Attached files

| file | filename |

|---|---|

| EX-99.1 - EX. 99-1_PRESS RELEASE - NORTHWESTERN CORP | ex99-1_pressrelease.htm |

| 8-K - 8-K_04/25/2012_EARNINGS RELEASE - NORTHWESTERN CORP | ek_04252012-er.htm |

Annual Shareholders Meeting

Butte, Montana April 25, 2012

Butte, Montana April 25, 2012

2

Forward looking statements

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements often

address our expected future business and financial performance, and often

contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements often

address our expected future business and financial performance, and often

contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” or “will.”

The information in this presentation is based upon our current expectations as

of the date hereof unless otherwise noted. Our actual future business and

financial performance may differ materially and adversely from our

expectations expressed in any forward-looking statements. We undertake no

obligation to revise or publicly update our forward-looking statements or this

presentation for any reason. Although our expectations and beliefs are based

on reasonable assumptions, actual results may differ materially. The factors

that may affect our results are listed in certain of our press releases and

disclosed in the Company’s public filings with the SEC.

of the date hereof unless otherwise noted. Our actual future business and

financial performance may differ materially and adversely from our

expectations expressed in any forward-looking statements. We undertake no

obligation to revise or publicly update our forward-looking statements or this

presentation for any reason. Although our expectations and beliefs are based

on reasonable assumptions, actual results may differ materially. The factors

that may affect our results are listed in certain of our press releases and

disclosed in the Company’s public filings with the SEC.

2

3

Who we are

Financial update

Investment opportunity

outlook

Financial update

Investment opportunity

outlook

Outline

4

Who we are

ð Our Vision: Enriching lives through a safe,

sustainable energy future

sustainable energy future

ð Our Mission: Working together to deliver safe,

reliable and innovative energy solutions

reliable and innovative energy solutions

ð Our Values:

Safety

Excellence

Respect

Value

Integrity

Community

Environment

5

Geographically positioned for success

ð Our service territory covers some of the

best wind regimes in the nation

ð We have the opportunity to provide

transmission services into two different

markets (West and

Midwest)

Midwest)

Great wind profile

Low unemployment rates

ð A fully-regulated utility located in states

with relatively stable economies with

opportunity for system investment and

grid expansion

6

7

With competitive customer rates

Typical

Customer

bills

Customer

bills

8

One hundred years later….

After a

hundred

years,

electricity

hundred

years,

electricity

is still a

great

value

great

value

9

Who we are

Financial update

Investment opportunity

outlook

Financial update

Investment opportunity

outlook

Outline

10

A strong credit profile

ð Long-term targeted total debt to

capitalization of 50-55% with a current

capitalization of 55.6%(1)

capitalization of 50-55% with a current

capitalization of 55.6%(1)

ð Total liquidity of $136 million as of Dec

31, ’11

ð Refinanced nearly all debt in the last 2 years

– Lowered average coupon on long-term

debt by 1.2% and extended maturities

11

Reaffirming 2012 earning guidance

Reaffirming 2012 guidance range of $2.35-$2.50 based upon, but not limited

to, the following major assumptions and expectations:

to, the following major assumptions and expectations:

• A consolidated income tax rate of approximately 18% - 20% of pre-tax income;

12

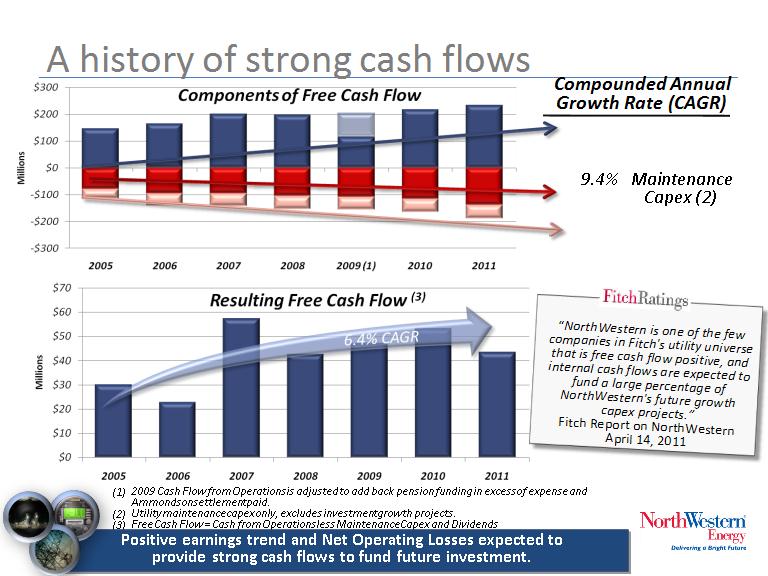

8.1% Cash From

Operations

Operations

6.5% Dividend Growth

13

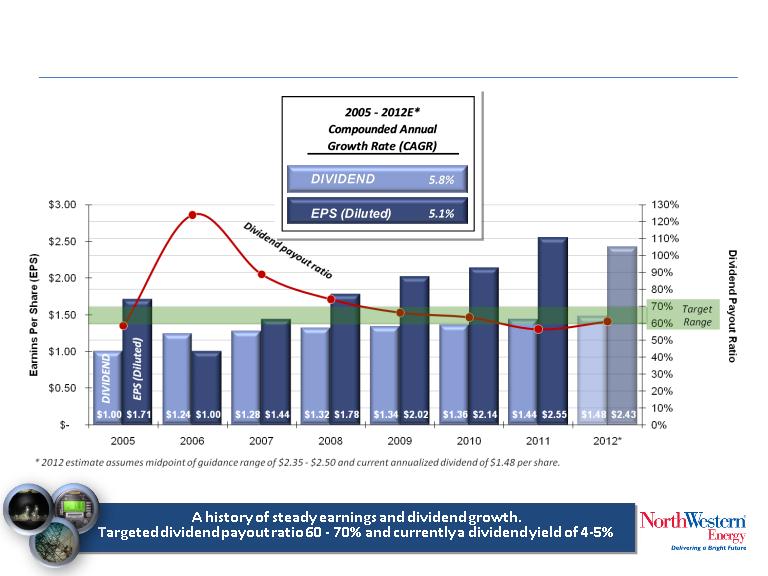

A history of earnings and dividend growth

14

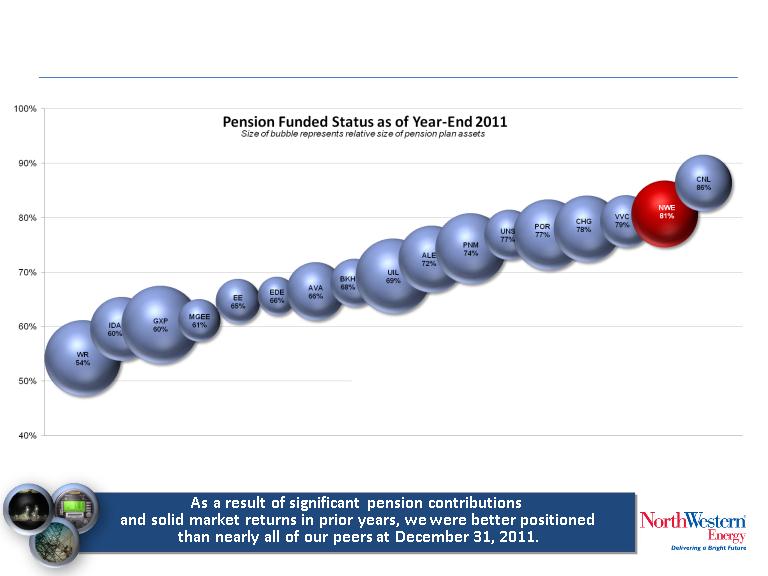

Solid pension funding

NorthWestern Energy’s Pension Assumptions

ð Target allocation 50% equity and 50%

fixed income

fixed income

ð Expected long-term rate of return of 7.00%

ð Discount rate of 4.40 - 4.55%

15

Who we are

Financial update

Investment opportunity

outlook

Financial update

Investment opportunity

outlook

Outline

16

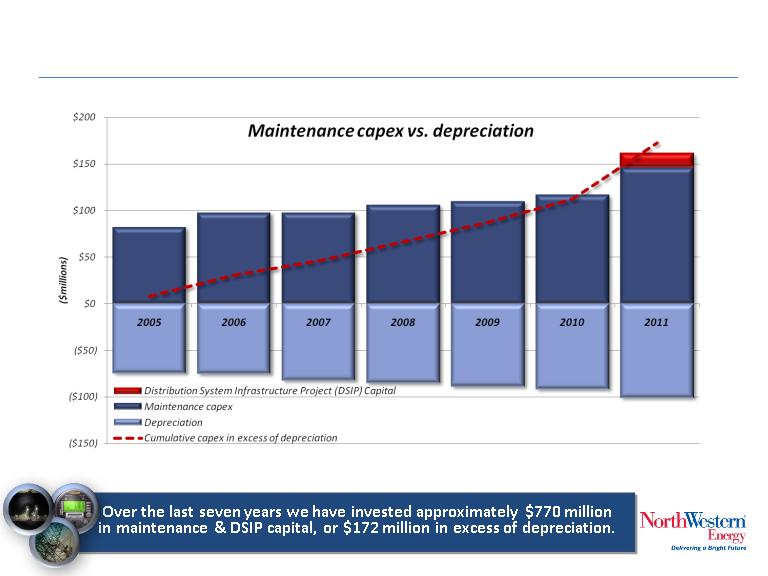

Growing investment in our existing system

17

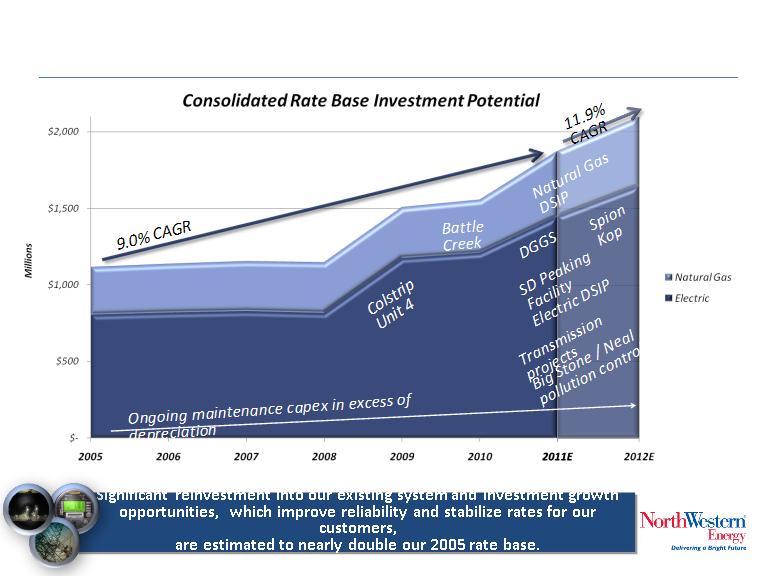

Great investment growth opportunities

18

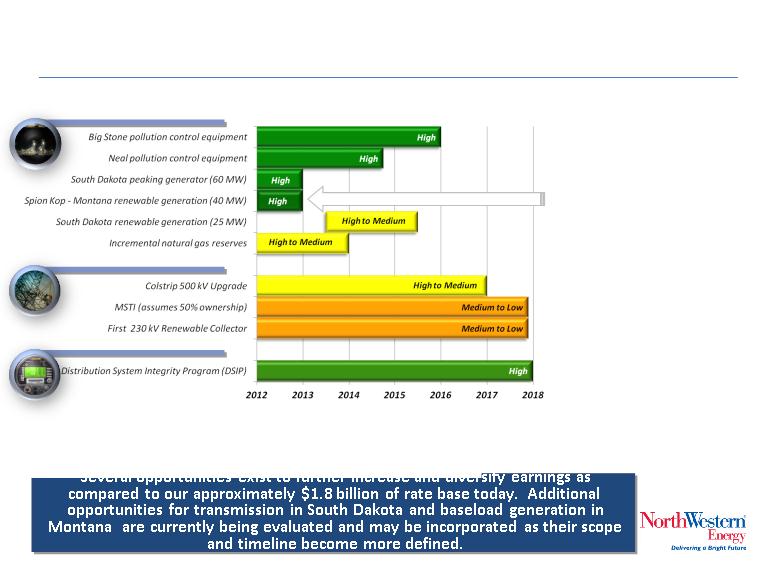

Investment project summary

Note: Color / label indicate NorthWestern Energy's current probability of execution and timing of

expenditures.

expenditures.

Changed to Green with MPSC pre-approval

granted Feb ‘12

granted Feb ‘12

19

20

Questions?

Thank you from all of us at NorthWestern Energy.