Attached files

| file | filename |

|---|---|

| 8-K - CAL DIVE FORM 8-K 4Q11 EARNINGS RELEASE - Cal Dive International, Inc. | form8k022912-4q11.htm |

| EX-99.1 - CAL DIVE 4Q11 EARNINGS RELEASE - Cal Dive International, Inc. | exh99_1.htm |

EXHIBIT 99.2

Cal Dive International

4th Quarter 2011 Earnings Conference Call

Forward-Looking Statements

This presentation may include “forward-looking” statements that are generally identifiable through our

use of words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project” and similar

expressions and include any statements that we make regarding our earnings expectations. The forward-

looking statements speak only as of the date of this presentation, and we undertake no obligation to

update or revise such statements to reflect new information or events as they occur. Our actual future

results may differ materially due to a variety of factors, including current economic and financial market

conditions, changes in commodity prices for natural gas and oil and in the level of offshore exploration,

development and production activity in the oil and natural gas industry, the impact on the market and

regulatory environment in the U.S. Gulf of Mexico resulting from the Macondo well blowout, our inability

to obtain contracts with favorable pricing terms if there is a downturn on our business cycle, intense

competition in our industry, the operational risks inherent in our business, and other risks detailed in our

Form 10-K on file with the Securities and Exchange Commission.

use of words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project” and similar

expressions and include any statements that we make regarding our earnings expectations. The forward-

looking statements speak only as of the date of this presentation, and we undertake no obligation to

update or revise such statements to reflect new information or events as they occur. Our actual future

results may differ materially due to a variety of factors, including current economic and financial market

conditions, changes in commodity prices for natural gas and oil and in the level of offshore exploration,

development and production activity in the oil and natural gas industry, the impact on the market and

regulatory environment in the U.S. Gulf of Mexico resulting from the Macondo well blowout, our inability

to obtain contracts with favorable pricing terms if there is a downturn on our business cycle, intense

competition in our industry, the operational risks inherent in our business, and other risks detailed in our

Form 10-K on file with the Securities and Exchange Commission.

2

Presentation Outline

3

Summary of 4Q 2011 Results

Backlog

Discussion of Financial Results

Non-GAAP Reconciliations

Questions & Answers

Summary of 4Q Results

4

Strong profitability in Australia for diving

related work on Gorgon project.

Decreased domestic financial results

compared to 4Q 10 due to harsher weather

in December and dry-dock of Uncle John.

Bahamas construction project performed in 4Q 10

did not reoccur in 4Q 11.

Strong free cash flow during quarter.

No borrowings under revolving credit facility

at year end.

Backlog

5

($ millions)

Financial Results

6

(1) See reconciliation on Non-GAAP financial measures at the end of the presentation.

(2) Tax effected.

|

(all amounts in thousands, except per share

amounts and percentages) |

|

|

Three Months

|

|

Twelve Months

|

||||

|

|

Ended December 31,

|

|

Ended December 31,

|

||||

|

|

2011

|

|

2010

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

$127,434

|

|

$161,040

|

|

$479,811

|

|

$536,468

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

7,788

|

|

23,673

|

|

14,266

|

|

62,442

|

|

Margins

|

6%

|

|

15%

|

|

3%

|

|

12%

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

($8,771)

|

|

($2,382)

|

|

($66,897)

|

|

($315,849)

|

|

Margins

|

(7%)

|

|

(1%)

|

|

(14%)

|

|

(59%)

|

|

|

|

|

|

|

|

|

|

|

Diluted Loss Per Share

|

($0.10)

|

|

($0.03)

|

|

($0.73)

|

|

($3.47)

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

($8,771)

|

|

($2,382)

|

|

($66,897)

|

|

($315,849)

|

|

Non-cash fixed asset impairments (2)

|

1,561

|

|

-

|

|

30,356

|

|

15,048

|

|

Non-cash goodwill impairment (2)

|

-

|

|

-

|

|

-

|

|

287,464

|

|

Net Loss excluding impairments

|

($7,210)

|

|

($2,382)

|

|

($36,541)

|

|

($13,337)

|

|

Margins

|

(6%)

|

|

(1%)

|

|

(8%)

|

|

(2%)

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Diluted Loss Per Share

|

($0.08)

|

|

($0.03)

|

|

($0.40)

|

|

($0.15)

|

|

|

|

|

|

|

|

|

|

|

EBITDA (1)

|

$12,610

|

|

$27,683

|

|

$36,913

|

|

$79,867

|

|

Margins

|

10%

|

|

17%

|

|

8%

|

|

15%

|

Utilization

7

(1) Effective vessel utilization is calculated by dividing the total number of days the vessels generated revenues by the total number of days the vessels were

available for operation in each period excluding days in which the vessels were in drydock or taken out of service for upgrades.

available for operation in each period excluding days in which the vessels were in drydock or taken out of service for upgrades.

|

(The following statistics are for owned

and operated vessels only) |

|

|

Three Months

|

|

Twelve Months

|

||

|

|

Ended December 31,

|

|

Ended December 31,

|

||

|

|

2011

|

2010

|

|

2011

|

2010

|

|

Effective Utilization (1) -

|

|

|

|

|

|

|

Saturation Diving Vessels

|

47%

|

66%

|

|

56%

|

65%

|

|

Surface Diving Vessels

|

20%

|

46%

|

|

39%

|

51%

|

|

Construction Barges

|

32%

|

33%

|

|

25%

|

29%

|

|

Total Fleet

|

31%

|

47%

|

|

39%

|

47%

|

|

|

|

|

|

||

|

Calendar Day Utilization -

|

|

|

|

|

|

|

Saturation Diving Vessels

|

43%

|

64%

|

|

51%

|

61%

|

|

Surface Diving Vessels

|

20%

|

43%

|

|

37%

|

49%

|

|

|

|||||

|

Total Fleet

|

30%

|

46%

|

|

37%

|

45%

|

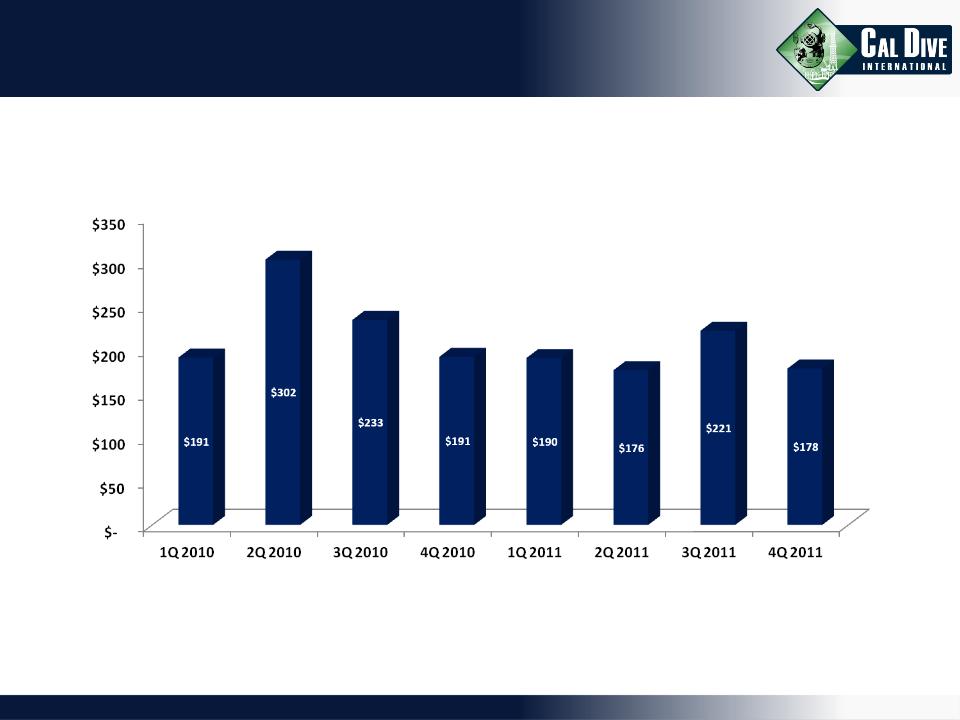

International Revenue

8

($ millions)

Debt Levels

9

(1) Calculated as Total Debt less Cash and Cash Equivalents.

(2) Calculated as Net Debt divided by Stockholders’ Equity plus Net Debt.

Liquidity

10

Cash at 12/31/2011:

$16 Million

$16 Million

*Revolver size temporarily steps

down to $75 million for 1Q12 and

then subsequently returns to $150

million.

down to $75 million for 1Q12 and

then subsequently returns to $150

million.

Non-GAAP Reconciliations

11

EBITDA Reconciliations

12

|

(all amounts in thousands)

|

|

|

Three Months

|

|

Twelve Months

|

||||

|

|

Ended December 31,

|

|

Ended December 31,

|

||||

|

|

2011

|

|

2010

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

EBITDA (unaudited)

|

$12,610

|

|

$27,683

|

|

$36,913

|

|

$79,867

|

|

|

|

|

|

|

|

|

|

|

Less: Depreciation & Amortization

|

15,524

|

|

17,008

|

|

66,692

|

|

68,961

|

|

Less: Non-Cash Stock Comp. Expense

|

2,400

|

|

2,061

|

|

9,563

|

|

7,427

|

|

Less: Interest Expense, net

|

2,815

|

|

2,225

|

|

9,227

|

|

9,060

|

|

Less: Income Tax Expense (Benefit)

|

(919)

|

|

8,680

|

|

(19,871)

|

|

(5,443)

|

|

Less: Non-Cash Goodwill Impairment Charge

|

-

|

|

-

|

|

-

|

|

292,469

|

|

Less: Non-Cash Fixed Asset Impairment Charge

|

1,561

|

|

91

|

|

38,199

|

|

23,242

|

|

Net Loss

|

($8,771)

|

|

($2,382)

|

|

($66,897)

|

|

($315,849)

|