Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SS&C Technologies Holdings Inc | d316258d8k.htm |

| EX-99 - EX-99.1 - SS&C Technologies Holdings Inc | d316258dex99.htm |

| EX-2.1 - EX-2.1 - SS&C Technologies Holdings Inc | d316258dex21.htm |

| EX-10 - EX-10.1 - SS&C Technologies Holdings Inc | d316258dex10.htm |

| EX-99 - EX-99.2 - SS&C Technologies Holdings Inc | d316258dex991.htm |

Investor presentation

Investor presentation

March 2012

March 2012

NASDAQ: SSNC

NASDAQ: SSNC

Exhibit 99.3 |

Safe

Harbor Statement Safe Harbor Statement

2

This presentation includes forward-looking statements that are based on the current expectations

of the management of SS&C and are subject to uncertainty and changes in

circumstances. The forward-looking statements contained herein include statements about

the expected effects on SS&C of the proposed acquisition of GlobeOp, the expected timing and

conditions precedent relating to the proposed acquisition of GlobeOp, anticipated earnings

enhancements and other strategic options and all other statements in this presentation other

than statements of historical fact. Forward-looking statements include, without limitation, statements typically

containing words such as “intends”, “expects”, “anticipates”,

“targets”, “estimates” and words of similar import. By their nature,

forward-looking statements are not guarantees of future performance or results and involve risks

and uncertainties because they relate to events and depend on circumstances that will occur in

the future. There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied by such forward-looking

statements. These factors include, but are not limited to, unanticipated issues associated with the

satisfaction of the conditions precedent to the proposed acquisition; issues associated with obtaining

necessary regulatory approvals and the terms and conditions of such approvals; the inability to

integrate successfully GlobeOp within SS&C; exposure to potential litigation and changes in

anticipated costs related to the acquisition of GlobeOp. Additional factors that could cause actual results

and developments to differ materially include, among others, unanticipated changes in revenue,

margins, costs, and capital expenditures; issues associated with new product introductions;

foreign currency fluctuations; risks associated with growth; geographic factors and political

and economic risks; actions of SS&C competitors; changes in economic or industry conditions

generally or in the markets served by SS&C and GlobeOp; the state of financial and credit markets;

work stoppages, labor negotiations, and labor rates; and the ability to complete and

appropriately integrate restructurings, consolidations, acquisitions, divestitures, strategic

alliances, and joint ventures. Information on the potential factors that could affect SS&C

is also included in its filings with the Securities and Exchange Commission, including, but not

limited to, its Annual Report on Form 10-K for the fiscal year ended December 31, 2011. SS&C

undertakes no obligation to update or revise forward-looking statements, whether as a result of

new information, future events or otherwise. Forward-looking statements only speak as of

the date on which they are made. |

Disclaimer

Disclaimer

Disclaimer

3

For the purposes of the following disclaimers, references to this “presentation” shall be

deemed to include references to the presenters’ speeches, the question and answer session

and any other related verbal or written communications.

This presentation is being made to you solely for your information and may not be reproduced, further

distributed to any other person or published, in whole or in part, for any purpose. This presentation

does not constitute an offer, invitation or inducement to acquire or sell any shares or other securities and no offer, invitation or

inducement to acquire or sell any shares or other securities is being made by or in connection with

this presentation. Although reasonable care has been taken to ensure that the facts stated in

this presentation are accurate and that the opinions expressed are fair and reasonable, the

contents of this presentation have not been verified by SS&C or any other person. Accordingly no

representation or warranty, express or implied, is made as to the fairness, accuracy,

completeness or correctness of the information and opinions contained in this presentation and no reliance

should be placed on such information or opinions. Neither SS&C nor any of its directors, officers,

employees or advisers nor any other person accepts any liability whatsoever for any loss

howsoever arising from any use of such information or opinions or otherwise arising in connection

with this presentation. Nothing in this presentation should be taken as profit forecasts or statements

regarding SS&C’s expectation for earnings per share during the remainder of 2012, for

2013 or for subsequent periods.

This presentation is not being made by, nor has it been approved by, an authorised person within the

meaning of the Financial Services and Markets Act 2000 (“FSMA”). This presentation is

being made and communicated in the UK on the basis that it is exempt from the general

restriction (in section 21 of the FSMA) on communications of invitations or inducements to engage in

investment activity as made only to persons (a) reasonably believed to be persons who have

professional experience in matters relating to investments falling within Article 19(5) of the FSMA

(Financial Promotion) Order 2005 (the “Order”), (b) reasonably believed to be high net worth

entities within Article 49(2) of the Order (all persons within (a) or (b) above being referred

to as “relevant persons”), (c) reasonably believed to be persons in the business of disseminating information

concerning controlled activities within Article 47(2) of the Order or (d) any other persons, who, for

the purposes of Article 69(2)(a) of the Order, have solicited this presentation. By attending

this presentation, all persons are soliciting the presentation. This presentation is not being made or

communicated to any other persons and such other persons should not rely or act upon this presentation

or any of its contents.

The distribution of this presentation in jurisdictions outside of the United Kingdom, Luxembourg or

the United States may be restricted by law, and persons into whose possession this presentation

comes should inform themselves about, and observe, any such restrictions. Any failure to comply

with any of those restrictions may constitute a violation of the securities laws of any such

jurisdictions. By participating in this presentation you agree to be bound by the above terms. |

SS&C Acquisition Of GlobeOp

SS&C Acquisition Of GlobeOp

Summary of Terms

Offer price of 485p per share I All cash offer

Enterprise Value of £504 million

(a)

I Diluted Equity Value of £572 million

Represents 11.5% premium to TPG’s standing offer of 435p

Unanimous SS&C Board approval and recommendation of the

Independent Directors of GlobeOp

Acceptance threshold of 70%

The transaction is subject to certain regulatory conditions

Transaction to be financed by a combination of SS&C’s existing cash

resources and new facilities

Expected to close in mid-2012

4

a)

Calculated

as

diluted

equity

value

net

of

cash

of

$106.8

million

at

12/31/2011

(converted

to

£

using

£:$

exchange

rate

of

£1:$1.5726). |

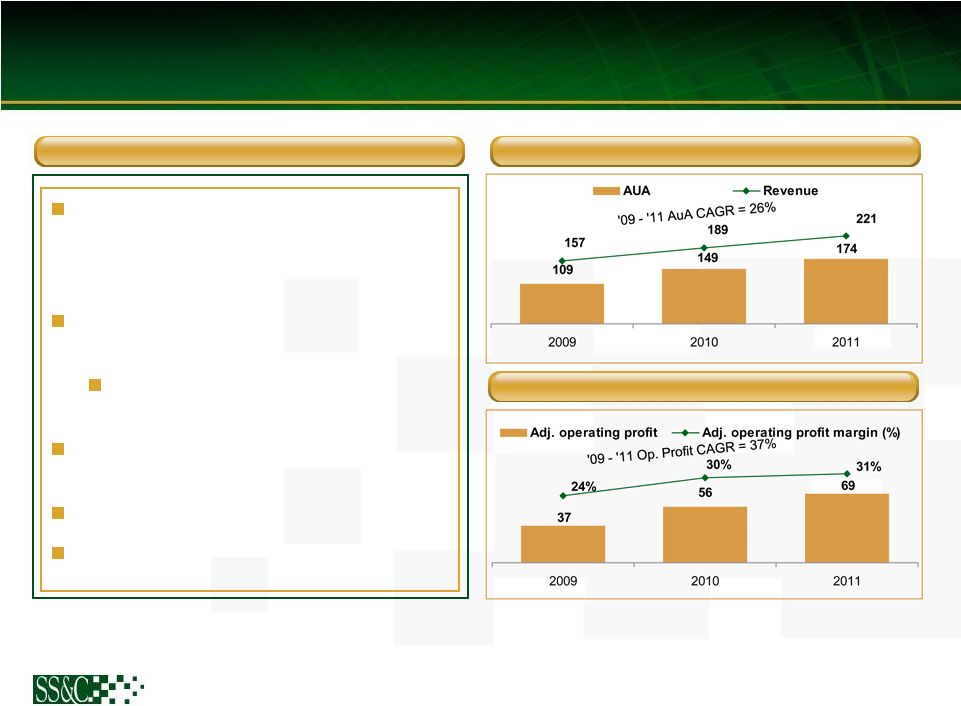

GlobeOp Overview

GlobeOp Overview

5

a)

Adjusted operating profit calculated as operating profit prior to depreciation and

amortization expense, employee costs related to share-based compensation, legal claims and tax reserves (net of

insurance), integration and redundancy costs and other costs.

Source:

GlobeOp filings

Leading independent provider of

business processing, technology

services and analytics to hedge fund

industry

Strong momentum as evidenced by

growing assets under administration

AuA has increased by ~60% since

2009

Leverages proprietary technology to

cater to complex strategies

Serves global blue chip client base

Recurring revenue model supports

strong cash flow generation

Historical AuA ($bn) and revenue ($m)

Historical adjusted operating profit

(a)

($m)

Key highlights |

Strategic Rationale

Strategic Rationale

6

1

2

3

4

5

a)

Includes full-year 2011 PORTIA revenues for illustrative purposes.

b)

Accretion

based

on

an

Adjusted

net

income

basis

using

underlying

consensus

forecasts

for

SS&C

and

GlobeOp

with

adjustments

for

PORTIA

acquisition

and

pro

forma

adjustments

for

acquisition

of

GlobeOp.

Adjusted

net

income

and

earnings

per

share

are

defined

as

earnings

before

amortization

of

intangible

assets

and

deferred

financing

costs, stock-based compensation, capital-based taxes and other unusual and

nonrecurring items. Unique opportunity to combine two independent hedge fund

administrators into a full service, global market leading business

Complements SS&C's core portfolio accounting and management offerings; augments

existing large and diverse blue chip client base and presents significant

cross-sell and cost saving opportunities

Business diversification increasing the recurring, highly predictable revenue base

with combined

2011

total

revenue

of

~$635m

(a)

;

supporting

strong

deleveraging

and

robust cash flow dynamics

Consistent with SS&C’s strong track record of value creation through

M&A, as evidenced by its 30+ acquisitions to date

Financially attractive:

Expected run-rate, pre-tax cost synergies of at least $25 million to be

achieved within 3 years following transaction close

Transaction

meaningfully

accretive

(b)

in

first

year

following

transaction

close |

Expected To Create A Top 3 Hedge Fund Administrator

With Strong Offerings In Key Areas…

Expected To Create A Top 3 Hedge Fund Administrator

With Strong Offerings In Key Areas…

7

Pro Forma Q4-11

$

% of total

1

Citco

$472

15.5%

2

State Street

409

13.4%

3

SS&C/GlobeOp

298

9.8%

4

BNY Mellon

293

9.6%

5

Goldman Sachs

196

6.5%

6

Northern Trust

182

6.0%

7

Citi

171

5.6%

8

Morgan Stanley

127

4.2%

9

HSBC

124

4.1%

10

SEI

86

2.8%

Top 10

$2,358

77.5%

Total

$3,042

100.0%

Note: Represents Hedge Fund Assets under administration.

Source:

HFN Q4 2011 Hedge Fund Administrator Survey

Hedge fund administrator ranking (AuA $bn)

Hedge fund administrator ranking (AuA $bn)

Acquisition expands product offering / capabilities

Acquisition expands product offering / capabilities

Post acquisition, will allow SS&C to have

substantial base across a number of fund

strategies, including fixed income, volatility

and active trading

GlobeOp middle-office offerings will

complement SS&C’s core portfolio of

accounting and management products and

services

Combined entity will provide a

comprehensive array of product offerings,

best in breed technologies, and

complementary services under a public,

independent, single platform

Combined

entity

(a)

with

strong

cloud

based

computing, mobility and sophisticated portal

capabilities, backed by combined ~500

strong development organization

a)

Includes PORTIA. |

Intended to Diversify The Business Mix And

Increase Recurring Revenue

Intended to Diversify The Business Mix And

Increase Recurring Revenue

8

2011 recurring revenue share

2011 recurring revenue share

a)

Includes full-year 2011 PORTIA revenues for illustrative purposes.

Source: Company filings

SS&C

Combined

GlobeOp

$414 million

$221 million

$635 million

Acquisition broadens product offering:

Expands SS&C’s offerings in Fixed Income and Diversified strategies,

where GlobeOp is an active participant, and strengthens SS&C’s

middle office capabilities

Provides SS&C with a strong European platform

Business mix

Business mix

(a)

Non-

recurring

13%

Recurring

87%

Recurring

88%

Non-

recurring

12%

Recurring

92%

Non-

recurring

8% |

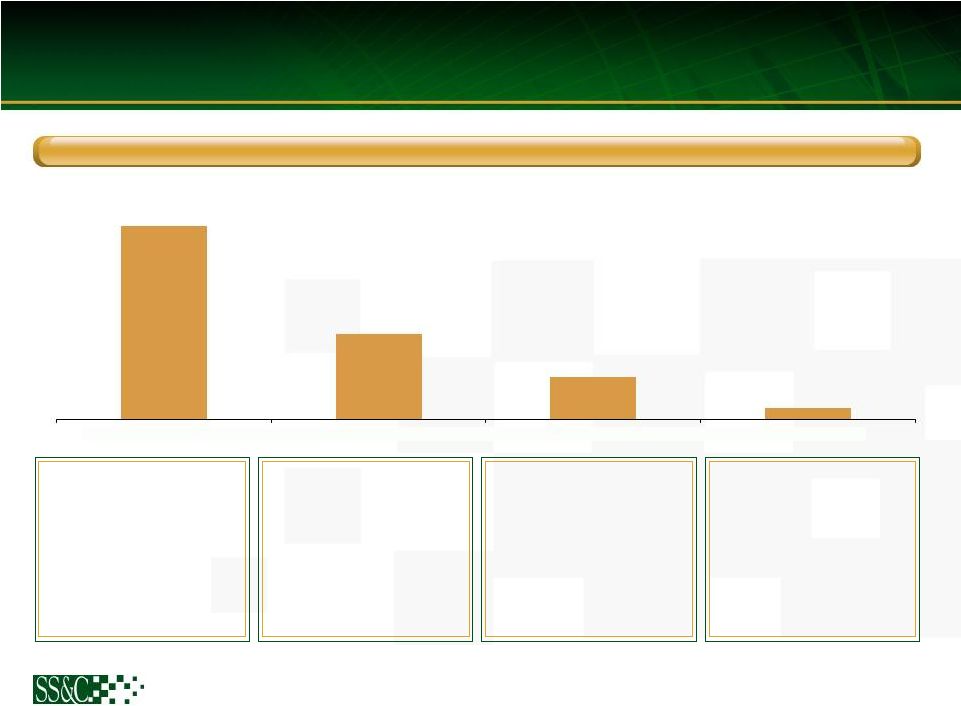

Successful History Of Deleveraging

…The Acquisition Of GlobeOp is intended to Generate Robust Cash Flows Over The

Long Run And Management Remains Committed to Supporting Value to All

Stakeholders… Successful History Of Deleveraging

…The Acquisition Of GlobeOp is intended to Generate Robust Cash Flows Over The

Long Run And Management Remains Committed to Supporting Value to All

Stakeholders… 9

Historical Leverage

(a)

Historical Leverage

(a)

11/23/2005

–

SS&C is taken

private by the Carlyle Group in

a $1.05 billion buyout

Debt/EBITDA: 7.0x

Net debt/EBITDA: 6.8x

3/31/2010

–

SS&C undergoes

its IPO since being taken

private, raising $134.6mm

Debt/EBITDA: 3.2x

Net debt/EBITDA: 3.0x

2/9/2011

–

SS&C issues a

follow-on offering, raising

$52.0mm

Debt/EBITDA: 2.1x

Net debt/EBITDA: 1.5x

Current

Debt/EBITDA: 0.7x

Net debt/EBITDA: 0.4x

a)

Defined as net debt / adjusted EBITDA.

b)

Balance sheet data as of 11/30/2005.

c)

Balance sheet data as of 3/31/2010.

d)

Balance sheet data as of 12/31/2010.

e)

Balance sheet data as of 12/31/2011.

6.8x

3.0x

1.5x

0.4x

LBO

(b)

IPO

(c)

Follow-on

(d)

Current

(e) |

Successful Acquisition History

SS&C has completed over 30 acquisitions to date

Successful Acquisition History

SS&C has completed over 30 acquisitions to date

10

Acquisition of Northport

Acquisition of Quantra

Acquisition of The Savid Group

Acquisition of Real-Time USA

Acquisition of DBC

Acquisition of OMR Systems

Acquisition of Investment Advisory

Network

Acquisition of NeoVision

Hypersystems

Acquisition of Eisnerfast

Acquisition of FMC

Acquisition of Financial Interactive

Acquisition of MarginMan

Acquisition of Open Information Systems

Acquisition of Achievement Technologies LLC

Acquisition of Evare

Acquisition of MAXIMIS business from Unisys

Acquisition of Tradeware

Acquisition of TheNextRound, Inc.

Acquisition of Chalke, Inc.

Acquisition of HedgeWare, Inc.

Acquisition of The Brookside

Corporation

Acquisition

of

Micro

Design

Services

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

Acquisition of Cogent Management

Acquisition of Zoologic

Acquisition of TimeShareWare

Acquisition of thinkorswim

Techonologies, Inc.

Acquisition of GIPS

Acquisition of Mabel Systems

Acquisition of Shepro Braun

Acquisition of Digital Visions

Acquisition of Amicorp Fund Services

2012

Acquisition of BDO Simpson Xavier Fund

Administrator

Acquisition of BenefitsXML

Pending acquisition of PORTIA |