Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MENTOR GRAPHICS CORP | d280300d8k.htm |

Gregory K.

Hinckley Needham Growth

Conference

President

January 2012

Exhibit 99.1 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Forward-Looking Statements

This

presentation

may

contain

“forward-looking”

statements

based

on

current

expectations

within

the

meaning of the Securities Exchange Act of 1934. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors that may cause the actual

results, performance or achievements

of

the

Company

or

industry

results

to

be

materially

different

from

any

results,

performance or achievements expressed or implied by such forward-looking statements. Such

factors include, among others, the following: (i) weakness or recession in the US, EU,

Japan or other economies; (ii) the Company’s ability to successfully offer products

and services that compete in the highly competitive EDA industry; (iii) product bundling

or discounting of products and services by competitors, which could force the Company to

lower its prices or offer other more favorable terms to customers; (iv) possible delayed

or canceled customer orders, a loss of key personnel or other consequences resulting

from the business disruption and uncertainty of prolonged proxy fights, offers to

purchase the Company’s securities or other actions of activist shareholders; (v) effects

of the increasing volatility of foreign currency fluctuations on the Company’s

business and operating results; (vi) changes in accounting or reporting rules or

interpretations; (vii) the impact of tax audits by the IRS or other taxing authorities,

or changes in the tax laws, regulations or enforcement practices where the Company

does

business;

(viii)

effects

of

unanticipated

shifts

in

product

mix

on

gross

margin;

and

(ix)

effects

of

customer seasonal purchasing patterns and the timing of significant orders, which may

negatively or positively impact the Company’s quarterly results of operations, all

as may be discussed in more detail under

the

heading

“Risk

Factors”

in

the

Company’s

most

recent

Form

10-K

or

Form

10-Q.

Given

these

uncertainties,

prospective

investors

are

cautioned

not

to

place

undue

reliance

on

such

forward-looking

statements. In addition, statements regarding guidance do not reflect potential impacts of

mergers or acquisitions that have not been announced or closed as of the time the

statements are made. The Company disclaims any obligation to update any such factors or

to publicly announce the results of any revisions to any of the forward-looking

statements to reflect future events or developments. 3

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Agenda

EDA and Mentor Overview

Let’s Talk SG&A

Financial Results, Q4 and FY12 Guidance

Questions

4

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

What Is Electronic Design Automation?

Critical design software used to create the world’s

electronic systems

Comprehensive EDA product portfolios address all levels –

from component to systems

Integrated

Circuit (IC)

Printed Circuit

Board (PCB)

Systems

5

GKH, Needham Growth Conference

-

January 2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

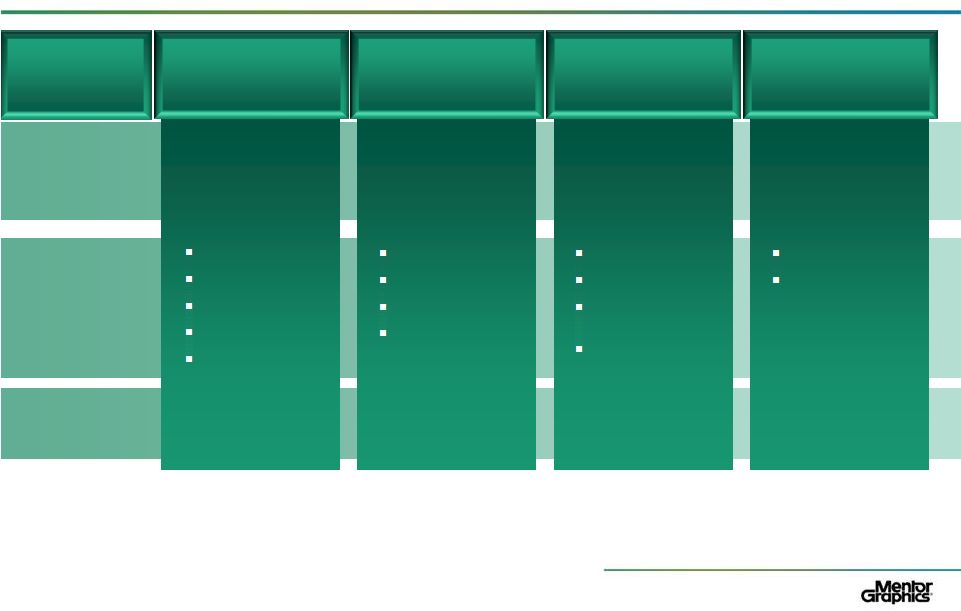

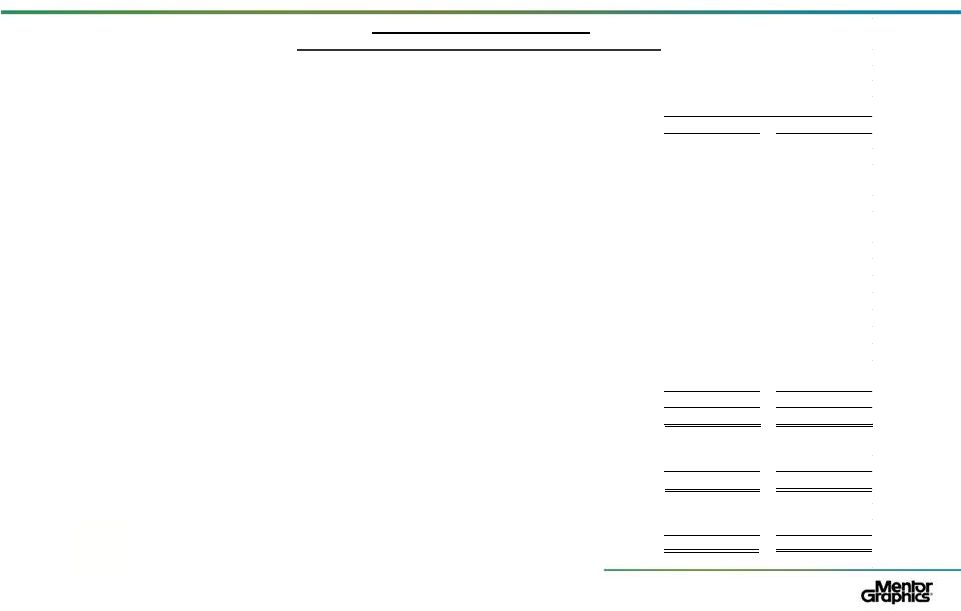

What We Sell

Integrated

System Design

PCB

Scalable

Verification

New & Emerging

Markets

IC Design-

to-Silicon

Tools for printed

circuit board (PCB)

and design and field

programmable gate

array (FPGA) design

Used to examine

and verify

functionality before

committing to silicon

Tools to create

integrated circuits

(ICs) for 90nm and

smaller

Products targeting

new and emerging

markets

Description

Expedition

Mechanical Analysis

PADS

Valor

Precision Synthesis

ModelSim

Questa

Veloce (Emulation)

ADVance MS

Calibre Platform

IC Custom Design

Olympus-SoC

Place & Route

Design-for-Test

Transportation

Embedded

Software

Key Product Areas

25%

25%

35%

10%

*Percent of YTD FY12

Revenue

*

Services & Other account for 5% of FY YTD bookings

6

GKH,

Needham

Growth

Conference

-

January

2012

Mentor

Reporting

Categories |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Who We Sell to

GKH,

Needham

Growth

Conference

-

January

2012

7

IC Companies ~50%

System Companies ~50% |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

The EDA Industry and Mentor’s Strategy

Mentor’s view of the EDA industry:

Segment leader gains share while others atrophy

Profitability within product segment driven by category size (linear) and

share (exponentially)

Traditional EDA growth modest, new challenges drive new spend by

customers

Mentor’s strategy:

Building #1 product positions

—

Mentor’s investments in recent years have yielded #1 product positions that

Mentor expects to maintain for years

Focus on internal development

Bolt-on acquisitions to build on #1 positions

Actively seeking TAM-expanding green field opportunities

8

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Agenda

EDA and Mentor Overview

Let’s Talk SG&A

Financial Results, Q4 and FY12 Guidance

Questions

9

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

SG&A Topics

Scope and purpose of analysis

Examination of Mentor’s SG&A expense vs. peers

Review of Mentor’s business

Technical software selling activities

Findings and implications

10

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Scope and Purpose of SG&A Analysis

Examine Mentor’s SG&A expenses vs. a 105-company

universe of publicly traded software companies

Compare and contrast our business and expenses with

IT-centric and technical software companies

—

IT-centric

software

–

database-oriented

software

–

largely

bought by IT organizations

—

Technical software –

tools focused on the design and analysis of

physical and

electronic

systems

–

largely

bought

by

end-users

Review Mentor’s product offering, served markets and

distribution

Conclusions

11

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Software Universe

Companies

(1 -

20)

Companies

(21 -

40)

Companies

(41 –

60)

Companies

(61 –

80)

Companies

(81 –

100)

Companies

(101 –

105)

20-20 Technologies

Cadence

Epiq Systems

Misys plc

Red Hat

Unit 4

Absolute Software

Cegedim S.A.

ESI Group

NedSense Enterprises

Salesforce.com

Verint Systems

Accelrys

Cerner Corp.

Exact Holding NV

Nemetschek AG

SAP

Vmware

ACI Worldwide

Check Point Software

Fair Isaac Corp.

NetSuite

Simulations Plus

Vocus

Adacel Technologies

Cimatron

F-Secure

NICE Systems

Softech

Zuken

Adobe

Citrix Systems

GSE Systems

Nuance Communications

Software AG

Akamai

ClickSoftware

Informatica

Omnicell

Solera Holdings

Allscripts Healthcare

CommVault

IntraLinks Holdings

OmniComm Systems

Sopheon

Altium

Computer Modelling Group

Intuit

Open Text Corporation

Springsoft

ANSYS

Compuware Corp.

Jack Henry & Associates

OPNET

SuccessFactors

Aspen Technology

Concur

JDA Software Group

Oracle

SXC Health Solutions

ASTEA

Convergys

Kewill

Parametric Technology

Symantec

Autodesk

Cranes Software

Kofax

PDF Solutions

Synopsys, Inc.

Autonomy Corp.

Dassault Systemes

Lectra SA

Pegasystems

Taleo

Aveva

DataWatch

Magma

Pervasive Software

Temenos

Bio-Key

Delcam

Mentor Graphics

Progress Software

The Sage Group

Bitstream

Deltek

Micro Focus Intl.

PROS Holdings

Tibco Software

BMC Software

DemandTec

Micros Systems

QAD Inc

Trend Micro

Bottomline Technologies

Descartes

Microsoft

Qlik Technologies

Tyler Technologies

CA Technologies

DST Systems

MicroStrategy

Quest Software

Ultimate Software

•

Publically Traded, Independent Companies

•

Limited Hardware & Services Business

•

No Systems Integrators or Resellers

12

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

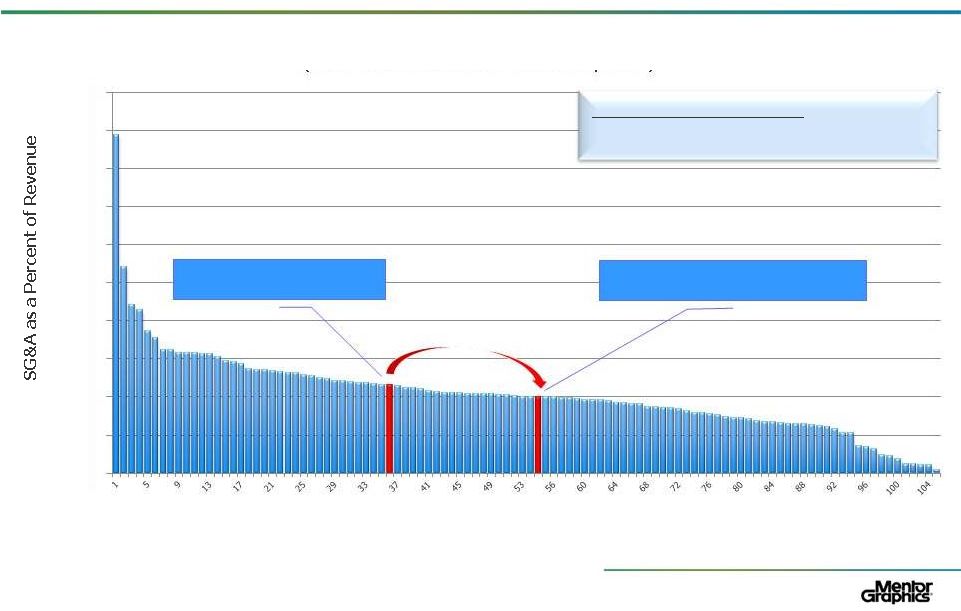

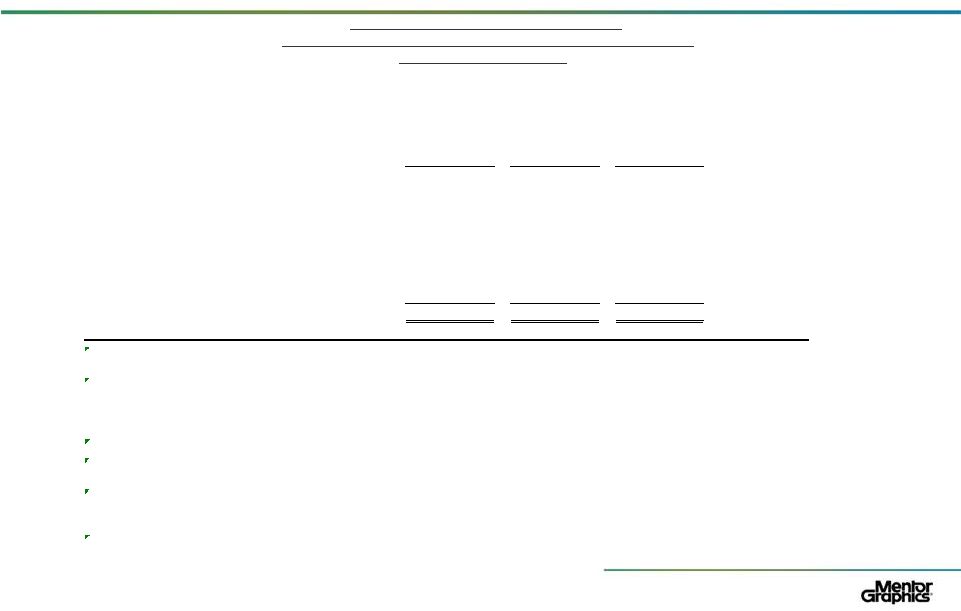

Software Universe SG&A Comparison

Source: Cap IQ and Mentor Graphics Analysis

SG&A from Software Universe

Average ………………….

41.5%

Median …………………..

40.2%

13

Mentor Graphics

FY2012 Plan –

40%

0%

20%

60%

80%

100%

120%

140%

160%

180%

200%

40%

Approximate SG&A as a Percent of Revenue CY 2010

(Total Software Universe 105 Companies)

Software Universe –

105 Companies

Mentor Graphics

FY2011 –

46%

-

GKH, Needham Growth Conference

-

January 2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

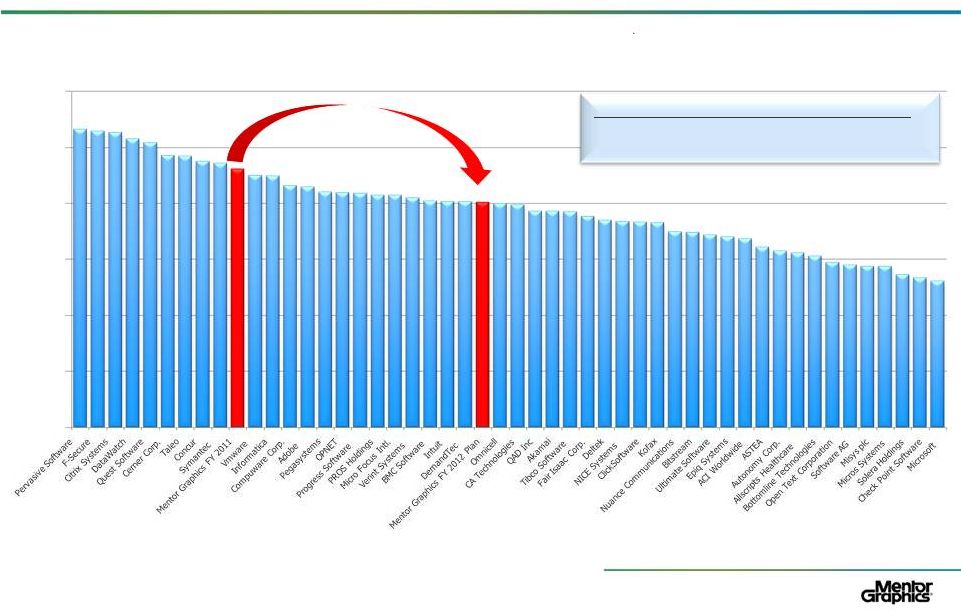

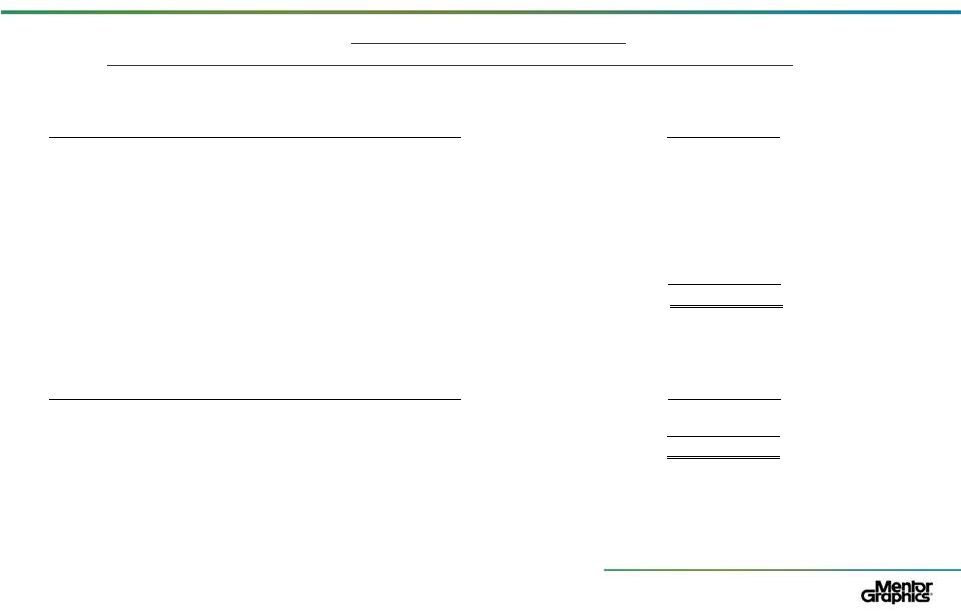

Source: Cap IQ and Mentor Graphics Analysis

Note: Trimmed top & bottom 12 for charting purposes

IT Software Universe CY 2010

14

GKH, Needham Growth Conference

-

January 2012

0%

10%

20%

30%

40%

50%

Approximate SG&A as a Percent of Revenue

(IT Company Universe)

60%

SG&A from Middle 49 IT Companies & MENT

Average ………………….

39%

Median …………………..

39% |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

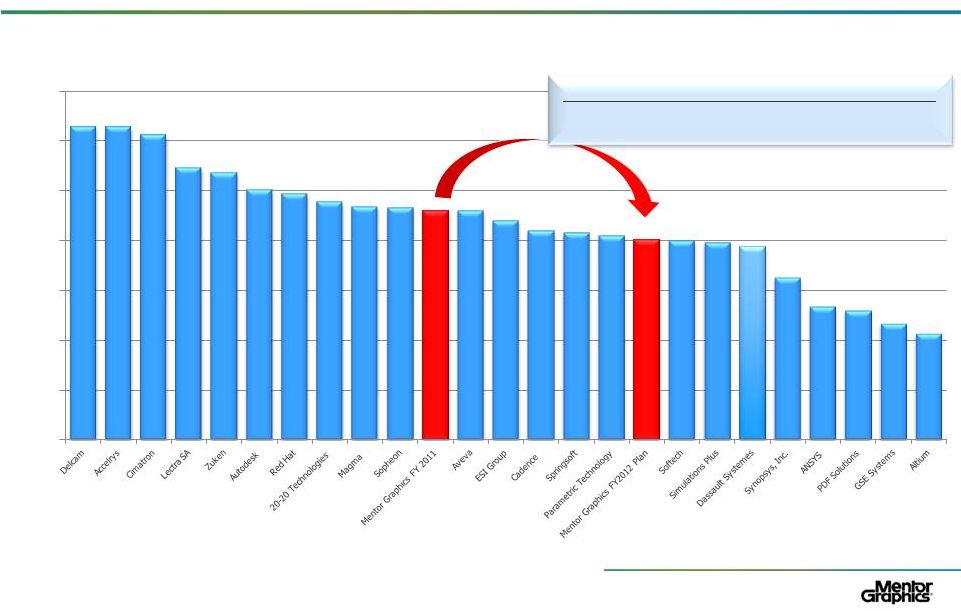

Technical Software Universe CY 2010

Source: Cap IQ and Mentor Graphics Analysis

Note: Trimmed top & bottom 4 for charting purposes

15

GKH,

Needham

Growth

Conference

-

January

2012

SG&A from Middle 24 Technical Software Companies

Average ………………….

43%

Median …………………..

45%

0%

10%

20%

30%

40%

50%

60%

70%

Approximate SG&A as a Percent of Revenue

(Technical Software Company Universe) |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

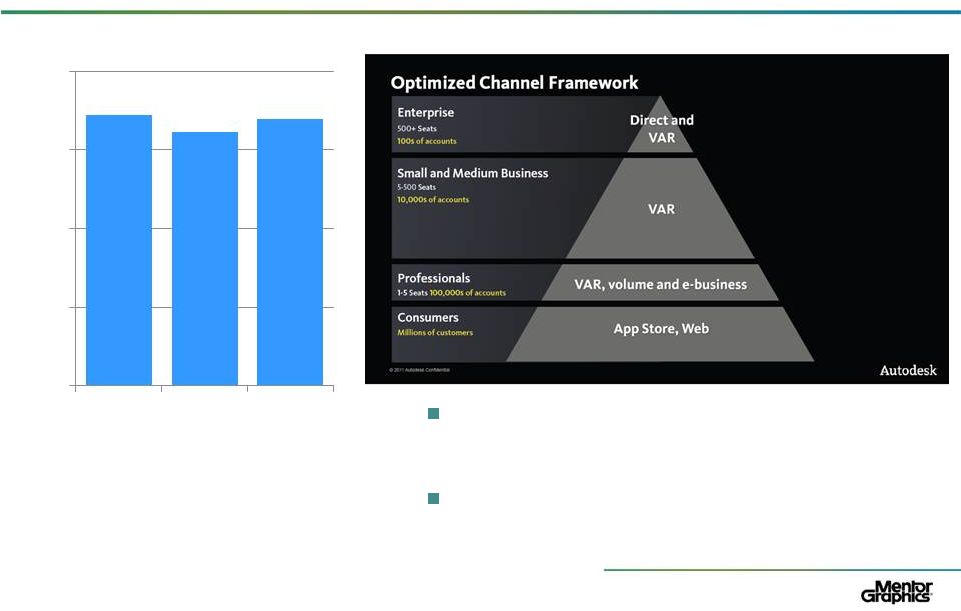

Technical Software -

Selling Models Structured

to Address Depth and Breadth of Customer Base

Distribution focused

—

Tiered distribution of resellers and VARs

—

Direct accounts established after grown from distribution

Direct large customer-focused

—

Highly concentrated customer base

—

No indirect distribution

GKH,

Needham

Growth

Conference

-

January

2012

16 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Autodesk SG&A ~50% of Revenue

Distribution Focused

Note: No single customer accounted for more

than 10% of the Company’s revenue in 2010,

2009 or 2008.

Broad global business network

—

2,000 Channel Partners

—

1,200 Authorized Training Centers

Direct sales ~15%,

—

Large, Enterprise Customers

Source: Financial Reports, Investor Presentation

17

GKH,

Needham

Growth

Conference

-

January

2012

86%

83%

85%

0%

25%

50%

75%

100%

2008

2009

2010

Indirect Channel Distribution

as a Percent of Total Revenue |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

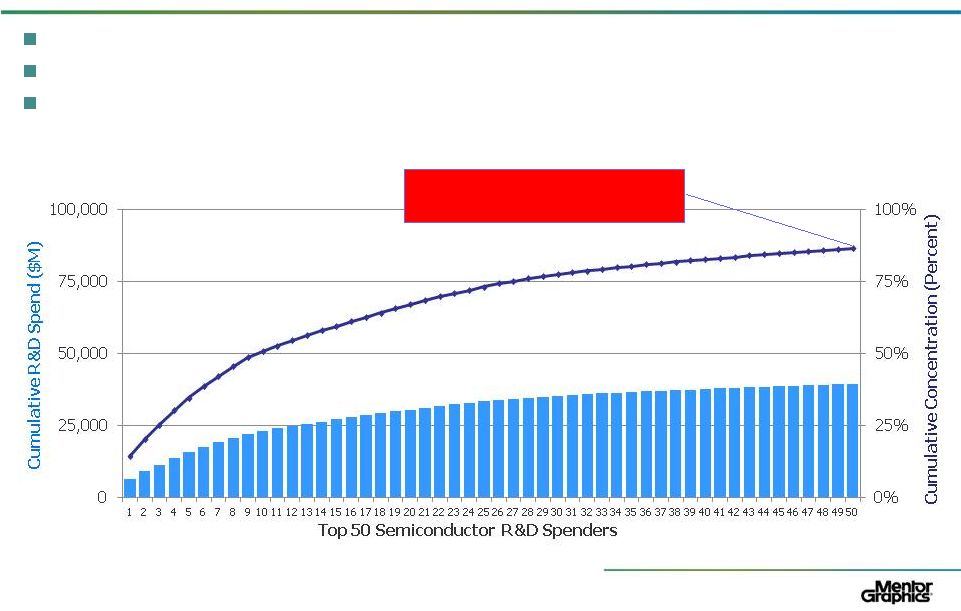

Synopsys SG&A ~32% of Revenue

Direct Large Customer Focus

Synopsys revenue is concentrated in semiconductor companies

Semiconductor R&D spend is highly concentrated

Semiconductor Total R&D Spend ~$45,700M

50 Companies are 86%

of Total R&D Spend

Source: IC Insights, Worldwide 2010 Top Semiconductor R&D Spenders

18

GKH, Needham Growth Conference -

January 2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

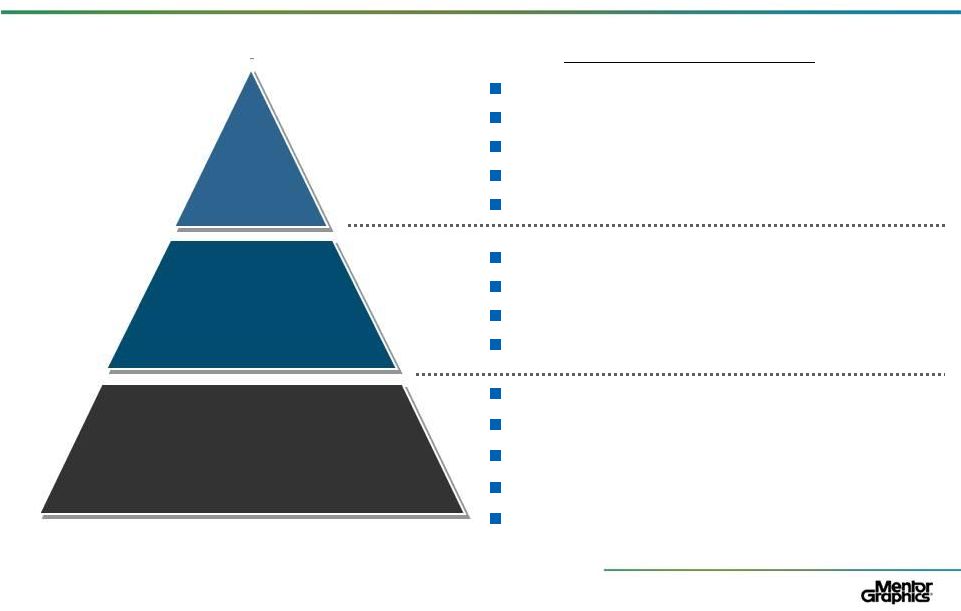

Complex global accounts with the largest EDA TAMs

Dispersion of users across multiple countries

Active long-term account plans

Complex Field & Factory initiatives

WW technical and account coverage coordination

Global /

Strategic

~ 50 Accounts

Key / National

Accounts

~300 Accounts

Complex national accounts with moderate EDA TAMs

Concentration of users is within a national boundary

Active long-term account plans

May include vertical teams

Geographically assigned territories

Small to medium sized TAM accounts

Moderate range of account complexity

Reseller involvement

Includes product-focused sales teams, such as MAC,

Valor, Embedded Systems, etc

Geographic / Territory

> 10,000 Accounts

Mentor SG&A ~40% of FY12 Revenue

Mixed Large Direct Accounts and Transactional Business

Current Segmentation

Tiered Selling Structure

19

GKH,

Needham

Growth

Conference

-

January

2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

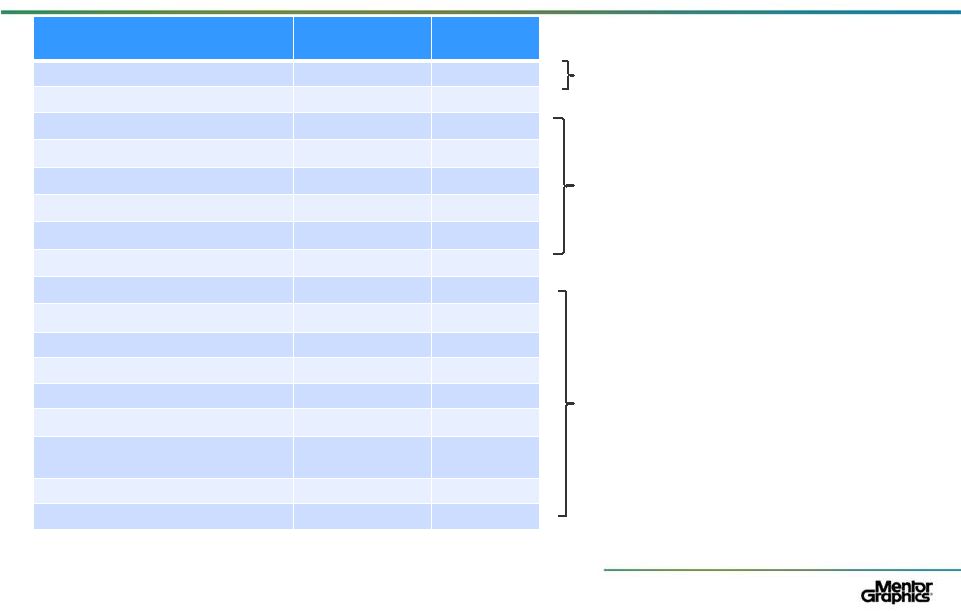

Technical Software Companies SG&A Costs

Name

Revenue

$M

CY2010

SG&A %

Autodesk

$1,952

50%

LogicVision (2008)

$12

71%

Magma

$135

47%

Synopsys

$1,415

32%

PDF Solutions

$62

26%

GSE Systems

$47

23%

Zuken

$218

54%

Valor (2008)

$40

51%

Synplicity (2007)

$71

51%

Cadence

$936

42%

SpringSoft

$75

41%

Parametric

$1,018

41%

Mentor Graphics

FY2012 Plan

$1,005

40%

Dassault Systemes

$2,097

39%

20

Distribution focused

50% SG&A of Revenue

Mixed direct and distribution

+/-

45% SG&A of Revenue

Direct customers

+/-

30% SG&A of Revenue

GKH, Needham Growth Conference

-

January 2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Mentor Business and Customers

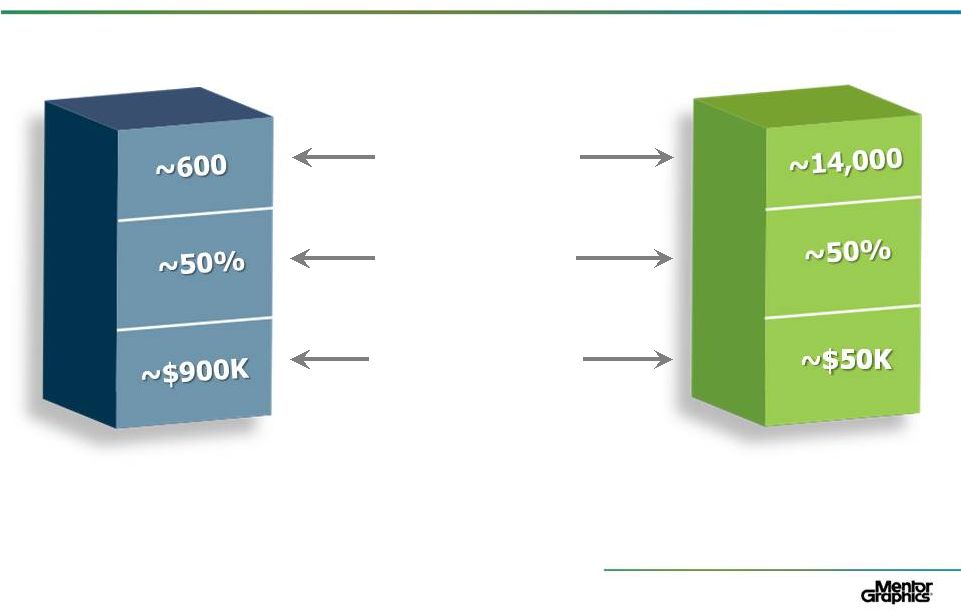

IC business ~600 customers

—

Market segments

–

Semiconductor companies: IDMs, foundries, fabless, start-ups and

semiconductor IP (SIP)

—

Products (1,764 parts across 18 prod families)

–

IC design, functional verification and manufacturing

Systems business ~14,000 customers

—

Market segments

–

Transportation

–

Mil/Aero

–

Industrial, test & measurement and medical

–

Computer & peripherals

–

Consumer electronics

–

Communications: wired & wireless

—

Products (4,750 parts across 24 prod families)

–

GUI, embedded software, PCB design-creation-manufacturing, packaging,

thermal, harness design and manufacturing, mechatronics, FPGA design

21

GKH, Needham Growth Conference

-

January 2012

Based upon review of customers between 1996 and 2011 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

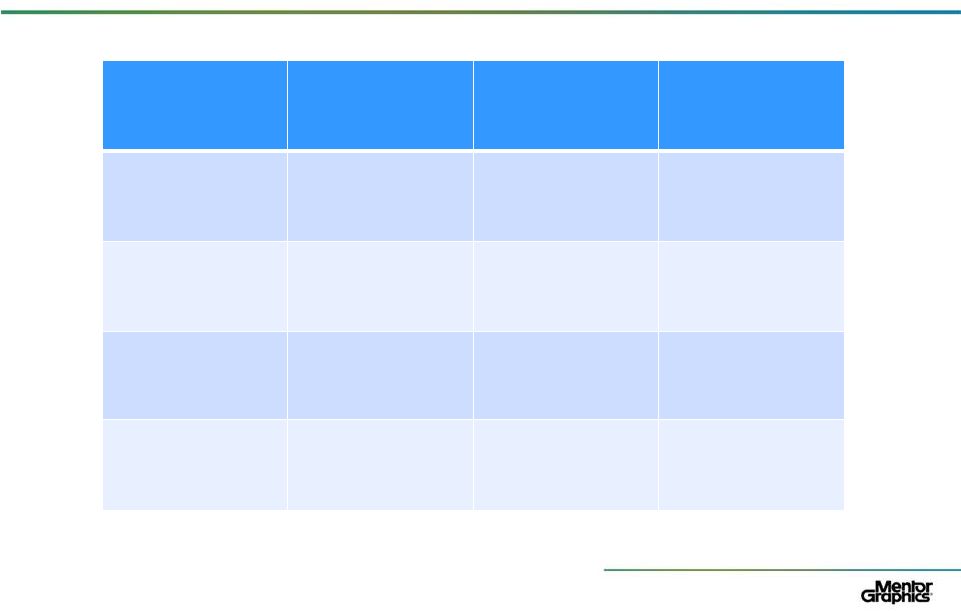

Customer & Product Segmentation Facts

Number of

Customers

Percent of

Bookings

Average

Transaction Size

IC Companies

Systems Companies

22

GKH, Needham Growth Conference

-

January 2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Estimated SG&A as a Percent of Revenue

Mentor Graphics FY12 Plan Based upon Activity-based Analysis

IC

Systems

Total

Selling

13%

33%

21%

Marketing

10%

10%

10%

Admin

9%

8%

9%

Total

32%

51%

40%

23

GKH, Needham Growth Conference

-

January 2012 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential

Mentor SG&A Findings

IC business FY12 plan SG&A costs (32%) similar to other

direct large customer focused companies

Systems business FY12 plan SG&A costs (51%) similar to

other distribution focused companies

Systems business and customers are unique within EDA

—

Diversifies customers and served markets

—

Sizeable customer set for IC products

—

Ready-made channel for non-traditional EDA products: wire

harness, mechanical and thermal analysis and embedded SW

Mentor’s FY12 Plan SG&A costs (40%) compare favorably

with other mixed direct and distribution selling companies

GKH,

Needham

Growth

Conference

-

January

2012

24 |

FINANCIAL

HIGHLIGHTS AND OUTLOOK |

©

2011 Mentor Graphics Corp.

www.mentor.com

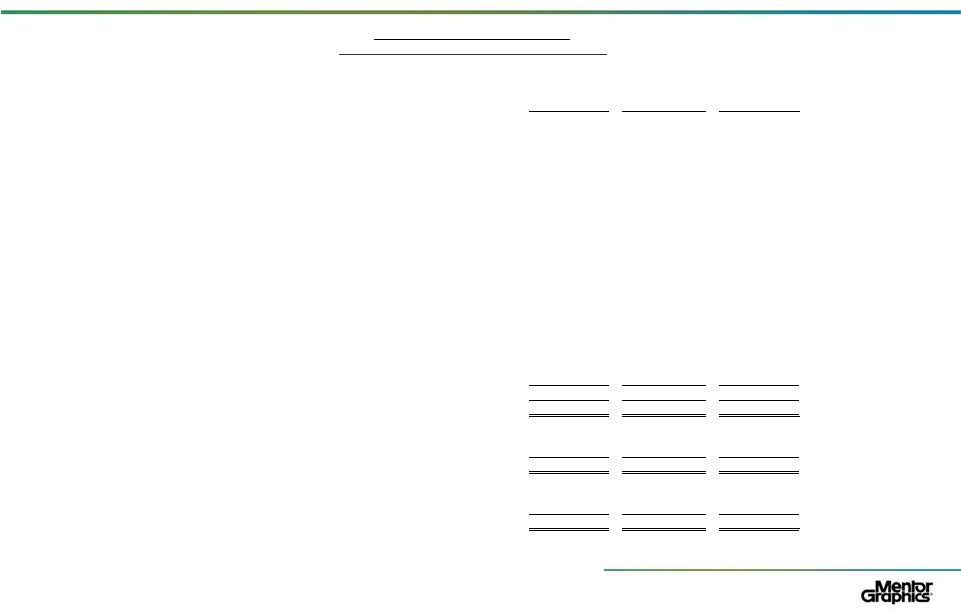

Q3 FY 2012 Results

Revenue, bookings and book to bill achieved all-time Q3 records

Growth of largest contract renewals was a strong 40%

Strength in design to silicon and Pac Rim driven by resolution enhancement and

28/20 nm build out

Q3 FY 2012 –

marked the eleventh consecutive quarter of exceeding non-GAAP

EPS guidance

26

26

*For

a

reconciliation

of

non-GAAP

to

GAAP

financial

measures,

see

the

appendix

to

this

presentation

Revenue ($mm)

Record

Q3

Non-GAAP

EPS

*

26

GKH,

Needham

Growth

Conference

-

January

2012

Green = GAAP EPS |

©

2011 Mentor Graphics Corp.

www.mentor.com

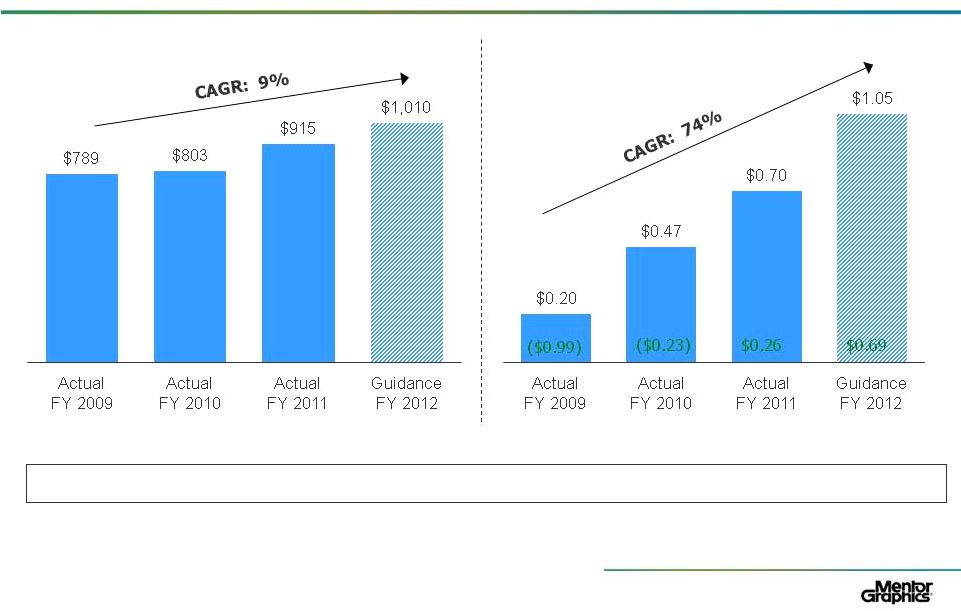

Fiscal 2012 Business Results and Outlook

First half business with strength in Integrated System

Design, Scalable Verification and New and Emerging

followed by strong Design to Silicon business in Q3

Q4 Fiscal 2012 expected revenue of approximately

$316 million and Non-GAAP EPS

*

of $0.50

—

GAAP EPS of approximately $0.46

Raising FY12 revenue guidance to $1.010 billion, an

increase of 10% year-over-year, and increasing Non-

GAAP EPS

*

to $1.05, up 50% from prior year

—

GAAP EPS of $0.69 vs $0.26

*For a reconciliation of non-GAAP to GAAP financial measures, see the appendix to this

presentation 27

GKH, Needham Growth Conference

-

January 2012 |

©

2011 Mentor Graphics Corp.

www.mentor.com

FY 2012 Guidance on a Foundation of

Strong Results

*For a reconciliation of non-GAAP to GAAP financial measures, see the appendix to this

presentation FY12 Non-GAAP EPS projected to grow 50% on a 10% growth in revenue

Revenue ($mm)

Non-GAAP EPS

*

28

GKH, Needham Growth Conference

-

January 2012

Green = GAAP EPS |

©

2011 Mentor Graphics Corp.

www.mentor.com

Long-Term Outlook and Capital Policy

Mentor’s leading industry products, presence in emerging markets and

leverageable operating model, create a platform anticipated to generate

significant returns for shareholders

EPS growth driven by top line momentum and operating margin expansion;

should be further enhanced by the use of our strong free cash flow to

repurchase shares

—

Mentor has historically operated on a leveraged net debt basis to reduce our

overall cost of capital and we presently anticipate using our strong cash flow to

return approximately $150 million of capital to shareholders through stock

repurchases or dividends

–

Mentor

has

repurchased

$90

million

of

stock

YTD

FY

2012

–

approximately

6% of our market capitalization

29

29

* For a reconciliation of non-GAAP to GAAP financial measures, see the appendix to this

presentation Long-Term

FY12

Model

Revenue Growth

10% Y-o-Y

8-10% CAGR

Growth in-line with industry analyst expectations

16%

20%+

Mild gross margin expansion due to both scale efficiencies and

structural operating changes

R&D constant at ~30% of revenues

SG&A declining as % of revenue due to scale efficiencies

Assumptions

Operating Margin

(non-GAAP)*

29

GKH, Needham Growth Conference

-

January 2012 |

©

2011 Mentor Graphics Corp.

www.mentor.com

Investment Highlights

Mentor’s pioneering EDA heritage, well diversified global customer

base and pioneering in new markets offers long-term growth

opportunities

Growth anticipated to continue to exceed underlying growth of

traditional EDA micro-electronic markets

Committed to enhancing shareholder value with a 20%+ non-GAAP

operating margin target and returning capital to our shareholders

through share repurchases

Integrated

Circuit (IC)

Printed Circuit

Board (PCB)

Systems

30

Mentor Graphics Investor Presentation, November 2011 |

APPENDIX

|

©

2011 Mentor Graphics Corp.

www.mentor.com

GAAP

vs

Non-GAAP

*

The Non-GAAP Metric:

Adopted by all public companies in the EDA industry

Used by all equity analysts that track the EDA industry

GAAP items excluded from non-GAAP results

—

Equity plan-related compensation

—

Special charges

—

Amortization of purchased technology

—

Amortization of other identified intangible assets

—

Amortization of debt discount and retirement costs

—

Other extraordinary items

33

*For a reconciliation of non-GAAP to GAAP financial measures, see the slides immediately

following this slide 33

Mentor Graphics Investor Presentation, November 2011 |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures

The Company’s

management evaluates and makes operating decisions using various

performance measures. In addition

to our GAAP results, we also consider adjusted gross margin, operating margin, net income

(loss), and earnings (loss) per share which we refer to as non-GAAP gross margin,

operating margin, net income (loss), and earnings (loss) per share, respectively.

These non-GAAP measures are derived from the revenues of our product, maintenance, and services

business operations and the costs directly related to the generation of those revenues, such as

cost of revenue, research and development, sales and marketing, and general and

administrative expenses, that management considers in evaluating our ongoing core

operating performance. These non-GAAP measures exclude amortization of intangible

assets,

special

charges,

equity

plan-related

compensation

expenses,

interest

expense

attributable

to

net

retirement

premiums or discounts on the early retirement of debt and associated debt issuance costs,

interest expense associated with the amortization of debt discount and premium on

convertible debt, and the equity in income (loss) of unconsolidated entities (except

Frontline PCB Solutions Limited Partnership (Frontline)), which management does not

consider reflective of our core operating business.

Management excludes from our non-GAAP measures certain recurring items to facilitate its

review of the comparability of our core operating performance on a

period-to-period basis because such items are not related to our ongoing core

operating performance as viewed by management. Management considers our core operating

performance to be that which can be affected by our managers in any particular period

through their management of the resources that affect our underlying revenue and profit

generating operations during that period. Management uses this view of our operating

performance for purposes of comparison with our business plan and individual operating budgets

and allocation of resources. Additionally, when evaluating potential acquisitions,

management excludes the items described above from its consideration of target

performance and valuation. More specifically, management adjusts for the excluded items for the

following reasons:

34

34

Mentor Graphics Investor Presentation, November 2011

Identified intangible assets consist primarily of purchased technology, backlog, trade names,

customer relationships, and employment agreements. Amortization charges for our

intangible assets can vary in frequency and amount due to the timing and magnitude of

acquisition transactions. We consider our operating results without these charges

when evaluating our core performance due to the variability. Generally, the most significant

impact to inter-period comparability of our net income (loss) is in the first twelve

months following an acquisition. |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

Special charges primarily consist of restructuring costs incurred for employee terminations,

including severance and benefits, driven by modifications of business strategy or

business emphasis. Special charges may also include expenses incurred related to

potential acquisitions, excess facility costs, and asset-related charges. Special charges

are incurred based on the particular facts and circumstances of acquisition and restructuring

decisions and can vary in size and frequency. These charges are excluded as they are not

ordinarily included in our annual operating plan and related budget due to the

unpredictability of economic trends and the rapidly changing technology and competitive

environment in our industry. We therefore exclude them when evaluating our managers'

performance internally. Equity plan-related compensation expenses represent the fair

value of all share-based payments to employees, including grants of employee stock

options and restricted stock units. We do not consider equity plan-related

compensation expense in evaluating our manager’s performance internally or our core

operations in any given period. Interest expense attributable to net retirement

premiums or discounts on the early retirement of debt, the write-off of associated

debt issuance costs and the amortization of the debt discount and premium on convertible debt are

excluded. Management does not consider these charges as a part

of our core operating performance. The early

retirement of debt and the associated debt issuance costs are not included in our annual

operating plan and related budget due to unpredictability of market conditions which

could facilitate an early retirement of debt. We do not consider the amortization

of the debt discount and premium on convertible debt to be a direct cost of operations.

In connection with the Company’s acquisition of Valor on March 18, 2010, we also acquired

Valor’s 50% interest in Frontline, a joint venture. We report our equity in

the earnings or losses of Frontline within operating income. We actively

participate in regular and periodic activities such as budgeting, business planning, marketing and direction of

research and development projects. Accordingly, we do not exclude our share of

Frontline’s earnings or losses from our non-GAAP results as management

considers the joint venture to be core to our operating performance. Equity in

earnings or losses of unconsolidated entities, with the exception of our investment in Frontline, represents

our equity in the net income (loss) of a common stock investment

accounted for under the equity method. The

carrying amount of our investment is adjusted for our share of earnings or losses of the

investee. The amounts are excluded from our non-GAAP results as we do

not control the results of operations for this investment and we do not participate in

regular and periodic operating activities; therefore, management does not consider these businesses a

part of our core operating performance.

Mentor Graphics Investor Presentation, November 2011

35 |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

36

36

36

Mentor Graphics Investor Presentation, November 2011

Income tax expense (benefit) is adjusted by the amount of additional tax expense or benefit that

we would accrue if we used non-GAAP results instead of GAAP results in the

calculation of our tax liability, taking into consideration our long-term tax

structure. We use a normalized effective tax rate of 17%, which reflects the weighted average tax rate

applicable under the various jurisdictions in which we operate. This non-GAAP tax rate

eliminates the effects of non- recurring and period specific items which are often

attributable to acquisition decisions and can vary in size and

frequency and considers our U.S. loss carryforwards that have not been previously

benefited. This rate is subject to change over time for various reasons, including

changes in the geographic business mix and changes in statutory tax rates. Our GAAP tax

rate for the full fiscal year 2012 GAAP is projected to be 2%. The GAAP tax rate considers

certain mandatory and other non-scalable tax costs which may adversely or beneficially

affect our tax rate depending upon our level of profitability in various jurisdictions.

In certain instances our GAAP results of operations may not be profitable when our

corresponding non-GAAP results are profitable or vice versa. The number of

shares on which our non-GAAP earnings per share is calculated may therefore differ

from the GAAP presentation due to the anti-dilutive effect of stock options and restricted stock units in a loss

situation.

Non-GAAP gross margin, operating margin, and net income (loss) are

supplemental measures of our performance that are not required by, or presented in

accordance with, GAAP. Moreover, they should not be considered as an alternative to any

performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as

a measure of our liquidity. We present non-GAAP gross margin, operating margin, and net

income (loss) because we consider them to be important supplemental measures of our

operating performance and profitability trends, and because we believe they give

investors useful information on period-to-period performance as evaluated by management. Non-

GAAP net income (loss) also facilitates comparison with other companies in our industry, which

use similar financial measures to supplement their GAAP results. Non-GAAP net income

(loss) has limitations as an analytical tool, and therefore should not be considered in

isolation or as a substitute for analysis of our results as reported under GAAP. In

the future we expect to continue to incur expenses similar to the non-GAAP adjustments

described above and exclusion of these items in our non-GAAP presentation should not

be construed as an inference that these costs are unusual, infrequent or

non-recurring. Some of the limitations in relying on non-GAAP net income (loss) are: |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

Amortization of intangibles represents the loss in value as the technology in our industry

evolves, is advanced, or is replaced over time. The expense associated with this loss in

value is not included in the non-GAAP net income (loss) presentation and therefore

does not reflect the full economic effect of the ongoing cost of maintaining our current

technological position in our competitive industry, which is addressed through our research and

development program.

We regularly engage in acquisition and assimilation activities as part of our ongoing business

and regularly evaluate our businesses to determine whether any operations should be

eliminated or curtailed. We therefore will continue to experience special charges

on a regular basis. These costs also directly impact our available funds. Our

stock option and stock purchase plans are important components of our incentive compensation arrangements

and will be reflected as expenses in our GAAP results. Our stock

option and stock purchase plans are important

components of our incentive compensation arrangements and will be reflected as expenses in our

GAAP results. Our income tax expense (benefit) will be ultimately based on our

GAAP taxable income and actual tax rates in effect,

which often differ significantly from the 17% rate assumed in our non-GAAP

presentation. In addition, if we have a GAAP loss and non-GAAP net income, our

non-GAAP results will not reflect any projected GAAP tax benefits. Similarly,

in the event we were to have GAAP net income and a non-GAAP loss, our GAAP tax expense would be

replaced by a credit in our non-GAAP presentation.

Other companies, including other companies in our industry, calculate non-GAAP net income

(loss) differently than we do, limiting its usefulness as a comparative measure.

37

Mentor Graphics Investor Presentation, November 2011 |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

38

Mentor Graphics Investor Presentation, November 2011

2011

2010

GAAP net income (loss)

24,071

$

15,257

$

Non-GAAP adjustments:

Equity plan-related compensation: (1)

Cost of revenues

249

221

Research and development

2,005

1,798

Marketing and selling

1,365

1,299

General and administration

1,495

1,589

Acquisition -

related items:

Amortization of purchased assets

Cost of revenues (2)

1,761

3,299

Frontline purchased technology and intangible assets (3)

1,242

1,242

Amortization of intangible assets (4)

1,296

1,445

Special charges (5)

1,164

1,578

Other income (expense), net (6)

(1,484)

-

Interest expense (7)

1,250

753

Non-GAAP income tax effects (8)

(7,050)

(4,133)

Total of non-GAAP adjustments

3,293

9,091

Non-GAAP net income

27,364

$

24,348

$

GAAP weighted average shares (diluted)

111,563

112,139

Non-GAAP adjustment

-

-

Non-GAAP weighted average shares (diluted)

111,563

112,139

GAAP net income per share (diluted)

0.22

$

0.14

$

Non-GAAP adjustments detailed

above 0.03

0.08

Non-GAAP net income per share (diluted)

0.25

$

0.22

$

MENTOR GRAPHICS CORPORATION

UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS

(In thousands, except earnings per share data)

Three Months Ended October 31, |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

39

Mentor Graphics Investor Presentation, November 2011

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

Non-GAAP income tax expense adjustment reflects the application of

our assumed normalized effective 17% tax rate, instead of our GAAP tax rate, to our non-

GAAP pre-tax income.

Equity plan-related compensation expense.

Amount represents amortization of purchased technology resulting from

acquisitions. Purchased intangible assets are amortized over two to five years.

Three months ended October 31, 2011:

Gain of $1,519 resulting from a change from an equity method

investment to a controlling interest and loss of $(35) on

investments accounted for under the equity method of accounting.

Three months ended October 31, 2011:

$1,250 in amortization of original issuance debt discount.

Three months ended October 31, 2010:

$753 in amortization of original issuance debt discount and bond

premiums, net. Amount represents amortization of purchased

technology and other identified intangible assets identified as part of the fair value of the Frontline P.C.B. Solutions

Limited Partnership (Frontline) investment. Mentor Graphics

acquired a 50% joint venture in Frontline as a result of the Valor Computerized Systems, Ltd.

acquisition in the first quarter of fiscal 2011. The purchased

technology will be amortized over three years, other identified intangible assets will be amortized over

three to four years, and are reflected in the income statement in the

equity in earnings of Frontline results. This expense is the same type as being adjusted for in

notes (2) above and (4) below.

Other identified intangible assets are amortized to other operating

expense over two to five years. Other identified intangible assets include trade names,

customer relationships, and backlog which are the result of acquisition

transactions. Three months ended October 31, 2011:

Special charges consist of (i) $1,227 of costs incurred for employee

rebalances which includes severance benefits, notice pay, and

outplacement services, (ii) $(19) in acquisition costs, (iii) $(173) related to the abandonment of excess lease space, and (iv) $129 in consulting fees

associated with our proxy contest.

Three months ended October 31, 2010:

Special charges consist of (i) $1,191 of costs incurred for employee

rebalances which includes severance benefits, notice pay, and

outplacement services, (ii) $432 in lease restoration costs, (iii) $302 related to the abandonment of excess lease space, (iv) $(513) in acquisition costs,

(v) $83 in advisory fees, and (vi) $83 in other adjustments.

|

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

40

Mentor Graphics Investor Presentation, November 2011

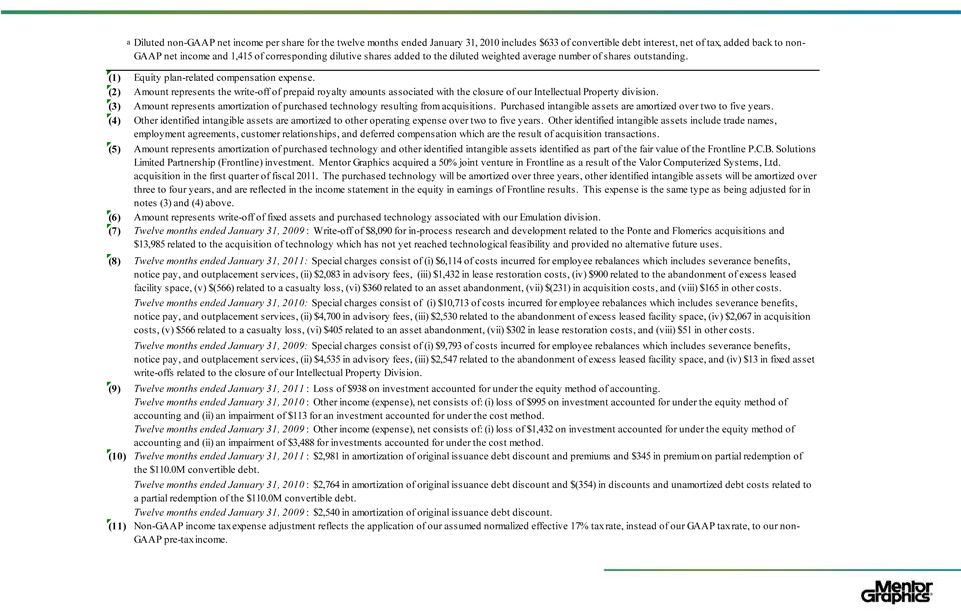

Estimated

Estimated

Estimated

Q3 FY12

Q4 FY12

FY12

Diluted GAAP net income per share

$0.18

$0.46

$0.69

Non-GAAP Adjustments:

Amortization of purchased intangible assets (1)

0.02

0.02

0.09

Amortization of other identified

intangible assets (2) 0.02

0.02

0.09

Equity plan-related compensation

(3) 0.06

0.05

0.19

Special charges (4)

-

-

0.07

Other expense, net and interest expense

(5) -

-

0.13

Non-GAAP income tax effects

(6) (0.07)

(0.05)

(0.21)

Non-GAAP net income per share

$0.21

$0.50

$1.05

(1)

(2)

(3)

(4)

(5)

(6)

Excludes amortization of other identified intangible assets including

trade names, customer relationships, and backlog resulting from acquisition

transactions. Other identified intangible assets are amortized

over two to five years. This line item also excludes amortization of purchased intangible

assets identified as part of the fair value of the Frontline P.C.B.

Solutions Limited Partnership investment. The purchased technology will be amortized

over three years and other identified intangible assets will be

amortized over three to four years. Excludes equity

plan-related compensation expense. Excludes special charges

consisting primarily of consulting fees associated with our proxy contest, costs incurred for employee rebalances (which

includes severance benefits, notice pay and outplacement services),

facility closures, and acquisition costs. Adjustment for fiscal

2012, reflects the amortization of original issuance debt discount and premium for our 6.25% Convertible Subordinated Debentures

due 2026, the amortization of original issuance debt discount for our

4.00% Convertible Subordinated Debentures due 2031, and charges associated

with the retirement of our 6.25% Convertible Subordinated Debentures

and Term Loan. Non-GAAP income tax expense adjustment

reflects the application of our assumed normalized effective 17% tax rate, instead of our GAAP tax rate, to

our non-GAAP pre-tax income.

Excludes amortization of purchased intangible assets resulting from

acquisition transactions. Purchased intangible assets are amortized over two to five

years.

The following table reconciles management's estimates of the specific

items excluded from GAAP in the calculation of estimated non-GAAP

net income per share for Q3 FY12, Q4 FY12, and fiscal 2012.

MENTOR GRAPHICS CORPORATION

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP

EARNINGS PER SHARE |

©

2011 Mentor Graphics Corp.

www.mentor.com

Mentor Graphics Investor Presentation, November 2011

41

Non-GAAP Financial Measures (cont.)

Estimated

FY 2012

GAAP operating income

108.1

$

Reconciling items to non-GAAP operating

income: Equity plan-related compensation

21.4

Amortization of purchased technology

9.7

Amortization of Frontline purchased technology and other

4.9

identified intangible assets

Amortization of other identified intangible assets

5.8

Special Charges

7.4

Non-GAAP operating income

157.3

$

Estimated

FY 2012

GAAP operating income as a percent of total revenues

11%

Non-GAAP adjustments detailed above

5%

Non-GAAP operating income as a percent of total revenues

16%

Twelve Months Ended January 31,

MENTOR

GRAPHICS

CORPORATION

(In millions, except percentages)

Twelve Months Ended January 31,

UNAUDITED RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP

FINANCIAL MEASURES |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

Actual

Actual

Actual

FY11

FY10

FY09

GAAP net income (loss)

28,584

$

(21,889)

$

(91,252)

$

Non-GAAP adjustments:

Equity plan-related compensation: (1)

Cost of revenues

888

1,618

1,544

Research and development

7,785

10,931

12,005

Marketing and selling

6,112

8,406

8,627

General and administration

5,726

5,204

6,047

System and software cost of

revenues (2) -

-

103

Acquisition -

related items: Amortization of purchased assets

Cost of revenues (3)

13,771

12,012

12,403

Amortization of intangible assets (4)

7,347

11,184

11,113

Frontline purchased technology and intangible

assets (5) 4,347

-

-

Impairment of long-lived assets (6)

-

-

4,553

In-process research and

development (7) -

-

22,075

Special charges (8)

10,257

21,334

16,888

Other income (expense), net (9)

938

1,108

4,920

Interest expense (10)

3,326

2,410

2,540

Non-GAAP income tax effects

(11) (12,298)

(7,028)

7,039

Total of non-GAAP

adjustments 48,199

67,179

109,857

Non-GAAP net income

76,783

$

45,290

$

18,605

$

GAAP weighted average shares (diluted)

109,861

96,474

91,829

Non-GAAP adjustment

-

1,901

714

Non-GAAP weighted

average shares (diluted) 109,861

98,375

92,543

GAAP net income (loss) per share

(diluted) 0.26

$

(0.23)

$

(0.99)

$

Non-GAAP adjustments detailed above

0.44

0.70

1.19

Non-GAAP net income per

share (diluted) 0.70

$

0.47

$

0.20

$

MENTOR GRAPHICS CORPORATION

RECONCILIATION OF NON-GAAP ADJUSTMENTS

(In thousands, except earnings per share data)

42

Mentor Graphics Investor Presentation, November 2011

a

a |

©

2011 Mentor Graphics Corp.

www.mentor.com

Non-GAAP Financial Measures (cont.)

43

Mentor Graphics Investor Presentation, November 2011 |

www.mentor.com

©

2011 Mentor Graphics Corp. Company Confidential |