Attached files

EXHIBIT 99.3

Space Above This Line For Recording Data

DEED OF TRUST

DATE AND PARTIES. The date of this Deed Of Trust (Security Instrument) is February 2, 2012. The parties and their addresses are:

GRANTOR:

ELDORADO ARTESIAN SPRINGS, INC.

A Colorado Corporation

1783 Dogwood Street

Louisville, CO 80027

TRUSTEE:

PUBLIC TRUSTEE OF BOULDER COUNTY, COLORADO

LENDER:

ANB BANK

Organized and existing under the laws of Colorado

3033 East First Ave

Denver, CO 80206

1. CONVEYANCE. For good and valuable consideration, the receipt and sufficiency of which is acknowledged, and to secure the Secured Debts and Grantor's performance under this Security Instrument, Grantor does hereby irrevocably grant, convey and sell to Trustee, in trust for the benefit of Lender, with power of sale, the folloWing described property:

See Attached Exhibit A

The property is located in Boulder County at 255 Artesian Drive; 23 Kneale Road; 35, 299,319-321 Eldorado Springs Drive, Eldorado Springs/Louisville, Colorado 80025-27.

Together with all rights, easements, appurtenances, royalties, mineral rights, oil and gas rights, crops, timber, all diversion payments or third party payments made to crop producers, all water and riparian rights, wells, ditches, reservoirs and water stock and all existing and future improvements, structures, fixtures, and replacements that may now, or at any time in the future, be part of the real estate described (all referred to as Property). This Security Instrument will remain in effect until the Secured Debts and all underlying agreements have been terminated in writing by Lender.

2. MAXIMUM OBLIGATION LIMIT. The total principal amount secured by this Security Instrument at any one time and from time to time will not exceed $2,815,892.00. Any limitation of amount does not include interest and other fees and charges validly made pursuant to this Security Instrument. Also, this limitation does not apply to advances made under the terms of this Security Instrument to protect Lender's security and to perform any of the covenants contained in this Security Instrument.

3. SECURED DEBTS. The term "Secured Debts" includes and this Security Instrument will secure each of the following:

A.: Specific Debts. The following debts and all extensions, renewals, refinancings, modifications and replacements. A promissory note or other agreement, No. 0130011704, dated February 2, 2012, from Eldorado Artesian Springs, Inc., Douglas A. Larson , Kevin M. Sipple and Jeremy S. Martin (Borrower) to Lender, with a loan amount of $2,815,892.00.

B. All Debts. All present and future debts from Eldorado Artesian Springs, Inc., Douglas A. Larson , Kevin M. Sipple and Jeremy S. Martin to Lender, even if this Security Instrument is not specifically referenced, or if the future debt is unrelated to or of a different type than this debt. If more than one person signs this Security Instrument, each agrees that it will secure debts incurred either individually or with others who may not sign this Security Instrument. Nothing in this Security Instrument constitutes a commitment to make additional or future loans or advances. Any such commitment must be in writing. In the event that Lender fails to provide any required notice of the right of rescission, Lender waives any subsequent security interest in the Grantor's principal dwelling that is created by this Security Instrument. This Security Instrument will not secure any debt for which a non-possessory, non-purchase money security interest is created in "household goods" in connection with a "consumer loan," as those terms are defined by federal law governing unfair and deceptive credit practices. This Security Instrument will not secure any debt for which a security interest is created in "margin stock" and Lender does not obtain a "statement of purpose, as defined and required by federal law governing securities. This Security Instrument will not secure any other debt if Lender fails, with respect to that other debt, to fulfill any necessary requirements or limitations of Sections 19(a), 32, or 35 of Regulation Z.

C. Sums Advanced. All sums advanced and expenses incurred by Lender under the terms of this Security Instrument.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

4. PAYMENTS. Grantor agrees that all payments under the Secured Debts will be paid when due and in accordance with the terms of the Secured Debts and this Security Instrument.

5. NCN-OBLIGATED GRANTOR. Any Grantor, who is not also identified as a Borrower in the Secured Debts section of this Security Instrument and who signs this Security Instrument, is defined as a cosigner for purposes of the Equal Credit Protection Act and the Federal Reserve Board's Regulation B, 12 C.F.R. 202.7(d)(4), and is referred to herein as a Non-Obligated Grantor. By signing this Security Instrument, the Non-Obligated Grantor does convey and assign their rights and interests in the Property to secure payment of the Secured Debts, to create a valid lien, to pass clear title, to waive inchoate rights and to assign earnings or rights to payment under any lease or rent of the Property. However, the Non-Obligated Grantor is not personally liable for the Secured Debts.

6. WARRANTY OF TITLE. Grantor warrants that Grantor is or will be lawfully seized of the estate conveyed by this Security Instrument and has the right to irrevocably grant, convey and sell the Property to Trustee, in trust, with power of sale. Grantor also warrants that the Property is unencumbered, except for encumbrances of record.

7. PRIOR SECURITY INTERESTS. With regard to any other mortgage, deed of trust, security agreement or other lien document that created a prior security interest or encumbrance on the Property, Grantor agrees:

A. To make all payments when due and to perform or comply with all covenants.

B. To promptly deliver to Lender any notices that Grantor receives from the holder.

C. Not to allow any modification or extension of, nor to request any future advances under any note or agreement secured by the lien document without Lender's prior written consent.

8. CLAIMS AGAINST TITLE. Grantor will pay all taxes, assessments, liens, encumbrances, lease payments, ground rents, utilities, and other charges relating to the Property when due. Lender may require Grantor to provide to Lender copies of all notices that such amounts are due and the receipts evidencing Grantor's payment. Grantor will defend title to the Property against any claims that would impair the lien of this Security Instrument. Grantor agrees to assign to Lender, as requested by Lender, any rights, claims or defenses Grantor may have against parties who supply labor or materials to maintain or improve the Property.

9. DUE ON SALE OR ENCUMBRANCE. Lender may, at its option, declare the entire balance of the Secured Debt to be immediately due and payable upon the creation of, or contract for the creation of, any lien, encurnbrance, transfer or sale of all or any part of the Property. This right is subject to the restrictions imposed by federal law (12 C.F.R. 591), as applicable.

10. TRANSFER OF AN INTEREST IN THE GRANTOR. If Grantor is an entity other than a natural person (such as a corporation, partnership, limited liability company or other organization). Lender may demand immediate payment if:

A. A beneficial interest in Grantor is sold or transferred.

B. There is a change in either the identity or number of members of a partnership or similar entity.

C. There is a change in ownership of more than 25 percent of the voting stock of a corporation, partnership, limited liability company or similar entity.

However, Lender may not demand payment in the above situations if it is prohibited by law as of the date of this Security Instrument.

11. WARRANTIES AND REPRESENTATIONS. Grantor makes to Lender the following warranties and representations which will continue as long as this Security Instrument is in effect:

A. Power. Grantor is duly organized, and validly existing and in good standing in all jurisdictions in which Grantor operates. Grantor has the power and authority to enter into this transaction and to carry on Grantor's business or activity as it is now being conducted and, as applicable, is qualified to do so in each jurisdiction in which Grantor operates.

B. Authority. The execution, delivery and performance of this Security Instrument and the obligation evidenced by this Security Instrument are within Grantor's powers, have been duly authorized, have received all .necessary governmental approval, will not violate any provision of law, or order of court or governmental agency, and will not violate any agreement to which Grantor is a party or to which Grantor is or any of Grantor's property is subject.

C. Name and Place of Business. Other than previously disclosed in writing to Lender, Grantor has hot changed Grantor's name or principal place of business within the last 10 years and has not used any other trade or fictitious name. Without Lender's prior written consent, Grantor does not and will not use any other name and will preserve Grantor's existing name, trade names and franchises.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

12. PROPERTY CONDITION, ALTERATIONS AND INSPECTION. Gran tor will keep the Property in good condition and make all repairs that are reasonably necessary. Grantor will not commit or allow any waste, impairment, or deterioration of the Property. Grantor will keep the Property free of noxious weeds and grasses. Grantor agrees that the nature of the occupancy and use will not substantially change without Lender's prior written consent. Grantor will not permit any change in any license, restrictive covenant or easement without Lender's prior written consent. Grantor will notify Lender of all demands, proceedings, claims, and actions against Grantor, and of any loss or damage to the Property.

No portion of the Property will be removed, demolished or materially altered without Lender's prior written consent except that Grantor has the right to remove items of personal property comprising a part of the Property that become worn or obsolete, provided that such personal property is replaced with other personal property at least equal in value to the replaced personal property, free from any title retention device, security agreement or other encumbrance. Such replacement of personal property will be deemed subject to the security interest created by this Security Instrument. Grantor will not partition or subdivide the Property without Lender's prior written consent.

Lender or Lender's agents may, at Lender's option, enter the Property at any reasonable time for the purpose of inspecting the Property. Lender will give Grantor notice at the time of or before an inspection specifying a reasonable purpose for the inspection. Any inspection of the Property will be entirely for Lender's benefit and Grantor will in no way rely on Lender's inspection.

13. AUTHORITY TO PERFORM. If Grantor fails to perform any duty or any of the covenants contained in this Security Instrument, Lender may, without notice, perform or cause them to be performed. Grantor appoints Lender as attorney in fact to sign Grantor's name or pay any amount necessary for performance. Lender's right to perform for Grantor will not create an obligation to perform, and Lender's failure to perform will not preclude Lender from exercising any of Lender's other rights under the law or this Security Instrument. If any construction on the Property is discontinued or not carried on in a reasonable manner. Lender may take all steps necessary to protect Lender's security interest in the Property, including completion of the construction.

14. ASSIGNMENT OF LEASES AND RENTS. Grantor irrevocably assigns, grants, conveys to Lender as additional security all the right, title and interest in the following (Property).

A. Existing or future leases, subleases, licenses, guaranties and any other written or verbal agreements ;for the use and occupancy of the Property, including but not limited to any extensions, renewals, modifications or Replacements (Leases).

B. Rents, issues and profits, including but not limited to security deposits, minimum rents, percentage rents, additional rents, common area maintenance charges, parking charges, real estate taxes, other applicable taxes, insurance premium contributions, liquidated damages following default, cancellation premiums, "loss of rents" insurance, guest receipts, revenues, royalties, proceeds, bonuses, accounts, contract rights, general intangibles, and all rights and claims which Grantor may have that in any way pertain to or are on account of the use or occupancy of the whole or any part of the Property (Rents).

In the event any item listed as Leases or Rents is determined to be personal property, this Assignment will also be regarded as a security agreement. Grantor will promptly provide Lender with copies of the Leases and Will certify these Leases are true and correct copies. The existing Leases will be provided on execution of the Assignment, and all future Leases and any other information with respect to these Leases will be provided immediately after they are executed. Grantor may collect, receive, enjoy and use the Rents so long as Grantor is not in default. Grantor will not collect in advance any Rents due in future lease periods, unless Grantor first obtains Lender's written consent. Upon default, Grantor will receive any Rents in trust for Lender and Grantor will not commingle the Rents with any other funds. When Lender so directs, Grantor will endorse and deliver any payments of Rents from the Property to Lender. Amounts collected will be applied at Lender's discretion to the Secured Debts, the costs of managing, protecting and preserving the Property, and other necessary expenses. Grantor agrees that this Security Instrument is immediately effective between Grantor and Lender. This Security Instrument will remain effective during any statutory redemption period until the Secured Debts are satisfied. Unless otherwise prohibited or prescribed by state law. Grantor agrees that Lender may take actual possession of the Property without the necessity of commencing any legal action or proceeding. Grantor agrees that actual possession of the Property is deemed to occur when Lender notifies Grantor of Grantor's default and demands that Grantor and Grantor's tenants pay all Rents due or to become due directly to Lender. Immediately after Lender gives Grantor the notice of default, Grantor agrees that either Lender or Grantor may immediately notify the tenants and demand that all future Rents be paid directly to Lender. As long as this Assignment is in effect, Grantor warrants and represents that no default exists under the Leases, and the parties subject to the Leases have not violated any applicable law on leases, licenses and landlords and tenants. Grantor, at its sole cost and expense, will keep, observe and perform, and require all other parties to the Leases to comply with the Leases and any applicable law. If Grantor or any party to the Lease defaults or fails to observe any applicable law, Grantor will promptly notify Lender. If Grantor neglects or refuses to enforce compliance with the terms of the Leases, then Lender may, at Lender's option, enforce compliance. Grantor will not sublet, modify, extend, cancel, or otherwise alter the Leases, or accept the surrender of the Property covered by the Leases (unless the Leases so require) without Lender's consent. Grantor will not assign, compromise, subordinate or encumber the Leases and Rents without Lender's prior written consent. Lender does not assume or become liable for the Property's maintenance, depreciation, or other losses or damages when Lender acts to manage, protect or preserve the Property, except for losses and damages due to Lender's gross.negligence or intentional torts. Otherwise, Grantor will indemnify Lender and hold Lender harmless for:all liability, loss or damage that Lender may incur when Lender opts to exercise any of its remedies against any party obligated under the Leases.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

15. DEFAULT. Grantor will be in default if any of the following events (known separately and collectively as an Event of Default) occur:

A. Payments. Grantor or Borrower fail to make a payment in full when due.

B. Insolvency or Bankruptcy. The death, dissolution or insolvency of, appointment of a receiver by or on behalf of, application of any debtor relief law, the assignment for the benefit of creditors by or on behalf of, the voluntary or involuntary termination of existence by, or the commencement of any proceeding under any present or future federal or state insolvency, bankruptcy, reorganization, composition or debtor relief law by or against Grantor, Borrower, or any co-signer, endorser, surety or guarantor of this Security Instrument or any other obligations Borrower has with Lender.

C. Business Termination. Grantor merges, dissolves, reorganizes, ends its business or existence, or a partner or majority owner dies or is declared legally incompetent.

D. Failure to Perform. Grantor fails to perform any condition or to keep any promise or covenant of this Security Instrument.

E. Other Documents. A default occurs under the terms of any other document relating to the Secured Debts.

F. Other Agreements. Grantor is in default on any other debt or agreement Grantor has with Lender.

G. Misrepresentation. Grantor makes any verbal or written statement or provides any financial information that is untrue, inaccurate, or conceals a material fact at the time it is made or provided.

H. Judgment. Grantor fails to satisfy or appeal any judgment against Grantor.

I. Forfeiture. The Property is used in a manner or for a purpose that threatens confiscation by a legal authority.

J. Name Change. Grantor changes Grantor's name or assumes an additional name without notifying Lender before making such a change.

K. Property Transfer. Grantor transfers all or a substantial part of Grantor's money or property. This condition of default, as it relates to the transfer of the Property, is subject to the restrictions contained in the DUE ON SALE section.

L. Property Value. Lender determines in good faith that the value of the Property has declined or is impaired.

M. Material Change. Without first notifying Lender, there is a material change in Grantor's business, including ownership, management, and financial conditions.

N. Insecurity. Lender determines in good faith that a material adverse change has occurred in Borrower's financial condition from the conditions set forth in Borrower's most recent financial statement before the date of this Security Instrument or that the prospect for payment or performance of the Secured Debts is impaired for any reason.

16. REMEDIES. On or after the occurrence of an Event of Default, Lender may use any and all remedies Lender has under state or federal law or in any document relating to the Secured Debts, including, without limitation, the power to sell the Property or foreclose on installments without acceleration. Any amounts advanced on Grantor's behalf will be immediately due and may be added to the balance owing under the Secured Debts. Lender may make a claim for any and all insurance benefits or refunds that may be available on Grantor's default.

Subject to any right to cure, required time schedules or any other notice rights Grantor may have under federal and state law. Lender may make all or any part of the amount owing by the terms of the Secured Debts immediately due and foreclose this Security Instrument in a manner provided by law upon the occurrence of Grantor's default or anytime thereafter.

If there is an occurrence of an Event of Default, Trustee will, in addition to any other permitted remedy, at the request of Lender, advertise and sell the Property as a whole or in separate parcels at public auction to the highest bidder for cash. Trustee will give notice of sale including the time, terms and place of sale and a description of the Property to be sold as required by the applicable law in effect at the time of the proposed sale.

Upon the sale of the Property, to the extent not prohibited by law, and at such time purchaser is legally entitled to it, Trustee shall make and deliver a deed to the Property sold which conveys title to the purchaser, and after first paying all fees, charges and costs, shall pay to Lender all monies advanced for repairs, taxes, insurance liens, assessments and prior encumbrances and interest thereon, and the principal and interest on the Secured Debt, paying the surplus, if any, to persons legally entitled to it. Lender may purchase the Property. The recitals in any deed of conveyance shall be prima facie evidence of the facts set forth therein.

All remedies are distinct, cumulative and not exclusive, and Lender is entitled to all remedies provided at law or equity, whether or not expressly set forth. The acceptance by Lender of any sum in payment or partial payment on the Secured Debts after the balance is due or is accelerated or after foreclosure proceedings are filed will not constitute a waiver of Lender's right to require full and complete cure of any existing default. .By not exercising any remedy, Lender does not waive Lender's right to later consider the event a default if it continues or happens again.

17. COLLECTION EXPENSES AND ATTORNEYS' FEES. On or after the occurrence of an Event of Default, to the extent permitted by law, Grantor agrees to pay all expenses of collection, enforcement or protection of Lender's rights and remedies under this Security Instrument or any other document relating to the Secured Debts. Grantor agrees to pay expenses for Lender to inspect and preserve the Property and for any recordation costs of releasing the Property from this Security Instrument. Expenses include, but are not limited ito, attorneys' fees, court costs and other legal expenses. These expenses are due and payable immediately. If pot paid immediately, these expenses will bear interest from the date of payment until paid in full at the highest interest rate in effect as provided for in the terms of the Secured Debts. In addition, to the extent permitted by the United States Bankruptcy Code, Grantor agrees to pay the reasonable attorneys' fees incurred by Lender to protect Lender's rights and interests in connection with any bankruptcy proceedings initiated by or against Grantor.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

18. ENVIRONMENTAL LAWS AND HAZARDOUS SUBSTANCES. As used in this section, (1) Environmental Law means, without limitation, the Comprehensive Environmental Response, Compensation and Liability Act Eldorado Artesian Springs, Inc. Colorado Deed Of Trust (CERCLA, 42 U.S.C. 9601 et seq.), all other federal, state and local laws, regulations, ordinances, court orders, attorney general opinions or interpretive letters concerning the public health, safety, welfare, environment or a hazardous substance; and (2) Hazardous Substance means any toxic, radioactive or hazardous material, waste, pollutant or contaminant which has characteristics which render the substance dangerous or potentially dangerous to the public health, safety, welfare or environment. The term includes, without limitation, any substances defined as "hazardous material," "toxic substance," "hazardous waste," "hazardous substance," or "regulated substance" under any Environmental Law.

Grantor represents, warrants and agrees that:

A. Except as previously disclosed and acknowledged in writing to Lender, no Hazardous Substance has been, is, or will be located, transported, manufactured, treated, refined, or handled by any person on, under or about the Property, except in the ordinary course of business and in strict compliance with all applicable Environmental Law.

B. Except as previously disclosed and acknowledged in writing to Lender, Grantor has not and will not cause contribute to, or permit the release of any Hazardous Substance on the Property.

C. Grantor will immediately notify Lender if (1) a release or threatened release of Hazardous Substance occurs on, under or about the Property or migrates or threatens to migrate from nearby property; or (2) there is a violation of any Environmental Law concerning the Property. In such an event, Grantor will take all necessary remedial action in accordance with Environmental Law.

D. Except as previously disclosed and acknowledged in writing to Lender, Grantor has no knowledge of or reason to believe there is any pending or threatened investigation, claim, or proceeding of any kind relating to (1) any Hazardous Substance located on, under or about the Property; or (2) any violation by Grantor or any tenant of any Environmental Law. Grantor will immediately notify Lender in writing as soon as Grantor has reason to believe there is any such pending or threatened investigation, claim, or proceeding. In such an event, Lender has the right, but not the obligation, to participate in any such proceeding including the right to receive copies of any documents relating to such proceedings.

E. Except as previously disclosed and acknowledged in writing to Lender, Grantor and every tenant have been, are and will remain in full compliance with any applicable Environmental Law.

F. Except as previously disclosed and acknowledged in writing to Lender, there are no underground storage tanks, private dumps or open wells located on or under the Property and no such tank, dump or well will be added unless Lender first consents in writing.

G. Grantor will regularly inspect the Property, monitor the activities and operations on the Property, and confirm that all permits, licenses or approvals required by any applicable Environmental Law are obtained and complied with.

H. Grantor will permit, or cause any tenant to permit, Lender or Lender's agent to enter and inspect the Property and review all records at any reasonable time to determine (1) the existence, location and nature of any Hazardous Substance on, under or about the Property; (2) the existence, location, nature, and magnitude of any Hazardous Substance that has been released on, under or about the Property; or (3) whether or pot Grantor and any tenant are in compliance with applicable Environmental Law.

I. Upon Lender's request and at any time, Grantor agrees, at Grantor's expense, to engage a qualified environmental engineer to prepare an environmental audit of the Property and to submit the results of such audit to Lender. The choice of the environmental engineer who will perform such audit is subject to Lender's approval.

J. Lender has the right, but not the obligation, to perform any of Grantor's obligations under this section at Grantor's expense.

K. As a consequence of any breach of any representation, warranty or promise made in this section, (1) Grantor will indemnify and hold Lender and Lender's successors or assigns harmless from and against all losses, claims, demands, liabilities, damages, cleanup, response and remediation costs, penalties and expenses, including without limitation all costs of litigation and attorneys' fees, which Lender and Lender's successors or assigns may sustain; and (2) at Lender's discretion, Lender may release this Security Instrument and in return Grantor will provide Lender with collateral of at least equal value to the Property without prejudice to any of Lender's rights under this Security Instrument.

L. Notwithstanding any of the language contained in this Security Instrument to the contrary, the terms of this section will survive any foreclosure or satisfaction of this Security Instrument regardless of any passage of title to Lender or any disposition by Lender of any or all of the Property. Any claims and defenses to the contrary are hereby waived.

19. CONDEMNATION. Grantor will give Lender prompt notice of any pending or threatened action by private or public entities to purchase or take any or all of the Property through condemnation, eminent domain, or any other means. Grantor authorizes Lender to intervene in Grantor's name in any of the above described actions or claims. Grantor assigns to Lender the proceeds of any award or claim for damages connected with) a condemnation or other taking of all or any part of the Property. Such proceeds will be considered payments and will be applied as provided in this Security Instrument. This assignment of proceeds is subject to the terms of any prior mortgage, deed of trust, security agreement or other lien document.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

|

|

||

20. INSURANCE. Grantor agrees to keep the Property insured against the risks reasonably associated with the Property. Grantor will maintain this insurance in the amounts Lender requires. This insurance will last until the Property is released from this Security Instrument. What Lender requires pursuant to the preceding two sentences can change during the term of the Secured Debts. Grantor may choose the insurance company, subject to Lender's approval, which will not be unreasonably withheld.

All insurance policies and renewals shall include a standard "mortgage clause" (or "lender loss payable clause") endorsement that names Lender as "mortgagee" and "loss payee". If required by Lender, all insurance policies and renewals will also include an "additional insured" endorsement that names Lender as an "additional insured". If required by Lender, Grantor agrees to maintain comprehensive general liability insurance and rental loss or business interruption insurance in amounts and under policies acceptable to Lender. The comprehensive general liability insurance must name Lender as an additional insured. The rental loss or business interruption insurance must be in an amount equal to at least coverage of one year's debt service, and required escrow account deposits (if agreed to separately in writing).

Grantor will give Lender and the insurance company immediate notice of any loss. All insurance proceeds will be applied to restoration or repair of the Property or to the Secured Debts, at Lender's option. If Lender acquires the Property in damaged condition, Grantor's rights to any insurance policies and proceeds will pass to Lender to the extent of the Secured Debts.

Grantor will immediately notify Lender of cancellation or termination of insurance. If Grantor fails to keep the Property insured, Lender may obtain insurance to protect Lender's interest in the Property and Grantor will pay for the insurance on Lender's demand. Lender may demand that Grantor pay for the insurance all at once or Lender may add the insurance premiums to the balance of the Secured Debts and charge interest on it at the rate that applies to the Secured Debts. This insurance may include coverages not originally required of Grantor, may be written by a company other than one Grantor would choose, and may be written at a higher rate than Grantor could obtain if Grantor purchased the insurance. Grantor acknowledges and agrees that Lender or one of Lender's affiliates may receive commissions on the purchase of this insurance.

21. ESCROW FOR TAXES AND INSURANCE. Grantor will not be required to pay to Lender funds for taxes and insurance in escrow.

22. WAIVERS. Except to the extent prohibited by law, Grantor waives all appraisement and homestead exemption rights relating to the Property.

23. OTHER TERMS. The following are applicable to this Security Instrument:

A. No Action by Lender. Nothing contained in this Security Instrument shall require Lender to take any action.

B. Additional Terms.

In Addition to all other remedies available to Lender under Security Instrument, Lender shall be entitled, as a matter of absolute right and without regard to the value of any security for the Secured Debts or the solvency of any person liable therefore, to the appointment of a receiver for the Property upon ex-parte application to any court of competent jurisdiction. Grantor waives any right to any hearing or notice, of hearing prior to the appointment of a receiver. Such receiver and his agents shall be empowered to take all actions as directed by a court of competent jurisdiction, including but not limited to each of the following:

A. Take possession of the Property and any business conducted by Grantor or any other person thereon and any business assets used in connection therewith and, if the receiver deems it appropriate, to operate the same.

B. Exclude Grantors agents, servants, and employees from the Property.

C. Collect the rents, issues, profits, and income there from.

D. Complete any construction which may be in progress.

E. Do such maintenance and make such repairs and alterations as the receiver deems necessary.

F. Use all stores of materials, supplies, and maintenance equipment on the Property and replace such items at the expense of the receivership estate.

G. Pay all taxes and assessments against the Property, all premiums for insurance thereon, all utility and other operating expenses incurred by the receiver or his agents, and shall constitute a part of the Secured Debts.

Any revenues collected by the receiver shall be applied first to the expenses of the receivership, including attorneys fees incurred by the receiver and by Lender, together with interest thereon at the interest rate in effect pursuant to the Secured Debts, from the date incurred until repaid, and the balance shall be applied toward the Secured Debts or in such other manner as the court may direct. Unless sooner terminated with the express consent of Lender, any such receivership will continue until the Secured Debts have been discharged in full, or until title to the Property has passed after foreclosure sale and all applicable periods of redemption have expired.

24. APPLICABLE LAW. This Security Instrument is governed by the laws of Colorado, the United States of America, and to the extent required, by the laws of the jurisdiction where the Property is located, except to the extent such state laws are preempted by federal law.

25. JOINT AND INDIVIDUAL LIABILITY AND SUCCESSORS. Each Grantor's obligations under this Security Instrument are independent of the obligations of any other Grantor. Lender may sue each Grantor individually or together with any other Grantor. Lender may release any part of the Property and Grantor will still be obligated under this Security Instrument for the remaining Property. Grantor agrees that Lender and any party to this Security Instrument may extend, modify or make any change in the terms of this Security Instrument or any evidence of debt without Grantor's consent. Such a change will not release Grantor from the terms of this Security Instrument. The duties and benefits of this Security Instrument will bind and benefit the successors and assigns of Lender and Grantor.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

|

|

||

26. AMENDMENT, INTEGRATION AND SEVERABILITY. This Security Instrument may not be amended or modified by oral agreement. No amendment or modification of this Security Instrument is effective unless made in writing and executed by Grantor and Lender. This Security Instrument and any other documents relating to the Secured Debts are the complete and final expression of the agreement. If any provision of this Security Instrument is unenforceable, then the unenforceable provision will be severed and the remaining provisions will still be enforceable.

27. INTERPRETATION. Whenever used, the singular includes the plural and the plural includes the singular. The section headings are for convenience only and are not to be used to interpret or define the terms of this Security Instrument.

28. NOTICE, ADDITIONAL DOCUMENTS AND RECORDING FEES. Unless otherwise required by law, any notice will be given by delivering it or mailing it by first class mail to the appropriate party's address listed in the DATE AND PARTIES section, or to any other address designated in writing. Notice to one Grantor will be deem]ed to be notice to all Grantors. Grantor will inform Lender in writing of any change in Grantor's name, address or other application information. Grantor will provide Lender any other, correct and complete information Lender requests to effectively mortgage or convey the Property. Grantor agrees to pay all expenses, charges and taxes in connection with the preparation and recording of this Security Instrument. Grantor agrees to sign, deliver, and file any additional documents or certifications that Lender may consider necessary to perfect, continue, and preserve Grantor's obligations under this Security Instrument and to confirm Lender's lien status on any Property, and Grantor agrees to pay all expenses, charges and taxes in connection with the preparation and recording thereof. Time is of the essence.

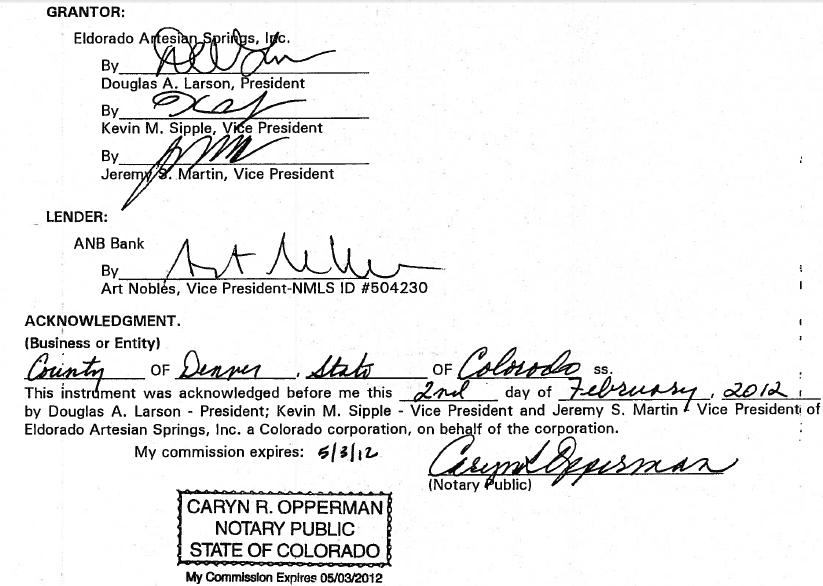

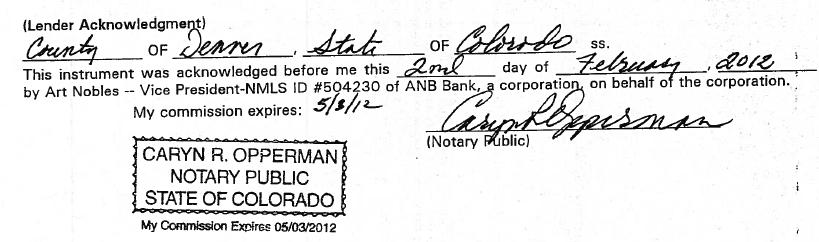

SIGNATURES. By signing, Grantor agrees to the terms and covenants contained in this Security Instrument. Grantor also acknowledges receipt of a copy of this Security Instrument.

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

|

|

||

|

Eldorado Artesian Springs, Inc.

|

|

|

|

Colorado Commercial Loan Agreement

|

||

|

CO/4XXXXVcox00225400007854030020112Y

|

Wolters Kluwer Financial Services "1996, 2012 Bankers Systems'" | |

|

|

||