Attached files

| file | filename |

|---|---|

| 8-K - JP MORGAN CONFERENCE FORM 8-K - OMNICARE INC | form8_kjpmorgan.htm |

1

Forward-Looking Statements

Forward-looking Statements

Certain of the statements made today and listed within the following presentation slides are forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, all statements regarding the intent, belief or current expectations regarding

the matters discussed in this presentation. Such forward-looking statements are based on management’s current expectations and involve known and unknown risks,

uncertainties, contingencies and other factors that could cause results, performance or achievements to differ materially from those stated. The most significant of these

risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q and Form 8-K reports filed with the Securities and Exchange Commission. Investors are

cautioned that such statements are only predictions and that actual events or results may differ materially.

Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, all statements regarding the intent, belief or current expectations regarding

the matters discussed in this presentation. Such forward-looking statements are based on management’s current expectations and involve known and unknown risks,

uncertainties, contingencies and other factors that could cause results, performance or achievements to differ materially from those stated. The most significant of these

risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q and Form 8-K reports filed with the Securities and Exchange Commission. Investors are

cautioned that such statements are only predictions and that actual events or results may differ materially.

These forward-looking statements speak only as of the date this presentation was originally given. We undertake no obligation to publicly release the results of any

revisions to the forward-looking statements made today, to reflect events or circumstances after today or to reflect the occurrence of unanticipated events.

revisions to the forward-looking statements made today, to reflect events or circumstances after today or to reflect the occurrence of unanticipated events.

Reconciliation to GAAP

To facilitate comparisons and enhance understanding of core operating performance, certain financial measures have been adjusted from the comparable amount under

Generally Accepted Accounting Principles (GAAP). A detailed reconciliation of adjusted numbers to GAAP is posted in the Investor Relations section of our Web site at

http://ir.omnicare.com. Additionally, all amounts are presented on a continuing operations basis, unless otherwise stated.

Generally Accepted Accounting Principles (GAAP). A detailed reconciliation of adjusted numbers to GAAP is posted in the Investor Relations section of our Web site at

http://ir.omnicare.com. Additionally, all amounts are presented on a continuing operations basis, unless otherwise stated.

Important Additional Information

On September 7, 2011, Philadelphia Acquisition Sub, Inc. ("Purchaser"), a wholly owned subsidiary of Omnicare, Inc. ("Omnicare"), commenced a tender offer to purchase

all issued and outstanding shares of common stock, par value $0.01 per share (together with the associated preferred share purchase rights, the "Shares") of PharMerica

Corporation ("PharMerica") at a price of $15.00 per Share, net to the seller in cash, without interest and subject to any required withholding of taxes, upon the terms and

subject to the conditions set forth in the Offer to Purchase and in the related Letter of Transmittal (which, together with any amendments or supplements thereto, constitute

the "Offer"). The Offer is scheduled to expire at 5:00 p.m., New York City time, on January 20, 2012, unless extended. If the Offer is extended, Omnicare will issue a

press release announcing the extension no later than 9:00 a.m., New York City time, on the next business day following the date the Offer was scheduled to expire. The

Offer is conditioned on, among other things, there being validly tendered and not withdrawn at least a majority of the total number of Shares outstanding on a fully diluted

basis, the board of directors of PharMerica redeeming or invalidating its "poison pill" stockholder rights plan, receipt of regulatory approvals and other customary closing

conditions as described in the Offer to Purchase. The Offer is not subject to any financing contingencies.

all issued and outstanding shares of common stock, par value $0.01 per share (together with the associated preferred share purchase rights, the "Shares") of PharMerica

Corporation ("PharMerica") at a price of $15.00 per Share, net to the seller in cash, without interest and subject to any required withholding of taxes, upon the terms and

subject to the conditions set forth in the Offer to Purchase and in the related Letter of Transmittal (which, together with any amendments or supplements thereto, constitute

the "Offer"). The Offer is scheduled to expire at 5:00 p.m., New York City time, on January 20, 2012, unless extended. If the Offer is extended, Omnicare will issue a

press release announcing the extension no later than 9:00 a.m., New York City time, on the next business day following the date the Offer was scheduled to expire. The

Offer is conditioned on, among other things, there being validly tendered and not withdrawn at least a majority of the total number of Shares outstanding on a fully diluted

basis, the board of directors of PharMerica redeeming or invalidating its "poison pill" stockholder rights plan, receipt of regulatory approvals and other customary closing

conditions as described in the Offer to Purchase. The Offer is not subject to any financing contingencies.

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. The Offer is being made pursuant to a tender offer statement on

Schedule TO (including the Offer to Purchase, Letter of Transmittal and other related tender offer materials) that was filed on September 7, 2011 by Omnicare and

Purchaser with the SEC. These materials, as they may be amended from time to time, contain important information, including the terms and conditions of the Offer, that

should be read carefully before any decision is made with respect to the Offer. Investors and security holders of PharMerica are able to obtain free copies of these

documents and other documents filed with the SEC by Omnicare through the web site maintained by the SEC at http://www.sec.gov or by directing a request to the

Corporate Secretary of Omnicare, Inc., 100 East RiverCenter Boulevard, Suite 1600, Covington, Kentucky 41011. Free copies of any such documents can also be

obtained by directing a request to Omnicare's information agent, D.F. King & Co., Inc., by phone at (212) 269-5550 or toll-free at (800) 769-7666 or by email at

info@dfking.com.

Schedule TO (including the Offer to Purchase, Letter of Transmittal and other related tender offer materials) that was filed on September 7, 2011 by Omnicare and

Purchaser with the SEC. These materials, as they may be amended from time to time, contain important information, including the terms and conditions of the Offer, that

should be read carefully before any decision is made with respect to the Offer. Investors and security holders of PharMerica are able to obtain free copies of these

documents and other documents filed with the SEC by Omnicare through the web site maintained by the SEC at http://www.sec.gov or by directing a request to the

Corporate Secretary of Omnicare, Inc., 100 East RiverCenter Boulevard, Suite 1600, Covington, Kentucky 41011. Free copies of any such documents can also be

obtained by directing a request to Omnicare's information agent, D.F. King & Co., Inc., by phone at (212) 269-5550 or toll-free at (800) 769-7666 or by email at

info@dfking.com.

2

Cash Flow

Generation

Generation

Specialty Care

Group

Group

Omnicare’s Fundamental Objective

Focused on Growth and Creating Value

Focused on Growth and Creating Value

Value

Creation

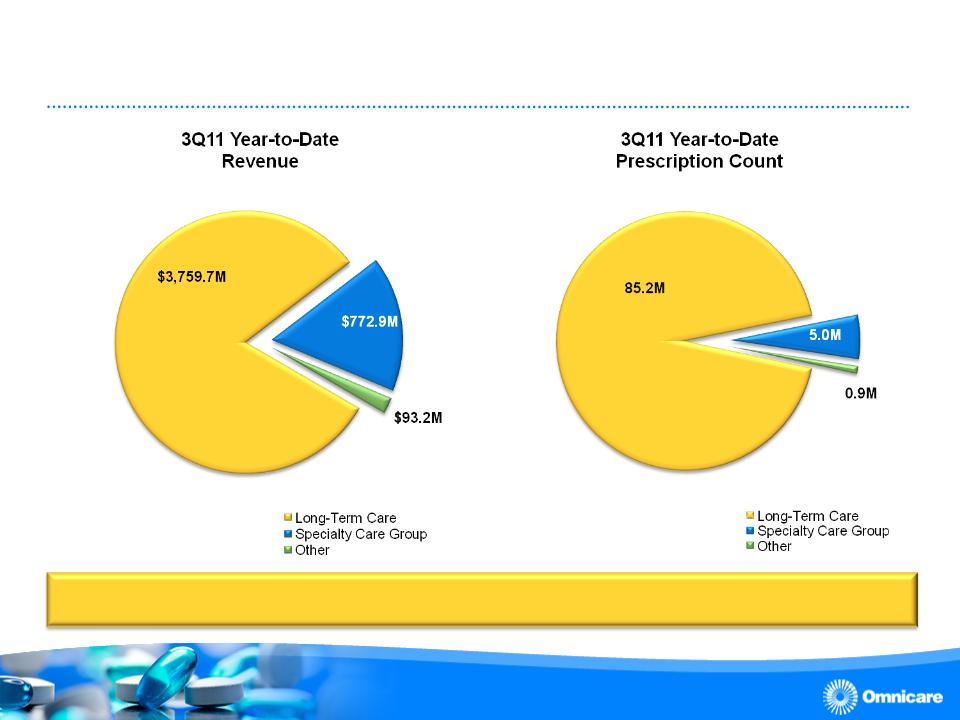

Sizing Up the Business

4

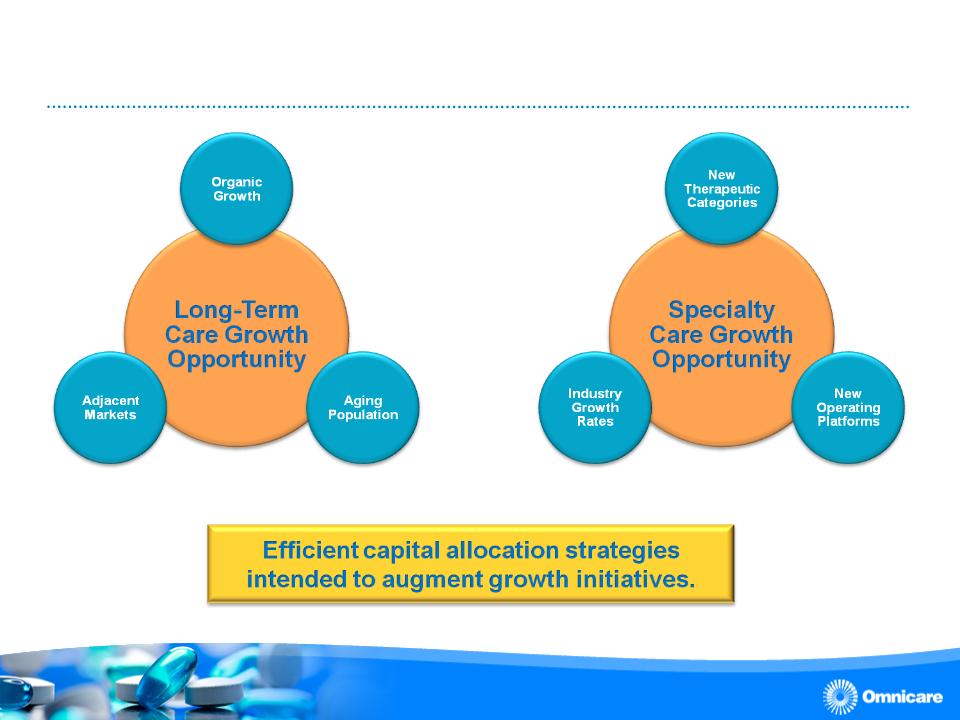

Long-Term Care and Specialty Care represent two platforms for growth

Industry Growth Dynamics

Continued Rise of Generics, Specialty Drugs

Continued Rise of Generics, Specialty Drugs

5

1. Source: IMS - Total US Pharma Prescriptions

Omnicare positioned well to capitalize on both

growing markets; generics and specialty.

growing markets; generics and specialty.

Forecasted Pharmaceutical Developments(1) by Drug Type

Industry Growth Dynamics

Aging Population Shaping US Healthcare System

Aging Population Shaping US Healthcare System

6

Source: U.S. Census Bureau

Seniors generally have higher pharmaceutical utilization rates, and

adherence to medication is essential to lowering overall healthcare costs

adherence to medication is essential to lowering overall healthcare costs

Transitioning to an Operations-Driven Company

Focus on Three Core Operating Objectives

Focus on Three Core Operating Objectives

• Establish

consistent organic growth in our Long-Term Care Group

consistent organic growth in our Long-Term Care Group

• Create

more standardization across the company

more standardization across the company

• Reposition

Specialty Care Group for an elevated level of growth

Specialty Care Group for an elevated level of growth

7

Long-Term Care Group

8

Transitioning to an Operations-Driven Company

Establish Consistent Organic Growth in LTC

Establish Consistent Organic Growth in LTC

• Improving our selling effectiveness, expanding beyond SNFs

– Greater coordination throughout selling process

– Size of sales force doubled within past year

– Conveying the “Omnicare Advantage” (Clinical Operational Specialty

Technology)

Technology)

– Assisted/independent living, psychiatric hospitals, VA facilities,

correctional facilities, development disability facilities

correctional facilities, development disability facilities

• Continued enhancements to the service delivery model

– Objective to sustain a 95% customer retention rate through:

• World-class service organization

• Innovation

• Clinical expertise

• Speed of generic conversion

9

Omnicare’s LTC offering revolves around value creation; investments

intended to drive growth while creating customer efficiencies

intended to drive growth while creating customer efficiencies

3Q11 YTD net organic bed loss is

49.5% lower than 3Q10 YTD

49.5% lower than 3Q10 YTD

Transitioning to an Operations-Driven Company

Establish Consistent Organic Growth in LTC

Establish Consistent Organic Growth in LTC

10

43.2% better

than 2010

than 2010

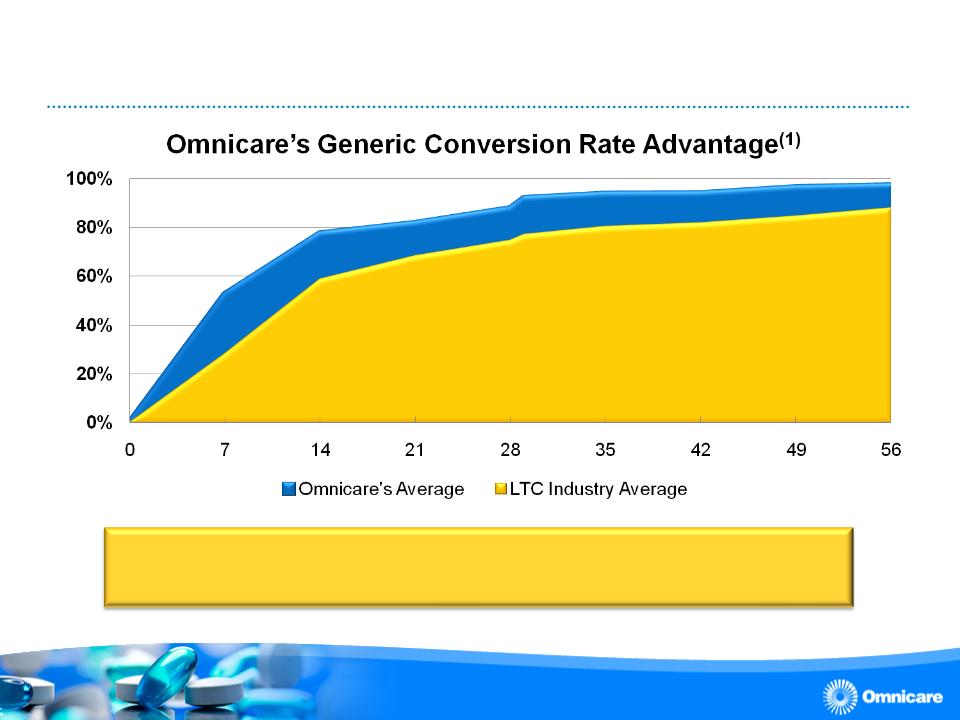

Generic Drug Efficiencies

Speed-to-Generic Conversion Drives Value

Speed-to-Generic Conversion Drives Value

11

Omnicare’s customers have realized over $200 million in

savings from generics launched for the trailing four quarters(2)

savings from generics launched for the trailing four quarters(2)

1. Source: Omnicare and IMS data for Aricept, Levaquin, Xalatan, Zyprexa and Zyprexa Zydis

2. For the period ended September 30, 2011

Transitioning to an Operations-Driven Company

Creating More Standardization

Creating More Standardization

• Operating efficiencies

– Benchmarking

– Insourcing

– Six Sigma-Focused Culture

• Technological improvements

– Automation

– Customer-facing technology

– Medication availability

– ONE System

12

Standardization opportunities expected

to be a longer-term growth driver

to be a longer-term growth driver

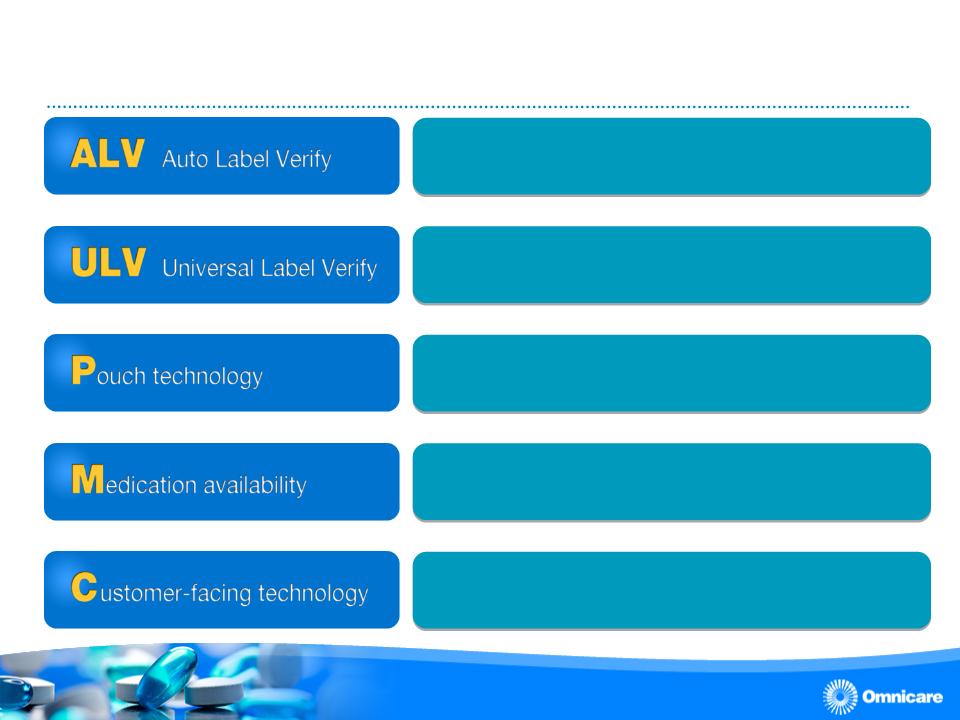

Leading Technology Initiatives

Technological Solutions Designed to Enhance Efficiency, Accuracy,

Service

Technological Solutions Designed to Enhance Efficiency, Accuracy,

Service

13

A proprietary robotic dispensing process for card and box products

18 ALV systems are currently in operation with plan to add systems in 2012

Combines the pick, label print & apply, verification and sorting steps into

one function

one function

Currently in pilot with roll-out commencing in mid-2012

Most efficient pouch dispensing technology leveraging Hub and Spoke

model for ALF

model for ALF

Pilot to begin in early 2012 with roll-out commencing by year-end

In-facility solution that improves: “Lack of Medication” events; Security and

access control; Management of controlled substances; Administration

access control; Management of controlled substances; Administration

Currently in pilot with multi-year roll-out commencing in mid-2012

OmniviewTM, OmniviewDr, MyOmniview

Leading Technology Initiatives

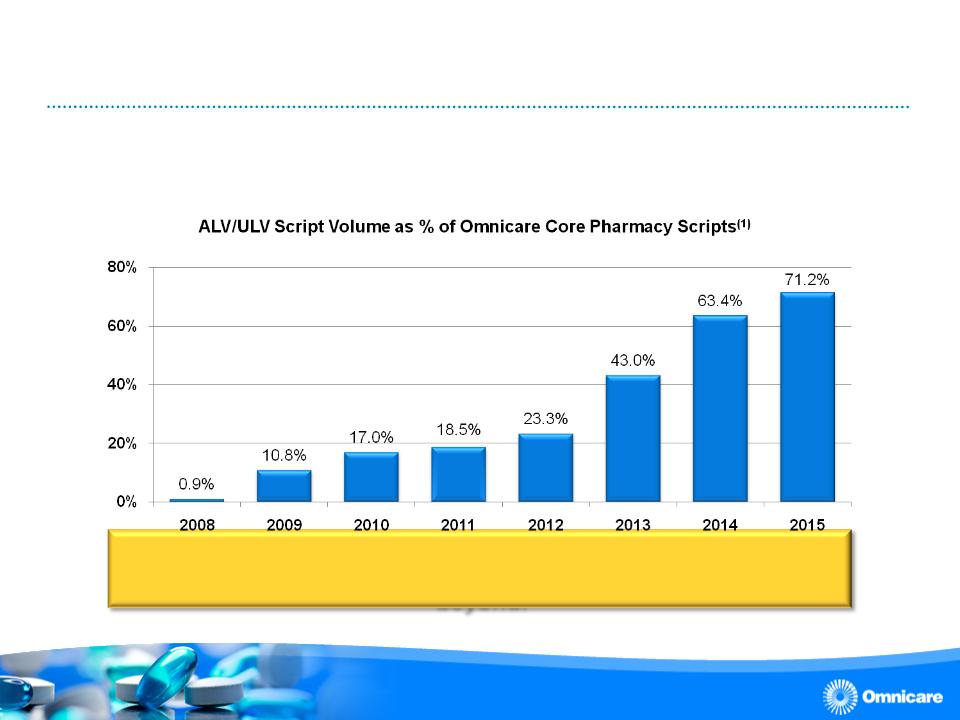

Increasing Automated Mix Expected to Further Drive Standardization

Increasing Automated Mix Expected to Further Drive Standardization

• The percentage of scripts automated is expected to increase dramatically

with the implementation of additional ALV units and planned ULV units

with the implementation of additional ALV units and planned ULV units

14

Technology initiatives expected to be a driver of cost savings,

retention and growth opportunities in late 2012 and beyond.

retention and growth opportunities in late 2012 and beyond.

1. Source: Omnicare internal estimate

Classic Omniview

Customer-Facing Technologies

Omniview™

Omniview™

Omnicare’s secure web-based worksite for

customer facilities, prescribers and patients

customer facilities, prescribers and patients

OmniviewDr

MyOmniview

Customer-Facing Technologies

Omniview™ Usage Increasing Among Customer Base

Omniview™ Usage Increasing Among Customer Base

16

ONE System Initiative

Efficiency-Driving Infrastructure Enhancement

Efficiency-Driving Infrastructure Enhancement

• Implementing plans to modernize our Pharmacy and Billing System

– Currently utilizing multiple dispensing systems running technology that

is not state of the art

is not state of the art

– Not fully integrated with LTC product lines and financial systems

– Specialty Care Group systems not integrated

• Oracle solution will update pharmacy systems with an integrated

ERP solution across all business units

ERP solution across all business units

– A combination of commercial software and custom development will be

required to improve technology platforms

required to improve technology platforms

• Projected timeline to develop and fully implement is 48 months

(started

in 2Q11) but some benefits are expected to start in late 2012

(started

in 2Q11) but some benefits are expected to start in late 2012

17

ONE System expected to be significant driver of efficiency improvements

Specialty Care Group

18

Specialty Drug Market Characteristics

Unique Solutions to Complex Disease States

Unique Solutions to Complex Disease States

• Specialty product

characteristics

characteristics

– Annual cost of therapy ($25,000

to $150,000 per year)

to $150,000 per year)

– Patient population (ranging from

hundreds to 250,000)

hundreds to 250,000)

– Route of administration

(frequently injected or infused)

(frequently injected or infused)

– Chronic disease states

– All branded products, typically

injectable

injectable

• Rapidly growing market sector

– 22% market share increase

from 2008 to 2010(1)

from 2008 to 2010(1)

– 15.4% growth rate in 2010 (2)

19

Specialty Therapeutic Categories

• Oncology

– Revlimid

– Gleevec

• Multiple Sclerosis

– Avonex

– Copaxone

– Betaseron

• Rheumatoid Arthritis

– Enbrel

– Humira

• Growth Hormones

– Norditripin

– Nutropin

20

1. Medco data

Specialty Care Group

Operational Platforms

Operational Platforms

21

End of Life

Care

Care

Specialty Care Group

Business Model, Economics Vary Depending Upon Operational

Platform

Business Model, Economics Vary Depending Upon Operational

Platform

22

Brand

Support

Services

Third

Party

Logistics

Party

Logistics

PAP &

Consigned

Pharmacy

Consigned

Pharmacy

Manufacturer

Fee for Service Model

Manufacturer owns the product

Specialty

Pharmacy

Pharmacy

Third Party

Payers

Payers

Buy/Sell

Model

Model

Hospices

Per Diem

Model

Model

SCG owns the product

Customer

Revenue

Product

Transitioning to an Operations-Driven Company

Repositioning Specialty Care Group for Elevated Growth

Repositioning Specialty Care Group for Elevated Growth

Omnicare specialty care growth has been robust…and opportunities

exist to further accelerate growth through:

exist to further accelerate growth through:

•Continued improvements to the organizational structure

– Investments made in manufacturer-focused sales organization

– Platform-specific experts added to expand breadth of knowledge

•Expanding into other specialty-focused platforms

•Penetrating additional disease states in specialty pharmacy platform

– Primary disease states currently multiple sclerosis and oncology

•Leveraging long-term care business to create new opportunities

23

Annual growth rate for Omnicare’s

specialty care businesses exceeds 20%(1)

specialty care businesses exceeds 20%(1)

1. Based on third-quarter 2011 results

Compelling Avenues for Growth

24

Financial Overview

25

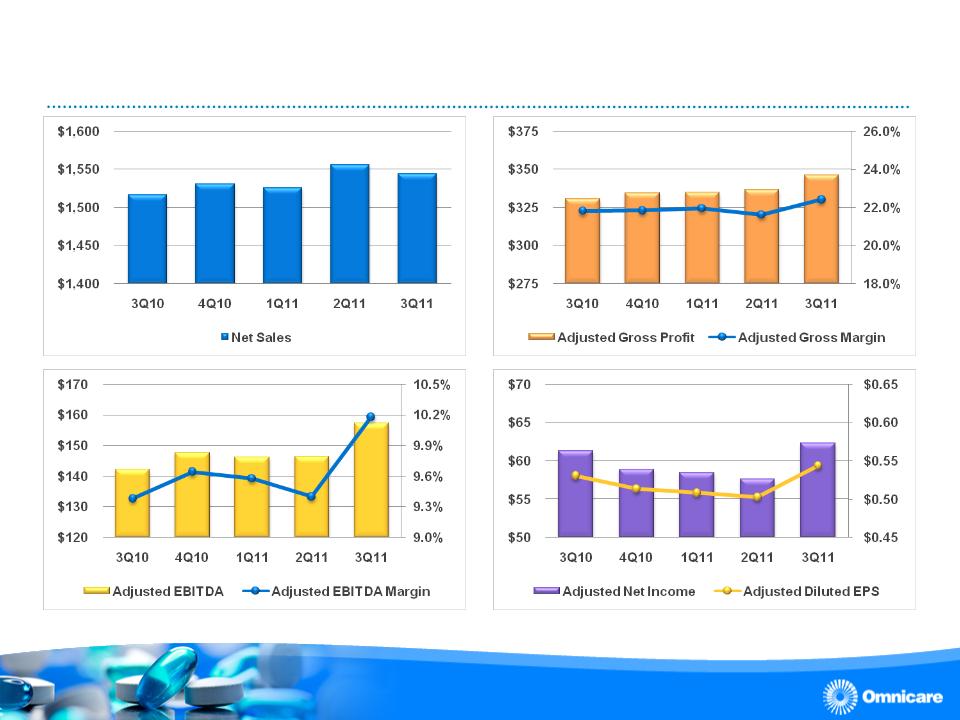

Operating Performance

Sequential Progression Five Quarter Trend(1) (in millions, except percentage

data)

Sequential Progression Five Quarter Trend(1) (in millions, except percentage

data)

26

1. Excludes discontinued operations.

Financial Performance

Sequential Progression Five Quarter Trend(1)(2) (in $ millions, except per

share data)

Sequential Progression Five Quarter Trend(1)(2) (in $ millions, except per

share data)

27

1. Excludes discontinued operations.

2. Excludes special items. A reconciliation of certain non-GAAP information is available on Omnicare’s Web site under ‘Supplemental Financial Information’ from the ‘Investors’ page.

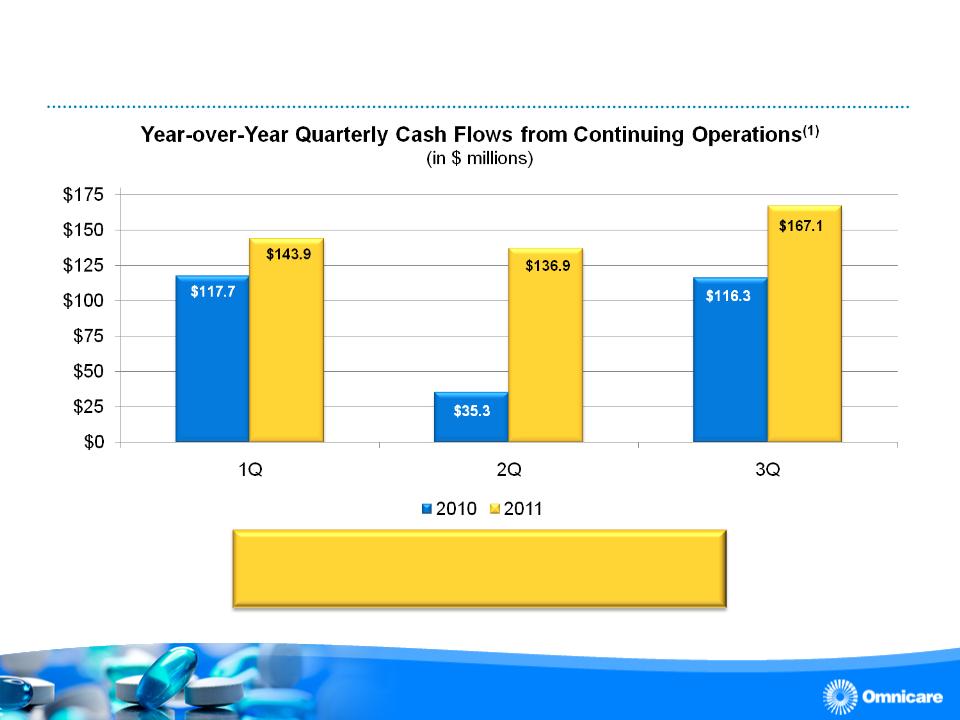

Focus on Cash Flow

Year-to-Date 2011 Performance

Year-to-Date 2011 Performance

28

1. Excludes discontinued operations.

3Q11 YTD cash flow from continuing

operations 66.4% higher than 3Q10 YTD

operations 66.4% higher than 3Q10 YTD

Focus on Cash Flow

High Quality of Earnings

High Quality of Earnings

29

A significant amount of Omnicare’s

earnings is converted into cash flow

earnings is converted into cash flow

1. Free cash flow = cash flow from continuing operations less capital expenditures and dividends paid. Free cash flow does not fully reflect the ability to freely deploy cash as it does

not reflect required payments on indebtedness and other obligations. A reconciliation of free cash flow to net cash flows from operating activities is available on Omnicare’s

website under ‘Supplemental Financial Information’ from the ‘Investors’ page.

not reflect required payments on indebtedness and other obligations. A reconciliation of free cash flow to net cash flows from operating activities is available on Omnicare’s

website under ‘Supplemental Financial Information’ from the ‘Investors’ page.

Focus on Cash Flow

Cash Flow Drives Substantial Value

Cash Flow Drives Substantial Value

• Highly compelling financial attribute is cash flow generation

capability

capability

– High quality of earnings

– Creates flexibility for capital allocation initiatives

• Substantial value exists below the EBITDA line

– Significant amount of ongoing intangible asset amortization

– Lower cash tax rate vs. effective tax rate

– Capital expenditure requirements relatively modest

30

1. As of the close of trading on 12/30/2011. Free cash flow = cash flow from continuing operations less capital expenditures and dividends paid. Free cash flow does not fully reflect the ability to freely deploy cash

as it does not reflect required payments on indebtedness and other obligations. A reconciliation of free cash flow to net cash flows from operating activities is available on Omnicare’s website under

‘Supplemental Financial Information’ from the ‘Investors’ page.

as it does not reflect required payments on indebtedness and other obligations. A reconciliation of free cash flow to net cash flows from operating activities is available on Omnicare’s website under

‘Supplemental Financial Information’ from the ‘Investors’ page.

13.5% free cash flow yield based on

current market capitalization(1)

current market capitalization(1)

Focus on Cash Flow

Substantial Long Term Value Exists Below the EBITDA Line

Substantial Long Term Value Exists Below the EBITDA Line

31

These items carry a weighted average life of over 9 years if the

company were to make no additional acquisitions

company were to make no additional acquisitions

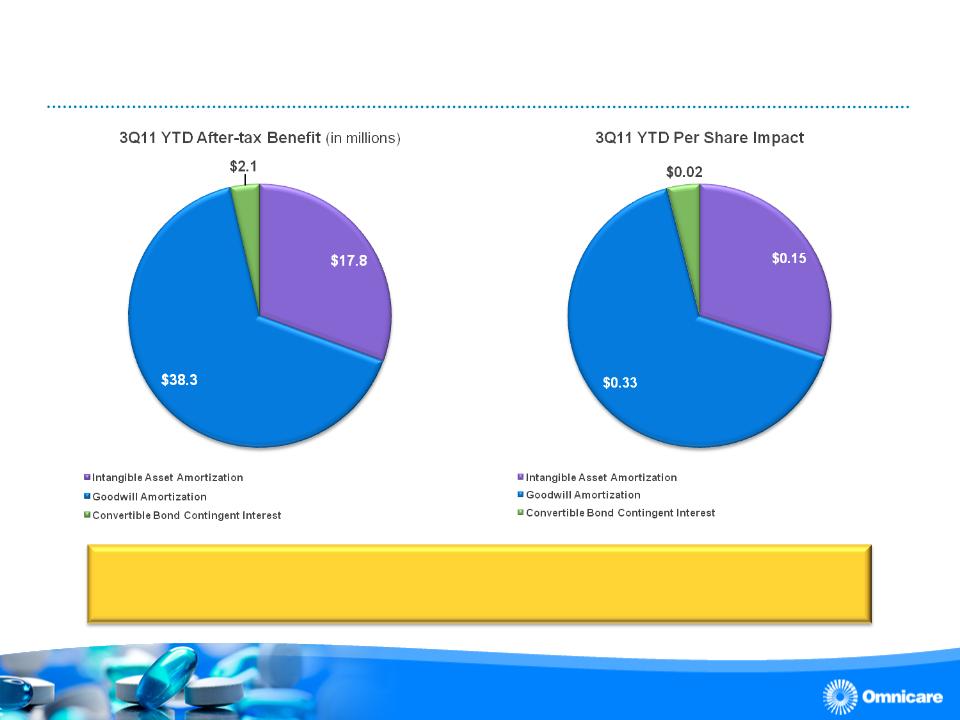

Focus on Cash Flow

Moving to Cash-Based EPS Reporting

Moving to Cash-Based EPS Reporting

32

Beginning in 2012, Omnicare will report adjusted earnings

excluding intangible asset amortization

excluding intangible asset amortization

While adding back:

Goodwill amortization tax deduction, and

Contingent convertible debenture interest tax deduction

Goodwill amortization tax deduction, and

Contingent convertible debenture interest tax deduction

Financial Performance

Focus on Cash Flow - Pro Forma Results (in $ millions, except per share

data)

Focus on Cash Flow - Pro Forma Results (in $ millions, except per share

data)

33

|

|

3Q11 YTD

|

|

|

(4)

|

Contingent Convertible Debenture Interest - after tax

|

2,125

|

|

(6)

|

Total Additional Special Items - after tax

|

$ 58,192

|

|

(7)

|

Diluted Adjusted EPS(2)

|

$ 1.55

|

|

(8)

|

Cash EPS Adjustments

|

$ 0.51

|

|

(9)

|

Diluted Adjusted Cash EPS(2)

|

$ 2.06

|

|

(10)

|

Effective Tax Rate

|

37.5%

|

|

(11)

|

Dil. Avg. Shares Outstanding

|

114,930

|

The after-tax benefit in 3Q11 YTD was

$58.2 million or $0.51 per diluted share

$58.2 million or $0.51 per diluted share

1. Excludes special items. A reconciliation of certain non-GAAP information has been attached to our earnings press release of October 25, 2011 and is available on Omnicare’s Web site under ‘Supplemental

Financial Information’ from the ‘Investors’ page

Financial Information’ from the ‘Investors’ page

2. Excludes discontinued operations

Efficient Capital Deployment to Augment Growth

Initiatives

Initiatives

34

Robust cash flow generation is expected

to be redeployed toward growth drivers

to be redeployed toward growth drivers

Capital Allocation

Putting the Robust Cash Flows to Work(1)

Putting the Robust Cash Flows to Work(1)

35

1. Cumulative % Returned = (Dividends Paid + Share Repurchases) / 12/31/10 Market Capitalization of $2,961.0 million

Third quarter year-to-date capital returned to shareholders increased 44.5% over 2010

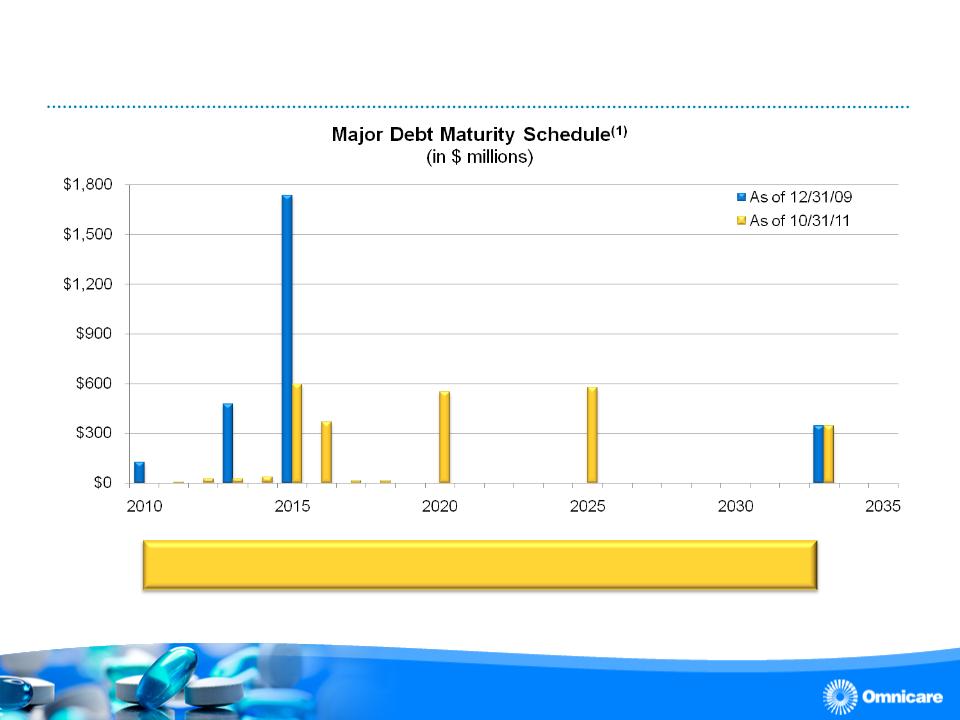

1. Assumes convertible debentures due 2035 are put to the company in 2015 with related tax recapture included and debt amounts shown are exclusive of unamortized debt discount.

Capital Structure

36

Goal is to spread out maturities to limit refinancing risk

Acquisition Program

Opportunities to Leverage Infrastructure

Opportunities to Leverage Infrastructure

• Omnicare’s scalable platform makes LTC acquisitions attractive

– Leverage synergies through direct purchasing of generics

– Utilize hub-and-spoke network and automation/technology platforms

– Improvements in customer retention efforts lowers customer attrition

risk

risk

• Disciplined approach to acquisitions with early involvement of

operators

operators

• Also considering acquisitions in rapidly growing specialty care space

– Opportunities to leverage synergies within existing specialty care

platforms

platforms

– Potential acquisition targets to round out specialty care portfolio

37

Disciplined approach to acquisitions requires at

least 15% after-tax returns, with acquisitions

compared to other capital allocation alternatives.

least 15% after-tax returns, with acquisitions

compared to other capital allocation alternatives.

New Disclosures for Greater Transparency

38

1. 2012 guidance to be presented both ways

Financial Performance

2012 Guidance and Forward-Looking Major Drivers(1)

2012 Guidance and Forward-Looking Major Drivers(1)

|

Major Drivers

|

2012

|

2013

|

2014

|

|

• Brand-to-generic

|

Positive

|

Neutral

|

Neutral

|

|

• Organic Growth - Long-Term Care

|

Neutral

|

Positive

|

Positive

|

|

• Reimbursement

|

Negative

|

Negative

|

Negative

|

|

• Specialty Care(2)

|

Positive

|

Positive

|

Positive

|

|

• ONE System

|

Neutral

|

Positive

|

Positive

|

|

• Standardization Initiatives

|

Neutral

|

Positive

|

Positive

|

|

• Automation

|

Neutral

|

Positive

|

Positive

|

|

• Omnicare-at-home

|

Neutral

|

Positive

|

Positive

|

39

2. Includes an assumption for acquisitions

3. Full-year 2012 guidance provided in Omnicare press release dated January 10, 2012.

Omnicare expects full-year 2012 adjusted EPS between $2.37 and $2.47(3).

Anticipated full-year 2012 cash-based EPS to be provided with 4Q11 earnings release.

Cash Flow

Generation

Generation

Specialty Care

Group

Group

Omnicare’s Fundamental Objective

Focused on Growth and Creating Value

Focused on Growth and Creating Value

Value

Creation

41