Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BRINKS CO | exhibit_99-1.htm |

| 8-K - FORM 8-K - BRINKS CO | form_8k.htm |

The Brink’s Company

First-Quarter 2012 Earnings

Conference Call

NYSE:BCO

April 26, 2012

Exhibit 99.2

Forward-Looking Statements

These materials contain forward-looking statements. Actual

results could differ materially from projected or estimated

results. Information regarding factors that could cause such

differences is available in today's release and in The Brink’s

Company’s most recent SEC filings.

results could differ materially from projected or estimated

results. Information regarding factors that could cause such

differences is available in today's release and in The Brink’s

Company’s most recent SEC filings.

Information discussed today is representative as of today

only and Brink's assumes no obligation to update any

forward-looking statements. These materials are

copyrighted and may not be used without written permission

from Brink's.

only and Brink's assumes no obligation to update any

forward-looking statements. These materials are

copyrighted and may not be used without written permission

from Brink's.

2

The Brink’s Company

Ed Cunningham

Director - Investor Relations

Highlights of First-Quarter Non-GAAP Results

• EPS $.58 vs $.39

• Revenue up 6%, 9% organic growth

• Segment Margin 7.2% vs. 5.8%

• Profit growth driven by Latin America

• EMEA and North America up slightly

• Improved 2012 outlook

Note: See reconciliation to GAAP results in Appendix

4

The Brink’s Company

Tom Schievelbein

Interim President and

Chief Executive Officer

CEO Overview

• Non-GAAP EPS up 49% on Latin America results

• 2012 margin guidance ~7%

• CEO Search on Schedule

• EMEA and NA: Improvement in 2012

6

Note: See reconciliation to GAAP results in Appendix

The Brink’s Company

Joe Dziedzic

Vice President and Chief

Financial Officer

Financial Officer

Review and Outlook

8

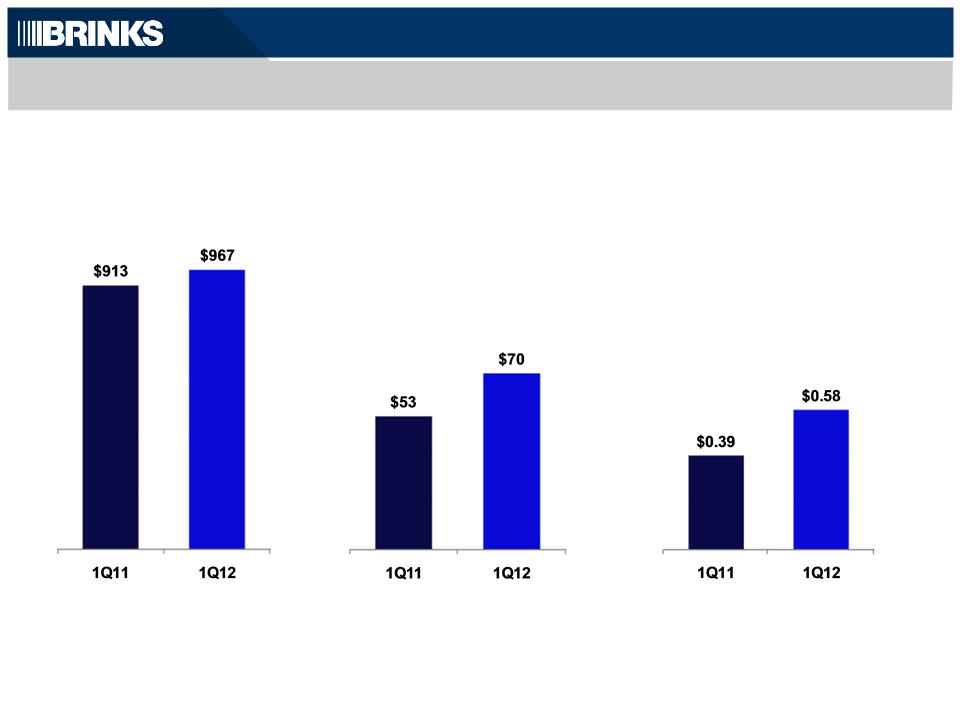

1Q12 Non-GAAP Results

($ millions, except EPS)

Segment

Operating Profit

Operating Profit

Revenue

|

|

|

|

|

|

Margin

|

5.8%

|

|

7.2%

|

EPS

Note: See reconciliation to GAAP results in Appendix

9

Non-GAAP EPS: 1Q12 Versus 1Q11

Segment

Operating Profit

Operating Profit

Non-Segment

Expense

Expense

Interest

Expense, Net

Expense, Net

Non-Controlling

Interest

Interest

Tax Rate

1Q11

1Q12

Note: See reconciliation to GAAP results in Appendix

Total Non-GAAP Segment Results and Outlook

($ millions)

1Q12 Results

2012 Outlook

— Increased margin guidance to ~7%

— 5% - 8% organic revenue growth

— U.S. actions improve profitability

— Europe operations stable to improving in a

difficult environment

difficult environment

— Continued strong Latin America growth

— Strong organic revenue growth

— Significant margin expansion, all organic

— Latin America drives performance, North

America & Europe slightly better

America & Europe slightly better

|

|

|

|

|

|

|

|

Margin

|

|

|

5.8%

|

|

7.2%

|

(a)

(a) See reconciliation to GAAP results in Appendix

(a)

10

|

Organic

|

|

|

|

|

|

|

Growth

|

|

|

(1%)

|

|

-

|

North America Non-GAAP Segment Results and Outlook

($ millions)

1Q12 Results

2012 Outlook

— Revenue flat

— Slight margin improvement

— U.S. cost actions offset price and volume

pressure

pressure

— Flat revenue in a difficult environment

— U.S. cost actions and productivity offset

price and volume pressure

price and volume pressure

— On track for margin of 4.5% to 5.5%

11

(a)

|

|

|

|

|

|

|

|

Margin

|

|

|

3.1%

|

|

3.4%

|

(a)

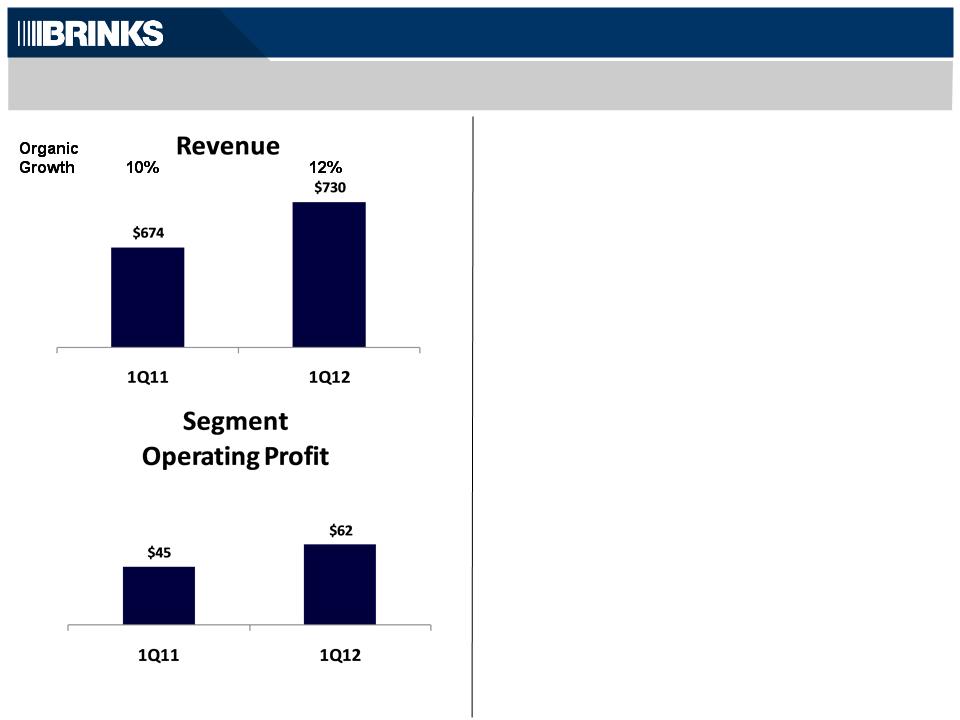

International Non-GAAP Segment Results and Outlook

1Q12 Results

2012 Outlook

($ millions)

— Revenue Growth

— Organic growth $84

— Currency down ($28)

— Profit Growth

— Organic growth $18

— Currency down ($2)

— Broad margin expansion in Latin America

— Mexico improving, expect more

restructuring in 2Q-4Q12

restructuring in 2Q-4Q12

— 7% to 8% margin rate

— Continued strong organic revenue growth

driven by Latin America

driven by Latin America

— Unfavorable currency impact

— Slight improvement in Mexico, positioned

for margin expansion 2013+

for margin expansion 2013+

(a) See reconciliation to GAAP results in Appendix

12

(a)

(a)

|

|

|

|

|

|

|

|

Margin

|

|

|

6.7%

|

|

8.4%

|

Non-GAAP Cash Flow, Capital Investment, and Net Debt

13

($ millions)

(a) See reconciliation to GAAP results in Appendix

13

Non-GAAP

CFOA

CFOA

(a)

$39

$43

North

America

America

International

Capital

Expenditures

and Capital

Leases

Expenditures

and Capital

Leases

Net Debt

(a)

2012 Outlook

($ millions)

Capital Deployment

— Pension contribution

— Capital Expenditures / Capital Leases

|

|

|

|

|

|

|

|

Margin

|

|

|

6.3%

|

|

~7%

|

(a)

(a) See reconciliation to GAAP results in Appendix

(a)

14

— Strong growth in Latin America

— Slow / No growth in North America

— Modest growth in Europe

Revenue

— Strong margin expansion in Latin America

— North America on track for 4.5% to 5.5%

— Slight margin expansion in Europe

Segment Profit

The Brink’s Company

First-Quarter 2012 Earnings

Conference Call

NYSE:BCO

April 26, 2012

Appendix - Non-GAAP Reconciliations

Non-GAAP Reconciliations - 1Q12

17

GAAP Basis

Gain on Sale of

Investments (a)

Investments (a)

Employee Benefit

Settlement Losses (b)

Settlement Losses (b)

U.S.

Retirement

Plans (c)

Retirement

Plans (c)

Adjust Income

Tax Rate (d)

Tax Rate (d)

Non-GAAP

Basis

Basis

First Quarter 2012

Operating profit:

International

$

60.9

-

0.8

-

-

61.7

North America

5.8

-

-

2.2

-

8.0

Segment operating profit

66.7

-

0.8

2.2

-

69.7

Non-segment

(24.3)

-

-

14.7

-

(9.6)

Operating profit

$

42.4

-

0.8

16.9

-

60.1

Amounts attributable to Brink’s:

Income from continuing operations

$

17.0

(1.2)

0.6

10.6

0.9

27.9

Diluted EPS - continuing operations

0.35

(0.02)

0.01

0.22

0.02

0.58

(a) To eliminate gain related to the sale of investments in mutual fund securities ($2 million). Proceeds from the sale were used to fund the settlement

of pension obligations related to the former CEO.

of pension obligations related to the former CEO.

(b) To eliminate employee benefit settlement losses related to severance payments made by Brink’s subsidiary in Mexico. Employee termination

benefits in Mexico are accounted for under FASB ASC Topic 715, Compensation - Retirement Benefits.

benefits in Mexico are accounted for under FASB ASC Topic 715, Compensation - Retirement Benefits.

(c) To eliminate expenses related to U.S. retirement plans.

(d) To adjust effective income tax rate in the interim period to be equal to the midpoint of the estimated range of the full-year non-GAAP effective

income tax rate. The midpoint of the estimated range of the full-year non-GAAP effective tax rate for 2012 is 38.5%.

income tax rate. The midpoint of the estimated range of the full-year non-GAAP effective tax rate for 2012 is 38.5%.

Amounts may not add due to rounding.

Non-GAAP Reconciliations -1Q11

18

GAAP Basis

Gains on Acquisitions and Asset

Dispositions (a)

Dispositions (a)

U.S. Retirement

Plans (b)

Plans (b)

Adjust Income

Tax Rate (c)

Tax Rate (c)

Non-GAAP

Basis

Basis

First Quarter 2011

Operating profit:

North America

6.8

-

0.7

-

7.5

Segment operating profit

52.0

-

0.7

-

52.7

Non-segment

(15.0)

(0.4)

6.2

-

(9.2)

Operating profit

$

37.0

(0.4)

6.9

-

43.5

Amounts attributable to Brink’s:

Income from continuing operations

$

18.9

(3.0)

4.4

(1.5)

18.8

Diluted EPS - continuing operations

0.39

(0.06)

0.09

(0.03)

0.39

(a) To eliminate gain related to acquisition of controlling interest in a subsidiary that was previously accounted for as an equity method investment

($0.4 million) and gains on sale of marketable securities ($4.4 million).

($0.4 million) and gains on sale of marketable securities ($4.4 million).

(b) To eliminate expenses related to U.S. retirement plans.

(c) To adjust effective income tax rate in the interim period to be equal to the full-year non-GAAP effective income tax rate. The non-GAAP effective

tax rate for 2011 was 38.6%.

tax rate for 2011 was 38.6%.

Amounts may not add due to rounding.

Non-GAAP Reconciliations - Cash Flows

19

|

|

|

First Quarter

|

||||

|

|

|

|

2012

|

|

|

2011

|

|

Cash flows from operating activities - GAAP

|

$

|

(16.4)

|

|

$

|

(5.7)

|

|

|

Decrease (increase) in certain customer obligations (a)

|

|

18.8

|

|

|

9.7

|

|

|

Cash outflows (inflows) related to discontinued operations (b)

|

|

-

|

|

|

(1.2)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities - Non-GAAP

|

$

|

2.4

|

|

$

|

2.8

|

(a) To eliminate the change in the balance of customer obligations related to cash received and processed in certain of our secure cash logistics

operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following

day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources.

operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following

day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources.

(b) To eliminate cash flows related to our discontinued operations.

Non-GAAP cash flows from operating activities are supplemental financial measures that are not required by, or presented in accordance with

GAAP. The purpose of the non-GAAP cash flows from operating activities is to report financial information excluding the impact of cash

received and processed in certain of our secure cash logistics operations and without cash flows from discontinued operations. Brink’s

believes this measure is helpful in assessing cash flows from operations, enables period-to-period comparability and is useful in predicting

future operating cash flows. Non-GAAP cash flows from operating activities should not be considered as an alternative to cash flows from

operating activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows.

GAAP. The purpose of the non-GAAP cash flows from operating activities is to report financial information excluding the impact of cash

received and processed in certain of our secure cash logistics operations and without cash flows from discontinued operations. Brink’s

believes this measure is helpful in assessing cash flows from operations, enables period-to-period comparability and is useful in predicting

future operating cash flows. Non-GAAP cash flows from operating activities should not be considered as an alternative to cash flows from

operating activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows.

20

|

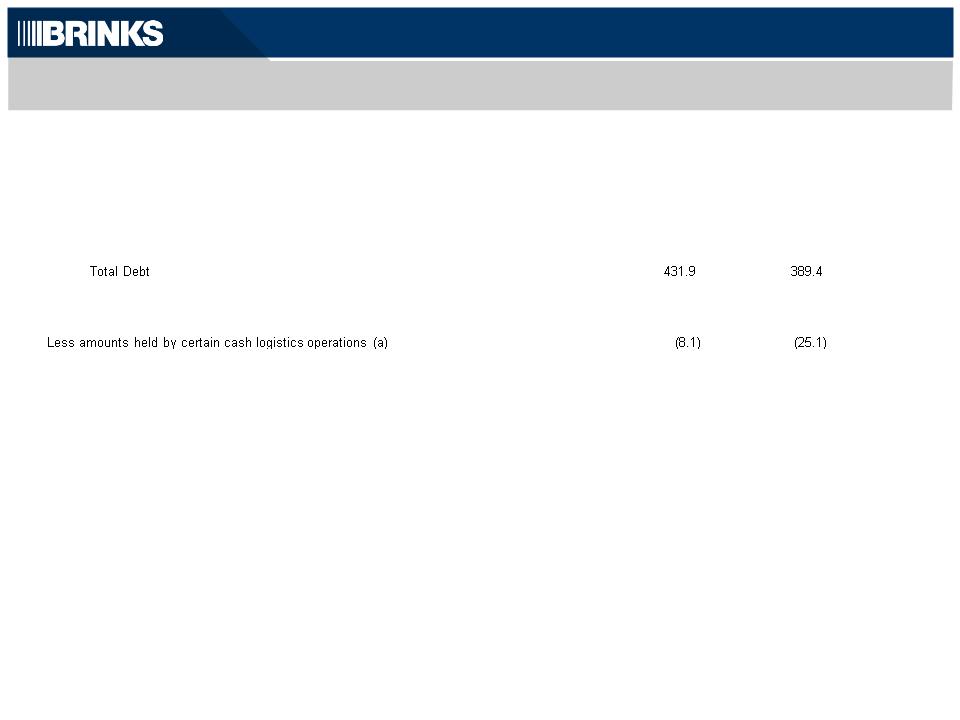

NET DEBT RECONCILED TO GAAP

|

|

|

March 31,

|

|

December 31,

|

|

|||

|

|

|

|

2012

|

|

2011

|

|

|||

|

Debt:

|

|

|

|

|

|

||||

|

|

Short-term debt

|

|

$

|

23.0

|

|

25.4

|

|

||

|

|

Long-term debt

|

|

|

408.9

|

|

364.0

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

155.5

|

|

182.9

|

|

|||

|

|

|

|

|

||||||

|

|

|

|

Amount available for general corporate purposes

|

|

|

147.4

|

|

157.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Debt

|

|

$

|

284.5

|

|

231.6

|

|

|

(a) Title to cash received and processed in certain of our secure cash logistics operations transfers to us for a short period of time. The cash is

generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the

management of our liquidity and capital resources and in our computation of Net Debt.

Net Debt is a supplemental financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of

our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should

not be considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our

consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most

directly comparable financial measure calculated and reported in accordance with GAAP. Net Debt excluding cash and debt in Venezuelan

operations was $307 million at March 31, 2012, and $242 million at December 31, 2011.

our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should

not be considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our

consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most

directly comparable financial measure calculated and reported in accordance with GAAP. Net Debt excluding cash and debt in Venezuelan

operations was $307 million at March 31, 2012, and $242 million at December 31, 2011.

Non-GAAP Reconciliations - Net Debt