Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - NEUSTAR INC | d293178dex991.htm |

| 8-K - FORM 8-K - NEUSTAR INC | d293178d8k.htm |

Earnings Report

February 2, 2012

Neustar, Inc

Supplemental Information

Exhibit 99.2 |

2

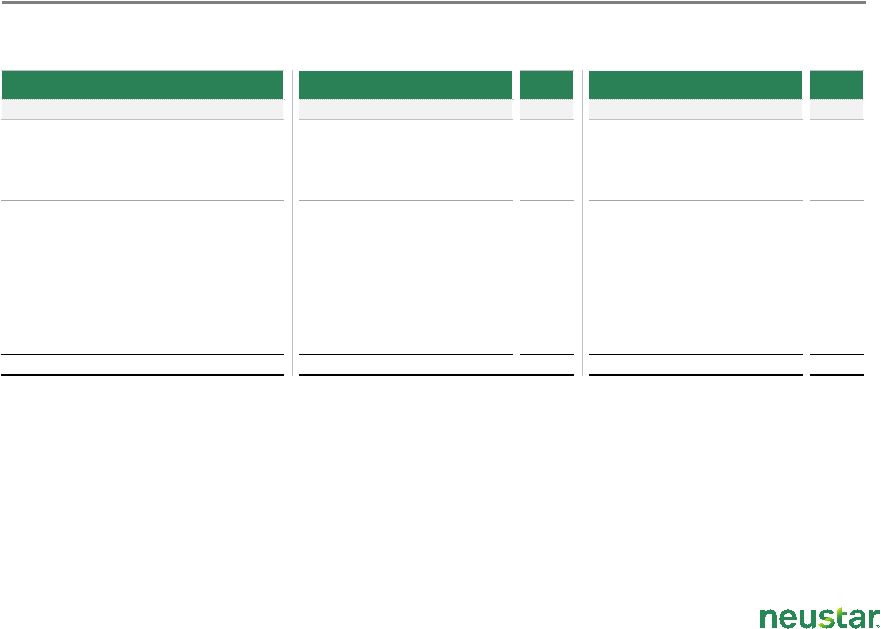

Revenue by Segment

Carrier Services:

Numbering

Services

–

We

operate

and

maintain

authoritative

databases

for

telephone

number

resources

utilized

by

our

carrier

customers

and

manage

the

telephone

number

lifecycle.

The

services

utilizing

these

databases

are:

NPAC

Services

in

the

United

States

and

Canada,

International

LNP

Services

(Taiwan

and

Brazil)

and

Number

Administration.

Order

Management

Services

–

Our

Order

Management

Services

(OMS)

permit

carrier

customers,

through

a

single

interface,

to

exchange

essential

operating

data

with

multiple

carriers

in

order

to

provision

services.

IP Services –

We provide scalable IP services to carriers which allow them to manage access for

the routing of IP communications. Enterprise Services:

Internet

Infrastructure

Services

–

We

provide

a

suite

of

domain

name

systems

(DNS)

services

to

our

enterprise

customers

built

on

a

global

directory

platform.

These

services

include

Managed

DNS,

Monitoring and Load Testing, and IP Geolocation.

Registry

Services

–

We

operate

the

authoritative

registries

for

certain

Internet

domain

names

and

operate

the

authoritative

U.S.

Common

Short

Code

(CSC)

registry

on

behalf

of

wireless

carriers

in

the

United

States.

These

services

include

the

registry

services

for

.biz,

.us,

.co,

.tel

and

.travel

domain

names,

as

well

as

the

registry

for

U.S.

Common

Short

Codes.

Information Services:

Identification

Services

–

Our

real-time

identification

services

include

the

provision

of

caller-name

and

related

information

to

telephony

providers,

delivery

of

identity

and

other

attribute

data

for

use

in

call

centers or in remarketing efforts, and geographic-based solutions for

intelligent call routing, Web-based location lookup, and site planning.

Verification

&

Analytics

Services

–

We

provide

verification

services

that

allow

clients

to

validate

customer-provided

information,

enhance

sales

leads

and

assign

quality

ratings

to

maximize

a

prospect’s

“reachability.”

Our broad-based analytic capabilities also utilize real-time predictive

scoring to determine which prospects are most likely to purchase, become a high-value customer or respond to a

particular marketing campaign.

We also provide an intelligent, privacy-friendly mechanism for delivering

targeted, real-time advertising on the Internet. Local

Search

&

Licensed

Data

Services

–

We

provide

an

online

listing

identity

management

solution

that

provides

the

essential

tools

to

verify,

enhance

and

manage

the

identity

of

local

listings

across

the

Web.

We also maintain an expansive data repository that provides a more current

alternative to Directory Listing and White Page compilations. |

3

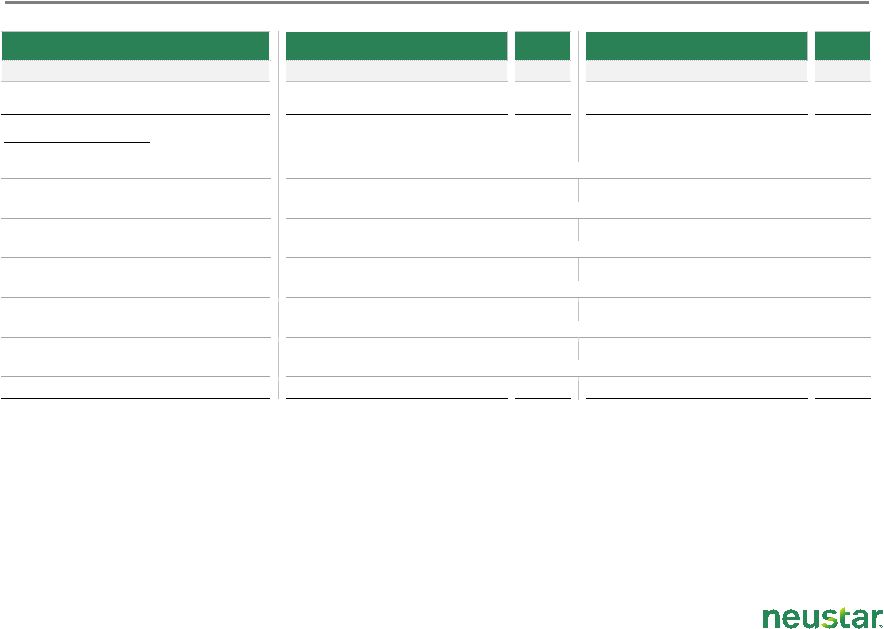

Reconciliation of Segment Contribution

RECONCILIATION OF NON-GAAP FINANCIAL MEASURE

Neustar

presents

certain

non-GAAP

financial

data.

To

place

this

data

in

an

appropriate

context,

above

is

a

reconciliation

of

our

segments’

revenue

and

contribution

to

consolidated income from continuing operations for the periods presented. The

reconciliation allows investors to appropriately consider each non-GAAP financial measure.

These non-GAAP financial measures, however, should not be considered a

substitute for or superior to, financial measures calculated in accordance with GAAP, and the

financial results calculated in accordance with GAAP and reconciliations from these

results should be carefully evaluated. Management believes that these measures enhance

investors’

understanding of the company’s financial performance and the comparability of

the company’s operating results to prior periods, as well as against the performance of

other companies. However, these non-GAAP financial measures may not be

comparable with similar non-GAAP financial measures used by other companies and should not be

considered in isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. $ in 000s

Full-Year

Full-Year

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2010

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Segment contribution

Carrier Services

87,227

87,999

86,561

90,530

352,317

96,579

97,570

99,302

97,549

391,000

Enterprise Services

12,788

13,261

15,733

17,502

59,284

15,651

15,418

16,551

17,460

65,080

Information Services

–

–

–

–

–

–

–

–

12,583

12,583

Total segment contribution

100,015

101,260

102,294

108,032

411,601

112,230

112,988

115,853

127,592

468,663

Indirect operating expenses:

Cost of revenue (excl. depreciation & amortization)

18,672

18,325

18,724

19,969

75,690

19,627

19,742

20,424

24,197

83,990

Sales and marketing

4,539

4,148

3,736

3,922

16,345

3,825

4,617

3,584

5,314

17,340

Research and development

3,505

2,667

3,119

2,580

11,871

3,598

2,912

3,575

6,149

16,234

General and administrative

17,296

14,273

15,557

16,624

63,750

19,287

21,108

19,742

32,180

92,317

Depreciation and amortization

7,801

7,769

8,255

9,036

32,861

9,146

9,386

10,486

17,191

46,209

Restructuring charges (recoveries)

1,235

771

(417)

3,772

5,361

432

(12)

(33)

3,162

3,549

Consolidated income from operations

46,967

53,307

53,320

52,129

205,723

56,315

55,235

58,075

39,399

209,024

2010 Quarter Ended,

2011 Quarter Ended, |

4

Key Performance Metrics |

5

Expense by Cost

by Quarter and as a Percentage of Revenue

Full-Year

Full-Year

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2010

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Revenue ($ in 000s)

126,835

127,731

129,438

136,862

520,866

146,095

147,683

152,497

174,180

620,455

Expense by type ($ in 000s)

Cost of revenue (excl. depreciation & amortization)

27,016

26,988

27,574

29,704

111,282

31,052

31,417

34,194

41,329

137,992

% of Revenue

21%

21%

21%

22%

21%

21%

21%

22%

24%

22%

Sales and marketing

22,160

21,204

21,322

21,677

86,363

24,939

26,267

25,069

33,580

109,855

% of Revenue

17%

17%

16%

16%

17%

17%

18%

16%

19%

18%

Research and development

4,021

3,108

3,519

3,132

13,780

3,996

3,441

3,746

6,326

17,509

% of Revenue

3%

2%

3%

2%

3%

3%

2%

2%

4%

3%

General and administrative

17,635

14,584

15,865

17,412

65,496

20,215

21,949

20,960

33,193

96,317

% of Revenue

14%

11%

12%

13%

13%

14%

15%

14%

19%

16%

Depreciation & amortization

7,801

7,769

8,255

9,036

32,861

9,146

9,386

10,486

17,191

46,209

% of Revenue

6%

6%

6%

7%

6%

6%

6%

7%

10%

7%

Restructuring charges (recoveries)

1,235

771

(417)

3,772

5,361

432

(12)

(33)

3,162

3,549

% of Revenue

1%

1%

0%

3%

1%

0%

0%

0%

2%

1%

Total operating expense

79,868

74,424

76,118

84,733

315,143

89,780

92,448

94,422

134,781

411,431

2010 Quarter Ended,

2011 Quarter Ended, |

6

Expense Details

Other Details and Headcount

Stock-based compensation by type ($ in 000s)

Full-

Year

Full-

Year

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2010

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Cost of revenue

513

655

635

510

2,313

476

616

780

940

2,812

Sales and marketing

1,171

1,370

1,285

1,245

5,071

1,726

1,989

1,907

2,378

8,000

Research and development

152

246

263

227

888

335

312

345

381

1,373

General and administrative

1,748

2,447

2,526

2,052

8,773

3,479

3,083

3,428

5,316

15,306

Total stock-based compensation expense

3,584

4,718

4,709

4,034

17,045

6,016

6,000

6,460

9,015

27,491

Amortization of intangibles ($ in 000s)

1,054

1,015

1,082

1,602

4,753

1,129

1,110

1,716

8,152

12,107

Headcount by type

Year-

End

Year-

End

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2010

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Cost of revenue

386

368

358

392

392

385

390

430

658

658

Sales and marketing

292

279

295

297

297

300

306

327

461

461

Research and development

81

81

84

82

82

83

78

77

137

137

General and administrative

176

181

187

193

193

199

200

200

232

232

Total headcount

935

909

924

964

964

967

974

1,034

1,488

1,488

2010 Quarter Ended,

2010 Quarter Ended,

2011 Quarter Ended,

2011 Quarter Ended, |

7

Statement of Operations

Note:

During

the

second

quarter

of

2011,

the

Company

completed

its

exit

from

the

Converged

Messaging

Services

business.

The

results

of

operations

of

the

Company’s

Converged

Messaging

Services

business

have

been

reclassified

as

discontinued

operations

for

all

periods

presented. |