Attached files

| file | filename |

|---|---|

| 8-K - OBAGI MEDICAL PRODUCTS 8-K 3-13-2012 - Obagi Medical Products, Inc. | form8k.htm |

Obagi: Strategic Direction Information Meetings

Welcome to the Obagi Transformation

We’ve been transforming women’s skin

for more than 20 years.

Now it’s our turn.

SAFE HARBOR

1

Today’s presentation contains forward-looking statements that can be identified by the use of forward looking

terminology such as the words "believes," "expects," "may," "will," "should," "potential," "anticipates," "plans,"

or "intends" and similar expressions. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results, events or developments to be materially different

from the future results, events or developments indicated in such forward-looking statements. Actual events and

performance may differ materially from expectations. Such factors include, but are not limited to the ability to

successfully implement the new online e-Commerce sales and fulfillment strategy, variability of quarterly

operating results, intense competition our products face and will face in the future, and the fact that our ability to

commercially distribute our products may be significantly harmed if the state or federal regulatory environment

governing our products changes. A more detailed discussion of these and other factors that could affect results is

contained in our filings with the U.S. Securities and Exchange Commission. These factors should be considered

carefully and readers are cautioned not to place undue reliance on such forward-looking statements. No

assurance can be given that the future results covered by the forward-looking statements will be achieved. The

forward-looking statements in this presentation speak only as of the date they are made and Obagi Medical

Products does not intend to update this information.

terminology such as the words "believes," "expects," "may," "will," "should," "potential," "anticipates," "plans,"

or "intends" and similar expressions. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results, events or developments to be materially different

from the future results, events or developments indicated in such forward-looking statements. Actual events and

performance may differ materially from expectations. Such factors include, but are not limited to the ability to

successfully implement the new online e-Commerce sales and fulfillment strategy, variability of quarterly

operating results, intense competition our products face and will face in the future, and the fact that our ability to

commercially distribute our products may be significantly harmed if the state or federal regulatory environment

governing our products changes. A more detailed discussion of these and other factors that could affect results is

contained in our filings with the U.S. Securities and Exchange Commission. These factors should be considered

carefully and readers are cautioned not to place undue reliance on such forward-looking statements. No

assurance can be given that the future results covered by the forward-looking statements will be achieved. The

forward-looking statements in this presentation speak only as of the date they are made and Obagi Medical

Products does not intend to update this information.

BUSINESS OVERVIEW

2

Obagi Medical Products: Who We Are

• Founded in 1997

• Headquarters: Long Beach, CA

• Employees: 199, including 141 in Sales & Marketing

• Accounts: Estimated ~12,500 physicians in U.S.

• Profitable, positive cash flow business

• Specialty pharmaceutical company that develops, markets and

sells proprietary topical aesthetic and therapeutic prescription-

strength skin care systems

sells proprietary topical aesthetic and therapeutic prescription-

strength skin care systems

• Designed to prevent and improve the most common and visible

skin disorders in adults

skin disorders in adults

Leading Company in the Physician-Dispensed Skin Care Market

3

• Segment: Medical care providers, spas/skin salons

and specialty retail stores

and specialty retail stores

• 2010 combined market: $900 million+1

• Sector: OMPI participates almost solely in the

medical care provider channel - $303 million in

20111

medical care provider channel - $303 million in

20111

• Segment CAGR: 7.1% 2006 to 2011

• OMPI CAGR: 8.0% (includes 1.0% negative impact

relating to Texas)

relating to Texas)

• OMPI market leader: all years, currently ~2x its

nearest competitor

nearest competitor

Obagi’s Existing Addressable Market

4

1. Source: Kline & Company, Inc.

Obagi Maintains Leading Brand Recognition

5

Elite

Products

Products

Medical/Spa

$$$

Estee Lauder

Laura Mercier

Chanel

Clinique

Dior

Kate Sommerville

Lancõme

Department

Store

Store

$$

Drug Store

$

Oil of Olay

L’Oreal

Cetaphil

Dove

Clearasil

Neutrogena

Aveeno

St. Ives

Clean & Clear

Obagi

Kinerase

LaMer

SkinCeuticals

MD Forte

La Roche Posay

Kiehl’s

SkinMedica

NeoStrata

Murad

Preuage

LaPraine

(spa)

(medical)

Dermalogica

Glytone

• At the apex of the

hierarchy of

consumer attitudes,

aspirations and

perceptions

hierarchy of

consumer attitudes,

aspirations and

perceptions

• OMPI: leader overall in the segment, and also in a number

of sub-categories

of sub-categories

• Nu-Derm: leading brand in the entire segment, with 20% of

all revenues

all revenues

• ELASTIderm: leading eye treatment, 20% of sub-segment

• CLENZIderm: leading acne treatment dispensed by

physicians, more than 30% of sub-segment

physicians, more than 30% of sub-segment

Obagi’s Market-Leading Products

6

7

Obagi’s Core Business is Robust

• The Obagi brand value and goodwill is reflected in the

Company’s strength and stability

Company’s strength and stability

• Products are accepted as clinically proven and effective

by medical professionals and by consumers

by medical professionals and by consumers

• Physician-dispense model enabled OMPI to compete

and win in a market targeted by much larger companies

and win in a market targeted by much larger companies

• OMPI dominates the physician-dispense segment it

helped create

helped create

• At the apex of the hierarchy of consumer attitudes,

aspirations and perceptions

aspirations and perceptions

OBAGI TRANSFORMATION:

EXPANDING THE ADDRESSABLE MARKET

EXPANDING THE ADDRESSABLE MARKET

8

• In the new global consumer community, strong brands

have extraordinary opportunities

have extraordinary opportunities

• Social media brings consumer behaviors and preferences

visible to the masses (Facebook, Twitter, 4Square, etc.)

visible to the masses (Facebook, Twitter, 4Square, etc.)

• Virtual communities are fast becoming the biggest factor in

consumer purchasing decisions

consumer purchasing decisions

• In a global consumer community connected by the web

and social media, the power of the Obagi brand can drive

consumer action

and social media, the power of the Obagi brand can drive

consumer action

• Our research indicates that millions of consumers are

already searching for us on the web every year

already searching for us on the web every year

Leveraging Strength of Obagi’s Brand to

Capitalize on Global Online Communities

Capitalize on Global Online Communities

9

• OMPI’s true revenue potential is bottled up:

– In the US alone, at least 60 million women represent potential

Obagi customers

Obagi customers

– However, at any one time, there are only approximately 500,000

active Obagi end-users

active Obagi end-users

• Yet, 400,000 web searches for Obagi occur each month

• Obviously, there is a disconnect between existing and

potential demand and conversion into sales

potential demand and conversion into sales

• This disconnect is a manifestation of the difference

between “old” and “new” business models, and between

“physical” and “virtual” marketplaces

between “old” and “new” business models, and between

“physical” and “virtual” marketplaces

Evolving Obagi’s Channel Strategy to

Accelerate Growth

Accelerate Growth

10

Potential New Market Opportunity

• Physical limitations vs. virtual limitlessness

– Currently, business is 100% wholesale; customer is exclusively a

reselling physician

reselling physician

– Revenues are bounded on the upside due to inventory

purchasing requirements placed upon physicians

purchasing requirements placed upon physicians

– Physicians are rarely willing or able to purchase, store and re-

offer the complete Obagi line, even if customers want them

offer the complete Obagi line, even if customers want them

– Thus the physical and financial limitations of its individual outlets

limits upside for Obagi

limits upside for Obagi

• The fact that prescriptions are required both complicates

the solution and creates a unique and exciting opportunity

the solution and creates a unique and exciting opportunity

11

12

Building an e-Commerce and Fulfillment

Operation

Operation

• Moving forward with innovation, creativity and vision

• Obagi-owned online pharmacy and fulfillment operation

will set ourselves apart in our industry by combining

will set ourselves apart in our industry by combining

– A dominant brand with prescription components, built on

– An ability to engage (in theory) directly with virtually all women

(through e-Commerce and new channels), which is

(through e-Commerce and new channels), which is

– Supported by direct fulfillment of individual customer orders,

including Rx, which in turn establishes

including Rx, which in turn establishes

– An ongoing personal dialogue with them, which we will

accomplish through

accomplish through

– Use of a customer profile created and maintained in a database

we will own

we will own

• Obagi’s new online pharmacy and fulfillment capability is

not just a marginal add-on to the existing business

not just a marginal add-on to the existing business

• Building a worldwide, Obagi-branded online community to

bring together in one place existing end-users, physicians

and millions of prospective new customers

bring together in one place existing end-users, physicians

and millions of prospective new customers

• A place to share information and experiences, create

affinities, refill prescriptions and buy products online

affinities, refill prescriptions and buy products online

• In time, this new environment will become the dominant, if

not the only, channel for the delivery of Obagi goods and

services to end-users

not the only, channel for the delivery of Obagi goods and

services to end-users

13

Creating a Dominant New Channel

Shopping

Online

Offline

Brands

Clothing/Accessories

Cars

Technology

Obagi is…

• Strong and powerful

• Fixes problems

• Somewhat exotic

• Flawless skin

Angelina

Jolie

Jolie

Celebrities

High Opportunity

Consumers

Consumers

Targeting New End Users and High Opportunity

Consumers Through e-Commerce

Consumers Through e-Commerce

14

15

Accelerating Future Growth

• The goal is to generate 15%-20% sustained annual

growth rates in revenues and profits

growth rates in revenues and profits

• Add up to $100 million in new revenue within 3-5 years

• Establish direct relationships with end-users on a major

scale

scale

• Maintain or improve contribution margins

• Avoid cannibalizing the existing business

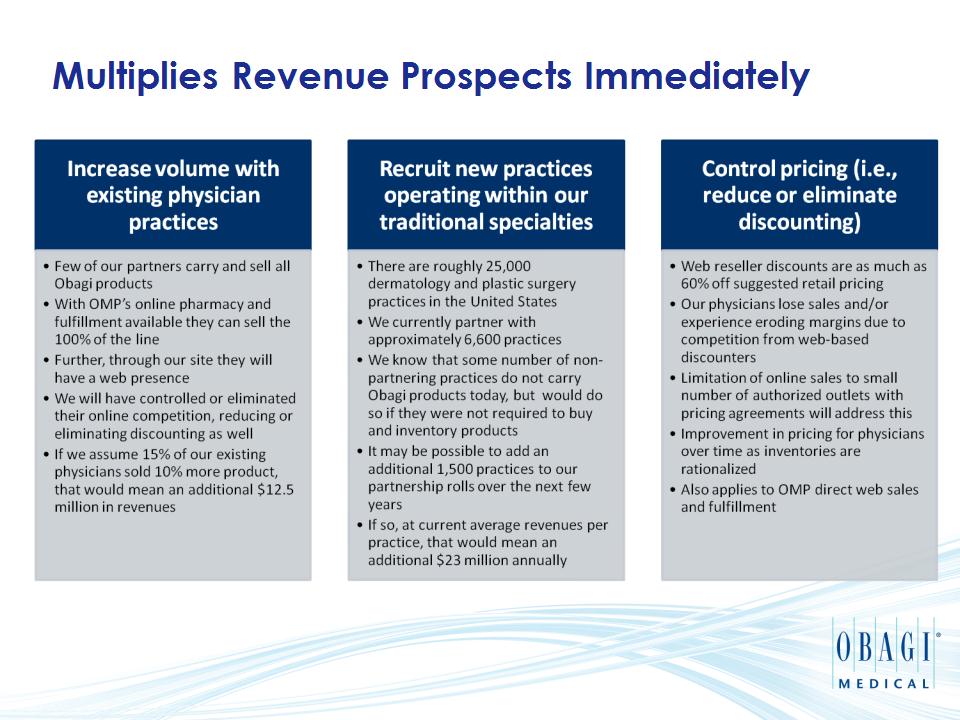

Multiplies Revenue Prospects Immediately

16

17

Expected Revenue Impact of Immediate Benefits

“Back of the Envelope” Revenues Discussed Above

18

2012 Investments - Management Estimates1

1. Other than Operations, some Sales & Marketing and Other, all listed expense items are one-time investments.

19

• Draw large numbers of new users into online community

• Spread to non-traditional medical channels

• International possibilities become interesting - particularly

Japan and Asia

Japan and Asia

Longer Term Opportunities

20

OBAGI FINANCIALS

21

Financial Overview

($’s in millions except for share price & EPS)

As of December 31, 2011

($’s in millions except for share price & EPS)

As of December 31, 2011

|

NASDAQ Ticker Symbol

|

|

OMPI

|

|

Stock price (3/9/2012)

|

|

$13.00

|

|

FD Shares outstanding

|

|

18.7M

|

|

Market cap (3/9/2012)

|

|

$243M

|

|

Financial Metrics (non-GAAP*)

|

|

2011

|

|

Gross Margin

|

|

79%

|

|

Operating Margin

|

|

21%

|

|

EBITDA Margin

|

|

24%

|

|

ROA

|

|

19%

|

|

ROE

|

|

25%

|

|

|

|

|

* See our Report on Form 8-K filed with the Commission on March 8, 2012 for non-GAAP financial measures. Non-GAAP financial

information excludes impact of the Texas Sales Provision.

information excludes impact of the Texas Sales Provision.

22

Comments to 2011 and 2012 Outlook

• 2011 Financial Results:

• Excludes any impact related to the Zein Obagi law suit and settlement

• Includes any negative impact due to Texas Hydroquinone; revenue and expenses

• GAAP revenue was $114.1M and non-GAAP EPS was $0.81

• 2012 Guidance:

• Core business:

• Revenue of between $122.0 M- $125.0M

• Earnings per share in the range of $0.89 - $0.91

• Impact of investments:

• Revenue impact of between <$1.0M> - <$3.0M>

• Earnings per share in the range of <$0.29> - <$0.31>

• Combined guidance:

• Total year revenue of between $119.0M - $124.0M

• Total year earnings per share in the range of $0.58 - $0.62

• Year-end 2012 cash balance at $43.0M - $45.0M; positive cash flow of $8.0M - $10.0M

• Q1 revenue of between $27.0M - $29.0M

• Q1 earnings per share in the range of $0.10 - $0.11

• Excludes potential costs associated with responding to any state

regulatory inquiry

regulatory inquiry

23

Note: See Form 8-K filed with the Commission on March 8, 2012. 2011 Non-GAAP financial information excludes the impact of

the Texas Sales Provision.

the Texas Sales Provision.

* See our Report on Form 8-K filed with the Commission on March 11, 2010 for Non-GAAP financial measures.

** See our Report on Form 8-K filed with the Commission on March 10, 2011 for Non-GAAP financial measures.

*** See our Report on Form 8-K filed with the Commission on March 8, 2012 for Non-GAAP financial measures. 2011 Non-

GAAP financial measures exclude the impact of the Texas Sales Provision. As a reminder, the Company completed a stock

buyback of 3.5 million shares in November 2010.

GAAP financial measures exclude the impact of the Texas Sales Provision. As a reminder, the Company completed a stock

buyback of 3.5 million shares in November 2010.

Annual Revenue & EPS Trends

($ in millions, except per share)

($ in millions, except per share)

•Revenues

•EPS

24

Balance Sheet Summary

($ in millions)

($ in millions)

|

|

Dec. 2011

|

|

Cash and Cash Equivalents

|

$35.0M

|

|

2011 Free Cash Flow (1)

|

$23.9M

|

|

Total Assets

|

$77.8M

|

|

Total Bank Debt (2)

|

$0

|

|

Shareholders’ Equity

|

$60.9M

|

|

Authorized Buyback (remaining)

|

$30.0M

|

(1) 2011 free cash flow before $5.0 million legal settlement paid to Dr. Obagi in May 2011.

(2) Obagi has access to up to $35.0 million in additional credit through its agreement with Comerica Bank,

including a Revolving Credit Facility of up to $20.0 million and potential term loans of up to $15.0 million.

including a Revolving Credit Facility of up to $20.0 million and potential term loans of up to $15.0 million.

25

CLOSING THOUGHTS

26

27

Key Takeaways and Investment Highlights

• Experienced Management Team

• Outstanding Brand Recognition and Track Record for

Product Innovation

Product Innovation

• Expansion of Distribution Channels to Accelerate Growth

• Targeted End Users Through e-Commerce Channel

Q&A

28