Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - dELiAs, Inc. | d280392d8k.htm |

ICR

XChange January 11, 2012

Exhibit 99.1 |

DESCRIPTION OF DELIA*S HOLIDAY 2011 COMMERCIAL

During the entire commercial music is playing in the background.

The

commercial consists of various models wearing, displaying and showing

dELiA*s apparel and accessories during catalog photo shoots.

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * *

* * *

* * * |

This

presentation

contains

forward-looking

statements.

Forward-looking

statements

are

based

on

current

expectations

and

projections

about

future

events

and

are

subject

to

risks,

uncertainties

and

assumptions

about

our

Company,

economic

and

market

sectors

and

the

industry

in

which

we

do

business,

among

other

things.

These

statements

are

not

guarantees

of

future

performance,

and

we

undertake

no

obligation

to

publicly

update

any

forward-looking

statements

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Actual

events

and

results

may

differ

from

those

expressed

in

any

forward-

looking

statements

due

to

a

number

of

factors.

Factors

that

could

cause

our

actual

performance,

future

results

and

actions

to

differ

materially

from

any

forward-looking

statements

include,

but

are

not

limited

to,

those

discussed

in

risk

factors

within

our

Form

10-K

for

the

fiscal

year

ended

January

29,

2011,

and

our

Form

10-Q

for

the

fiscal

quarter

ended

October

29,

2011,

as

filed

with

the

Securities

and

Exchange

Commission.

Disclaimer

3 |

Investment

Highlights Well-established multi-channel, multi-brand retailer serving teens

and young women's market

•

dELiA*s brand offers the trend focused teen girl differentiated

assortments from the competition

•

Alloy offers a wide selection of

juniors targeted name brands

Opportunity to drive significant store productivity through restructured

merchandising approach and enhanced selling techniques

Store expansion potential and improving store four-wall economics

E-commerce growth potential with new web site and merchandise

architecture changes driving increased productivity and conversion

Turnaround story with significant upside to EBITDA

4 |

Where We Were

Vertical product development with long lead times

Extensive investment in key items

Fashion misses in key items and a disconnect with the customer led to

increased markdowns

High IMU with deep markdowns lowered merchandise margins

Unprofitable retail segment

5 |

New Objectives

Align and strengthen the dELiA*s brand

across all 3 channels: Retail Stores,

Catalog and Website

Drive increased sales productivity

through improvements in each metric

of the sales equation

Accelerate web marketing techniques

and social media exposure

Evaluate and redirect overhead and

selling costs

Generate positive cash flow to fund

growth

6 |

3-Pronged

Strategy 7 |

Product

Merchandising 8

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

|

9

|

Architecture

Sell the outfit with increased cc count offering

Increase web/store tests, with ability to react quickly through new sourcing model

and vendor structure

New

category mix

Now

Then

Consistent flow of merchandise

4 quarterly floorsets with updates

Less dependence on key items

70% of sales and inventory in 30 key items

Fashion buys 4 weeks of supply

Fashion buys 8 weeks of supply

10 |

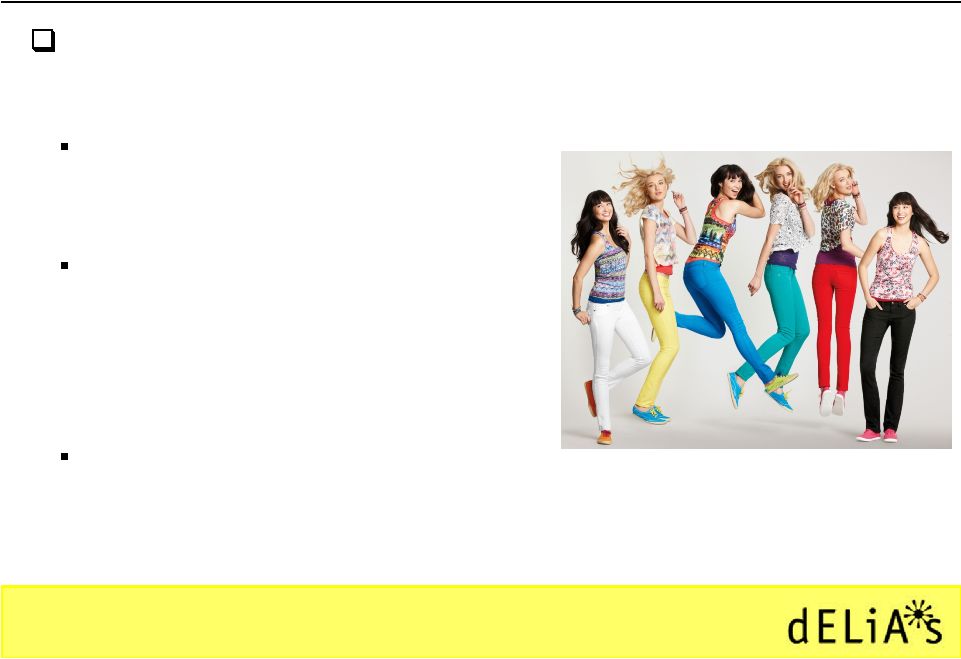

Product

Development Shift mix to

fashion merchandise/less

emphasis on key items

•

Drive UPTs

with focus on outfitting

New sourcing model enables faster “market to

customer”

product flow

•

Increase product testing and chase supported

by new sourcing model and flexible vendor

structure

Increase frequency of floor sets to 12 per year

•

With flow of new product every week

11

Focus on trend-right merchandise, more frequent flow of

new product and faster turns |

Pricing and

Promotions 12

Achieve higher fashion sell-through at

planned price points

Plan promotional buys around key

events in her life

Promotions planned upfront not

reactionary

Support with marketing strategy

Maintain leaner inventory levels with

more frequent faster-turning deliveries

Better sourcing on key items to reduce

cost |

Driving Sales

Productivity in All Channels 13

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

|

14

|

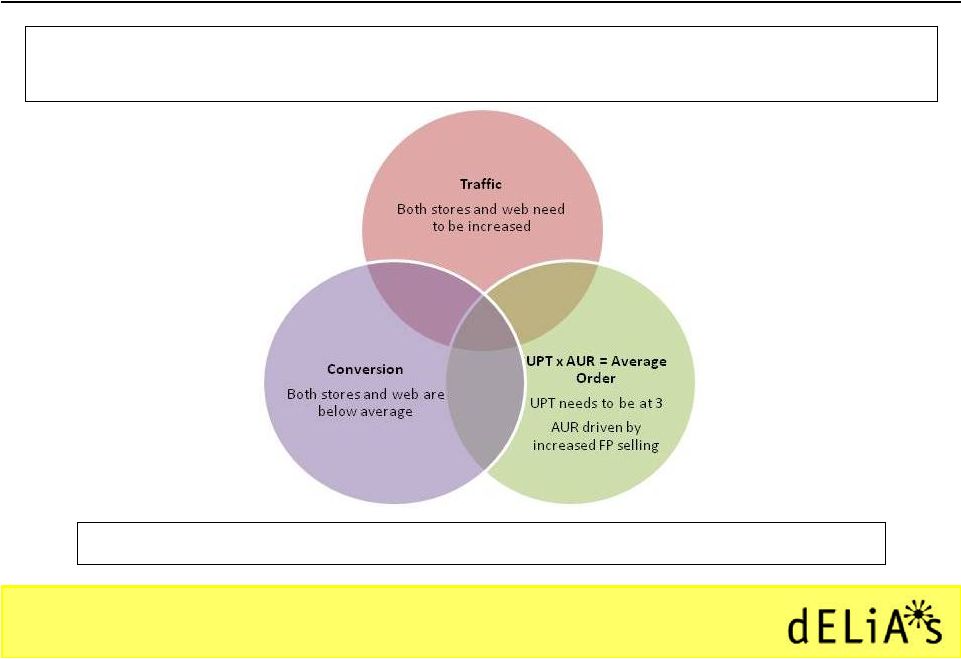

In all channels

we see opportunities for significant improvement in all parts of

the selling equation

Strategies must drive improvement in all metrics of the sales equation

Sales Equation

15 |

16

Strategies to Drive Traffic

Stores

Increase frequency of new

merchandise offerings

Enhance window displays and

visuals

Capitalize on catalog and email

Plan promotional events around

events in her life

Web

Increase frequency of new

merchandise offerings

New web front-end via partnership

with MarketLive

•

Enhance search capability

•

Enhance visual merchandising

technique

•

Enhance customer marketing abilities

Capitalize on Alloy Media and

Marketing to drive traffic

Align customer experience across dELiA*s retail stores and

delias.com |

Conversion

17

Stores

Web

New merchandise more often

New pricing and promotional

model

More consistent merchandising

offering

More changes to visual

merchandising with emphasis on

outfitting

Addition of a runway to stores to

show and sell outfits

Grow accessory business

New merchandise more often

New pricing and promotional

model

New web site with best of breed

functionality by BTS 2012

•

Functionality to personalize

promotional offerings

Conversion has increased in stores and on web |

Average

Order 18

Stores

Web

Drive UPT to 3 through more

outfitting and doubling the

accessory business

Increase top to bottom ratio from

current ratio to a minimum 3 to 1

New pricing and promotional

model

More frequent changes to visual

outfitting throughout the store

New functionality that supports

both up selling and outfit selling

New pricing and promotional

model

Catalog focus on outfit completion |

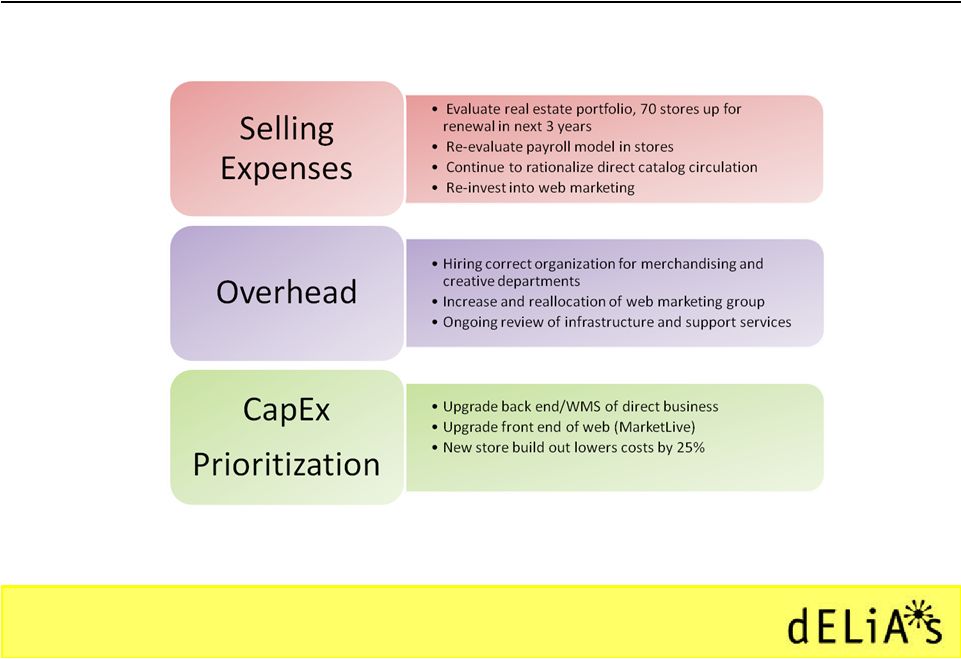

Selling

Expenses Overhead

CapEx

19

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

|

20

|

Selling

Expenses, Overhead, CapEx 21 |

Financials

22

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

* * * * * * * * * ** * * * * * * * * ** * * * * * * * * *

|

23

|

Nine Months

Ended 2011 Income Statement 1) Third Quarter Fiscal 2010 operating income, net loss and

EPS adjusted to exclude a pretax non-cash goodwill impairment charge of $7.6

million related to the direct segment.

24

October 29, 2011

October 30, 2010

Net Revenues

151,560

$

153,784

$

Gross Profit

47,179

$

48,808

$

Operating Loss

(19,033)

$

(20,478)

$

Net Loss

(18,506)

$

(14,724)

$

EPS

(0.59)

$

(0.47)

$

For the Thirty-Nine Weeks Ended

dELiA*s, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited) |

Third Quarter

2011 Balance Sheet Statement October 29, 2011

October 30, 2010

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

15,778

$

14,356

$

Inventories, net

41,655

$

41,838

$

Other current assets

7,350

$

24,750

$

Other Assets

52,576

$

59,464

$

TOTAL ASSETS

117,359

$

140,408

$

LIABILITIES AND STOCKHOLDERS' EQUITY

TOTAL LIABILITIES

51,250

$

56,274

$

TOTAL STOCKHOLDERS' EQUITY

66,109

$

84,134

$

dELiA*s, Inc.

BALANCE SHEETS

(in thousands)

(unaudited)

25 |

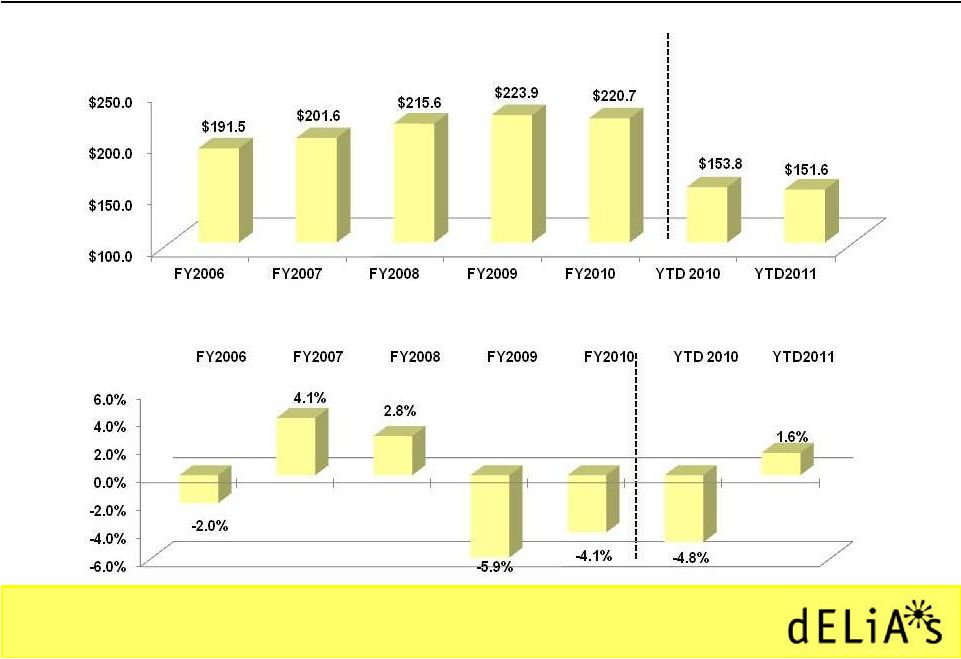

Net Sales and

Comparable Store Sales Comparable Store Sales

Net Sales

26

YTD=First Nine Months Ended October 29, 2011 and October 30, 2010,

respectively |

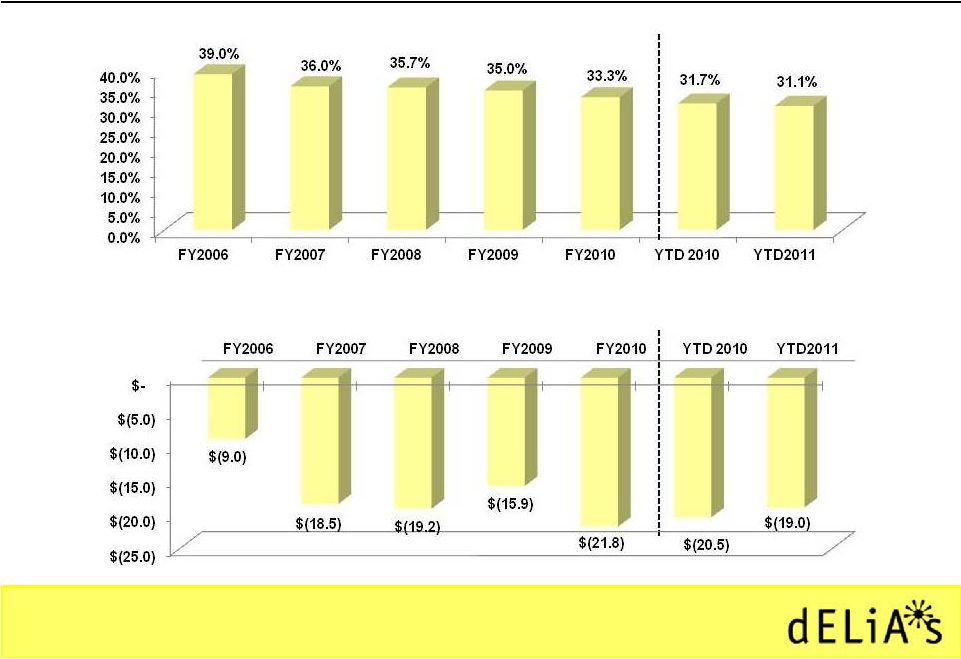

Gross Margin and

Operating Profit Gross Margin

1)

FY and YTD operating profit exclude Third Quarter Fiscal 2010 pretax non-cash

goodwill impairment charge of $7.6 million related to the direct segment

2)

YTD=First Nine Months Ended October 29, 2011 and October 30, 2010,

respectively 27

Operating Profit |

2012 Financial

Goals Positive sales growth in both retail and direct

Improved margins resulting from merchandising and promotional

changes

Evaluate real estate portfolio, 70 stores up for renewal in next 3 years

Continued rationalization and reallocation of selling and overhead expenses

Positive EBITDA

Inventory growth rate below sales growth rate

28 |