Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEDISYS INC | d281433d8k.htm |

| EX-99.2 - RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES - AMEDISYS INC | d281433dex992.htm |

January

2012 JP Morgan Healthcare Conference

clinical

quality

innovative

care models

better

communities

Exhibit 99.1 |

Leading Home

Health & Hospice Forward-looking statements

This presentation may include forward-looking statements as defined by the

Private Securities Litigation Reform Act of 1995. These forward-looking

statements are based upon current expectations and assumptions about our

business that are subject to a variety of risks and uncertainties that could

cause actual

results

to

differ

materially

from

those

described

in

this

presentation.

You

should not rely on forward-looking statements as a prediction of future events.

Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially from those discussed in any forward-looking statements are described

in reports and registration statements we file with the SEC, including our

Annual Report on Form 10-K and subsequent Quarterly Reports on Form

10-Q and Current Reports on Form 8-K, copies of which are available

on the Amedisys internet

website

http://www.amedisys.com

or

by

contacting

the

Amedisys

Investor

Relations department at (800) 467-2662.

We disclaim any obligation to update any forward-looking statements or any

changes in events, conditions or circumstances upon which any

forward-looking statement may be based except as required by law.

2

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we

have posted additional important

information such as press releases,

profiles concerning our business

and clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-

critical information regarding the

Company in advance of or in lieu of

distributing a press release or a

filing with the SEC disclosing the

same information. |

Leading Home

Health & Hospice Company overview

1

3

•

Founded in 1982, publicly listed 1994

•

572 locations in 45 states

•

$1.5 billion in TTM revenue

•

Leading provider of home health

services

-

Services include skilled nursing

and therapy services

•

Growing hospice business

•

94% of home health revenue is

episodic based (both Medicare &

non-Medicare)

16,850 employees

Home Health Division:

-3Q11 admissions of 69,000

-8.4 million annualized visits

Hospice Division:

-

Average daily census = 4,902

-

Average length of stay = 86 days

1

For the quarter ended September 30, 2011

Stats

Revenue Mix

83%

17%

Home Health

Hospice |

4

Care Center Locations 2004

108 -

Home Health locations

2 -

Hospice locations

Leading Home Health & Hospice |

Care

Center Locations 2011 5

482 -

Home Health locations

90 -

Hospice locations

*As of September 30, 2011

Leading Home Health & Hospice |

Leading Home

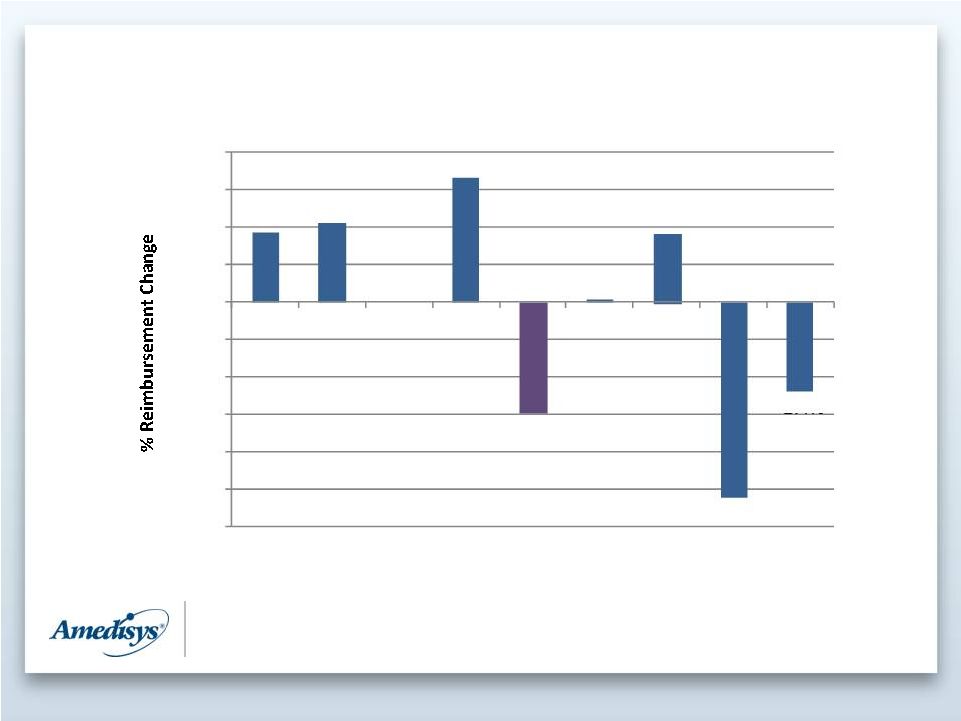

Health & Hospice Home Health Base Rate Changes

6

1.9%

2.1%

0.0%

3.3%

-2.9%

0.1%

1.8%

-5.2%

-2.4%

-6.0%

-5.0%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

Leading Home

Health & Hospice Value Proposition

•

Home health is the lowest total cost, lowest daily cost, and provides

care over the longest period of time

7

*Source: National Association for Home Health & Hospice, Medpac June 2011 Data

Book Hospital

SNF

Hospice

Home

Health

Average Cost of Stay

$30,380

$16,794

$11,008

$5,848

Average Length of Stay

4.9 days

27 days

86 days

120 days

Per Diem Cost

$6,200

$622

$128

$49 |

Leading Home

Health & Hospice Operational Focus

8

•

Realignment

–

Enhanced

leadership

focus

on

growth

-

organic

and

managed

care

–

Managing continuum of post acute care

Combining leadership of home health and hospice under Jim Robinson

Reorganizing field into 5 geographic regions

Better capture of home health and hospice synergies

–

Closing/consolidating of ~50 care centers

Annualized revenue of $34 million and $10 million in contribution

losses •

Operating tenets

–

Clinical

–

Growth

–

Efficiency |

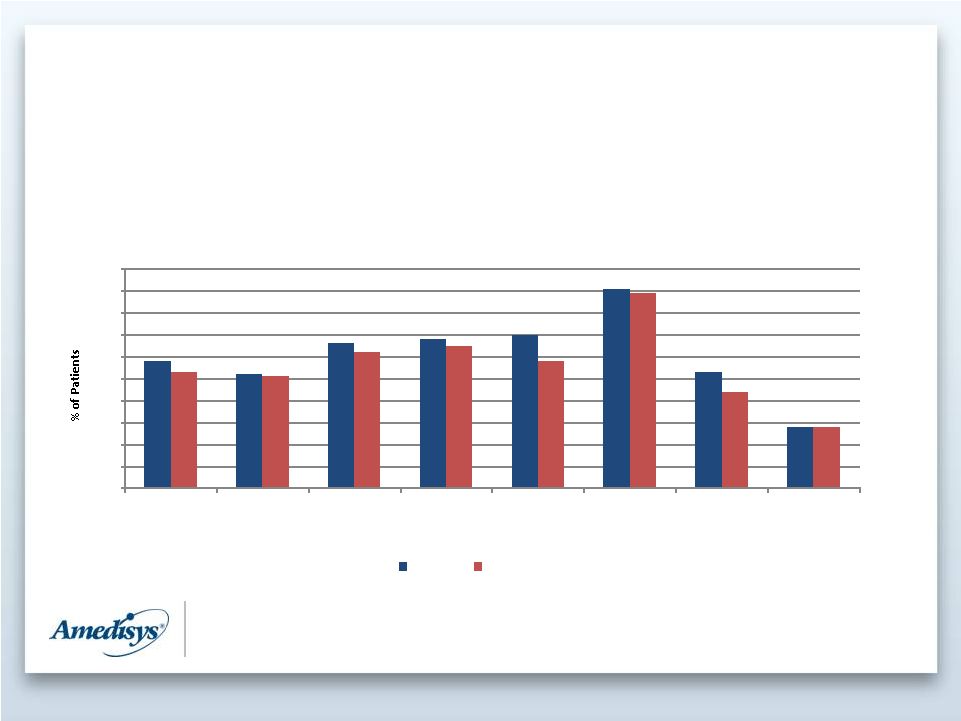

Leading Home

Health & Hospice Focus on Operating Tenets

9

•

Clinical Outcomes

–

Exceeded or met 8 out of 8 outcomes vs. footprint of reported measures

*

Lower % is better

Source: Medicare

Amedisys vs. Footprint –

Outcomes June 2011

58

52

66

68

70

91

53

28

53

51

62

65

58

89

44

28

0

10

20

30

40

50

60

70

80

90

100

Impovement in

Ambulation

Improvement in

Transferring

Improvement in

Bathing

Improvement in

Pain

Breathing

Improvement

Improvement of

Surgical Wounds

Improvement in

Mgmt of Oral

Meds

Acute Care

Hospitalization*

Amedisys

Footprint |

Leading Home

Health & Hospice Focus on Operating Tenets

10

•

Clinical Focus

–

Care Transitions

–

Investing in clinical leadership team

–

AMS3

•

Quality recognitions

–

CMS quality bonus payments in 2010

and 2011

–

Home Care Elite |

Leading Home

Health & Hospice Focus on Operating Tenets

11

•

Growth

–

Organic

Leadership focus

Market intelligence

Managed care

Going deep in markets

Incentives

–

Longer term consolidation opportunities |

Leading Home

Health & Hospice Focus on Operating Tenets

12

•

Efficiency

–

ERP System

–

Industry leading operating system (AMS)

–

Point-of-care

•

Future system enhancements

–

Technical

–

Economics

–

Strategic

–

Clinical

–

Quality

–

Connectivity |

Leading Home

Health & Hospice Financial Review

13 |

Leading Home

Health & Hospice Financial highlights

14

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2004

2005

2006

2007

2008

2009

2010

2011

Revenue

Projected Revenue

Projected Adj. EPS

Adj. EPS |

Leading Home

Health & Hospice 15

Summary financial results

($ in millions, except per share data)

2009

2010

3Q10

3Q11

Net revenue

$1,513.5

$1,634.3

$404.7

$374.9

Adjusted EBITDA

261.8

242.0

51.9

29.4

Adjusted EBITDA Margin

17.3%

14.8%

12.8%

7.8%

Adjusted

Fully-diluted

EPS

$4.89

$4.29

$0.89

$0.36

1 Adjusted

EBITDA,

a

non-GAAP

financial

measure,

is

defined

as

net

income

attributable

to

Amedisys,

Inc.

before

provision

for

income

taxes,

net

interest

(income)

expense,

and

depreciation and amortization plus certain adjustments (i.e. certain items incurred

in 2010 and 2011, which are detailed in our Form 8-K filed with the Securities and Exchange

Commission on February 22, 2011 and November 1, 2011, respectively). Adjusted

diluted earnings per share, a non-GAAP financial measure, is defined as diluted earnings per

share plus the earnings per share effect of the certain adjustments noted

above. These non-GAAP financial measures should not be considered as an alternative to, or more

meaningful than, income before income taxes, cash flow from operating activities,

or other traditional indicators of operating performance. The calculations of these non-GAAP

financial measures may not be comparable to similarly titled measures reported by

other companies, since not all companies calculate these non-GAAP financial measures in the

same manner.

1

1 |

Leading Home

Health & Hospice 16

Summary performance results

2009

2010

3Q10

3Q11

Home Health

Agencies at period end

521

486

537

482

Total visits

8,702,146

9,065,549

2,260,608

2,113,413

Episodic-based admissions

231,782

253,763

63,472

58,145

Completed episodes

411,975

424,988

104,997

98,020

Revenue per episode

$3,166

$3,311

$3,294

$2,975

Hospice

Agencies at period end

65

67

72

90

Total admissions

9,002

11,510

2,782

4,608

Daily census

2,150

2,880

2,978

4,902

Average length of stay

82

87

87

86 |

Leading Home

Health & Hospice 17

Summary balance sheet

Dec. 31, 2010

Sep. 30, 2011

Assets

Cash

$ 120.3

$ 29.5

Accounts Receivable, Net

141.5

151.2

Property and Equipment

138.6

146.9

Goodwill

791.4

335.8

Other

108.1

183.4

Total Assets

$ 1,299.9

$ 846.8

Liabilities and Equity

Debt

$ 181.9

$ 153.3

All Other Liabilities

238.3

181.5

Equity

879.7

512.0

Total Liabilities and Equity

$ 1,299.9

$ 846.8

Leverage Ratio

0.8x

0.9x |

Leading Home

Health & Hospice 18

Liquidity

•

Cash balance at 9/30/11 = $29M

•

Available line of credit (LOC): 9/30/11 = $231M

•

2011 Cash Flow -

Cap Ex = ~$75M -

$85M

•

Days Sales Outstanding = 35.9 |

Leading Home

Health & Hospice 19

Guidance

Calendar Year 2011

Net revenue:

$1.475 -

$1.5 billion

EPS:

$1.90 -

$2.00

Diluted shares:

29.3 million

2

Guidance excludes the effects of the following: non-cash impairment charge, any future

acquisitions, if any are made; effects of any share repurchases; non-recurring costs (i.e.

certain items) that may be incurred during the year; or the impact of the final 2012 Medicare

rate changes. Provided as of the date of our form 8-K filed with the Securities and Exchange Commission on

November 1,

2011.

1

2

1 |

Leading Home

Health & Hospice Investment Rationale

•

Favorable industry growth rates

•

IT infrastructure/scalability

•

Clinical quality and innovation

•

Strong liquidity and capital position

•

Market share capture opportunities

20 |

Leading Home

Health & Hospice Contact information

Kevin B. LeBlanc

Director of Investor Relations

Amedisys, Inc.

5959 S. Sherwood Forest Boulevard

Baton Rouge, LA 70816

Office: 225.299.3391

Fax: 225.298.6435

kevin.leblanc@amedisys.com

21 |