Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - APARTMENT INVESTMENT & MANAGEMENT CO | d320521d8k.htm |

1

Analyst Meeting Discussion Materials

March 22, 2012

Exhibit 99.1 |

2

What We Expect

How We Plan to Get There

Operations

A Solid Year Ahead

Conventional

Same-Store

NOI

5.25%

-

7.25%

Affordable

Same-Store

NOI

0.0%

-

1.0%

Total

Same-Store

NOI

4.5%

-

6.25%

Revenue

4.5% -

5.5%: 2.1% “in the bank”

from 2011 and

5.0%+ increase in 2012 lease

rates

Expenses

2.5% -

3.0% due to increases in real estate

taxes & insurance; operating expenses flat

Portfolio

Better Than Ever

Conventional rents

~10% to $1,260 from $1,143 today

Affordable portfolio < 10% of NAV

Conventional

NOI

margin

~1.5%

to

~64%

Conventional

Free

Cash

Flow

margin

(1)

~3%

to

~58%

Dispositions $550 -

$650M

Sell 25+ Conventional properties with average rents

< $700

Sell 60+ Affordable properties with average ownership

of 41%

Acquisitions $220M+ with $160M in partnerships

Redevelopment

Full Speed Ahead

Conventional

redevelopment

$125

-

$150M

Robust

pipeline;

5%

-

6%

of

NAV

under

redevelopment

at

one

time

Eight projects underway in 2012; four in coastal California

and four others in Seattle, Chicago and Philadelphia;

~$400M multi-year investment

Three vacant properties; ~1,220 units returned to service

over next two years; target rents > $2,400

Current returns on un-trended rents > 7%, Free Cash Flow

IRRs > 10%

Balance Sheet

Lower Leverage

(2)

EBITDA:Interest 2.5:1

EBITDA:Interest & Preferred Dividends 2.0:1

Debt:EBITDA 7.5x

Debt & Preferreds:EBITDA 8.7x

Continue to be non-recourse, long-term, fixed rate borrower

Increasing property income

Property debt amortization $83M or ~2% of debt

Refinance maturing debt of $118M or ~2.5% of debt

Opportunistic redemption of high cost preferreds

Business

Simpler

Average

ownership

in

Conventional

properties

to

96%

Sale of third-party asset management business; ~$0.01 per share

of 2011 and 2012 FFO

Average

ownership

in

Affordable

properties

to

74%

Tender or merge 11 partnerships with 19 properties; 7 public

partnerships with average annual administration costs of

~$1M

Earn-in of technology initiatives, scale reductions and

efficiency gains

Earnings & Dividend

Moving Up

FFO of $1.72 -

$1.82 per share

8%

AFFO of $1.17 -

$1.29 per share

21%

Dividend

50%

to

$0.72

per

share

per

year;

~60%

AFFO

payout

Stick to the plan

Aimco 2012 Plan

(1)

Free Cash Flow is defined as property NOI less assumed capital replacement expenditures of $850 per

unit. (2)

Leverage metrics based on annualized projected 4Q 2012 EBITDA. |

3

Property Operations Strategy

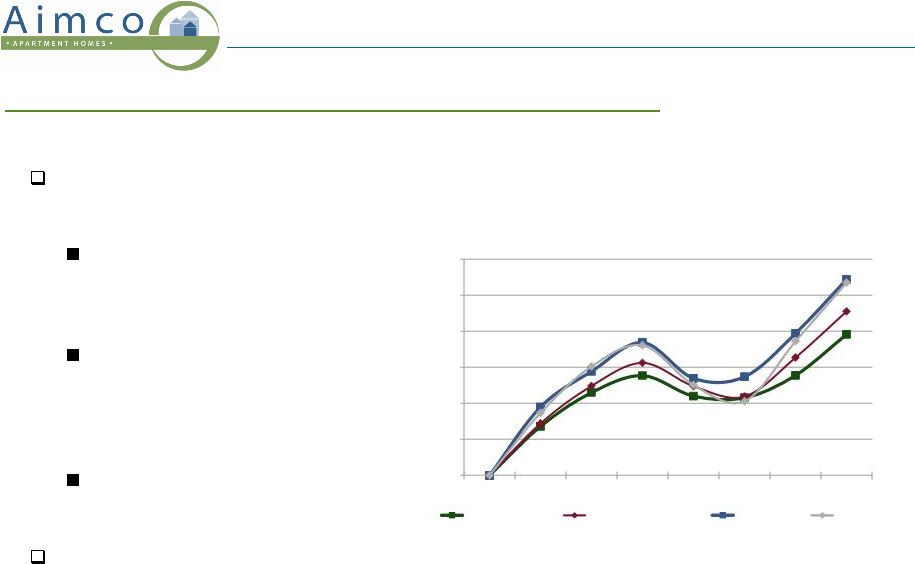

Low turnover strategy contributes to NOI performance

Low turnover strategy:

Customer retention is key to greater

NOI contribution and more predictable

operating results

Aimco’s annual turnover of 48% is

significantly lower than an

apartment industry average of 55%

-

60%

(1)

By maintaining lower than industry

average turnover, Aimco avoids

expensed and capitalized turn

costs, vacancy loss and marketing

expense of $10 -

$12M annually

Renewal lease rates are generally

less volatile and are, on average,

higher than new lease rates

On average, customers choose to rent

an Aimco apartment for 22 months, up

22% from 2007

(2)

Conventional Same-Store Revenue & NOI Growth

2006 -

2012E

100

105

110

115

120

125

130

(2)

2005

2006

2007

2008

2009

2010

2011

2012E

(2)

AIV Revenue

Peer Avg Revenue

AIV NOI

Peer Avg NOI

AIV Revenue

AIV NOI

(1)

Based on information collected by YieldStar.

(2)

Peer group consists of AvalonBay, Camden, Equity Residential, Essex, Home Properties and UDR.

2006 - 2011 averages computed based on individual company results as reported by SNL Financial. 2012E

represents midpoint of company guidance. |

4

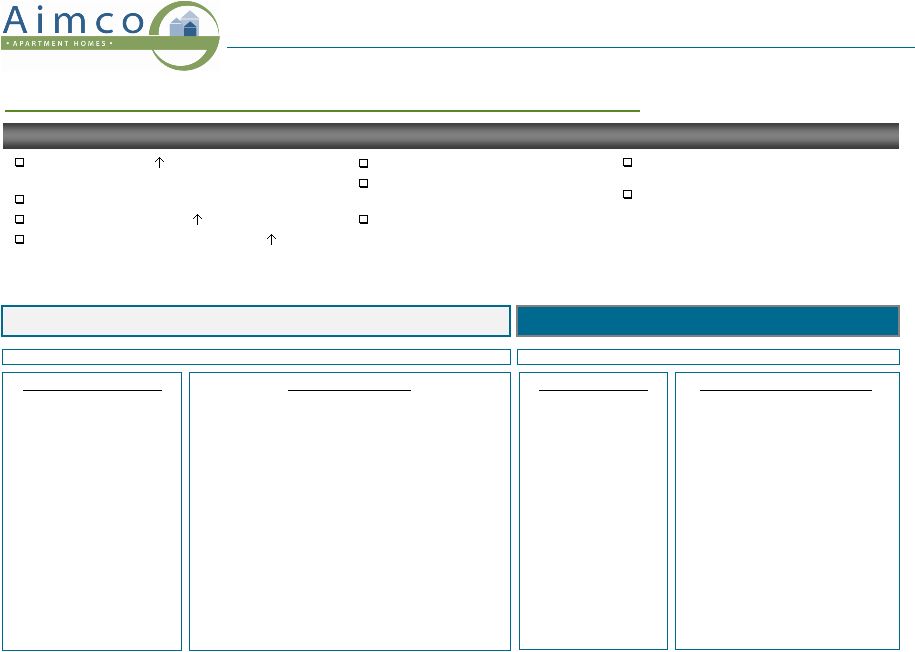

2012 Plan: Property Operations

Property operations are on track for a solid year

What We Expect

How We Plan to Get There

Year-to-Date Progress

Conventional Same-Store NOI

5.25% -

7.25%

Affordable Same-Store NOI

0.0% -

1.0%

Total Same-Store NOI

4.5% -

6.25%

Revenue

4.5% -

5.5%:

2.1% “in the bank”

from 2011

5.0%+ increase in 2012 lease

rates

Expenses

2.5% -

3.0%:

real estate taxes & insurance

operating expenses flat

Lease rates on track

High occupancy

Expenses tracking better than

expected due to mild winter

Jan

Feb

Year-to-Date

New leases

0.3%

1.4%

0.8%

Renewal leases

4.6%

5.5%

5.1%

Blended

2.4%

3.4%

2.9%

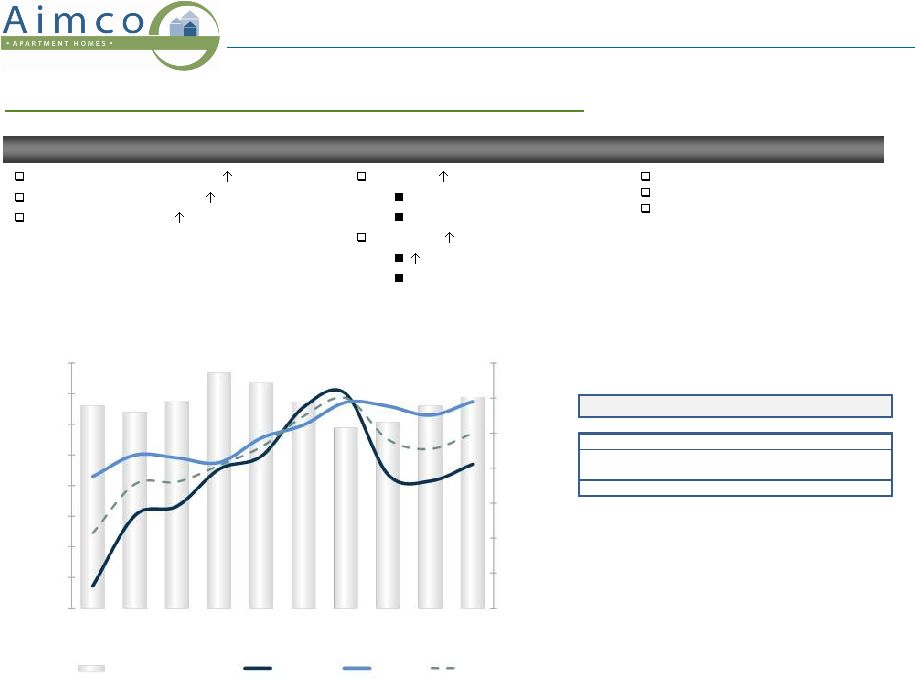

Seasonal Acceleration in Lease Rates

90.0%

91.0%

92.0%

93.0%

94.0%

95.0%

96.0%

97.0%

-8.0%

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

Jan-12

Feb-12

Average Daily Occupancy

New Lease

Renewal

Blended

Conventional Same-Store Rate & Occupancy |

5

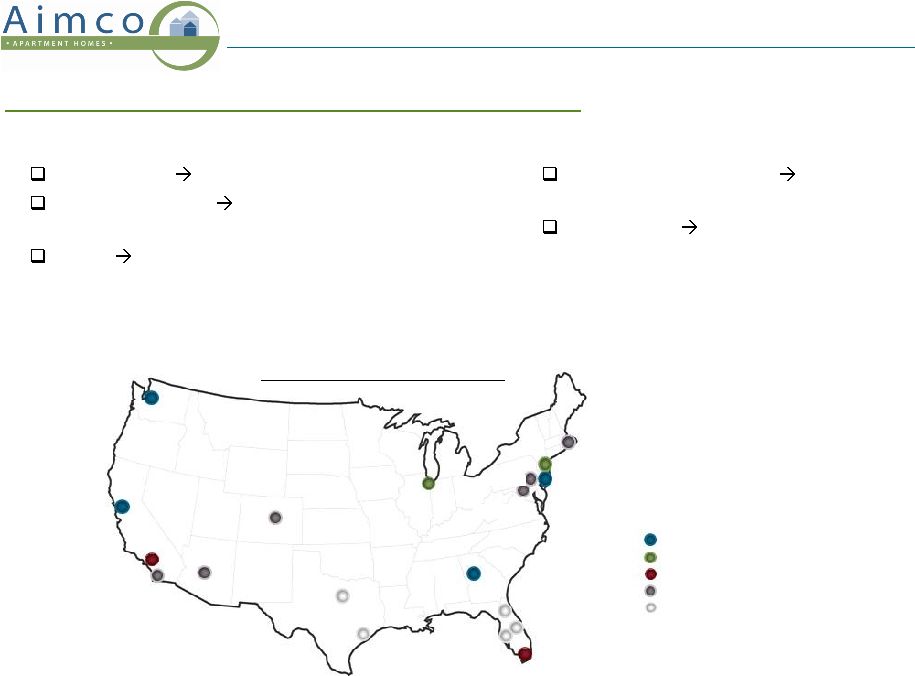

Our target customers are:

Aged 24 -

40

high propensity to rent

College-educated

strongest job and earnings

growth, lowest unemployment

Single

homeownership is a lifestyle choice; not

yet motivated by marriage, children

Portfolio Strategy

And they want to live in:

Hub and gateway cities

lifestyle, job

opportunities

Urban areas

proximity to jobs

Portfolio designed around our target customers

Manhattan

Boston

Philadelphia

Suburban NY / NJ

Washington

Greater Los Angeles

Denver

Phoenix

Chicago

Houston

South Florida

Atlanta

Seattle

Bay Area

San Diego

Jacksonville

Orlando

Tampa

Dallas / Ft Worth

Increase capital (redevelopment, acquisitions)

Maintain capital

Decrease capital

Upgrade locations within market

Recycle out

Long-Term Capital Allocation Objectives:

Portfolio increasingly concentrated in the locations where our target customers

want to live Portfolio as of 12/31/2011 |

6

2012 Plan: Portfolio

What We Expect

How We Plan to Get There

Year-to-Date Progress

Conventional rents

~10% to $1,260 from $1,143

at the end of 2011

Affordable portfolio < 10% of NAV

Conventional

NOI

margin

~1.5%

to

~

64%

Conventional

Free

Cash

Flow

margin

*

~3%

to

~58%

Dispositions $550 -

$650M

Acquisitions $220M+ with $160M in

partnerships

Opportunistic acceleration of 2013 -

2014 planned dispositions of ~$1B

with average rents ~$800 would

increase average rents at year-end

2012 to ~$1,400

Sold four properties with 725 units,

Aimco share of gross proceeds ~$45M

Completed seven public partnership

mergers, acquiring $130M of real estate

Portfolio plan is on track, may accelerate asset sales

AIV Share: $550 -

$650M

Conventional Properties

Portfolio average rents

increase ~5% through sales

of 25+ properties with

average rents

< $700

AIV share of gross

dispositions $500 -

$600M

FCF margin increases at rate

twice that of NOI margin due

to levering effect of capital

replacement spending

Affordable Properties

Sell 60+ properties in which Aimco's average ownership

is ~41%

AIV share of gross dispositions ~$50M

In connection with sale of asset managed portfolio, sell

20+ consolidated NAPICO properties in which Aimco’s

average ownership is ~14%

YE 2012 affordable portfolio:

•

~25 properties to be sold by the end of 2013

•

~65 tax credit redevelopment properties, most to be

liquidated over the next five years as credits are

delivered

Eliminate compliance activities, lower offsite costs

INVESTMENTS

Real Estate: $220M

$130M in seven public

partnerships

$90M in other

partnership tenders and

mergers, and property

purchases

DISPOSITIONS

Total: $345 -

$370M

Redevelopment: $125 -

$150M

Eight projects underway in 2012; four

in coastal California and four others in

Seattle, Chicago and Philadelphia;

~$400M multi-year investment

Three vacant properties; ~1,220 units

returned to service over next two

years; target rents > $2,400

Current returns on un-trended rents

> 7%, Free Cash Flow IRRs > 10%

* Free Cash Flow is defined as property NOI less assumed capital replacement expenditures of $850 per

unit |

7

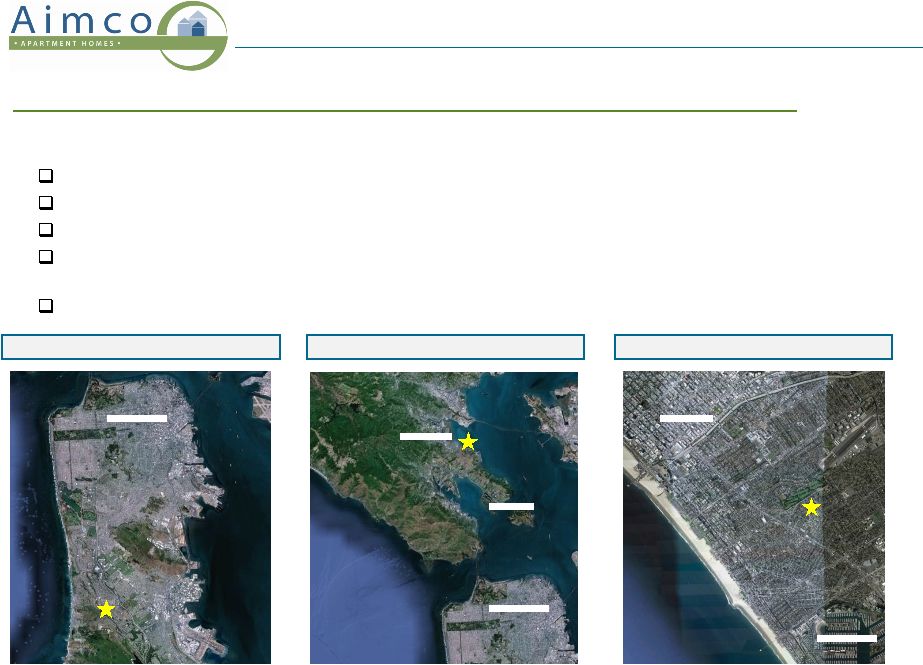

Redevelopment Strategy

Pipeline of opportunities to generate higher risk-adjusted returns

Redevelopment philosophy:

Land in quality locations appreciates over time

Older assets in quality locations provide opportunity for redevelopment

Redevelopment is a short-cycle business making it a lower-risk activity

than ground-up development Currently, redevelopment provides higher

risk-adjusted returns than acquisitions, with 2012 projects generating

current returns > 7% with un-trended rents in markets where cap rates average ~4.5%

Aimco’s

portfolio

composition

and

expertise

in

redevelopment

provide

a

pipeline

of

opportunities

Pacific Bay Vistas, San Bruno CA

Madera Vista, Corte Madera CA

Lincoln Place Apartments, Venice CA

San Francisco

Tiburon

Corte Madera

San Francisco

Santa Monica

Marina Del Rey |

8

2012 Plan: Redevelopment

What We Expect

How We Plan to Get There

Year-to-Date Progress

Conventional

redevelopment

$125

-

$150M

Robust pipeline; up to 5% -

6% of NAV under

redevelopment at one time and future annual

spend of $150 -

$250M

Eight projects underway in 2012 with

~$400M multi-year investment

Three vacant properties; ~1,220 units

returned to service over next two years

Current returns on un-trended rents > 7%,

Free Cash Flow IRRs > 10%

Lincoln Place and Pacific Bay Vistas

are under construction

Palazzo West will start construction

by the end of March

Madera Vista, 2900 on First and

Elm Creek will start construction

during 2Q

The Sterling and Park Towne will

start construction during 4Q

Redevelopment plan is on track

Palazzo West

$17M ($140K/unit)

Lincoln Place

$150M ($185K/unit)

Pacific Bay Vistas

$52M ($170K/unit)

2900 on First

$13M ($95K/unit)

Elm Creek

$10M (~$345K/unit -

new construction)

The Sterling

Final costs TBD

Park Towne

Final costs TBD

Madera Vista

$30M ($240K/unit) |

9

2012 Redevelopment Disclosure

Example of expanded quarterly disclosure to begin with 1Q 2012 report

Summary of Redevelopment Activity

As of December 31, 2011

(dollars in millions)

(unaudited)

Project

Number of

Units

Total Project

Cost

(1)

Inception-to-

Date

Investment

Construction

Start

Initial

Occupancy

Construction

Complete

Stabilized/

Restabilized

Operations

Pre-

Redevelopment

(2)

Stabilized

(3)

Quarter-End

Physical

Occupancy

Pacific Bay Vistas, San Bruno, CA

308

93.0

$

40.1

$

4Q 2011

3Q 2012

3Q 2013

4Q 2013

n/a

2,200

$

Vacant

(2) Average rents for the quarter preceding redevelopment start.

(3) Rents based on market rents for comparable product for the quarter preceding redevelopment

start. Does not include future market rent growth. Schedule

Average Rents

(1) Total cost of redevelopment project including pre-construction costs, hard construction costs

and capitalized operating costs, property taxes, overhead and interest. Pre-redevelopment basis is net of 4Q 2008 impairment loss of

$5.7 million. Aimco anticipates project to provide ~7% current return on un-trended

rents. |

10

Balance Sheet Strategy

Balance

sheet

designed

for

safety

Leverage strategy:

Limit entity risk by avoiding recourse debt, of which Aimco has virtually

none Reduce repricing risk by using fixed rate loans and refinancing

nearer-term maturities to lock in current interest rates

Reduce refunding risk by laddering maturities of long-term, non-recourse,

amortizing property loans with little or no near-term maturities and

perpetual preferred stock Hedge against inflation and cap rate expansion by

using long-dated, fixed rate leverage Non

-Recourse Property Debt Maturities

Weighted Average Term to Maturity: 8.2 Years*

2012*

2013

2014

2015

2016

2017

2018

2019

2020

2021

Thereafter

$0

$100

$200

$300

$400

$500

$600

$700

$800

Avg cost: 5.50%

Avg cost: 7.55%

Aimco Leverage

as of 12/31/2011

* As of 12/31/2011 with the exception that 2012 maturities exclude $56M of committed financings and

$69M of refinancing activity occurring during the first quarter 2012. |

11

2012 Plan: Balance Sheet

What We Expect

*

How We Plan to Get There

Year-to-Date Progress

EBITDA:Interest 2.5:1

EBITDA:Interest & Preferred Dividends 2.0:1

Debt:EBITDA 7.5x

Debt & Preferreds:EBITDA 8.7x

Continue to be non-recourse, long-term, fixed

rate borrower

Increasing property income

Property debt amortization $83M or

~2% of debt

Opportunistic redemption of high cost

preferreds

Property operations plan is on track

Loans are self-amortizing, on track

Refinanced $69M of maturing property debt

year-to-date, leaving $49M to refinance

during 2012

High cost of preferred stock makes

redemption a compelling use of property

sales proceeds

De-levering plan is on track, may accelerate

* 2012 leverage metrics are based on annualized projected 4Q 2012 EBITDA.

Preferred stock available for redemption

600,938

$

7.86%

47,217

$

Amount

($000s)

Coupon

Cost

($000s)

Perpetual Preferred Stock:

Class T

150,000

$

8.00%

12,000

$

Class U

300,000

7.75%

23,250

Class V

64,688

8.00%

5,175

Class Y

86,250

7.88%

6,792

Class Z

21,729

7.00%

1,521

37,000

1.62%

599

Subtotal/weighted avg

659,667

$

7.48%

49,338

$

Preferred Partnership Units

82,515

8.10%

6,680

Total preferred securities

742,182

$

7.55%

56,018

$

Preferred Securities Outstanding

Series A Community Reinvestment Act

Currently

available for

redemption |

12

Balance Sheet Targets

Targeting lower leverage

Clear path to achieve targets by year-end 2015

(1)

Aimco’s leverage will continue to be comprised of long-term, fixed rate,

amortizing property debt and perpetual preferred securities; however, the amount of property debt and the amount of perpetual preferred

securities may or may not vary from today's proportions, dependent upon future

factors such as the availability and pricing of capital. (2)

Based

on

midpoint

of

Aimco

2012

NOI

growth

guidance

and

Green

Street

Advisors’

2013

-

2015

NOI

growth

estimates

published

in

its

March

6,

2012

“Residential

Sector

Update”.

Redemption of high-cost preferred securities could improve Debt + Preferred /

EBITDA by ~1.0x

Y2011

Y2012

Annualized

4Q EBITDA

Long-Term

Targets

EBITDA/Interest

2.18:1

2.50:1

2.75:1

EBITDA/Interest + Preferred

1.78:1

2.00:1

2.50:1

Debt/EBITDA

8.7x

7.5x

See Note (1)

Debt + Preferred/EBITDA

10.0x

8.7x

< 7.0x

Balance Sheet Metrics

2012 Guidance

8.7x

2012 - 2015 Amortization of property debt

< 0.4 >

2012 - 2015 Property NOI growth

(2)

< 0.9 >

2012 - 2015 Redevelopment earn-in

< 0.3 >

Potential annualized 4Q 2015 result

7.1x

Debt + Preferred / EBITDA

Target: < 7.0x |

13

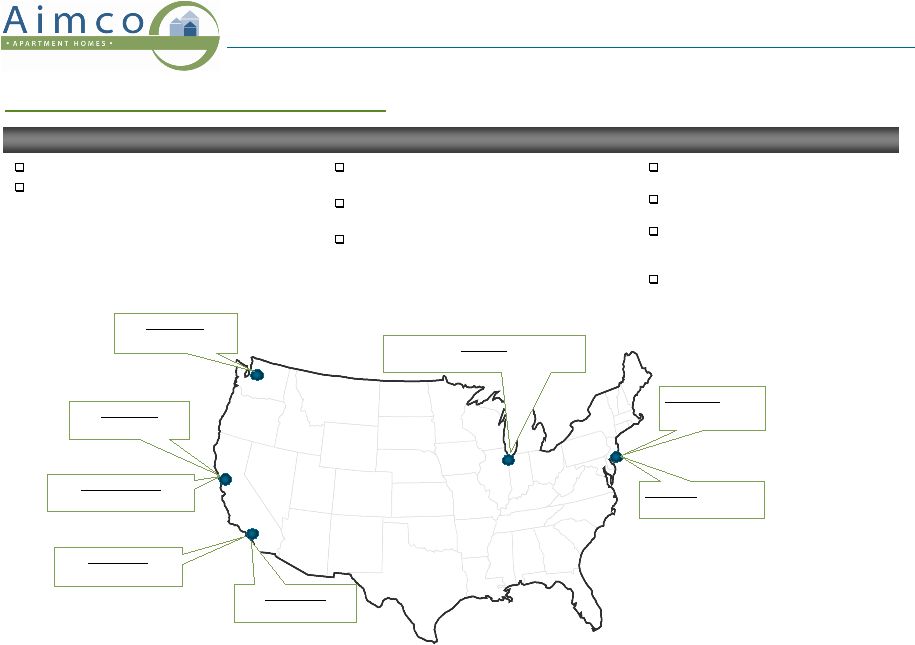

Business Strategy

Simple business: own and operate apartments, redevelop some

Business strategy:

Own and operate B+ apartments in desirable markets serving customers with high

and rising incomes

Redevelop properties where returns are > 150 basis points higher

than acquisitions

Eliminate non-core activities, simplify structure and reduce costs:

IN PROCESS

COMPLETED

Reduce number of partnerships

Reduce investment in Affordable

properties

Exit third-party property management

Exit third-party asset management

Exit tax credit redevelopment |

14

2012 Plan: Business

What We Expect

How We Plan to Get There

Year-to-Date Progress

Reduce number of partnerships

Sale of third-party asset management business;

~$0.01 per share of 2011 and 2012 FFO

Eliminate 7 public partnerships that own

13 properties, saving annual

administration costs of ~$1M

Eliminate 4 private partnerships that own

6 properties

Earn-in of technology initiatives, scale

reductions and efficiency gains

Public partnership mergers complete

Private partnership tenders and

mergers progressing as expected

Earn-in of prior year initiatives is as

expected

Entered into agreement to sell asset

managed portfolio (NAPICO) consisting

of ~12,500 units; closing expected later

this year

Simplification plans are on-track

Amount

%

$

Asset Management and Tax Credit Activities

Non-Recurring Revenues

$6M

-30%

-

$ 2.6M

Non-Recurring Expenses

$3M

Flat

Flat

Offsite Costs

Property Management Expenses

$35M

-15%

-

$ 6.5M

General and Administrative Expenses

$47M

-6%

-

$ 2.9M

$8M

-23%

-

$ 2.5M

$90M

-12%

-

$11.8M

2012 Guidance

Investment Management Expenses,

including non-recurring expenses

Total Offsite Costs

Change vs 2011 |

15

2012 Plan: Earnings & Dividend

Increasing earnings,

higher dividends

FFO

$1.72 -

$1.82

AFFO

$1.17 -

$1.29

Dividend

$0.72, ~ 60% AFFO payout

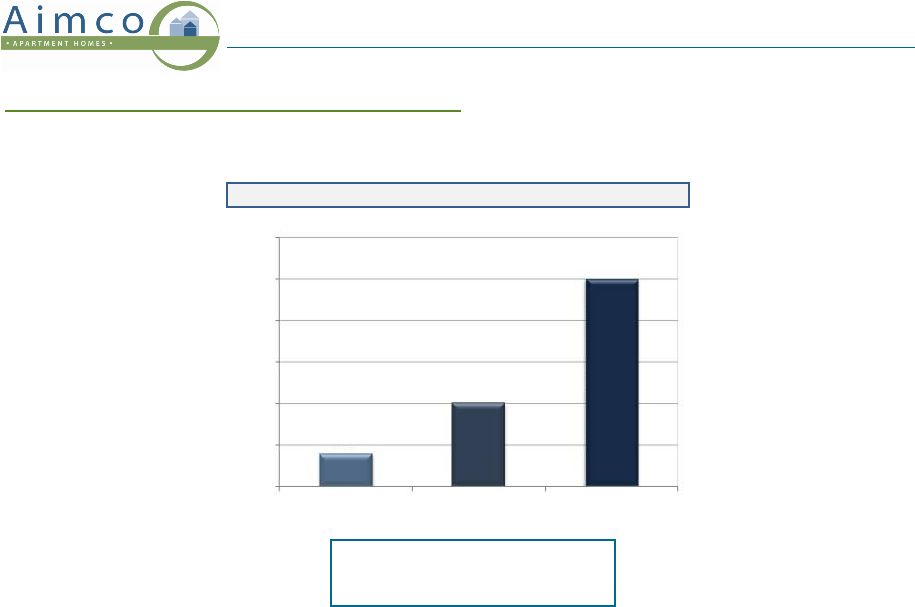

2012 Guidance

8%

20%

50%

0%

10%

20%

30%

40%

50%

60%

FFO

AFFO

Dividend |

16

Forward-Looking Statements and Other Information

This presentation contains forward-looking statements within the meaning of the

federal securities laws, including statements regarding projected results

and specifically: projected 2012 operating results, asset sales and

redevelopment investment; projected returns on redevelopment projects

started during 2012; the impact of acquisition, disposition and other

investment activities on portfolio metrics; and projected 2012 leverage ratios.

These forward- looking statements reflect management’s judgment as

of this date, and Aimco assumes no obligation to revise or update them to

reflect future events or circumstances. These forward- looking statements

include certain risks and uncertainties. Readers should carefully review

Aimco’s financial statements and notes thereto, as well as the risk factors

described in Aimco’s Annual Report on Form 10-K for the year ended

December 31, 2011, and the other documents Aimco files from time to time

with the Securities and Exchange Commission. This presentation

does not constitute an offer of securities for sale. |