Attached files

| file | filename |

|---|---|

| 8-K - 8-K_03/20/2012 SIDOTI WILLIAMS PRESENTATION - NORTHWESTERN CORP | ek_031912.htm |

Sidoti & Company - 16th Annual Investor Forum

New York, NY March 20, 2012

Financial Update

New York, NY March 20, 2012

Financial Update

2

Who we are

Financial update

Investment opportunity outlook

Appendix

- Financial statements

- Regulatory update

Financial update

Investment opportunity outlook

Appendix

- Financial statements

- Regulatory update

Outline

3

Forward looking statements

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

3

4

Who we are

ð Our Vision: Enriching lives through a safe, sustainable

energy future

energy future

ð Our Mission: Working together to deliver safe, reliable

and innovative energy solutions

and innovative energy solutions

ð Our Values:

Safety

Excellence

Respect

Value

Integrity

Community

Environment

5

Geographically positioned for success

ð Our service territory covers some of the

best wind regimes in the nation

best wind regimes in the nation

ð We have the opportunity to provide

transmission services into two different

markets (West and Midwest)

transmission services into two different

markets (West and Midwest)

Great wind profile

Low unemployment rates

ð A fully-regulated utility located in states

with relatively stable economies with

opportunity for system investment and

grid expansion

with relatively stable economies with

opportunity for system investment and

grid expansion

6

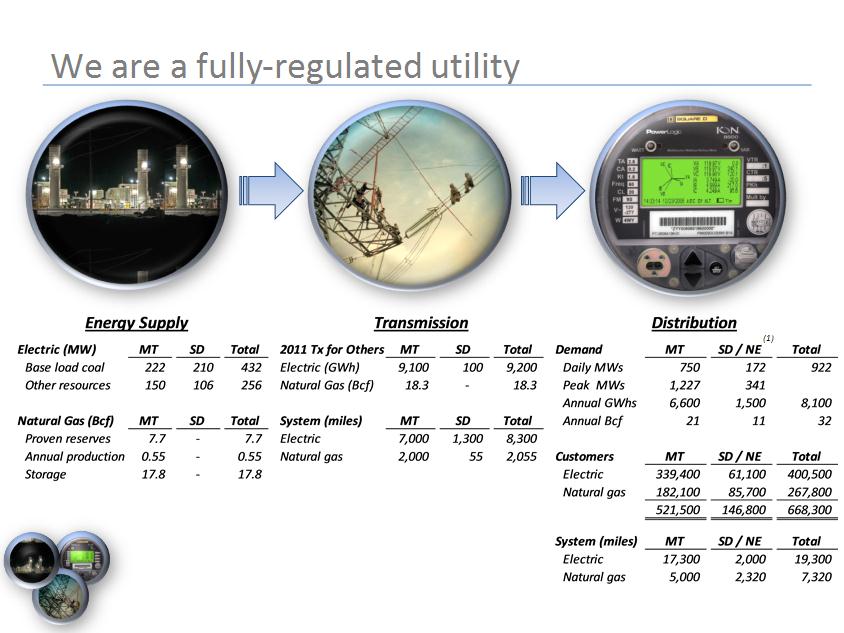

Note: Statistics above are as of 12/31/2011

(1) Nebraska is a natural gas only jurisdiction

7

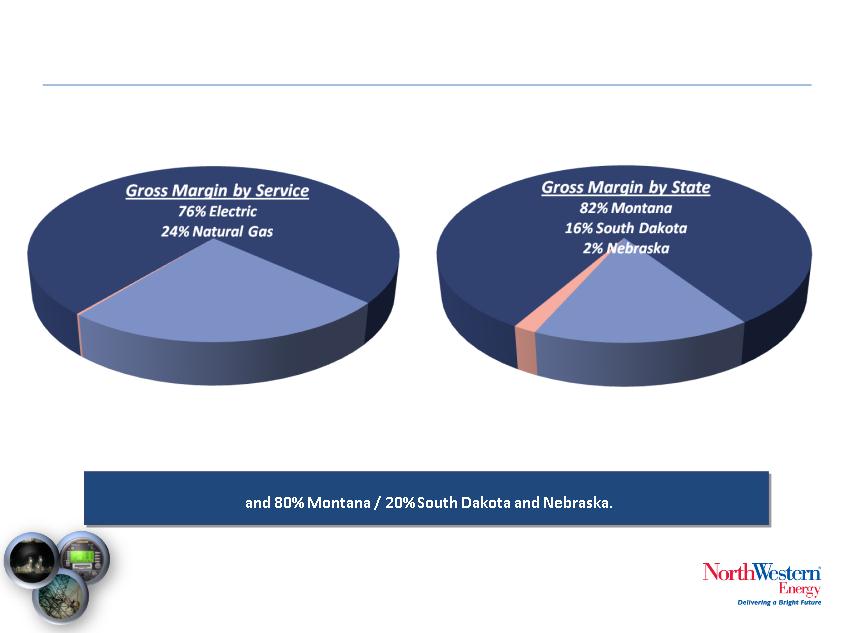

A multi-state electric & natural gas utility

The “80 / 20” rules of NorthWestern. We are approximately 80% electric / 20% natural gas

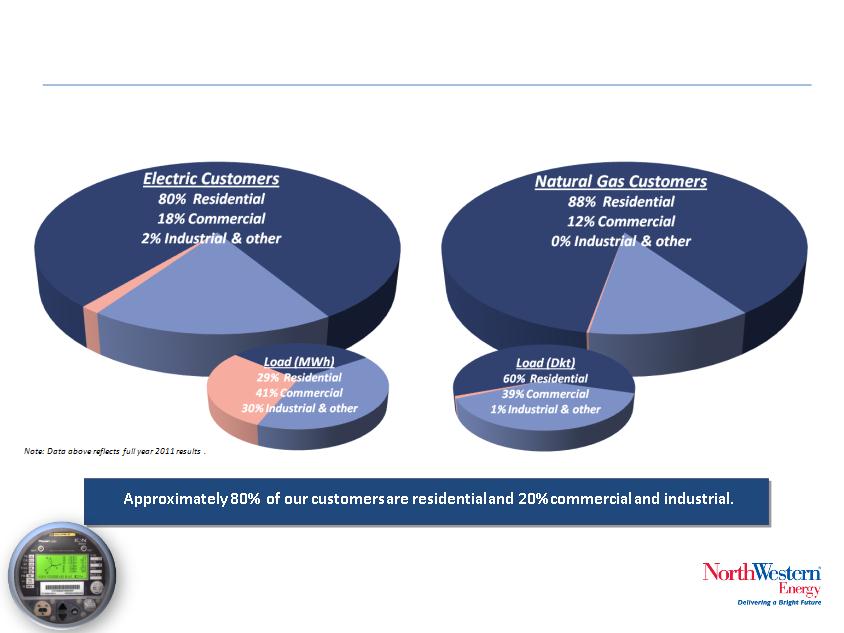

Note: Data above reflects full year 2011 results .

8

A diverse distribution customer base

9

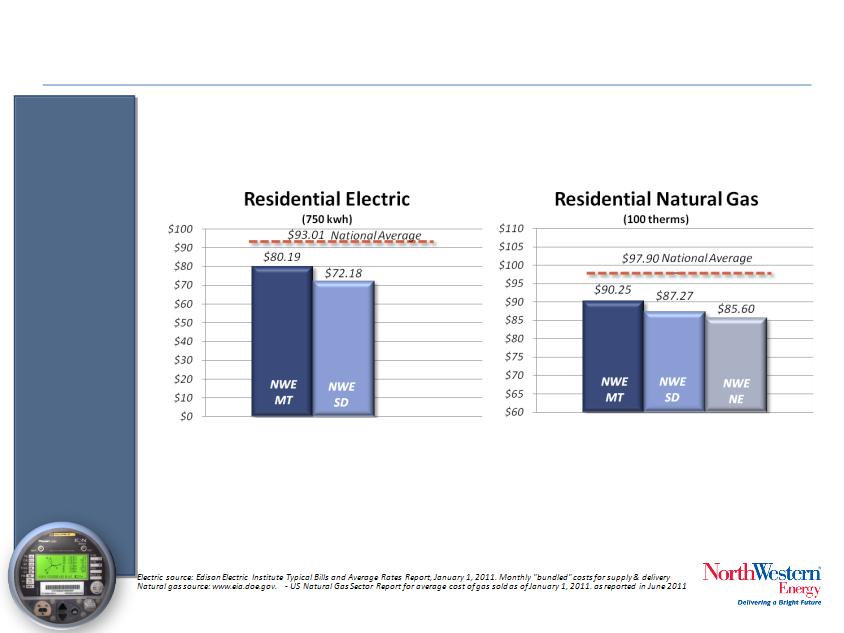

With competitive customer rates

Typical

Customer

bills

Customer

bills

10

Who we are

Financial update

Investment opportunity outlook

Appendix

- Financial statements

- Regulatory update

Financial update

Investment opportunity outlook

Appendix

- Financial statements

- Regulatory update

Outline

11

8.1% Cash From

Operations

Operations

6.5% Dividend Growth

Compounded Annual

Growth Rate (CAGR)

Growth Rate (CAGR)

12

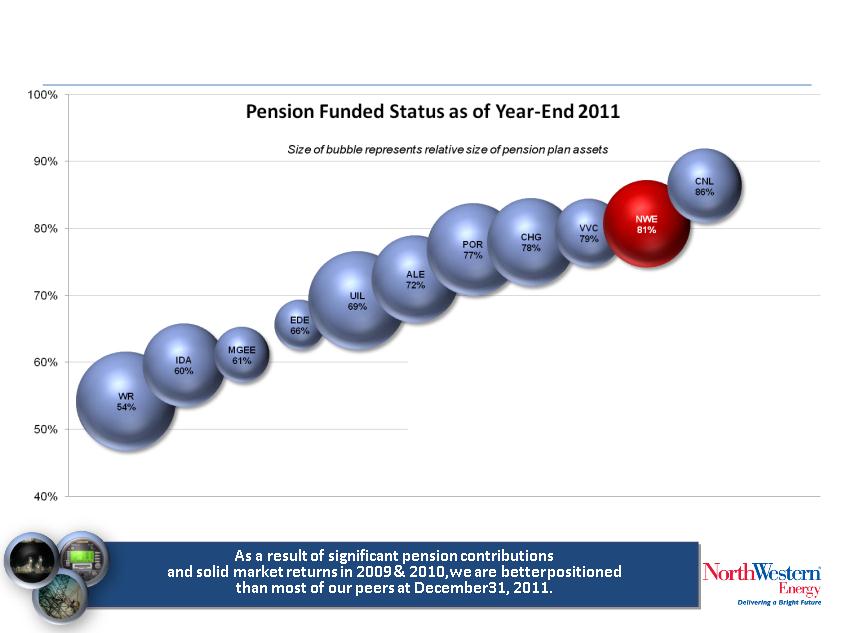

Solid pension funding

NorthWestern Energy’s Pension Assumptions

ð Target allocation 50% equity and 50% fixed income

ð Expected long-term rate of return of 7.00%

ð Discount rate of 4.40 - 4.55%

Six remaining identified peers had not yet filed year-end 2011 financial information as of 02/27/12 and are not included above.

These companies include AVA, BKH, EE, GXP, PNM, and UNS.

13

A security rating is not a recommendation to buy, sell or hold securities. Such rating may be subject to revision or withdrawal

at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

14

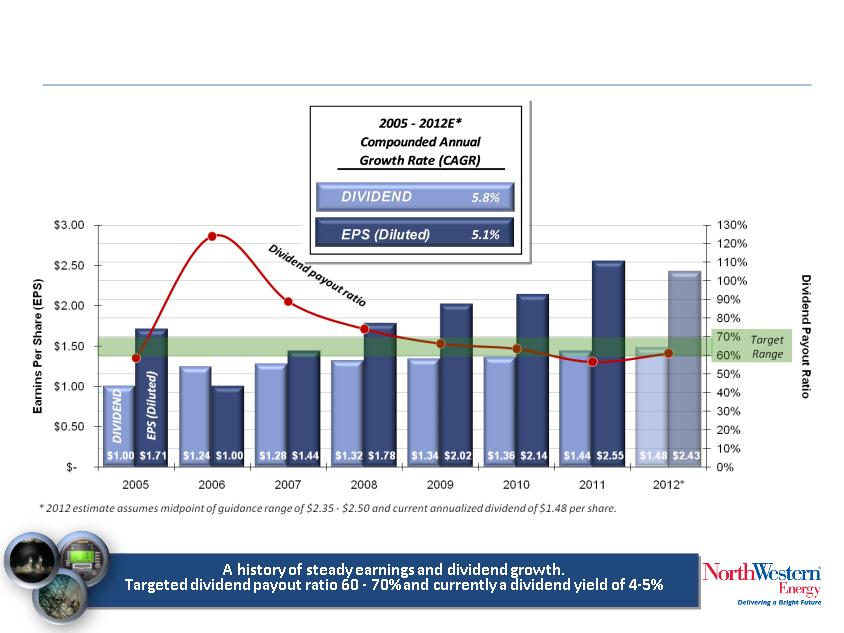

A history of earnings and dividend growth

15

Reaffirming 2012 earning guidance

Reaffirming 2012 guidance range of $2.35-$2.50 based upon, but not limited to, the following

major assumptions and expectations:

major assumptions and expectations:

• A consolidated income tax rate of approximately 18% - 20% of pre-tax income;

•No significant scheduled, or unscheduled, maintenance at Colstrip Unit 4, Neal or Big Stone Plants;

•No expected increase in insurance reserves or insurance recoveries in 2012;

16

Investment opportunity outlook

ð Energy Supply

– Big Stone/Neal pollution control

– South Dakota natural gas peaking generation

– Montana Spion Kop Wind facility

– South Dakota Titan Wind facility buyout

– Other vertical integration opportunities in Montana

including gas reserves or base load generation

including gas reserves or base load generation

ð Transmission

– Network upgrades and large generation

interconnections

interconnections

– Colstrip 500kV upgrade

– Mountain States Transmission Intertie (MSTI)

– 230kV Renewable Collector System

– South Dakota transmission opportunities

ð Distribution

17

Montana base load opportunity

Our post PPL supply

opportunity is

approximately

200 GWh / month or

about 280 MWs of

capacity

opportunity is

approximately

200 GWh / month or

about 280 MWs of

capacity

18

Hard assets providing value

2005-07 valuation affected by pending and

ultimately terminated acquisition

ultimately terminated acquisition

19

Growing investment in our existing system

20

Great investment growth opportunities

21

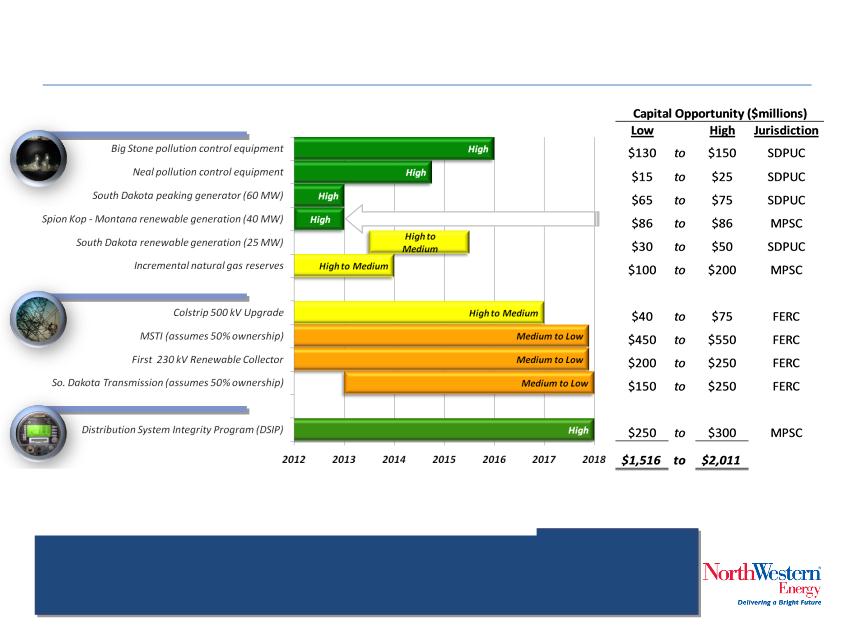

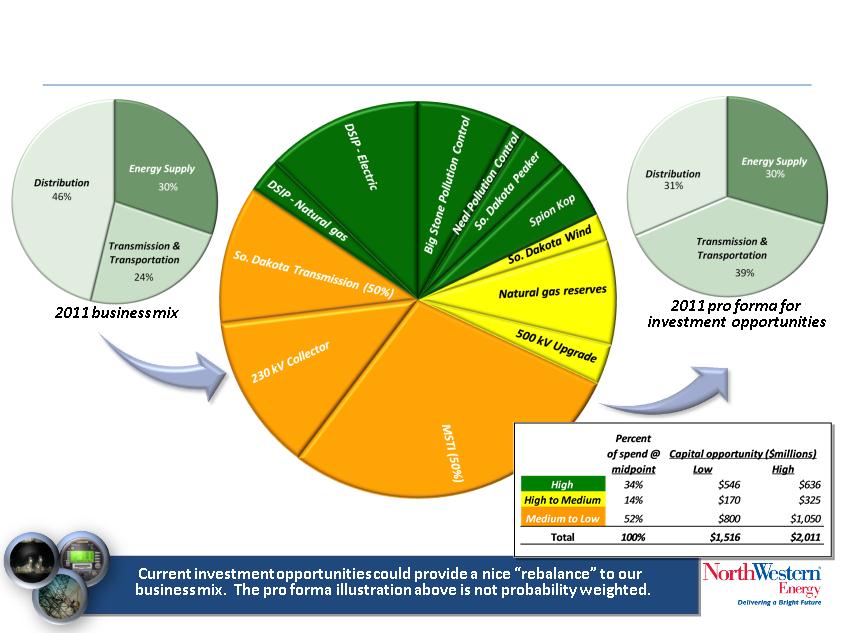

Investment project summary

Several opportunities exist to further increase and diversify earnings as compared to our

approximately $1.8 billion of rate base today. Additional Montana base load opportunities

are currently being evaluated and may be incorporated at the appropriate time.

approximately $1.8 billion of rate base today. Additional Montana base load opportunities

are currently being evaluated and may be incorporated at the appropriate time.

Note: Color / label indicate NorthWestern Energy's current probability of execution and timing of expenditures.

Adjustments to the project summary since last presented at EEI in November 2011 include:

- Spion Kop changed from Yellow to Green based upon MPSC pre-approval and timing delays in all 4 transmission projects

Changed to Green with MPSC pre-approval granted Feb ‘12

22

Another way to slice the pie

(at midpoint of range)

23

24

Who we are

Financial update

Investment opportunity outlook

Appendix

- Financial statements

- Regulatory update

Financial update

Investment opportunity outlook

Appendix

- Financial statements

- Regulatory update

Outline

25

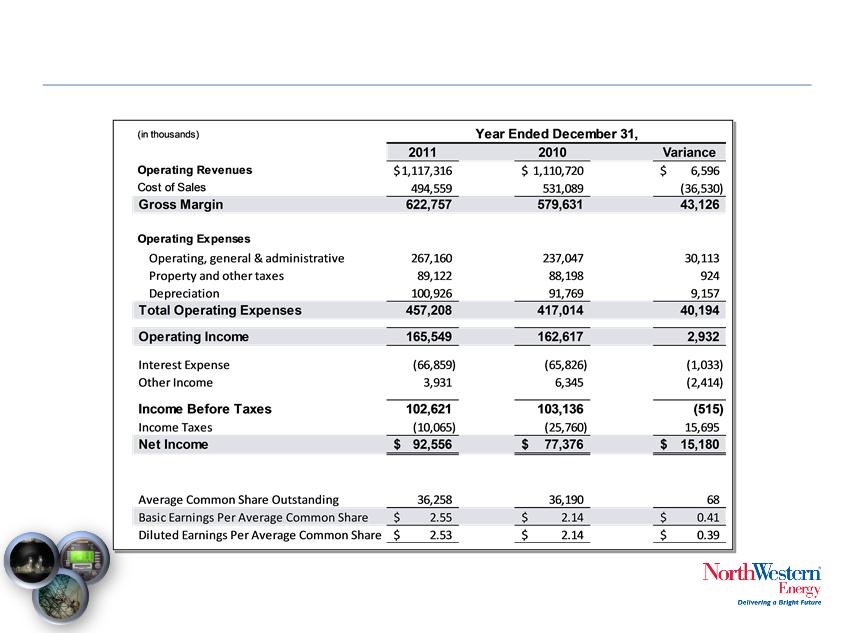

Consolidated statement of income

26

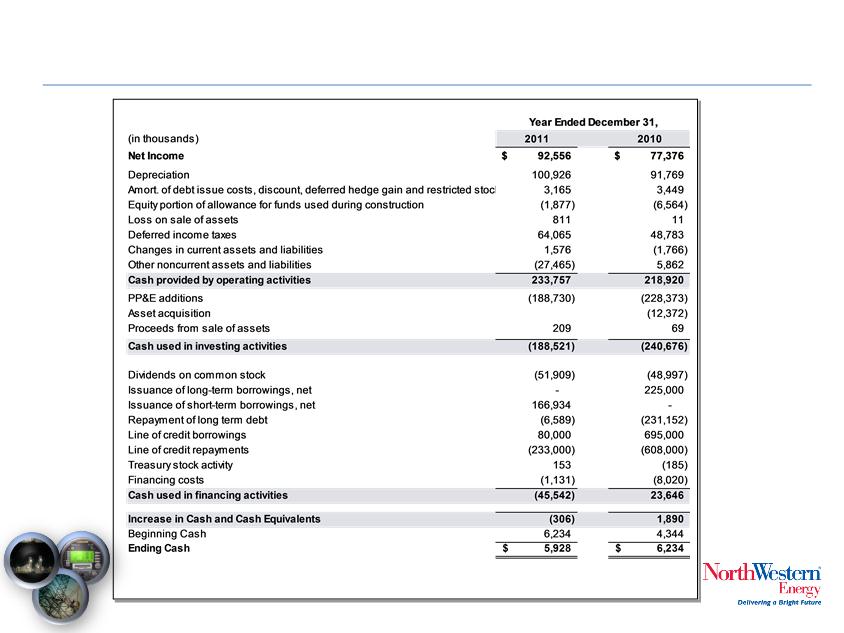

Consolidated statement of cash flows

27

Consolidated balance sheet

28

Earnings reconciliation

29

Other miscellaneous earnings items

30

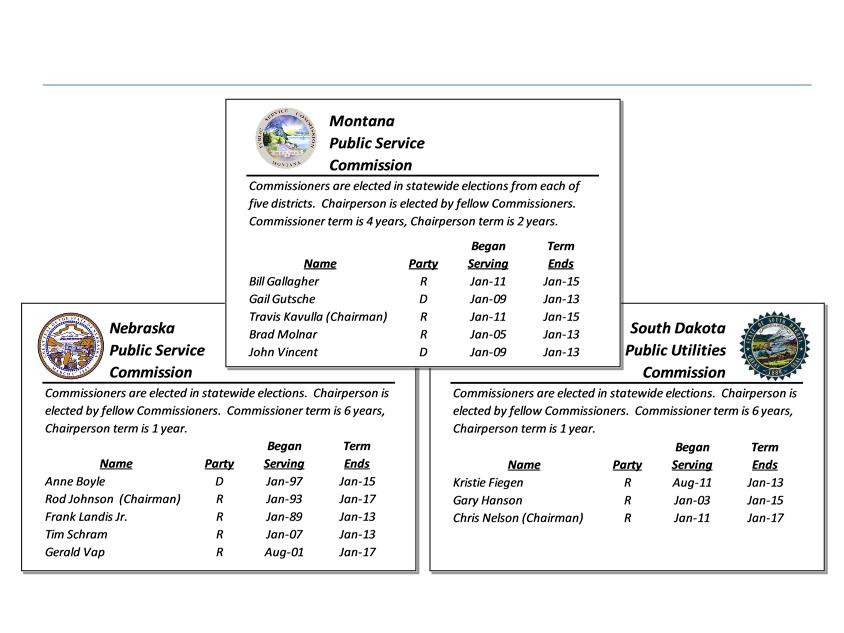

Our Commissioners

31

Environmental compliance