Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PROVIDENT FINANCIAL SERVICES INC | d340439d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED BY THE COMPANY ON APRIL 26, 2012 - PROVIDENT FINANCIAL SERVICES INC | d340439dex991.htm |

1

Annual Meeting

of Stockholders

April 26, 2012

Our Commitment Shines Through

Exhibit 99.2 |

Forward

Looking Statements

2

Certain statements contained herein are "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act

of 1934. Such forward-looking statements may be identified by reference to a

future period or periods, or by the use of forward-looking terminology,

such as "may," "will," "believe," "expect,"

"estimate," "anticipate," "continue," or similar terms

or variations on those terms,

or the negative of those terms. Forward-looking statements are subject to

numerous risks and uncertainties, including, but not limited to, those

related to the economic environment, particularly in the market areas in

which Provident Financial Services, Inc. (the “Company”)

operates, competitive products and pricing, fiscal and monetary policies of the

U.S. Government, changes in government regulations affecting financial

institutions, including regulatory fees and capital requirements, changes

in prevailing interest rates, acquisitions and the integration of acquired

businesses, credit risk management, asset-liability management, the

financial and securities markets and the availability of and costs

associated with sources of liquidity.

The Company cautions readers not to place undue reliance on any such

forward-looking statements which speak only as of the date made. The

Company also advises readers that the factors listed above could affect the

Company's financial performance and could cause the Company's actual

results for future periods to differ materially from any opinions or

statements expressed with respect to future periods in any current statements. The

Company does not undertake and specifically declines any obligation to

publicly release the result of any revisions which may be made to any

forward-looking statements to reflect events or circumstances after the

date of such statements or to reflect the occurrence of anticipated or

unanticipated events. |

Company

Profile 3

Holding Company for The Provident Bank

–

Founded in 1839 -

oldest New Jersey chartered bank

–

Over 80 branches in 11 counties

IPO Date: January 2003

NYSE Symbol: PFS

Market Cap: $824.0 million at 4/23/12

Average Daily Volume: 286,052 shares*

* 1 year period ended 4/23/12 |

Experienced

Management Team 4

Christopher Martin

Chairman, President & Chief Executive Officer

31 Years

John F. Kuntz

EVP, Chief Adminstrative Officer & General Counsel

25 Years

Thomas M. Lyons

EVP & Chief Financial Officer

24 Years

Michael A. Raimonde

EVP & Director of Retail Banking

38 Years

Brian Giovinazzi

EVP & Chief Credit Officer

35 Years

Jack Novielli

EVP & Chief Information Officer

34 Years

Donald W. Blum

EVP & Chief Lending Officer

33 Years

Janet D. Krasowski

EVP & Chief Human Resources Officer

33 Years

Frank Muzio

SVP & Chief Accounting Officer

25 Years

James Christy

SVP, Chief Risk Officer & General Auditor

23 Years

James D. Nesci

President of Beacon Trust Company

20 Years |

5

All outside directors deemed independent

Independent lead director and committee chairs with no

management on committees

Broad diversification and business backgrounds

Strong financial and corporate governance expertise

Integral to the strategic direction of the organization

Independent Board Leadership |

Operating

Strategies 6

Committed to building successful customer relationships

through straightforward communication, personal

attention and integrity

Provide solutions for our customers’

needs with

competitive and diverse product offerings

Continue to diversify the balance sheet composition with

emphasis on commercial relationships

Conservatively manage our company for consistent long-

term profitability and growth

Logically grow in markets relevant to our company

Maintain margin while protecting against a rise in interest

rates |

7

Build upon our low-cost, core deposit funding base

Build and grow fee income sources (specifically Wealth

Management via Beacon Trust)

Challenge our officers and staff to further enhance

operating efficiencies

Continue

to

foster

a

“Pay

for

Performance”

culture

within

our organization

Maintain sufficient capital to support growth and manage

risk effectively

Evaluate the M & A environment for accretive opportunities

Operating Strategies (cont.) |

Stockholder

Value 8

Adhering to these strategies results in:

–

Competitive advantage

–

Profitable growth

–

Increased earnings

–

Enhanced long-term stockholder

value |

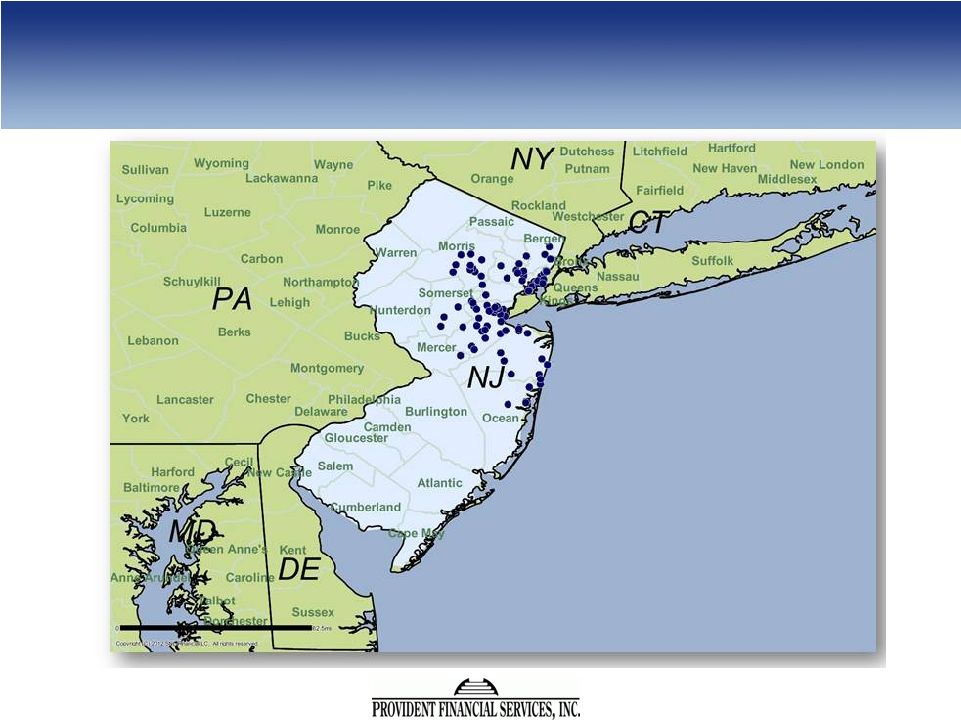

Branch

Map 9 |

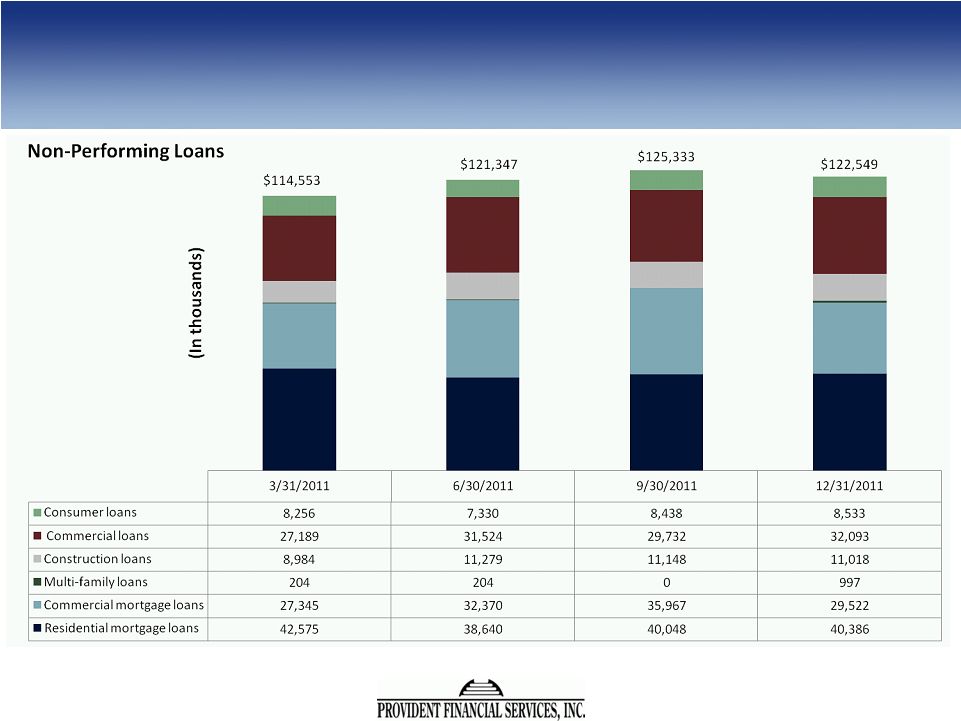

Asset

Quality 10 |

Allowance for

Loan Losses to Total Loans 11 |

Capital

– At 12/31/11

Amount

Ratio

Amount

Ratio

Regulatory Tier 1 leverage capital

267,308

$

4.00%

583,770

$

8.74%

Tier 1 risk-based capital

182,477

$

4.00%

583,770

$

12.80%

Total risk-based capital

364,953

$

8.00%

641,008

$

14.05%

REQUIRED

ACTUAL

(Dollars in thousands)

The Company continues to exceed all current

regulatory requirements and is “well capitalized.”

12 |

Total

Return 13 |

Current

Dividend Yield (as of 4/23/12) = 3.51% Quarterly Cash Dividends since IPO

14 |

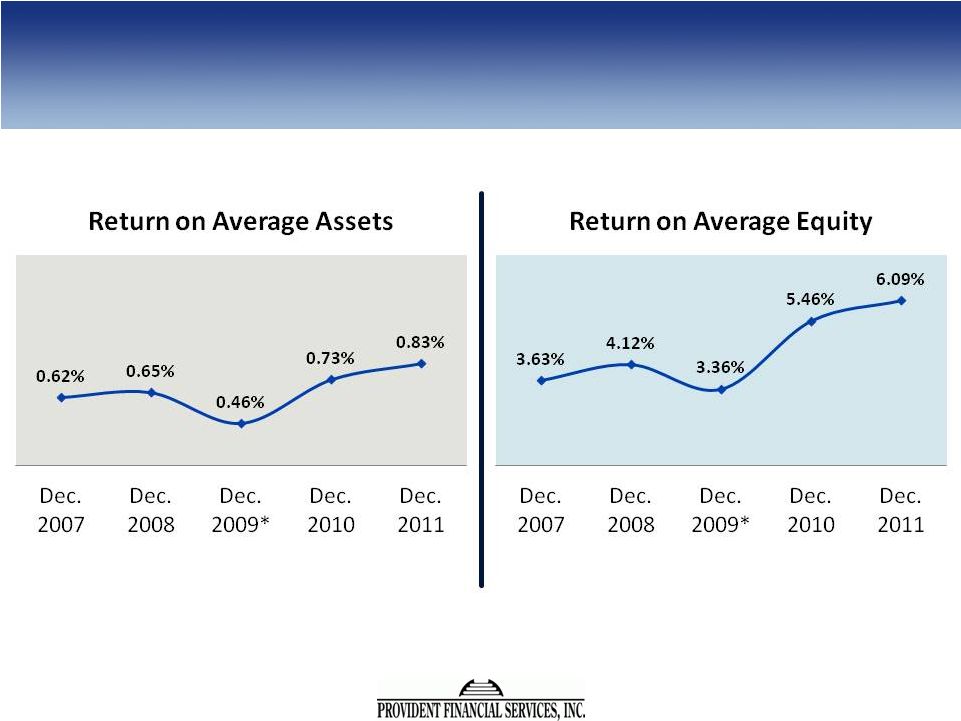

ROA &

ROE 15

*Operating ROA & ROE. Excludes Goodwill impairment. |

2011

Highlights 16

Record Loan Originations of $1.5 Billion

Net Loan Growth of $244 Million or 6%

Improving Asset Quality Metrics

Total Deposits Increased $279 Million or 6%, Core Increased $428

Million or 12%, Non-Interest Bearing Increased $148 Million or 27%

Beacon Acquisition, Organic Growth Increased Wealth Assets Under

Administration Nearly 5x

15% Growth in Net Income to $57.3 million

Record Earnings per Share of $1.01

Commitment from 968 FTE Employees = RESULTS |

17

THANK YOU FOR ATTENDING! |