Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - INTERMOLECULAR INC | a2207823zex-23_1.htm |

| EX-10.8 - EX-10.8 - INTERMOLECULAR INC | a2207823zex-10_8.htm |

| EX-31.2 - EX-31.2 - INTERMOLECULAR INC | a2207823zex-31_2.htm |

| EX-31.1 - EX-31.1 - INTERMOLECULAR INC | a2207823zex-31_1.htm |

| EX-32.1 - EX-32.1 - INTERMOLECULAR INC | a2207823zex-32_1.htm |

| EX-32.2 - EX-32.2 - INTERMOLECULAR INC | a2207823zex-32_2.htm |

| EX-3.1 - EX-3.1 - INTERMOLECULAR INC | a2207823zex-3_1.htm |

| EX-3.2 - EX-3.2 - INTERMOLECULAR INC | a2207823zex-3_2.htm |

| EX-4.5 - EX-4.5 - INTERMOLECULAR INC | a2207823zex-4_5.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-35348

Intermolecular, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

20-1616267 (I.R.S. Employer Identification No.) |

|

3011 N. First Street San Jose, California (Address of Principal Executive Offices) |

95134 (Zip Code) |

(408) 582-5700

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.001 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of December 31, 2011, the aggregate market value of the registrant's common stock, par value $0.001, held by non-affiliates of the registrant was approximately $150 million, based upon the closing sale price of such shares on the NASDAQ Global Select Market on December 30, 2011, which was the last trading day of 2011. The registrant has provided this information as of December 31, 2011 because, as of June 30, 2011, the last business day of the registrant's most recently completed second fiscal quarter, the registrant's common stock was not listed on any exchange or over-the-counter market. For purposes of this disclosure, shares of common stock held by executive officers and directors of the registrant and by each person who owned 10% or more of the outstanding common stock on December 31, 2011 have been excluded because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 15, 2012, the number of outstanding shares of the registrant's common stock, par value $0.001 per share, was 42,277,706.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant's 2012 Annual Meeting of Stockholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this Report. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant's fiscal year ended December 31, 2011. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

INTERMOLECULAR, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The following discussion and analysis should be read in conjunction with our audited consolidated financial statements and the related notes that appear elsewhere in this Annual Report on Form 10-K. This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, particularly in Part I, Item 1: "Business," Part I, Item 1A: "Risk Factors" and Part 2, Item 7: "Management's Discussion and Analysis of Financial Condition and Results of Operations." These statements are often identified by the use of words such as "may," "will," "expect," "believe," "anticipate," "intend," "could," "should," "estimate," or "continue," and similar expressions or variations. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to: any projections of financial information; any statements about historical results that may suggest trends for our business; any statements of the plans, strategies, and objectives of management for future operations; any statements of expectation or belief regarding future events, technology developments, our customers and collaborative development programs (CDPs), expenses, liquidity, cash flow, growth rates or enforceability of our intellectual property rights and related litigation expenses; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Accordingly, we caution you not to place undue reliance on these statements. For Intermolecular, particular uncertainties that could affect future results include: our dependence on a limited number of customers; our ability to manage our growth, including an increasing number of employees, customers and CDPs; the length of our sales and development cycles, and our ability to generate material revenue after we have devoted significant resources to developing a project; our ability to evolve existing products, anticipate trends in technology development and introduce new developments in a timely manner in the rapidly changing semiconductor and clean-energy industries; our customers' ability to manufacture, market and sell products that incorporate technology developed through the CDPs; fluctuations in the number and price of products sold by our customers that incorporate technology developed through the CDPs, and the shortening life cycles of those products, in each case impacting our licensing and royalty revenue; our ability to scale our development efforts, our ability to secure new CDPs with new or existing customers and the timing of those CDPs; the degree to which existing CDPs are completed or expanded; our ability to maintain existing commercial terms or enter into new licensing arrangements with our customers once they begin to sell their end products; our ability to make the substantial research and development investments required to stay competitive in our business; our ability to develop our high productivity combinatorial (HPC) platform and expertise to support our future growth plans in adjacent vertical markets such as clean-energy markets; any potential involvement in intellectual property litigation; any potential payments to our customers resulting from our intellectual property indemnification policies and obligations; our reliance on our customers to deliver timely and accurate information to accurately report our financial results from licensing and royalty revenue; our potential need for additional capital to finance our business; any delay in shipments caused by shortages of components incorporated in our customers' products, design errors or other manufacturing problems associated with our customers' products; the highly cyclical nature of and price volatility in the semiconductor industry; the emerging and uncertain nature of the clean-energy industry; potential warranty claims, product recalls and product liability for our HPC tools and for our customers' products that incorporate technology developed through our CDPs; global or regional economic, political and social conditions; and business interruptions such as earthquakes and other natural disasters. For a discussion of some of the factors that could cause actual results to differ materially from our forward-looking statements, see the discussion on risk factors that appear in Part I, Item 1A: "Risk Factors" of this Annual Report on Form 10-K and other risks and uncertainties detailed in this and our other reports and filings with the Securities and Exchange Commission, or SEC. The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

3

Overview

We have pioneered a proprietary approach to accelerate research and development, innovation and time-to-market for the semiconductor and clean-energy industries. Through paid collaborative development programs (CDPs) with our customers, we develop proprietary technology and intellectual property (IP) for our customers focused on advanced materials, processes, integration and device architectures. This technology enables our customers to bring optimized, high-volume manufacturing-ready integrated devices to market faster and with less risk than traditional approaches to research and development (R&D). We provide our customers with proprietary technology through various fee arrangements and grant them rights to associated IP, primarily through royalty-bearing licenses. Our proprietary approach is broadly applicable to high-volume integrated device markets, which include the markets for semiconductors, flat glass coatings and glass-based devices, solar cells, light-emitting diodes (LEDs), flat-panel displays, advanced batteries and other energy-efficient technologies.

Our approach consists of our proprietary high productivity combinatorial (HPC) platform, coupled with our multi-disciplinary team. Our HPC platform consists of our Tempus HPC processing tools, automated characterization and informatics and analysis software. Our platform is purpose-built for R&D using combinatorial process systems. Combinatorial processing is a methodology for discovery and development that employs parallel and other high-throughput experimentation, which allows R&D experimentation to be performed at speeds up to 100 times faster than traditional methods. Our processing tools allow us to perform up to 192 experiments on a single substrate as compared to traditional methods, which typically allow only a single experiment at a time. Our automated characterization systems and proprietary informatics and analytics match the high throughput of our processing tools. Our multi-disciplinary team of approximately 147 scientists and engineers as of December 31, 2011, of whom approximately 60 have Ph.D.s, designs customized workflows for our customers' specific applications using the HPC platform and applies the workflows in collaboration with our customers. The combination of the HPC platform and our team generates significant competitive advantages for our customers. By accelerating innovation and enabling our customers to commercialize higher-performance and lower-cost integrated devices faster than through traditional methods of R&D, we provide them an opportunity to gain market share and generate higher margins, including through a first-mover advantage.

Our business model aligns our interests with those of our customers as we collaborate to develop differentiated proprietary technology and IP for high-volume integrated devices through collaborative development programs. Customers pay us development services fees during multi-year CDPs, which typically initially last for two years and may range from one to three years. Our customers receive rights to the technology and IP developed during the CDPs, and once our customers commercialize products using this technology and IP, they pay us primarily through royalties. In certain cases, we sell HPC processing tools to our customers who pay a recurring license to operate those tools with our combinatorial processing capabilities. By aligning our interests with those of our customers, we facilitate collaboration and open communication that is more likely to result in innovative, differentiated products and future CDPs with those customers.

We currently target large, high-volume semiconductor and high-growth emerging clean-energy markets, including DRAM, flash memory, complex logic, flat glass coatings and glass-based devices, solar cells, LEDs and other energy-efficient technologies. Within these broad markets, we target customers that have track records of technological innovation, deploy significant resources and are pursuing technical advancements that are critical to their success and strategy. Our customers include ATMI, Elpida Memory, GLOBALFOUNDRIES, Guardian Industries, SanDisk, Taiwan Semiconductor Manufacturing Company (TSMC) and Toshiba. Each of ATMI, Elpida, and GLOBALFOUNDRIES

4

accounted for 10% or more of our revenue for the year ended December 31, 2011, and each of ATMI and Elpida accounted for 10% or more of our revenue for the year ended December 31, 2010. ATMI and Elpida have commenced shipping products incorporating technology developed through our CDPs and pay us licensing and royalty fees. To date, we have received the majority of our revenue from customers in DRAM, flash memory, complex logic and energy-efficient applications in flat glass, and have not yet received a material amount of revenue from customers in solar cells, LEDs and other energy-efficient technologies.

Industry Background

High-volume integrated devices serve large and growing markets, including the markets for semiconductors, flat glass, solar cells, LEDs, flat-panel displays, advanced batteries and other energy-efficient technologies. Success in these markets requires rapid and cost-effective product innovation, fast time-to-market, competitive pricing, production scalability and the ability to achieve specific requirements. These devices are typically manufactured using thin-film deposition of advanced materials through customized processes that create a specific device architecture. It is increasingly necessary to evaluate elements in the periodic table that have previously not been used in high-volume manufacturing to deliver performance and cost improvements, and to develop advanced device structures capable of addressing particular application requirements. These device structures must then be scaled and integrated into cost-effective manufacturing processes to serve high-volume integrated device markets. Traditional R&D approaches are increasingly challenged by the market need to accelerate innovation and time-to-market for the semiconductor and clean-energy industries.

Semiconductor Industry

Since the inception of the semiconductor industry more than 50 years ago, innovation has been continually driven by consumer demands for smaller, higher-performance, more power-efficient and less expensive electronic products. Recently, this innovation has been driven by broad end-market demand for smartphones, PCs, tablet computers, cloud computing, high-definition media, and advanced aerospace and industrial applications. The semiconductor industry is characterized by intense competition, with many semiconductor companies seeking to gain market advantage over competitors by expanding their broad product portfolios, using their deep design and/or process capabilities and leveraging their IP libraries. Increasingly, these companies are relying on combinations of advanced materials, processes, integration and device architectures to compete and differentiate their products.

Historically, the pace of semiconductor innovation has been enabled by device scaling, in which, according to Moore's Law, the number of transistors in a design generally doubles every two years. This increasing density has reduced costs and improved capabilities over time, thereby driving market demand and growth. However, semiconductors are approaching the limitations of device scaling with the current set of materials and manufacturing processes. Consequently, semiconductor manufacturers are turning to advanced materials, processes, integration and new device architectures to enable continued device scaling and to deliver improved product performance and cost competitiveness. The reliance on advanced materials, processes, integration and new device architectures has in turn made advancements in semiconductor technology increasingly complex and expensive. Each new process node requires experimentation with more elements in the periodic table and more material combinations to deliver the desired physical and electrical characteristics for device performance and manufacturability. For example, the broad adoption of copper interconnects enabled the industry to continue device scaling in the microprocessor field, but as this advancement required changes not only in materials, but also in processes, integration and device architectures to achieve high-volume, cost-effective manufacturing, the transition was challenging and slow.

Semiconductor manufacturing companies have used device scaling to shrink transistors and develop new process technology nodes to address customer requirements for lower cost and higher performance

5

integrated circuits (ICs). However, advanced R&D and new fabrication facility costs have increased significantly over time, especially as the use of advanced materials and processes have become increasingly important to the development and introduction of the latest generation process technology nodes. The greater expertise and higher costs required to explore advanced materials, processes, integration and new device architectures have led to increased specialization among materials, capital equipment, semiconductor manufacturing and IC design companies. However, this specialization has left gaps in the industry knowledge base with respect to the complexities of the interaction between materials science, process technology, device integration and the scale-up to high-volume IC production.

To succeed in the market and deliver an appropriate financial return, semiconductor companies are under intense pressure to rapidly develop optimized ICs and efficiently scale them to cost-effective production. Using advanced semiconductor materials, processes, integration and new device architectures requires intensive, time-consuming experimentation because advanced materials are not well understood and accurate, robust models do not exist. As a result, semiconductor companies must increasingly rely on time and resource-intensive, empirical R&D to develop innovative solutions and enable manufacturability at lower costs.

Clean-Energy Industry

The emerging clean-energy markets also depend on improvements in advanced materials, processes, integration and new device architectures. Clean-energy markets, which include the markets for flat glass coatings and glass-based devices, solar cells, LEDs, advanced batteries and other energy-efficient technologies, remain in early stages of technological evolution. Companies in the fast-evolving clean-energy markets are in the early stages of understanding materials, processes, integration, device architectures and manufacturing methodologies. As a result, those companies that successfully develop relevant, scalable proprietary materials and device technologies will likely have a competitive advantage over their peers in both time-to-market and price.

Decreasing prices, government policies and social awareness are driving growth in the clean-energy markets and certain sectors have entered high-volume production. Reduced prices and improved performance relative to traditional alternatives generally catalyze widespread adoption of new technologies. For example, LEDs, for the general illumination market, are currently more expensive to purchase than incandescent and fluorescent lighting. To increase penetration of the general lighting market, price reductions and improvements in performance, such as brightness, color and form factor will be critical. New advanced materials, improved process technologies and new device architectures will enable larger wafer sizes, less costly substrate materials, higher-volume production and improved yields for lower-cost and higher-performing LEDs.

Because of the early stages of technology development in the clean-energy markets, there are significant opportunities for cost savings and potential competitive advantage. Market participants who resolve the price-performance challenges ahead of their competitors through advanced materials, processes, integration and new device architectures may greatly accelerate market adoption and establish themselves as market leaders. These opportunities amplify the importance of empirical R&D to develop low-cost, high-performance solutions in these early-stage markets.

Current Challenges with Innovation in High-Volume Integrated Device Markets

Advanced materials and device integration are driving forces behind technology advancement in the high-volume integrated device markets. In addition, innovation in these markets and control of the resulting IP are critical to enable competitive differentiation. However, the existing approach used to explore new materials, processes, integration and device architectures is complex, time-consuming and requires empirical R&D.

6

Traditionally, device manufacturers have conducted R&D using expensive high-volume manufacturing tools that are not specifically built for that purpose. Production tools typically can only run one process at a time, which leads to limited cycles of learning. Furthermore, using tools deployed in a production environment for R&D requires reserving tool time on high-volume manufacturing lines to evaluate each experiment, resulting in substantial opportunity costs for existing product manufacturing. High-volume manufacturing environments are also not conducive to R&D because these environments require stability to minimize risk and to reduce contamination that the research-based introduction of new materials, tools or processes may cause. Additionally, high-volume manufacturing is conducted by operators focused on repetitive, mistake-free processing, not on many cycles of trial and error. In addition to some of the challenges above, certain clean-energy device manufacturers use laboratory-scale tools for R&D, which do not address the scale-up requirements critical to high-volume manufacturing. These factors combine to increase development risks due to long learning cycles, limited data sets, narrow exploration capabilities and slow time-to-market.

Successful R&D programs require flexibility around experimentation and the introduction of new materials, chemicals, processes and tools to derive the most efficient high-volume integrated device solutions. Furthermore, we believe they are best administered by scientists and engineers with experience across various disciplines of equipment, materials, device architectures and processes to conduct successful experiments and derive optimized solutions.

The following existing approaches have been used to complement internal R&D, but each has specific limitations:

- •

- Equipment

suppliers. Equipment suppliers provide solutions that are not tailored to specific customer applications. Additionally, they provide

high-volume manufacturing solutions that are not purpose-built for researching the interaction of advanced materials, processes, integration and device architectures.

- •

- Industry

consortia. Industry consortia provide solutions that offer no competitive differentiation because the customer must share the IP with

all consortium participants, including competitors.

- •

- Alliance

partnerships. Alliance partnerships impose limitations on the overall outcome, as they are typically structured to find generic

solutions rather than the solutions for a particular application. Additionally, these generic solutions are offered to a small set of competitors and are not customer-specific or application-specific.

- •

- University

research. University research provides theoretical solutions requiring additional work and time to commercialize, since this work

typically does not address manufacturing or commercialization challenges.

- •

- Third-party IP licensing. Third-party IP licensing is primarily used for defensive purposes or market access. Those who cross-license IP do not receive a solution that is specific to the customer, manufacturing process or application, and the received solution is not differentiated from what their competitors receive through the same license.

7

Substantially improved methodologies are required to generate the learning cycles necessary to accelerate innovation, improve product development and ensure manufacturing scalability of high-volume integrated devices. Further, companies require new ways to develop proprietary technology and obtain IP rights to support competitive advantage for their new products.

Our Solution

We have pioneered a proprietary approach to accelerate research and development, innovation and time-to-market for the semiconductor and clean-energy industries. Using our approach, we develop technology and IP rights focused on advanced materials, processes, integration and device architectures in collaboration with our customers. This technology enables our customers to bring optimized, high-volume manufacturing-ready integrated devices to market faster and with less risk than traditional approaches to R&D. Our proprietary HPC platform consists of our Tempus HPC processing tools, automated characterization and informatics and analysis software. Our HPC platform increases R&D productivity because it is purpose-built for R&D and utilizes advanced combinatorial processing systems, which allow for experiments to be performed at speeds up to 100 times faster than traditional methods. We provide our customers with proprietary technology through various fee arrangements and grant them rights to IP developed during the collaboration, primarily through royalty-bearing licenses. Our multi-disciplinary team of approximately 147 scientists and engineers as of December 31, 2011, of whom approximately 60 have Ph.D.s, designs customized workflows for our customers' specific applications using our HPC platform and applies the workflows in collaboration with our customers to develop proprietary technology for them.

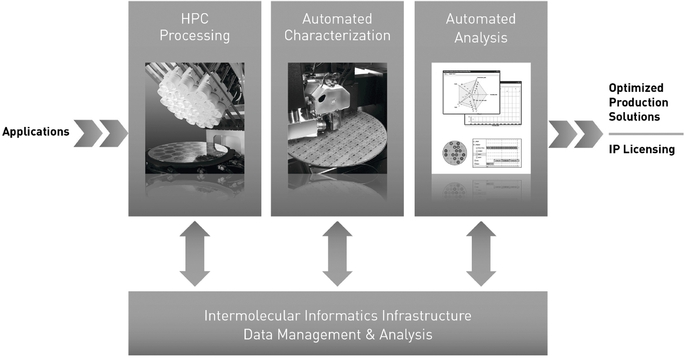

The key elements of our HPC platform include the following:

- •

- Tempus HPC

processing. We use our Tempus HPC processing tools to rapidly process different experiments consisting of various combinations of

materials, processing parameters, sequencing and device structures. We are able to perform up to 192 experiments on a single substrate, as compared to traditional methods, which typically allow only a

single experiment at a time.

- •

- Automated

characterization. We use automated characterization systems to characterize the substrates processed by our Tempus HPC processing tools,

thereby rapidly generating experimental data while matching our processing throughput.

- •

- Informatics and analysis software. We use our informatics and analysis software to automate experiment generation, characterization, data analysis and reporting, in each case while matching our processing throughput, and to create an aggregated and searchable database of information that includes the experimental results we generate.

8

The following graphic illustrates how these elements combine to form our HPC platform:

Benefits to Our Customers

Our business model aligns our interests with those of our customers as we collaborate to develop optimized, manufacturing-ready IP for high-volume integrated devices. We provide our customers with proprietary technology through various fee arrangements and grant them rights to IP developed during our CDPs, primarily through royalty-bearing licenses. Our differentiated platform solution and approach to collaborative engagements are designed to deliver the following significant benefits to our customers:

- •

- Accelerated time-to-market with better,

lower-cost products. Faster processing of experiments, throughput-matched characterization and real-time data

management and analysis allow additional learning cycles and broader exploration of materials and process solution combinations. In highly competitive markets, the resulting speed to market with

improved, lower-cost products enables our customers to gain market share and improve profitability.

- •

- Development of application and manufacturing-ready IP tailored to our

customers' specifications. When we engage in a CDP with our customers, we use our HPC platform and customized workflows to develop

IP-protected, proprietary technology that is tailored to our customers' applications and ready for high-volume manufacturing. We provide our customers rights to the IP for

their applications primarily through royalty-bearing licenses.

- •

- Increased R&D productivity and reduced technology risk. Using our combinatorial processes, we narrow the potential combinations of advanced materials, processes and device architecture solutions through a series of increasingly rigorous screening stages to guide the selection of solutions that meet device performance requirements and that are cost-efficient and ready for high-volume manufacturing. The combinatorial process of screening and evaluating these solutions and their manufacturability mitigates our customers' technology risk earlier in the development cycle.

9

Strengths

We have pioneered, developed and patented a proprietary platform and methodology for accelerating R&D in the semiconductor and clean-energy markets. Our strengths include:

- •

- Proprietary and patented HPC

platform. Our HPC platform employs proprietary and patented combinatorial methods to parallel process up to 192 experiments on a single

substrate as compared to traditional methods, which typically allow only a single experiment at a time. As of December 31, 2011, we owned or had exclusive rights within our field of use to 730

U.S. patents and patent applications (some of which also have foreign counterparts), which provide us with a competitive advantage in the use of combinatorial methods and systems in our target

markets.

- •

- Flexible technology platform configurable for and extendable to

multiple markets. Our HPC platform can be configured for many applications and extended to address the broad set of integrated device

markets. Because of the similarities in materials deposition, manufacturing processes and device integration complexities across markets, our platform allows us to create customized workflows and

support innovation across multiple markets.

- •

- Seasoned engineering team with multi-disciplinary

expertise. We have assembled a multi-disciplinary team of approximately147 scientists and engineers, of whom approximately 60 have

Ph.D.s, with expertise across various disciplines, fields and technologies, including engineering, materials science, process development and integration, equipment, device process technologies and

device integration.

- •

- Collaborative customer engagements leading to IP generation and

strategic alignment. Our business model aligns our financial interests with those of our customers, to whom we grant rights to

proprietary technology and IP developed during our collaborations. Customers pay us development service and HPC platform subscription fees during multi-year CDPs. As they commercialize

products incorporating technology developed through the CDPs, our customers then pay licensing fees and/or royalties, including fixed fees and fees based on percentages of revenue and/or fee per

product. In certain cases, we sell HPC processing tools to our customers and receive recurring license fees. This alignment of interests facilitates collaboration and open communication that improves

development efficiencies and is more likely to result in innovative, differentiated products, which in turn creates a cycle of success that leads to future CDPs with those customers.

- •

- Attractive business model with contracted CDP revenue and recurring high-margin royalties. Our multi-year CDPs generate predictable CDP and services revenue from our customers. Our CDPs also establish the terms upon which we will receive licensing and royalty revenue from the sale of our customers' products that incorporate technology developed through our CDPs. These royalty arrangements create a business model with attractive margins and a high degree of near-term visibility. We expect to generate more revenue through royalty-based licenses as more of our customers commercialize and ramp production of products incorporating technology developed through the CDPs.

Our Strategy

Our mission is to drive our customers' success by transforming R&D and accelerating innovation in markets that derive competitive advantage from the interaction of materials science, processes, integration and device architecture. To accomplish this, we:

- •

- Target large, high-volume semiconductor markets. We target large, high-volume semiconductor markets, including DRAM, flash memory and complex logic. Success in these markets requires semiconductor companies to consistently remain at the leading edge of cost and performance,

10

- •

- Target large, high-growth, emerging clean-energy

markets. We target large, high growth, emerging clean-energy markets, including the markets for flat glass coatings and glass-based

devices, thin film and crystalline solar cells, LEDs, advanced batteries and other energy-efficient technologies. We believe we can deliver significant improvements in cost, performance and

manufacturability in these markets with our HPC platform.

- •

- Engage with existing and potential market leaders in our target

markets. We enter into CDPs with companies that are well-positioned to lead their markets. We engage with customers that

have track records of technological innovation, deploy significant resources and are pursuing advancements that are critical to their success and strategy.

- •

- Create proprietary IP with our

customers. We develop differentiated, IP-protected technologies with our customers, and we grant them rights to these

technologies and IP, primarily through royalty-bearing licenses. We structure our customer engagements so that our business interests align with their market success.

- •

- Enhance our HPC platform and multi-disciplinary

team. We continue to develop, broaden and protect our processing, characterization, data analysis and workflow capabilities. To enhance

our existing platform, we will expand our existing multi-disciplinary team by continuing to recruit personnel with broad skill sets.

- •

- Explore and develop new technologies in high-volume integrated devices. We will continue to explore and internally develop new technologies and expertise to serve future customers in our targeted markets, including, in particular, clean energy. We will focus these efforts in markets which are in the early stages of development to speed innovation, capture value and facilitate success for customers.

which demands innovation around materials science, processes, integration and device architectures.

Our Platform

HPC Workflows

We begin the development and discovery process by working with our customers to define the specific requirements a new solution should have to meet the needs of a given application. Generally, these criteria are well beyond the performance attributes of currently available solution sets. We then apply the components of our HPC platform to develop and discover solution sets that match these criteria.

Once an experiment is processed, the data sets of each experiment are stored in a secure database and analyzed for desired properties. As with processing, our clean room labs include a broad array of characterization and metrology instruments and software to evaluate different properties under a wide variety of process conditions. These properties include physical, electrical, mechanical, thermal, chemical, and optical properties. In general, we are able to design, process and characterize tens to hundreds of experiments in a single day.

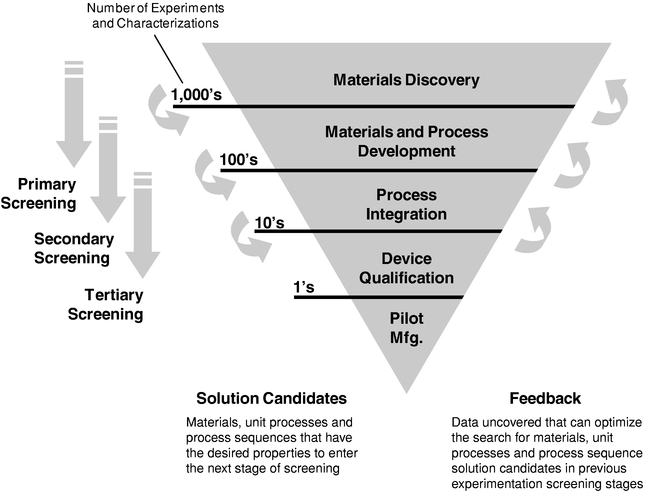

To reach the point of commercialization or transfer to our customers' manufacturing process qualification, a solution set must progress through an extensive series of screening stages. Below is an

11

illustration of the screening process of the HPC platform for use in evaluating materials, unit processes, and process sequences.

- •

- Primary Screening. Primary screening incorporates and

focuses on materials discovery. Materials are screened for certain properties to select possible candidates for a next level of screening. In the initial primary screening there may be thousands of

candidates that are subsequently reduced to hundreds of candidates.

- •

- Secondary Screening. Solution candidate materials from

primary screening are advanced to secondary screening processes that will examine materials and unit process development. In this secondary screening, processes and integration may be additionally

considered to narrow the candidates from hundreds of candidates to tens of candidates.

- •

- Tertiary Screening. Solution candidate materials and

process conditions that continue to meet or exceed the defined criteria through the secondary screening stage are then either transferred to our customer or processed internally for additional

characterization and scale up. These candidates are then characterized on a larger scale, and correlation of the desired process is developed to allow the transfer of the developed technology in a

manufacturing scale process.

- •

- Manufacturing and Commercialization. Once a candidate has passed this development scale analysis, it is ready for commercialization and the customer will decide whether to commercialize the developed technology.

Secondary screening begins while primary screening is still ongoing, and while we are still generating additional primary screening candidates. Tertiary screening begins once we have identified a

12

reasonable set of options from secondary screening, and while we are still generating additional secondary screening candidates. As these stages overlap, there may be feedback from later stages that is then incorporated back into an earlier stage to further optimize the selection of materials, unit processes and process sequences.

Wet Processing Tools

We offer a series of wet processing tools which apply HPC methods to fluids-based applications such as cleans, deposition and wet etch, self-assembly, and surface treatment processes. These tools, which can be used alone or in combination, include:

- •

- Tempus F-10. A stand-alone system used for

primary screening through the automatic creation of formulations, especially those involving powders and viscous liquids.

- •

- Tempus F-20. A stand-alone system for

materials and process screening, which is used for library creation as well as processing of wafer coupons. This product can be used for primary or secondary screening, depending on the reactor block

design and the substrate type.

- •

- Tempus F-30. A stand-alone system for integration and tertiary scale up screening, which is used to scale up the most promising results from primary and secondary screening to full-size patterned wafers (200 or 300mm).

Dry Processing Tools

In addition, we offer dry processing tools which apply HPC methods to vapor-based applications. Each of these tools can be used in primary, secondary and tertiary screening. These tools, which can be used alone or in combination, include:

- •

- Tempus P-30-HPC-Physical Vapor Deposition

(PVD). A 300mm chamber with the ability to use up to four PVD sources and three optional deposition methods (including DC, RF and pulse

DC) on a vast range of film thicknesses and/or compositions and/or film stacks within each site-isolated region of a substrate.

- •

- Tempus A-30-HPC-Atomic Layer Deposition

(ALD). A 300mm chamber capable of site isolation of both metal and dielectric films across quadrants of the wafer, with the ability to

introduce variation of film thickness and/or composition and/or film stacks within each quadrant.

- •

- Tempus AP-30. A configurable platform with multiple A-30 or P-30 chambers and common support modules to facilitate both ALD and PVD for rapid screening of thin-film metal alloys, dielectrics and multilayer stacks. Processes can be scaled to facilitate high-volume manufacturing.

Automated Characterization

Immediately after processing substrates on our Tempus HPC processing tools, we use automated and customized characterization instruments to rapidly generate physical and electrical data from the experiments. The aggregated data is automatically loaded into our informatics data warehouse. As with processing, our clean room labs include a broad array of characterization and metrology instruments and software to evaluate different properties under a wide variety of process conditions. Our characterization instruments match the throughput of our processing tools to maximize experimental learning cycles.

13

Informatics Software, Analysis and Services

Our informatics software has the ability to automate the capture, entry and storage of HPC processing and automated characterization and metrology data and then to evaluate, summarize and securely distribute in real time this data to the appropriate parties. Additionally, we use our informatics software to leverage experiments processed and characterized in the past for a customer to increase the speed and effectiveness of the engagement. The key components of our informatics software include:

- •

- Workflow management software. Manages the design and

process of experiments, metrology and collection of data and summarizes aggregated data to the various working teams in the form of status reports; provides our customers with real-time

access to results of our experiments and analysis;

- •

- Analysis and reporting software. Provides data and

analysis tools to evaluate process distributions, correlate electrical distributions, map defectivity distributions, perform spectral analysis and facilitate interactive creation of summary reporting;

- •

- Security and collaboration management software. Provides

secure communication between geographically dispersed working teams, ensures the security of created documentation and presentations, manages the minutes for meetings, provides programs and project

plans to coordinate working teams, shares summary reports across the working team and provides reviews of finished processes and status of ongoing processes; and

- •

- Integration services. Facilitate collaboration between our tools and the customer's process and metrology tools, automate the recipe loading, automate data collection and leverage software to customize reports.

Our Technology

Embedded throughout our hardware and software, our technology is based upon the parallel and/or rapid serial experimentation capabilities of combinatorial methods. High-productivity combinatorial methods generally refer to techniques that vary materials, unit processes, process, and device integration sequences across multiple regions of one or more substrates, the output of which can then be evaluated in parallel. Our informatics software and analytical methods characterize and analyze these combinations of materials, unit processes, process, and device integration sequences for the most promising solutions in a structured, automated and throughput-matched fashion. The relationship between materials, processes, integration and device output are established earlier in the development process, so that performance and manufacturability considerations are taken into account from the outset, instead of late in the R&D process.

Although our approach is unique in the semiconductor and clean-energy industries, combinatorial technology has been widely used in other industries, especially where new materials function as primary enablers of product innovation. Examples include the pharmaceutical, biotechnology, and energy sectors, where combinatorial techniques have been accelerating development since the early 1990s.

We are able to deploy and benefit from our proprietary combinatorial methods because of our multi-disciplinary team of approximately 147 scientists and engineers as of December 31, 2011, of

14

whom approximately 60 have Ph.D.s. Our team has expertise in a wide range of disciplines, fields and technologies, including the following:

Disciplines

|

Applications | Equipment (Hardware & Process) |

Devices (Processes and Integration) |

|||

|---|---|---|---|---|---|---|

| Chemistry Physics Materials science Engineering • Chemical • Electrical • Mechanical • Software • Controls • Systems |

Equipment development •

Systems engineering • Semiconductor tools • Flat panel display tools • Software Design, qualification, manufacturing • Modeling / TCAD • Development / integration • Yield management • Statistical methods • Test structures • Inspection, review & characterization • Electrical test |

Deposition • ALD • PVD • PECVD • CVD (metals/dielectrics) • ECD / electroless • CBD / curtain coating • MOCVD Lithography/Etch Wet processing Laser annealing Rapid Thermal Annealing Defect detection • CBD / curtain coating • CBD / curtain coating contrast |

Process, equipment, integration • DRAM / Non-Volatile Memory • Microprocessors • Solar cells (CIGS, thin film Si,

cSi) • Low e glass

coatings • LED • Flash • Emerging Memories Process technologies • Selenization / absorber formation • Shallow trench isolation gapfill • High-k / metal gate • Contact & advanced silicide • Advanced Cu—interconnect (Cu,

Al) • Advanced packaging • Nitride Epitaxy • Transparent Conductive Oxide • Oxidation • Nitridation • Rapid Thermal Processing DRAM Flash Emerging Memories |

Our Collaborative Development Programs

Our CDPs allow our customers to collaborate with our multi-disciplinary team on specific technical problems. We establish processes and procedures to protect our customers' confidential information during these CDPs. Our CDP work is primarily carried out at our facility in close collaboration with our customers. In addition, we support device qualification for pilot manufacturing at our customers' manufacturing and development sites. Customer teams and our teams collaborate on development of new materials, unit processes, process modules and integration sequences, and qualify the supply chain for high-volume manufacturing. Our multi-disciplinary team can rapidly adapt our Tempus HPC platform to meet customer requirements and develop and optimize device and product technologies to ensure success with customer programs.

We typically initiate new customer engagements with smaller, customer-paid programs called micro-CDPs. Our micro-CDPs precede the full CDP. These are smaller programs that require significantly less investment from our team but allow us to demonstrate the capabilities of our HPC platform to a customer without requiring a customer to commit to a multi-year agreement. We use

15

these micro-CDPs to demonstrate the capabilities and value of our HPC platform to these new customers, with the objective of engaging with these customers in a full CDP.

Our CDPs are designed to result in the development of proprietary technology and IP for new devices, manufacturing process technology and materials, which we license to our customers for use in volume production. We provide our customers with proprietary technology through various fee arrangements and grant them rights to associated IP primarily through royalty-bearing licenses.

In the early stages of developing our business, we structured engagements with customers to allow us to continue to grow while also giving customers an opportunity to invest in our business and success. We do not expect to continue to provide our customers and partners with opportunities to invest in our company in the future, independent of their ability to do so in the open market.

Our Customers

Our customers include semiconductor device, semiconductor materials and equipment and clean-energy market leaders, including ATMI, Elpida, GLOBALFOUNDRIES, Guardian, SanDisk, Toshiba and TSMC. Typically, our customers engage in CDPs with our team leveraging our HPC platform to develop and commercialize high-volume integrated devices using collaboratively developed technology. To date, ATMI and Elpida have already successfully developed products through their CDPs and we have granted them rights to the associated technology and IP rights through royalty-bearing licenses. Successes in our initial CDPs have led to expanded relationships and follow-on programs with existing customers for new products and applications.

The majority of our revenue in 2011 comes from ATMI, Elpida, GLOBALFOUNDRIES, SanDisk and Toshiba, which represented a combined 83% of our total revenue during the year ended December 31, 2011, compared with 72% and 88% of our revenue coming from two customers, ATMI and Eplida, during the years ended December 31, 2010 and 2009, respectively. We believe that the revenue concentration associated with these customers will likely decline as our other customers begin to transition technology developed through CDPs into licensing and royalty revenue and as we continue to enter into new CDPs with new and existing customers in the semiconductor and clean-energy markets. In addition, revenue from Elpida may decline as a result of Elpida's February 2012 filing for protection under the Corporate Reorganization Act in Japan. For example, as part of any restructuring under this Act our CDP services may be reduced or even eliminated, and Elpida may either voluntarily or involuntarily reduce or eliminate payments owed to us or shipments of products that include our licensed technology.

Intellectual Property

Our success depends in large part on our IP. We have patented and continue to seek patent protection for combinatorial methods and systems included in our HPC platform. We have also patented and continue to seek patent protection of innovations that result from applying our HPC platform to design, develop and manufacture ICs, solar cells, glass coatings and glass-based devices, LEDs and thin films for electronics, optical and energy applications (Fields). As of December 31, 2011, we owned 404 U.S. patents and patent applications (some of which also have foreign counterparts), of which 224 are related to the HPC platform and 180 are related to innovations in the Fields. We also have a license to approximately 326 U.S. patents and patent applications granted to us by Symyx Technologies, Inc. (Symyx), a wholly-owned subsidiary of Accelrys, Inc., that exclusively provides us the right to use combinatorial methods and systems in the Fields.

As of December 31, 2011, we owned 75 patents and 149 patent applications related to our HPC platform in the United States, and 38 patents and 49 patent applications in other jurisdictions. The expiration dates of these patent rights range from October 2014 to December 2031. We continue to file patent applications to seek protection for further advancements of our HPC platform. We own all

16

rights to such patents and generally do not grant licenses to third parties under these patents other than in connection with the use of our HPC platform. Our patents and patent applications cover the following aspects of the HPC platform:

- •

- Combinatorial systems and methods related to fluids-based processing;

- •

- Combinatorial systems and methods related to vacuum-based processes, including deposition and etch;

- •

- Systems and methods for site-isolated processing;

- •

- Combinatorial systems and methods related to high-volume manufacturing; and

- •

- Processing techniques using combinatorial and non-combinatorial methods.

We also have and seek patent protection for innovations developed using our HPC Platform (applications IP). Such innovations cover advancements in new materials, processes, process conditions, process sequences and device architectures in applications such as semiconductor memory, semiconductor complex logic, glass coatings and glass-based devices, solar cells and LEDs. As of December 31, 2011, we owned 28 patents and 152 patent applications in the U.S. covering applications IP, as well as 1 patent and 27 patent applications in other countries. We may develop applications IP either on our own or in collaboration with our customers through CDPs.

In most cases, we maintain an ownership interest in the applications IP that results from CDPs and we grant licenses under this applications IP to the CDP customer. Such licenses generally allow the CDP customer to have exclusivity for a limited term in a particular field. We keep the right to grant licenses under the CDP patents outside that field. Furthermore, if the CDP customer elects to not extend the term of exclusivity beyond the limited term, we have the right to grant licenses to third parties within the field. If required we assign separate teams for each CDP, maintain separate databases of experimental data and limit access to such databases only to the specific team that assists the CDP customer.

We may also develop applications IP internally where we believe such IP may have broad applicability in the relevant market. We are able to leverage this IP to begin CDPs with new customers. In addition, our ability to own the applications IP in these situations allows us to leverage learning and patent protection across industries and applications while providing our existing customers with the IP rights they desire to gain competitive advantage in their fields for the markets they serve.

Sales and Marketing

We sell and market our solutions worldwide through our own sales force by developing direct relationships with our customers. We have sales personnel located in Japan, Taiwan, Europe and the United States, including account managers, who are responsible for specific customer accounts, and product marketing personnel, who provide business development support and application and workflow platform expertise. We often base customer support personnel at or near the offices of our major customers to improve our level of service and expand our sales.

Our business development and product marketing group focuses on our strategy, platform and technology roadmap, new platform introduction process, demand assessment and competitive analysis. The group coordinates new application evaluation and development both internally with our engineering teams and externally with new and existing customers. We intend to increase our sales and marketing efforts and further expand our business development and product marketing organization.

17

Manufacturing

We manufacture our HPC tools through partnerships with experienced contract manufacturers that manufacture and assemble sub assemblies incorporating our designs. We believe that our third party manufacturers have adequate sources and supplies of the raw materials needed to manufacture our products. We believe that partnering with contract manufacturers provides us with access to the most current facilities and processes without significant capital outlay on our part, allowing us to focus our resources on R&D, product design and collaboration program support. Although we have historically relied on a small number of contract manufacturers for the manufacture and assembly of a majority of our workflow platforms, we have relationships with a variety of contract manufacturers and are not dependent on any single contract manufacturer.

Research and Development

We conduct R&D activities for CDPs and for internal research and development on both workflow platform development and application R&D. As of December 31, 2011, we employed a research and development team of 178 full-time employees. This R&D team includes many experienced semiconductor engineers with advanced degrees from leading universities around the world and managers with experience from leading chip manufacturers, solar PV companies and equipment suppliers. We believe these R&D professionals on our team have enabled us to develop our HPC platform, support customer CDPs, implement our technology roadmap rapidly and provide us with the foundation for our technology advancement in the future.

Our customer-sponsored R&D expenses included in cost of revenue were $23.8 million in 2011, $16.9 million in 2010 and $8.8 million in 2009, which represented approximately 44%, 40% and 33%, respectively, of our revenue in those years.

We devote a substantial portion of our resources to engineering next generation platforms by integrating future generations of technology and developing a standardized software and informatics platform. We work closely with multiple vendors during the development of new workflows or workflow modifications for use in our future platforms. We work with our software and component vendors to establish integration standards. To that end, we are developing scalable software architectures that will allow us to integrate new processes requested by our customers to further expand the opportunities with new and existing customers, accelerate time-to-market, and allow our workflow platforms to operate with adjacent vertical technologies such as clean-energy markets. Our internal R&D expenses were $19.3 million, $13.9 million and $11.0 million for the fiscal years ended December 31, 2011, 2010 and 2009, respectively, which represented approximately 36%, 33% and 41%, respectively, of our revenue in those years.

Competition

The principal capabilities required to be competitive in our market include technical expertise, processes and integration capabilities, diversity of platform offerings, development speed and performance, quality and reliability of field engineers, depth of collaboration with customers and technical support. We believe we compete favorably with respect to these factors because of the breadth of capabilities of our HPC platform, the depth of multi-disciplinary expertise of our internal research team and external engineering teams who collaborate with customers and our use of combinatorial processing and throughput matched characterization and analysis. These differentiating factors allow us to explore more comprehensive solution sets and provide faster solutions to our customers. We are not aware of any companies that currently compete or have to date competed with us in the use of combinatorial methods in research and development applications; however, we do believe that we compete for the R&D resources of our customers with equipment suppliers, industry consortia, alliance partnership, university research and third-party IP licensing. In addition, many of our

18

customers design, develop, manufacture and market solutions based on their own unique device architectures and develop their own intellectual property in-house.

A portion of our revenue is generated from the sales of end products by our customers, and our competitive position therefore is dependent on their competitive positions. The markets for our customers' products that incorporate technology developed through our CDPs are intensely competitive and characterized by rapid technological change. These changes result in frequent product introductions, short product development cycles and increased product capabilities typically representing significant price and performance improvements.

Environmental Regulation

We are subject to various foreign, federal, state and local environmental laws and regulations governing, among other matters, emissions and discharges of hazardous materials into the air and water, the use, generation, storage, handling, transportation and disposal of, and exposure to, hazardous materials and wastes, remediation of contamination and employee health and safety. In addition, under certain of these environmental laws, liability can be joint and several and without regard to comparative fault. Our operations involve the use of hazardous materials and produce hazardous waste, and we could become liable for any injury or contamination that could arise due to such use or disposal of these materials. Failure to comply with environmental laws and regulations or to obtain or maintain required environmental permits could result in the imposition of substantial civil and criminal fines and sanctions, could require operational changes or limits or the installation of costly equipment or otherwise lead to third party claims. Future environmental laws and regulations, stricter enforcement of existing laws and regulations, or the discovery of previously unknown contamination or violations of such laws and regulations could require us to incur costs, or become the basis for new or increased liabilities or subject us to fines or other sanctions.

Employees

As of December 31, 2011, we had a total of 212 full-time employees, consisting of 178 people engaged in CDPs and R&D activities and 34 people in sales and marketing, legal and general and administrative roles. None of our employees are represented by a labor union, and we consider our employee relations to be good.

Our CDPs are labor-intensive, and as we engage in additional CDPs, we will need to hire enough highly-skilled engineers and other technical staff to support the CDPs. We evaluate our hiring needs on a project by project basis, taking into account current and anticipated CDP timelines and lifecycles. We believe our location in San Jose, California provides us with access to a large population of highly-skilled engineers who will be able to meet the technical requirements of our new CDPs.

Initial Public Offering

On November 23, 2011, we closed our sale of 5,681,796 shares of common stock as part of our initial public offering at an offering price of $10.00 per share, resulting in net proceeds to us of approximately $47.8 million, after deducting underwriting discounts, commissions and offering expenses paid or reimbursed by us, which includes a $1.4 million reimbursement paid to Symyx in connection with the Symyx asset purchase transaction. For further information regarding our initial public offering, see "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Repurchase of Equity Securities—Use of Proceeds from Registered Securities."

19

Financial Information about Segments and Geographic Areas

We derive a significant portion of our revenue from customers in foreign countries, particularly those based in Japan. Revenue generated from customers in Japan accounted for 28%, 29% and 30% of total revenue for the years ended December 31, 2011, 2010 and 2009, respectively. We expect that a significant portion of our total future revenue will continue to be derived from companies based in Japan and other foreign countries.

For geographic information, see Note 12 to our consolidated financial statements included in this Annual Report on Form 10-K. We report as a single reporting segment.

Customer and Collaborative Agreements

The descriptions below contain only a summary of the material terms of the agreements as of December 31, 2011 and do not purport to be complete. These descriptions are qualified in their entirety by reference to the respective agreements.

Collaborative Development Program Agreement with GLOBALFOUNDRIES (GF)

In June 2011, we entered into a CDP agreement with GF to develop and improve certain semiconductor products.

Under the agreement, we will provide development services to GF and grant GF non-exclusive use of our proprietary HPC platform (which includes a subscription to the platform and a license to the associated software) for the purpose of developing and improving certain semiconductor products.

Each party will own the rights arising out of the CDP created by its inventors ("GF CDP IP"). We agreed that we would not grant a license under our rights in the GF CDP IP to any third party outside a certain field without the prior written consent of GF.

GF has agreed to pay us (i) royalties on sales of products that incorporate the GF CDP IP, (ii) fees for providing development services to GF, (iii) subscription and license fees for use of the HPC platform, and (iv) certain pre-approved expenses and material costs. GF may grant sublicenses to use the GF CDP IP to third parties, but must share with us the royalties it receives from certain third party sublicenses. We also granted GF an option to purchase certain HPC processing tools.

We are required to supply a certain number of full-time employees or contractors dedicated to supporting the development activities under the CDP.

The initial period for development activities and use of the HPC platform is three years, and will automatically renew for additional one-year periods unless either party elects to terminate. The initial term of the agreement is five years from the date of the last sale of a product that incorporates GF CDP IP.

Collaborative Development Program Agreement with Toshiba and SanDisk

In March 2010, we entered into a CDP agreement with Toshiba and SanDisk to develop certain memory technologies and related materials.

Under the agreement, we will provide development services to Toshiba and SanDisk and grant Toshiba and SanDisk non-exclusive use of our proprietary HPC platform (which includes a subscription to the platform and a license to the associated software).

Toshiba and SanDisk will own the rights to the technology and IP arising out of the CDP that is based on Toshiba or SanDisk background technology or that is solely developed by Toshiba or SanDisk. We will own the rights to the technology and IP arising out of the CDP that is solely developed by us and that is based on our background technology. Jointly developed technology and IP arising out of the

20

CDP that is based on our background technology will be jointly owned. Patent rights based on technology solely developed by us that is based on Toshiba or SanDisk background technology will be jointly owned.

We granted Toshiba and SanDisk an exclusive license under our rights in the technology and IP arising out of the CDP (Toshiba-SanDisk CDP IP) during the term of the CDP. After the conclusion of the CDP term, Toshiba and SanDisk each shall have the option (i) to continue to maintain an exclusive license to certain or all of the Toshiba-SanDisk CDP IP, (ii) to convert the exclusive license to non-exclusive, or (iii) to terminate the exclusive license.

Toshiba and SanDisk have agreed to pay us (i) volume-based royalties on sales of products that incorporate the Toshiba-SanDisk CDP IP subject to certain minimum and maximum levels, (ii) fees for providing development services to Toshiba and SanDisk, (iii) subscription and license fees for use of the HPC platform, and (iv) certain pre-approved expenses and material costs. Toshiba or SanDisk may request that we grant to other third parties a royalty-bearing license to the Toshiba-SanDisk CDP IP.

The initial period for the development activities is two years, and may be extended for up to two additional one-year periods. The obligations of Toshiba and SanDisk to pay royalties under the licenses granted by us shall continue for the duration of such licenses.

Advanced Memory Development Program Agreement with Elpida Memory, Inc. (Elpida)

In May 2008, we entered into an Advanced Memory Development Program Agreement with Elpida relating to a CDP to develop and improve certain advanced memory products. The Elpida agreement was supplemented and/or amended in August 2008, January 2009, May 2009 and July 2010.

Under the agreement, we will provide development services to Elpida and grant Elpida non-exclusive use of our proprietary HPC platform (which includes a subscription to the platform and a license to the associated software) for the purpose of developing and improving certain advanced memory products.

We own the rights for certain technology and IP arising out of the CDP (our CDP IP). Elpida owns the rights for certain other technology and IP arising out of the CDP (Elpida CDP IP). All other technology and IP arising out of the CDP will be jointly owned by Elpida and us (joint CDP IP). We have also granted Elpida an exclusive license to use our CDP IP and the joint CDP IP in certain fields during the term of the agreement.

Elpida has agreed to pay us (i) royalties on sales of products that incorporate our technology, our CDP IP, Elpida CDP IP or joint CDP IP subject to certain minimum and maximum levels; (ii) fees for providing development services to Elpida, (iii) subscription and license fees for use of the HPC platform, and (iv) certain pre-approved expenses and material costs.

The current period for development activities and use of the HPC platform is through April 1, 2013, after which the exclusive license converts to a non-exclusive license unless Elpida meets certain minimum quarterly sales thresholds from high-volume manufacturing of royalty-bearing products. In addition, as part of any restructuring of Elpida under the Corporate Reorganization Act in Japan, our development period may terminate sooner and the exclusive license may be converted to a non-exclusive license. Elpida's obligation to pay royalties under the licenses granted by us shall continue for the duration of such licenses.

ATMI Engagement

In November 2006, we entered into an alliance agreement with ATMI to develop advanced materials for semiconductor products under one or more individual CDPs as agreed between the parties from time to time. Each CDP would provide payments from ATMI to us (i) for providing

21

development services to ATMI, (ii) for subscription and license fees for use of the HPC platform, and (iii) for certain pre-approved expenses and material costs. ATMI owns any technology and IP that it independently creates during the alliance agreement. We own the technology and IP we independently create. Unless modified by the terms of a CDP, we also own the Alliance Technology arising out of the CDP and the HPC technology. The initial term of the alliance activities is ten years.

The parties have had one CDP under the alliance agreement. Under that CDP, ATMI owns any technology and IP that it independently creates during the alliance agreement, as well as any materials manufacturing technology and associated IP rights that are created during the course of the alliance agreement (the Alliance Materials Manufacturing Technology). We own the technology and IP we independently create and, other than the Alliance Materials Manufacturing Technology, any other technology and IP that is created during the course of the alliance agreement (the Alliance IP). We granted to ATMI a limited, field-restricted, exclusive license to use the Alliance IP, with the right to sublicense, and ATMI has agreed to pay us royalties or share revenues on the sales or licenses of ATMI products that incorporate the Alliance IP. We retained the right to be the sole licensor of any Alliance IP to any IC manufacturers or original equipment manufacturers.

In July 2007, we entered into a Wets Workflow Purchase Agreement with ATMI, which was extended through amendments in December 2007, December 2008, March 2009, August 2010, March 2011 and October 2011 (as amended, the ATMI Wets Workflow Agreement), pursuant to which we agreed to sell to ATMI certain HPC processing tools and license informatics software related to liquid or fluids-based materials (wets) used in semiconductor processing and manufacturing (collectively, the wets workflow). The wets workflow may only be used at certain designated sites and solely for the purpose of developing and commercializing materials, wets processing processes, products and materials manufacturing technologies in a certain field. ATMI is obligated to pay us royalties on products that incorporate any material identified, first synthesized, or discovered through use of any wets workflow (the ATMI products). During the term of the agreement, we have agreed not to enter into any joint marketing, sales or development agreements in certain fields with certain competitors of ATMI. During the term of the agreement and subject to economic terms, we also agreed not to ship certain elements of the wets workflow and certain other proprietary HPC processing tools to certain ATMI competitors for use in certain defined fields. We have agreed to evaluate ATMI materials for CDPs between us and integrated device manufacturers for an IC or solar application. We have agreed to recommend ATMI materials to our customers in these CDPs, provided that the ATMI materials are timely available, meet our customer's requirements and are cost competitive. If we identify an opportunity for ATMI and us to work in a joint development program or if ATMI introduces us to such an opportunity with an integrated device manufacturer, we and ATMI will enter into good faith negotiations to agree on an economic arrangement, unless ATMI does not have HPC-related resources available to contribute to such an opportunity. In addition, we agreed to introduce one of ATMI's workflows to one of our other customers in exchange for ATMI committing to providing its support to such customer. We are required to supply a certain number of full-time employees or contractors dedicated to supporting ATMI's use of the wets workflow. The agreement will continue in effect as long as any license granted under any applicable purchase order under the agreement remains in effect, which will be at least through December 15, 2014.

In December 2008, we entered into a Dry Workflow Purchase Agreement with ATMI, which was extended thru amendments in August 2010, March 2011 and October 2011 (as amended, the ATMI Dry Workflow Agreement), pursuant to which we agreed to sell to ATMI certain HPC processing tools and license informatics software related to vapor-based applications (dry) used in semiconductor processing and manufacturing (collectively, the dry workflow). For sales of compounds or materials (or composition of compounds or materials) identified, first synthesized, or discovered in whole or in part through the use of the dry workflow, and any derivative thereof (the ATMI dry products), ATMI would pay us a royalty on these ATMI dry products. We are required to supply a certain number of full-time

22

employees or contractors dedicated to supporting ATMI's use of the dry workflow. In addition, we will provide support from October 2011 to August 2012 to a customer of ATMI who will be utilizing the dry workflow ATMI purchased from us. The agreement will continue in effect as long as any license granted under any applicable purchase order under the agreement remains in effect, which will be at least through December 31, 2013.

Symyx Asset Purchase