Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DATALINK CORP | a12-10494_18k.htm |

| EX-99.1 - EX-99.1 - DATALINK CORP | a12-10494_1ex99d1.htm |

Exhibit 99.2

Q1 2012 Investor Conference Call Script

April 25, 2012

Paul Lidsky:

Thank you, operator. Good afternoon. I’d like to welcome everyone to this afternoon’s conference call. Thank you for joining us. With me today is Greg Barnum, our Vice President of Finance and Chief Financial Officer. I’ll now turn the call over to Greg to discuss our first-quarter results and our outlook for the second quarter of 2012 and then I will provide some additional perspectives on the quarter.

Greg Barnum:

Thanks Paul.

Before we begin with the quarter’s results let me first remind everyone that in today’s conference call we will be discussing our views regarding future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties. Actual future results and trends may differ materially from historical results or those anticipated, depending on a variety of factors. Please refer to Datalink’s filings with the Securities and Exchange Commission for a full discussion of our company’s risk factors.

Revenues for the first quarter ended March 31, 2012 increased 39% to $119.1 million compared to $85.7 million for the prior-year first quarter and increased 3.8% from the fourth quarter of last year.

On a GAAP basis income from operations for the first quarter of 2012 was $3.6 million or 3.0% of revenues, compared to $3.0 million or 3.5% of revenues in the first quarter of 2011. Net earnings for the first quarter of 2012 were $2.2 million or $0.12 per share. This compares to net earnings of $1.7 million or $0.12 per share in the first quarter of 2011.

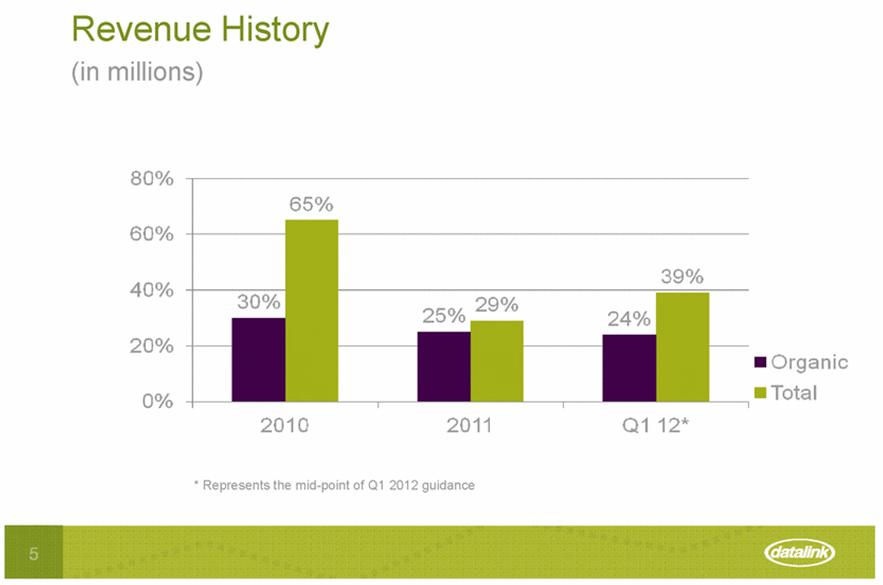

The 39% increase from the first quarter of last year does include revenues from the acquisition of Midwave in October 2011. Without the acquisition the revenue growth would have been approximately 24%. Furthermore if the effect of the accounting change relating to revenue recognition which increased first quarter 2011 revenues by $7.5 million was excluded, overall revenue growth would have been 52% and organic growth would have been approximately 36%. Keep in mind that since we integrate acquisitions immediately it is difficult to break out the first quarter revenues contributed solely by Midwave and that this is only an approximation.

For the rest of my comments on the income statement, I will be referring to non-GAAP amounts and percentages as reported in today’s press release. A detailed

reconciliation between GAAP and non-GAAP information is contained in the tables included in the today’s press release. The primary adjustments to GAAP results relate to stock based compensation charges, the amortization of intangibles, and integration and acquisition costs, net of income taxes.

In the first quarter of 2012 our product revenues increased 44% to $80.2 million, and our service revenues increased 29% to $38.9 million compared to the first quarter of 2011, both records for Datalink. On a sequential basis we saw product revenues increase 3% and service revenues increase 6%.

Our revenue mix for the quarter was 41% storage, 16% networking and servers, 7% software, 3% tape, and 33% service. This mix represents a significant increase in our networking and server revenues from the first quarter of last year when networking and servers comprised 9% of our total revenues.

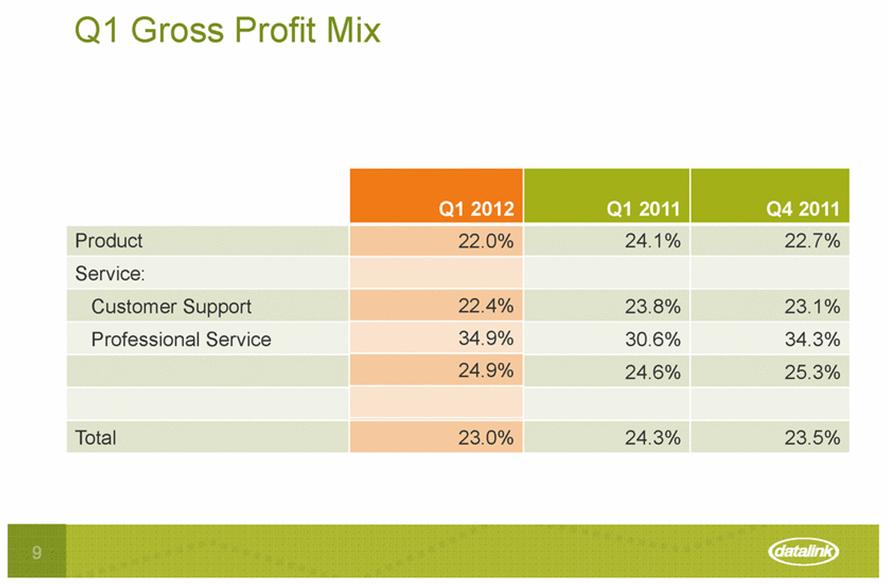

Overall gross margin in the first quarter of 2012 was 23% which is down from 23.4% in the first quarter of 2011. This decrease is mainly due to the increase in our networking and server business, which historically have carried lower gross margins than storage. In addition we closed several very competitive deals during the quarter which carried slightly lower overall margins. This is evidenced by a 47% increase in the number of customers spending more than $1 million with us during the quarter.

Operating income for the first quarter of 2012 was a record $4.9 million or 4.1% of revenue compared to $3.8 million or 4.5% in the first quarter of last year. The 40

basis point decline in operating margin is mainly due to the planned investment in infrastructure, including human resources, customer support and IT systems.

Net earnings for the first quarter of 2012 were a record $2.9 million or $0.17 per share. This compares to net earnings of $2.2 million or $0.16 per share in the first quarter of 2011. Earnings per share for the first quarter of 2012 reflect the full impact of the 3.3 million share secondary offering completed in mid-March of 2011.

We furthered strengthened our balance sheet during the quarter. Our working capital position at the end of the quarter was $41.6 million, compared to $37.9 million at the end of last year. We generated $5.7 million of cash from operations during the quarter, our cash and investment balance at the end of March was $26.7 million and our balance sheet remains debt free.

Looking out to the second quarter of 2012, based on our backlog, current sales pipeline, and the higher operating costs we historically experience in the first half of the year, we expect reported revenues to be between $125.0 million and $135.0 million for the second quarter of 2012, which represents a 40% to 52% increase over revenues of $89.5 million in the second quarter of last year. We expect second quarter 2012 net earnings to be between $0.14 and $0.20 per share on a GAAP basis, and net earnings of between $0.20 and $0.26 per share on a non-GAAP basis.

Let me now turn the call over to Paul.

Paul Lidsky:

Thanks Greg.

I am very pleased with Datalink’s first quarter performance and the progress we are making in our integrated data center strategy. We can see the results in our record revenue growth — both in products and services — and in the significant growth in our networking practice as a percentage of total revenues.

Our first-quarter revenues were at the high end of our guidance, and we had our twelfth consecutive quarter of non-GAAP net earnings with a one-cent gain per share. Our focus is to expand the quarter over quarter earnings per share gains, and I expect to see that start to happen in the second half of the year as we continue to leverage the investment we made in last October’s acquisition of Midwave, the build out of our managed services business that we will talk about shortly, and the other strategies we have put in place to grow our overall business.

Revenue / Gross Profit / Operating Income

As Greg outlined, we saw significant growth in revenue and operating income between Q1 2011 and Q1 2012. To recap, that includes a 39% revenue increase from the prior-year first quarter – or 24% without the acquisition of Midwave in October 2011 – with a 44% increase in product revenues and a 29% increase in service revenues. In addition, it is noteworthy that we had sequential revenue growth of 4% from Q4 2011 to Q1 2012 instead of the typical 10% decrease.

These are strong numbers, but they are even more impressive when you consider that we achieved that 39% revenue increase with a 15% quarter over quarter increase in account executive productivity. Each account executive is selling more, and that’s because our expanded portfolio of data center products and services is driving increased wallet share. Individual customers are buying more from us than in the past because we have more to offer. That means we can scale our revenues without scaling our sales force. It’s a highly efficient and cost-effective way of fueling growth.

Product Mix

The fact that customers are taking advantage of our expanded offerings is also changing our product mix in exactly the way we envisioned when we initiated the move from selling silo’d storage to entire data center infrastructures. As Greg mentioned, our networking and server revenues grew from 9% to16% of total revenues between Q1 2011 and Q1 2012. That shows that the market is increasingly taking a holistic view of the data center and understanding that you gain efficiencies if you deploy newer technologies that integrate server, storage, network and virtualized solutions. We have positioned Datalink to be the trusted advisor to our customers as they go through this transformation, and that is fueling these sales.

This change in product mix — specifically in rising sales of networking and server products with historically lower gross margins — is the primary reason for our slippage in profit margins along with the large customer sales that Greg talked

about. But these products are important to the totality of the data center sale and the change in margins was expected. You can’t build a modern data center without them, and they drive other business — including services with higher margins.

Customers / Numbers

Another factor in the margin slippage is our success in new customer acquisition. In the first quarter this year we signed 143 new customers, more than double the 67 for the same quarter in 2011. It’s obviously more expensive to win new customers than to sell to our existing install base. But new customers are important to our long-term growth plan because approximately 95% of our revenues come from existing customers — including higher-margin service sales. That means the one-time margin degradation is more than offset by each customer’s lifetime value.

We also saw significant increases in multimillion-dollar accounts and in customers purchasing the unified data center solutions — also known as virtualized data centers or VDC for short — that are a key component of our growth strategy.

Twenty two customers spent over $1 million with us in Q1 this year compared to 15 in the comparable quarter, reflecting that increased wallet share we talked about earlier. We also had 17 VDC sales valued at $16.6 million compared to just 7 deals worth $410,000 in Q1 2011. That’s an indication of how much the market is moving in the direction we have chosen.

I want to take a few minutes to examine these trends in more detail by looking at some of our customer wins during the past quarter.

Storage Wins (long-time customer value)

First let’s look at two contracts from long-time customers. These are both storage wins — our legacy business — but the fact that they involve install base customers illustrates the point I was making a few minutes ago: that each customer represents an opportunity for repeat business even years after their first order. In these two cases:

· A high tech content generation firm awarded Datalink a storage project valued at $2.0 million. We expanded their storage environment to support their high data growth rate. Currently, they have 9 petabyes of data, which is projected to grow by 1-2 petabyes per month. All of this data is stored on Datalink-designed and deployed infrastructure, which was carried out in in multiple phases. We also provide ongoing support services for this infrastructure.

· A financial services organization chose Datalink to conduct a total storage tech refresh valued at $3.6 million in order to gain additional storage capacity and enhanced disaster recovery capabilities.

It’s also significant that these were both multi-million dollar purchases. All of this says a lot about our ability to retain customers and build wallet share from them.

Virtual Data Centers

In the area of virtualized data centers or VDCs, the fact that the number of deals more than doubled quarter over quarter from 7 to 17 — and the value of those deals jumped from $410,000 to $16.6 million, — clearly shows that we are capitalizing on the market shift from silo’d products to data center infrastructures that unify network, compute and storage platforms to achieve greater agility and efficiency. They also take advantage of cloud and virtualization technologies. As you know, these solutions are marketed under brand names including Flexpod by NetApp with Cisco and VMware; and VBlock and VCE by EMC with Cisco & VMware.

Here is an example of our success in this area in Q1:

· A health services organization awarded us a virtual data center project amounting to $1.3 million. The Datalink-designed and deployed FlexPod infrastructure, which spanned storage, servers and networks, provides the organization with greater scalability and efficiency, along with site-to-site disaster recovery capabilities. This project also included OneCall Unified Support Services.

As more companies become aware of the advantages of integrated data centers, the market will continue to shift toward this model, and Datalink is in an ideal position to provide not only the products but also the services needed to support them.

Cisco

It is worth noting here that a lot of our VDC sales include products from our partner Cisco - notably the Cisco Unified Computing or UCS System. In simple

terms, UCS is the plumbing of the modern data center. It’s important because it reduces server, cabling, power, cooling and management needs through strategies like virtualization.

Increased UCS sales were an important factor in our Q1 Cisco sales, which increased 335% over the first quarter of 2011. Our Midwave acquisition helped to accelerate these results.

Services

The last topic I want to cover concerning our Q1 performance involves services. As Greg noted, our services revenues increased 29% during the quarter. That growth is coming from professional services, consulting and the customer support contracts including our OneCall unified support we offer for integrated data centers. We have seen significant growth in our OneCall revenues as the overwhelming majority of our VDC customers are adding OneCall to their purchase. Our VDC customers recognize the value of a single support contact and support organization for a multiple vendor system.

All of these services are part of our high touch model — that is, providing value to customers beyond the product sale in order to establish long-term relationships. We want customers to depend on our expertise both in designing data centers and in supporting them on an ongoing basis.

To that end, in May we will be announcing the launch of two new managed services — managed monitoring and managed backup. These new offerings are part

of our ongoing initiative to increase services revenues by adding new high-touch programs. They are made possible in part by the mature infrastructure monitoring and management services we gained in the acquisition of Midwave.

These managed services efforts are already bearing fruit. For example:

· A financial services organization is using our managed backup service to optimize backups for 195 servers spanning two locations and running key applications like Oracle, SQL, SharePoint and Exchange. Datalink is providing 24x7 management of 600+ daily data backups, which includes monitoring the health and performance of the backup infrastructure. Our team has already made a significant impact on the performance, increasing the backup success rate over 25% in the first month.

· A storage OEM signed a 2-year, $2 million managed backup service agreement in Q1 that will be deployed in Q2. We will be managing backups of 75,000 GB of customer data residing on 6 storage devices. We will also be designing and deploying the backup infrastructure at the customer’s environment, including Cisco UCS servers, Quantum libraries, Brocade FC switches, and Symantec NBU software.

· A biotech company awarded us a one-year managed backup services contract. The service scope includes one location with 4 servers, 16 clients and 2 tape libraries. This customer was already leveraging Datalink on an hourly basis to supplement their backup operations, but their internal team

did not have the skills or time to fully manage the environment. Outsourcing the entire operations to Datalink was a natural extension of the services we have already been providing.

Guidance

All of this adds up to continued strong growth. As Greg stated earlier, we expect reported revenues to be between $125.0 million and $135.0 million for the second quarter of 2012, which represents a 40% to 52% increase over the second quarter of last year. Our overall sales pipeline continues to grow and within that, demand for integrated data centers continues to grow as market adoption for these new technologies steadily increases. We also continue to leverage the Midwave acquisition, not only in the managed services and the Cisco areas I have already mentioned, but also in other arenas including their sales team’s ability to: bundle higher value OneCall services with their storage and data center sales; their increasing growth in higher margin storage sales as a percent of their overall sales; and the contribution of their consulting practice to our overall national consulting practice. These factors, along with projected continued strong sales, growing technology spending and the overall improvements in the economy, bode well for Q2 and beyond.

With that, I’ll turn the call back to the operator so that we can take your questions.

Operator:

Operator conducts Q&A session.

Paul Lidsky:

Thank you again for joining us today. Have a great afternoon.

|

|

First Quarter 2012 Investor Call April 25, 2012 Paul Lidsky, CEO Greg Barnum, CFO |

|

|

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 With the exception of historical information, the statements set forth in this presentation include forward-looking statements that involve risk and uncertainties. The Company wishes to caution that a number of important factors could cause actual results to differ materially from those in the forward-looking statements. These and other factors which could cause actual results to differ materially from those in the forward-looking statements are discussed in the Company’s filings with the Securities and Exchange Commission. |

|

|

Numbers |

|

|

GAAP Quarterly Results (dollars in millions, except per share data) 2011 Q1 2011 Change Q4 2012 Revenue Q1 Gross Margin Gross Margin Operating Inc. Operating Margin EPS $119.1 $85.7 39% $114.7 $27.3 $20.8 31% $25.9 22.9% 24.3% 22.6% $3.6 $3.0 20% $4.6 3.0% 3.5% 4.0% $0.12 $0.12 $0.15 |

|

|

Revenue History * Represents the mid-point of Q1 2012 guidance (in millions) 80% 60% 40% 20% 0% 30% 65% 25% 29% 24% 39% 2010 2011 Q1 12* Organic Total |

|

|

GAAP vs. Non-GAAP Adjustments (dollars in thousands) 2011 Q1 2012 Q1 Non-GAAP Adjustments: Stock Based Compensation $590 $425 Intangibles & Integration Costs $651 $418 Income Tax Effect ($520) ($352) $721 $491 These non-GAAP measures are not in accordance with, or an alternative for measures prepared in accordance with, GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. |

|

|

Q1 Revenue Mix Q1 2012 Q1 2011 Change Product $80.2 $ 55.6 44% Service: Customer Support 31.0 26.5 17% Professional Service 7.9 3.6 119% $38.9 $ 30.1 29% Total $ 119.1 $ 85.7 39% (dollars in thousands) |

|

|

Q1 Product Mix Q1 2012 Q1 2011 Q4 2011 Storage 43% 39% Networking & Servers 9% 16% Software 5% 10% Tape 7% 3% Service 35% 32% 41% 16% 7% 3% 33% |

|

|

Q1 Gross Profit Mix Q1 2012 Q1 2011 Q4 2011 Product 24.1% 22.7% Service: Customer Support 23.8% 23.1% Professional Service 30.6% 34.3% 24.6% 25.3% Total 23.0% 24.3% 23.5% 22.0% 22.4% 34.9% 24.9% 23.0% |

|

|

GAAP vs. Non-GAAP Operating Income Q1 2012 Q1 2011 GAAP Operating Income $3,000 GAAP Operating Margin 3.5% Non-GAAP Adjustments $ 843 Non-GAAP Operating Income $3,843 Non-GAAP Operating Margin 4.5% $3,644 3.1% $ 1,241 $ 4,885 4.1% |

|

|

GAAP vs. Non-GAAP Net Earnings Q1 2012 Q1 2011 GAAP Net Earnings $1,748 GAAP Diluted EPS $ 0.12 Non-GAAP Adjustments, net of tax $ 491 Non-GAAP Net Earnings $2,239 Non-GAAP Diluted EPS $ 0.16 (in thousands, except per share data) $2,161 $ 0.12 $ 721 $ 2,882 $ 0.17 |

|

|

Balance Sheet Highlights Dec 31, 2011 Cash $ 22.4 Working capital $ 37.9 Debt $- Cash from operations $ 5.1 Cash value / share $ 1.25 in millions, except per share data Mar. 31, 2012 $ 26.7 $ 41.6 $- $ 5.7 $ 1.48 |

|

|

Second Quarter 2012 Guidance June 30, 2011 Change Revenue $ 89.5 40% - 52% GAAP EPS $ 0.15 Non-GAAP EPS $ 0.18 in millions, except per share data June 30, 2012 $ 125.0 - $ 135.0 $ 0.14 - $ 0.20 $ 0.20 - $ 0.26 |

|

|

Key Points |

|

|

Financials 39% increase in revenues with same number of sales representatives 4% Q4 2011 to Q1 2012 increase in revenues Increased wallet share from individual customers Changing product mix reflecting Datalink’s holistic data center strategy Rising services revenues based on Datalink’s services expansion Margin pressures created by shifting product mix |

|

|

Customers & Services 143 new customers Up from 67 in Q1 2011 22 customers with $1 million+ spend Up from 15 in Q1 2011 17 VDC sales totaling $16.6 million Up from 7 totaling $410,000 |

|

|

Customers & Services 29% increase in services revenues quarter over quarter OneCall Professional services Consulting Managed services expansion to drive more services business Two new services to be announced in May (Continued) |

|

|

Questions |

|

|

Thank you |