Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERITAGE FINANCIAL CORP /WA/ | d301870d8k.htm |

Brian

L. Vance, President and CEO Donald J. Hinson, Senior Vice President &

CFO Exhibit 99.1

Investor Presentation

Investor Presentation

1

1

st

st

Quarter 2012

Quarter 2012

Heritage Financial Corporation

Heritage Financial Corporation |

2

“Safe Harbor” statement under the Private Securities Litigation Reform Act of

1995: This presentation contains forward-looking statements that are subject to risks and

uncertainties, including, but not limited to: the credit risks of lending activities,

including changes in the level and trend of loan delinquencies and write-offs and changes in our

allowance for loan losses and provision for loan losses that may be impacted by

deterioration in the housing and commercial real estate markets; changes in general economic

conditions, either nationally or in our market areas; changes in the levels of general

interest rates, and the relative differences between short and long term interest rates, deposit

interest rates, our net interest margin and funding sources; fluctuations in the demand

for loans, the number of unsold homes and other properties and fluctuations in real estate

values in our market areas; results of examinations of us by the Board of Governors of

the Federal Reserve System (the “Federal Reserve Board”) and of our bank subsidiaries by

the Federal Deposit Insurance Corporation (the “FDIC”), the Washington State

Department of Financial Institutions, Division of Banks (the “Washington DFI”) or other regulatory

authorities, including the possibility that any such regulatory authority may, among

other things, require us to increase our reserve for loan losses, write-down assets, change our

regulatory capital position or affect our ability to borrow funds or maintain or

increase deposits, which could adversely affect our liquidity and earnings; legislative or regulatory

changes that adversely affect our business including changes in regulatory policies and

principles, including the interpretation of regulatory capital or other rules, the interpretation

of regulatory capital or other rules including changes from the Dodd-Frank Wall

Street Reform and Consumer Protection Act and regulations that have been or will be promulgated

thereunder; our ability to control operating costs and expenses; the use of estimates

in determining fair value of certain of our assets, which estimates may prove to be incorrect

and result in significant declines in valuation; difficulties in reducing risk

associated with the loans on our balance sheet; staffing fluctuations in response to product demand or the

implementation of corporate strategies that affect our workforce and potential

associated charges; computer systems on which we depend could fail or experience a security

breach; our ability to retain key members of our senior management team; costs and

effects of litigation, including settlements and judgments; our ability to implement our branch

expansion strategy; our ability to implement our expansion strategy; our ability to

successfully integrate any assets, liabilities, customers, systems, and management personnel we

have acquired including the Cowlitz Bank and Pierce Commercial Bank transactions or may

in the future acquire into our operations and our ability to realize related revenue

synergies and cost savings within expected time frames and any goodwill charges related

thereto; or may in the future acquire into our operations and our ability to realize related

revenue synergies and cost savings within expected time frames and any goodwill charges

related thereto; risks relating to acquiring assets or entering markets in which we have

not previously operated and may not be familiar, changes in consumer spending,

borrowing and savings habits; the availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; adverse changes in the securities

markets; inability of key third-party providers to perform their obligations to us; changes in

accounting policies and practices, as may be adopted by the financial institution

regulatory agencies or the Financial Accounting Standards Board, including additional guidance

and interpretation on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental, regulatory, and technological

factors affecting our operations, pricing, products and services; and other risks

detailed from time to time in our filings with the Securities and Exchange Commission.

The Company cautions readers not to place undue reliance on any forward-looking

statements. Moreover, you should treat these statements as speaking only as of the date they

are made and based only on information then actually known to the Company. The Company

does not undertake and specifically disclaims any obligation to revise any forward-

looking statements to reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. These risks could cause our actual results

for 2011 and beyond to differ materially from those expressed in any

forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating and

stock price performance.

Forward Looking Statement |

•

Company & Economic Information

•

Recent Growth Initiatives

•

Financial Performance

•

Core Strategies

3

Overview |

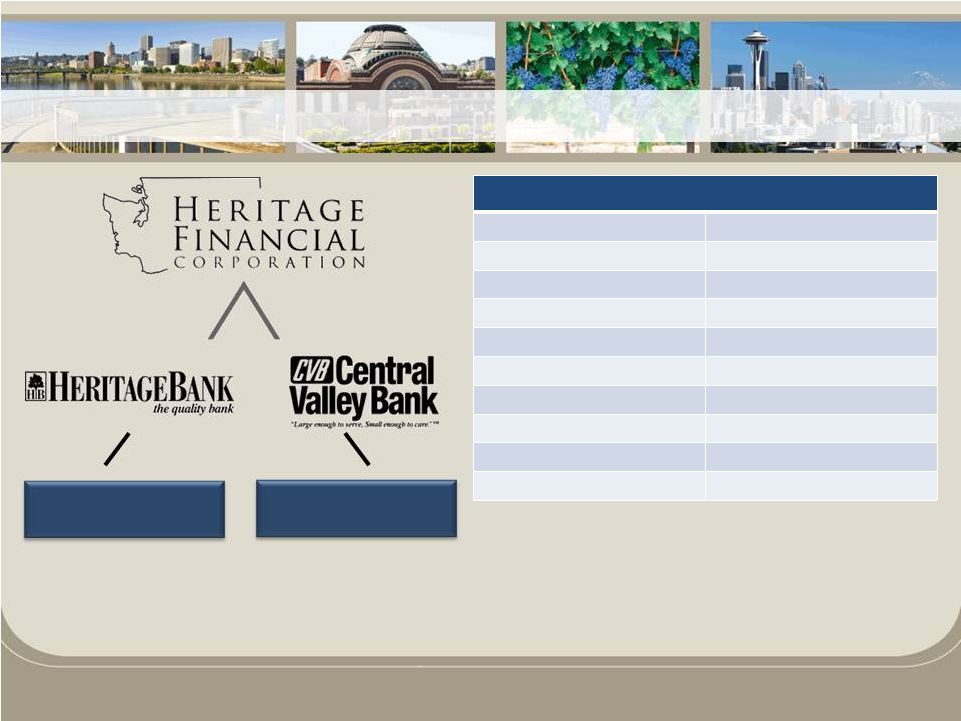

Company

and Economic Company and Economic

Information

Information

4 |

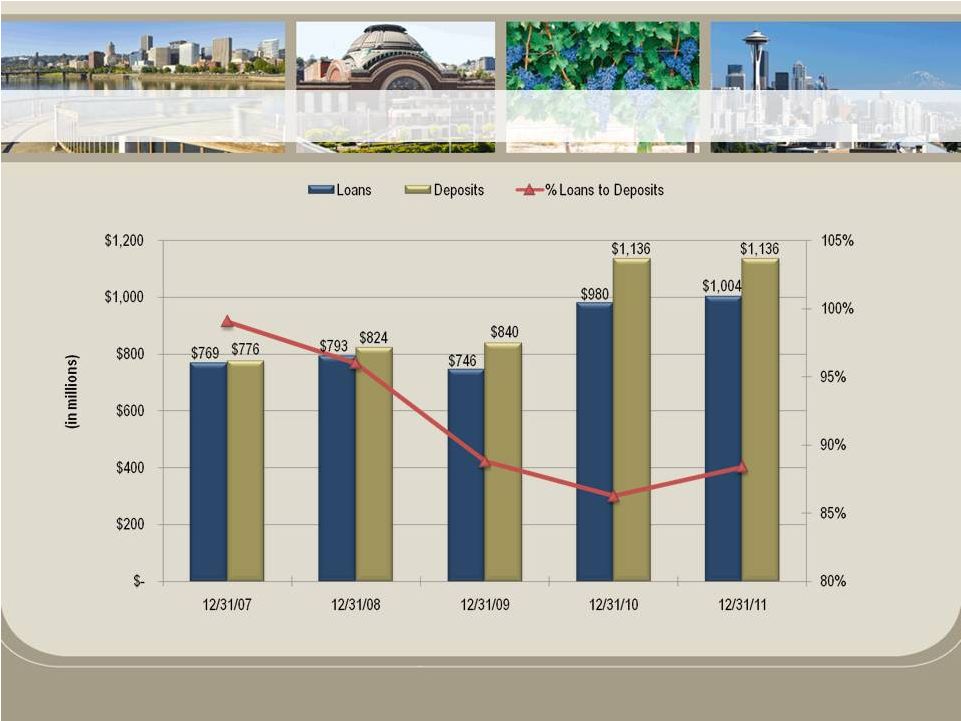

Financial Highlights

Total Assets

$1.37 billion

Net Loans

$1.00 billion

Total Deposits

$1.14 billion

Tangible Common Equity

$188.0 million

Loan/Deposit Ratio

88.6%

Coverage Ratio (1)

103.5%

Core Deposit Ratio (2)

93.7%

Net Interest Margin

5.18% (Q4’11) 5.41% (FY2011)

Cost of Funds

0.58% (Q4’11) 0.71% (FY2011)

PTPP ROAA (3)

1.91% (Q4’11) 1.75% (FY2011)

(1) Allowance for loan loss/nonperforming loans (originated loans only)

(2) All deposits less wholesale CDs and CDs over $250,000

(3) Pre-tax, pre-provision return on average assets

Note: Numbers rounded for presentation purposes only

Financial data as of December 31, 2011 unless otherwise indicated

5

Total assets: $1.20 billion

Branches: 27

Total assets: $165.6 million

Branches: 6

Corporate Structure |

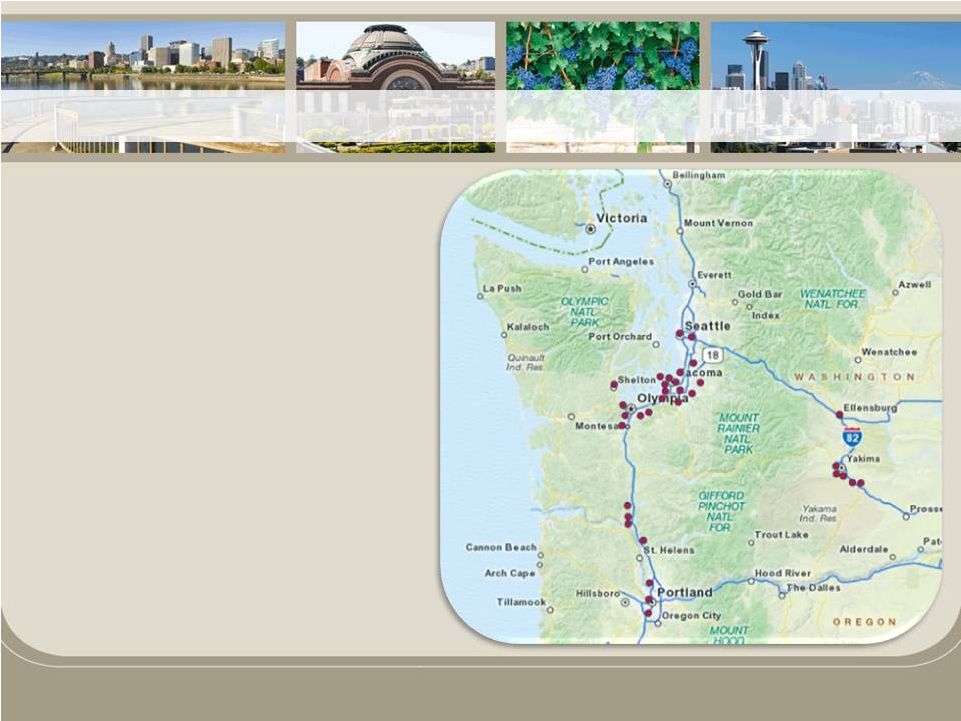

•

33 Branches

–

27 Heritage Bank

branches along I-5 corridor

–

6 Central Valley Bank

branches in Central WA

6

Our Market Area |

•

We have not yet achieved measurable and

sustainable economic growth in the Pacific

Northwest

•

Our local economy will continue to struggle until

unemployment and real estate values improve

•

However, we are beginning to see signs of

improvement in some areas

7

Economic Outlook

Economic Outlook |

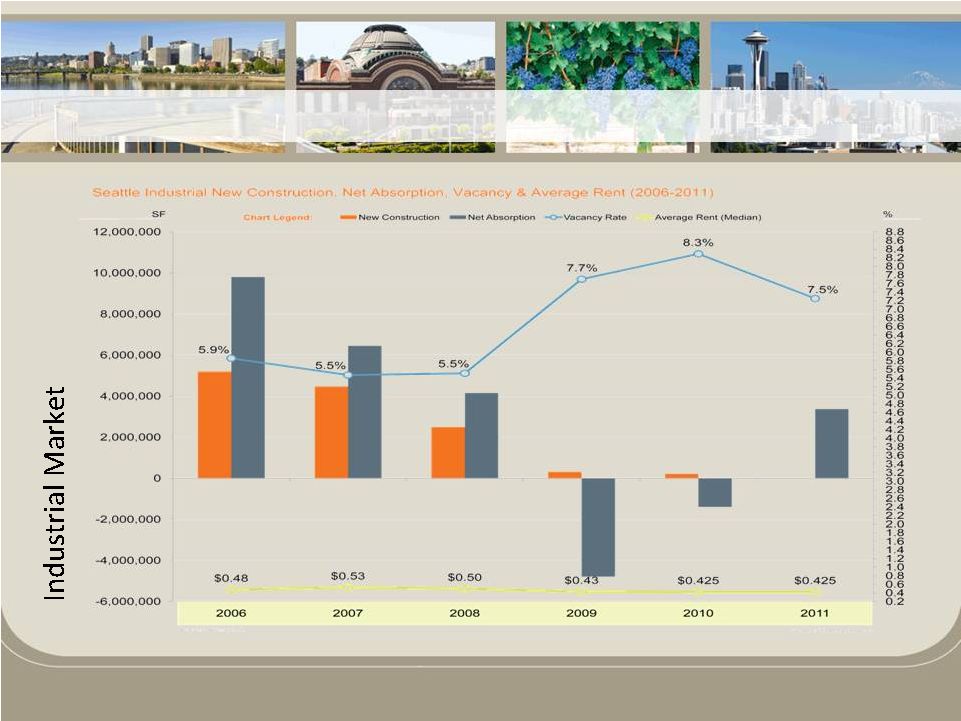

Source:

Kidder Mathews Q4 Industrial Report 8

Economic Information |

Source: Kidder Mathews Q4 Industrial Report

9

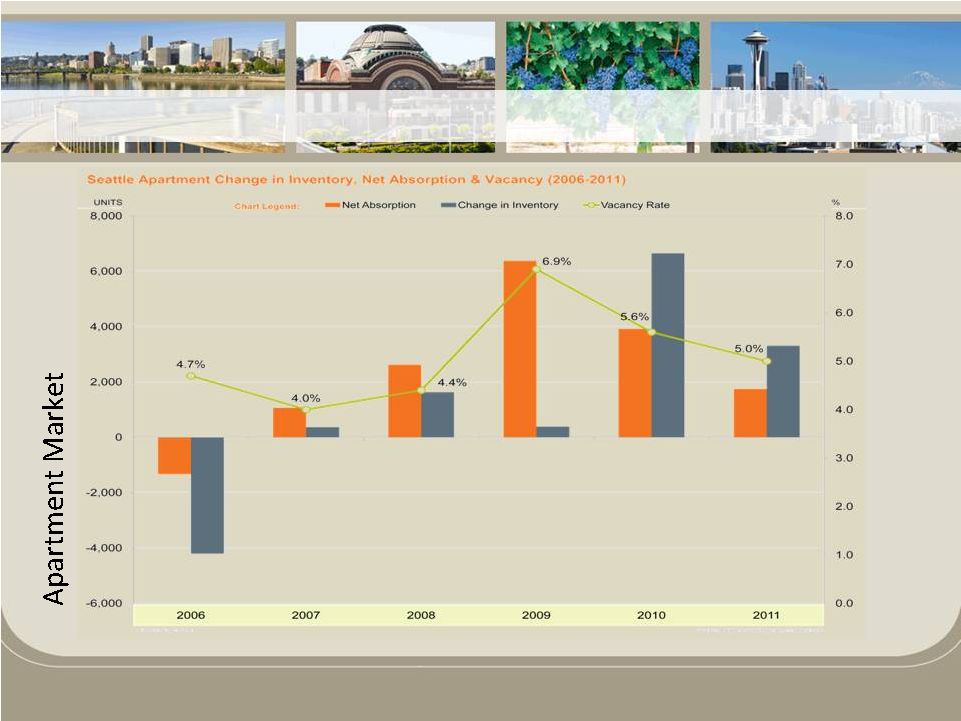

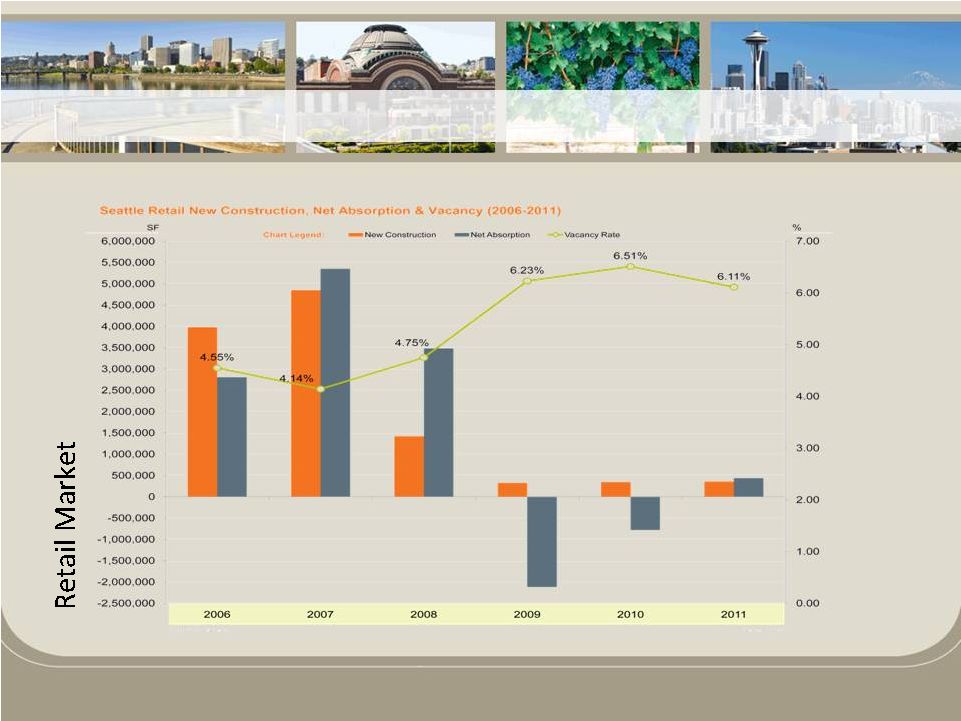

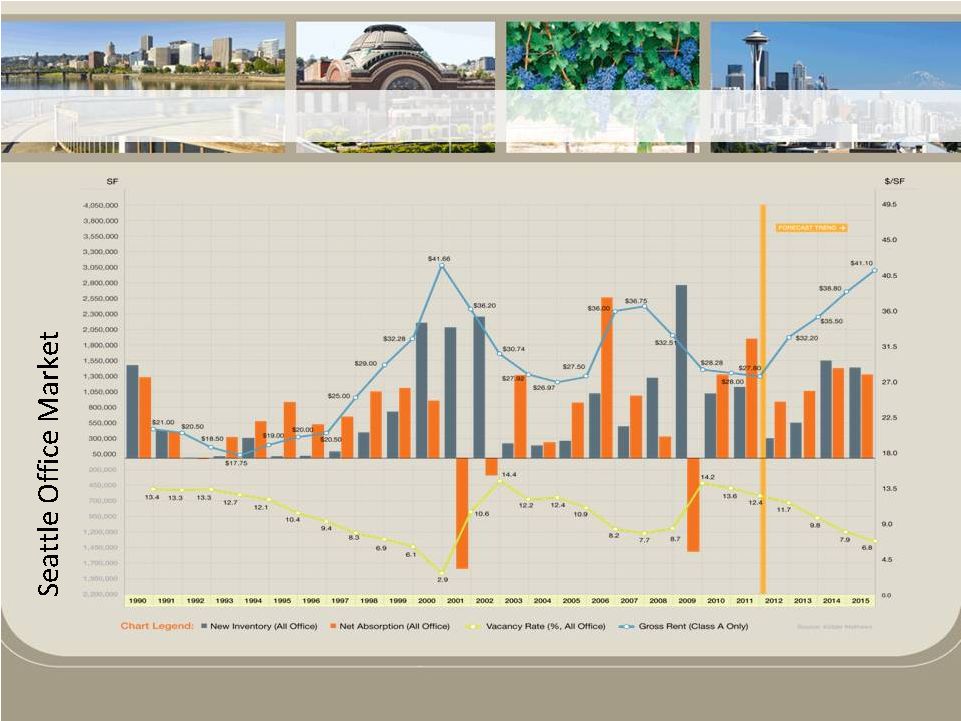

Economic Information |

Source: Kidder Mathews Q4 Industrial Report

10

Economic Information |

Source: Kidder Mathews Q4 Industrial Report

11

Economic Information |

According to PwC and ULI “Emerging Trends in Real Estate

2012”

survey, Seattle ranks as follows for investment

opportunities among all metro areas in the Nation:

Source: Urban Land Institute, in conjunction with Price Waterhouse Cooper, conducted

an annual survey of commercial real estate metrics and trends.

12

Economic Outlook

•

#1

in

Retail

Real

Estate

•

#1

in

Industrial

Real

Estate

•

#2

in

Office

Real

Estate

•

#3

in

Apartment

Real

Estate

•

#7

in

Hotel

Real

Estate |

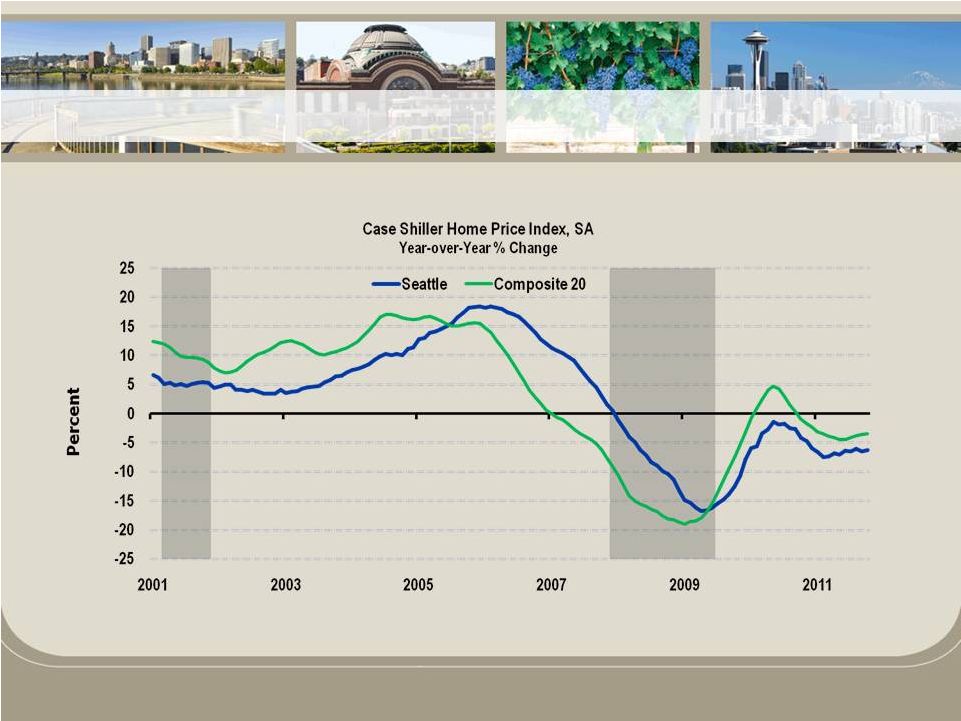

Single-family home prices continue to decline

Oct 2011:

U.S. is down 3.4%; SEA is down 6.2%

Source: S&P/Case-Shiller; data through October 2011

13

Economic Information |

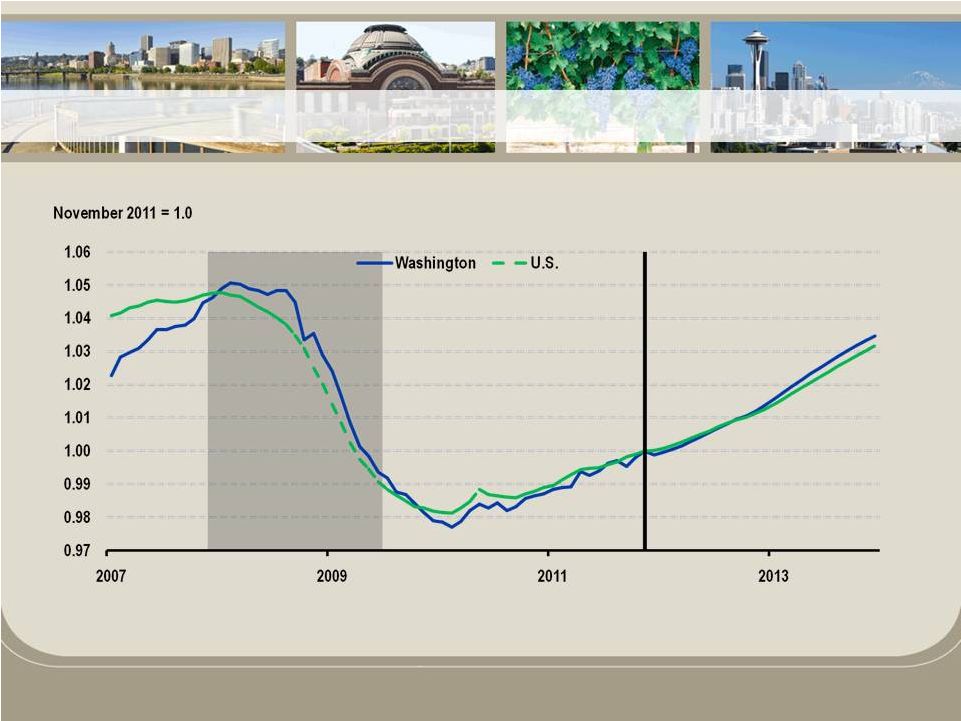

WA

employment peaked 1 month after U.S. (Feb. 2008 vs. Jan. 2008) Both WA and the

U.S. reached a trough in Feb. 2010 Both WA and the U.S. won’t reach their

previous peak until after 2013 WA employment will recover slightly faster than the

U.S. 14

Economic Information

Source: WA State Economic and Revenue Forecast Council; November 2011 forecast |

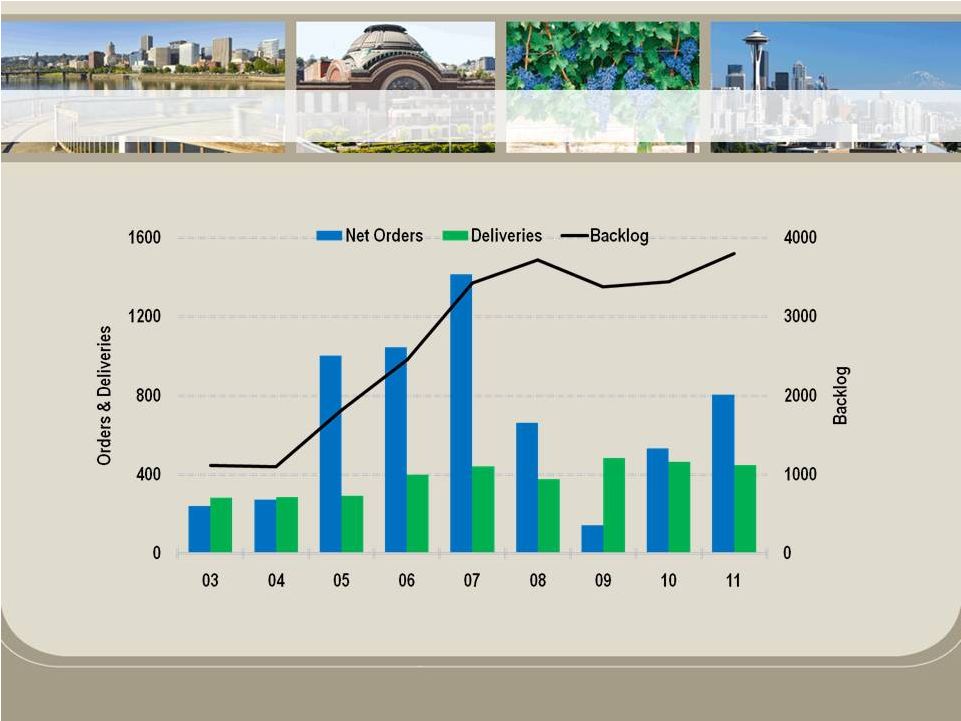

Excludes the military’s new refueling tanker

Source: Boeing; data through December 2011

Boeing has over 7 years of commercial orders on its books

15

Economic Information |

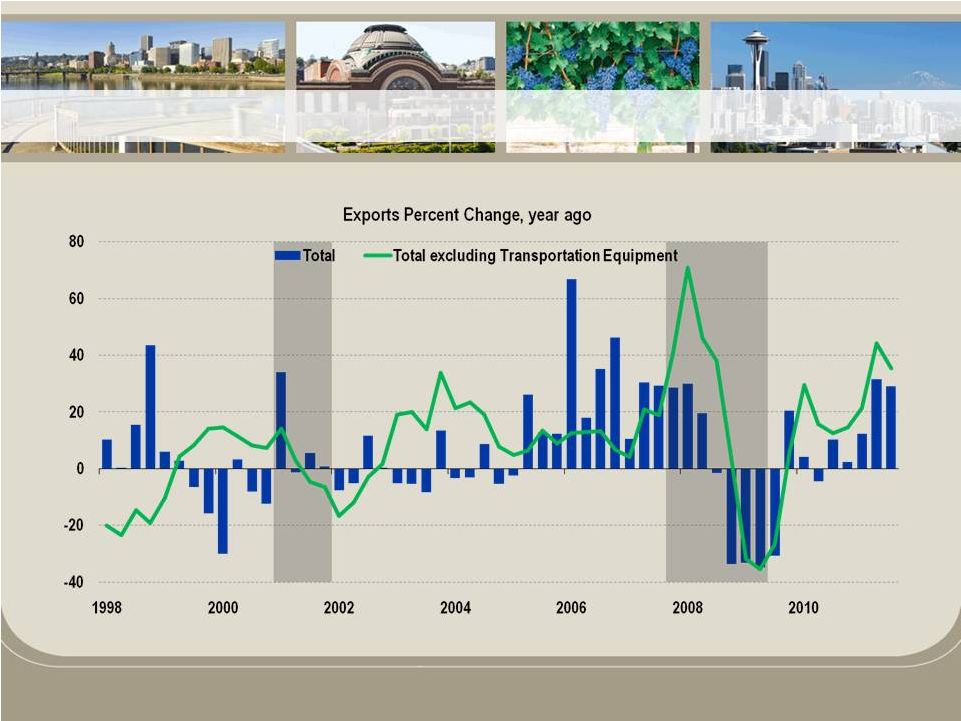

Total

exports were up 29% y/y in Q3 Source: Wiser Trade Data; through Q3 2011

WA export growth is strong, and will help state outperform in the recovery

16

Economic Information |

Recent

Growth Initiatives Recent Growth Initiatives

17 |

•

Organic Growth

•

FDIC Assisted Transactions

•

Open Bank M&A Activity

18

Growth Strategies |

•

Core deposits showing strong growth

–

Non-maturity deposits (total deposits less CDs)

•

Increased $73.1 million, or 10.0%, during 2011

•

Non-maturity deposits increased to 71.0% of total deposits

•

Demand deposits increased $36.4 million, or 18.7%, during 2011

•

Demand deposits increased to 20.4% of total deposits

19

Organic Growth |

•

Deposits at acquired branches reporting steady

growth since acquisition

–

Former Cowlitz Bank branches (acquired in July

2010) increased deposits by 19.5% during 2011

20

Organic Growth |

•

2011 Lender Recruitment

–

During 2011 we hired 7 new Lenders and a Market

Executive

•

3 lenders in King County (Seattle/Bellevue/Kent)

•

2 lenders in Pierce County (Tacoma)

•

1 lender in Thurston County (Olympia)

•

1 lender in Portland, OR

•

1 Market Executive for Vancouver, WA / OR

21

Organic Growth |

•

Q4 2011 Loan Growth

–

Originated loans

•

Increased $35 million, or 4.4%

–

Net loans (including acquired portfolios)

•

Increased $20.2 million, or 2.0%

•

2011 Loan Growth

–

Originated loans

•

Increased $95.9 million, or 12.9%

22

Organic Loan Growth |

•

FDIC Acquisitions

–

Successfully completed two FDIC acquisitions

–

Continue to participate in FDIC bidding process

–

Expect less than five closures in WA/OR in 2012

•

Open Bank

–

Opportunistically review deals

23

Acquisitions |

Financial Performance

Financial Performance

24 |

25

Loan and Deposit Growth |

Loan

Portfolio Financial data as of December 31, 2011

26

CRE Owner

Occupied

22%

CRE Non-

Owner

Occupied

27%

Commercial &

Industrial

34%

Residential

Construction

3%

Commercial

Construction

5%

Residential Real

Estate

4%

Consumer

5%

Diversified Loan Portfolio |

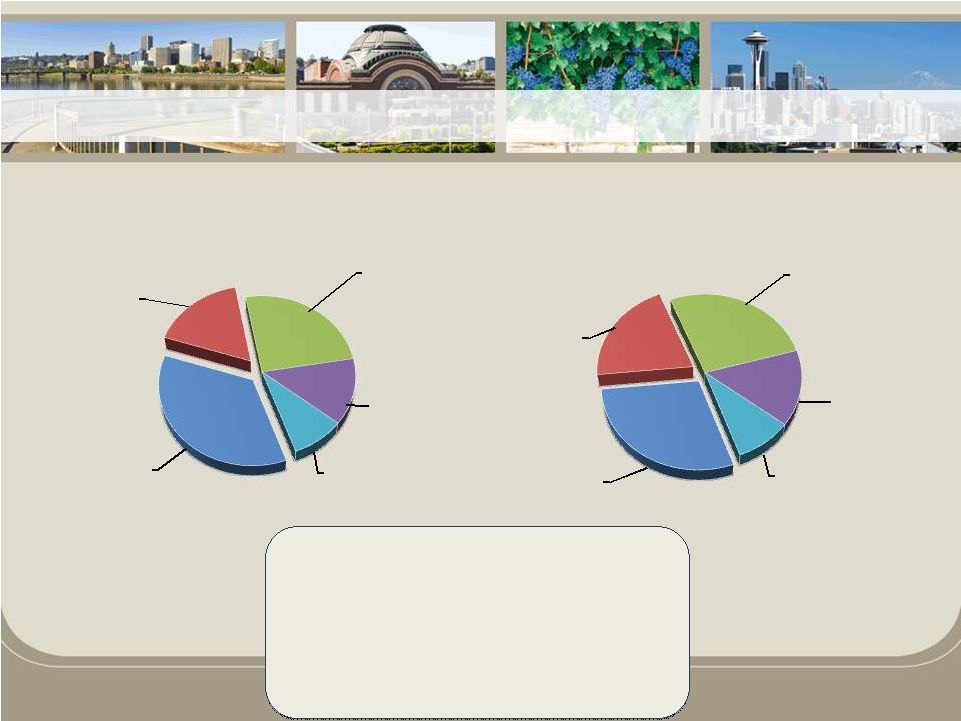

December

31, 2010 December 31, 2011

Deposit Composition

27

Attractive Deposit Base

CDs

36%

Non-

Interest

Bearing

Demand

17%

Interest

Checking

(NOW)

25%

Money

Market

13%

Savings

9%

CDs

29%

Non-

Interest

Bearing

Demand

20%

Interest

Checking

(NOW)

27%

Money

Market

15%

Savings

9%

Financial Data as of December 31, 2011

–

Total Deposits

$1.1 billion

–

Total Non-Maturity Deposits

–

Non-Maturity Deposits / Total Dep.

–

Non-Int. Bearing Dep. / Total Dep.

20.4%

–

Cost of Int. Bear. Deposits

0.71%

–

Cost of Deposits

0.58%

$806 million

71.0% |

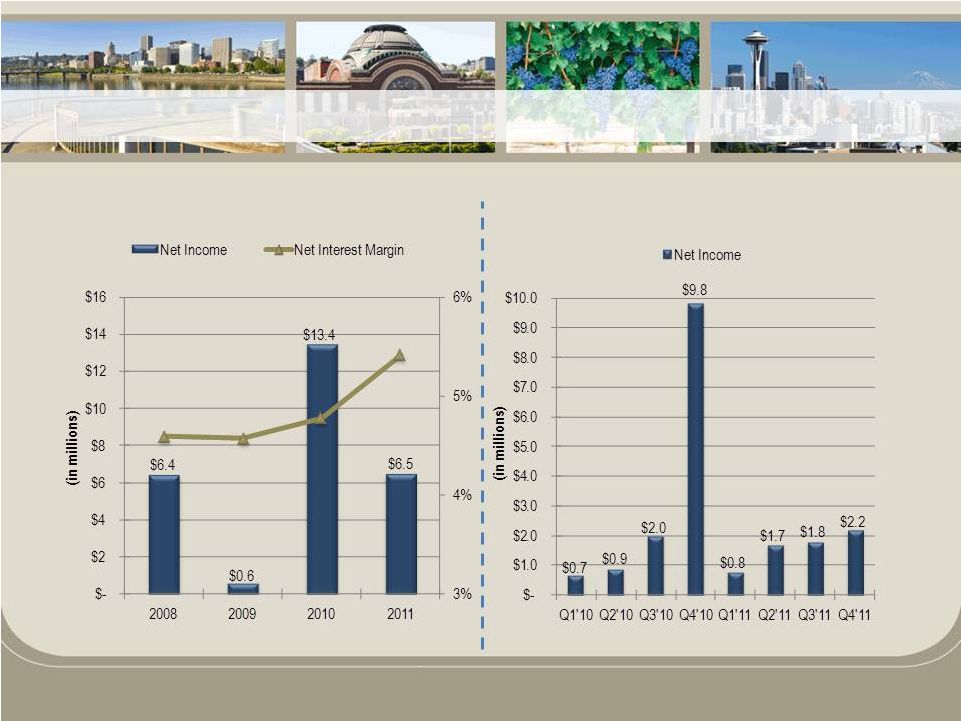

Annual

Earnings Quarterly Earnings

28

Annual Earnings |

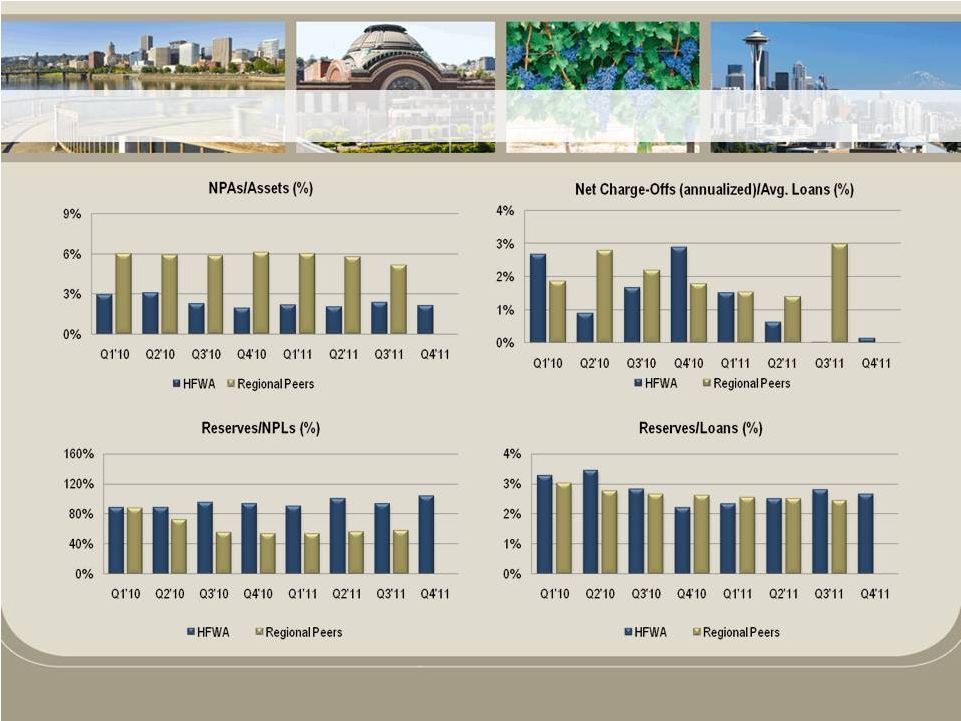

Peer

Source: SNL Financial Regional Peer Group (12): Ticker Symbols –

BANR, CACB, COLB, FFNW, HOME, NRIM, PCBK, PRWT, RVSB, TSBK, WBCO, WCBO

29

Credit Quality |

•

Cash Dividends

–

Resumed quarterly cash dividend in Q2 2011 at $0.03

–

Increased quarterly dividend to $0.05 for Q3 and Q4 2011

–

Special dividend of $0.25 in Q4 2011

–

Increased quarterly dividend to $0.06 for Q1 2012

•

Stock Repurchases

–

Announced 5% repurchase program in Q3 2011

–

During 2011, repurchased 201,205 shares (26% of repurchase

program at an average price of $11.63)

30

Capital Management Strategies |

Core

Strategies Core Strategies

31 |

32

Maintain

Core

Quality Loan

Growth

Fill in PNW

Footprint

Leverage

Capital

Core Strategies |

•

Experienced management team supported by a

strong Board of Directors

•

Disciplined approach to acquisitions

•

Well-positioned to take advantage of the right

opportunities

•

Continuing focus on building long-term franchise

value

•

Solid financial performance trends

33

Investment Value |

Thank

You Thank You

Questions?

Questions?

Heritage Financial Corporation

Heritage Financial Corporation

34 |