Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GAIN Capital Holdings, Inc. | d307544d8k.htm |

| EX-99.1 - PRESS RELEASE - GAIN Capital Holdings, Inc. | d307544dex991.htm |

4

th

Quarter and Full Year 2011

Financial and Operating Results

February 28, 2012

Exhibit 99.2 |

Special Note Regarding Forward-Looking Information

In addition to historical information, this presentation contains

"forward-looking" statements that reflect management's

expectations for the future. A variety of important factors could cause

results to differ materially from such statements. These factors are noted

throughout GAIN Capital’s annual report on Form 10-K, as filed with the Securities

and Exchange Commission on March 30, 2011, and include, but are not limited to, the

actions of both current and potential new competitors, fluctuations in

market trading volumes, financial market volatility, evolving industry

regulations, errors or malfunctions in our systems or technology, rapid

changes in technology, effects of inflation, customer trading patterns, the

success of our products and service offerings, our ability to continue to

innovate and meet the demands of our customers for new or enhanced products, our

ability to successfully integrate assets and companies we have acquired, changes in

tax policy or accounting rules, fluctuations in foreign exchange rates,

adverse changes or volatility in interest rates, as well as general

economic, business, credit and financial market conditions, internationally

or nationally, and our ability to continue paying a quarterly dividend in

light of future financial performance and financing needs. The

forward-looking statements included herein represent GAIN Capital’s views

as of the date of this presentation. GAIN Capital undertakes no obligation

to revise or update publicly any forward-looking statement for any

reason unless required by law. 2 |

Overview

Glenn Stevens, CEO |

4

th

Quarter and FY 2011 Results Overview

4

•

Q4 2011 Financial Results

•

Net Revenue: $31.6 million

•

EBITDA

(1)

: ($3.1) million

•

Net Income: ($3.3) million

•

Adjusted Net Income

(2)

: ($1.6) million

•

FY 2011 Financial Summary

•

Net Revenue: $181.5 million

•

EBITDA

(1)

: $36.6 million (20.1% margin)

•

Net Income: $15.7 million (8.7% margin)

•

Adjusted Net Income

(2)

: $21.7 million (12.0% margin)

•

EPS (Diluted): $0.40

•

Adjusted EPS (Diluted)

(3)

: $0.56

•

Operating Metrics

(4)

•

Total trading volume up 62% to $2.5 trillion

•

Retail volume increased 19% to $1.6 trillion

•

Institutional volume increased 298% to $953.6 billion

•

Client assets up 21% to $310.4 million as of December 31, 2011

(Comparisons are referenced to FY 2010)

(1) EBITDA is a non-GAAP financial measure that represents our earnings

before interest, taxes, depreciation and amortization. A reconciliation of net income to EBITDA and EBITDA margin is available

in the appendix to this presentation.

(2) Adjusted net income is a non-GAAP financial measure that prior

to the closing of our initial public offering in December 2010 represented our net income/(loss) excluding the change in fair value of the

embedded derivative in our

preferred stock and purchase intangible amortization. With the consummation of our IPO, all outstanding shares of our preferred stock converted into common stock and in

2011 and in future periods adjusted net income no longer reflects an adjustment related to the embedded

derivative. A reconciliation of net income to adjusted net income and adjusted net income

margin is available in the appendix to this

presentation. (3) Reconciliation of EPS to adjusted EPS is available in

the appendix to this presentation. (4) Definitions for all our operating

metrics are available in the appendix to this presentation. |

Recent

Developments – Retail

•

Launch of new German market offering

–

Fastest growing European market for Forex and CFD trading

•

New strategic partnerships

–

Asia, Middle East and North America

•

Continued momentum in mobile trading

–

412% year-over-year volume growth

–

Strong take-up of iPad app

•

14% of mobile volume in December, three months post-launch

5 |

Recent

Developments – Institutional

•

Strategic Asian partnerships

–

Provide liquidity and credit & matching services to Asian exchange

–

Launch a new national electronic dealing service in China

•

Exclusive agreement with one of the largest independent energy

brokers for cross-distribution of energy and forex services

•

Product enhancement

–

Basket trading

–

Meta-bridge

–

Streaming Non-Deliverable Forwards (NDF)

6 |

2011

FY Highlights Retail

•

–

China

regulatory

approval,

new

office

in

Beijing,

Korea

partnerships,

growth

in

Japan,

enhanced Middle East

offering and presence

•

Transparency Initiatives

–

Introduced Monthly Execution Scorecard

–

Enhanced with 3rd party Pricing Comparison

•

Product Enhancements

–

Expanded mobile offering (iPhone, iPad and Android), new FOREXTrader Pro active

trader platform and broadened CFD offering (commodities, global

indices) •

Acquisition

–

dbFX (Deutsche Bank’s retail FX business)

Institutional

•

Momentum

–

298% year-over-year trading volume increase

•

Service Enhancements

–

GTX Direct offering, Agency Execution Desk

•

Product Enhancements

–

Metals & NDF Trading

7

Global Expansion |

Financial and Operating Metric Review

Daryl Carlough, Interim CFO |

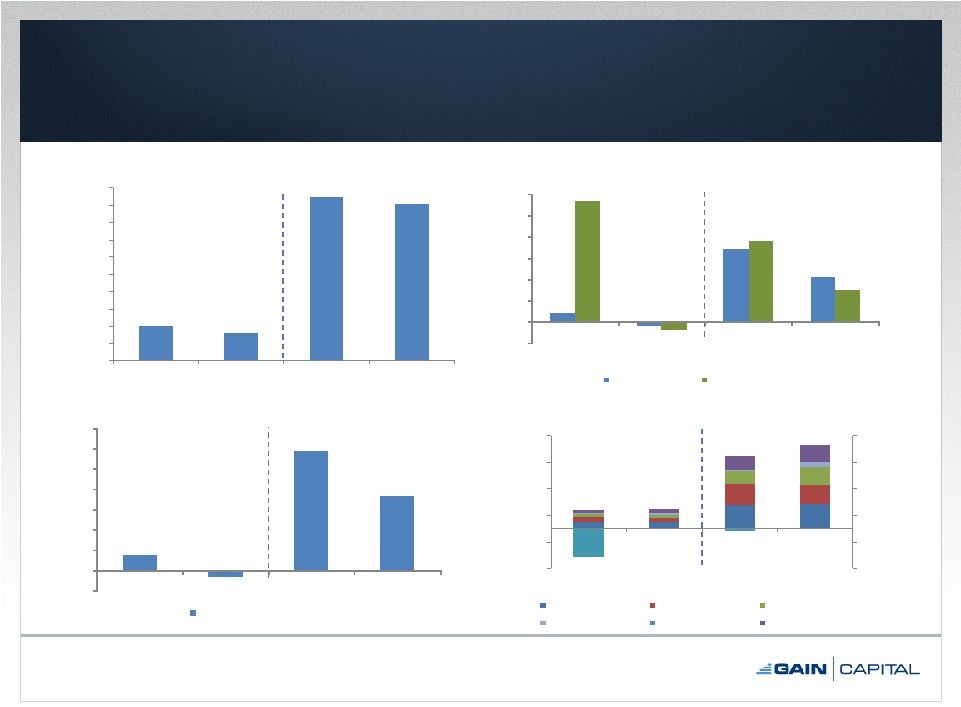

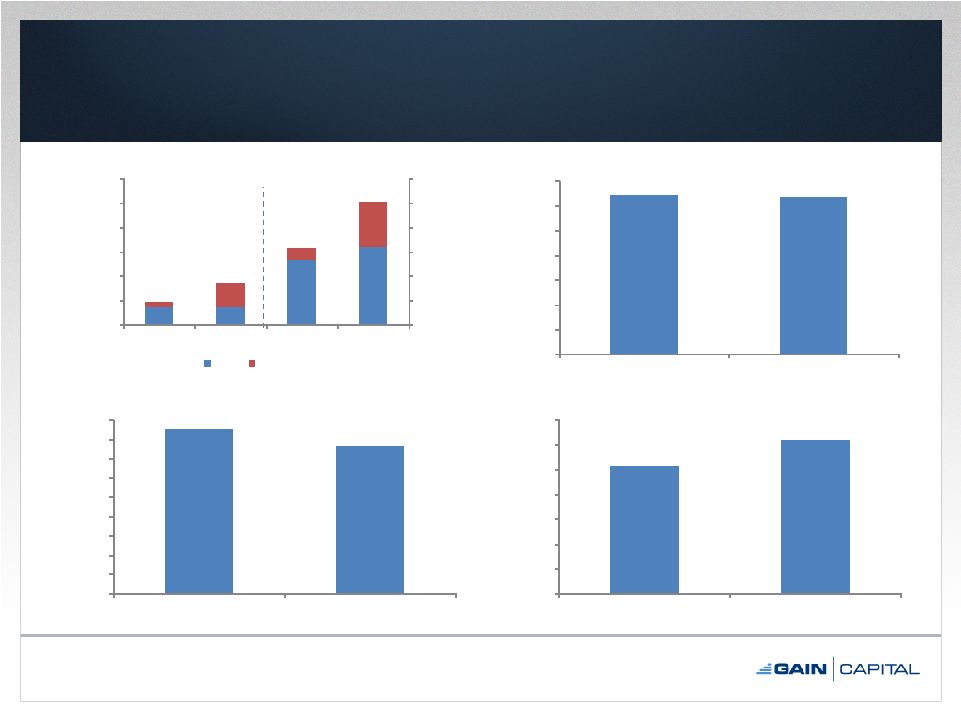

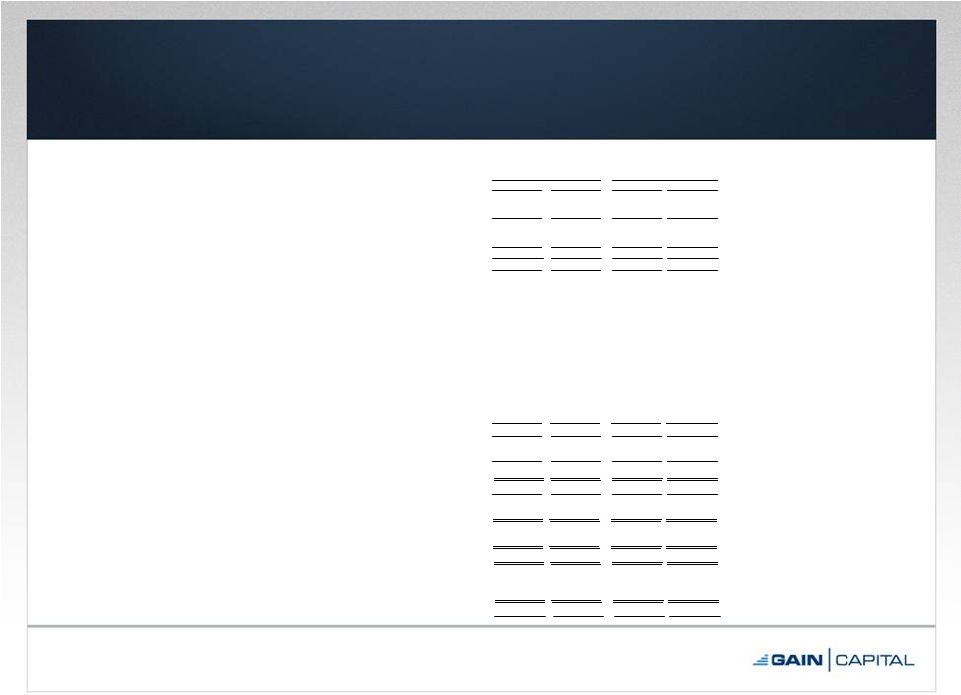

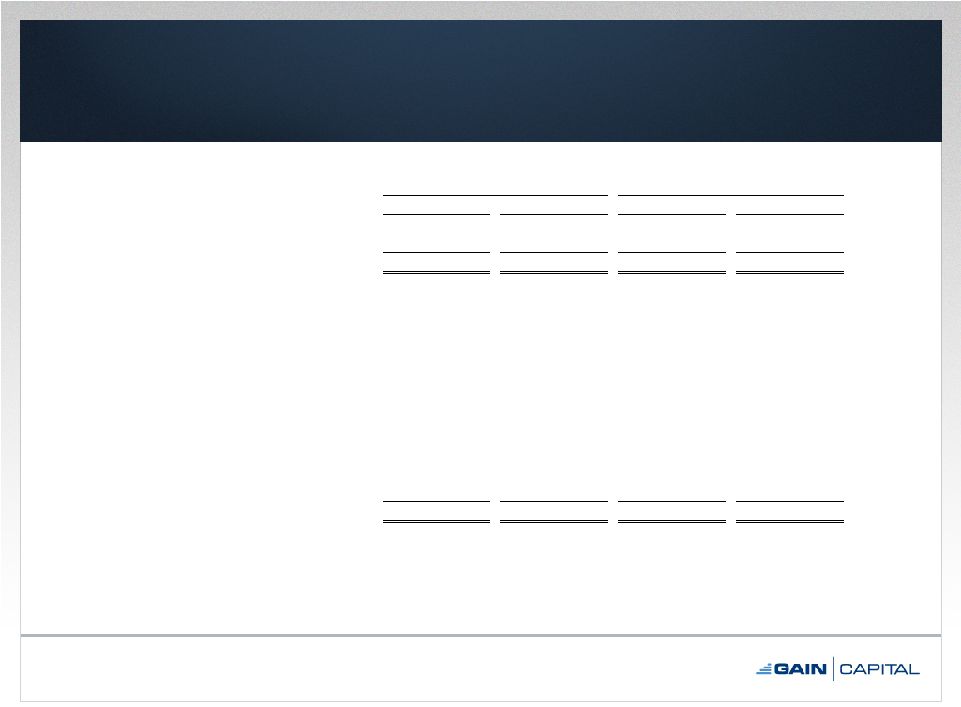

($17.7)

$38.3

$131.7

$158.2

($75.0)

($25.0)

$25.0

$75.0

$125.0

$175.0

($75.0)

($25.0)

$25.0

$75.0

$125.0

$175.0

2010

2011

2010

2011

Total Expenses

Comp & Benefits

Marketing

Trading

Purchase Intangible Amort.

Embedded Derivative

All Other

$40.9

$31.6

$189.1

$181.5

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

2010

2011

2010

2011

Net Revenue

Financial Results

9

Q4

FY

Q4

FY

Q4

FY

Q4

FY

$7.2

($3.1)

$58.5

$36.6

($10.0)

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

2010

2011

2010

2011

EBITDA (Adjusted EBITDA in 2010)

(2)(3)

EBITDA/Adjusted EBITDA

$4.0

($1.6)

$33.9

$21.7

$56.8

($3.3)

$37.8

$15.7

(10.0)

-

10.0

20.0

30.0

40.0

50.0

60.0

2010

2011

2010

2011

GAAP & Adjusted Net Income

(1)

Adjusted Net Income

GAAP Net Income

Note: Dollars in millions.

(1) Reconciliation of net income to

adjusted net income available in appendix.

(2) Adjusted EBITDA is a non-GAAP

financial measure that prior to the closing of our initial public offering in December 2010 represented our earnings before interest, taxes, depreciation and amortization and

excluded the change in fair

value of the embedded derivative in our preferred stock. With the consummation of our IPO, all outstanding shares of our preferred stock converted into common stock. Accordingly,

in 2011 we no longer adjusted EBITDA for

the embedded derivative. A reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation.

(3) EBITDA is a non-GAAP financial

measure that represents our earnings before interest, taxes, depreciation and amortization. A reconciliation of net income to EBITDA is available in the appendix to this

presentation. |

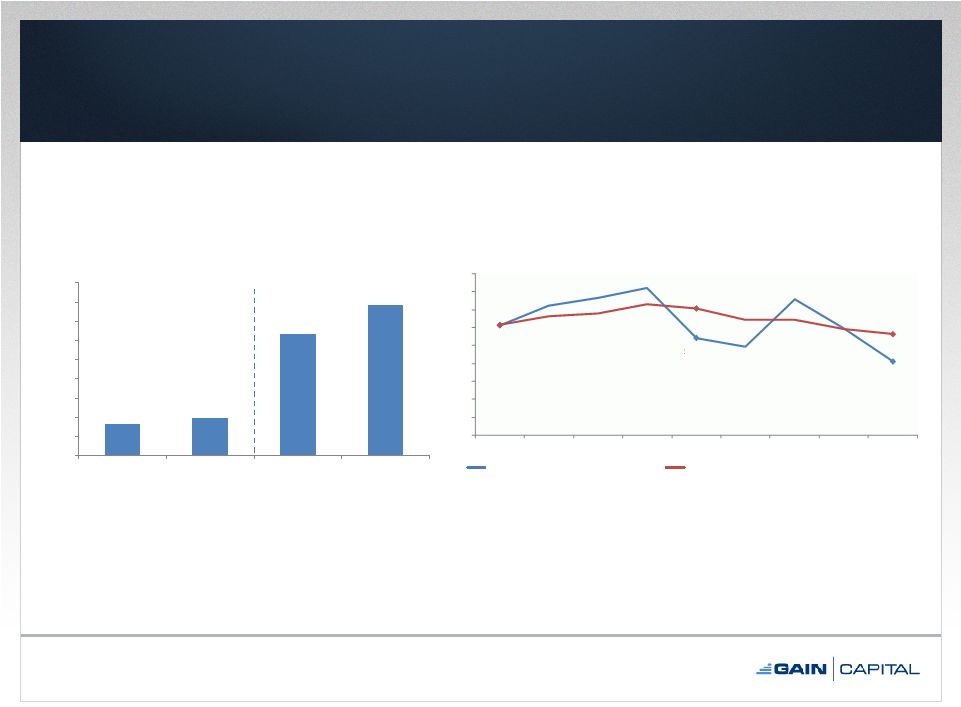

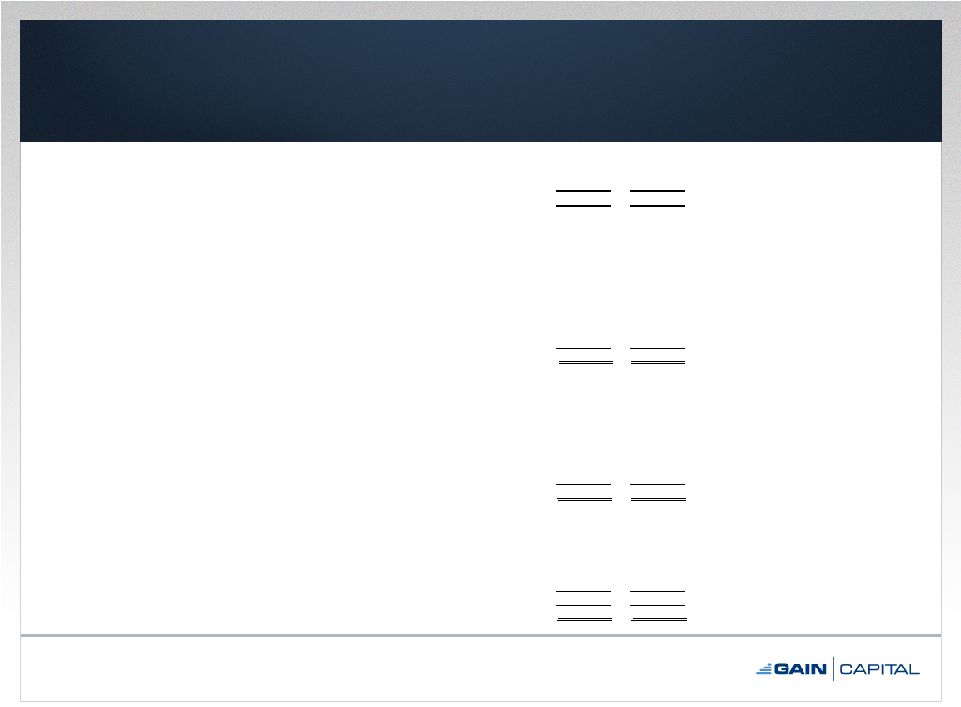

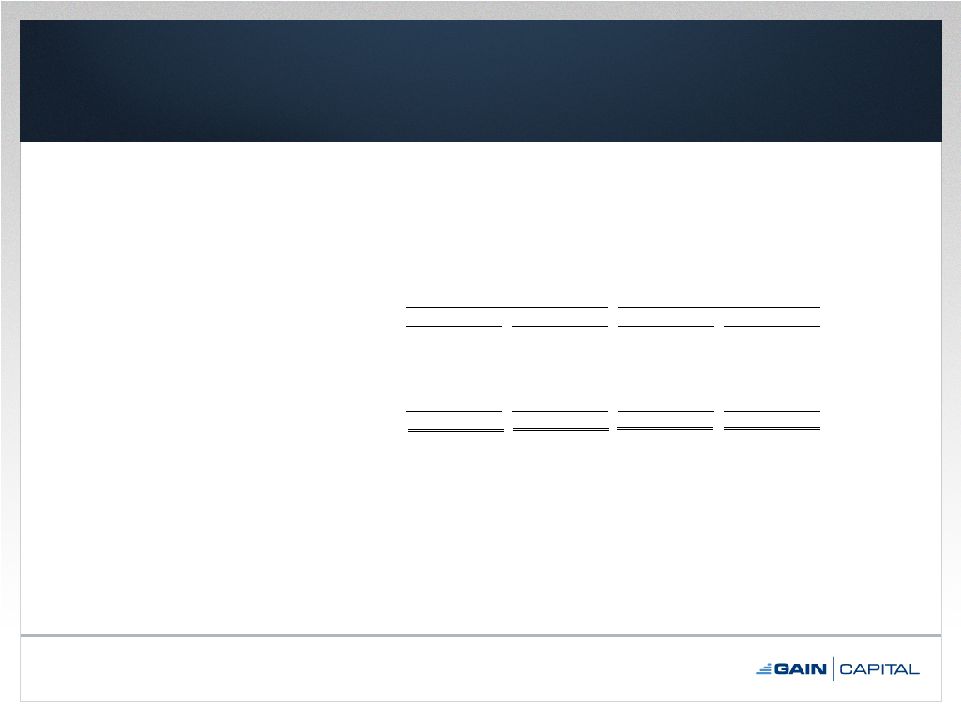

Operating Metrics

(1)

10

Note: Trading volume in billions. Client assets in millions.

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. (2)

For periods ending December 31.

(3)

As of December 31.

Q4

FY

Traded Retail Accounts

(2)

$366.3

$366.4

$1,324.8

$1,574.0

$103.9

$486.2

$239.3

$953.6

$470.2

$852.6

$1,564.1

$2,527.6

$0.0

$500.0

$1,000.0

$1,500.0

$2,000.0

$2,500.0

$3,000.0

$0.0

$500.0

$1,000.0

$1,500.0

$2,000.0

$2,500.0

$3,000.0

2010

2011

2010

2011

Retail

Institutional

Total

Trading

Volume

(2)

64,313

63,436

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2010

2011

85,562

76,485

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

2010

2011

Funded Retail Accounts

(3)

$256.7

$310.4

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

2010

2011

Client Assets

(3) |

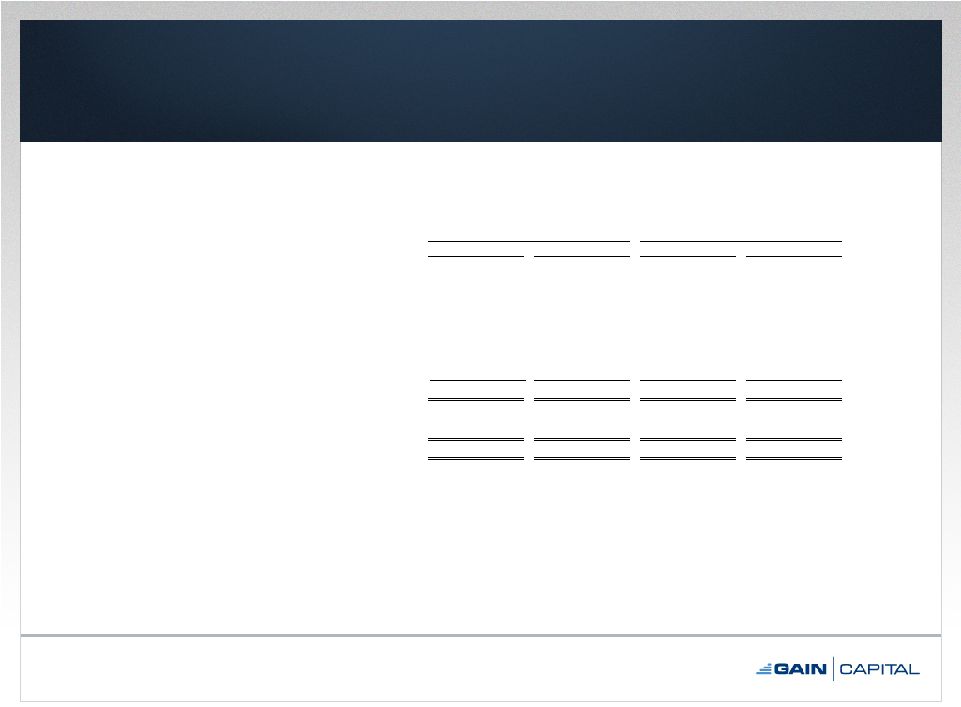

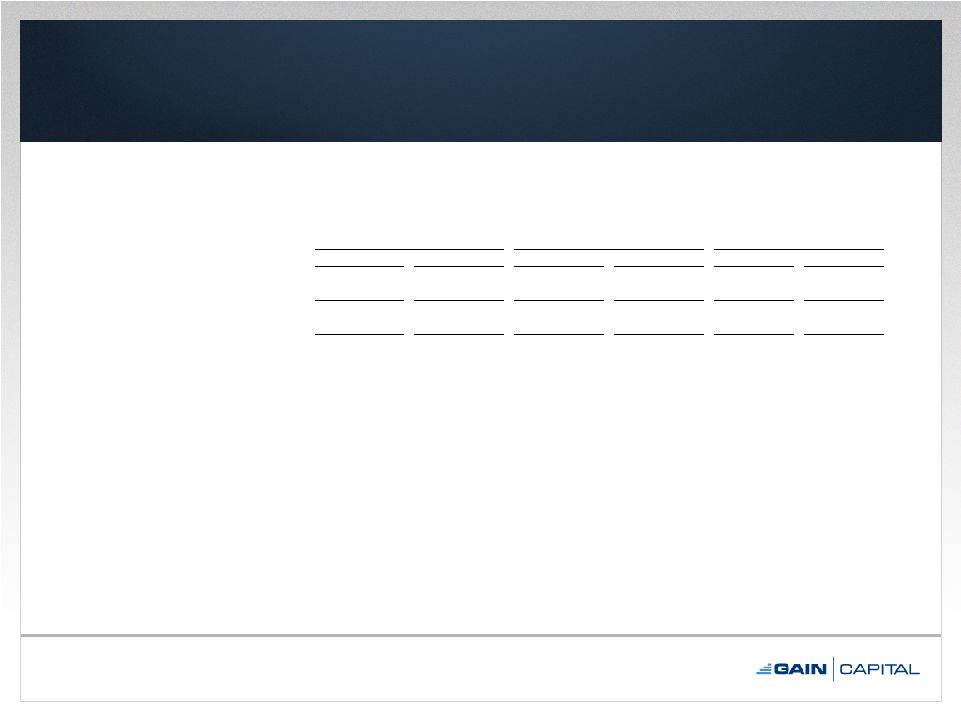

Operating

Metrics

(cont.)

(1)

11

Note: Trades in millions.

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. (2)

For periods ending December 31.

Q4

FY

8.2

9.9

31.7

39.2

-

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

45.0

2010

2011

2010

2011

Trades

(2)

$122.6

$108.5

$81.3

$123.0

$141.5

$111.7

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Retail Trading Revenue per Million

Retail Trading Revenue per Million (Quarterly)

Retail Trading Revenue per Million (Last Twelve Months) |

Strong Liquidity and Capital Allocation

•

Strong cash position

–

$80mm

of

excess

net

capital

(1)

–

$50mm available under revolver

•

$0.05 per share quarterly dividend approved

–

Record Date: March 13

–

Payment Date: March 22

12

(1)

As of February 27, 2012. |

Looking Ahead –

2012

•

Retail Product Expansion

–

Expanded CFD offering for international markets

•

Large market opportunity: $1.3 billion per annum (Europe & Australia

alone) –

Social trading initiatives

•

Geographic Expansion

–

Middle East: Local presence in 2012

–

Japan: Increased GAIN GTX penetration; capitalizing on market

consolidation

13 |

Appendix |

Condensed Consolidated Statements of Operations

15

2011

2010

2011

2010

Revenue

Trading revenue

29.8

$

39.7

$

175.9

$

187.4

$

Other revenue

1.8

1.5

6.4

3.4

Total non-interest revenue

31.6

41.2

182.3

190.8

Interest revenue

0.3

0.1

0.6

0.4

Interest expense

(0.3)

(0.4)

(1.4)

(2.1)

Total net interest revenue (expense)

-

(0.3)

(0.8)

(1.7)

Net revenue

31.6

40.9

181.5

189.1

Expenses

Employee compensation and benefits

11.5

11.4

46.4

45.4

Selling and marketing

8.2

10.0

36.2

37.7

Trading expenses and commissions

7.5

7.1

33.0

25.7

Bank fees

0.8

1.0

4.2

4.2

Depreciation and amortization

1.0

0.9

3.9

3.4

Purchase intangible amortization

2.5

1.2

8.9

1.2

Communications and data processing

0.8

0.7

2.9

3.0

Occupancy and equipment

1.2

1.1

4.7

4.1

Bad debt provision

0.1

0.1

0.9

0.6

Professional fees

1.4

0.4

5.2

2.0

Product development, software and maintenance

1.2

1.0

4.2

3.5

Change in fair value of convertible, redeemable preferred stock embedded

derivative

(1)

-

(53.6)

-

(4.7)

Other

2.1

1.0

7.7

5.6

Total

38.3

(17.7)

158.2

131.7

Income / (loss) before tax expense

(6.7)

58.6

23.3

57.4

Income tax expense / (benefit)

(3.4)

1.8

7.6

20.0

Net Income / (loss)

(3.3)

$

56.8

$

15.7

$

37.4

$

Net loss applicable to noncontrolling interest

-

-

-

(0.4)

Net income / (loss) applicable to GAIN

Capital Holdings, Inc.

(3.3)

$

56.8

$

15.7

$

37.8

$

Earnings / (loss) per common share

(2)

:

Basic

(0.10)

$

6.62

$

0.46

$

8.62

$

Diluted

(0.10)

$

1.44

$

0.40

$

1.00

$

Weighted average common shares outstanding used

in computing earnings per common share

(2)

:

Basic

34,205,991

8,570,387

34,286,840

4,392,798

Diluted

34,205,991

39,347,111

38,981,792

37,742,902

(unaudited)

December 31,

December 31,

Three Months Ended

Twelve Months Ended

In millions, except per share data

(1)

For the periods prior to the closing of our initial public offering in December 2010, in accordance

with Financial Accounting Standards Board Accounting Standards Codification 815, Derivatives and Hedging,

we accounted for an embedded derivative liability attributable to the redemption feature of our

previously outstanding preferred stock. This redemption feature and the associated embedded derivative liability

was no longer required to be recognized following the conversion of all of our preferred stock into

common stock in connection with the completion of our initial public offering in December 2010 (the “IPO”).

(2)

In connection with our IPO, our board of directors approved a 2.29-for-1 stock split of our

common stock to be effective immediately prior to the completion of the IPO. The 2.29-for-1 stock split, after

giving effect to the receipt by us of 407,692 shares of common stock from all of our pre-IPO common

stockholders (on a pro-rata basis) in satisfaction of previously outstanding obligations owed by such

stockholders to us, resulted in an effective stock split of 2.26-for-1. Accordingly, all

references to share and per share data have been retroactively restated for the three and twelve months ended

December 31, 2010 to reflect the effective 2.26-for-1 stock split.

|

Consolidated Balance Sheet

16

December 31,

December

31,

2011

2010

ASSETS:

Cash and cash equivalents

$

370.7

$

284.2

Short term investments

0.1

0.1

Trading securities

–

20.1

Receivables from brokers

85.4

98.1

Property and equipment, net

7.5

7.3

Prepaid assets

9.9

9.9

Goodwill

3.1

3.1

Intangible assets, net

10.8

9.1

Other assets, net

18.1

11.2

Total assets

$

505.6

$

443.1

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to brokers, dealers, FCMs and other regulated entities

$

17.3

$

6.1

Payables to customers

293.1

250.6

Accrued compensation and benefits

4.9

5.1

Accrued expenses and other liabilities

14.9

10.5

Income tax payable

2.6

2.6

Notes payable

7.9

18.4

Total liabilities

340.7

293.3

Shareholders' equity

Common Stock

–

–

Accumulated other comprehensive income

0.3

0.4

Additional paid-in capital

79.6

73.4

Treasury stock, at cost (850,121 shares at December 31, 2011 and

zero shares at December 31, 2010)

(5.0)

–

Retained earnings

90.0

76.0

Total shareholders' equity

164.9

149.8

Total liabilities and shareholders' equity

$

505.6

$

443.1

In millions, except share data

(unaudited) |

Adjusted Net Income / Margin Reconciliation

17

Note: Dollars in millions, except per share data.

(1)

In

connection

with

our

IPO,

our

board

of

directors

approved

a

2.29-for-1

stock

split

of

our

common

stock

to

be

effective

immediately

prior

to

the

completion

of

the

IPO.

The

2.29-for-1

stock

split,

after

giving

effect

to

the

receipt

by

us

of

407,692

shares

of

common

stock

from

all

of

our

pre-IPO

common

stockholders

(on

a

pro-rata

basis)

in

satisfaction

of

previously

outstanding

obligations

owed

by

such

stockholders

to

us,

resulted

in

an

effective

stock

split

of

2.26-for-1.

Accordingly,

all

references

to

share

and

per

share

data

have

been

retroactively restated for the three and twelve months ended December 31, 2010 to

reflect the effective 2.26-for-1 stock split. Three Months Ended December

31,Twelve Months Ended December 31, 2011

2010

2011

2010

Net Revenue

31.6

$

40.9

$

181.5

$

189.1

$

Net income/(loss) applicable to GAIN

Capital Holdings, Inc.

(3.3)

56.8

15.7

37.8

Change in fair value of convertible,

redeemable preferred stock embedded

derivative

–

(53.6)

–

(4.7)

Plus: Purchase intangible amortization (net of tax)

1.7

0.8

6.0

0.8

Adjusted Net Income/(Loss)

(1.6)

$

4.0

$

21.7

$

33.9

$

Adjusted Earnings/(Loss) per Share

(1)

Basic

(0.05)

$

0.45

$

0.63

$

7.72

$

Diluted

(0.05)

$

0.10

$

0.56

$

0.90

$

Net Income Margin %

(10.4%)

138.9%

8.7%

20.0%

Adjusted Net Income Margin %

(5.1%)

9.8%

12.0%

17.9% |

EBITDA/Adjusted EBITDA / Margin Reconciliation

18

Note: Dollars in millions.

(1)

EBITDA is not adjusted in 2011 because the embedded derivative relating to our

previously outstanding preferred stock was extinguished in connection with our IPO.

Three Months Ended December 31,

Twelve Months Ended December 31,

2011

2010

2011

2010

Net Revenue

31.6

$

40.9

$

181.5

$

189.1

$

Interest on Note Payable

0.1

0.2

0.5

1.1

Net Revenue (ex. Interest on Note)

31.7

$

41.1

$

182.0

$

190.2

$

Net income/(loss) applicable to GAIN

Capital Holdings, Inc.

(3.3)

$

56.8

$

15.7

$

37.8

$

Change in fair value of convertible,

redeemable preferred stock embedded

derivative

–

(53.6)

–

(4.7)

Plus: Depreciation & amortization

1.0

0.9

3.9

3.4

Plus: Purchase intangible amortization

2.5

1.2

8.9

1.2

Plus: Interest expense of note payable

0.1

0.2

0.5

1.1

Plus/(Less): Income tax expense/(benefit)

(3.4)

1.8

7.6

20.0

Less: Net loss applicable to

non-controlling interest

–

–

–

(0.4)

EBITDA/Adjusted

EBITDA

(1)

(3.1)

$

7.2

$

36.6

$

58.5

$

EBITDA/Adjusted

EBITDA

Margin

%

(1)

(9.8%)

17.5%

20.1%

30.8% |

Adjusted EPS (Diluted) Reconciliation

19

(1)

Net of tax.

(2)

In connection with our IPO, our board of directors approved a 2.29-for-1

stock split of our common stock to be effective immediately prior to the completion of the IPO. The 2.29-for-1

stock

split,

after

giving

effect

to

the

receipt

by

us

of

407,692

shares

of

common

stock

from

all

of

our

pre-IPO

common

stockholders

(on

a

pro-rata

basis)

in

satisfaction

of

previously

outstanding

obligations

owed

by

such

stockholders

to

us,

resulted

in

an

effective

stock

split

of

2.26-for-1.

Accordingly,

all

references

to

share

and

per

share

data

have

been

retroactively restated for the three and twelve months ended December 31, 2010 to

reflect the effective 2.26-for-1 stock split. Three Months Ended December

31, Twelve

Months

Ended

December

31,

2011

2010

2011

2010

GAAP Earnings per Share (Diluted)

(0.10)

$

1.44

$

0.40

$

1.00

$

Change in fair value of convertible,

redeemable preferred stock embedded

derivative

–

(1.36)

–

(0.12)

Plus: Purchase intangible amortization

(1)

0.05

0.02

0.16

0.02

Adjusted Earnings per Share (Diluted)

(2)

(0.05)

$

0.10

$

0.56

$

0.90

$

|

Q4

& Full Year 2011 Financial Summary 20

Note: Dollars in millions, except per share data.

(1)

See page 18 for a reconciliation of GAAP net income to adjusted EBITDA. EBITDA

is not adjusted in 2011 since the embedded derivative relating to our previously

outstanding preferred stock was extinguished in connection with our IPO.

(2)

See page 17 for a reconciliation of GAAP net income to adjusted net income.

(3)

See page 19 for a reconciliation of GAAP EPS to adjusted EPS.

3 Mos. Ended December 31,

12 Mos. Ended December 31,

'11 v '10 % Change

2011

2010

2011

2010

Q4

FY

Net Revenue

$31.6

$40.9

$181.5

$189.1

(23%)

(4%)

Interest Expense on Note Payable

0.1

0.2

0.5

1.1

(45%)

(51%)

Net Revenue (ex. Interest on Note)

$31.7

$41.1

$182.0

$190.2

(23%)

(4%)

Operating Expenses

34.8

$33.9

145.4

131.7

3%

10%

EBITDA/Adjusted

EBITDA

(1)

($3.1)

$7.2

$36.6

$58.5

(143%)

(37%)

GAAP Net Income

($3.3)

$56.8

$15.7

$37.8

(106%)

(58%)

Adjusted

Net

Income

(2)

(1.6)

4.0

21.7

33.9

(140%)

(36%)

GAAP EPS (Diluted)

($0.10)

$1.44

$0.40

$1.00

(107%)

(60%)

Adjusted

EPS

(Diluted)

(3)

($0.05)

$0.10

$0.56

$0.90

(150%)

(38%)

EBITDA/Adjusted

EBITDA

Margin

%

(1)

(9.8%)

17.5%

20.1%

30.8%

NA

(11 pts)

Net Income Margin %

(10.4%)

138.9%

8.7%

20.0%

NA

(12 pts)

Adjusted

Net

Income

Margin

%

(2)

(5.1%)

9.8%

12.0%

17.9%

NA

(6 pts) |

Q4

& Full Year 2011 Operating Metrics 21

Note: Dollars in millions, except retail trading revenue per million.

(1)

Average calculated using excess net capital balance at each month-end during the

relevant period. 4th Quarter

Full Year

'11 v '10 % Change

2011

2010

2011

2010

Q4

FY

For Period Ending December 31,

Total Trading Volume (billions)

$852.6

$470.2

$2,527.6

$1,564.1

81%

62%

Retail

366.4

366.3

1,574.0

1,324.8

0%

19%

Institutional

486.2

103.9

953.6

239.3

368%

298%

Traded Retail Accounts (Period)

34,019

36,241

63,436

64,313

(6%)

(1%)

Traded Retail Accounts (Last 12 Months)

63,436

64,313

63,436

64,313

(1%)

(1%)

New Retail Accounts

6,897

8,924

31,661

38,417

(23%)

(18%)

Net Deposits from Retail Customers

$43.3

$61.4

$233.2

$267.8

(29%)

(13%)

Trades

9,852,951

8,161,012

39,192,219

31,747,019

21%

23%

Retail Trading Revenue per Million

$81.3

$108.5

$111.7

$141.5

(25%)

(21%)

Average Excess Net Capital

(1)

$57.8

$69.5

$56.0

$63.3

(17%)

(11%)

As of December 31,

Funded Retail Accounts

76,485

85,562

76,485

85,562

(11%)

(11%)

Client Assets

$310.4

$256.7

$310.4

$256.7

21%

21% |

Monthly Operating Metrics

(1)

22

Note: Dollars in millions.

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. (2)

As of period ended.

(3)

For period ended.

(4)

Excludes 1,650 accounts from GAIN Capital’s acquisition of dbFX.

Funded

New Retail

Client

Month

Retail Accts.

(2)

Accounts

(3)

Assets

(2)

Jan 2011

86,236

2,902

$277.0

Feb 2011

87,049

2,874

286.3

Mar 2011

85,698

3,132

283.0

Apr 2011

80,915

2,801

239.2

May 2011

79,623

2,775

(4)

290.8

Jun 2011

78,379

2,428

293.1

Jul 2011

78,082

2,350

283.4

Aug 2011

77,140

2,886

303.7

Sep 2011

77,013

2,616

286.4

Oct 2011

76,496

2,372

311.8

Nov 2011

76,647

2,330

319.3

Dec 2011

76,485

2,195

310.4

|

Quarterly Operating Metrics

(1)

23

Note: For period ended. Volume in billions. Net deposits in

millions. (1)

Definitions for all our operating metrics are available in the appendix to this

presentation. Net Deposits

Volume

Traded Retail

From Retail

Quarter

Retail

Institutional

Accts. (Period)

Customers

Trades

Q1 11

$402.5

$110.1

36,570

$60.7

9,025,828

Q2 11

357.2

97.4

36,868

64.3

9,363,640

Q3 11

447.9

260.0

36,927

64.8

10,949,800

Q4 11

366.4

486.2

34,019

43.3

9,852,951 |

Definition of Metrics

•

Total Trading Volume

–

Represents the U.S. dollar equivalent of notional amounts traded

•

Traded Retail Accounts

–

Retail accounts who executed a transaction during a given period

•

Funded Retail Accounts

–

Retail accounts who maintain a cash balance

•

Client Assets

–

Represents amounts due to clients, including customer deposits and unrealized

gains or losses arising from open positions

•

New Retail Accounts

–

The number of customer accounts that have initially opened and funded their

accounts •

Net Deposits from Retail Customers

–

Represents

customers’

deposits

less

withdrawals

for

a

given

period

•

Trades

–

The

number

of

transactions

retail

customers

have

completed

for

a

given

period

•

Retail Trading Revenue per Million

–

The revenue we realize from our forex, CFDs and metals trading activities per one

million of U.S. dollar-equivalent trading volume

•

Excess Net Capital

–

Represents the excess funds held over the regulatory minimum capital requirements,

as defined by the regulatory bodies that regulate our operating

subsidiaries 24 |

4

th

Quarter and Full Year 2011

Financial and Operating Results

February 28, 2012 |