Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONOCOPHILLIPS | d341683d8k.htm |

| EX-2.1 - SEPARATION AND DISTRIBUTION AGREEMENT - CONOCOPHILLIPS | d341683dex21.htm |

| EX-10.5 - TRANSITION SERVICES AGREEMENT - CONOCOPHILLIPS | d341683dex105.htm |

| EX-99.1 - PRESS RELEASE - CONOCOPHILLIPS | d341683dex991.htm |

| EX-10.2 - INTELLECTUAL PROPERTY ASSIGNMENT AND LICENSE AGREEMENT - CONOCOPHILLIPS | d341683dex102.htm |

| EX-10.1 - INDEMNIFICATION AND RELEASE AGREEMENT - CONOCOPHILLIPS | d341683dex101.htm |

| EX-10.4 - EMPLOYEE MATTERS AGREEMENT - CONOCOPHILLIPS | d341683dex104.htm |

| EX-10.3 - TAX SHARING AGREEMENT - CONOCOPHILLIPS | d341683dex103.htm |

Exhibit 99.2

April 3, 2012

ConocoPhillips and its Board of Directors

600 N. Dairy Ashford

Houston, TX 77079

Ladies and Gentlemen:

We have acted as special counsel to ConocoPhillips, a Delaware corporation (“ConocoPhillips”), in connection with the transactions contemplated by the Separation and Distribution Agreement (the “Agreement”) to be entered into by and between ConocoPhillips and Phillips 66, a Delaware corporation (“Phillips 66”). At your request, we are rendering our opinion as to certain United States federal income tax consequences of certain transactions contemplated by the Agreement. All capitalized terms used but not defined herein shall have the meanings ascribed to them in the ConocoPhillips Certificate dated as of the date hereof and delivered in connection herewith (the “ConocoPhillips Certificate”), and any reference to any document includes a reference to any exhibit, appendix, or similar attachment thereto.

In providing this opinion, we have reviewed and relied upon: (i) the Agreement; (ii) the ConocoPhillips Certificate and the Phillips 66 Certificate dated as of the date hereof and delivered in connection herewith (the “Phillips 66 Certificate,” and, together with the ConocoPhillips Certificate, the “Certificates”); (iii) the Tax Sharing Agreement to be entered into by and among ConocoPhillips, ConocoPhillips Company, a Delaware corporation and a wholly-owned subsidiary of ConocoPhillips (“ConocoPhillips Company”), Phillips 66, and

ConocoPhillips

April 3, 2012

Page 2

Phillips 66 Company, a Delaware corporation and a wholly-owned subsidiary of ConocoPhillips Company (“Phillips 66 Company”); (iv) the ruling request relating to Sections 332, 351, 355, 368 and certain other provisions of the Internal Revenue Code of 1986, as amended (the “Code”) filed by ConocoPhillips with the Internal Revenue Service in connection with the transactions contemplated by the Agreement and all supplemental submissions filed in connection therewith (together, the “Request for Rulings”); (v) the private letter ruling issued to ConocoPhillips by the Internal Revenue Service in response to the Request for Rulings (the “Private Letter Ruling”); (vi) the registration statement of Phillips 66 on Form 10 filed with the Securities and Exchange Commission on November 14, 2011 (as amended through the date hereof) (the “Registration Statement”), ConocoPhillips’s annual reports on Form 10-K for its fiscal years ended December 31, 2010 and December 31, 2011, and ConocoPhillips’s proxy statement relating to the annual meeting of ConocoPhillips’s shareholders held on May 11, 2011 (collectively, the “Public Documents”); and (vii) such other documents, records, and papers as we have deemed necessary or appropriate in order to give this opinion.

For purposes of this opinion, we have assumed: (i) that the statements, representations, and assumptions (which statements, representations, and assumptions we have neither investigated nor verified) contained, respectively, in the Request for Rulings, the Private Letter Ruling, the Certificates, and the Agreement are true, complete, and correct as of the date of this opinion, and will remain true, complete, and correct at all times up to and including the Distribution Date; (ii) that all statements and representations qualified by knowledge, belief, or materiality or comparable qualification are true, complete, and correct as if made without such qualification; (iii) that all documents submitted to us as originals are authentic, that all documents submitted to us as copies conform to the originals, that all relevant documents have been or will be duly executed in the form presented to us, and that all natural persons are of legal capacity; (iv) that the transactions contemplated by the Agreement will be consummated in accordance with the provisions of the Agreement, without amendment, waiver, or modification of any of the terms or conditions set forth therein, and in the manner described in the Request for Rulings and the Private Letter Ruling; (v) that ConocoPhillips and Phillips 66 will treat the Contribution (as defined below) and the Distribution (as defined below) for United States federal income tax consequences in a manner consistent with this opinion; (vi) that the Public Documents are true, complete, and correct; and (vii) that all applicable reporting requirements have been or will be satisfied.

Based upon and subject to the foregoing, it is our opinion that, under presently applicable provisions of the Code, and the rules and regulations promulgated thereunder:

| (1) | The contribution by ConocoPhillips to Phillips 66 of (i) all the outstanding shares of Phillips 66 Company and (ii) any other property relating to the Transferred Businesses held directly by ConocoPhillips in exchange for (i) Phillips 66 Common Stock, (ii) the assumption by Phillips 66 of related liabilities, and (iii) the Special Cash Distribution (the “Contribution”), followed by the distribution by ConocoPhillips to holders of shares of ConocoPhillips Common Stock of all the outstanding shares of Phillips 66 Common Stock (the “Distribution”) will qualify as a transaction that is described in Sections 355(a) and 368(a)(1)(D) of the Code; and |

ConocoPhillips

April 3, 2012

Page 3

| (2) | The summary of material U.S. federal income tax consequences of the Distribution set forth in the amended registration statement of Phillips 66 on Form 10 filed with the Securities and Exchange Commission on March 1, 2012 under the caption “Material U.S. Federal Income Tax Consequences of the Distribution” is accurate in all material respects. |

We render no opinion as to any United States federal income tax issues or other matters except as specifically set forth above. We render no opinion as to the United States federal income tax consequences of (i) any conditions existing at the time of, or effects resulting from, the transaction that are not specifically covered above; (ii) any transactions contemplated by the Agreement or described in the Private Letter Ruling other than the Contribution and the Distribution; (iii) non-arm’s length payments (if any) made in connection with the transaction; or (iv) any continuing transactions between or among any of ConocoPhillips or ConocoPhillips’s subsidiaries and Phillips 66 or Phillips 66’s subsidiaries and any payments made in connection with such continuing transactions. We render no opinion as to the tax consequences of the transaction under state, local, or foreign tax laws.

This opinion is based on the Code, the Treasury Regulations promulgated thereunder, published pronouncements of the Internal Revenue Service, and case law, all as in effect as of the date hereof. We assume no responsibility to inform ConocoPhillips of any change or inaccuracy that may occur or come to our attention after the date hereof that may affect the continuing validity of this opinion.

We are furnishing this opinion solely for the benefit of ConocoPhillips. Furthermore, we are furnishing this opinion solely in connection with the transactions contemplated by the Agreement, and it is not to be relied upon, used, circulated, quoted, or otherwise referred to for any other purpose or by any other party without our consent. We hereby consent to the filing of this opinion with the Securities and Exchange Commission. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

Very truly yours,

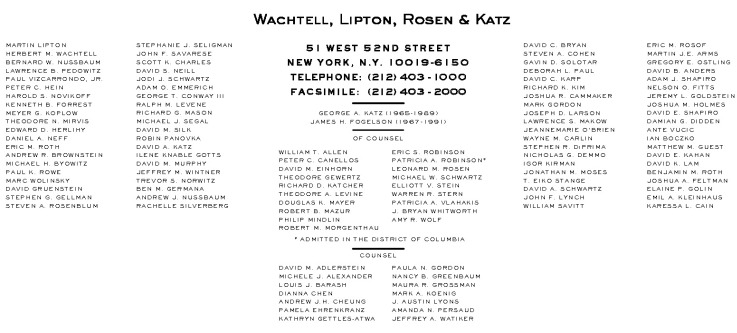

/s/ Wachtell, Lipton, Rosen & Katz