Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - ZIOPHARM ONCOLOGY INC | v245063_8k.htm |

Exhibit 99.1

30 th Annual J.P. Morgan Healthcare Conference Jonathan Lewis, MD, PhD Chief Executive Officer Better Cancer Medicine

Forward - Looking Statements This presentation contains certain forward - looking information about ZIOPHARM Oncology that is intended to be covered by the safe harbor for “forward - looking statements” provided by the Private Securities Litigation Reform Act of 1995, as amended. Forward - looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “wi ll,” “may,” “anticipate(s)” and similar expressions are intended to identify forward - looking statements. These statements include, but are not limited to, statements regarding our ability to successfully develop and commercialize our therapeutic products; our ability to expand our long - term business opportunities; financial projections and estimates and their underlying assumptions; and future performance. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward - looking information and statements. These risks and uncertainties include, but are not limited to: whether any of our therapeutic candidates will advance further in the clinical trials process and whe the r and when, if at all, they will receive final approval from the U.S. Food and Drug Administration or equivalent foreign regula tor y agencies and for which indications; whether any of our therapeutic candidates will be successfully marketed if approved; whether our DNA - based biotherapeutics discovery and development efforts will be successful; our ability to achieve the results contemplated by our collaboration agreements; the strength and enforceability of our intellectual property rights; competitio n from pharmaceutical and biotechnology companies; the development of and our ability to take advantage of the market for DNA - based biotherapeutics; our ability to raise additional capital to fund our operations on terms acceptable to us; general economic conditions; and the other risk factors contained in our periodic and interim reports filed with the SEC including, b ut not limited to, our Annual Report on Form 10 - K for the fiscal year ended December 31, 2010, our Quarterly Report on Form 10 - Q for the quarter ended September 30, 2011, and our Current Reports on Form 8 - K filed from time to time with the Securities and Exchange Commission. Our audience is cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward - looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non - occurrence of any events.

• A late - stage oncology company with a compelling product portfolio • Ongoing pivotal Phase 3 study with another pivotal study to initiate in 2012 • A revolutionary technology for drug discovery poised to cure cancers

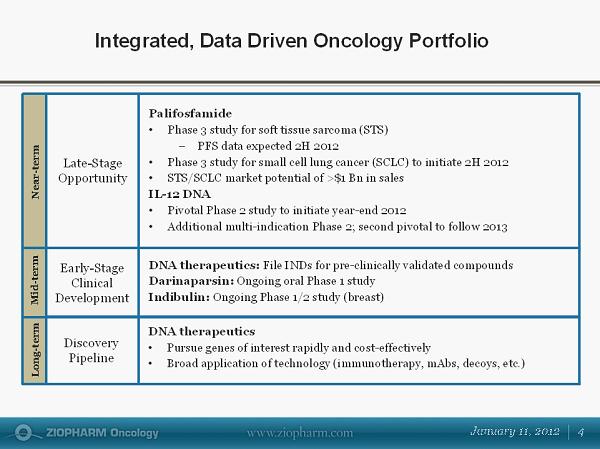

Integrated, Data Driven Oncology Portfolio Late - Stage Opportunity Palifosfamide • Phase 3 study for soft tissue sarcoma (STS) − PFS data expected 2H 2012 • Phase 3 study for small cell lung cancer (SCLC) to initiate 2H 2012 • STS/SCLC market potential of >$1 Bn in sales IL - 12 DNA • Pivotal Phase 2 study to initiate year - end 2012 • Additional multi - indication Phase 2; second pivotal to follow 2013 DNA therapeutics: File INDs for pre - clinically validated compounds Darinaparsin : Ongoing oral Phase 1 study Indibulin: Ongoing Phase 1/2 study (breast) Early - Stage Clinical Development Discovery Pipeline DNA therapeutics • Pursue genes of interest rapidly and cost - effectively • Broad application of technology (immunotherapy, mAbs, decoys, etc.) Long - term Mid - term Near - term

Palifosfamide (Zymafos ® or ZIO - 201)

• More effective, less toxic than in - class agents, improved QOL , ease of administration and flexible pricing • First indication in STS ; second indication in SCLC • Orphan Drug status for STS in U.S. and Europe • U.S. pharmaceutical composition patent rights extending to 2029; other pending applications WW Palifosfamide: Novel DNA Cross - linker

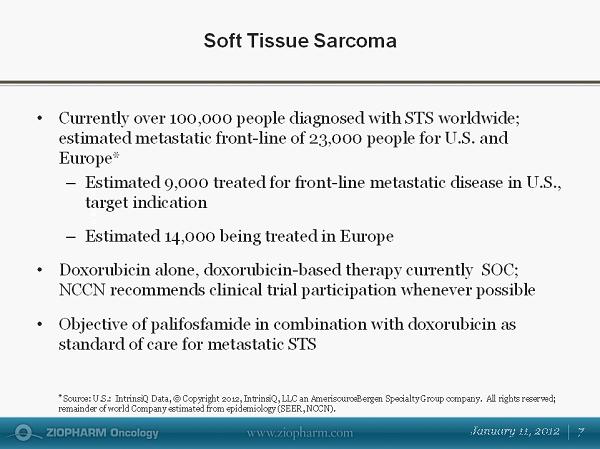

Soft Tissue Sarcoma $ in Millions • Currently over 100,000 people diagnosed with STS worldwide; estimated metastatic front - line of 23,000 people for U.S. and Europe* – Estimated 9,000 treated for front - line metastatic disease in U.S., target indication – Estimated 14,000 being treated in Europe • Doxorubicin alone, doxorubicin - based therapy currently SOC; NCCN recommends clinical trial participation whenever possible • Objective of palifosfamide in combination with doxorubicin as standard of care for metastatic STS * Source: U.S.: IntrinsiQ Data, © Copyright 2012, IntrinsiQ , LLC an AmerisourceBergen Specialty Group company. All rights reserved; remainder of world Company estimated from epidemiology (SEER, NCCN).

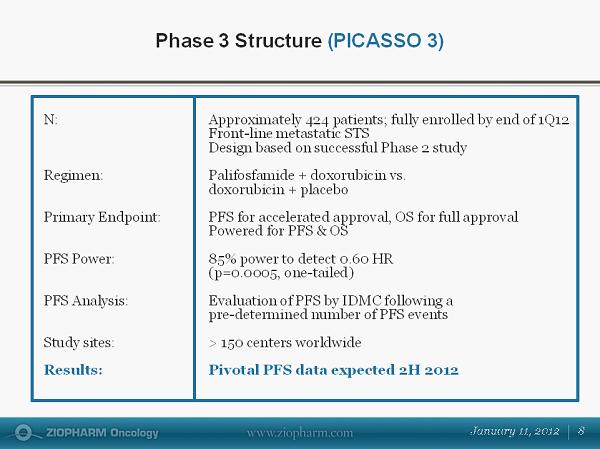

Phase 3 Structure ( PICASSO 3) N : Approximately 424 patients; fully enrolled by end of 1Q12 Front - line metastatic STS Design based on successful Phase 2 study Regimen: Palifosfamide + doxorubicin vs. doxorubicin + placebo Primary Endpoint: PFS for accelerated approval, OS for full approval Powered for PFS & OS PFS Power: 85% power to detect 0.60 HR (p=0.0005, one - tailed) PFS Analysis: Evaluation of PFS by IDMC following a pre - determined number of PFS events Study sites: > 150 centers worldwide Results: Pivotal PFS data expected 2H 2012

Strong Randomized Phase 2 Foundation (PICASSO) Selected Best of ASCO 2010 Phase 2 (PICASSO) Randomized Outcome • 67 patients randomized, 66 treated, 62 eligible • Palifosfamide administered with doxorubicin compared to single - agent doxorubicin in front - and second - line unresectable or metastatic STS ─ PFS endpoint • 28 documented PFS events (18 dox, 10 dox plus pali) • Hazard ratio of 0.43 favoring the combination, (p - value 0.019) • Median PFS 4.4 months for dox alone, 7.8 months for combination; 3.4 month difference • Data presented at 2010 ASCO; selected as Best of ASCO

PFS Receiving/Censored at ≤ 6 Cycles ( w/out ongoing or cross - over palifosfamide ) 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1 2 3 4 5 6 MONTHS palifosfamide + doxorubicin (30 ) doxorubicin (32) p = 0.023 HR = 0.39

Small Cell Lung Cancer • Approximately 15% of lung cancers • Estimated 30,000 - 35,000 U.S. annual incidence, 200,000 worldwide 1 ( C hina annual incidence alone growing to >150,000 2 ) • Platinum plus etoposide SOC front - line extensive disease (80 - 90%); only topotecan approved second - line • Cisplatin plus etoposide with and without ifosfamide in extensive small - cell lung cancer; statistically significant improvement in median time to progression and median survival benefit with high toxicity 3 • Objective is to add palifosfamide to platinum and etoposide as SOC for extensive front - line SCLC 1 SEER, Globocon. 2 Derived from: Liu et. al. Emerging tobacco hazards in China: 1. Retrospective proportional mortality study of one million deaths. BMJ. 1998;317:1411. 3 Hoosier Oncology Group study - Einhorn et. al.

Phase 3 study starting 2H 2012 Data of Phase 1b Study: Palifosfamide Plus Carboplatin/Etoposide Presented at AACR NCI EORTC Response Assessment 1 Number of Patients 2 ( 22 enrolled as of 10/26/11) Cancer Types PR 5 Germ Cell Tumor, NSCLC, Ovarian, SCLC (2) SD 4 Ovarian, NSCLC, SCLC, Uterine Leiomyosarcoma PD 4 Adeno carinoma , Mediastinal Carcinoid , Pancreatic, SCLC 1 Response Assessment per RECIST 1.1 definitions; and/or assessed per biomarkers. 2 7 Active patients not yet evaluated for response as their follow - up scans are still pending. 2 Patients did not continue past cycle 1 due to adverse events. Combination well tolerated; dose limiting toxicity: neutropenic fever Tumor Response

Compelling Efficacy: Primary Mediastinal Nonseminomatous Germ Cell Tumor • Normalization of tumor markers: ─ Previously treated ( including ifosfamide containing regimen – developed encephalopathy) ─ β HCG reduction: 2358 to 12 mU/Ml ─ Completed 4 cycles of therapy 0 500 1000 1500 2000 2500 β HCG mU/Ml 1 mo. 2 mo. 3 mo. 4 mo.

Worldwide Estimated Sales: STS & SCLC Blended EU/US Price Per Patient SCLC Patients Treated $ 30,000 $ 40,000 $ 50,000 14,000 $ 420 $ 560 $ 700 16,000 $ 480 $ 640 $ 800 18,000 $ 540 $ 720 $ 900 Blended EU/US Price Per Patient STS Patients Treated $ 30,000 $ 40,000 $ 50,000 9,000 $ 270 $ 360 $ 450 10,000 $ 300 $ 400 $ 500 11,000 $ 330 $ 440 $ 550 Soft Tissue Sarcoma Year 5 Sales Small Cell Lung Cancer Year 5 Sales Asia/Latin America Opportunity: +$400 – $600 M Asia/Latin America Opportunity: +$200 – $300 M (in millions) * Source: Based on Company projections. >$1 Bn total market potential

IL - 12 DNA

Exclusive channel partnership (ECP) formed 1/6/11 ZIOPHARM Exclusive Channel Collaboration Pre - Discovery Lead Generation Lead Optimization Pre - clinical Studies Clinical Trials Market Pre - clinical and clinical product development and commercialization Technology development, product discovery, manufacturing API Controllable and scalable synthetic biology allows for discovery of viable product candidates

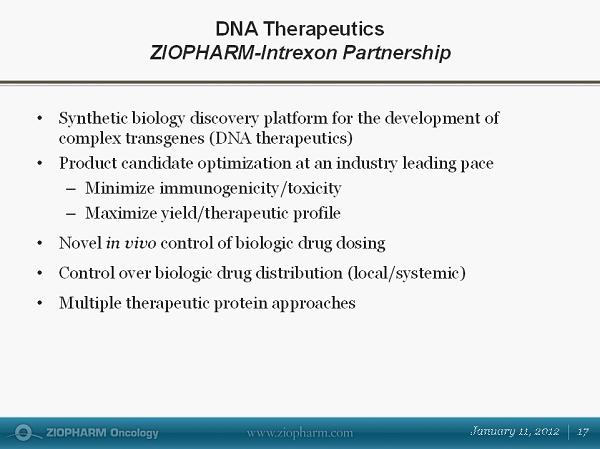

• Synthetic biology discovery platform for the development of complex transgenes (DNA therapeutics) • Product candidate optimization at an industry leading pace – Minimize immunogenicity/toxicity – Maximize yield/therapeutic profile • Novel in vivo control of biologic drug dosing • Control over biologic drug distribution (local/systemic) • Multiple therapeutic protein approaches DNA Therapeutics ZIOPHARM - Intrexon Partnership

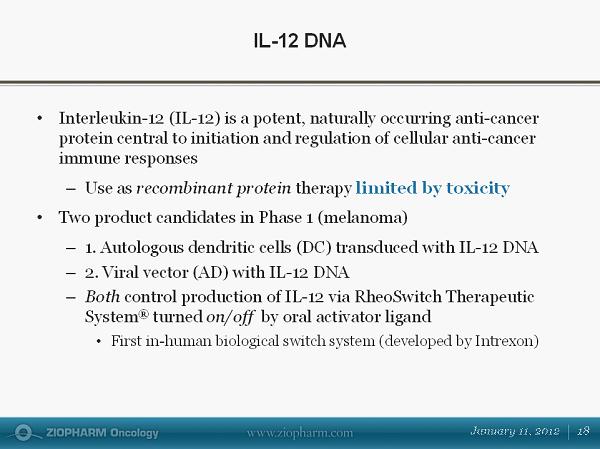

• Interleukin - 12 (IL - 12) is a potent, naturally occurring anti - cancer protein central to initiation and regulation of cellular anti - cancer immune responses – Use as recombinant protein therapy limited by toxicity • Two product candidates in Phase 1 (melanoma) – 1. Autologous dendritic cells (DC) transduced with IL - 12 DNA – 2. Viral vector (AD) with IL - 12 DNA – Both control production of IL - 12 via RheoSwitch Therapeutic System ® turned on/off by oral activator ligand • First in - human biological switch system (developed by Intrexon ) IL - 12 DNA

• DC - IL - 12 clinical POC data presented ASCO 2011 • AD - IL - 12 mid - Phase 1 • Pivotal Phase 2 study to initiate end of 2012 • Additional multi - indication Phase 2; second pivotal to follow 2013 ZIOPHARM Advances Lead Candidate for Pivotal Study Late 2012

ASCO 2011 First Proof of Concept in Humans Clinical Responses No. of evaluable patients Partial response (PR) 1 Stable disease (SD) 3 Progressive disease (PD) 4 Disease control rate (CR,PR, and SD): 50% Adverse Events were mild to moderate with nausea, vomiting, anorexia, arthralgia, fever, chills being reported . There was one SAE occurring 18 hours after treatment onset that completely resolved . "Immunotherapy of advanced melanoma by intra - tumoral injections of autologous, purified dendritic cells transduced with gene construct of interleukin - 12, with dose - dependent expression under the control of an oral activator ligand” Schwartzentruber et al.

Early - Stage Clinical Development

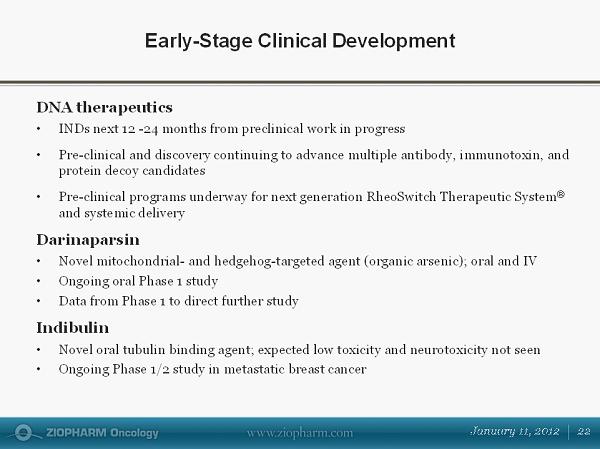

DNA therapeutics • INDs next 12 - 24 months from preclinical work in progress • Pre - clinical and discovery continuing to advance multiple antibody, immunotoxin , and protein decoy candidates • Pre - clinical programs underway for next generation RheoSwitch Therapeutic System ® and systemic delivery Darinaparsin • Novel mitochondrial - and hedgehog - targeted agent (organic arsenic); oral and IV • Ongoing oral Phase 1 study • Data from Phase 1 to direct further study Indibulin • Novel oral tubulin binding agent; expected low toxicity and neurotoxicity not seen • Ongoing Phase 1/2 study in metastatic breast cancer Early - Stage Clinical Development

• Primary shares outstanding: approximately 68.5MM • Cash: approximately $119MM @ 9/30/11 • Current cash resources expected to support operations into early 2013 Financial Highlights

2012 Anticipated Key Clinical Milestones Palifosfamide IL - 12 DNA Early Stage Development Full Enrollment 1Q 2012 STS Pivotal PFS Data 2H 2012 SCLC Adaptive Phase 3 Initiation 2H 2012 IL - 12 DNA Program Phase 1 Data 2012 Pivotal Phase 2 2H 2012 Additional multi - indication Phase 2 2H 2012 • Second pivotal study 2013 New DNA Candidates • Preclinical Data 2012 • IND 2012 - 13 Darinaparsin • Further Study with IV and/or Oral 2H 2012 Indibulin • Oral Phase 1/2 Data 2012

• An intelligent portfolio of therapeutics addressing unmet medical needs in cancer – Near - term, Phase 3 study results with palifosfamide in STS • Phase 3 for SCLC in 2H 2012 • >$1 Bn total market potential – DNA therapeutics targeting established treatment pathway into pivotal study in 2012 – Small molecule therapeutics targeting multiple indications • World - class synthetic biology discovery platform • Ability to commercialize on a global basis Key Investment Highlights

30 th Annual J.P. Morgan Healthcare Conference Jonathan Lewis, MD, PhD Chief Executive Officer Better Cancer Medicine