2012 Autobytel Inc.

9

Comments

§SAAR US Light Vehicle sales hit 15M in February 2012, the highest in four years, on 1.1M vehicles sold

§Total US Light Vehicle sales were up 13% in Q1 2012 vs. prior year and up 6% sequentially due to fleet sales.

Retail sales, however, were down 1% sequentially from Q4 2011 to Q1 2012

Retail sales, however, were down 1% sequentially from Q4 2011 to Q1 2012

§Earlier this week, Automotive News released April 2012 US Light Vehicle sales at 1.2M, up 2% over prior year, and

April 2012 US Light Vehicle SAAR at 14.4M, up 9% over prior year

April 2012 US Light Vehicle SAAR at 14.4M, up 9% over prior year

Source: J.D. Power and Associates and Automotive News for April 2012

Historical Auto Industry Sales

Autobytel.com

Copyright (c) 2012 Autobytel Inc.

§ Unique consumer proposition “Your

Lifetime Automotive Advisor”™

Lifetime Automotive Advisor”™

§ Distinctive consumer content,

engagement and social dialogue

engagement and social dialogue

• What Car is Right for Me?

• MyGarage®

• Used Car Finder

• What’s Hot NowSM

• Sell Your Car

• Intuitive Navigation to Make and Model

Pages

Pages

• Detail page features Overviews, Expert

Reviews, Pricing and Specs along with

Consumer Ratings

Reviews, Pricing and Specs along with

Consumer Ratings

• Car Comparison Tools

• Incentives & Rebates Information

• Car and Truck of the Year Awards

• Mobile Site launching in Q2

10