Attached files

| file | filename |

|---|---|

| 8-K - KAI FORM 8-K 04-26-2012 - KADANT INC | kaiform8k4262012.htm |

First Quarter 2012 Business Review

Jonathan W. Painter, President & CEO

Thomas M. O’Brien, Executive Vice President & CFO

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Forward-Looking Statements

The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of

1995: This presentation contains forward-looking statements that involve a number of risks and

uncertainties, including forward-looking statements about our expected future financial and operating

performance, demand for our products, economic and industry outlook, and pending orders. There can be

no assurance that we will be able to record bookings or recognize revenues on pending orders. Our actual

results may differ materially from these forward-looking statements as a result of various important

factors, including those set forth under the heading “Risk Factors” in Kadant’s annual report on Form 10-K

for the year ended December 31, 2011. These include risks and uncertainties relating to our dependence

on the pulp and paper industry; significance of sales and operation of manufacturing facilities in China; our

ability to adjust operating costs and manufacturing sufficiently in China to meet demand; commodity and

component price increases or shortages; international sales and operations; competition; soundness of

suppliers and customers; our effective tax rate; future restructurings; soundness of financial institutions;

our debt obligations; restrictions in our credit agreement; litigation costs related to our discontinued

operation; our acquisition strategy; protection of patents and proprietary rights; failure of our information

systems or breaches of data security; fluctuations in our share price; and anti-takeover provisions. We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new

information, future events, or otherwise.

1995: This presentation contains forward-looking statements that involve a number of risks and

uncertainties, including forward-looking statements about our expected future financial and operating

performance, demand for our products, economic and industry outlook, and pending orders. There can be

no assurance that we will be able to record bookings or recognize revenues on pending orders. Our actual

results may differ materially from these forward-looking statements as a result of various important

factors, including those set forth under the heading “Risk Factors” in Kadant’s annual report on Form 10-K

for the year ended December 31, 2011. These include risks and uncertainties relating to our dependence

on the pulp and paper industry; significance of sales and operation of manufacturing facilities in China; our

ability to adjust operating costs and manufacturing sufficiently in China to meet demand; commodity and

component price increases or shortages; international sales and operations; competition; soundness of

suppliers and customers; our effective tax rate; future restructurings; soundness of financial institutions;

our debt obligations; restrictions in our credit agreement; litigation costs related to our discontinued

operation; our acquisition strategy; protection of patents and proprietary rights; failure of our information

systems or breaches of data security; fluctuations in our share price; and anti-takeover provisions. We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new

information, future events, or otherwise.

2

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance with generally accepted

accounting principles (GAAP), we use certain non-GAAP financial measures, including increases

or decreases in revenues excluding the effect of foreign currency translation and earnings

before interest, taxes, depreciation, and amortization (EBITDA).

accounting principles (GAAP), we use certain non-GAAP financial measures, including increases

or decreases in revenues excluding the effect of foreign currency translation and earnings

before interest, taxes, depreciation, and amortization (EBITDA).

A reconciliation of those numbers to the most directly comparable U.S. GAAP financial measures

is shown in our 2012 first quarter earnings press release issued April 25, 2012, which is available

in the Investors section of our website at www.kadant.com under the heading Investor News.

is shown in our 2012 first quarter earnings press release issued April 25, 2012, which is available

in the Investors section of our website at www.kadant.com under the heading Investor News.

3

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

BUSINESS REVIEW

Jonathan W. Painter

President & CEO

4

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Q1 2012 Financial Highlights

|

|

Q1 2012

|

Q1 2011

|

|

Revenue

|

$84.1 million

|

$71.7 million

|

|

Gross Margin

|

45.6%

|

47.6%

|

|

Operating Income1

|

$10.4 million

|

$8.3 million

|

|

Net Income1

|

$7.1 million

|

$5.9 million

|

|

Diluted EPS1

|

$0.61

|

$0.47

|

|

EBITDA2

|

$12.6 million

|

$10.2 million

|

|

EBITDA2/Sales

|

15.0%

|

14.2%

|

|

Net Cash

|

$31 million

|

$40 million

|

1 Operating Income, Net Income, and Diluted EPS are from continuing operations.

2 EBITDA (earnings before interest, taxes, depreciation, and amortization) is a non-GAAP financial measure that excludes certain items as

detailed in our Q1 2012 earnings press release issued April 25, 2012.

detailed in our Q1 2012 earnings press release issued April 25, 2012.

5

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Revenue By Product Line: Q1 2012

$84.1 million, up 17.3% compared to Q1 2011

$84.1 million, up 17.3% compared to Q1 2011

|

($ Millions)

|

Q1 2012

|

Q1 2011

|

% CHANGE

|

EXCL. FX

|

|

Stock-Preparation

|

$32.7

|

$23.3

|

40.3%

|

40.5%

|

|

Fluid-Handling

|

22.4

|

22.6

|

-1.2%

|

0.5%

|

|

Doctoring

|

13.6

|

14.1

|

-3.0%

|

-1.3%

|

|

Water-Management

|

10.8

|

6.8

|

58.6%

|

60.9%

|

|

Fiber-based Products

|

4.0

|

4.2

|

-4.4%

|

-4.4%

|

|

Other

|

0.6

|

0.7

|

-11.3%

|

-4.6%

|

|

TOTAL

|

$84.1

|

$71.7

|

17.3%

|

18.6%

|

Percent change calculated using actual numbers reported in our Q1 2012 earnings release dated April 25, 2012.

6

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Bookings By Product Line: Q1 2012

$77.6 million, down 8.0% compared to Q1 2011

$77.6 million, down 8.0% compared to Q1 2011

|

($ Millions)

|

Q1 2012

|

Q1 2011

|

% CHANGE

|

EXCL. FX

|

|

Stock-Preparation

|

$20.3

|

$29.8

|

-32.1%

|

-32.1%

|

|

Fluid-Handling

|

26.4

|

27.0

|

-2.1%

|

-0.3%

|

|

Doctoring

|

14.3

|

14.4

|

-0.7%

|

1.3%

|

|

Water-Management

|

12.6

|

8.4

|

51.0%

|

52.2%

|

|

Fiber-based Products

|

3.4

|

4.0

|

-16.2%

|

-16.2%

|

|

Other

|

0.6

|

0.7

|

-11.0%

|

-4.3%

|

|

TOTAL

|

$77.6

|

$84.3

|

-8.0%

|

-6.9%

|

7

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

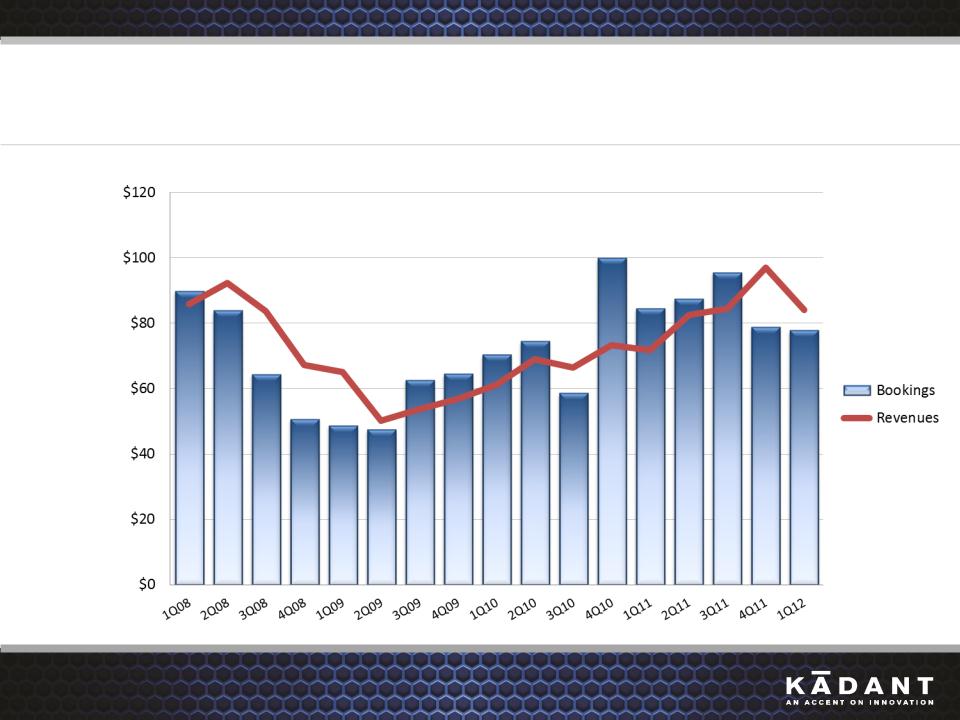

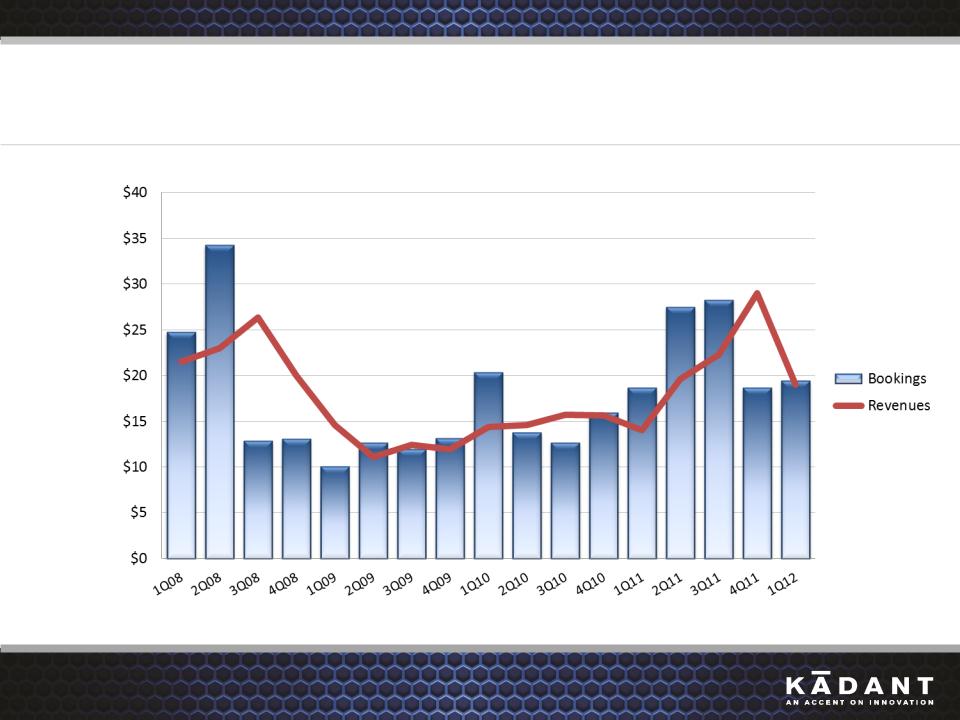

Bookings and Revenues Trends

US$ (millions)

8

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

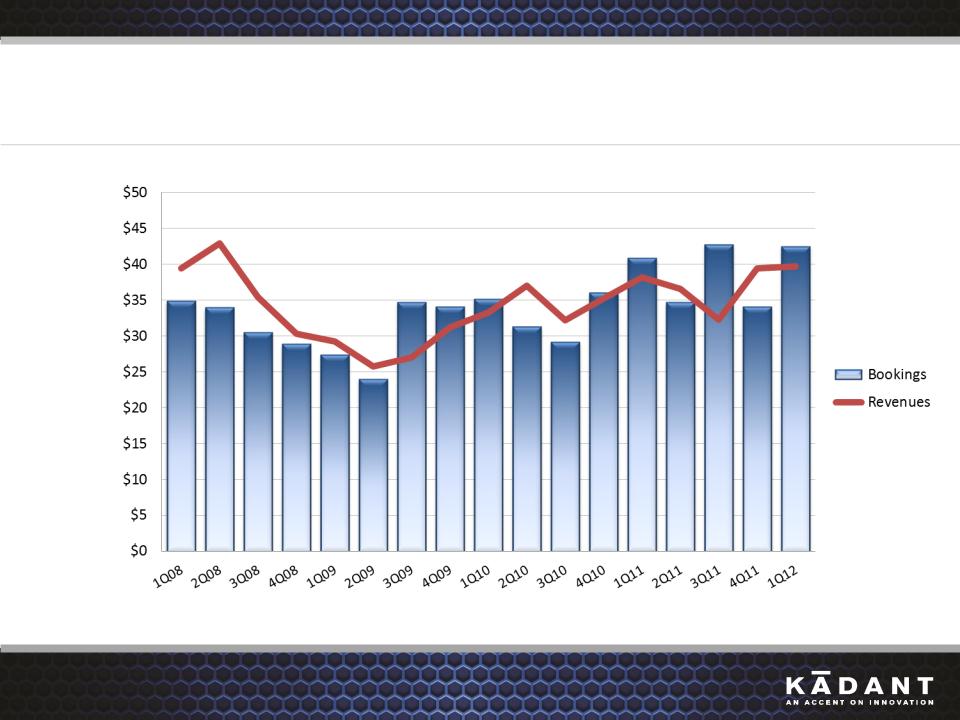

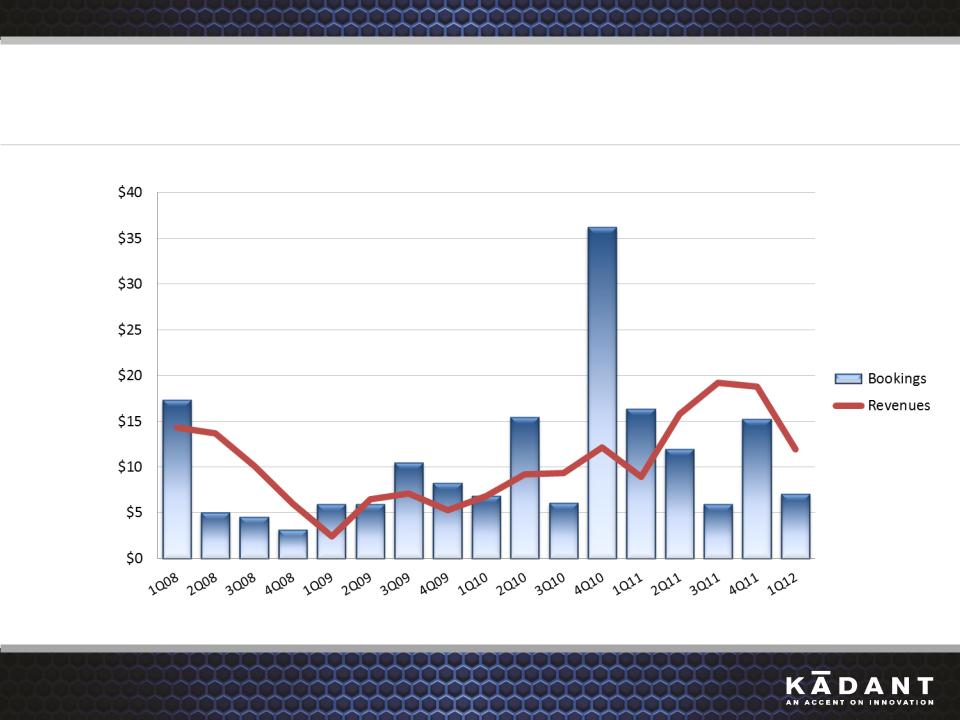

Parts and Consumables Bookings and Revenues

US$ (millions)

9

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

REGIONAL PERFORMANCE

10

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

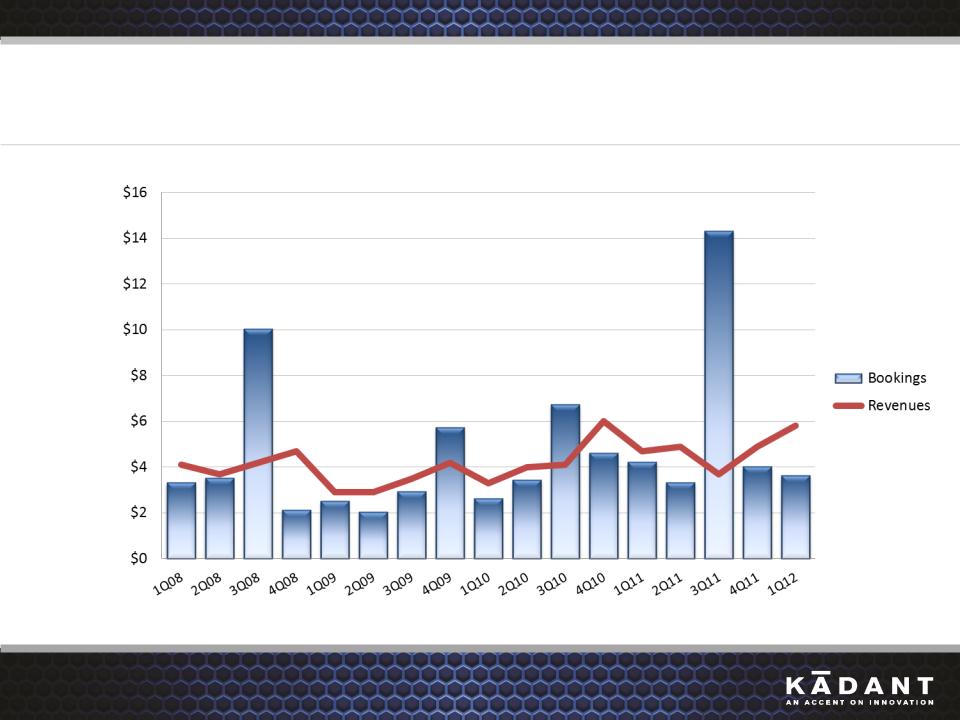

North America Bookings and Revenues

US$ (millions)

Geographic revenues and bookings are attributed to regions based on customer location. Prior period amounts have been recasted to conform to the current presentation.

11

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

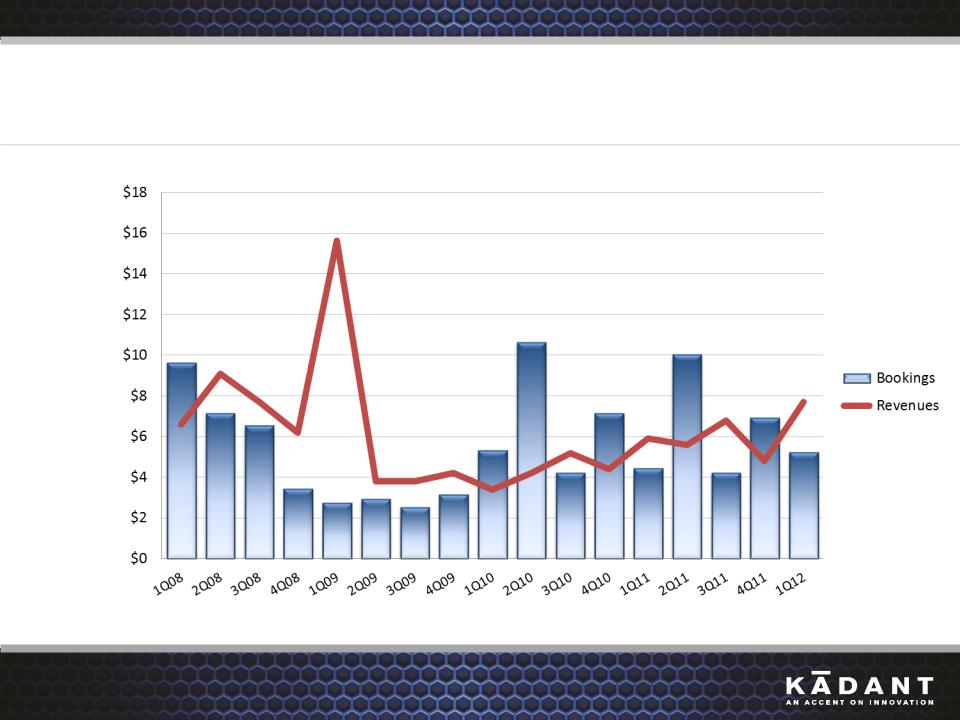

Europe Bookings and Revenues

US$ (millions)

Geographic revenues and bookings are attributed to regions based on customer location. Prior period amounts have been recasted to conform to the current presentation.

12

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

China Bookings and Revenues

US$ (millions)

Geographic revenues and bookings are attributed to regions based on customer location. Prior period amounts have been recasted to conform to the current presentation.

13

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

South America Bookings and Revenues

US$ (millions)

Geographic revenues and bookings are attributed to regions based on customer location. Prior period amounts have been recasted to conform to the current presentation.

14

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Rest-of-World Bookings and Revenues

US$ (millions)

Geographic revenues and bookings are attributed to regions based on customer location. Prior period amounts have been recasted to conform to the current presentation.

15

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Guidance for Continuing Operations

• FY 2012 GAAP diluted EPS of $2.10 to $2.20

• FY 2012 revenues of $335 to $345 million

• Q2 2012 GAAP diluted EPS of $0.50 to $0.52

• Q2 2012 revenues of $83 to $85 million

16

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

FINANCIAL REVIEW

Thomas M. O’Brien

Executive Vice President & Chief Financial Officer

17

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

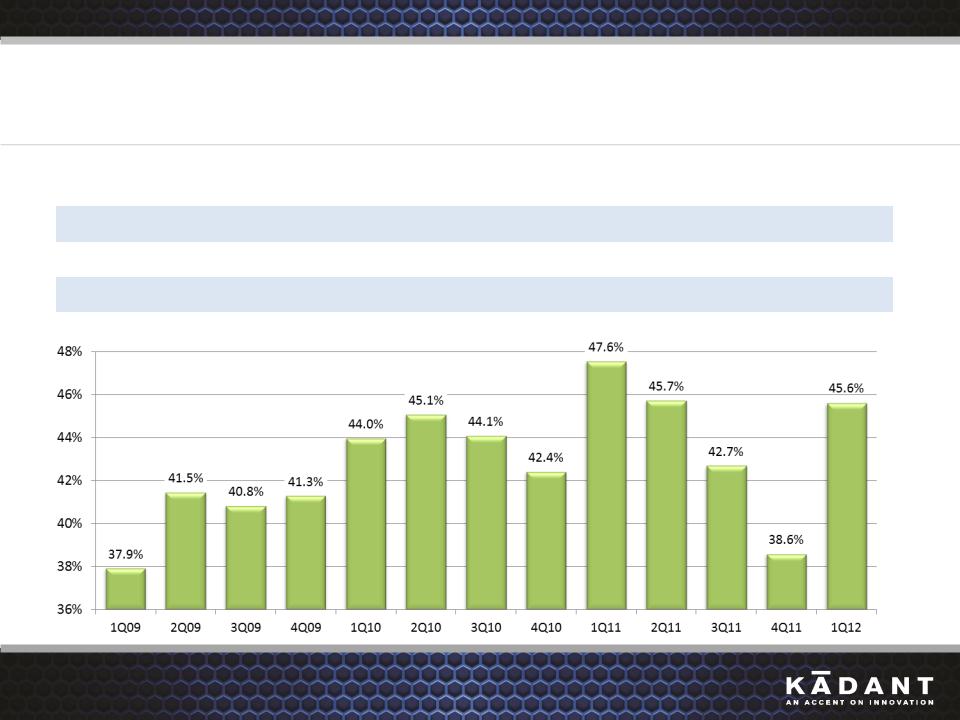

Gross Margins

|

|

1Q12

|

4Q11

|

1Q11

|

Sequential ∆

|

Y-O-Y ∆

|

|

Papermaking Systems Segment

|

45.1%

|

38.3%

|

47.4%

|

6.8%

|

-2.3%

|

|

Fiber-based Products

|

56.3%

|

49.9%

|

50.8%

|

6.4%

|

5.5%

|

|

TOTAL

|

45.6%

|

38.6%

|

47.6%

|

7.0%

|

-2.0%

|

18

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

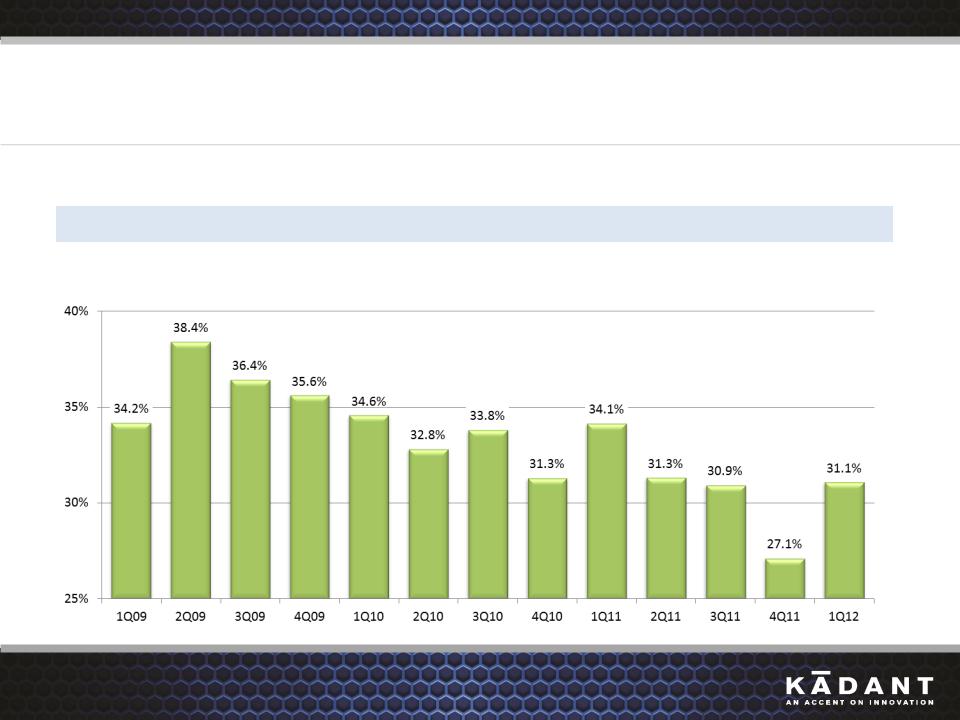

SG&A

|

($ Millions)

|

1Q12

|

4Q11

|

1Q11

|

Sequential ∆

|

Y-O-Y ∆

|

|

SG&A

|

$26.1

|

$26.3

|

$24.5

|

$(0.2)

|

$1.6

|

|

% Revenues

|

31.1%

|

27.1%

|

34.1%

|

4.0%

|

-3.0%

|

19

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

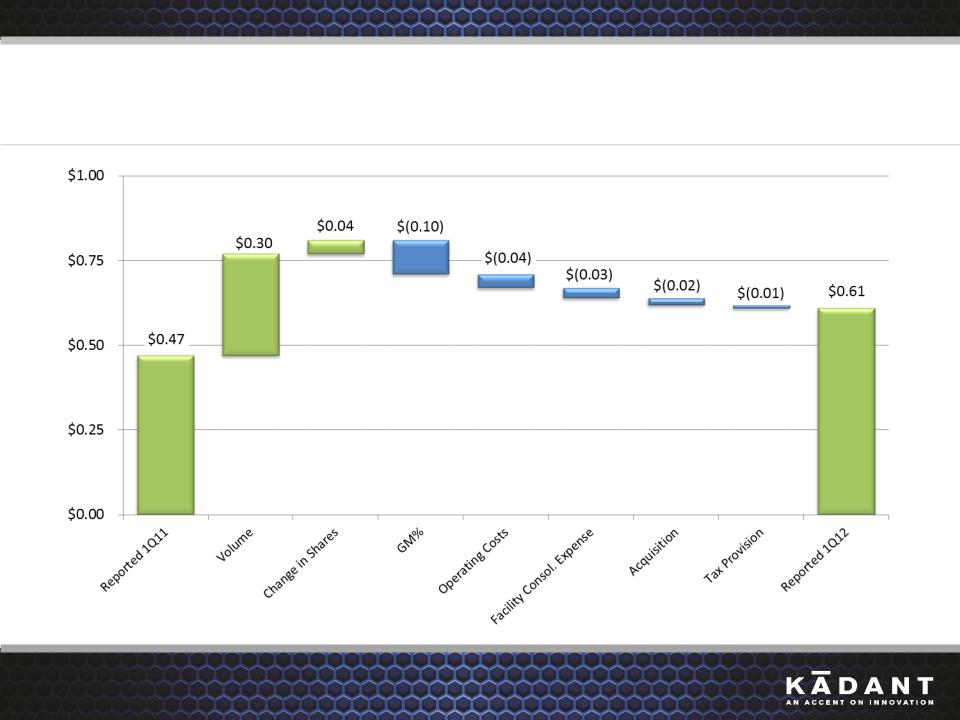

1Q11 to 1Q12 Diluted EPS from Continuing Operations

20

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Cash Flow

|

($ Millions)

|

1Q12

|

1Q11

|

|

Income from Continuing Operations

|

$7.1

|

$5.9

|

|

Depreciation and Amortization

|

2.2

|

1.9

|

|

Stock-Based Compensation

|

1.1

|

0.8

|

|

Other Items

|

(0.2)

|

0.5

|

|

Change in Current Assets & Liabilities (excl. acquisitions)

|

(14.2)

|

(8.7)

|

|

Cash (Used in) Provided by Continuing Operations

|

$(4.0)

|

$0.4

|

21

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

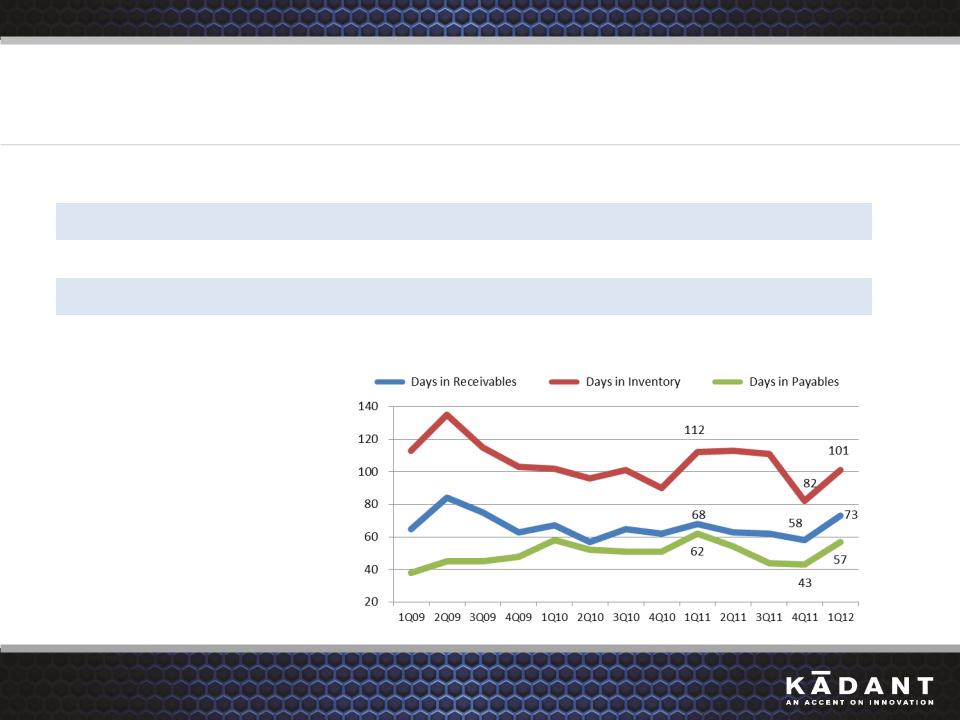

Key Working Capital Metrics

*Working Capital is defined as current

assets less current liabilities, excluding

cash, debt, and the discontinued operation.

assets less current liabilities, excluding

cash, debt, and the discontinued operation.

|

|

1Q12

|

4Q11

|

1Q11

|

|

Days in Receivables

|

73

|

58

|

68

|

|

Days in Payables

|

57

|

43

|

62

|

|

Days in Inventory

|

101

|

82

|

112

|

|

Working Capital % LTM Revenues*

|

13.7%

|

9.9%

|

12.0%

|

22

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

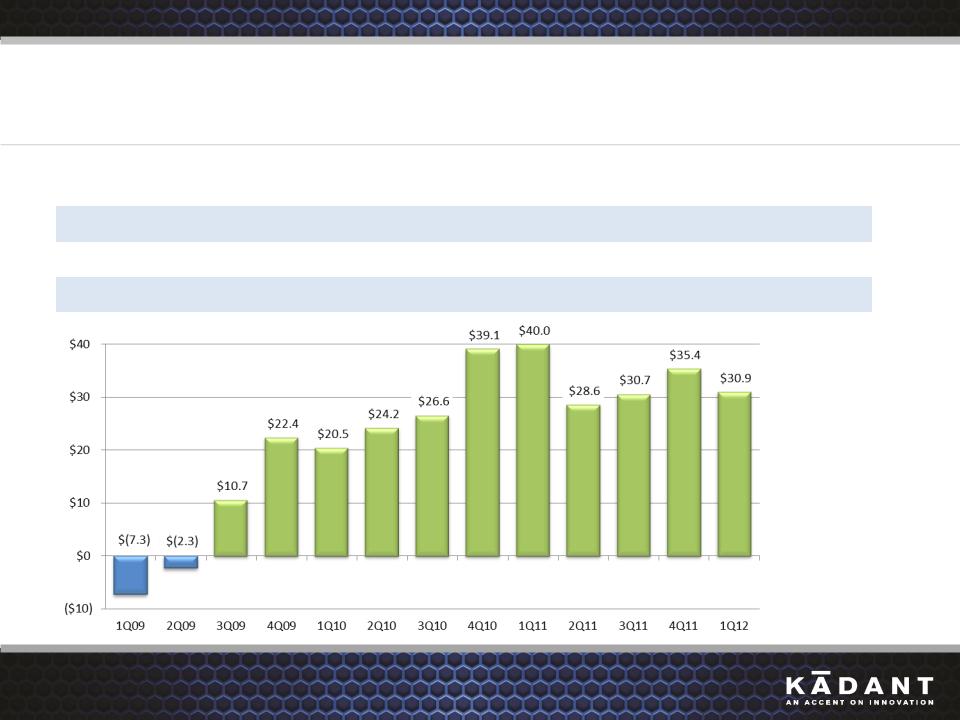

Cash and Debt

|

($ Millions)

|

1Q12

|

4Q11

|

1Q11

|

|

Cash, cash equivalents, restricted cash

|

$43.0

|

$47.7

|

$57.6

|

|

Debt

|

(12.1)

|

(12.3)

|

(17.6)

|

|

NET CASH

|

$30.9

|

$ 35.4

|

$40.0

|

23

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

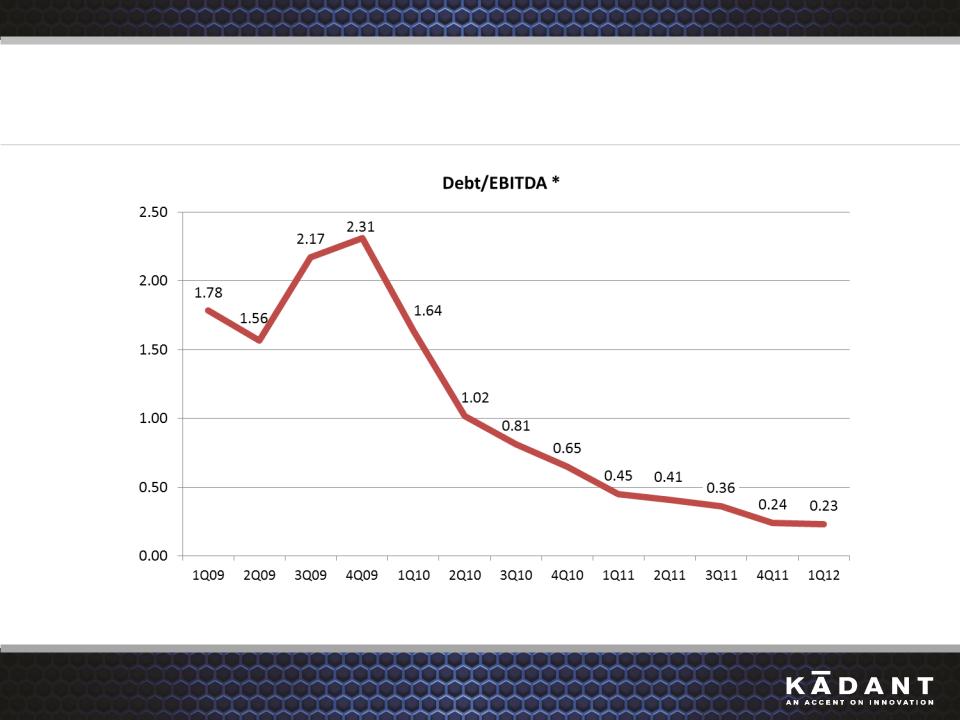

Leverage Ratio

* Calculated by adding or subtracting certain items, as required by our Credit Facility, from Adjusted EBITDA.

24

*

KAI 1Q12 Business Review-April 26, 2012

© 2012 Kadant Inc. All rights reserved.

Questions & Answers

To ask a question, please call 866-804-6926 within the U.S. or

+1-857-350-1672 outside the U.S. and reference 83375884.

+1-857-350-1672 outside the U.S. and reference 83375884.

Please mute the audio on your computer.

25

First Quarter 2012 Business Review

Jonathan W. Painter, President & CEO

Thomas M. O’Brien, Executive Vice President & CFO

26