Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYNEX CAPITAL INC | form8-kearningsreleaseq420.htm |

| EX-99.1 - Q4 EARNINGINGS PRESS RELEASE - DYNEX CAPITAL INC | q411pressrelease.htm |

Dynex Capital, Inc. Fourth Quarter 2011 Earnings Conference Call February 22, 2012

2 Safe Harbor Statement NOTE: This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about projected future investment strategies and leverage ratios, financial performance, the projected impact of NOL carryforwards, future dividends paid to shareholders, and future investment opportunities and capital raising activities. The words “will,” “believe,” “expect,” “forecast,” “anticipate,” “intend,” “estimate,” “assume,” “project,” “plan,” “continue,” and similar expressions also identify forward-looking statements that are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Although these forward- looking statements reflect our current beliefs, assumptions and expectations based on information currently available to us, the Company’s actual results and timing of certain events could differ materially from those projected in or contemplated by these statements. Our forward-looking statements are subject to the following principal risks and uncertainties: our ability to find suitable reinvestment opportunities; changes in economic conditions; changes in interest rates and interest rate spreads, including the repricing of interest-earnings assets and interest-bearing liabilities; our investment portfolio performance particularly as it relates to cash flow, prepayment rates and credit performance; adverse reactions in financial markets related to the budget deficit or national debt of the United States government; potential or actual default by the United States government on Treasury securities; and potential or actual downgrades to the sovereign credit rating of the United States or the credit ratings of GSEs; the cost and availability of financing; the cost and availability of new equity capital; changes in our use of leverage; the quality of performance of third-party service providers of our loans and loans underlying our securities; the level of defaults by borrowers on loans we have securitized; changes in our industry; increased competition; changes in government regulations affecting our business; government initiatives to support the U.S financial system and U.S. housing and real estate markets; GSE reform or other government policies and actions; and an ownership shift under Section 382 of the Internal Revenue Code that impacts the use of our tax NOL carryforward. For additional information, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2011, June 30, 2011, and September 30, 2011 and other reports filed with and furnished to the Securities and Exchange Commission.

3 Fourth Quarter 2011 Highlights • Reported diluted earnings per common share of $0.36 • Reported book value per common share of $9.20 • Generated a net interest spread of 2.56% • Declared a dividend of $0.28 per share, representing a 12.3% yield on an annualized basis (1) • Generated an annualized return on average equity of 15.6% • Overall leverage of 6.0x equity capital • Constant prepayment rate (CPR) of 17.8% (1) Based on the December 30, 2011 closing price of $9.13 per share. See the Company’s press release issued February 21, 2012 for further discussion.

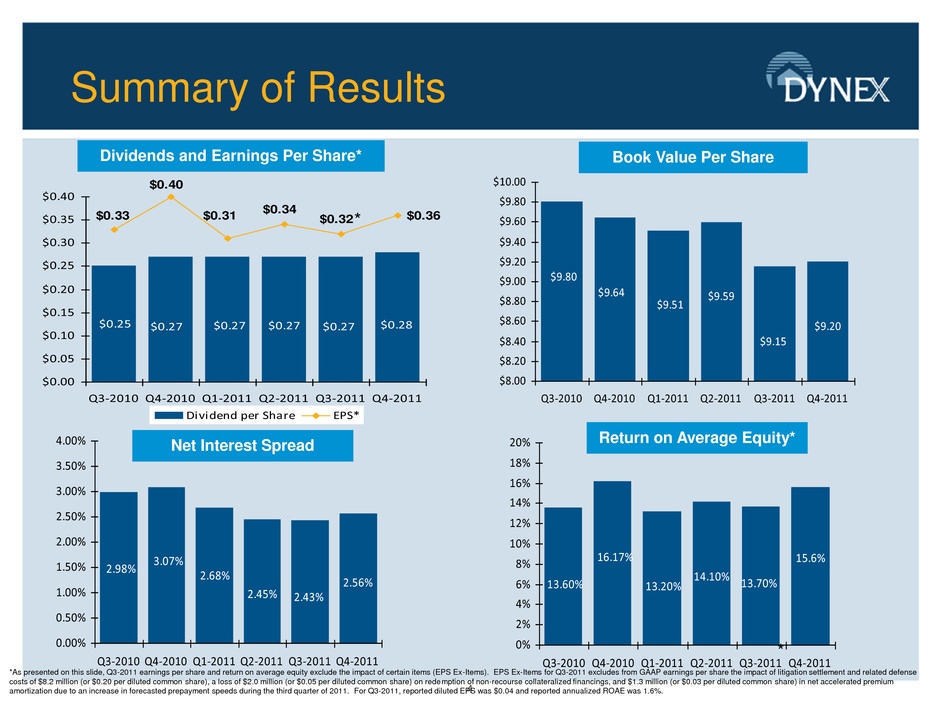

4 Summary of Results $0.28$0.25 $0.27 $0.27 $0.27 $0.27 $0.36 $0.34 $0.32$0.31 $0.40 $0.33 $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 Q3-2010 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Dividend per Share EPS* Dividends and Earnings Per Share* $9.20 $9.80 $9.64 $9.51 $9.59 $9.15 $8.00 $8.20 $8.40 $8.60 $8.80 $9.00 $9.20 $9.40 $9.60 $9.80 $10.00 Q3-2 10 Q4-2010 Q1-20 1 Q2-201 Q3-2 Q4-2011 Book Value Per Share 2.43%2.45% 2.68% 3.07% 2.98% 2.56% 0.00% 0.50% 1.00% 1.5 % 2.0 % 2.50% 3.00% 3.50% 4.00% Q3-2010 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 15.6% 13.60% 16.17% 13.20% 14.10% 3.70% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% Q3-2010 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Net Interest Spread Return on Average Equity* *As presented on this slide, Q3-2011 earnings per share and return on average equity exclude the impact of certain items (EPS Ex-Items). EPS Ex-Items for Q3-2011 excludes from GAAP earnings per share the impact of litigation settlement and related defense costs of $8.2 million (or $0.20 per diluted common share), a loss of $2.0 million (or $0.05 per diluted common share) on redemption of non-recourse collateralized financings, and $1.3 million (or $0.03 per diluted common share) in net accelerated premium amortization due to an increase in forecasted prepayment speeds during the third quarter of 2011. For Q3-2011, reported diluted EPS was $0.04 and reported annualized ROAE was 1.6%. * *

5 Investment Portfolio Review • Our portfolio is constructed to perform well despite volatile markets as we have focused on high credit quality short duration assets. • We continue to maintain a selective approach to adding assets to help minimize prepayment risk. • We opportunistically allocated our prior capital raises between Agency and non-Agency securities backed by both residential and commercial loans. • As spreads widened in 2011 we rotated our marginal investments into the CMBS sector with our main focus on the multi-family marketplace. • There is a great opportunity to grow this strategy further as CMBS spreads continue to be attractive and agency securities offer mid-teens returns. • We have confidence in our risk profile as we have steadily generated double-digit returns without extending far out of the risk spectrum. • The DX portfolio has weathered multiple market challenges since 2008 including high volatility, lower interest rates, and a faster prepayment environment, the FN/FH buyouts of 2010, wider non-Agency securities spreads.

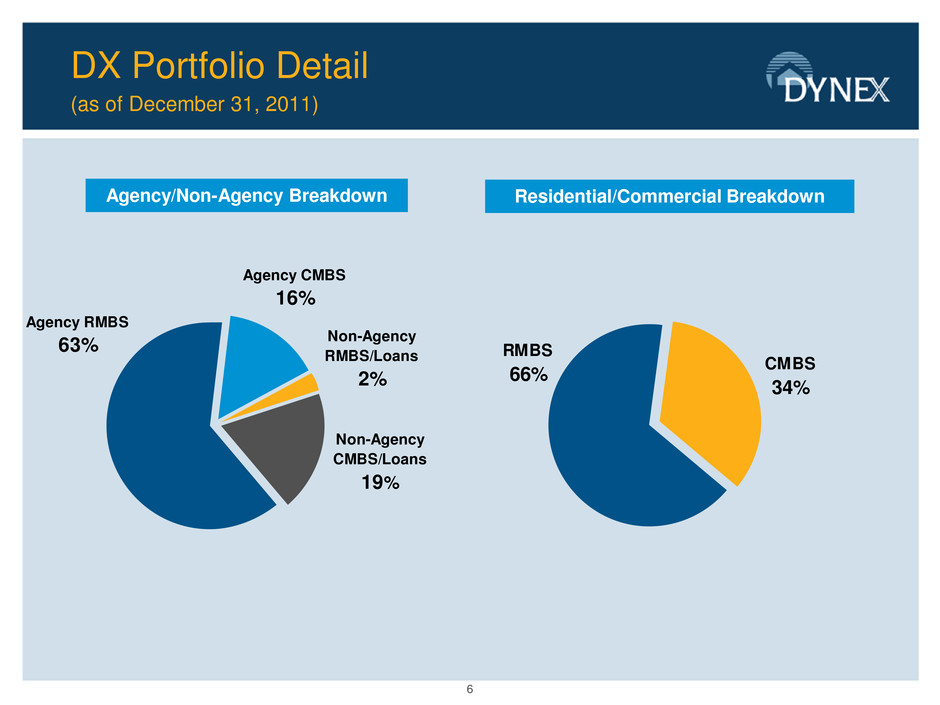

6 DX Portfolio Detail (as of December 31, 2011) Non-Agency CMBS/Loans 19% Non-Agency RMBS/Loans 2% Agency RMBS 63% Agency CMBS 16% CMBS 34% RMBS 66% Agency/Non-Agency Breakdown Residential/Commercial Breakdown

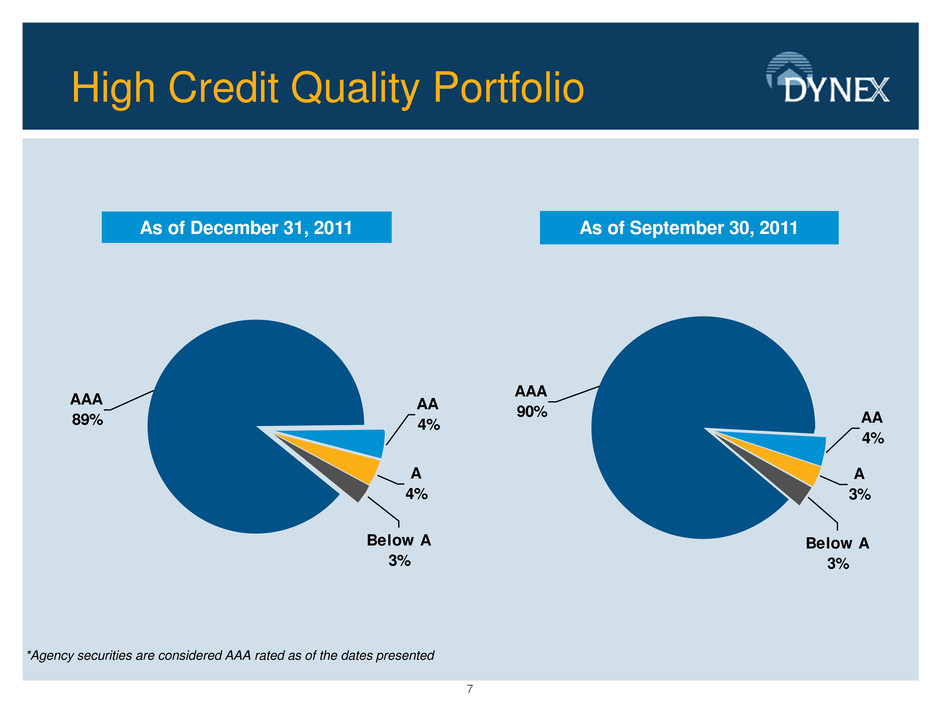

7 High Credit Quality Portfolio A 3% Below A 3% AA 4% AAA 90% As of September 30, 2011 As of December 31, 2011 *Agency securities are considered AAA rated as of the dates presented A 4% Below A 3% AA 4% AAA 89%

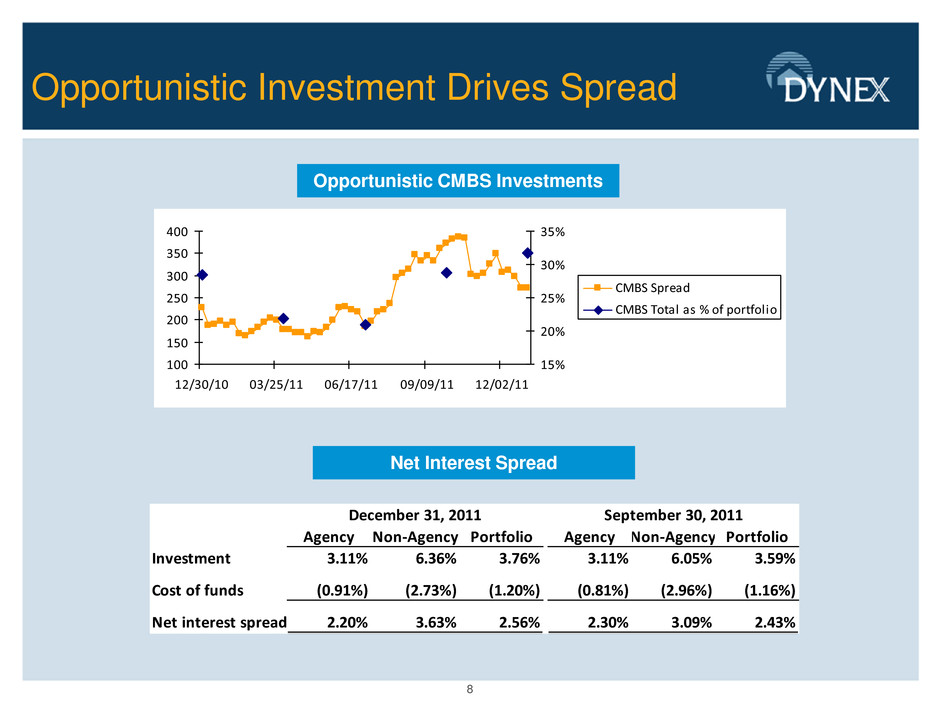

8 Opportunistic Investment Drives Spread December 31, 2011 September 30, 2011 Agency Non-Agency Portfolio Agency Non-Agency Portfolio Investment 3.11% 6.36% 3.76% 3.11% 6.05% 3.59% Cost of funds (0.91%) (2.73%) (1.20%) (0.81%) (2.96%) (1.16%) Net interest spread 2.20% 3.63% 2.56% 2.30% 3.09% 2.43% Net Interest Spread Opportunistic CMBS Investments 100 150 200 250 300 350 400 12/30/10 03/25/11 06/17/11 09/09/11 12/02/11 15% 20% 25% 30% 35% CMBS Spread CMBS Total as % of portfolio

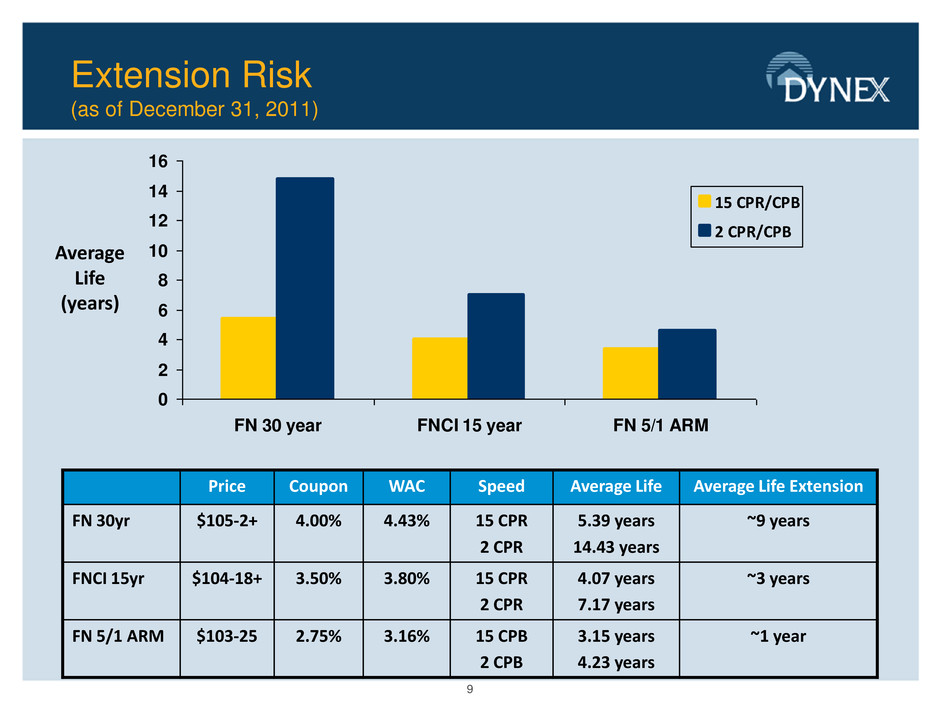

9 Extension Risk (as of December 31, 2011) 0 2 4 6 8 10 12 14 16 FN 30 year FNCI 15 year FN 5/1 ARM 15 CPR/CPB 2 CPR/CPB Average Life (years) Price Coupon WAC Speed Average Life Average Life Extension FN 30yr $105-2+ 4.00% 4.43% 15 CPR 2 CPR 5.39 years 14.43 years ~9 years FNCI 15yr $104-18+ 3.50% 3.80% 15 CPR 2 CPR 4.07 years 7.17 years ~3 years FN 5/1 ARM $103-25 2.75% 3.16% 15 CPB 2 CPB 3.15 years 4.23 years ~1 year

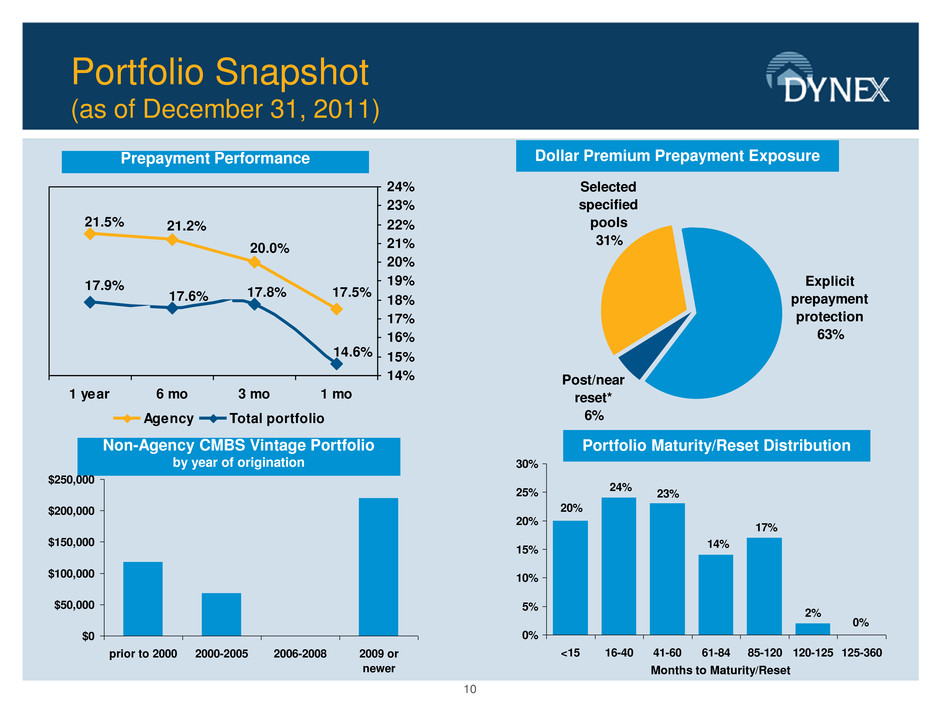

10 Portfolio Snapshot (as of December 31, 2011) Prepayment Performance Dollar Premium Prepayment Exposure Post/near reset* 6% Selected specified pools 31% Explicit prepayment protection 63% 21.5% 21.2% 20.0% 17.5% 17.9% 17.6% 17.8% 14.6% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 1 mo3 mo6 mo1 year Agency Total portfolio Non-Agency CMBS Vintage Portfolio by year of origination Portfolio Maturity/Reset Distribution $0 $50,000 $100,000 $150,000 $200,000 $250,000 prior to 2000 2000-2005 2006-2008 2009 or newer 0% 2% 17% 14% 20% 23% 24% 0% 5% 10% 15% 20% 25% 30% <15 16-40 41-60 61-84 85-120 120-125 125-360 Months to Maturity/Reset

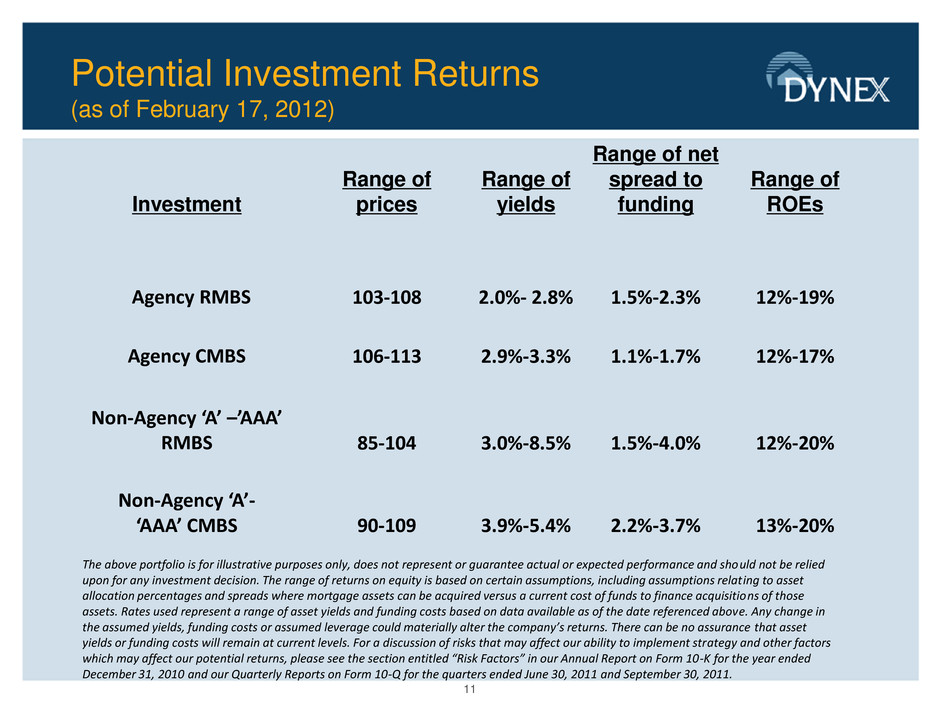

11 Potential Investment Returns (as of February 17, 2012) Investment Range of prices Range of yields Range of net spread to funding Range of ROEs Agency RMBS 103-108 2.0%- 2.8% 1.5%-2.3% 12%-19% Agency CMBS 106-113 2.9%-3.3% 1.1%-1.7% 12%-17% Non-Agency ‘A’ –’AAA’ RMBS 85-104 3.0%-8.5% 1.5%-4.0% 12%-20% Non-Agency ‘A’- ‘AAA’ CMBS 90-109 3.9%-5.4% 2.2%-3.7% 13%-20% The above portfolio is for illustrative purposes only, does not represent or guarantee actual or expected performance and should not be relied upon for any investment decision. The range of returns on equity is based on certain assumptions, including assumptions relating to asset allocation percentages and spreads where mortgage assets can be acquired versus a current cost of funds to finance acquisitions of those assets. Rates used represent a range of asset yields and funding costs based on data available as of the date referenced above. Any change in the assumed yields, funding costs or assumed leverage could materially alter the company’s returns. There can be no assurance that asset yields or funding costs will remain at current levels. For a discussion of risks that may affect our ability to implement strategy and other factors which may affect our potential returns, please see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2010 and our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2011 and September 30, 2011.

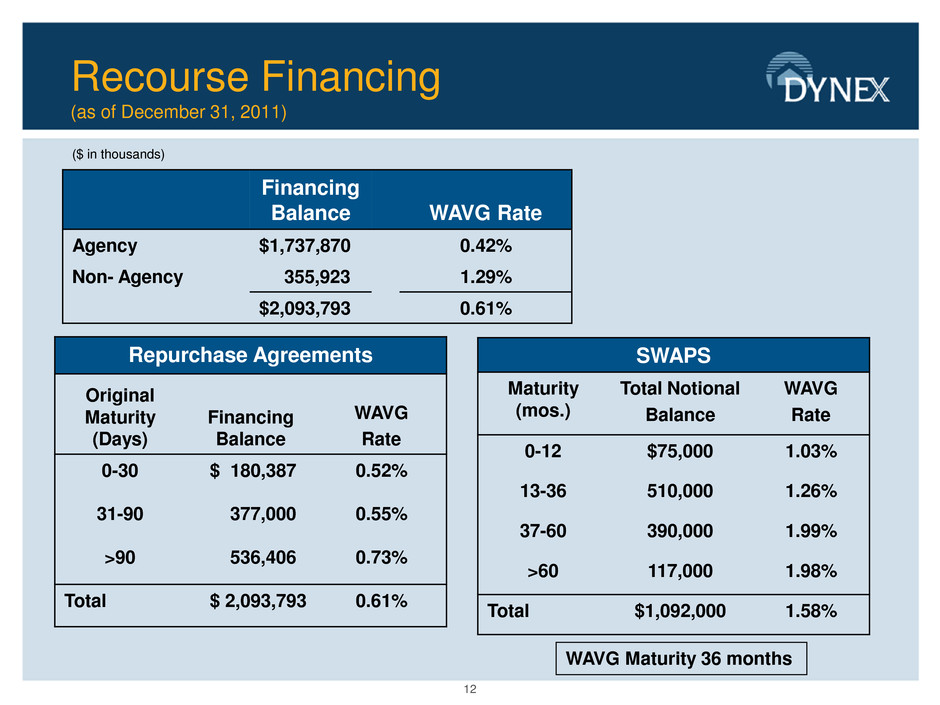

12 Recourse Financing (as of December 31, 2011) SWAPS Maturity (mos.) Total Notional Balance WAVG Rate 0-12 $75,000 1.03% 13-36 510,000 1.26% 37-60 390,000 1.99% >60 117,000 1.98% Total $1,092,000 1.58% Repurchase Agreements Original Maturity (Days) Financing Balance WAVG Rate 0-30 $ 180,387 0.52% 31-90 377,000 0.55% >90 536,406 0.73% Total $ 2,093,793 0.61% Financing Balance WAVG Rate Agency $1,737,870 0.42% Non- Agency 355,923 1.29% $2,093,793 0.61% WAVG Maturity 36 months ($ in thousands)

13 Portfolio Summary • Our portfolio has performed well since 2008 and the earnings power today remains relatively intact. • Prepayment risk is mitigated by superior portfolio construction and HARP 2.0 should have less impact on Hybrid ARMs. • Credit risk is mitigated by highly-rated securities, superior loan origination years and concentration in multifamily collateral. • Extension risk is mitigated by the short-duration investment portfolio with 67% of the investments maturing or resetting within five years (as of December 31, 2011). • There continues to be attractive investment opportunities to deploy capital despite the volatile financial markets.

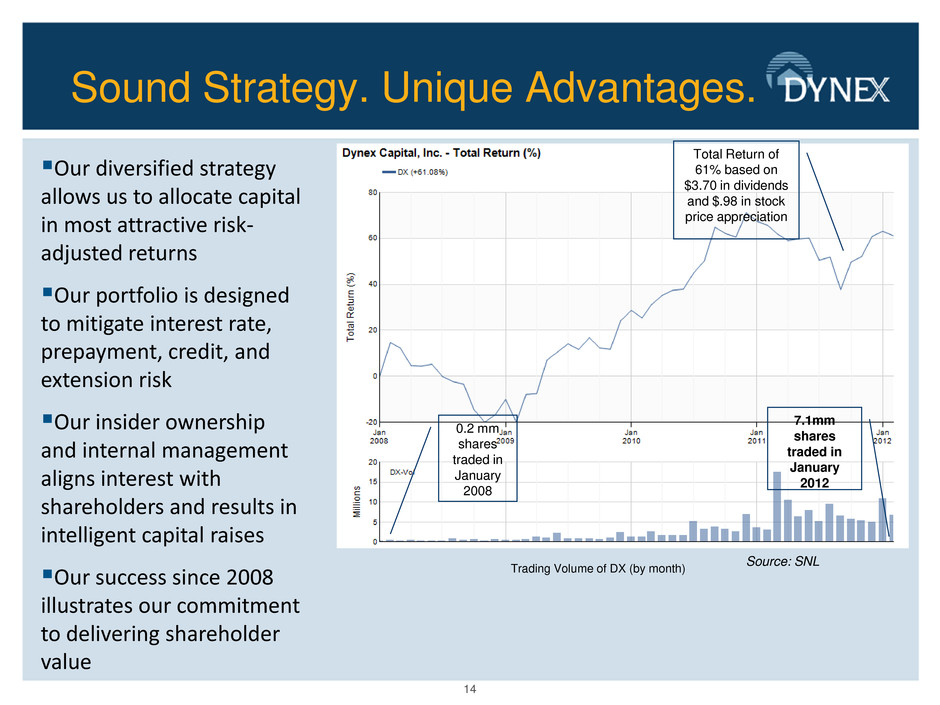

14 Sound Strategy. Unique Advantages. Total Return of 61% based on $3.70 in dividends and $.98 in stock price appreciation 7.1mm shares traded in January 2012 0.2 mm shares traded in January 2008 Source: SNL Trading Volume of DX (by month) Our diversified strategy allows us to allocate capital in most attractive risk- adjusted returns Our portfolio is designed to mitigate interest rate, prepayment, credit, and extension risk Our insider ownership and internal management aligns interest with shareholders and results in intelligent capital raises Our success since 2008 illustrates our commitment to delivering shareholder value

15 APPENDIX

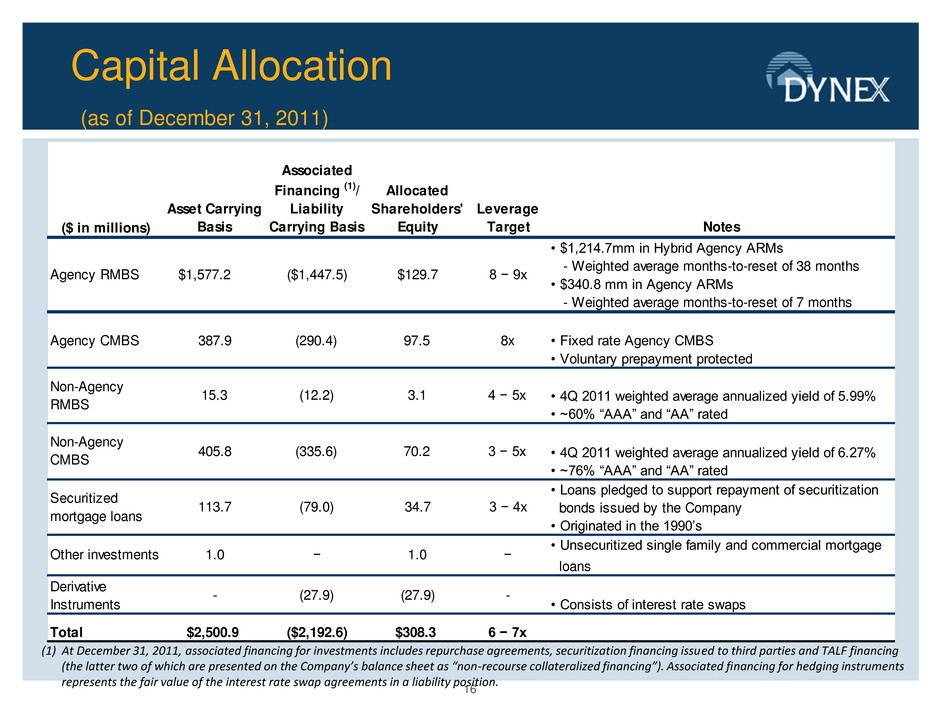

16 Capital Allocation (as of December 31, 2011) (1) At December 31, 2011, associated financing for investments includes repurchase agreements, securitization financing issued to third parties and TALF financing (the latter two of which are presented on the Company’s balance sheet as “non-recourse collateralized financing”). Associated financing for hedging instruments represents the fair value of the interest rate swap agreements in a liability position. ($ in millions) Asset Carrying Basis Associated Financing (1)/ Liability Carrying Basis Allocated Shareholders' Equity Leverage Target Notes • $1,214.7mm in Hybrid Agency ARMs - Weighted average months-to-reset of 38 months • $340.8 mm in Agency ARMs - Weighted average months-to-reset of 7 months Agency CMBS 387.9 (290.4) 97.5 8x • Fixed rate Agency CMBS • Voluntary prepayment protected • 4Q 2011 weighted average annualized yield of 5.99% • ~60% “AAA” and “AA” rated • 4Q 2011 weighted average annualized yield of 6.27% • ~76% “AAA” and “AA” rated • Loans pledged to support repayment of securitization bonds issued by the Company • Originated in the 1990’s • Unsecuritized single family and commercial mortgage loans Derivative Instruments - (27.9) (27.9) - • Consists of interest rate swaps Total $2,500.9 ($2,192.6) $308.3 6 − 7x − 1.0 − (79.0) 34.7 3 − 4x (335.6) 70.2 3 − 5x $129.7 8 − 9x 3.1 4 − 5x Agency RMBS Non-Agency RMBS ($1,447.5) (12.2) $1,577.2 15.3 113.7 1.0 Non-Agency CMBS Securitized mortgage loans Other investments 405.8

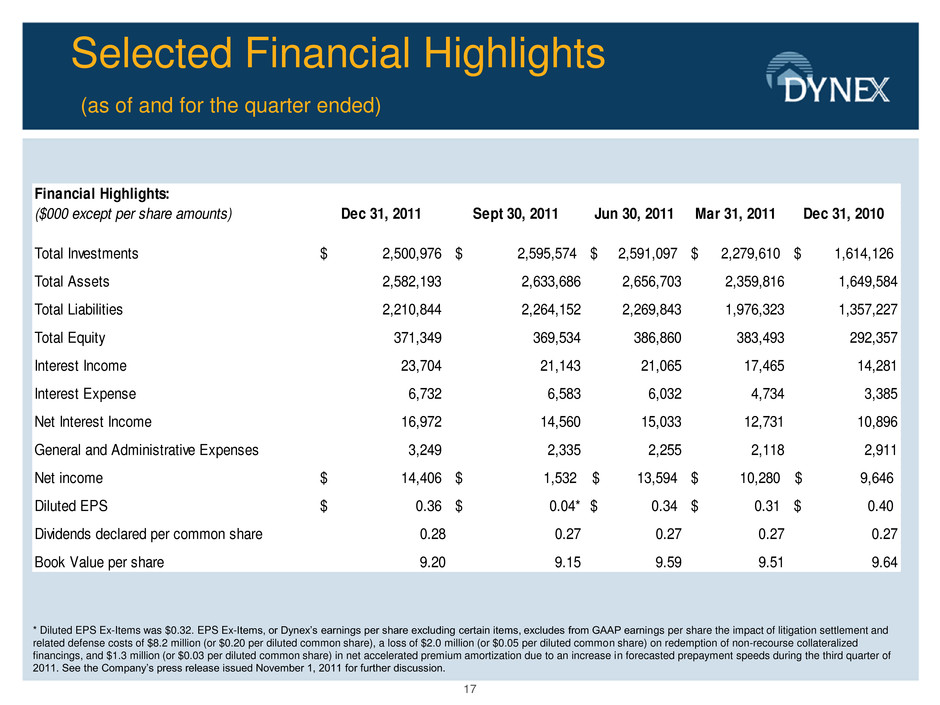

17 Selected Financial Highlights (as of and for the quarter ended) Financial Highlights: ($000 except per share amounts) Dec 31, 2011 Sept 30, 2011 Jun 30, 2011 Mar 31, 2011 Dec 31, 2010 Total Investments 2,500,976$ 2,595,574$ 2,591,097$ 2,279,610$ 1,614,126$ Total Assets 2,582,193 2,633,686 2,656,703 2,359,816 1,649,584 Total Liabilities 2,210,844 2,264,152 2,269,843 1,976,323 1,357,227 Total Equity 371,349 369,534 386,860 383,493 292,357 Interest Income 23,704 21,143 21,065 17,465 14,281 Interest Expense 6,732 6,583 6,032 4,734 3,385 Net Interest Income 16,972 14,560 15,033 12,731 10,896 General and Administrative Expenses 3,249 2,335 2,255 2,118 2,911 Net income 14,406$ 1,532$ 13,594$ 10,280$ 9,646$ Diluted EPS 0.36$ $ 0.04* 0.34$ 0.31$ 0.40$ Dividends declared per common share 0.28 0.27 0.27 0.27 0.27 Book Value per share 9.20 9.15 9.59 9.51 9.64 * Diluted EPS Ex-Items was $0.32. EPS Ex-Items, or Dynex’s earnings per share excluding certain items, excludes from GAAP earnings per share the impact of litigation settlement and related defense costs of $8.2 million (or $0.20 per diluted common share), a loss of $2.0 million (or $0.05 per diluted common share) on redemption of non-recourse collateralized financings, and $1.3 million (or $0.03 per diluted common share) in net accelerated premium amortization due to an increase in forecasted prepayment speeds during the third quarter of 2011. See the Company’s press release issued November 1, 2011 for further discussion.

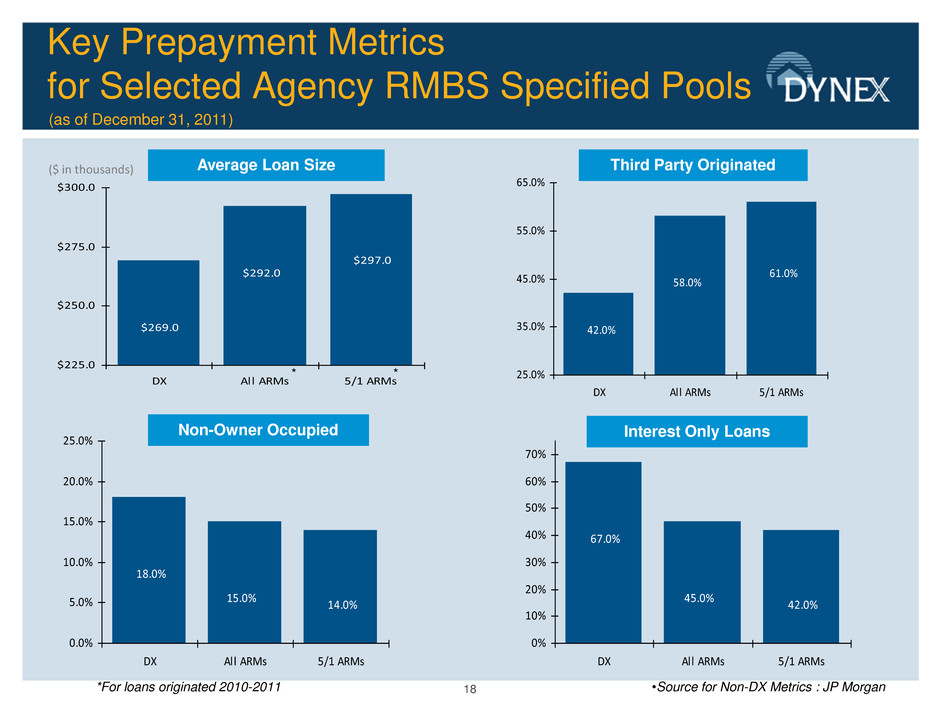

18 Key Prepayment Metrics for Selected Agency RMBS Specified Pools $269.0 $292.0 $297.0 $225.0 $250.0 $275.0 $300.0 DX All ARMs 5/1 ARMs Average Loan Size 42.0% 58.0% 61.0% 25.0% 35.0% 45.0% 55.0% 65.0% DX All ARMs 5/1 ARMs Third Party Originated 18.0% 15.0% 14.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% DX All ARMs 5/1 ARMs 67.0% 45.0% 42.0% 0% 10% 20% 30% 40% 50% 60% 70% DX All ARMs 5/1 ARMs Non-Owner Occupied Interest Only Loans *For loans originated 2010-2011 ($ in thousands) (as of December 31, 2011) * * •Source for Non-DX Metrics : JP Morgan