Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - rue21, inc. | d279550d8k.htm |

Exhibit 99.1 |

Safe

Harbor Statement Certain statements in this presentation and responses to various

questions may be “forward-looking statements” which reflect the

company’s current expectations or beliefs concerning future events.

Actual results of operations may differ materially from historical

results or current expectations. Any such forward-looking statements

are subject to various risks and uncertainties, including the strength

of the economy, changes in the overall level of consumer spending or

preferences in apparel, our ability to compete with other retailers, the

performance of the company’s products within the prevailing retail

environment, our strategy and expansion plans, reliance on key

personnel, trade restrictions, political or financial instability in

countries where the company’s goods are manufactured, availability

of suitable store locations at appropriate terms and other factors

which are set forth in the company’s SEC filings, which are available

on our website. |

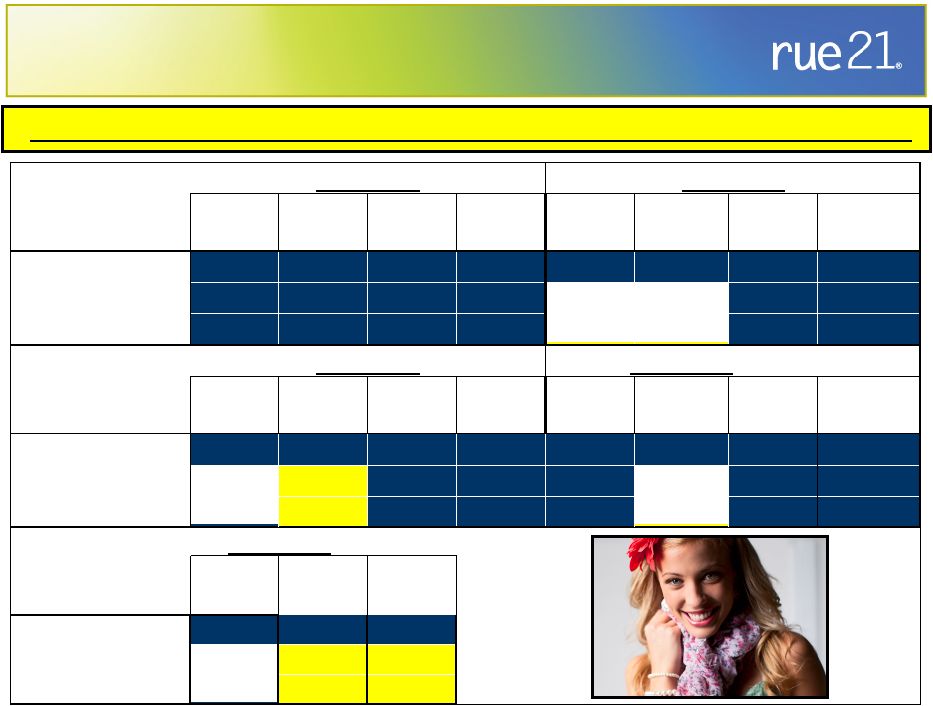

Product:

diversified, branded, exclusive labels

Real Estate

flexibility

Square Footage Growth

opportunity

Management

Team

depth

and

experience

System Infrastructure

continually

investing for the future

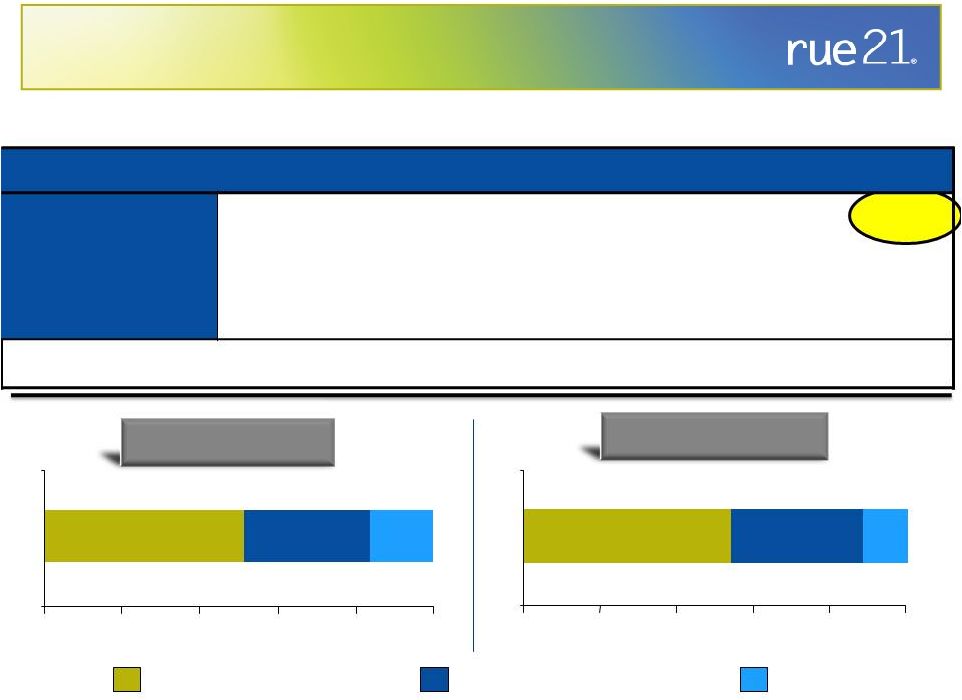

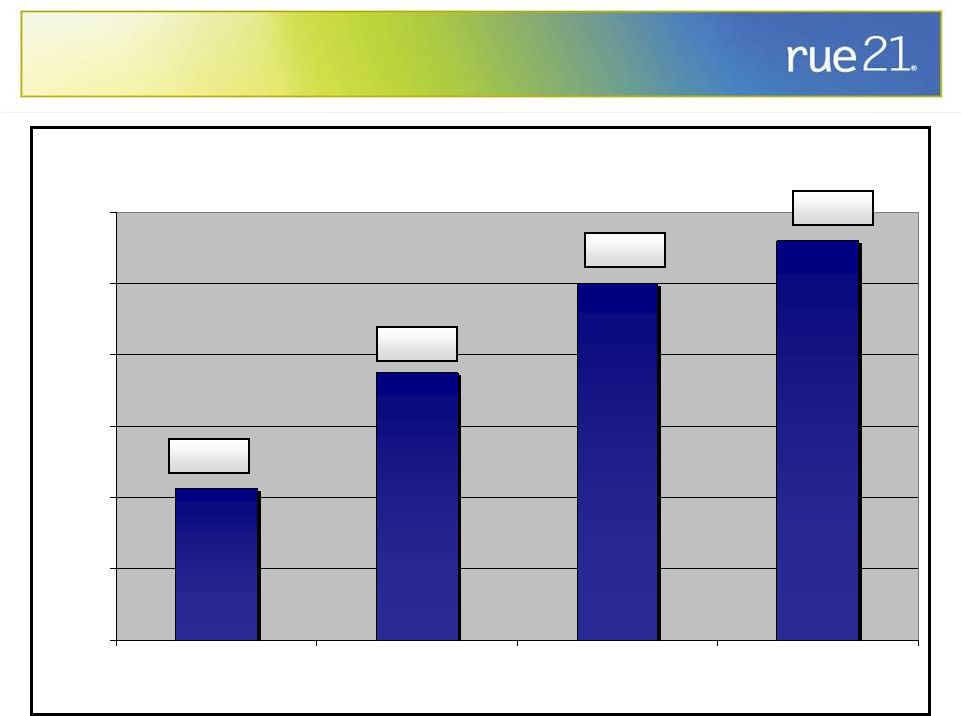

Doubled Store Base Twice!

and Plan to Do It Again!

352

755

1,500

0

300

600

800

1,000

1,500

2007

2011

2018E

Over 2x

Over 2x

Who

is

rue21

and

how

do

we

generate

predictable

growth? |

Consistent

Total Sales Growth

Compound Sales Growth of 28% over 7 yrs.

Millions

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

$700.0

$800.0

2003

2004

2005

2006

2007

2008

2009

2010

3Q '11

TTM

$120.6

$146.9

$192.8

$225.6

$296.9

$391.4

$730.5

$634.7

$525.6 |

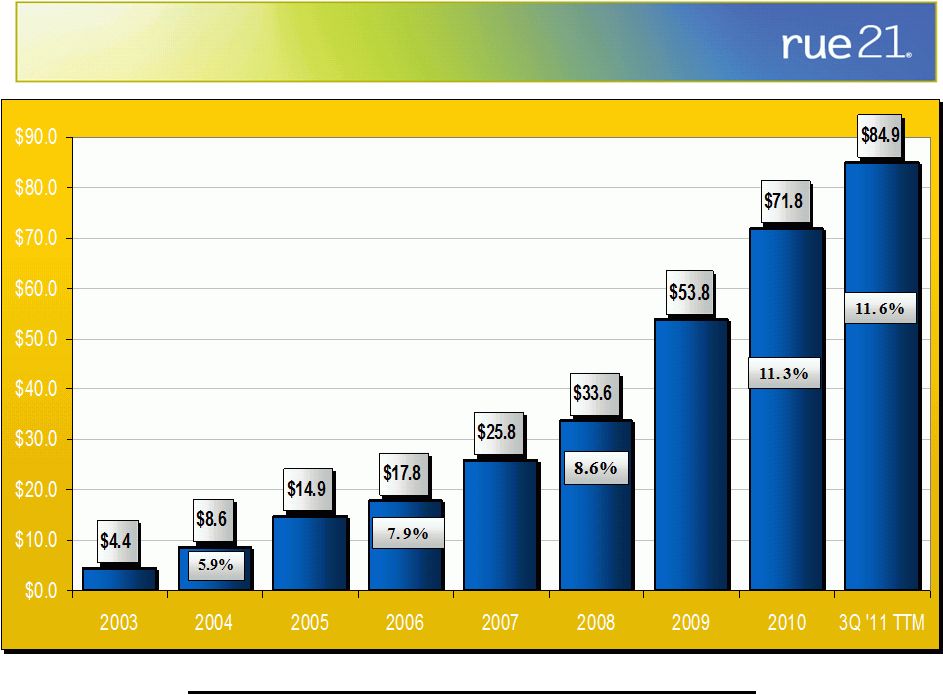

Compound

EBITDA Growth of 49% over 7 yrs. Proven Earnings Growth and Margin Expansion

Millions |

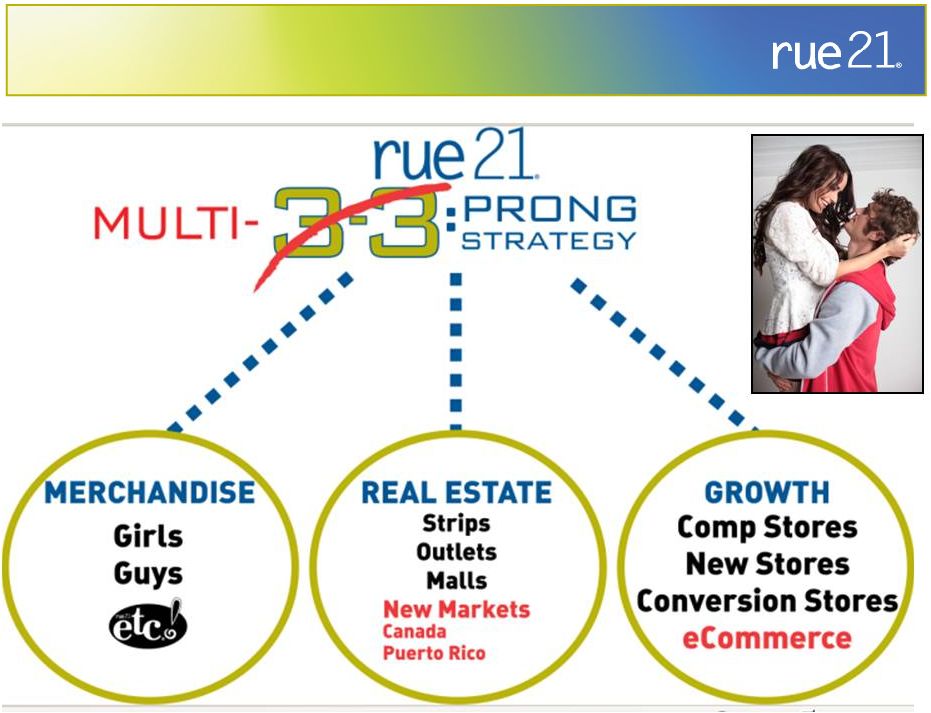

Historical

Predictable Growth From 3 –

3 Pronged Strategy |

Future

Predictable Growth From Multi-Pronged Strategy Future Predictable Growth From Multi-Pronged Strategy |

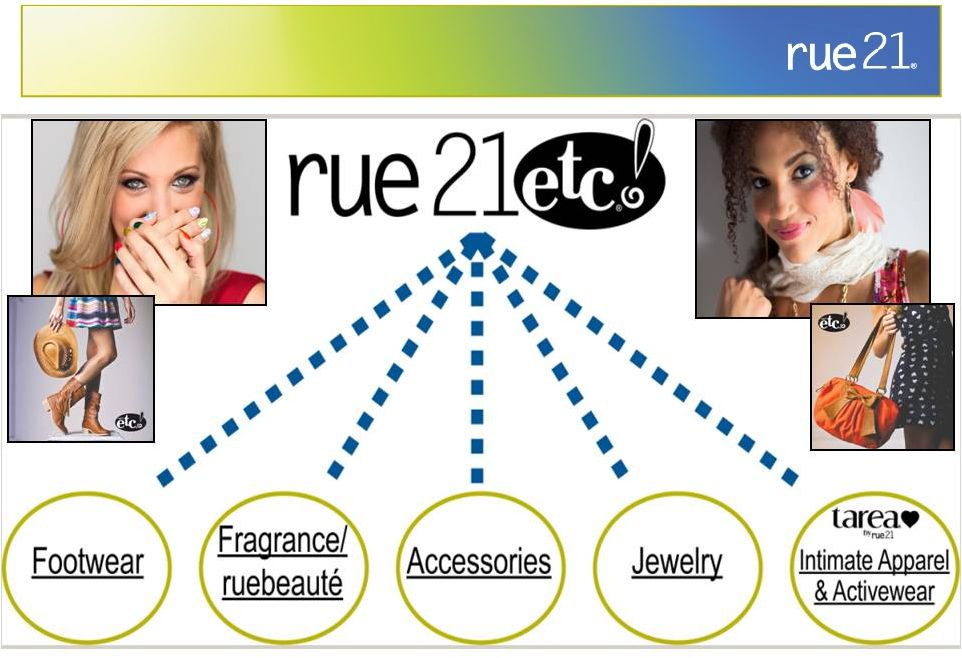

Comp

Drivers–Continuing Accessories Diversification Represents

26%

of business and growing |

&

Fragrance Comp Drivers

Comp Drivers

–

–

Diverse

Diverse

Branded

Branded

Product

Product

Offerings

Offerings |

Comp

Drivers – Expanding Fashion Offerings

at everyday

rue21 value

•

“club rue”

•

active sportswear

•

denim, good, better, best

•

guys business including

denim and accessories

•

dresses

•

buy back programs |

Continuing Attractive U.S. Real Estate Opportunities

Growth Potential by U.S. Shopping Center Type

rue21 Current Store Count

Identified Location

Share

Strip Centers

Regional Mall

Outlet Center

395

250

110

2,500

1,100

175

16%

23%

63%

Total

755

3,775

20%

Current Store Mix

Current Store Mix

Future Store Mix

Future Store Mix

51.6%

33.0%

15.4%

0%

20%

40%

60%

80%

100%

Strip Centers

Regional Malls

Outlet

35%

0%

20%

40%

60%

80%

100%

10%

55% |

London,

KY |

Paris,

TX |

Moscow,

ID |

Employee

Development & Operations Execution “rueniversity”

–

global training tool used for all field employees

•

Expansion

of

Operations

Executive

Team

-

Zone

Vice

President

positions

added

•

Operations Technology Committee –

Executive team focused on field systems

“MAD”–

Management Advancement Development

for up & coming Potential DM’s, Managers and Assistants

“S-O-S”

–

Store

Opening

Specialists

Power teams that assist Managers and DM’s opening new

stores that spread the Fun and Lively rue21 Culture

Throughout the Organization

•

Strengthening

of

HR

Team

–

VP

of

Talent

Management,

regional

recruiters,

HRIS

systems leads added |

Margin

Expansion Opportunity 6.0 -

7.0%

5.1%

4.8%

4.2%

Net Income

10.5 -

11.0%

8.2%

7.8%

6.9%

Pre-Tax Income Margin

10.5%

8.2%

7.9%

7.0%

Operating Income Margin

3.0%

3.5%

3.4%

3.2%

Depreciation and

Amortization

25.0 -

25.5%

25.9%

25.7%

25.5%

Selling, General and

Administrative

38.5 -

39.0%

37.5%

37.0%

35.8%

Gross Margin

GOAL

Oct-11

Jan -11

Jan -10

Long Term

TTM

Years Ended |

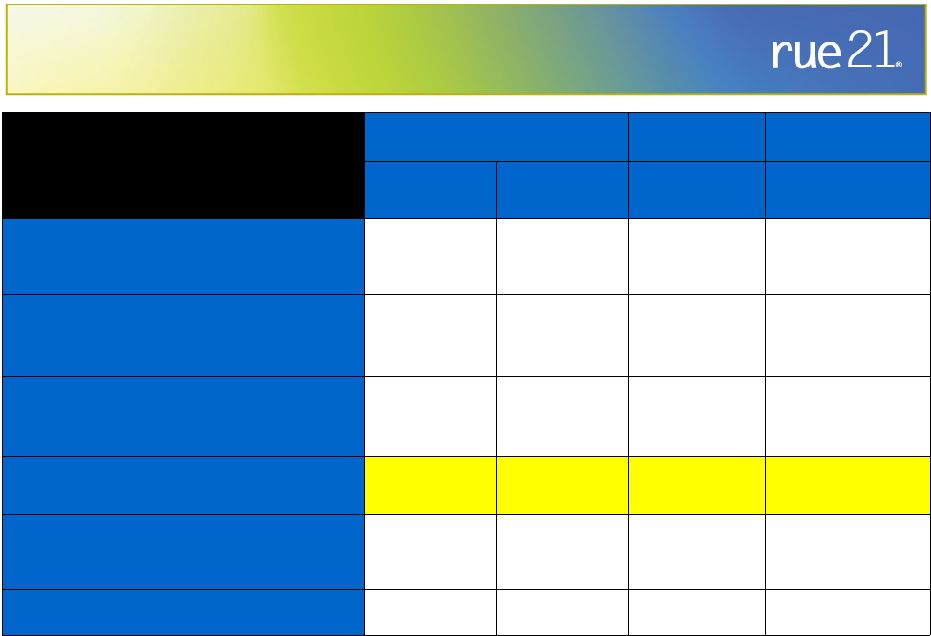

Status

Investments Made to Support Our Growth

Headquarters

Commentary

Systems

Software –

latest releases, ERP, financial, real

estate, HRIS with state of the art hardware

Planning and Allocation Systems

Headquarters recently expanded to 84,000 sq

ft to support 25% future associate growth

Team

Focus on recruiting and talent management

Expanded field management organization &

focus

Distribution Center

Doubled DC square footage to support up to

1,600 stores with potential eCommerce

incubator |

DC space

doubled and HQ space tripled |

Note:

Dollars in thousands. Contribution

Contribution

Investment

Investment

~5,200

19%

$900 -

$1,100

$130

40

$170

Payback Period

Less Than 1 Year

Pre-tax ROIC

> 100%

Compelling and Continuing

New Store Economics

High-Return Stores That Payback Investment in Less Than a Year

High-Return Stores That Payback Investment in Less Than a Year

•

Average store size (sq ft) •

Annual sales (year

1) •

4-wall contribution (year 1) •

Net Build-out

•

Net Inventory

•

Total Investment

|

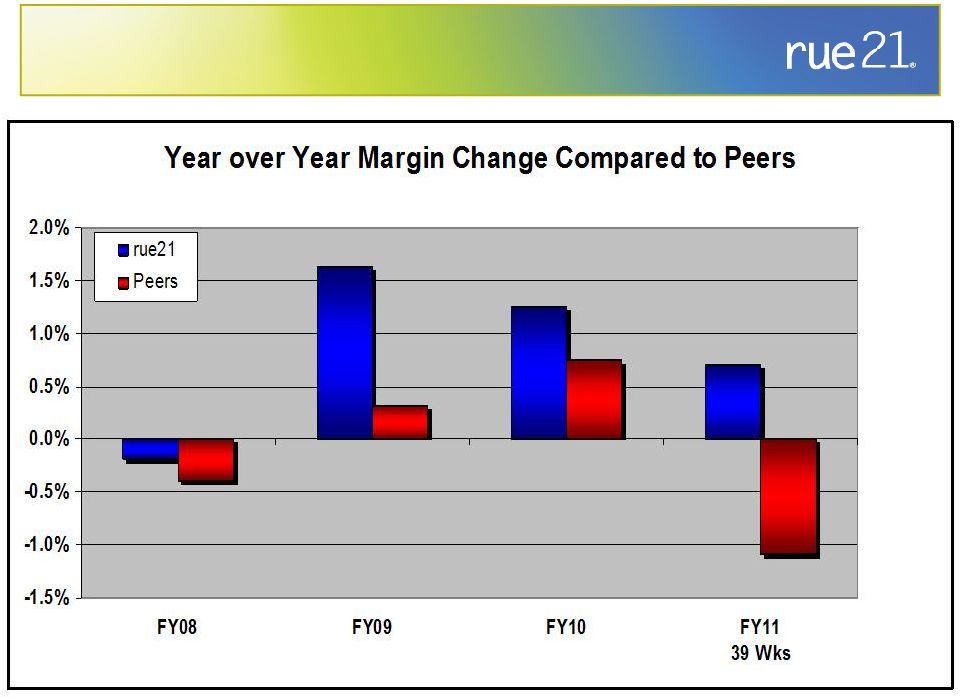

rue21 Gross

Margin 32.0%

33.0%

34.0%

35.0%

36.0%

37.0%

38.0%

FY08

FY09

FY10

Q3 FY11

TTM

34.1%

35.8%

37.5%

37.0%

Consistent Long Term Gross Margin Growth |

Real

Gross Margin Long Term Gains |

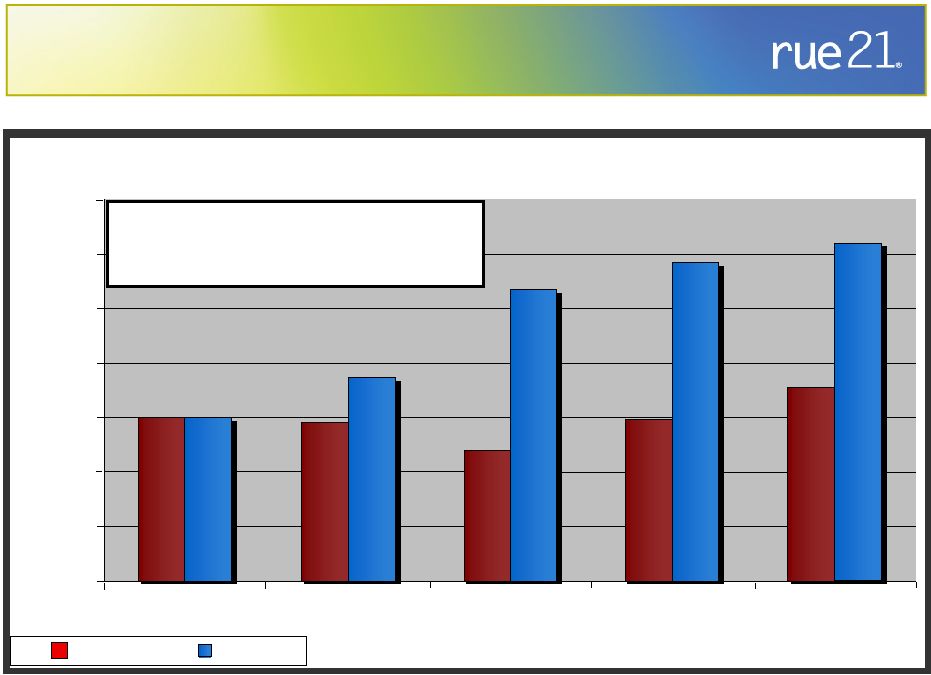

Real and

Consistent Long Term Comp Sales Gains $100 Valued by Successive Comp Store %

Performances $103.70

$111.79

$114.14

$115.89

$99.47

$96.94

$99.78

$102.80

$100.00

$100.00

$85.00

$90.00

$95.00

$100.00

$105.00

$110.00

$115.00

$120.00

2007

2008

2009

2010

FY 11

39 wks

Peers

rue21

3 year average comp growth

for rue 21 4.5% vs. -0.1% peer group |

Expansion of

Net Income First

Second

Third

Fourth

First

Second

Third

Fourth

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

40.1%

42.0%

27.9%

20.9%

20.4%

26.9%

33.6%

43.6%

Net Income Growth

249.7%

59.0%

50.9%

22.5%

56.3%

31.2%

55.8%

33.1%

Comp Store Sales

12.7%

8.9%

9.8%

1.8%

-5.2%

0.7%

6.6%

11.2%

First

Second

Third

Fourth

First

Second

Third

Fourth

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

40.7%

27.6%

40.7%

30.5%

27.6%

14.3%

19.5%

22.3%

Net Income Growth

257.5%

23.5%

106.9%

67.9%

94.7%

20.0%

19.5%

41.0%

Comp Store Sales

8.3%

0.6%

13.5%

8.6%

7.7%

-1.6%

1.8%

1.5%

First

Second

Third

Quarter

Quarter

Quarter

Net Sales Growth

25.5%

21.0%

18.8%

Net Income Growth

65.2%

20.0%

22.4%

Comp Store Sales

5.2%

-0.3%

0.0%

Fiscal 2011

Fiscal 2007

Fiscal 2009

Fiscal 2010

Fiscal 2008

Ability

to

Expand

Net

Income

by

Double

Digits

in

Low

Comp

Growth

Quarters |

METRIC

METRIC

LONG-TERM TARGET

LONG-TERM TARGET

SQUARE FOOTAGE CAGR

MID TO HIGH TEENS

COMPARABLE STORE SALES

GROWTH

LOW SINGLE DIGITS

GROSS MARGIN

150 BPS IMPROVEMENT

NET INCOME CAGR

+ 20%

Long Term Financial Targets

Save

the

Date:

Analyst

/

Investor

Day

at

rue21

April

18

th

2012 |

|